In the modern world of consumerization we all love a good bargain. One method of gaining substantial savings from your purchases is via P60 Tax Rebate Forms. P60 Tax Rebate Forms are marketing strategies employed by retailers and manufacturers to offer consumers a partial cash back on their purchases once they have done so. In this article, we will explore the world of P60 Tax Rebate Forms. We'll look at what they are, how they work, and the best way to increase your savings via these cost-effective incentives.

Get Latest P60 Tax Rebate Form Below

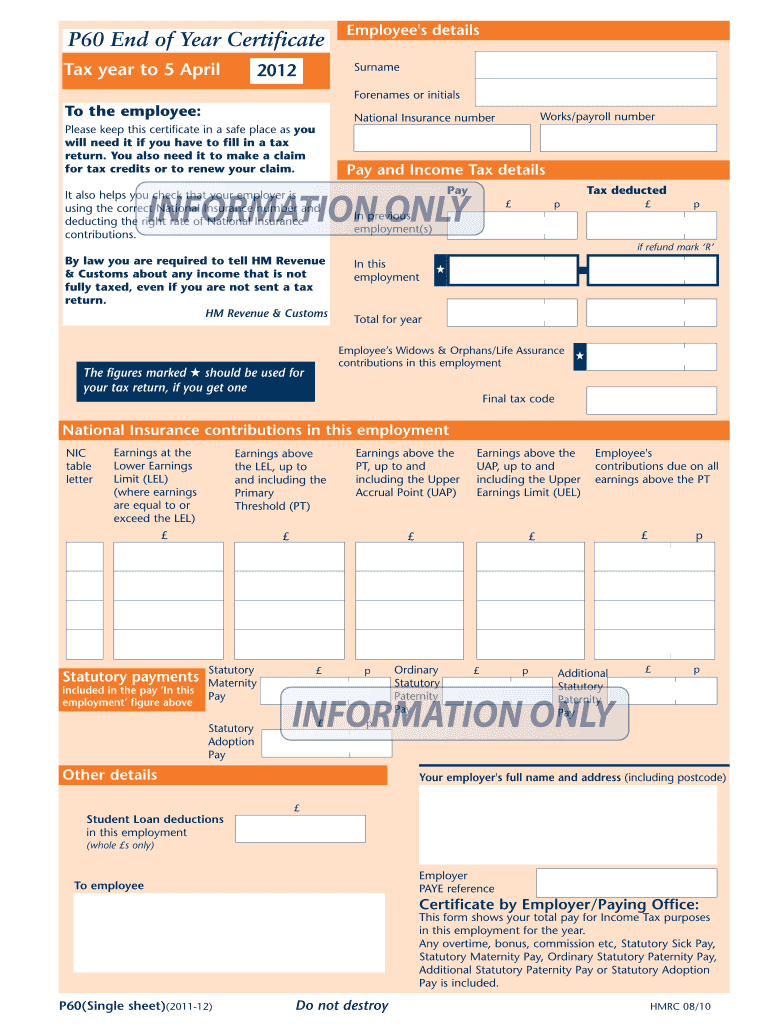

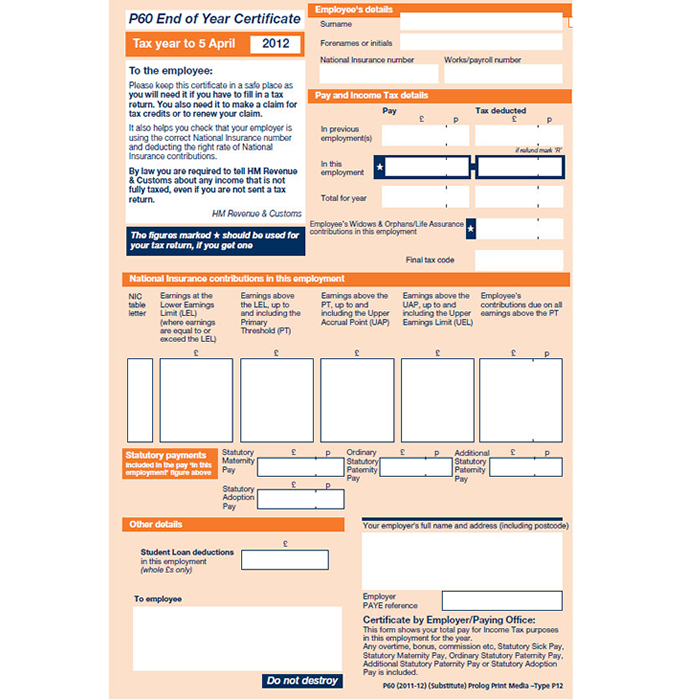

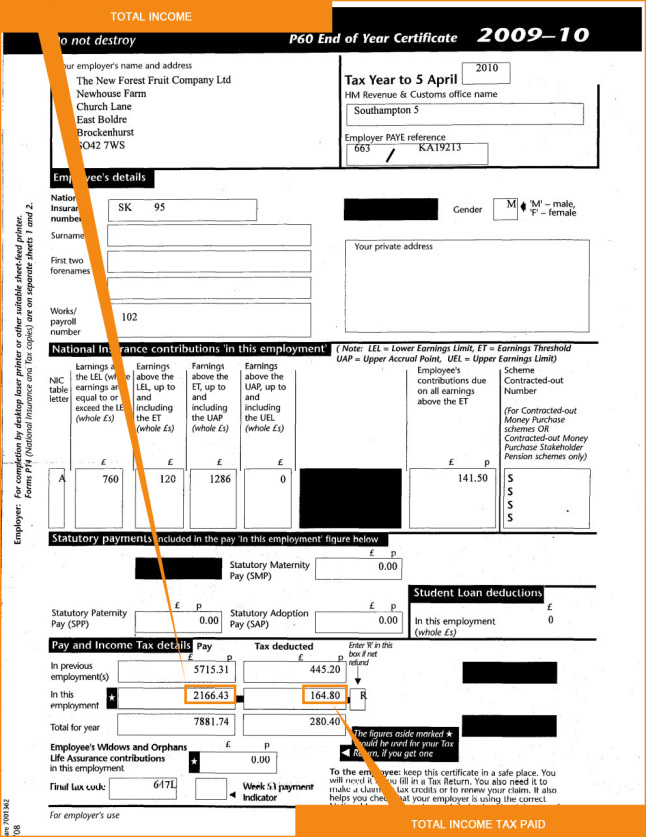

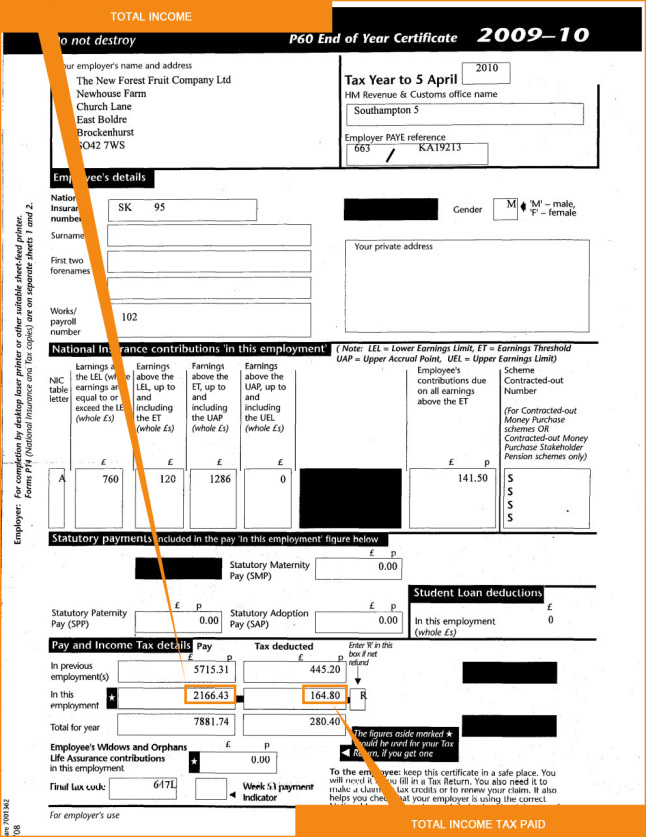

P60 Tax Rebate Form

P60 Tax Rebate Form -

Web What is a P60 Your P60 and tax rebates When you re claiming a tax rebate whether for essential work expenses or because you only worked for part of the year your P60 is a

Web A P60 tax refund is a repayment of income tax because you have paid too much The figures on the P60 will show whether you ve paid too much tax against the income you

A P60 Tax Rebate Form or P60 Tax Rebate Form, in its most basic type, is a reimbursement to a buyer who has purchased a particular product or service. It's a powerful instrument that businesses use to draw customers, increase sales, and advertise specific products.

Types of P60 Tax Rebate Form

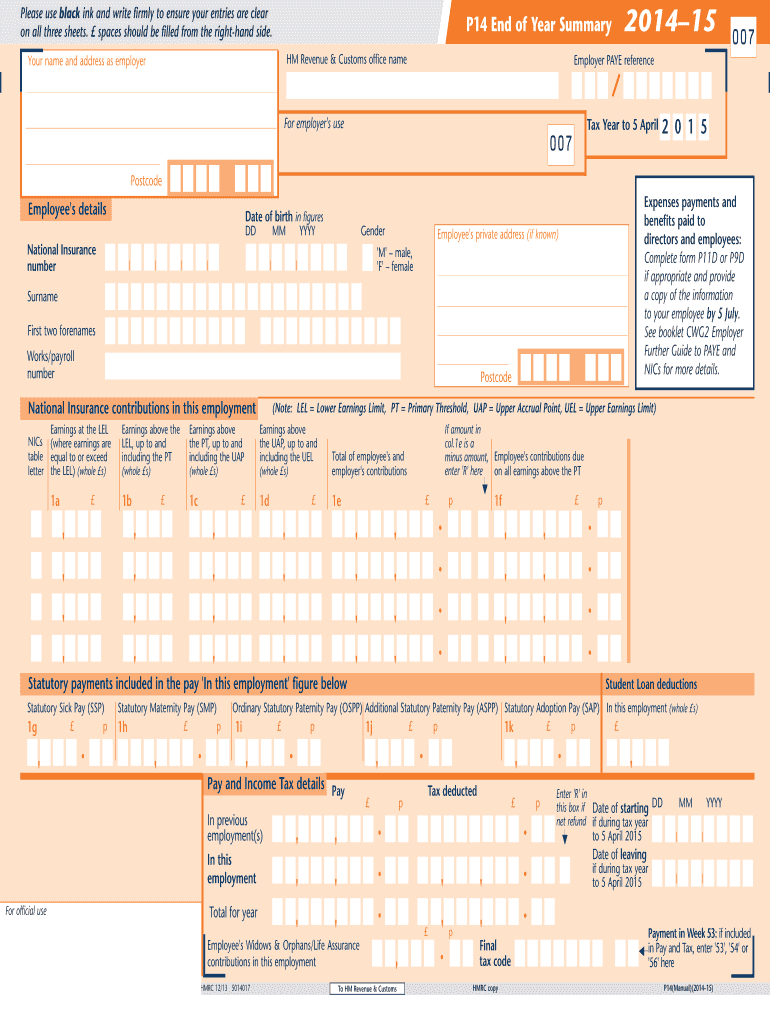

A Guide To UK PAYE Tax Forms P45 P60 And P11D

A Guide To UK PAYE Tax Forms P45 P60 And P11D

Web 28 oct 2022 nbsp 0183 32 October 28 2022 8 mins In the UK P60 forms are used by taxpayers to report their income and tax liabilities for the previous tax year These forms are

Web P60 End of Year Certificate Tax year to 5 April 2022 To the employee Please keep this certificate in a safe place as you will need it if you have to fill in a tax return You also

Cash P60 Tax Rebate Form

Cash P60 Tax Rebate Form are by far the easiest type of P60 Tax Rebate Form. The customer receives a particular amount of money when buying a product. These are often used for big-ticket items, like electronics and appliances.

Mail-In P60 Tax Rebate Form

Mail-in P60 Tax Rebate Form require consumers to send in evidence of purchase to get their cash back. They're somewhat more complicated, but they can provide significant savings.

Instant P60 Tax Rebate Form

Instant P60 Tax Rebate Form are applied at point of sale, reducing your purchase cost instantly. Customers don't have to wait for savings through this kind of offer.

How P60 Tax Rebate Form Work

2017 2020 Form UK HMRC P60 Single Sheet Fill Online Printable

2017 2020 Form UK HMRC P60 Single Sheet Fill Online Printable

Web iCalculator P60 Explained P60 Explained A P60 is a form used by HMRC A P60 is issued at the end of each tax year A P60 contains exact information about how much

The P60 Tax Rebate Form Process

The process generally involves a few simple steps:

-

Buy the product: At first then, you buy the item just like you normally would.

-

Fill in this P60 Tax Rebate Form application: In order to claim your P60 Tax Rebate Form, you'll need to provide some information, such as your address, name, and the purchase details, in order to take advantage of your P60 Tax Rebate Form.

-

In order to submit the P60 Tax Rebate Form In accordance with the kind of P60 Tax Rebate Form, you may need to mail a P60 Tax Rebate Form form in or upload it online.

-

Wait until the company approves: The company will evaluate your claim and ensure that it's compliant with P60 Tax Rebate Form's terms and conditions.

-

Accept your P60 Tax Rebate Form After you've been approved, you'll receive your cash back using a check or prepaid card, or another option specified by the offer.

Pros and Cons of P60 Tax Rebate Form

Advantages

-

Cost savings: P60 Tax Rebate Form can significantly decrease the price for products.

-

Promotional Deals Incentivize customers to try new products or brands.

-

Improve Sales P60 Tax Rebate Form are a great way to boost the company's sales as well as market share.

Disadvantages

-

Complexity In particular, mail-in P60 Tax Rebate Form particularly could be cumbersome and costly.

-

End Dates A lot of P60 Tax Rebate Form have deadlines for submission.

-

The risk of non-payment: Some customers may have their P60 Tax Rebate Form delayed if they do not adhere to the guidelines exactly.

Download P60 Tax Rebate Form

FAQs

1. Are P60 Tax Rebate Form equivalent to discounts? No, they are only a partial reimbursement following the purchase, whereas discounts cut the purchase price at moment of sale.

2. Are there any P60 Tax Rebate Form that I can use for the same product This depends on the conditions of the P60 Tax Rebate Form offers and the product's eligibility. Certain businesses may allow it, but others won't.

3. How long will it take to receive a P60 Tax Rebate Form? The time frame can vary, but typically it will take a couple of weeks or a several months to receive a P60 Tax Rebate Form.

4. Do I have to pay taxes regarding P60 Tax Rebate Form amount? the majority of cases, P60 Tax Rebate Form amounts are not considered to be taxable income.

5. Should I be able to trust P60 Tax Rebate Form deals from lesser-known brands It is essential to investigate and make sure that the company giving the P60 Tax Rebate Form is reputable before making an purchase.

P60 2020 2022 Fill And Sign Printable Template Online US Legal Forms

P60 Form Fill Online Printable Fillable Blank PdfFiller

Check more sample of P60 Tax Rebate Form below

2015 2023 Form UK HMRC P14 P60 Fill Online Printable Fillable Blank

P45 Vs P60 What s The Difference Revolut

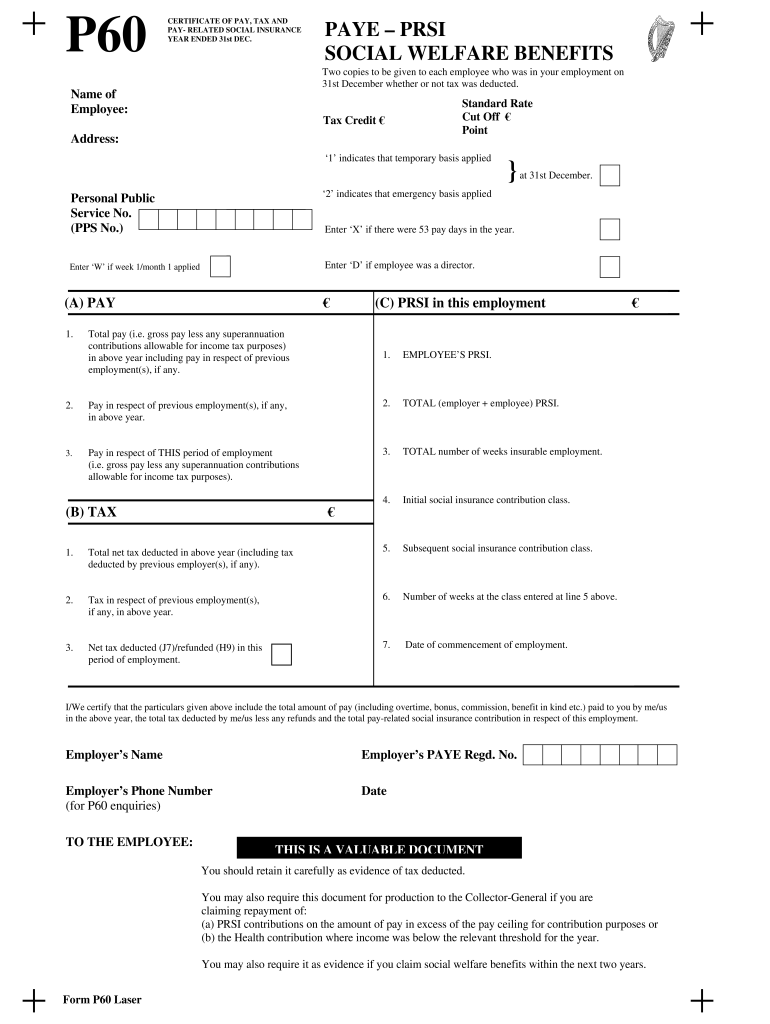

P60 Ireland Fill Online Printable Fillable Blank PdfFiller

Can I Claim Ppi Back From My Catalogue

P60ukpdf

Order Replacement P60 UK National Insurance Number Paying Taxes

https://www.taxrebateservices.co.uk/tax-faqs/income-tax-forms/what-is-a-p60

Web A P60 tax refund is a repayment of income tax because you have paid too much The figures on the P60 will show whether you ve paid too much tax against the income you

https://www.simplybusiness.co.uk/.../articles/2022/03/how-to-get-a-p60

Web 29 mars 2022 nbsp 0183 32 How to claim tax back with a P60 It s good practice to check the figures on P60s because if they re wrong you or your employees could be paying too much tax If

Web A P60 tax refund is a repayment of income tax because you have paid too much The figures on the P60 will show whether you ve paid too much tax against the income you

Web 29 mars 2022 nbsp 0183 32 How to claim tax back with a P60 It s good practice to check the figures on P60s because if they re wrong you or your employees could be paying too much tax If

Can I Claim Ppi Back From My Catalogue

P45 Vs P60 What s The Difference Revolut

P60ukpdf

Order Replacement P60 UK National Insurance Number Paying Taxes

What Is P60 Download Form P60 DNS Accountants

How To Check Your P60 Form Or Payslips For Tax Rebate Payslips

How To Check Your P60 Form Or Payslips For Tax Rebate Payslips

P60 TAX FORM END OF YEAR CERTIFICATE P60 REVENUE