In this day and age of consuming everyone appreciates a great deal. One way to score significant savings on your purchases is by using Hmrc Uniform Tax Rebate Application Forms. Hmrc Uniform Tax Rebate Application Forms can be a way of marketing used by manufacturers and retailers in order to offer customers a small return on their purchases once they've bought them. In this post, we'll explore the world of Hmrc Uniform Tax Rebate Application Forms, looking at the nature of them, how they work, and ways to maximize the savings you can make by using these cost-effective incentives.

Get Latest Hmrc Uniform Tax Rebate Application Form Below

Hmrc Uniform Tax Rebate Application Form

Hmrc Uniform Tax Rebate Application Form -

Web If as part of its normal tax admin HMRC sends you a P810 Tax Review form to check your tax code is correct you can also fill this in to claim tax relief For expenses over 163 1 000 or if you changed jobs midway

Web How much you can claim You can either claim tax relief on 163 6 a week from 6 April 2020 for previous tax years the rate is 163 4 a week you will not need to keep evidence of your

A Hmrc Uniform Tax Rebate Application Form is, in its most basic definition, is a refund given to a client who has purchased a particular product or service. It's a highly effective tool that businesses use to draw customers, increase sales, and also to advertise certain products.

Types of Hmrc Uniform Tax Rebate Application Form

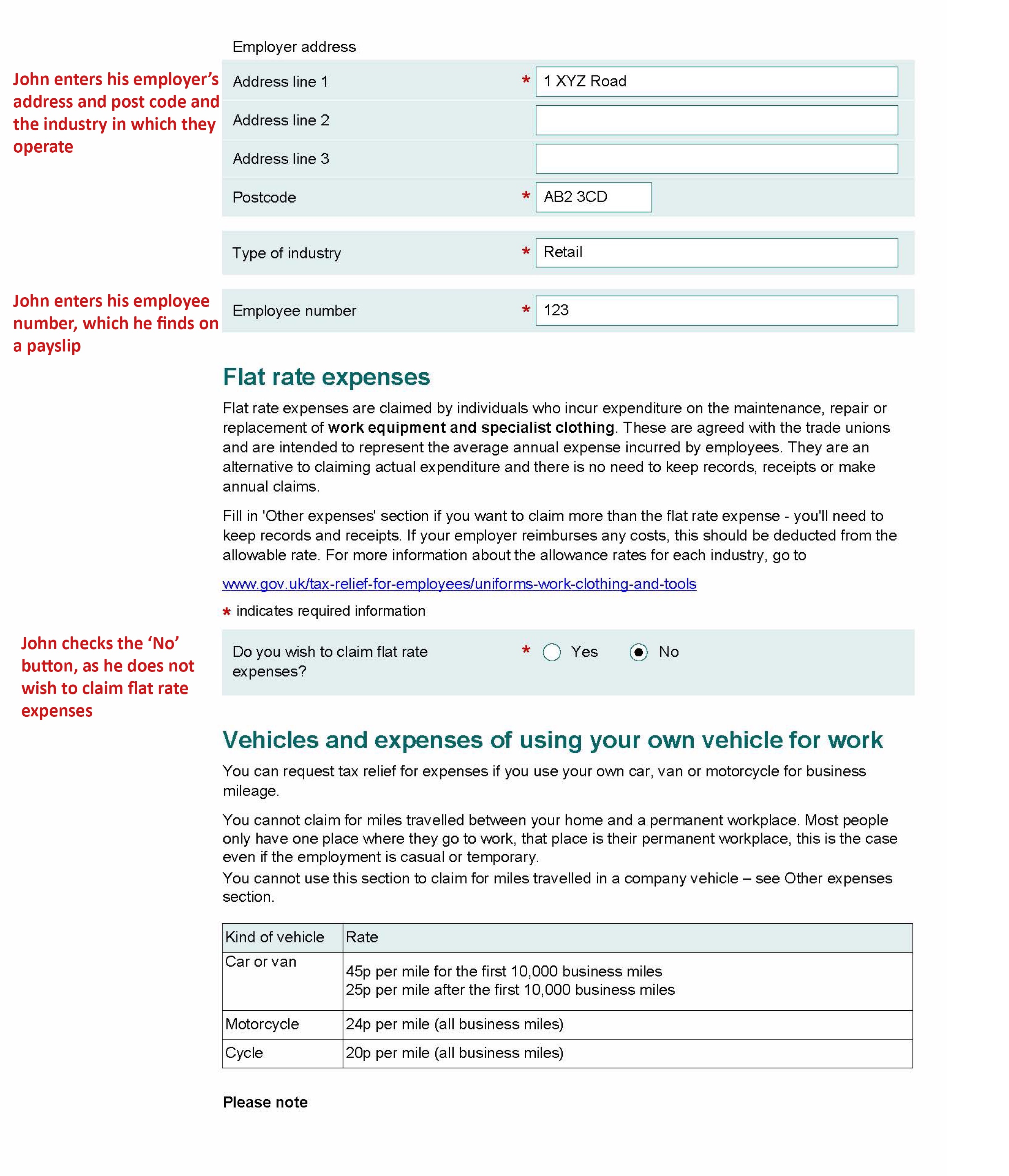

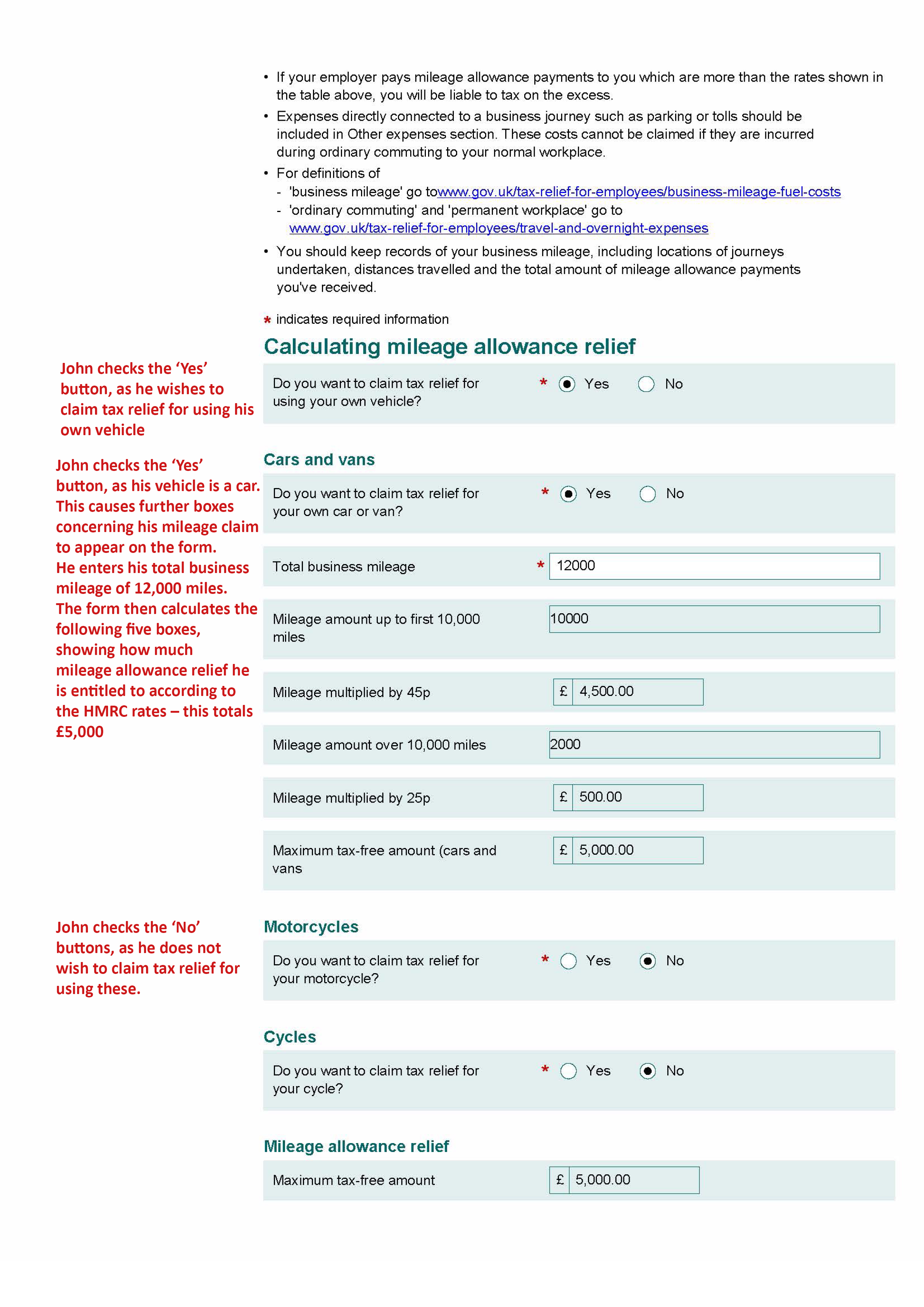

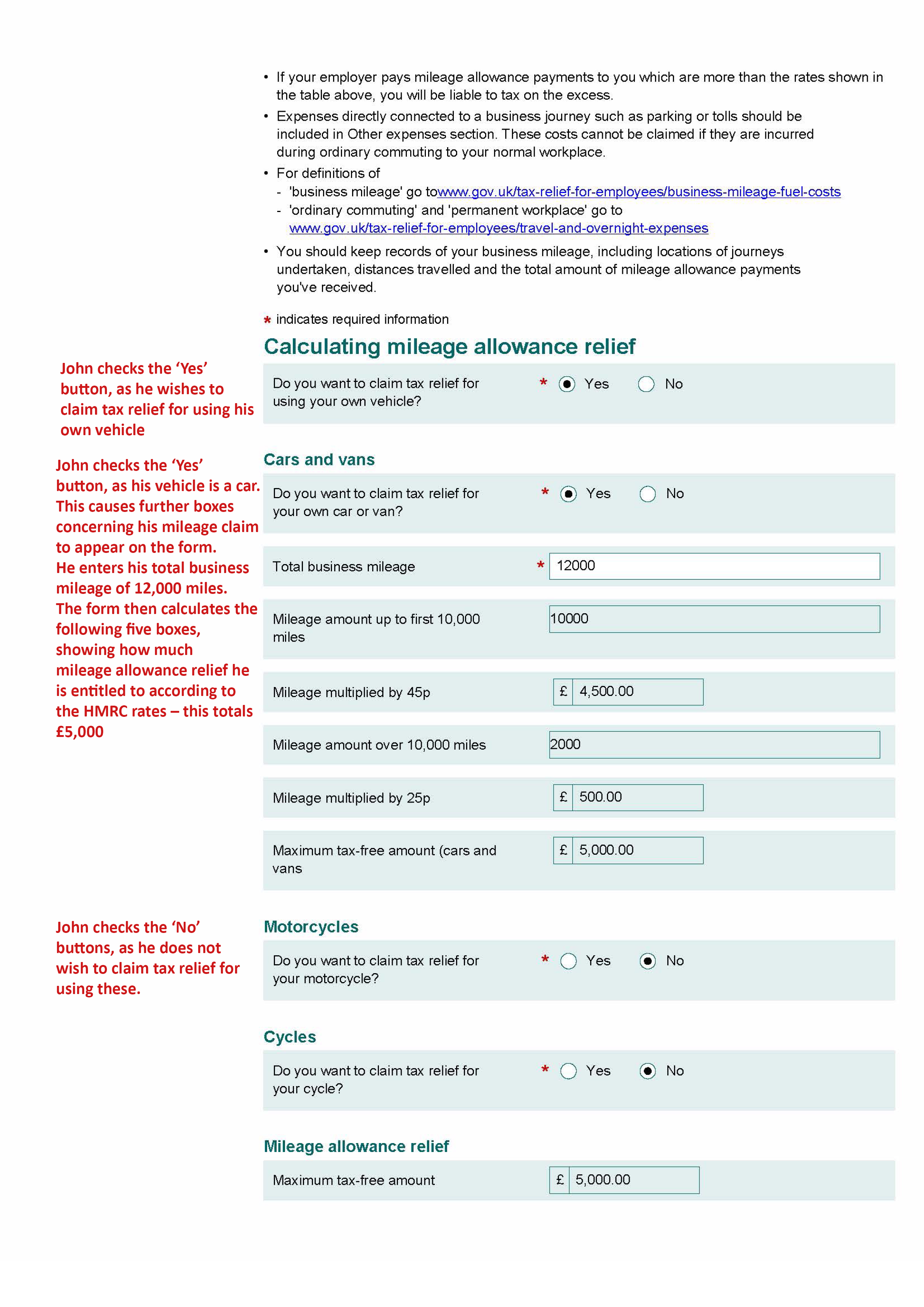

Download Form P87 For Claiming Uniform Tax Rebate DNS Accountants

Download Form P87 For Claiming Uniform Tax Rebate DNS Accountants

Web 1 janv 2014 nbsp 0183 32 HM Revenue and Customs HMRC forms and associated guides notes helpsheets and supplementary pages

Web 19 nov 2014 nbsp 0183 32 1 March 2018 Form Claim a tax refund if you re a non resident merchant seafarer 22 April 2020 Form Claim an Income Tax refund 15 August 2014 Form Claim

Cash Hmrc Uniform Tax Rebate Application Form

Cash Hmrc Uniform Tax Rebate Application Form are by far the easiest kind of Hmrc Uniform Tax Rebate Application Form. Customers receive a certain amount of money when buying a product. They are typically used to purchase costly items like electronics or appliances.

Mail-In Hmrc Uniform Tax Rebate Application Form

Mail-in Hmrc Uniform Tax Rebate Application Form demand that customers submit their proof of purchase before receiving their cash back. They're a bit more complicated but could provide significant savings.

Instant Hmrc Uniform Tax Rebate Application Form

Instant Hmrc Uniform Tax Rebate Application Form will be applied at place of purchase, reducing the price instantly. Customers don't need to wait around for savings through this kind of offer.

How Hmrc Uniform Tax Rebate Application Form Work

HMRC P46 FORM DOWNLOAD

HMRC P46 FORM DOWNLOAD

Web 21 mars 2022 nbsp 0183 32 From 7 May HMRC is mandating the use of the standard P87 form for claiming income tax relief on employment expenses on gov uk and will reject claims that

The Hmrc Uniform Tax Rebate Application Form Process

The procedure usually involves a number of easy steps:

-

You purchase the item: First, you buy the product just like you normally would.

-

Fill out this Hmrc Uniform Tax Rebate Application Form forms: The Hmrc Uniform Tax Rebate Application Form form will have to provide some data, such as your name, address and purchase information, to claim your Hmrc Uniform Tax Rebate Application Form.

-

In order to submit the Hmrc Uniform Tax Rebate Application Form Based on the nature of Hmrc Uniform Tax Rebate Application Form you might need to fill out a form and mail it in or make it available online.

-

Wait for the company's approval: They will look over your submission and ensure that it's compliant with reimbursement's terms and condition.

-

Redeem your Hmrc Uniform Tax Rebate Application Form Once it's approved, you'll receive a refund whether by check, prepaid card or another method that is specified in the offer.

Pros and Cons of Hmrc Uniform Tax Rebate Application Form

Advantages

-

Cost Savings Rewards can drastically reduce the cost for a product.

-

Promotional Deals These deals encourage customers to try out new products or brands.

-

Increase Sales Hmrc Uniform Tax Rebate Application Form can increase a company's sales and market share.

Disadvantages

-

Complexity Hmrc Uniform Tax Rebate Application Form that are mail-in, particularly is a time-consuming process and costly.

-

Extension Dates Many Hmrc Uniform Tax Rebate Application Form are subject to deadlines for submission.

-

Risk of Non-Payment Customers may not be able to receive their Hmrc Uniform Tax Rebate Application Form if they do not follow the rules exactly.

Download Hmrc Uniform Tax Rebate Application Form

Download Hmrc Uniform Tax Rebate Application Form

FAQs

1. Are Hmrc Uniform Tax Rebate Application Form similar to discounts? Not at all, Hmrc Uniform Tax Rebate Application Form provide one-third of the amount refunded following purchase, whereas discounts decrease the price of the purchase at the time of sale.

2. Can I use multiple Hmrc Uniform Tax Rebate Application Form on the same product This depends on the conditions that apply to the Hmrc Uniform Tax Rebate Application Form is offered as well as the merchandise's qualification. Certain companies may permit it, and some don't.

3. What is the time frame to get a Hmrc Uniform Tax Rebate Application Form? The length of time differs, but it can be anywhere from a few weeks up to a couple of months to receive your Hmrc Uniform Tax Rebate Application Form.

4. Do I have to pay taxes regarding Hmrc Uniform Tax Rebate Application Form the amount? most circumstances, Hmrc Uniform Tax Rebate Application Form amounts are not considered taxable income.

5. Can I trust Hmrc Uniform Tax Rebate Application Form deals from lesser-known brands Do I need to conduct a thorough research and confirm that the company giving the Hmrc Uniform Tax Rebate Application Form is trustworthy prior to making an acquisition.

Fillable Online Hmrc Gov Form Us Company 2002 2010 Fax Email Print

PSA HMRC Will Not E mail Or Call You About Tax Rebates CasualUK

Check more sample of Hmrc Uniform Tax Rebate Application Form below

Hmrc P87 Printable Form Printable Forms Free Online

Form P87 Claim For Tax Relief For Expenses Of Employment Low

Blog Archives Page 2 Of 3 Atkins Co Local Accountants

HMRC Give Tax Relief Pre approval Save The Thorold Arms

It s Not A Tax Rebate It s An HMRC Phishing Scam IT Governance Blog

Fill Free Fillable HM Revenue Customs PDF Forms

https://www.gov.uk/tax-relief-for-employees/working-at-home?_cldee...

Web How much you can claim You can either claim tax relief on 163 6 a week from 6 April 2020 for previous tax years the rate is 163 4 a week you will not need to keep evidence of your

https://www.gov.uk/government/publications/income-tax-tax-claim-r38

Web 15 ao 251 t 2014 nbsp 0183 32 Details If you ve paid too much tax and want to claim back the over payment use form R38 You can also use this form to authorise a representative to get the

Web How much you can claim You can either claim tax relief on 163 6 a week from 6 April 2020 for previous tax years the rate is 163 4 a week you will not need to keep evidence of your

Web 15 ao 251 t 2014 nbsp 0183 32 Details If you ve paid too much tax and want to claim back the over payment use form R38 You can also use this form to authorise a representative to get the

HMRC Give Tax Relief Pre approval Save The Thorold Arms

Form P87 Claim For Tax Relief For Expenses Of Employment Low

It s Not A Tax Rebate It s An HMRC Phishing Scam IT Governance Blog

Fill Free Fillable HM Revenue Customs PDF Forms

HMRC P50 FORM TO FREE DOWNLOAD

HMRC Give Tax Relief Pre approval Save The Thorold Arms

HMRC Give Tax Relief Pre approval Save The Thorold Arms

HMRC GOV UK FORMS P87 PDF