In this modern-day world of consumers, everyone loves a good bargain. One option to obtain substantial savings on your purchases is by using Investment Property Hst Rebate Forms. Investment Property Hst Rebate Forms can be a way of marketing that retailers and manufacturers use to offer customers a partial return on their purchases once they have done so. In this post, we'll investigate the world of Investment Property Hst Rebate Forms, looking at the nature of them as well as how they work and how you can maximize your savings through these cost-effective incentives.

Get Latest Investment Property Hst Rebate Form Below

Investment Property Hst Rebate Form

Investment Property Hst Rebate Form - Rental Property Hst Rebate Form, Apply For Hst Rebate On Investment Property, Who Qualifies For Hst Rebate, How Do You Qualify For Hst Rebate, Who Qualifies For Hst Rebate In Ontario

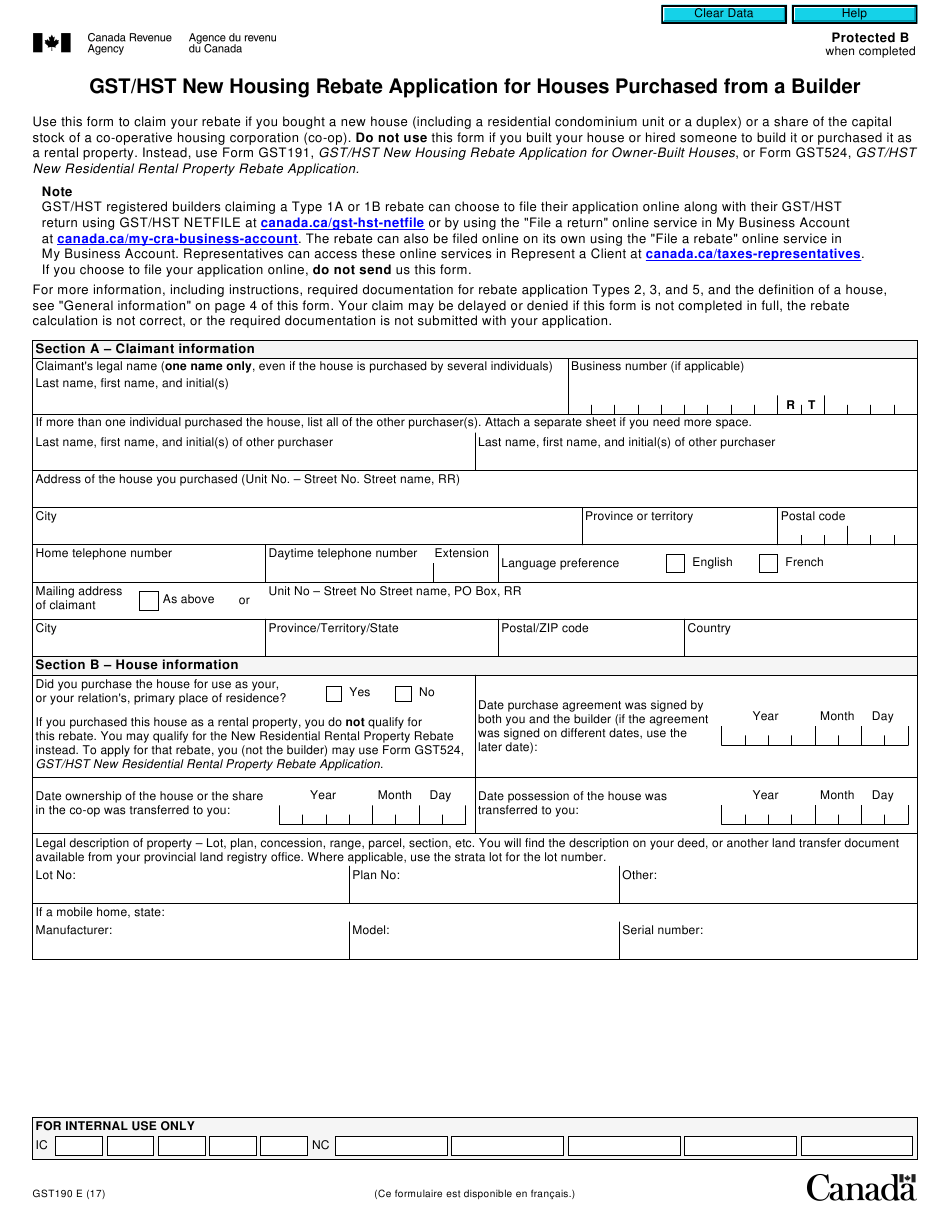

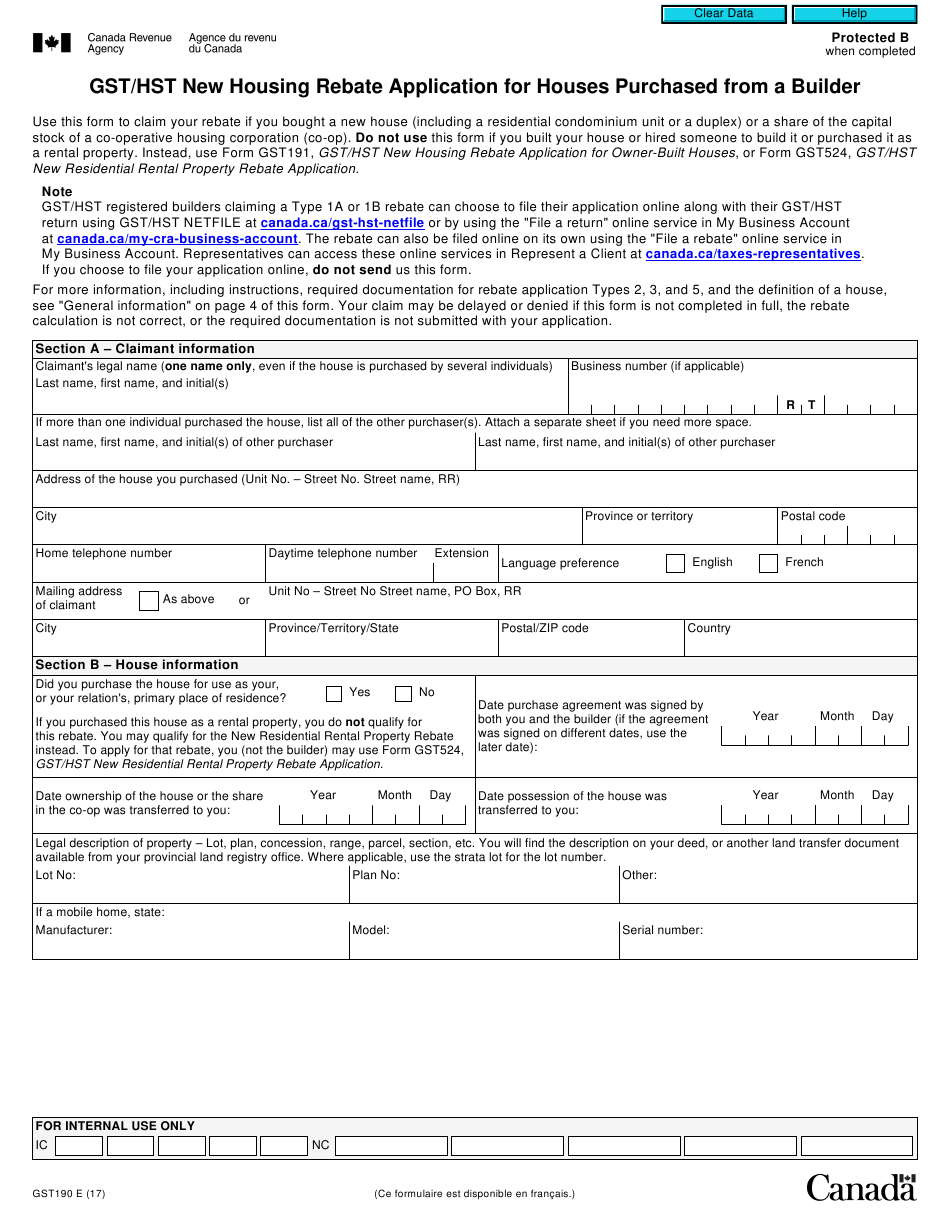

Web The GST HST new housing rebate allows an individual to recover some of the GST or the federal part of the HST paid for a new or substantially renovated house that is for use as

Web 2 sept 2020 nbsp 0183 32 The good news is that CRA is offering an HST new housing rebate for investment property The bad news is that the HST must still

A Investment Property Hst Rebate Form or Investment Property Hst Rebate Form, in its most basic type, is a cash refund provided to customers who has purchased a particular product or service. It's a very effective technique used by businesses to attract customers, increase sales and promote specific products.

Types of Investment Property Hst Rebate Form

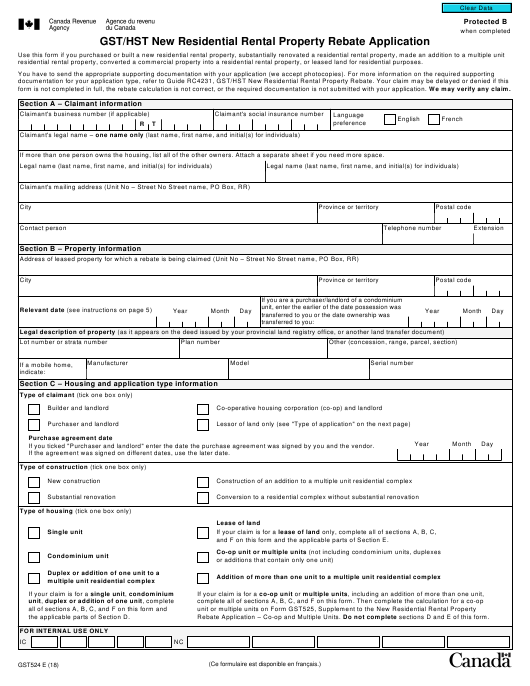

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

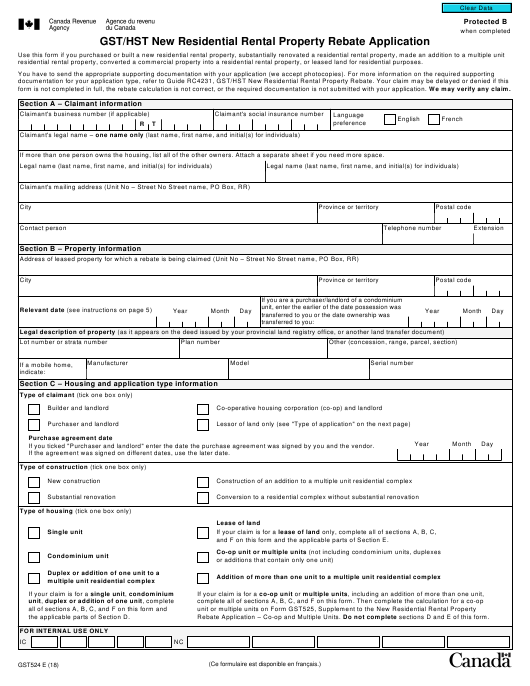

Web 30 oct 2020 nbsp 0183 32 This guide provides information for landlords of new residential rental properties on how to apply for the GST HST new residential rental property rebate It

Web What is a qualifying residential unit Fair market value Timing rules for when tax is payable Ontario NRRP rebate Application types Application Type 6 Lease of building and land

Cash Investment Property Hst Rebate Form

Cash Investment Property Hst Rebate Form is the most basic kind of Investment Property Hst Rebate Form. Clients receive a predetermined amount of money after purchasing a product. These are usually used for products that are expensive, such as electronics or appliances.

Mail-In Investment Property Hst Rebate Form

Mail-in Investment Property Hst Rebate Form are based on the requirement that customers present proof of purchase to receive their money back. They're more involved but can offer huge savings.

Instant Investment Property Hst Rebate Form

Instant Investment Property Hst Rebate Form will be applied at point of sale and reduce the price instantly. Customers don't have to wait for their savings in this manner.

How Investment Property Hst Rebate Form Work

How To Fill Out Hst Rebate Form By State Printable Rebate Form

How To Fill Out Hst Rebate Form By State Printable Rebate Form

Web You may be eligible for up to 30 000 in HST rebates Call to learn more Experienced tax consultants helping new home buyers in Ontario receive their maximum new home HST

The Investment Property Hst Rebate Form Process

The process typically involves few simple steps:

-

Buy the product: At first you buy the product exactly as you would normally.

-

Complete your Investment Property Hst Rebate Form form: You'll need to provide some information including your name, address and information about the purchase in order to submit your Investment Property Hst Rebate Form.

-

To submit the Investment Property Hst Rebate Form It is dependent on the nature of Investment Property Hst Rebate Form you may have to either mail in a request form or submit it online.

-

Wait for the company's approval: They will examine your application to ensure it meets the terms and conditions of the Investment Property Hst Rebate Form.

-

You will receive your Investment Property Hst Rebate Form When it's approved you'll be able to receive your reimbursement, using a check or prepaid card, or other option as per the terms of the offer.

Pros and Cons of Investment Property Hst Rebate Form

Advantages

-

Cost Savings Investment Property Hst Rebate Form can substantially reduce the cost for an item.

-

Promotional Deals: They encourage customers to explore new products or brands.

-

Improve Sales Investment Property Hst Rebate Form are a great way to boost companies' sales and market share.

Disadvantages

-

Complexity In particular, mail-in Investment Property Hst Rebate Form particularly the case of HTML0, can be a hassle and time-consuming.

-

Deadlines for Expiration Many Investment Property Hst Rebate Form are subject to very strict deadlines for filing.

-

Risque of Non-Payment Certain customers could not be able to receive their Investment Property Hst Rebate Form if they don't observe the rules exactly.

Download Investment Property Hst Rebate Form

Download Investment Property Hst Rebate Form

FAQs

1. Are Investment Property Hst Rebate Form equivalent to discounts? No, Investment Property Hst Rebate Form involve some form of refund following the purchase, while discounts reduce costs at moment of sale.

2. Can I get multiple Investment Property Hst Rebate Form for the same product It's contingent upon the terms and conditions of Investment Property Hst Rebate Form offered and product's qualification. Certain businesses may allow this, whereas others will not.

3. How long will it take to get an Investment Property Hst Rebate Form What is the timeframe? is different, but it could take anywhere from a few weeks to a few months before you receive your Investment Property Hst Rebate Form.

4. Do I have to pay tax upon Investment Property Hst Rebate Form the amount? most instances, Investment Property Hst Rebate Form amounts are not considered to be taxable income.

5. Do I have confidence in Investment Property Hst Rebate Form offers from lesser-known brands You must research to ensure that the name that is offering the Investment Property Hst Rebate Form is reputable prior making a purchase.

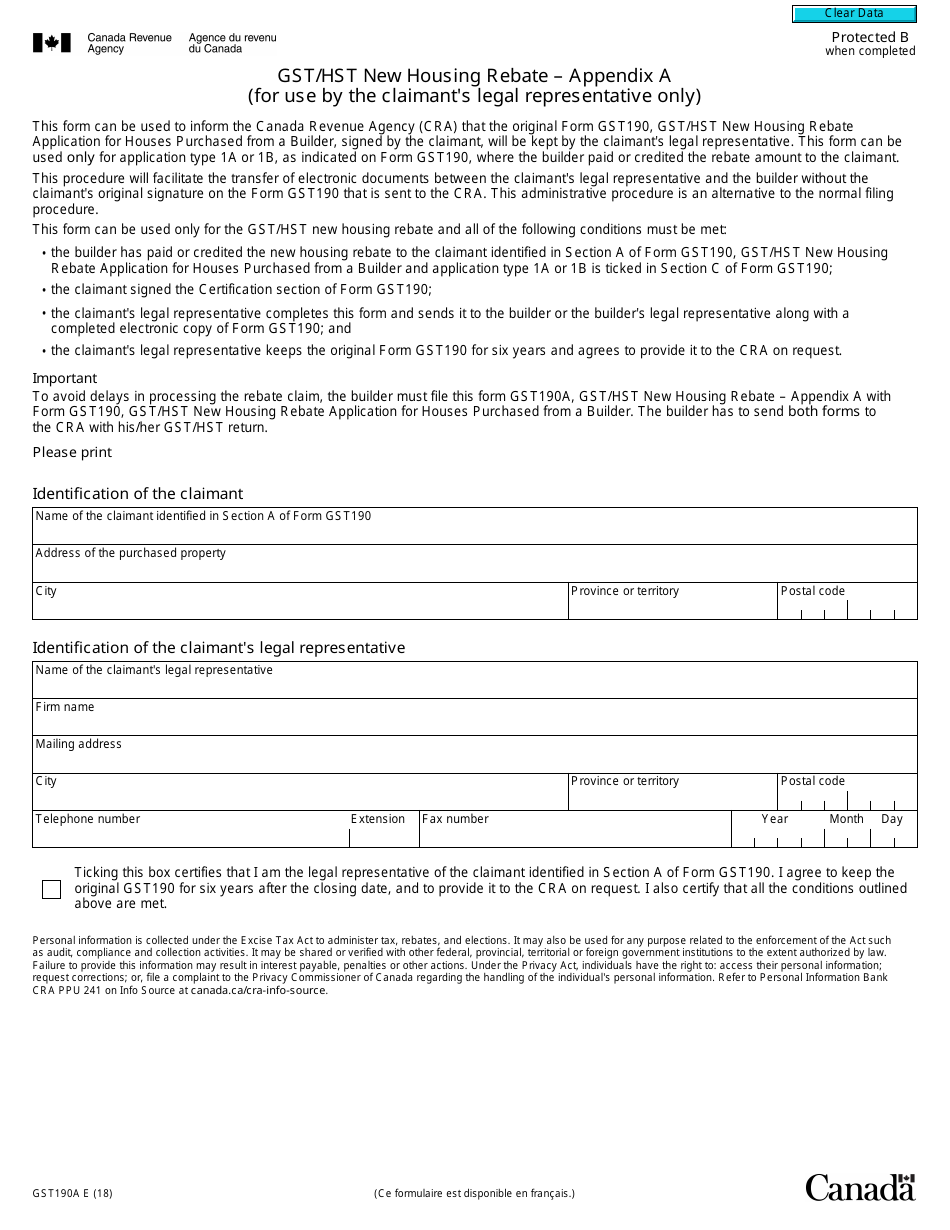

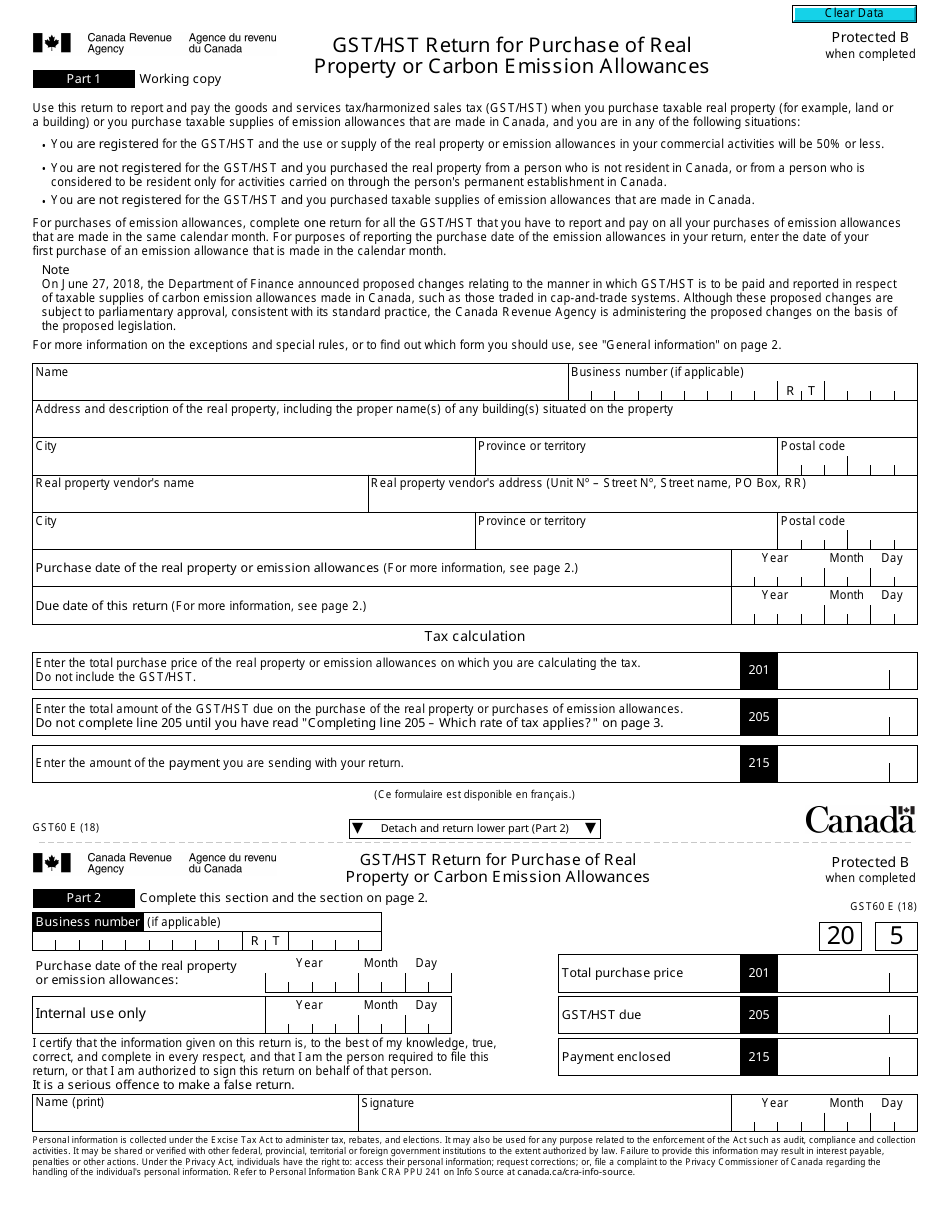

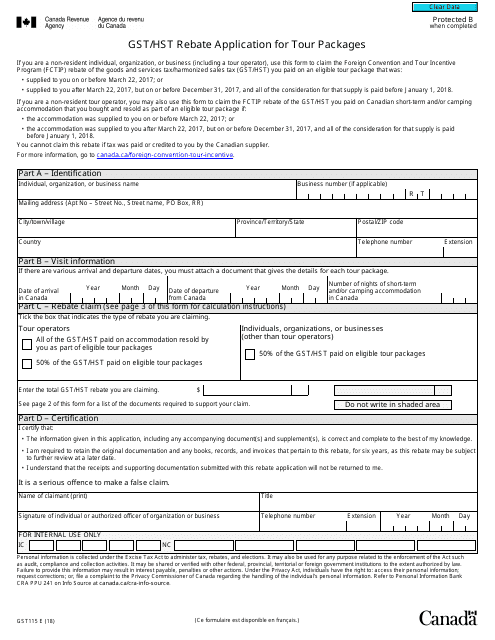

Form GST190A Schedule A Download Fillable PDF Or Fill Online Gst Hst

Gst Fillable Form Printable Forms Free Online

Check more sample of Investment Property Hst Rebate Form below

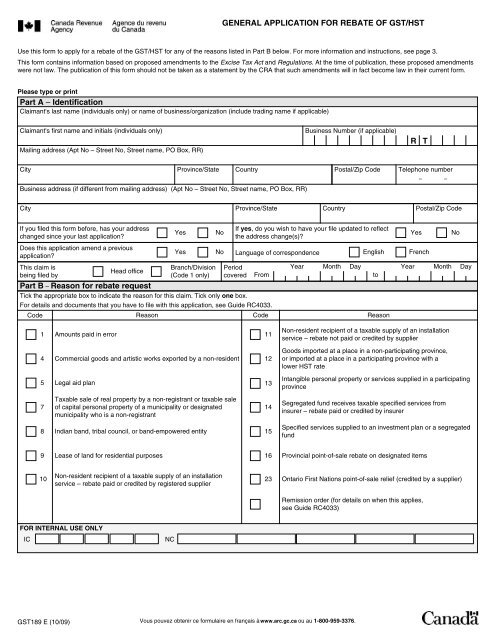

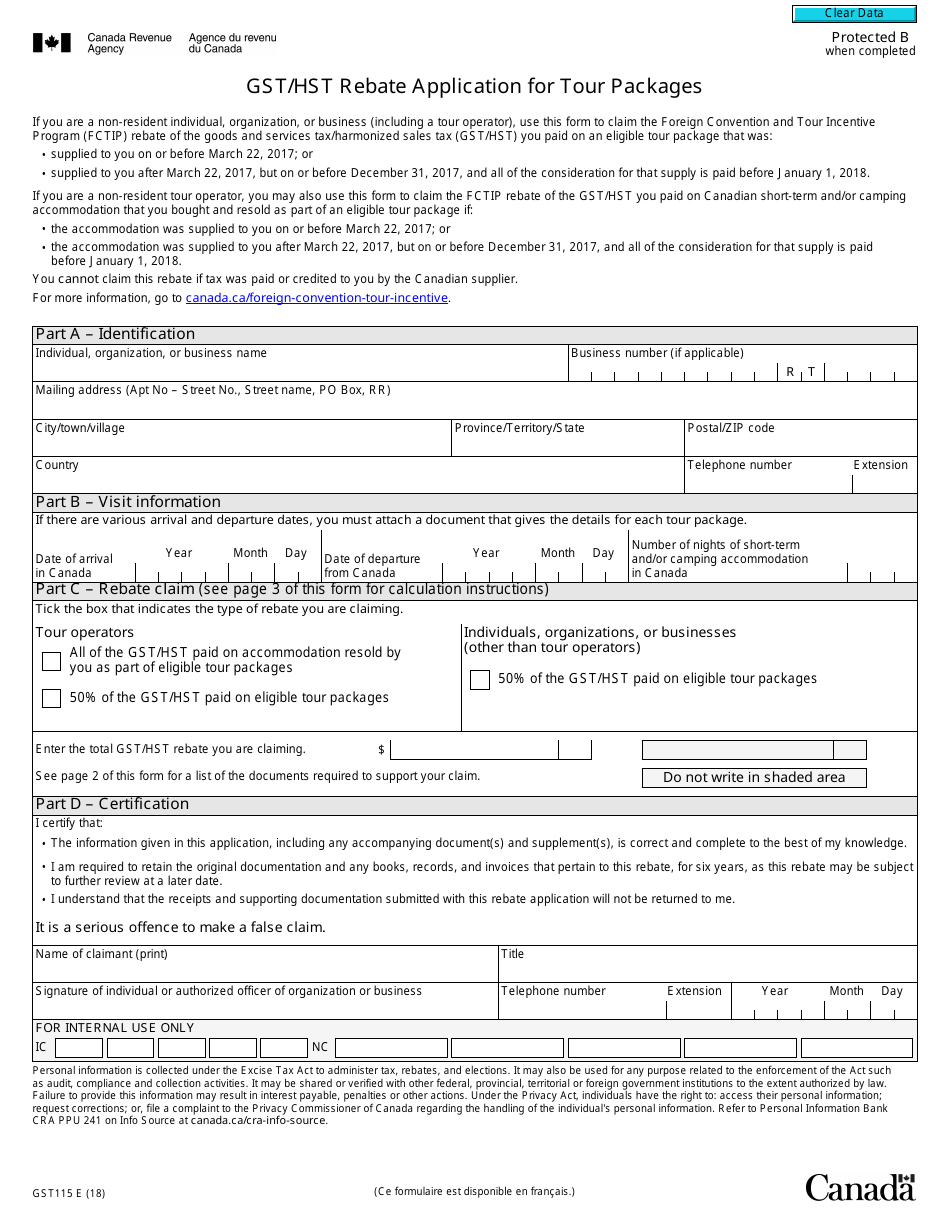

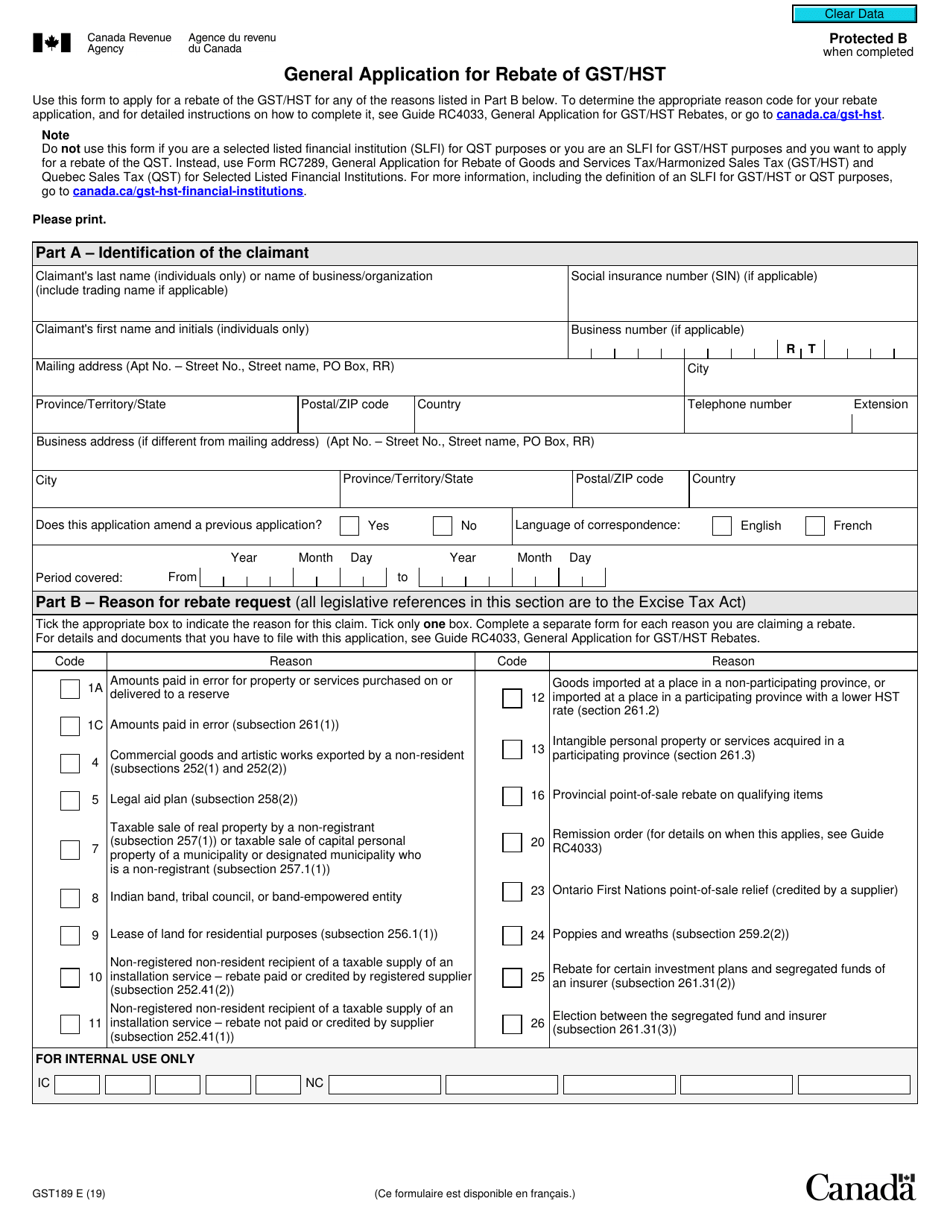

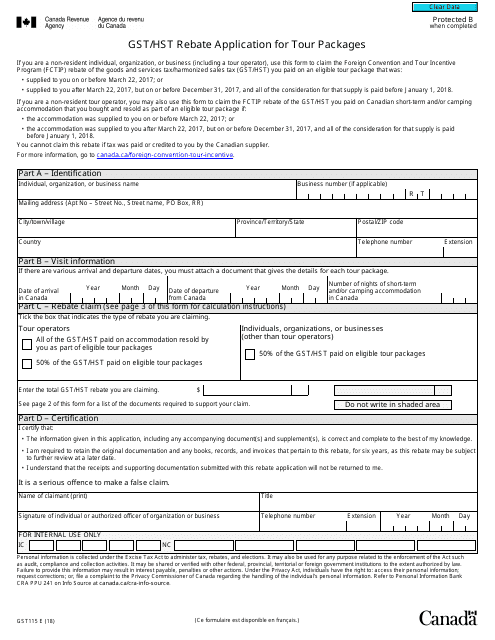

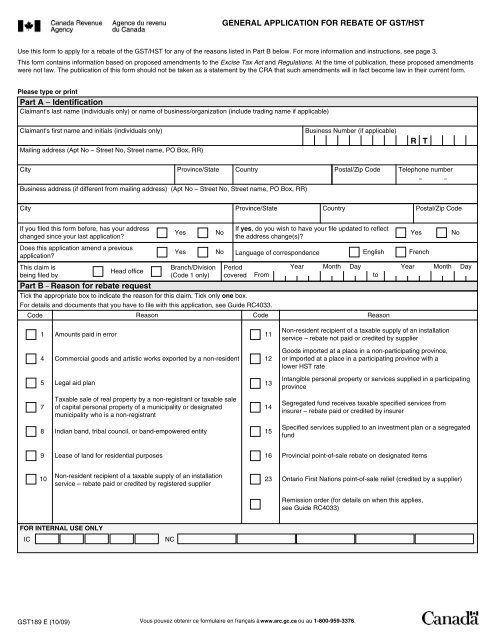

Form GST189 Download Fillable PDF Or Fill Online General Application

Hst Fillable Form Printable Forms Free Online

Gst Fillable Form Printable Forms Free Online

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

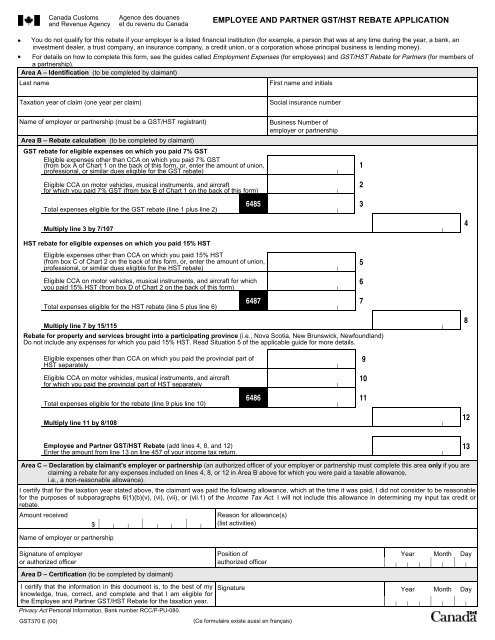

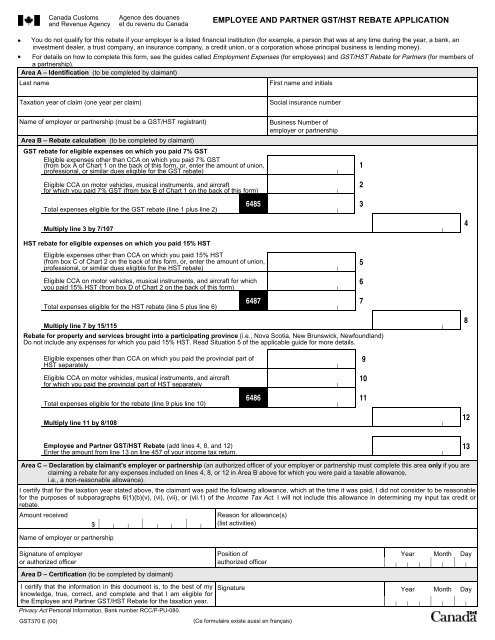

GST370 Employee And Partner GST HST Rebate Application

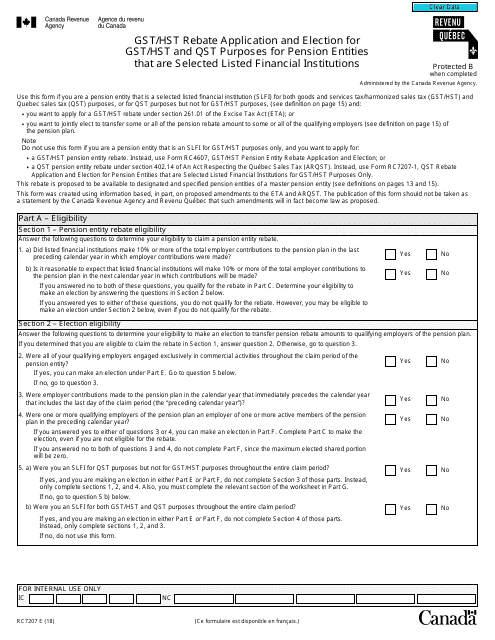

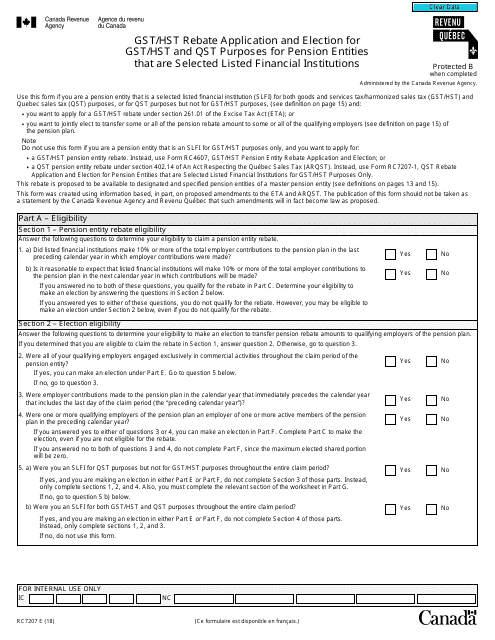

Form R7207 Download Fillable PDF Or Fill Online Gst Hst Rebate

https://capexcpa.com/blogs/2020/9/1/hst-on-i…

Web 2 sept 2020 nbsp 0183 32 The good news is that CRA is offering an HST new housing rebate for investment property The bad news is that the HST must still

https://www.canada.ca/.../gst-hst-rebates/application.html

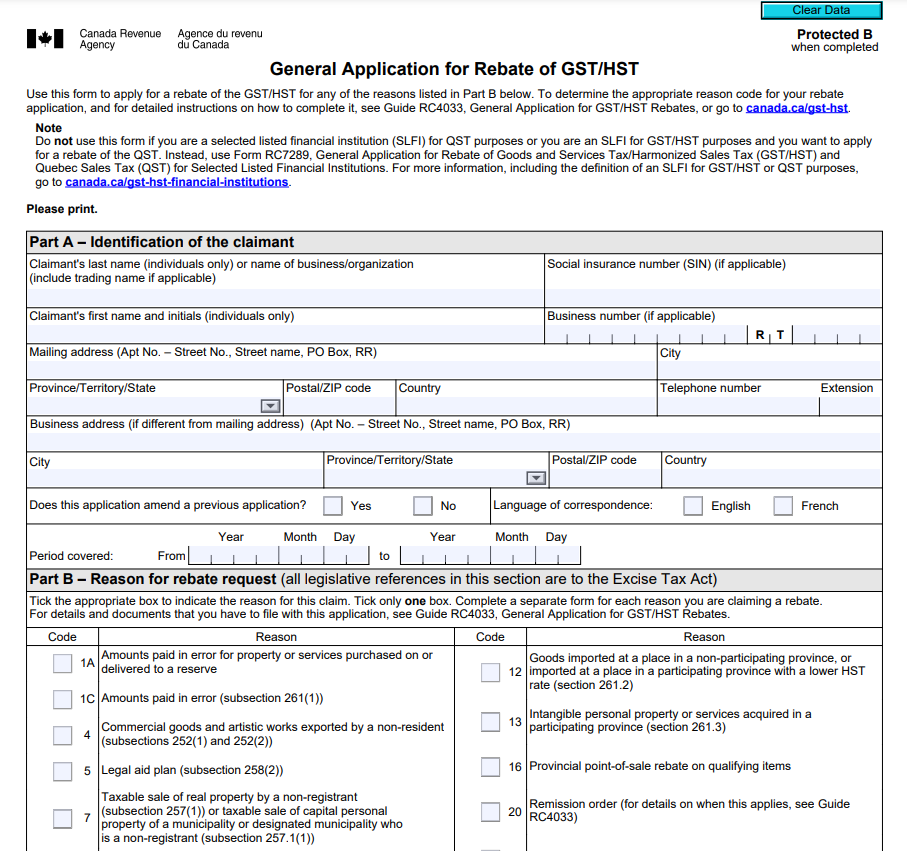

Web 1 oct 2017 nbsp 0183 32 How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per rebate

Web 2 sept 2020 nbsp 0183 32 The good news is that CRA is offering an HST new housing rebate for investment property The bad news is that the HST must still

Web 1 oct 2017 nbsp 0183 32 How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per rebate

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

Hst Fillable Form Printable Forms Free Online

GST370 Employee And Partner GST HST Rebate Application

Form R7207 Download Fillable PDF Or Fill Online Gst Hst Rebate

Hst New Housing Rebate Ontario Forms Printable Rebate Form

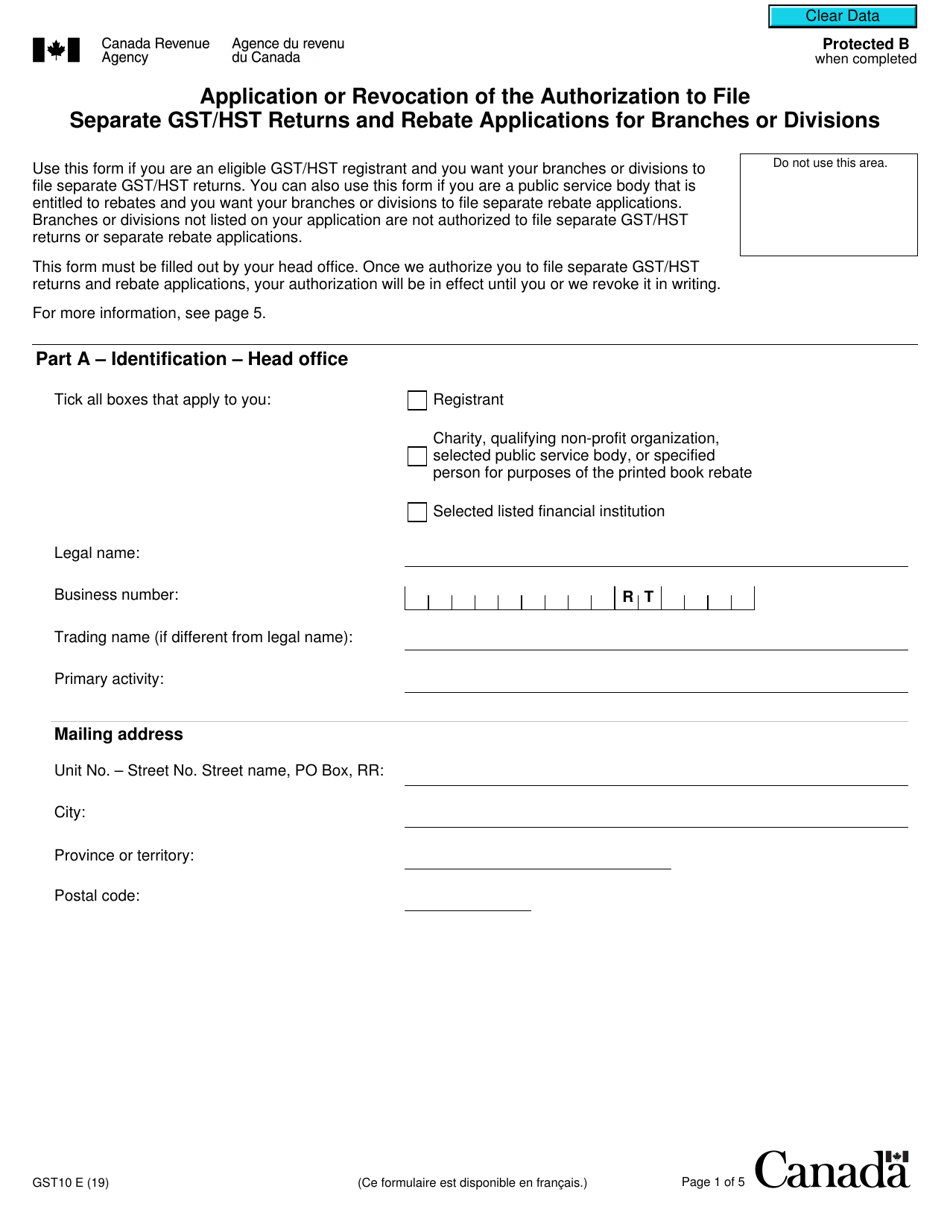

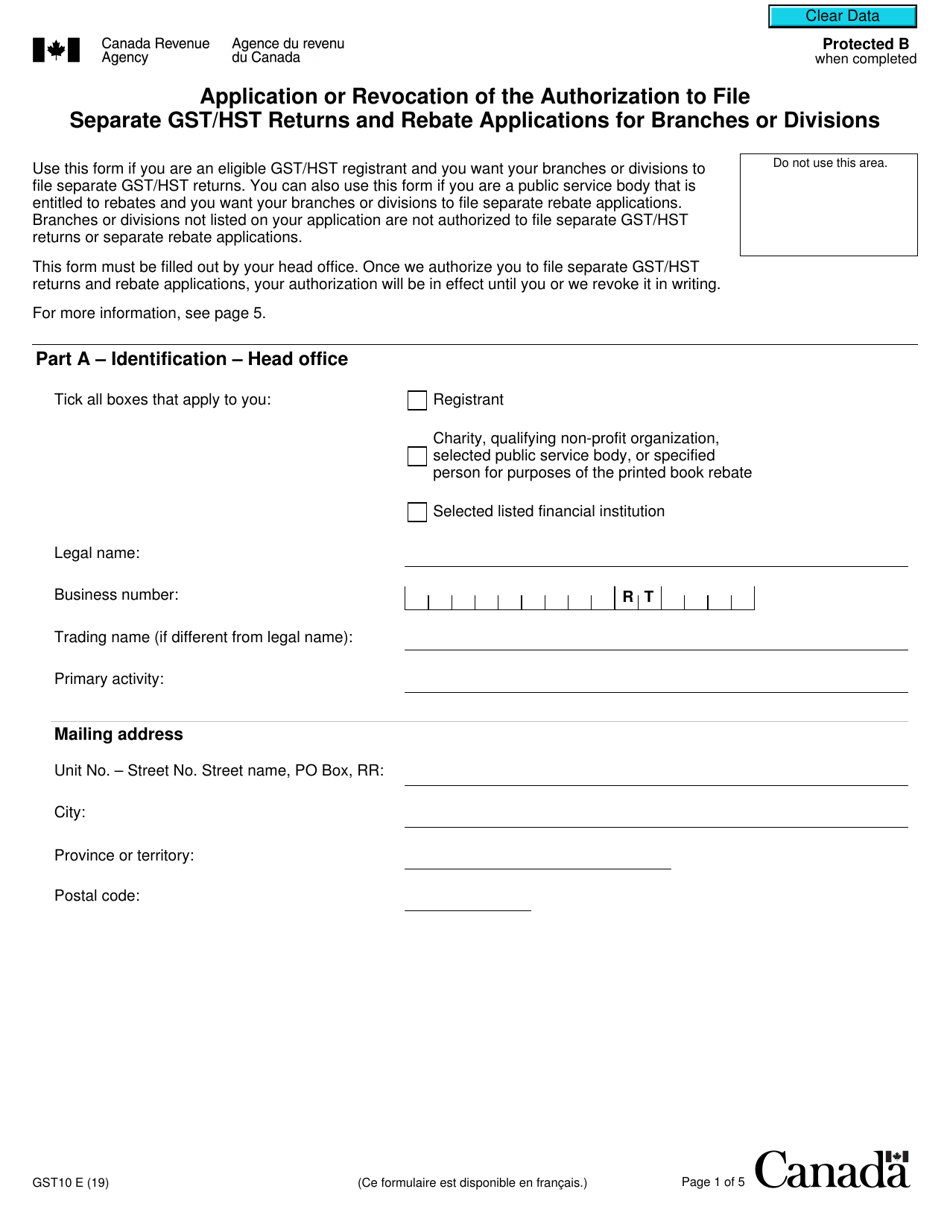

Form GST10 Download Fillable PDF Or Fill Online Application Or

Form GST10 Download Fillable PDF Or Fill Online Application Or

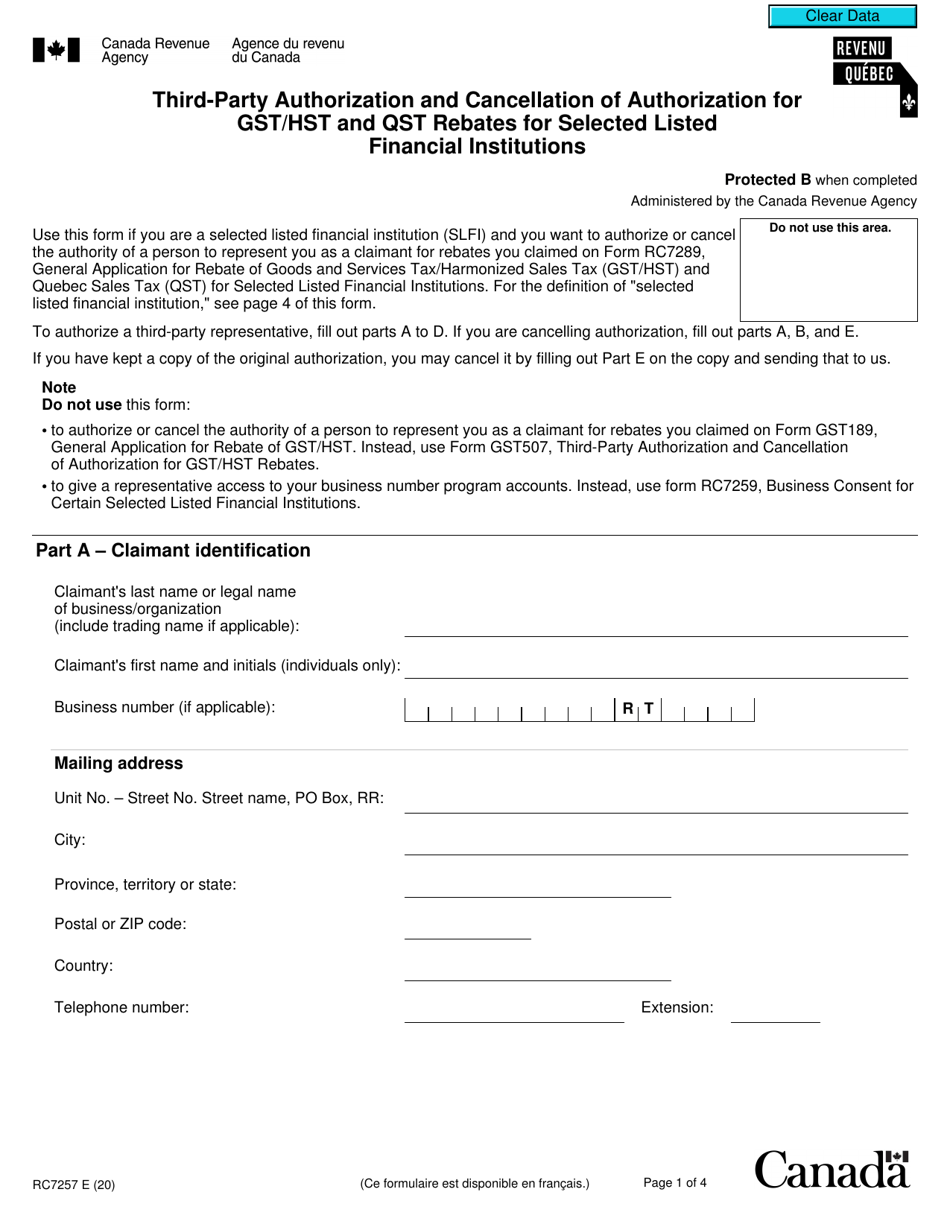

Form RC7257 Download Fillable PDF Or Fill Online Third Party