In today's consumer-driven world everyone enjoys a good bargain. One way to earn substantial savings on your purchases is by using Fuel Tax Credit Rebate Forms. Fuel Tax Credit Rebate Forms are an effective marketing tactic that retailers and manufacturers use to offer consumers a partial cash back on their purchases once they have placed them. In this post, we'll look into the world of Fuel Tax Credit Rebate Forms, looking at the nature of them what they are, how they function, and how you can maximise your savings using these low-cost incentives.

Get Latest Fuel Tax Credit Rebate Form Below

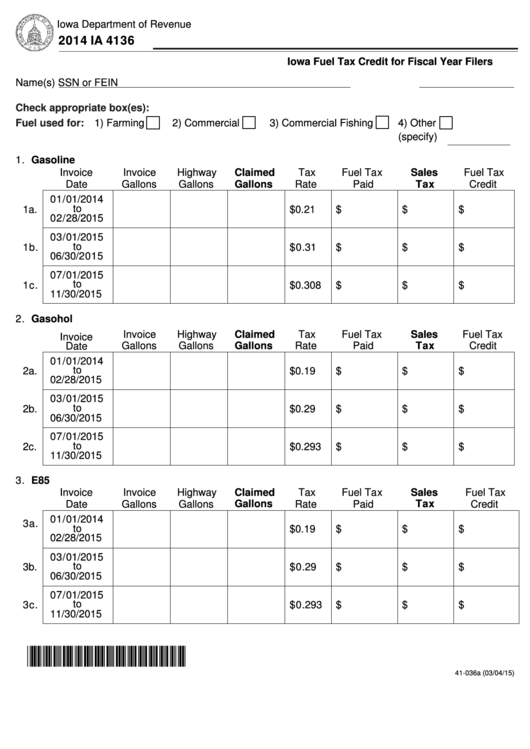

Fuel Tax Credit Rebate Form

Fuel Tax Credit Rebate Form -

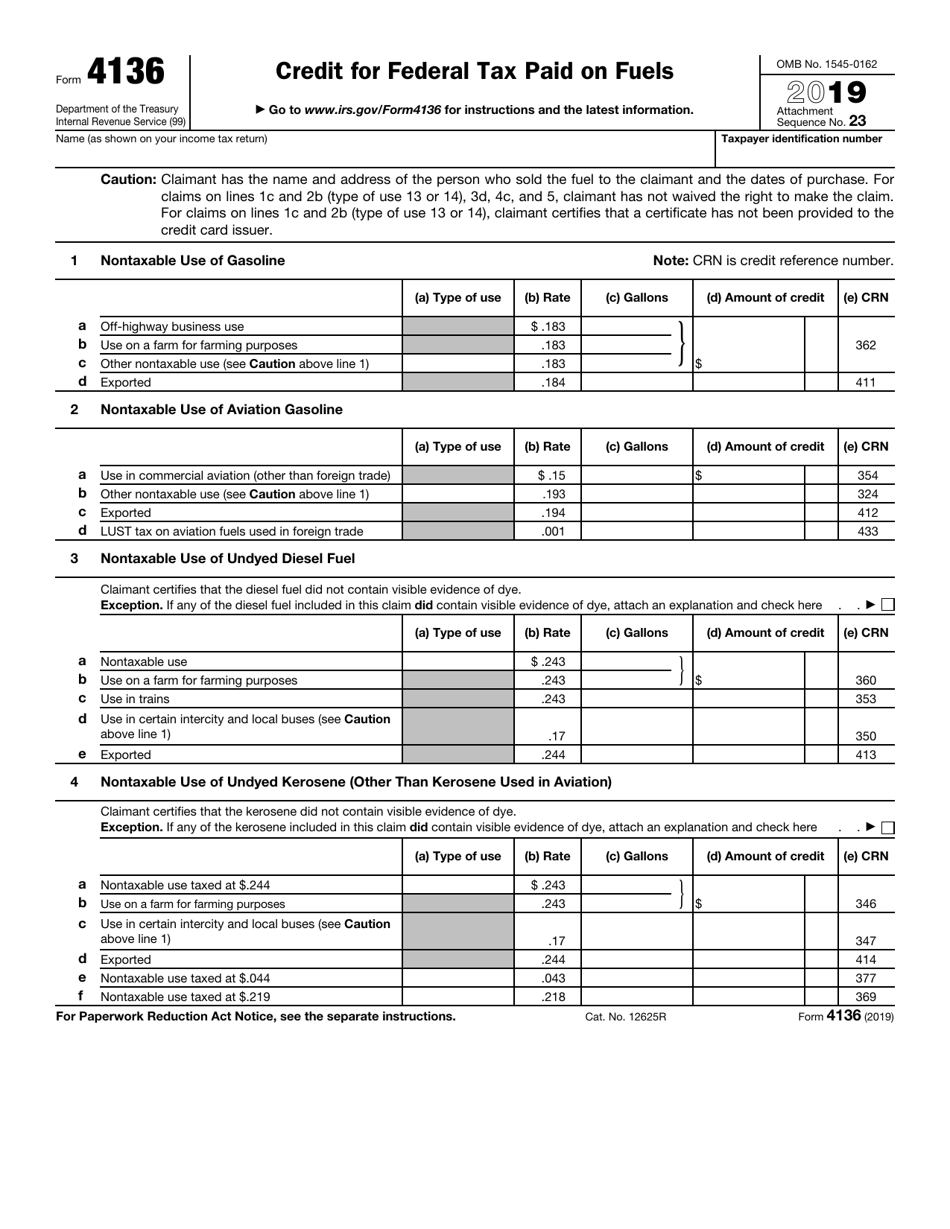

Web 2 juin 2023 nbsp 0183 32 Certain uses of fuels are untaxed however and fuel users can get a credit for the taxes they ve paid by filing Form 4136 The one most familiar to taxpayers is probably the federal gas tax 18 4

Web How to claim the credit Any alternative fuel credit must first be claimed on Form 720 Schedule C to reduce your section 4041 taxable fuel liability for alternative fuel and

A Fuel Tax Credit Rebate Form as it is understood in its simplest definition, is a refund to a purchaser after they've purchased a good or service. It's an effective way employed by companies to draw customers, boost sales, as well as promote particular products.

Types of Fuel Tax Credit Rebate Form

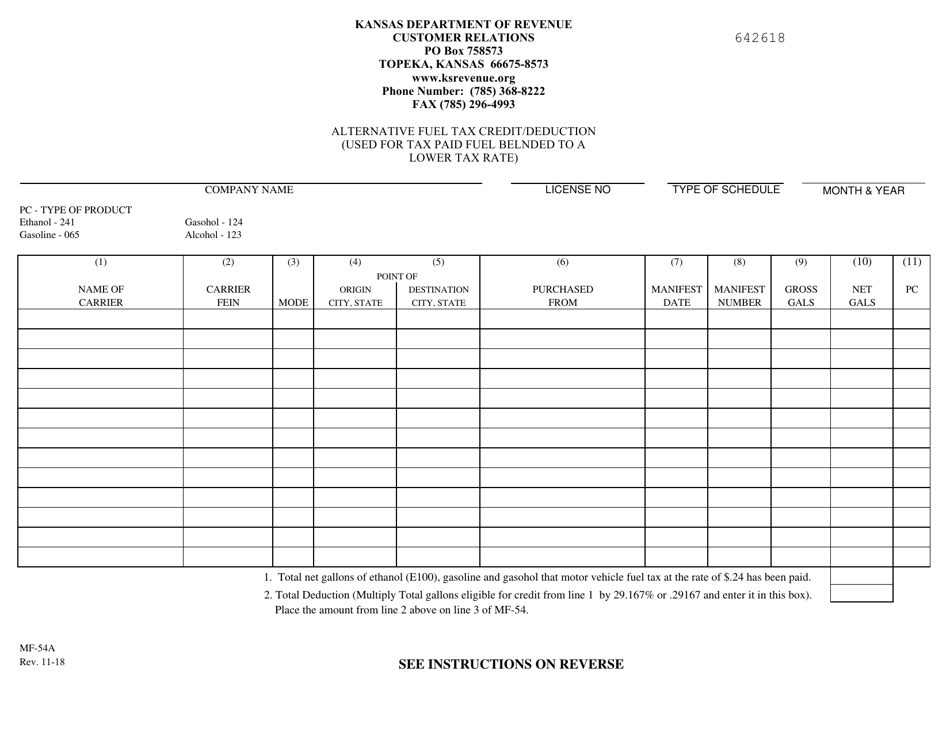

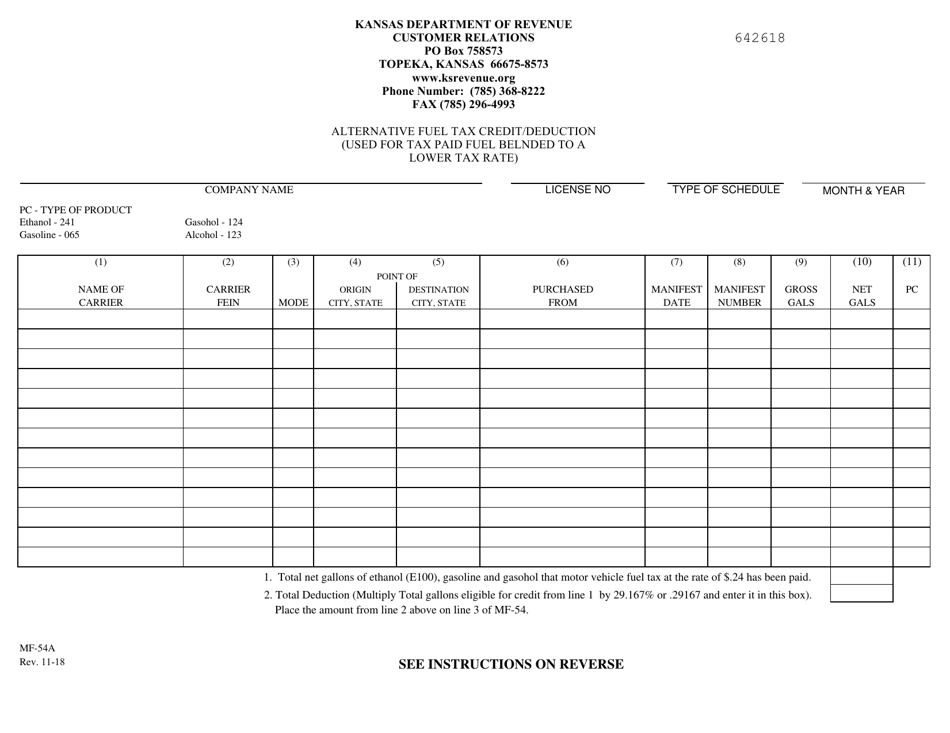

Form MF 54A Download Fillable PDF Or Fill Online Alternative Fuel Tax

Form MF 54A Download Fillable PDF Or Fill Online Alternative Fuel Tax

Web Information about Form 4136 Credit For Federal Tax Paid On Fuels including recent updates related forms and instructions on how to file Use Form 4136 to claim a credit

Web 28 sept 2021 nbsp 0183 32 Fuel Tax Credit A federal subsidy that allows businesses to reduce their taxable income dollar for dollar based on specific types of fuel costs There are several types of fuel credits For

Cash Fuel Tax Credit Rebate Form

Cash Fuel Tax Credit Rebate Form are the most basic type of Fuel Tax Credit Rebate Form. Customers receive a specific amount of money back after buying a product. This is often for more expensive items such electronics or appliances.

Mail-In Fuel Tax Credit Rebate Form

Mail-in Fuel Tax Credit Rebate Form require customers to present proof of purchase to receive their refund. They're a little more involved, but can result in huge savings.

Instant Fuel Tax Credit Rebate Form

Instant Fuel Tax Credit Rebate Form are made at the point of sale. They reduce the price instantly. Customers don't need to wait around for savings when they purchase this type of Fuel Tax Credit Rebate Form.

How Fuel Tax Credit Rebate Form Work

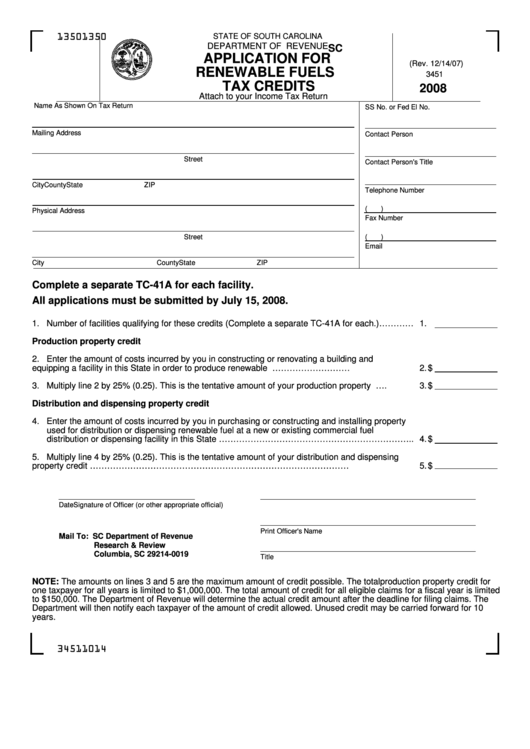

Form Sc Sch tc 41a Application For Renewable Fuels Tax Credits

Form Sc Sch tc 41a Application For Renewable Fuels Tax Credits

Web The calculator is quick and easy to use and will help you get your claim right If you claim under 10 000 in fuel tax credits in a year there are simpler ways to record and

The Fuel Tax Credit Rebate Form Process

The process generally involves a few steps:

-

Buy the product: Firstly make sure you purchase the product like you would normally.

-

Fill in your Fuel Tax Credit Rebate Form application: In order to claim your Fuel Tax Credit Rebate Form, you'll have provide certain information like your name, address along with the purchase details, to submit your Fuel Tax Credit Rebate Form.

-

To submit the Fuel Tax Credit Rebate Form In accordance with the kind of Fuel Tax Credit Rebate Form you may have to mail in a form or upload it online.

-

Wait for approval: The company will scrutinize your submission to make sure it is in line with the reimbursement's terms and condition.

-

Pay your Fuel Tax Credit Rebate Form: Once approved, you'll get your refund, either by check, prepaid card or another method as specified by the offer.

Pros and Cons of Fuel Tax Credit Rebate Form

Advantages

-

Cost savings Rewards can drastically cut the price you pay for a product.

-

Promotional Deals they encourage their customers to try new products or brands.

-

Enhance Sales The benefits of a Fuel Tax Credit Rebate Form can improve a company's sales and market share.

Disadvantages

-

Complexity: Mail-in Fuel Tax Credit Rebate Form, in particular difficult and long-winded.

-

The Expiration Dates Most Fuel Tax Credit Rebate Form come with specific deadlines for submission.

-

Risk of Not Being Paid: Some customers may lose their Fuel Tax Credit Rebate Form in the event that they don't follow the rules precisely.

Download Fuel Tax Credit Rebate Form

Download Fuel Tax Credit Rebate Form

FAQs

1. Are Fuel Tax Credit Rebate Form similar to discounts? Not at all, Fuel Tax Credit Rebate Form provide an amount of money that is refunded after the purchase, whereas discounts decrease the purchase price at the time of sale.

2. Can I make use of multiple Fuel Tax Credit Rebate Form for the same product It's contingent upon the conditions for the Fuel Tax Credit Rebate Form provides and the particular product's potential eligibility. Some companies may allow it, but some will not.

3. How long will it take to get the Fuel Tax Credit Rebate Form? The amount of time will vary, but it may take a couple of weeks or a several months to receive a Fuel Tax Credit Rebate Form.

4. Do I have to pay taxes upon Fuel Tax Credit Rebate Form montants? most situations, Fuel Tax Credit Rebate Form amounts are not considered taxable income.

5. Should I be able to trust Fuel Tax Credit Rebate Form deals from lesser-known brands Do I need to conduct a thorough research to ensure that the name giving the Fuel Tax Credit Rebate Form is reputable prior making a purchase.

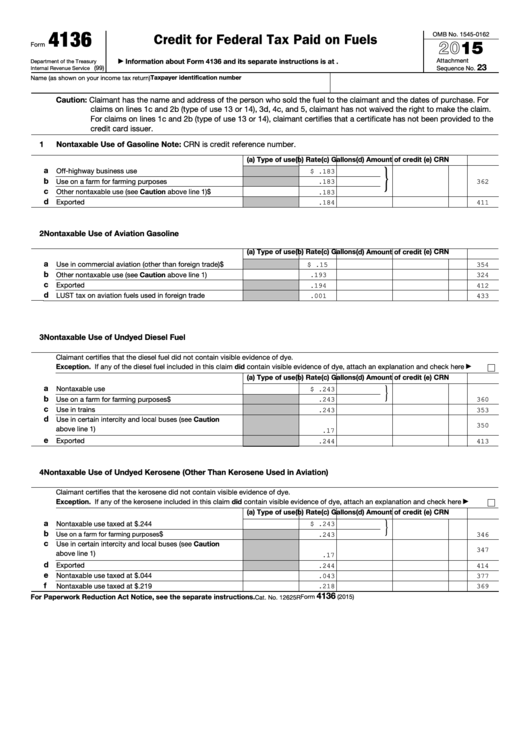

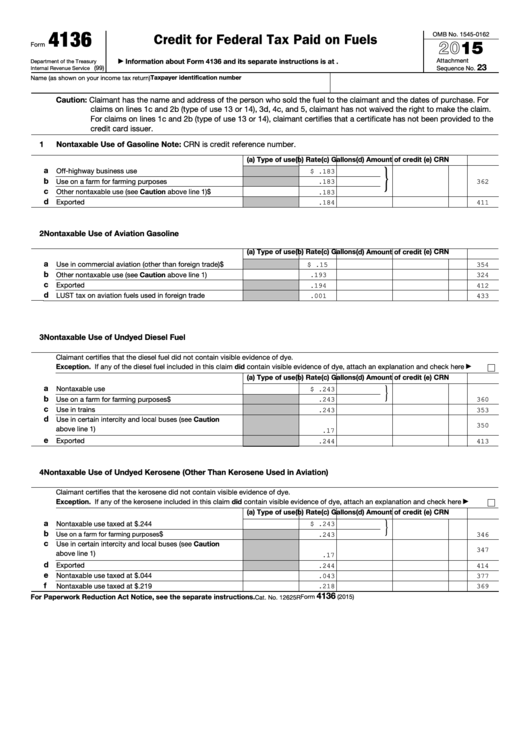

Form 4136 Credit For Federal Tax Paid On Fuels 2015 Free Download

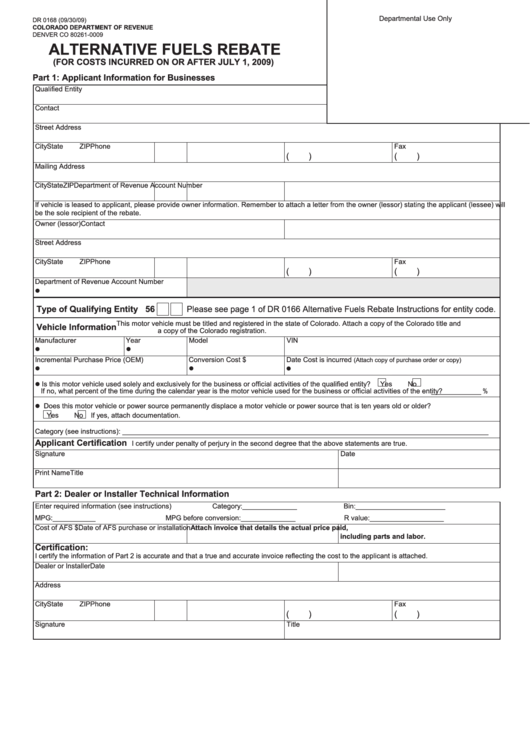

Form Dr 0168 Alternative Fuels Rebate 2009 Printable Pdf Download

Check more sample of Fuel Tax Credit Rebate Form below

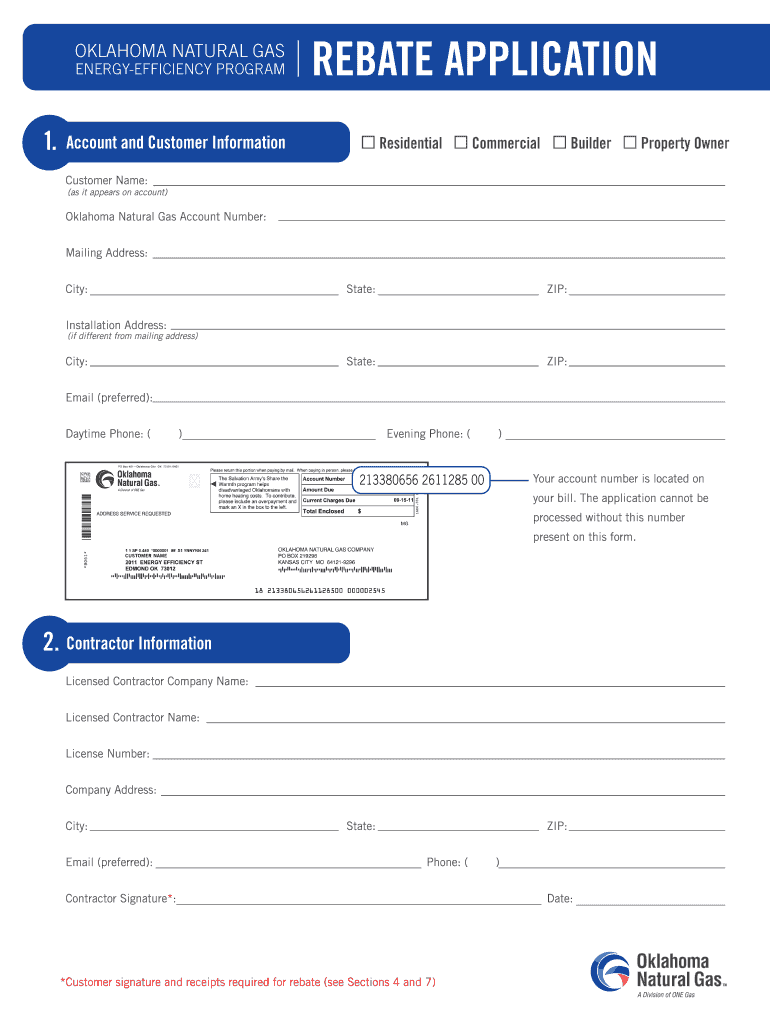

Ong Rebates Form Fill Out And Sign Printable PDF Template SignNow

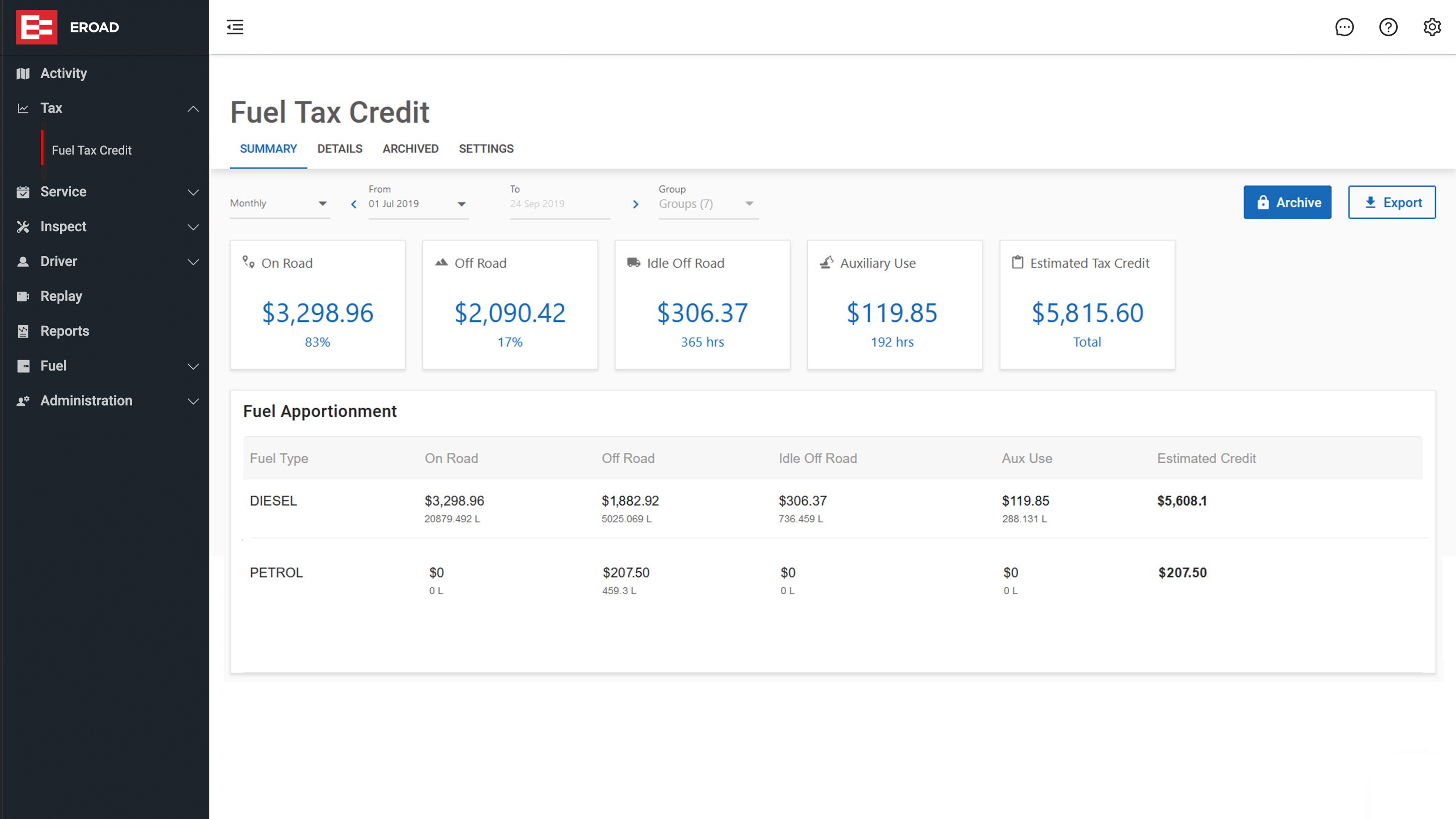

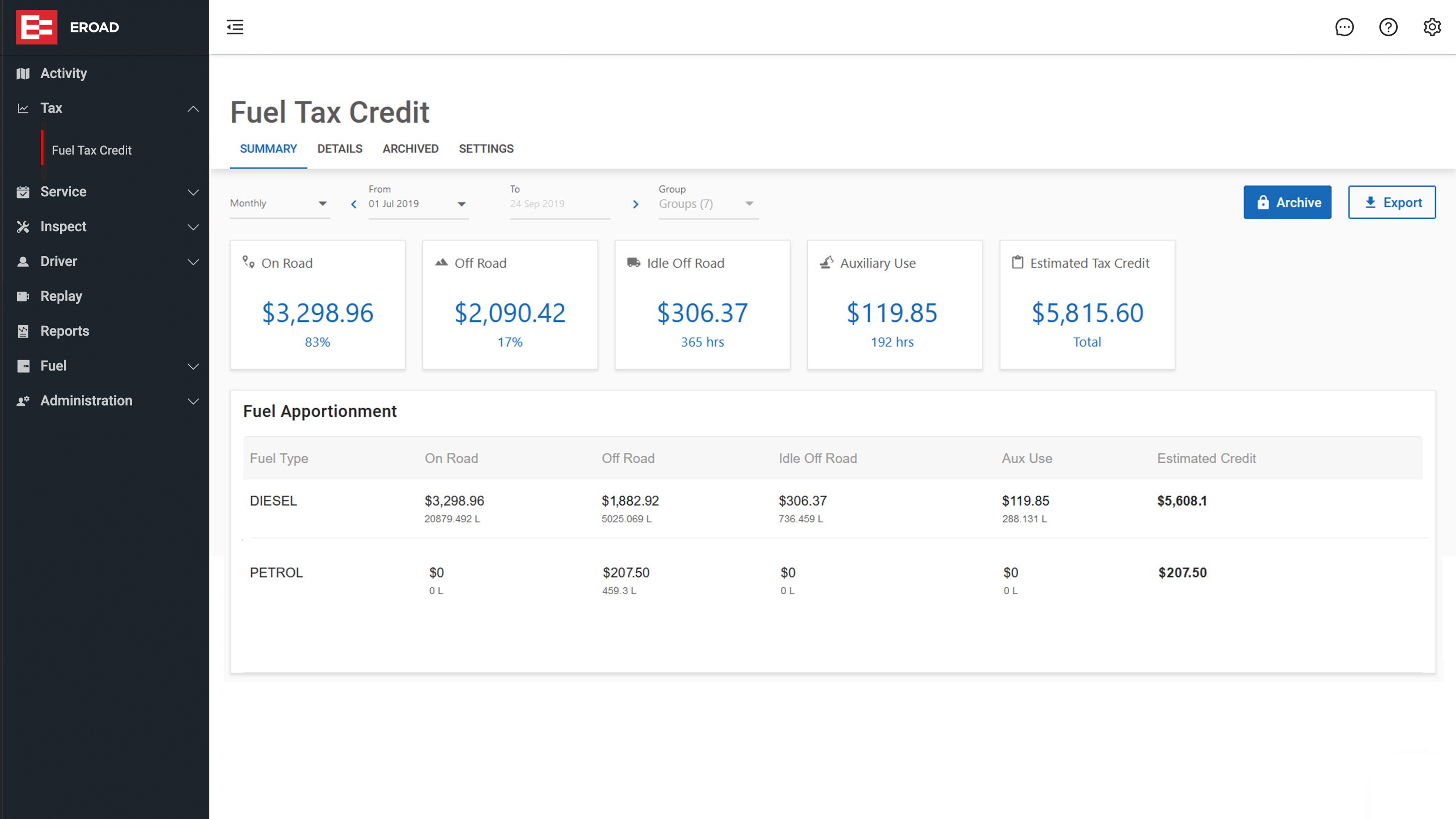

Automate Fuel Tax Credits And Unlock Higher FTC Rebates EROAD AU

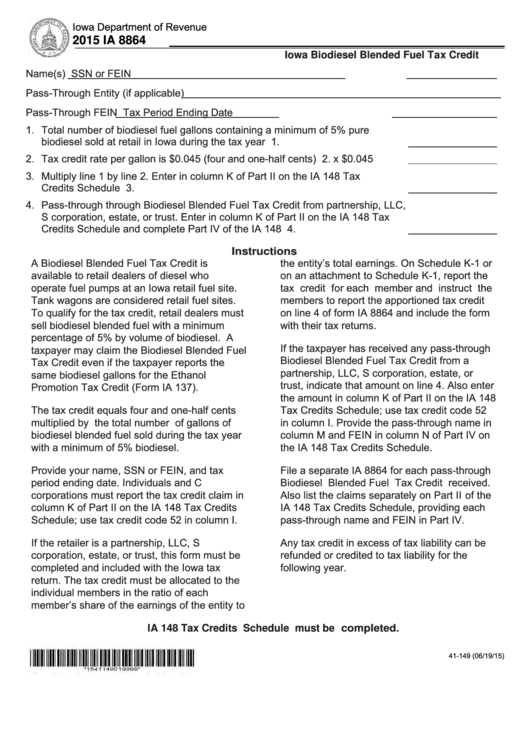

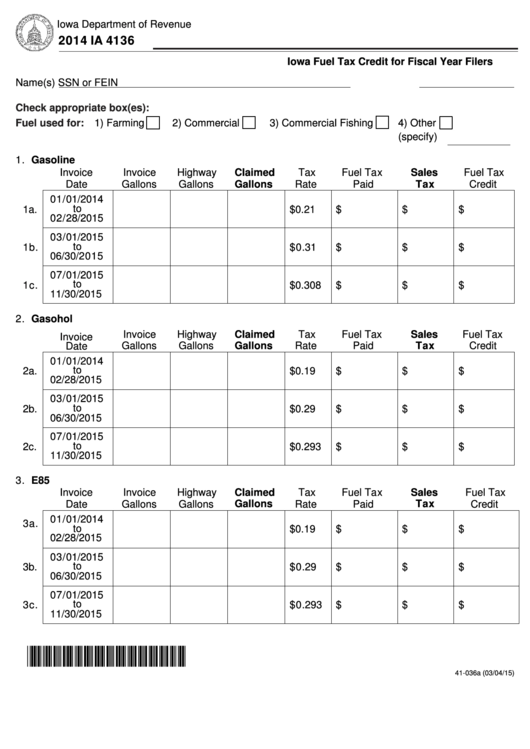

Fillable Form Ia 8864 Iowa Biodiesel Blended Fuel Tax Credit 2015

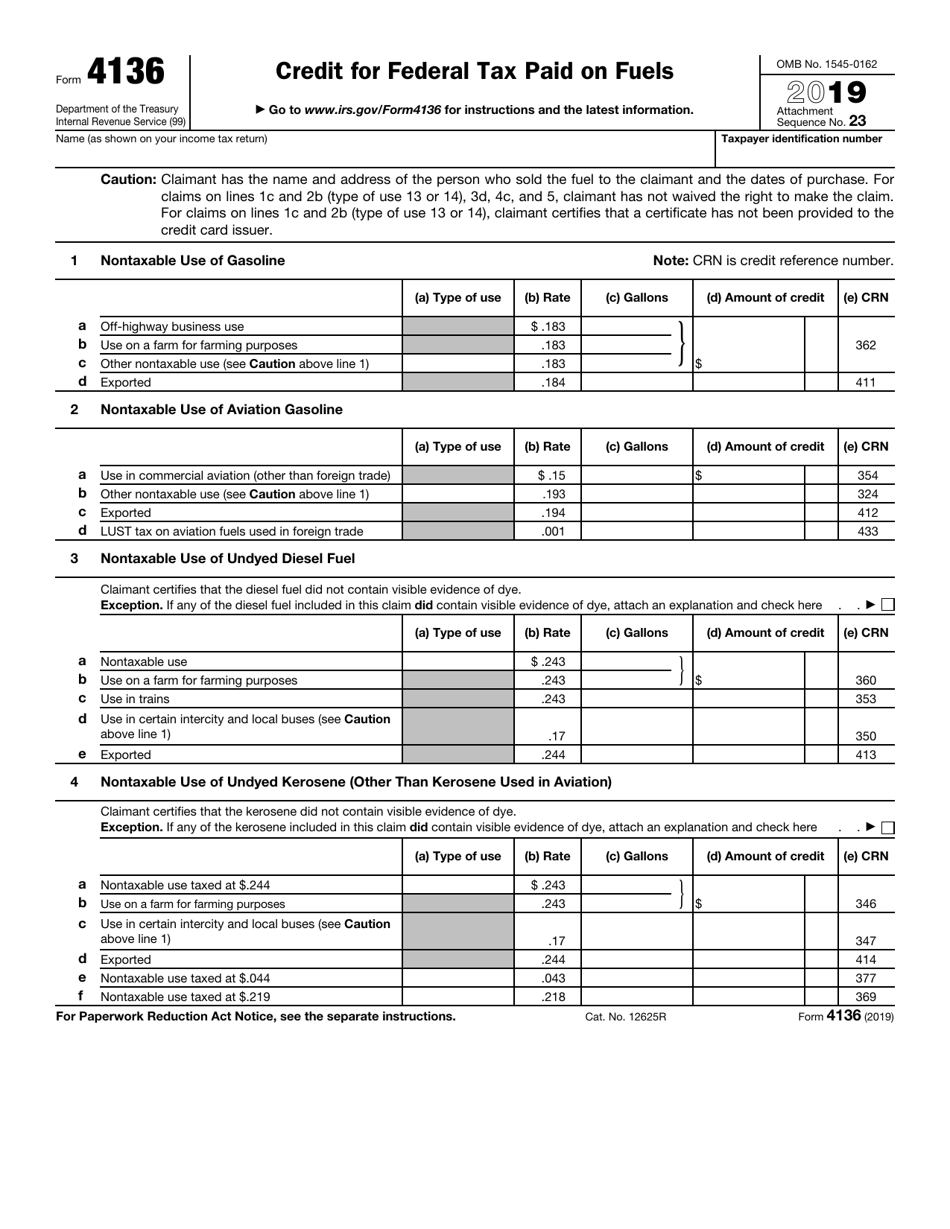

Fillable Form 4136 Printable Forms Free Online

Fuel Tax Credits Calculation Worksheet

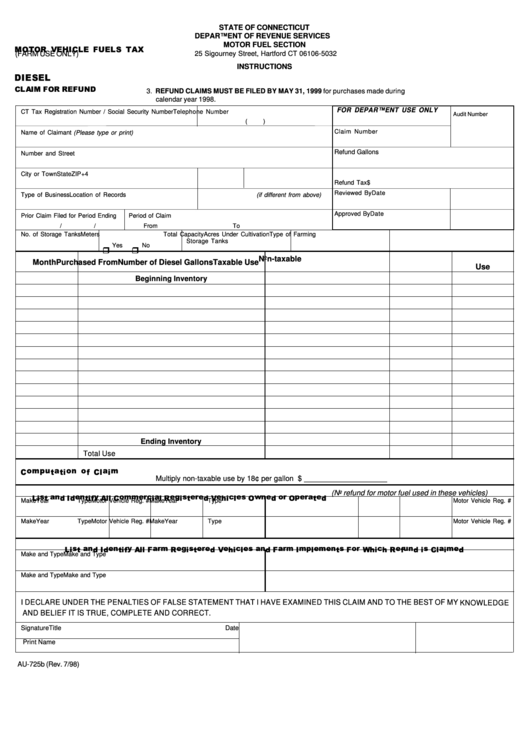

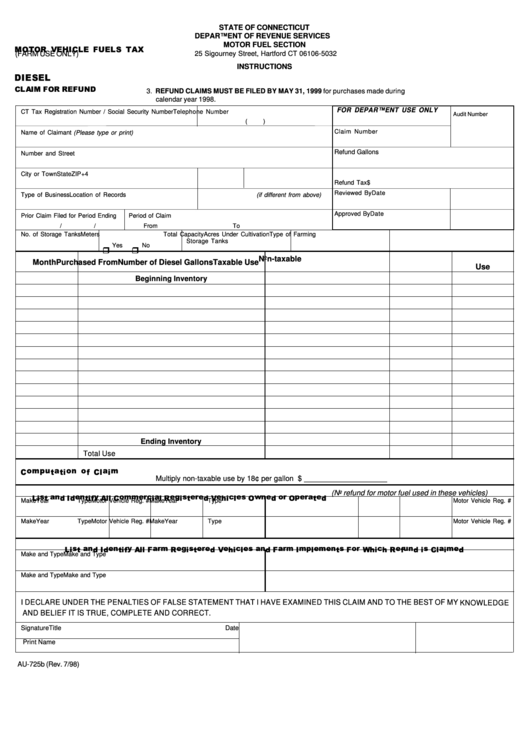

Fillable Form Au 725b Motor Vehicle Fuels Tax Farm Use Only

https://www.irs.gov/instructions/i4136

Web How to claim the credit Any alternative fuel credit must first be claimed on Form 720 Schedule C to reduce your section 4041 taxable fuel liability for alternative fuel and

https://www.irs.gov/pub/irs-pdf/i4136.pdf

Web Form 8849 Claim for Refund of Excise Taxes to claim a periodic refund or Form 720 Quarterly Federal Excise Tax Return to claim a credit against your excise tax liability

Web How to claim the credit Any alternative fuel credit must first be claimed on Form 720 Schedule C to reduce your section 4041 taxable fuel liability for alternative fuel and

Web Form 8849 Claim for Refund of Excise Taxes to claim a periodic refund or Form 720 Quarterly Federal Excise Tax Return to claim a credit against your excise tax liability

Fillable Form 4136 Printable Forms Free Online

Automate Fuel Tax Credits And Unlock Higher FTC Rebates EROAD AU

Fuel Tax Credits Calculation Worksheet

Fillable Form Au 725b Motor Vehicle Fuels Tax Farm Use Only

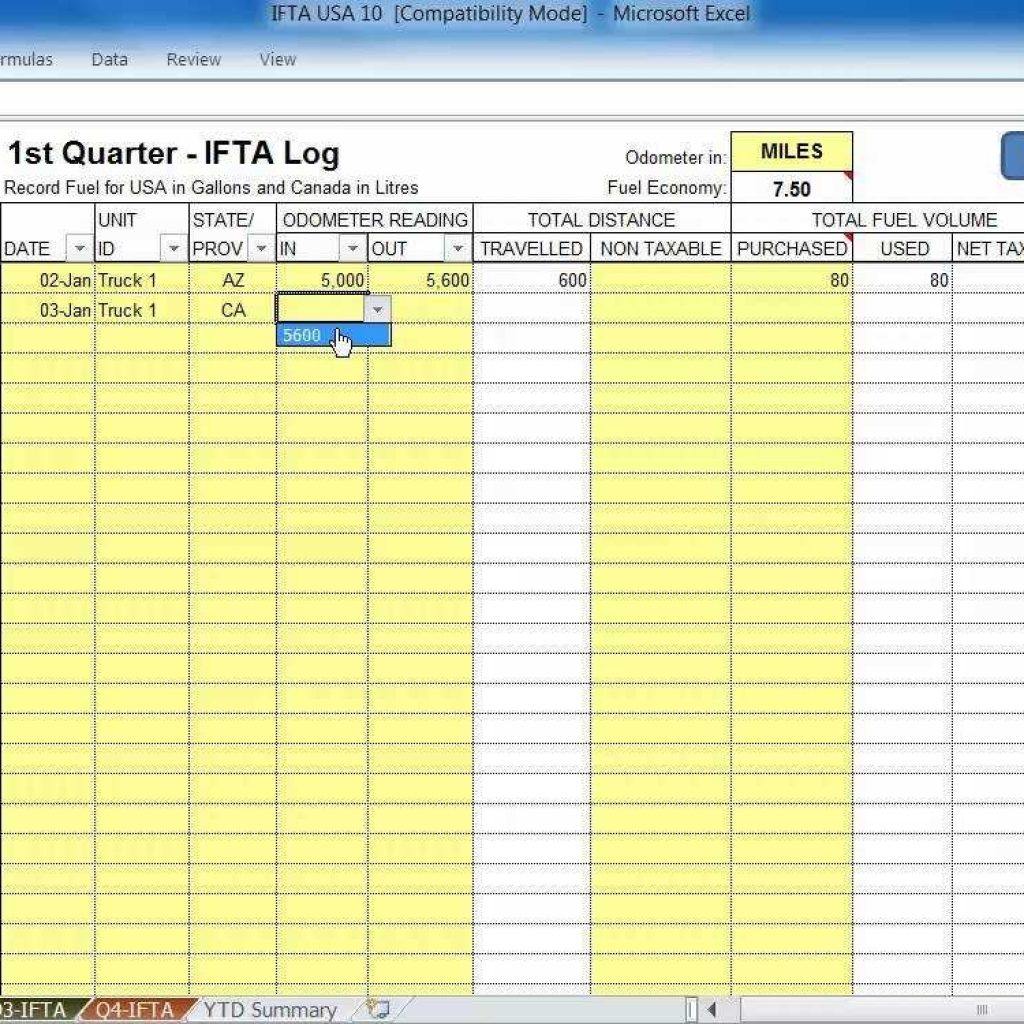

Ifta Fuel Tax Spreadsheet Spreadsheet Downloa Ifta Fuel Tax Spreadsheet

Here s How To Get A Refund For Missouri s Gas Tax Increase Howell

Here s How To Get A Refund For Missouri s Gas Tax Increase Howell

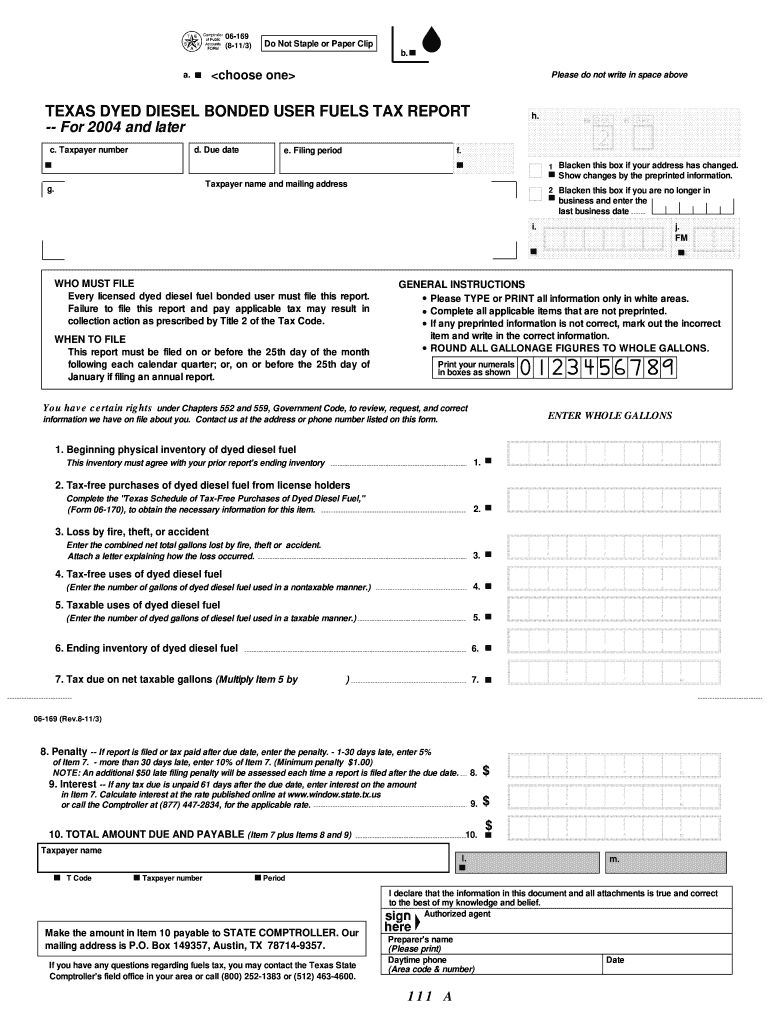

Texas Dyed Diesel Bonded User Fuels Tax Report Fill Out And Sign