In our modern, consumer-driven society everybody loves a good bargain. One method of gaining significant savings in your purchase is through Medical Tax Rebate Forms. Medical Tax Rebate Forms are a strategy for marketing used by manufacturers and retailers for offering customers a percentage payment on their purchases, after they've completed them. In this article, we will explore the world of Medical Tax Rebate Forms and explore what they are, how they work, and ways you can increase your savings through these efficient incentives.

Get Latest Medical Tax Rebate Form Below

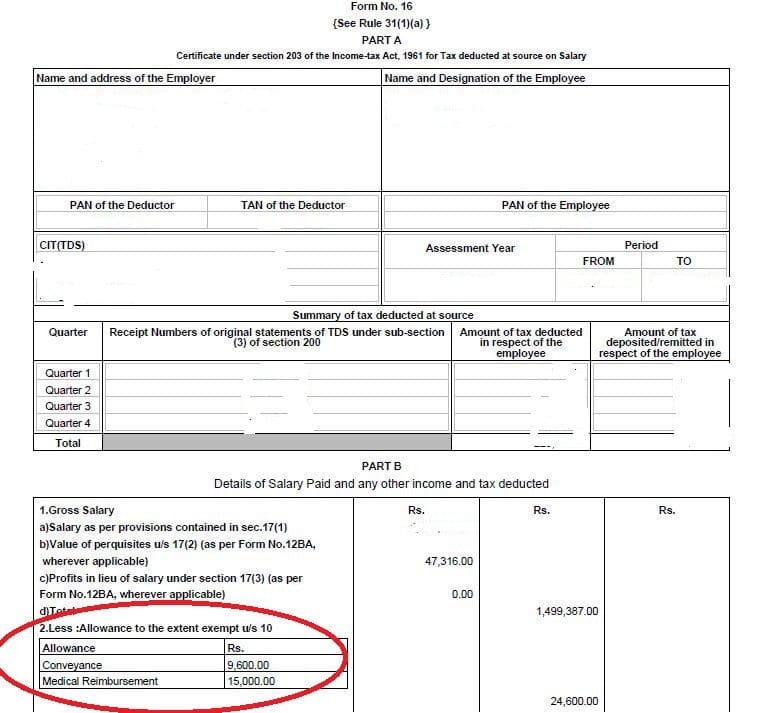

Medical Tax Rebate Form

Medical Tax Rebate Form -

Web L aide m 233 dicale de l 201 tat AME s inscrit dans le cadre de la lutte contre les exclusions Cette protection sant 233 s adresse aux ressortissants 233 trangers en situation irr 233 guli 232 re et

Web What s in the guides The most comprehensive speciality specific step by step guide to claiming a tax rebate for doctors written by experts What

A Medical Tax Rebate Form in its most basic form, is a partial reimbursement to a buyer when they purchase a product or service. It is a powerful tool employed by companies to attract customers, boost sales, and advertise specific products.

Types of Medical Tax Rebate Form

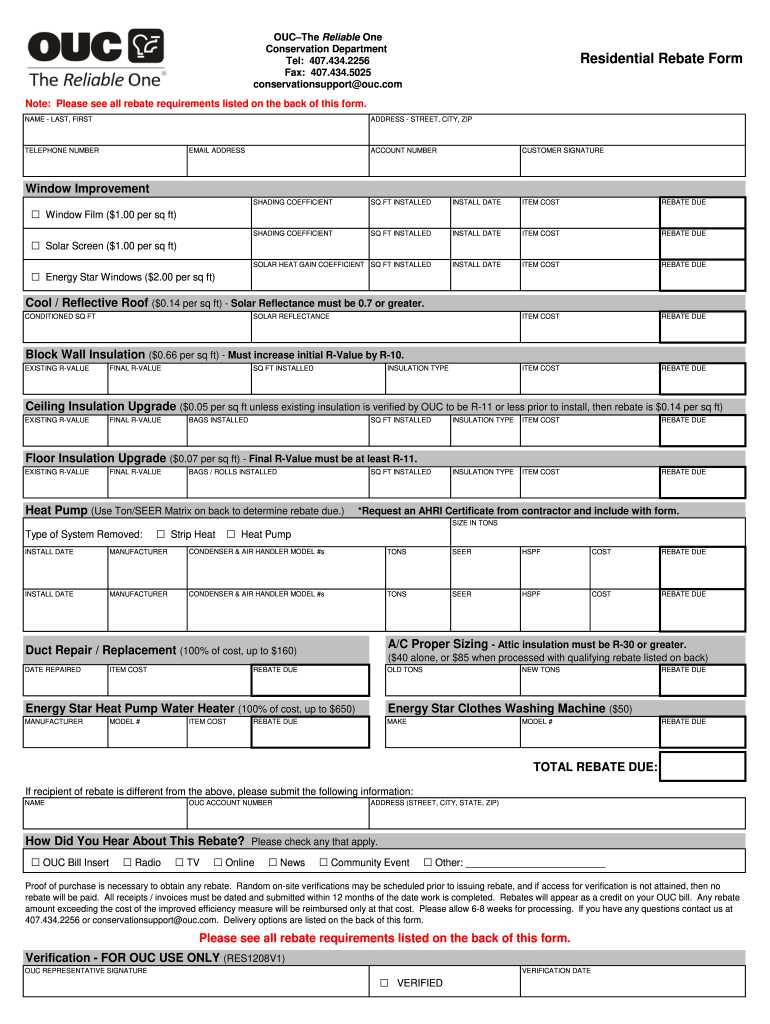

Ouc Rebates Pdf Fill And Sign Printable Template Online US Legal Forms

Ouc Rebates Pdf Fill And Sign Printable Template Online US Legal Forms

Web 11 f 233 vr 2019 nbsp 0183 32 A Personal Tax Account allows doctors to claim tax relief for expenses such as your GMC BMA MDU and MPS fees as well as any

Web 12 avr 2019 nbsp 0183 32 7 45 am Allowable Expenses for NHS Doctors If you work for the NHS then it is worth understanding the HMRC rules around what you can and can t claim for against

Cash Medical Tax Rebate Form

Cash Medical Tax Rebate Form are a simple kind of Medical Tax Rebate Form. The customer receives a particular amount back in cash after purchasing a item. They are typically used to purchase large-ticket items such as electronics and appliances.

Mail-In Medical Tax Rebate Form

Customers who want to receive mail-in Medical Tax Rebate Form must present the proof of purchase in order to receive their reimbursement. They're more involved but offer huge savings.

Instant Medical Tax Rebate Form

Instant Medical Tax Rebate Form are applied at the points of sale. This reduces the purchase price immediately. Customers do not have to wait until they can save with this type.

How Medical Tax Rebate Form Work

Printable Yearly Itemized Tax Deduction Worksheet Fill Out Sign

Printable Yearly Itemized Tax Deduction Worksheet Fill Out Sign

Web 27 f 233 vr 2023 nbsp 0183 32 La taxe sur les bureaux applicable dans la r 233 gion d 206 le de France TSB IDF est une taxe annuelle qui concerne les locaux 224 usage de bureaux locaux commerciaux

The Medical Tax Rebate Form Process

The process generally involves a number of easy steps:

-

Purchase the product: First make sure you purchase the product just like you normally would.

-

Complete your Medical Tax Rebate Form questionnaire: you'll need to fill in some information like your name, address, along with the purchase details, to be eligible for a Medical Tax Rebate Form.

-

You must submit the Medical Tax Rebate Form If you want to submit the Medical Tax Rebate Form, based on the type of Medical Tax Rebate Form you might need to fill out a paper form or upload it online.

-

Wait until the company approves: The company will review your submission to confirm that it complies with the requirements of the Medical Tax Rebate Form.

-

Get your Medical Tax Rebate Form After approval, you'll receive the refund using a check or prepaid card or another method that is specified in the offer.

Pros and Cons of Medical Tax Rebate Form

Advantages

-

Cost savings Rewards can drastically decrease the price for the product.

-

Promotional Deals They encourage customers to explore new products or brands.

-

Accelerate Sales Reward programs can boost a company's sales and market share.

Disadvantages

-

Complexity Reward mail-ins particularly are often time-consuming and slow-going.

-

Expiration Dates A lot of Medical Tax Rebate Form have specific deadlines for submission.

-

Risk of Non-Payment Certain customers could not be able to receive their Medical Tax Rebate Form if they do not adhere to the guidelines precisely.

Download Medical Tax Rebate Form

Download Medical Tax Rebate Form

FAQs

1. Are Medical Tax Rebate Form the same as discounts? No, Medical Tax Rebate Form involve a partial refund after the purchase, but discounts can reduce the price of the purchase at the point of sale.

2. Are there Medical Tax Rebate Form that can be used on the same item The answer is dependent on the terms of the Medical Tax Rebate Form offer and also the item's eligibility. Some companies will allow this, whereas others will not.

3. What is the time frame to receive an Medical Tax Rebate Form? The timing is different, but it could take a couple of weeks or a couple of months before you get your Medical Tax Rebate Form.

4. Do I have to pay taxes on Medical Tax Rebate Form montants? the majority of cases, Medical Tax Rebate Form amounts are not considered taxable income.

5. Can I trust Medical Tax Rebate Form offers from brands that aren't well-known It is essential to investigate and confirm that the brand offering the Medical Tax Rebate Form is legitimate prior to making an acquisition.

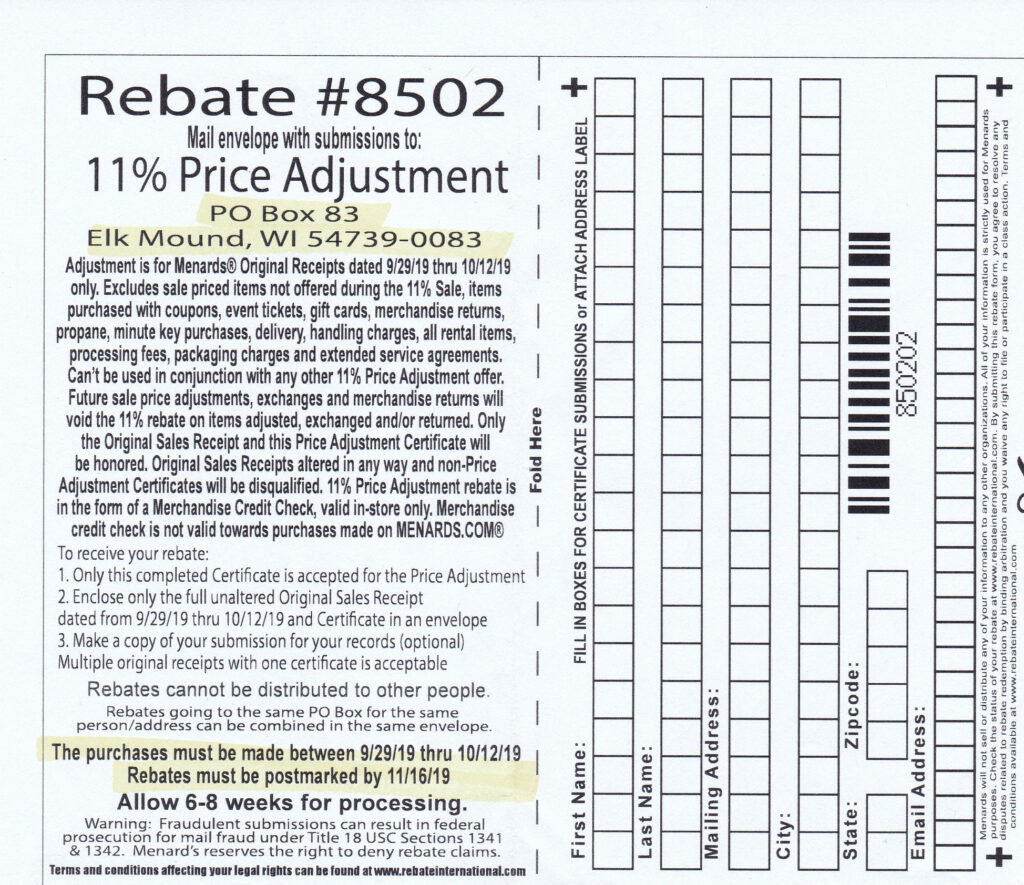

Menards Rebate Form 6564 MenardsRebate Form

Ct 3 S 2018 Fill Out Sign Online DocHub

Check more sample of Medical Tax Rebate Form below

Top Mass Save Rebate Form Templates Free To Download In PDF Format

PPL Rebates Printable Rebate Form

Rebate Form Fill And Sign Printable Template Online US Legal Forms

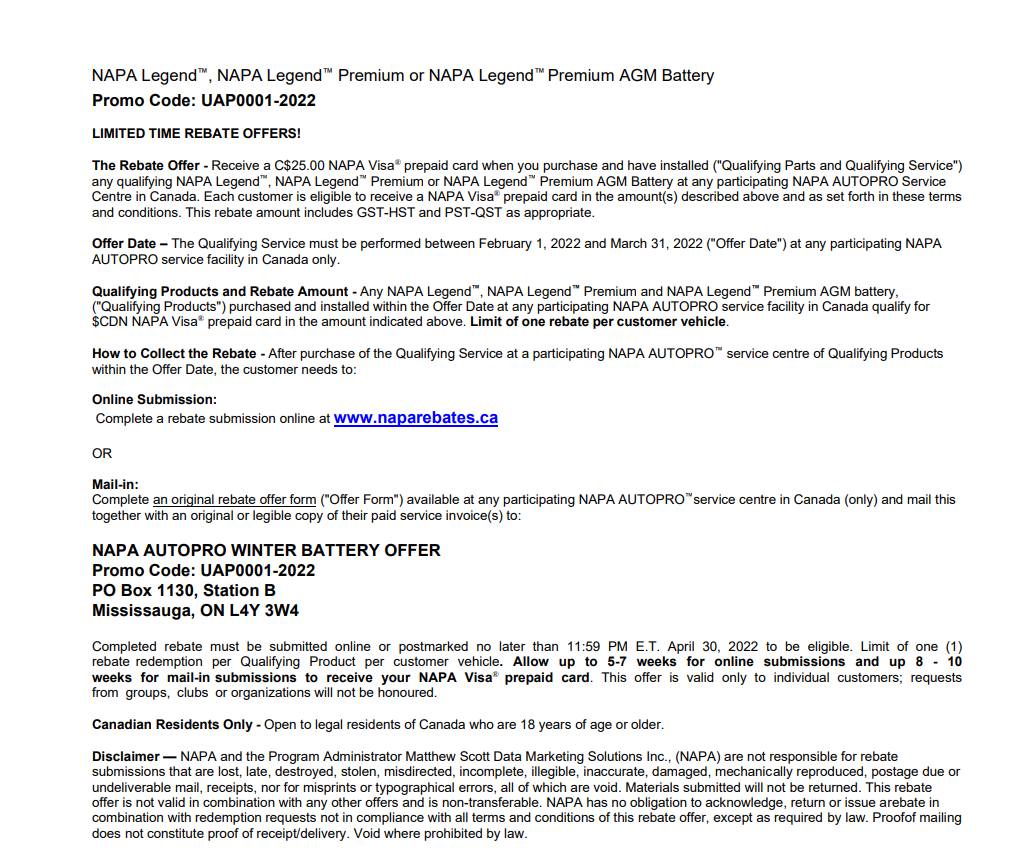

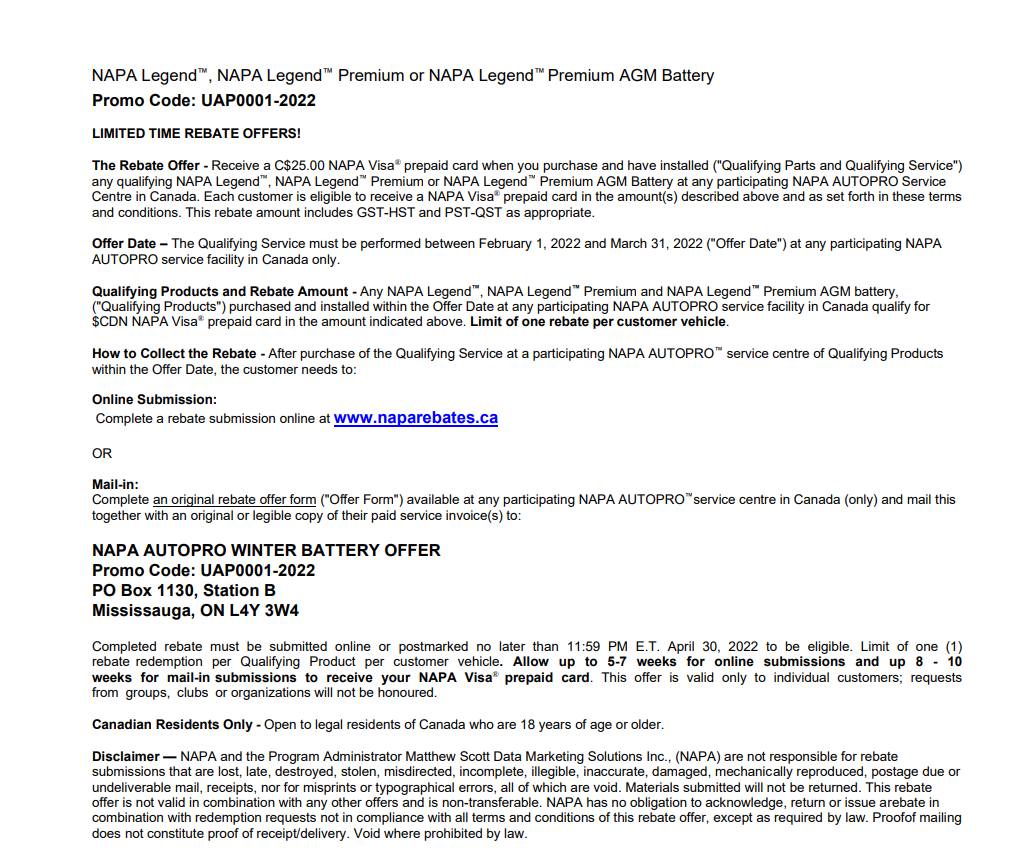

Napa Rebates Printable Rebate Form

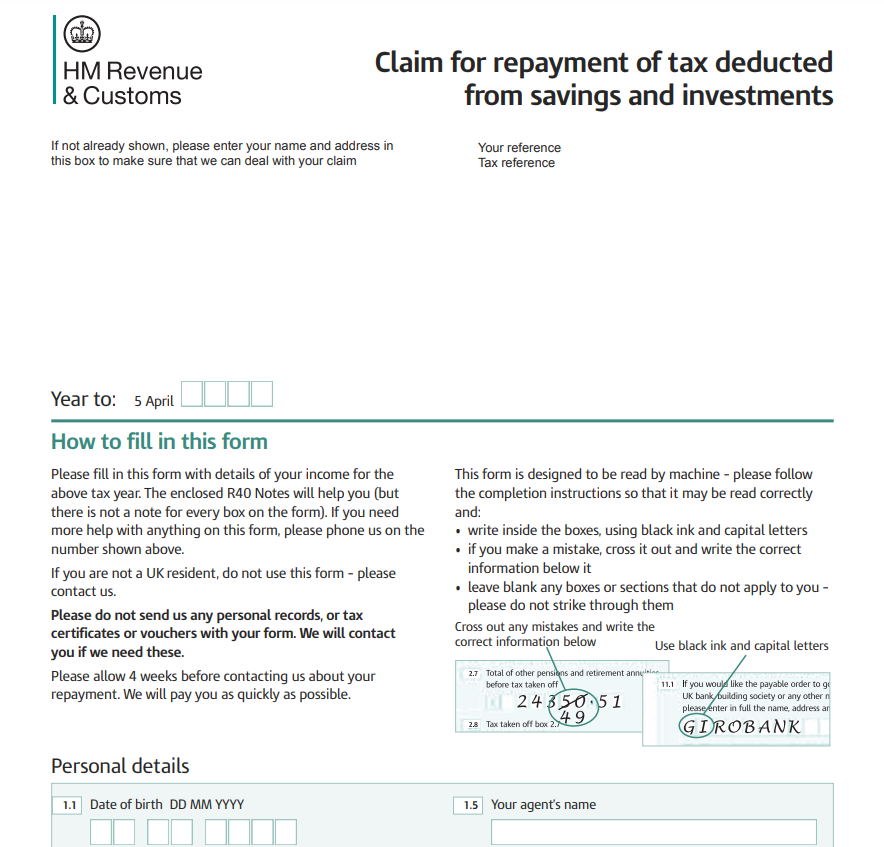

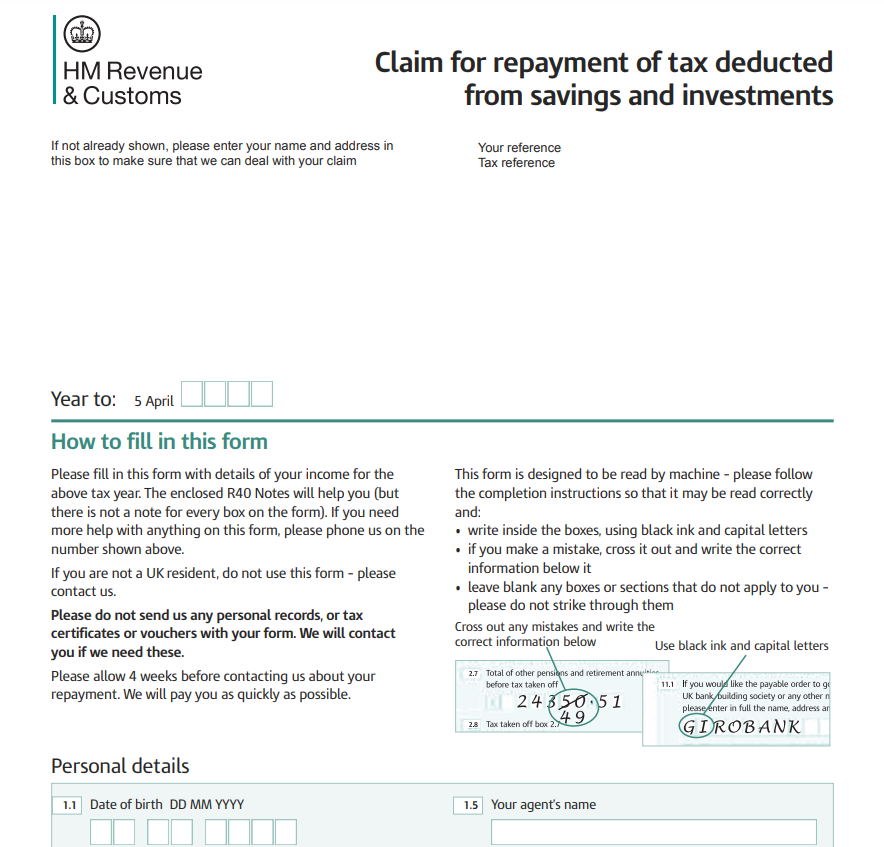

Ppi Tax Rebate Form Amount Printable Rebate Form

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

https://www.medicsmoney.co.uk/free-guide

Web What s in the guides The most comprehensive speciality specific step by step guide to claiming a tax rebate for doctors written by experts What

https://www.sars.gov.za/.../additional-medical-expenses-tax-credit

Web 16 nov 2022 nbsp 0183 32 An Additional Medical Expenses Tax Credit also known as an AMTC is a rebate which in itself is non refundable but which is used to reduce the normal tax a

Web What s in the guides The most comprehensive speciality specific step by step guide to claiming a tax rebate for doctors written by experts What

Web 16 nov 2022 nbsp 0183 32 An Additional Medical Expenses Tax Credit also known as an AMTC is a rebate which in itself is non refundable but which is used to reduce the normal tax a

Napa Rebates Printable Rebate Form

PPL Rebates Printable Rebate Form

Ppi Tax Rebate Form Amount Printable Rebate Form

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Menards 11 Rebate 4468 Purchases 8 19 18 8 25 18

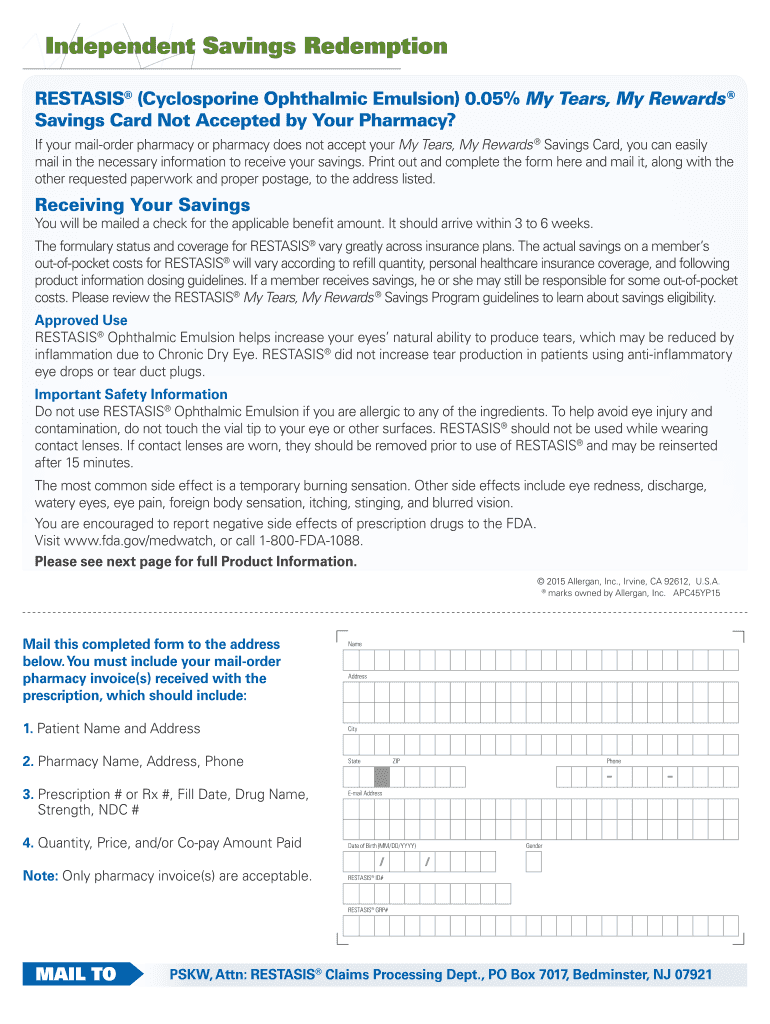

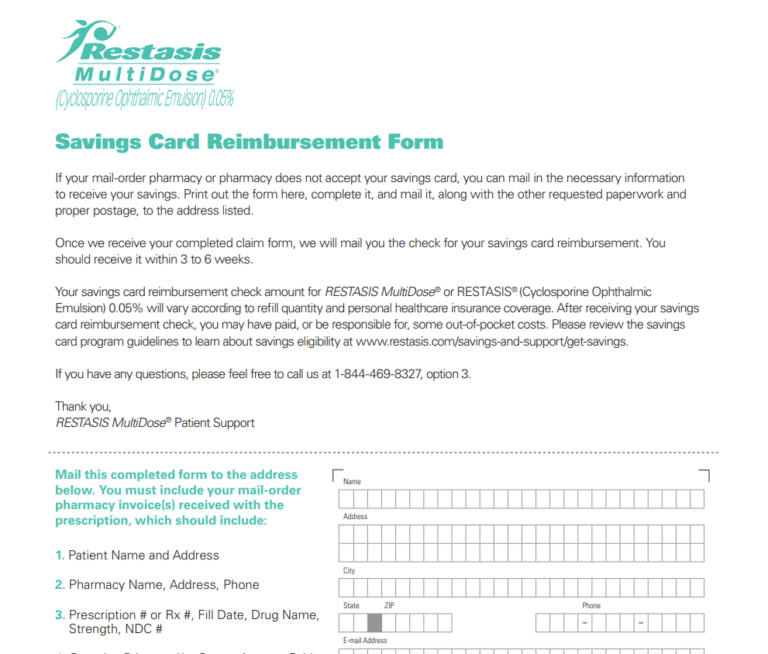

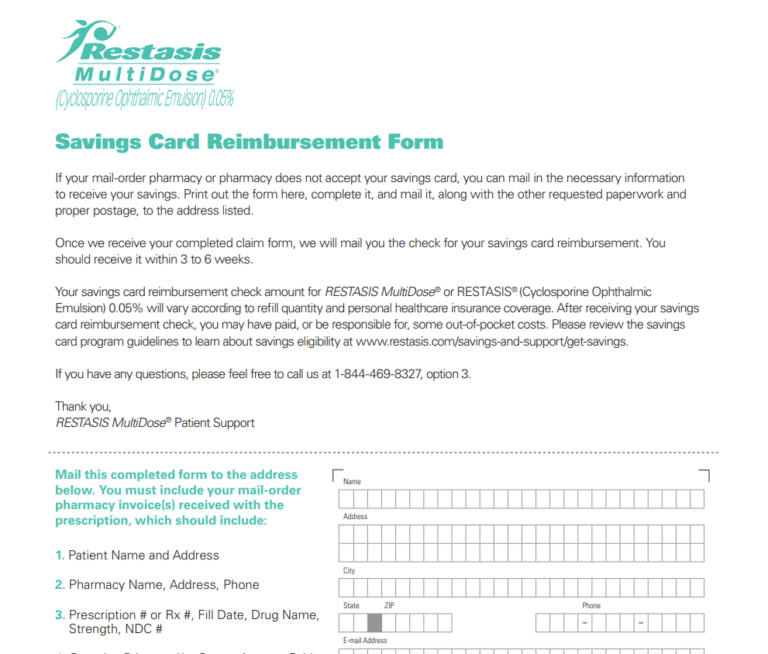

Restasis Rebate Printable Rebate Form

Restasis Rebate Printable Rebate Form

Menards 11 Rebate Form Printable Rebate Form 11Rebate