In today's world of consumerism everyone is looking for a great bargain. One way to gain substantial savings on your purchases is through Nj Division Taxatiion Homestate Rebate Forms. The use of Nj Division Taxatiion Homestate Rebate Forms is a method used by manufacturers and retailers to offer customers a refund on their purchases after they have made them. In this post, we'll look into the world of Nj Division Taxatiion Homestate Rebate Forms. We'll discuss what they are and how they operate, and how you can maximise the value of these incentives.

Get Latest Nj Division Taxatiion Homestate Rebate Form Below

Nj Division Taxatiion Homestate Rebate Form

Nj Division Taxatiion Homestate Rebate Form -

Web form in this booklet You may use this form if You shared ownership of your principal residence main home with someone who was not your spouse civil union partner

Web This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current

A Nj Division Taxatiion Homestate Rebate Form in its simplest form, is a payment to a consumer following the purchase of a product or service. It is a powerful tool employed by companies to attract clients, increase sales and to promote certain products.

Types of Nj Division Taxatiion Homestate Rebate Form

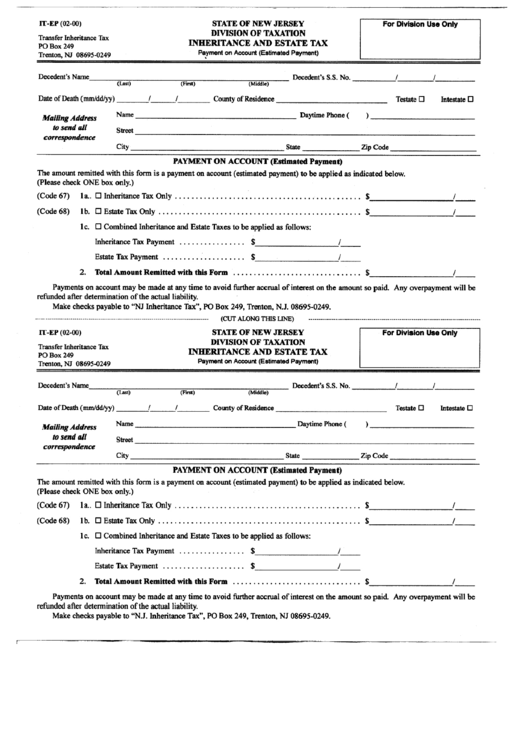

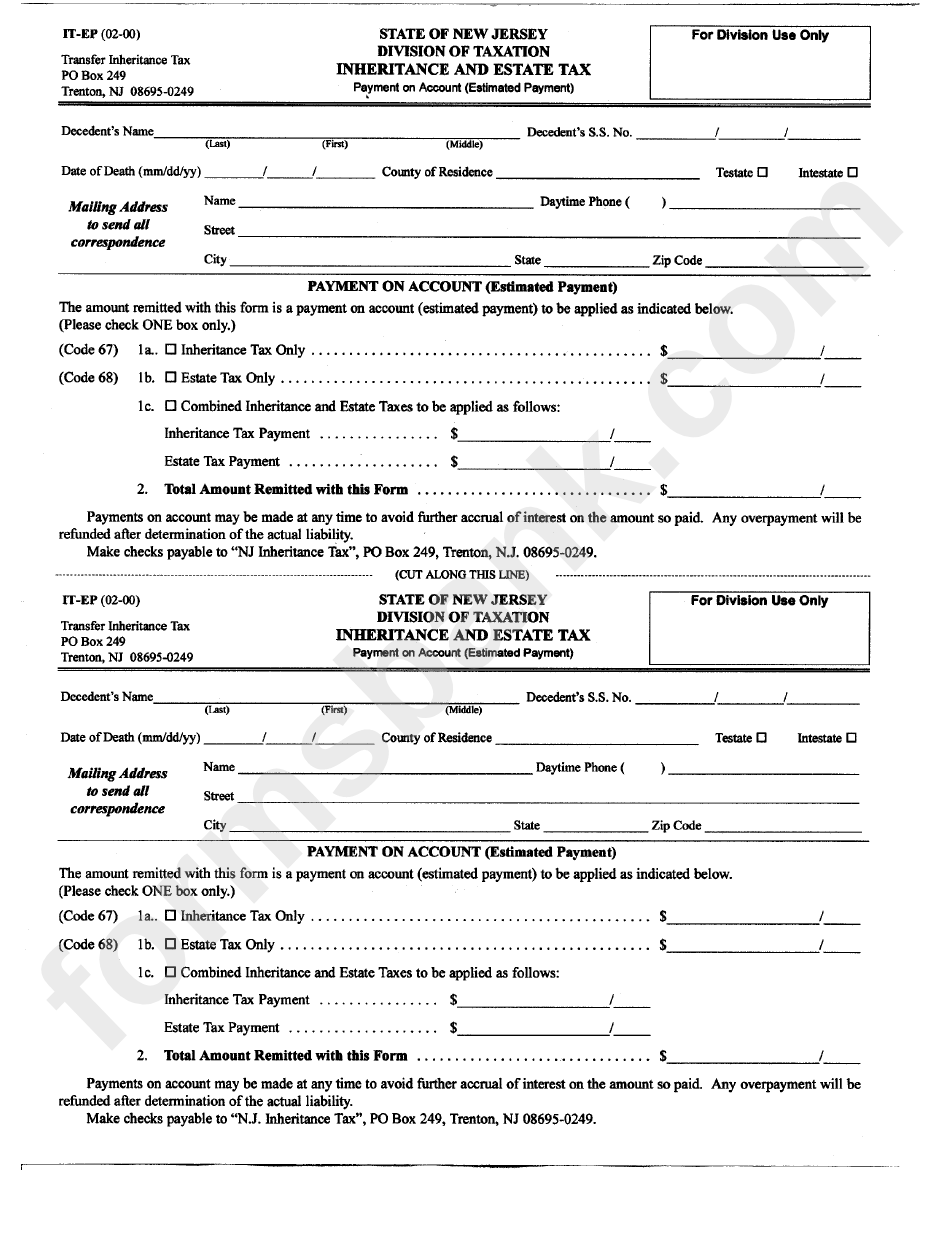

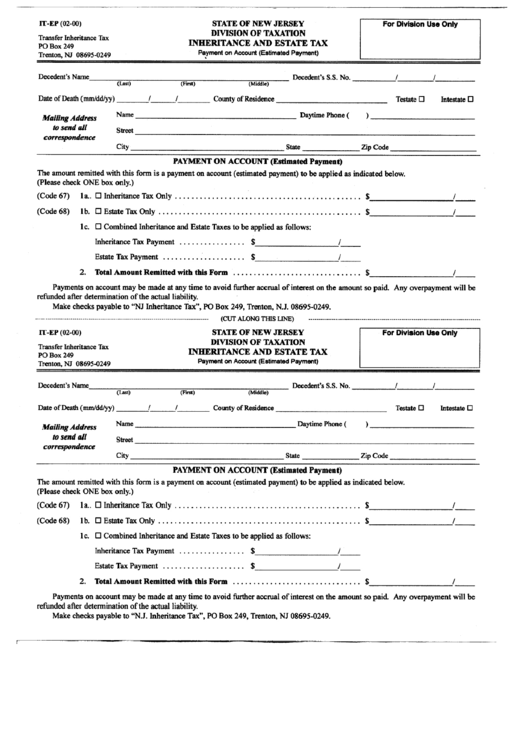

Form It Ep State Of New Jersey Division Of Taxation Inheritance And

Form It Ep State Of New Jersey Division Of Taxation Inheritance And

Web 19 mai 2022 nbsp 0183 32 Sales and Use Tax Senior Freeze Property Tax Reimbursement Alcoholic Beverage Tax Cigarette Tax Corporate Business Tax Banking and Financial

Web rebate may file only the HR 1040 to claim a rebate It is not necessary to file the NJ 1040 along with the Homestead Rebate Application These residents have until January 15

Cash Nj Division Taxatiion Homestate Rebate Form

Cash Nj Division Taxatiion Homestate Rebate Form are the most straightforward type of Nj Division Taxatiion Homestate Rebate Form. Customers receive a specified amount of money in return for purchasing a item. This is often for high-ticket items like electronics or appliances.

Mail-In Nj Division Taxatiion Homestate Rebate Form

Mail-in Nj Division Taxatiion Homestate Rebate Form demand that customers send in proof of purchase in order to receive their reimbursement. They're more involved but offer significant savings.

Instant Nj Division Taxatiion Homestate Rebate Form

Instant Nj Division Taxatiion Homestate Rebate Form apply at the point of sale, reducing the purchase price immediately. Customers don't have to wait around for savings in this manner.

How Nj Division Taxatiion Homestate Rebate Form Work

Form It Ep State Of New Jersey Division Of Taxation Inheritance And

Form It Ep State Of New Jersey Division Of Taxation Inheritance And

Web Under the new program known as ANCHOR homeowners making up to 150 000 will receive 1 500 rebates on their property tax bills and those making 150 000 to

The Nj Division Taxatiion Homestate Rebate Form Process

The process usually involves a few easy steps:

-

Buy the product: At first, you purchase the item like you would normally.

-

Fill out the Nj Division Taxatiion Homestate Rebate Form application: In order to claim your Nj Division Taxatiion Homestate Rebate Form, you'll have submit some information, such as your name, address, and information about the purchase to take advantage of your Nj Division Taxatiion Homestate Rebate Form.

-

Send in the Nj Division Taxatiion Homestate Rebate Form It is dependent on the kind of Nj Division Taxatiion Homestate Rebate Form there may be a requirement to fill out a form and mail it in or upload it online.

-

Wait for approval: The business will evaluate your claim to make sure it is in line with the Nj Division Taxatiion Homestate Rebate Form's terms and conditions.

-

Accept your Nj Division Taxatiion Homestate Rebate Form If it is approved, you'll receive your money back, whether by check, prepaid card, or another method specified by the offer.

Pros and Cons of Nj Division Taxatiion Homestate Rebate Form

Advantages

-

Cost savings The use of Nj Division Taxatiion Homestate Rebate Form can greatly cut the price you pay for products.

-

Promotional Deals The aim is to encourage customers to experiment with new products, or brands.

-

increase sales Reward programs can boost an organization's sales and market share.

Disadvantages

-

Complexity: Mail-in Nj Division Taxatiion Homestate Rebate Form, in particular are often time-consuming and tedious.

-

Expiration Dates A majority of Nj Division Taxatiion Homestate Rebate Form have very strict deadlines for filing.

-

Risk of not receiving payment: Some customers may not get their Nj Division Taxatiion Homestate Rebate Form if they do not follow the rules exactly.

Download Nj Division Taxatiion Homestate Rebate Form

Download Nj Division Taxatiion Homestate Rebate Form

FAQs

1. Are Nj Division Taxatiion Homestate Rebate Form equivalent to discounts? No, Nj Division Taxatiion Homestate Rebate Form offer one-third of the amount refunded following purchase, and discounts are a reduction of the purchase price at the time of sale.

2. Are there multiple Nj Division Taxatiion Homestate Rebate Form I can get on the same item The answer is dependent on the conditions on the Nj Division Taxatiion Homestate Rebate Form deals and product's eligibility. Certain companies may allow it, and some don't.

3. What is the time frame to get an Nj Division Taxatiion Homestate Rebate Form? The time frame will vary, but it may be anywhere from a few weeks up to a couple of months before you get your Nj Division Taxatiion Homestate Rebate Form.

4. Do I need to pay taxes with respect to Nj Division Taxatiion Homestate Rebate Form the amount? most cases, Nj Division Taxatiion Homestate Rebate Form amounts are not considered taxable income.

5. Can I trust Nj Division Taxatiion Homestate Rebate Form offers from brands that aren't well-known? It's essential to research and confirm that the company providing the Nj Division Taxatiion Homestate Rebate Form is credible prior to making an investment.

New Jersey Renters Rebate 2023 Printable Rebate Form

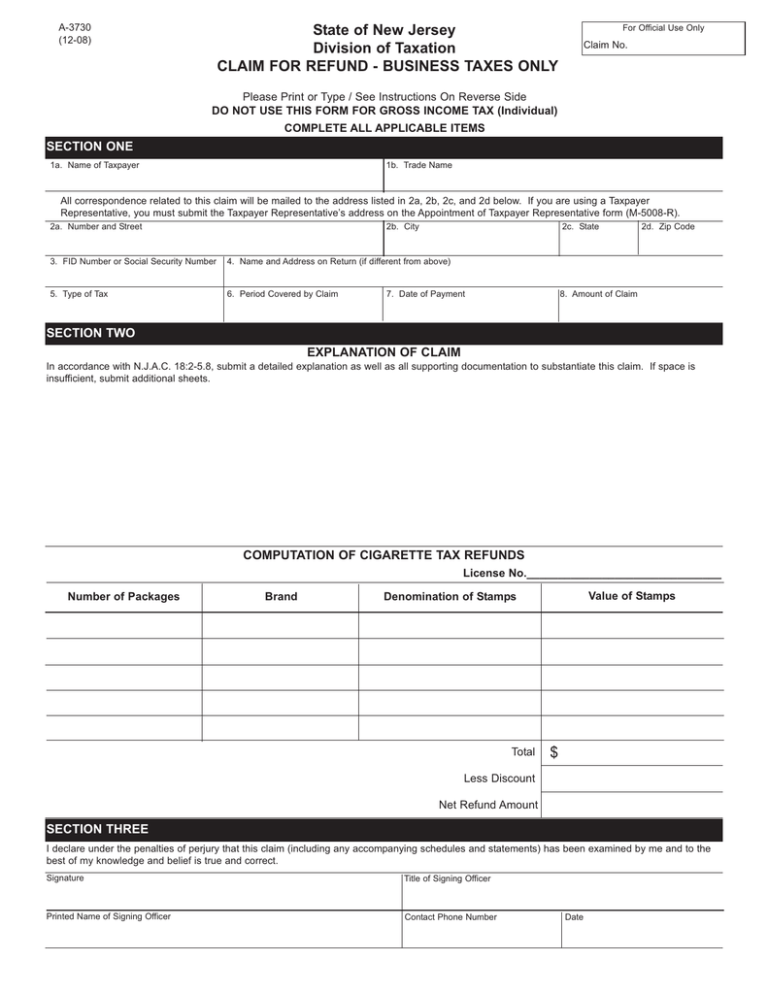

State Of New Jersey Division Of Taxation CLAIM FOR REFUND

Check more sample of Nj Division Taxatiion Homestate Rebate Form below

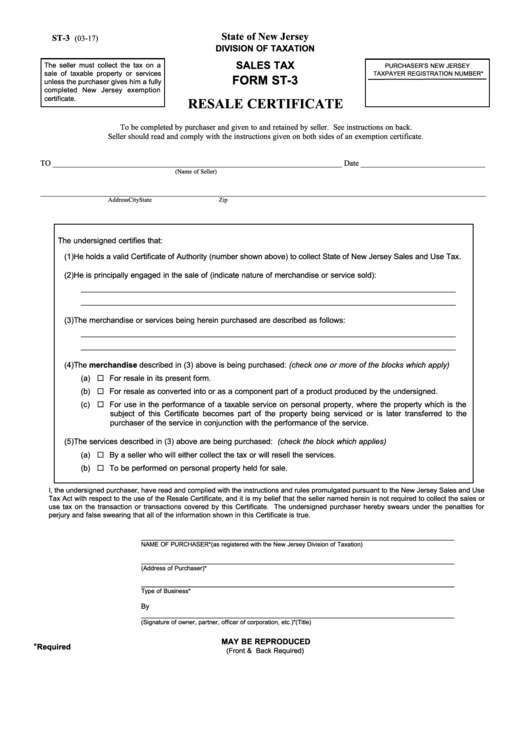

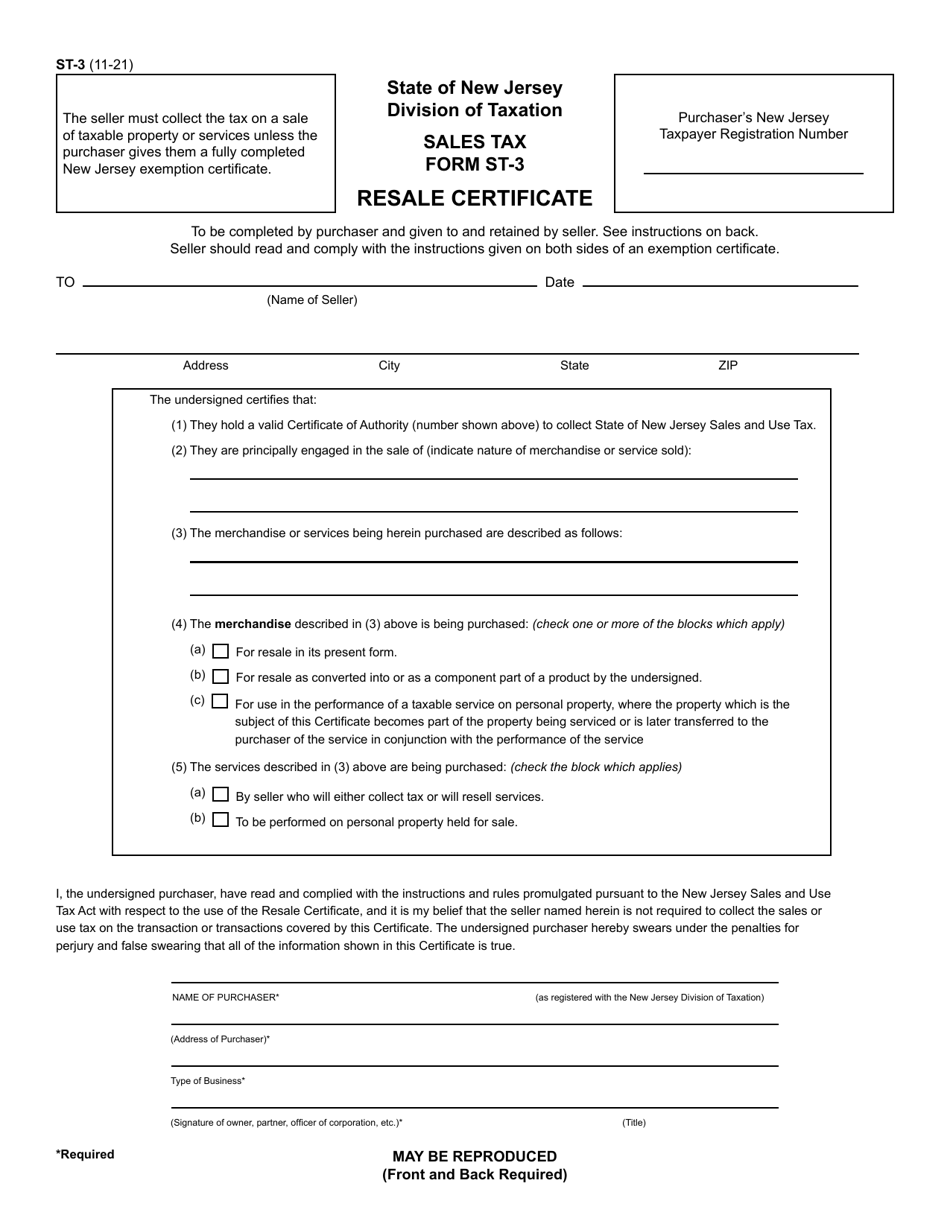

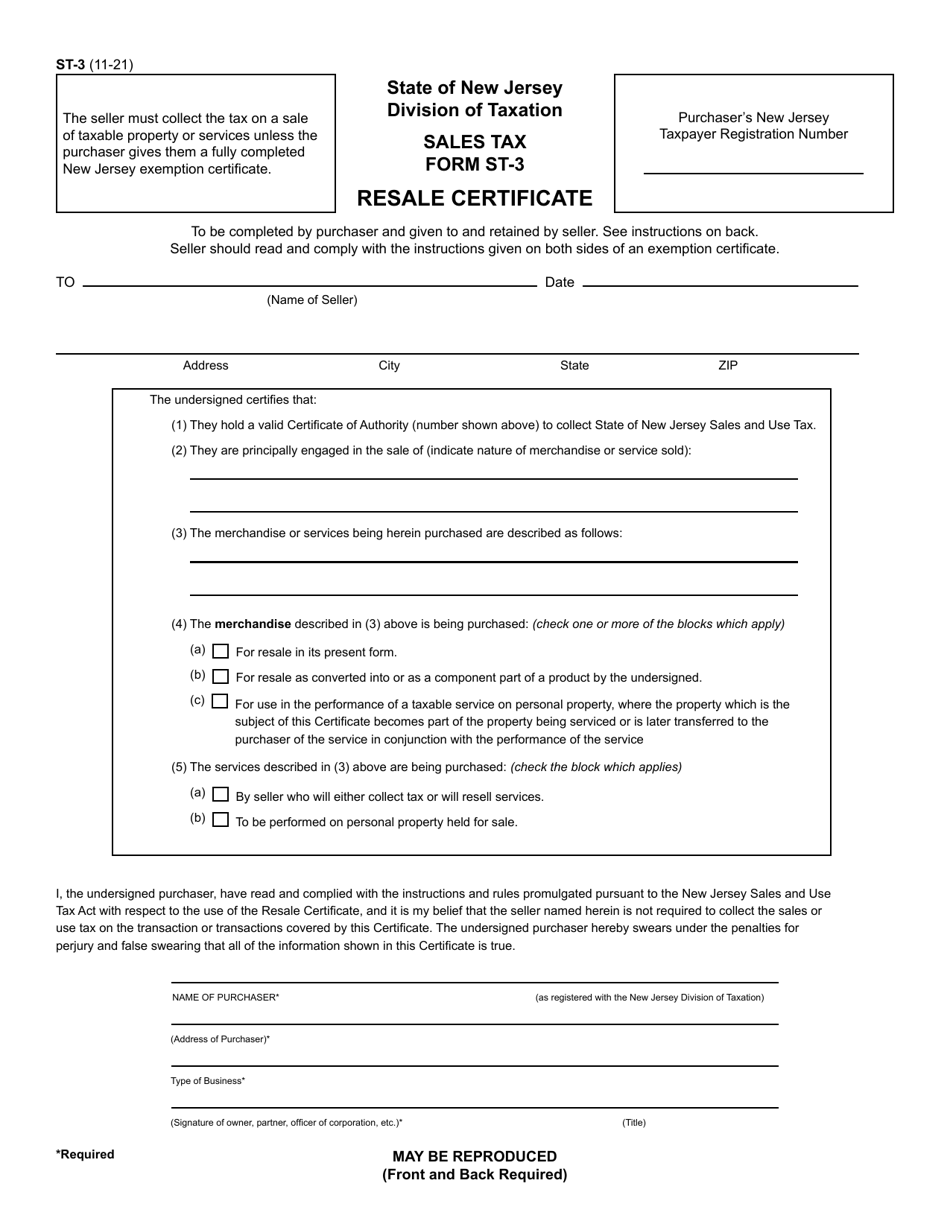

Form St 3 Resale Certificate State Of New Jersey Division Of

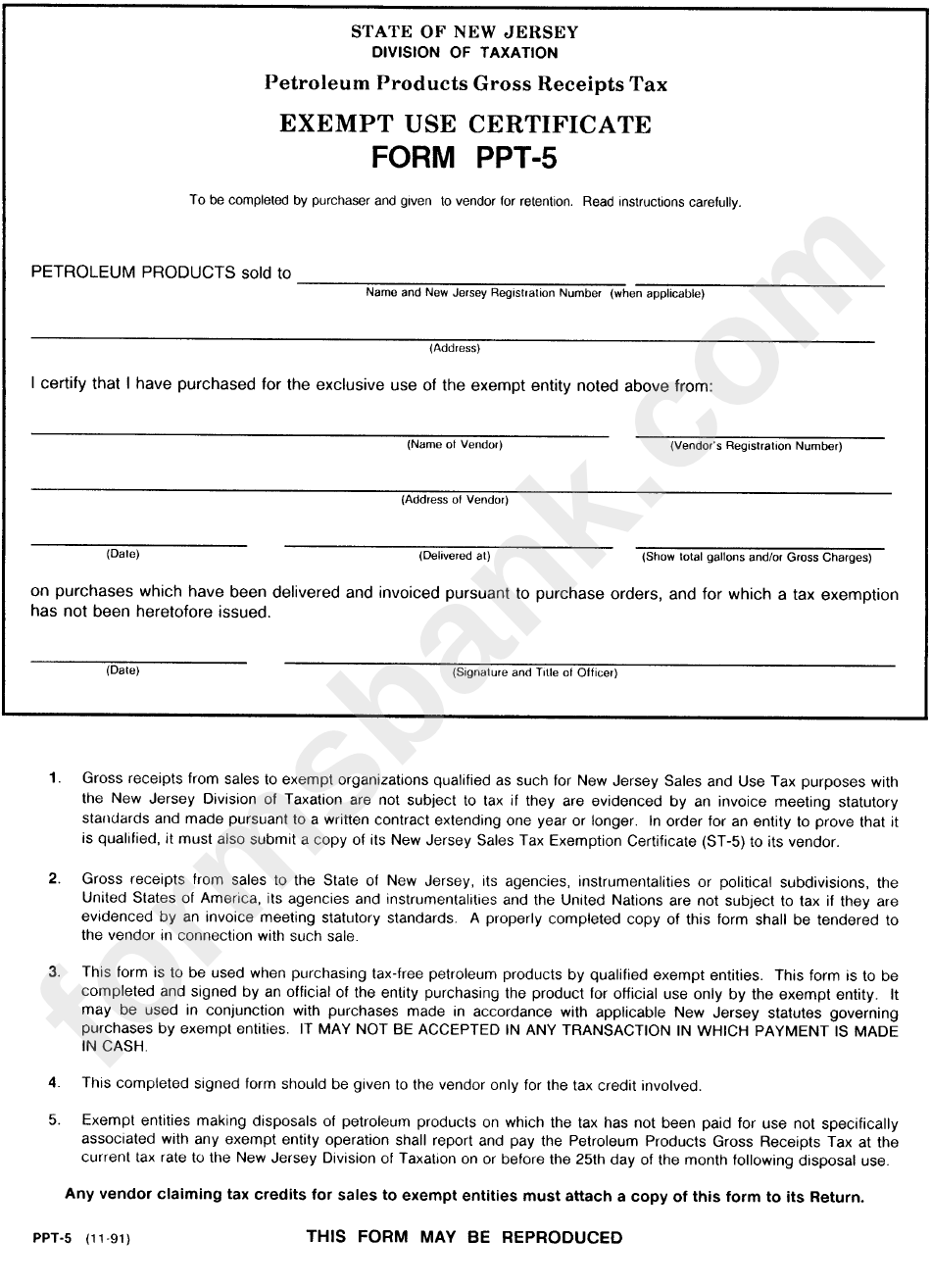

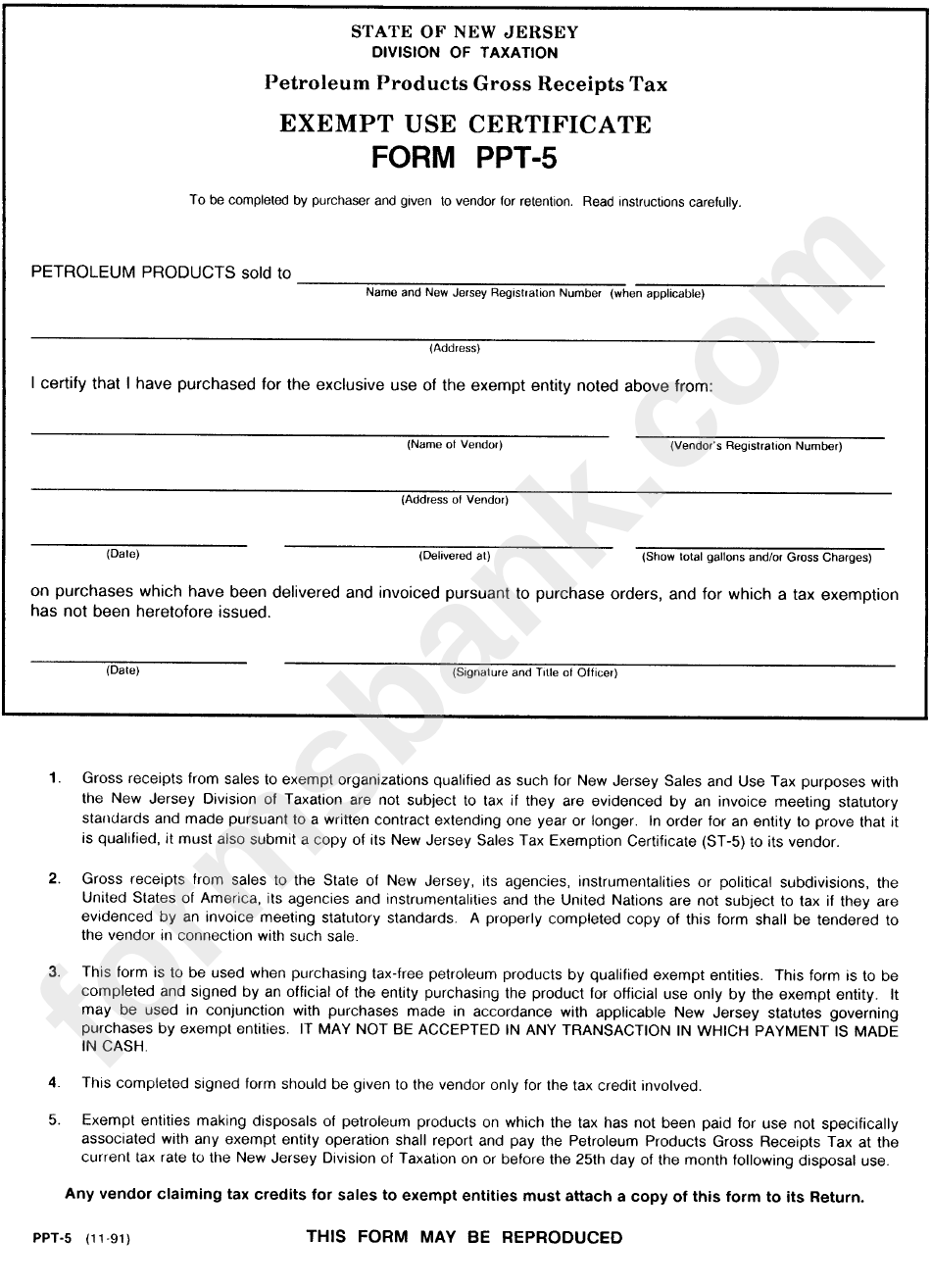

Form Ppt 5 Exempt Use Certificate New Jersey Division Of Taxation

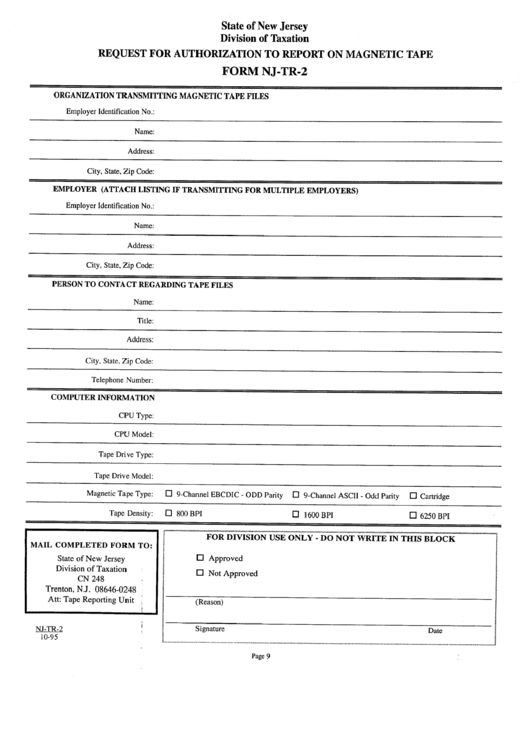

Form Nj Tr 2 Request For Authorization To Report On Magnetic Tape

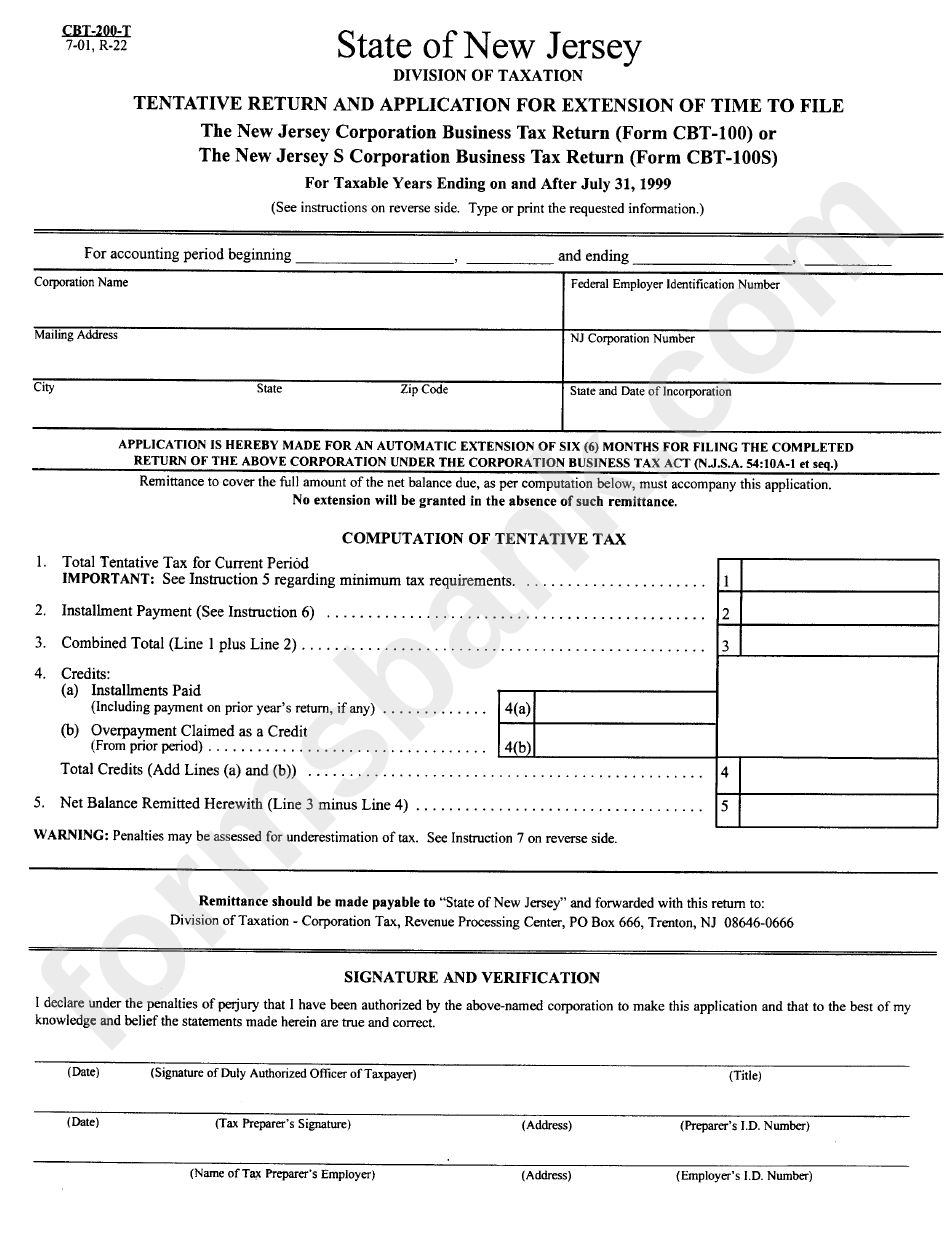

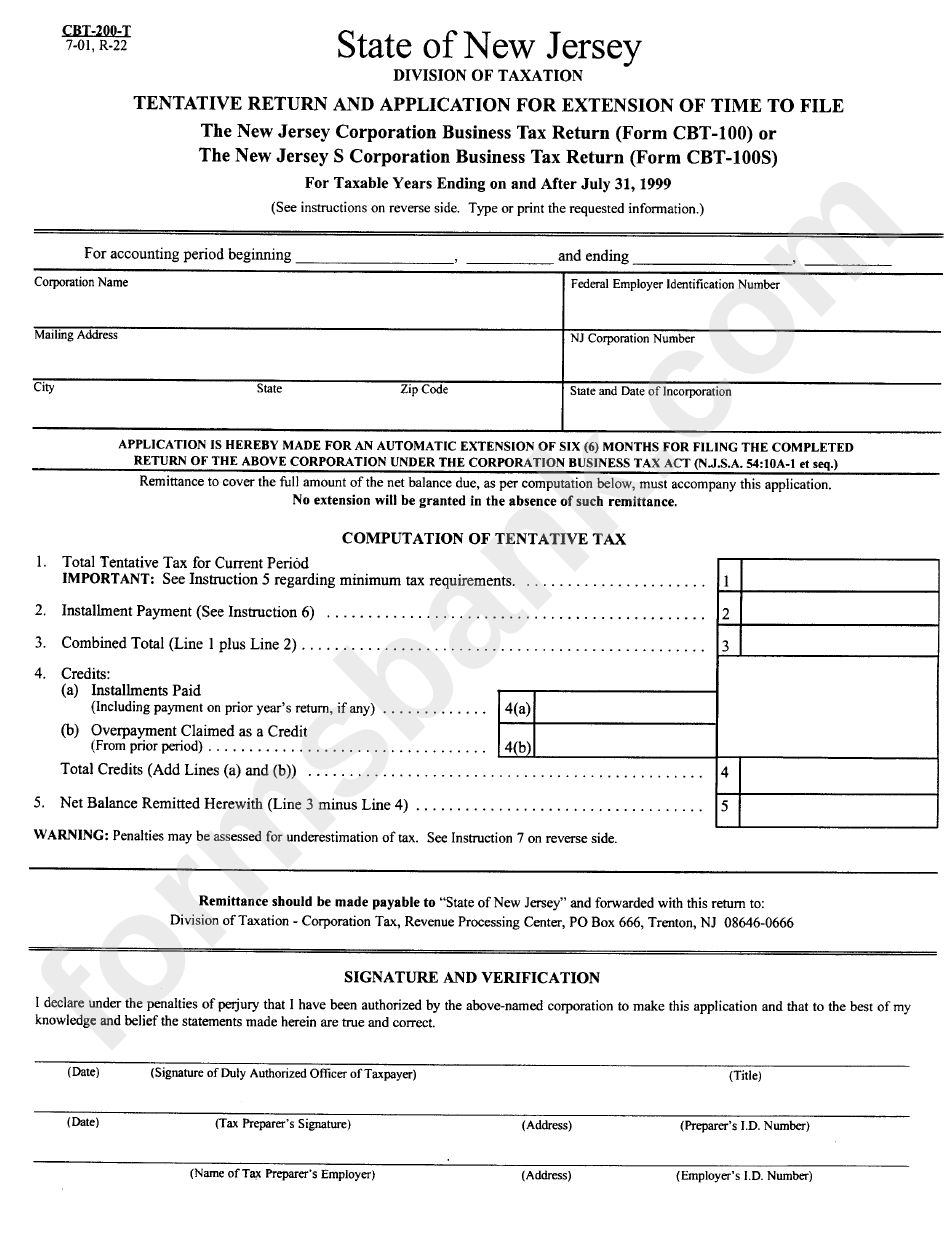

Form Cbt 200 T Tentative Return And Application For Extension Of Time

Form ST 3 Download Printable PDF Or Fill Online Resale Certificate New

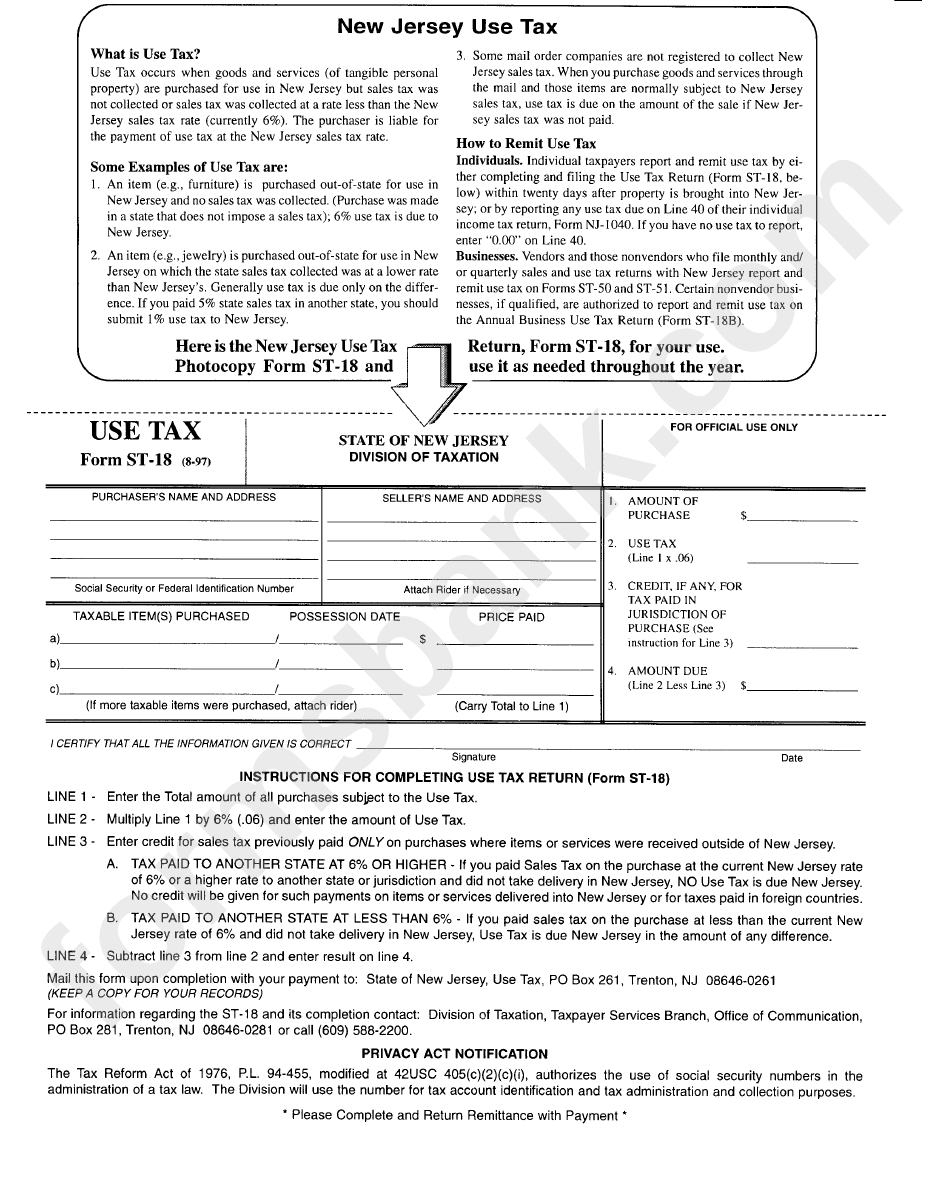

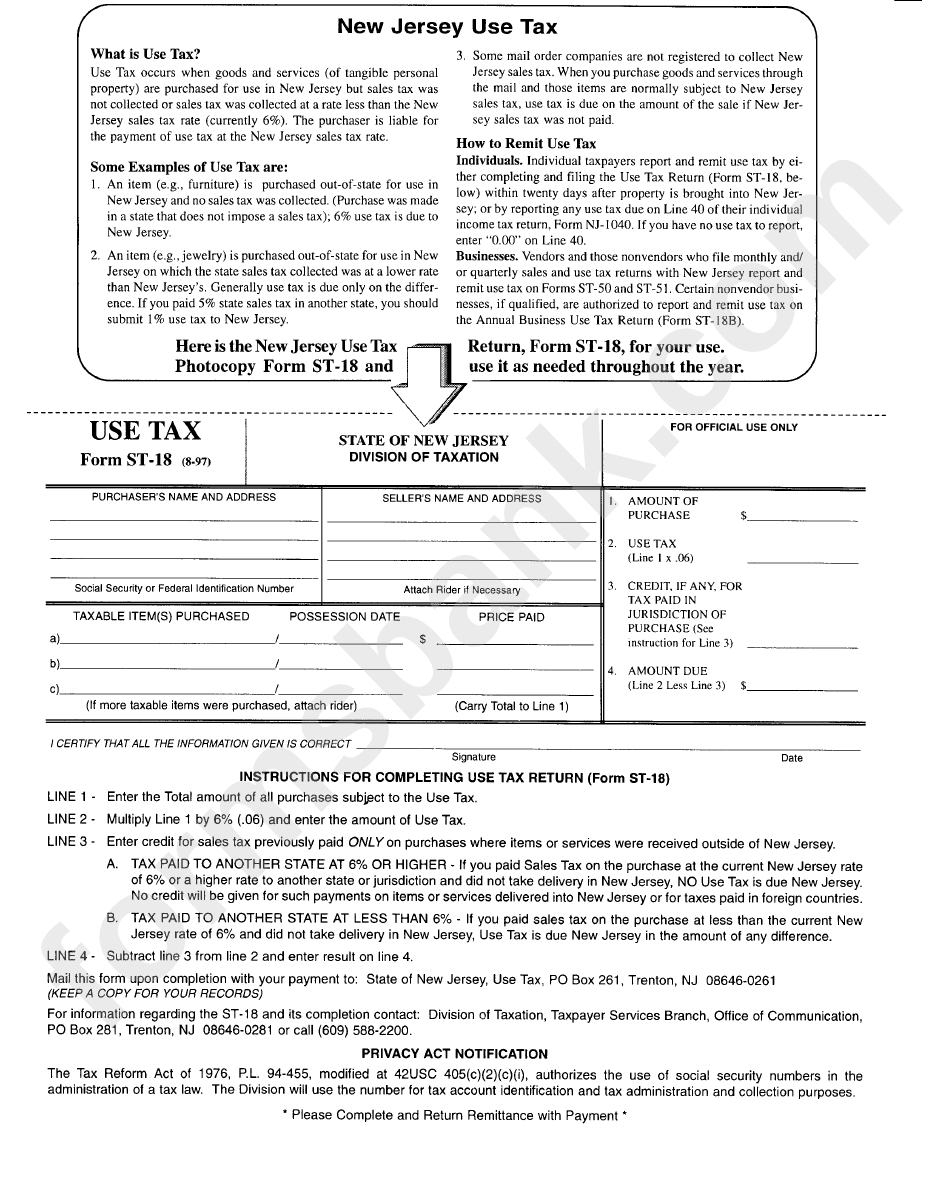

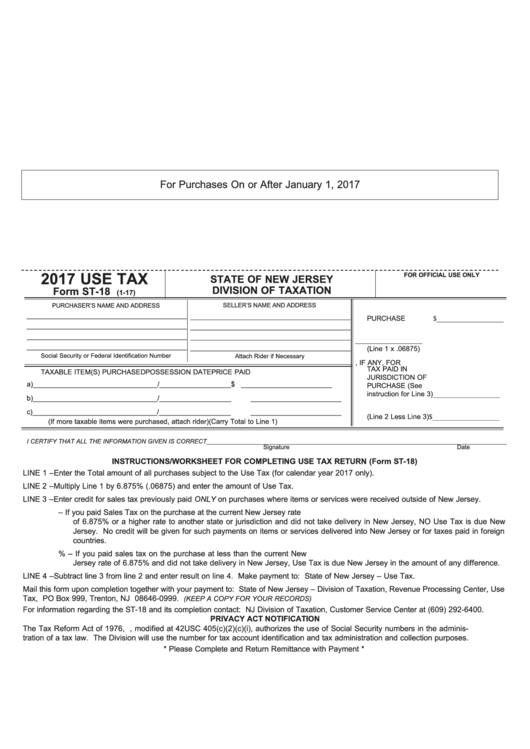

Fillable Form St 18 Use Tax Form New Jersey Division Of Taxation

https://nj.gov/treasury/taxation/anchor/index.shtml

Web This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current

https://www.state.nj.us/treasury/taxation/anchor/home.shtml

Web Eligibility requirements You are eligible if you met these requirements You were a New Jersey resident and You owned and occupied a home in New Jersey that was your

Web This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current

Web Eligibility requirements You are eligible if you met these requirements You were a New Jersey resident and You owned and occupied a home in New Jersey that was your

Form Cbt 200 T Tentative Return And Application For Extension Of Time

Form Ppt 5 Exempt Use Certificate New Jersey Division Of Taxation

Form ST 3 Download Printable PDF Or Fill Online Resale Certificate New

Fillable Form St 18 Use Tax Form New Jersey Division Of Taxation

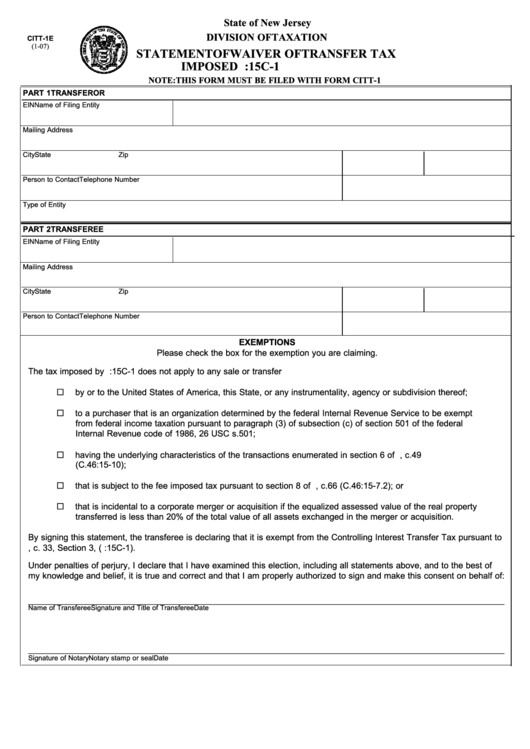

Fillable Form Citt 1e Statement Of Waiver Of Transfer Tax Imposed By

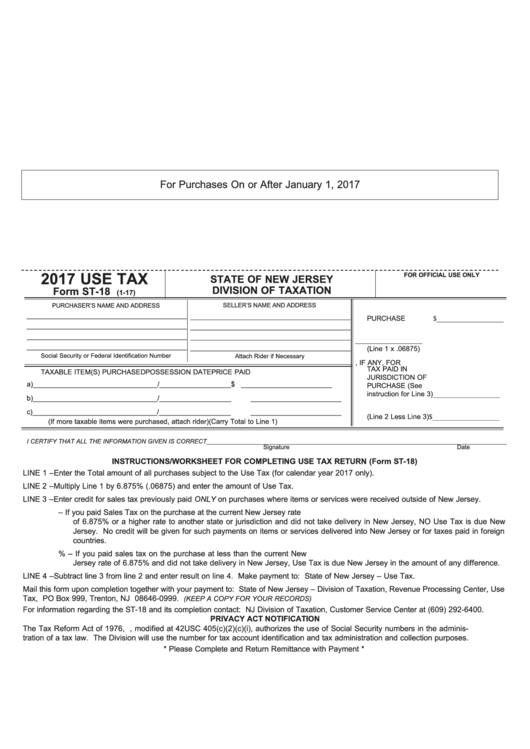

Form St 18 Use Tax New Jersey Division Of Taxation 2017 Printable

Form St 18 Use Tax New Jersey Division Of Taxation 2017 Printable

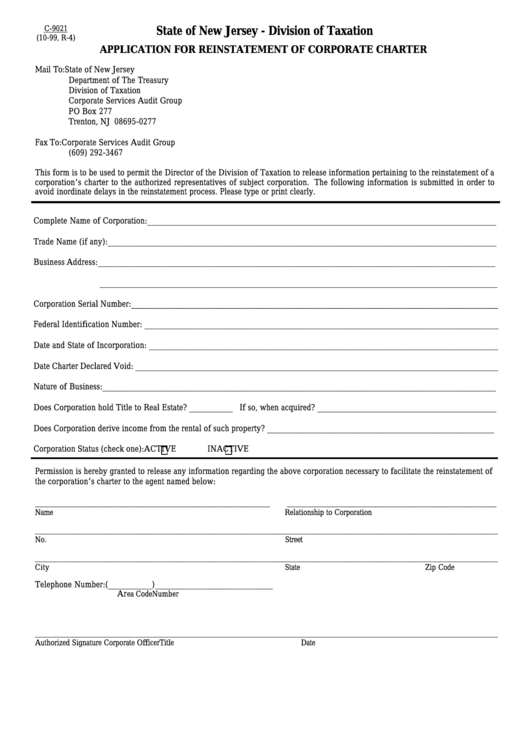

Fillable Form C 9021 Application For Reinstatement Of Corporate