In this day and age of consuming, everyone loves a good deal. One way to score substantial savings on your purchases is by using Mchenry County Real Estate Tax Rebate Forms. Mchenry County Real Estate Tax Rebate Forms are an effective marketing tactic that retailers and manufacturers use for offering customers a percentage cash back on their purchases once they've taken them. In this article, we'll investigate the world of Mchenry County Real Estate Tax Rebate Forms. We'll discuss the nature of them what they are, how they function, and how you can maximise your savings by taking advantage of these cost-effective incentives.

Get Latest Mchenry County Real Estate Tax Rebate Form Below

Mchenry County Real Estate Tax Rebate Form

Mchenry County Real Estate Tax Rebate Form -

Web Current and past assessments for property in McHenry County Mission Statement The Office of Assessments strives to administer an accurate fair uniform and timely

Web Reduction in equalized assessed value up to 6 000 Available for all owner occupied residences No age requirement Check your last tax bill To add it contact your

A Mchenry County Real Estate Tax Rebate Form as it is understood in its simplest version, is an ad-hoc reimbursement to a buyer after having purchased a item or service. It's a very effective technique that businesses use to draw buyers, increase sales and even promote certain products.

Types of Mchenry County Real Estate Tax Rebate Form

Farms Business Cut Out Of Jack Franks Valley Hi Property Tax Rebate

Farms Business Cut Out Of Jack Franks Valley Hi Property Tax Rebate

Web Options for paying your property tax bill Payments can be mailed Mailing address is PO Box 458 Crystal Lake IL 60039 Do not mail cash Payments can be in person at our

Web Property Tax Relieving Homestead Exemptions PIO 74 Property Tax Relief Homesteads Exemptions PIO 74 Property Tax Exemptions County News McHenry

Cash Mchenry County Real Estate Tax Rebate Form

Cash Mchenry County Real Estate Tax Rebate Form is the most basic kind of Mchenry County Real Estate Tax Rebate Form. Customers receive a specified amount back in cash after buying a product. These are typically applied to more expensive items such electronics or appliances.

Mail-In Mchenry County Real Estate Tax Rebate Form

Mail-in Mchenry County Real Estate Tax Rebate Form need customers to send in proof of purchase in order to receive the money. They are a bit more involved, but can result in significant savings.

Instant Mchenry County Real Estate Tax Rebate Form

Instant Mchenry County Real Estate Tax Rebate Form are made at the point of sale, and can reduce the price of purchases immediately. Customers don't have to wait around for savings by using this method.

How Mchenry County Real Estate Tax Rebate Form Work

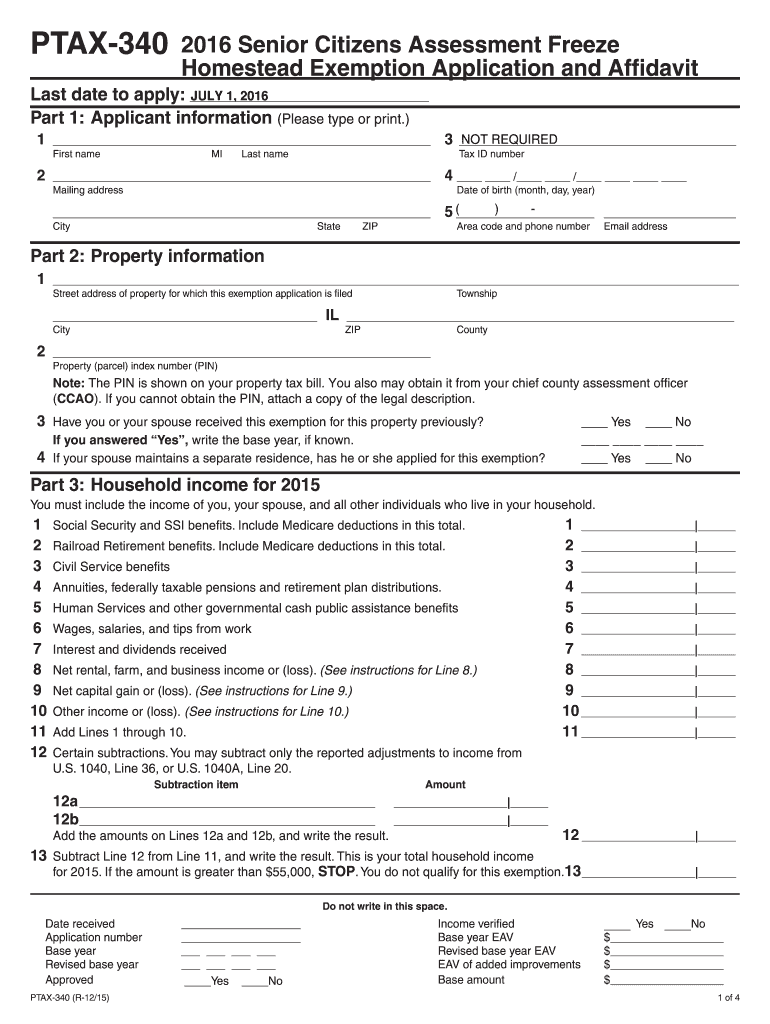

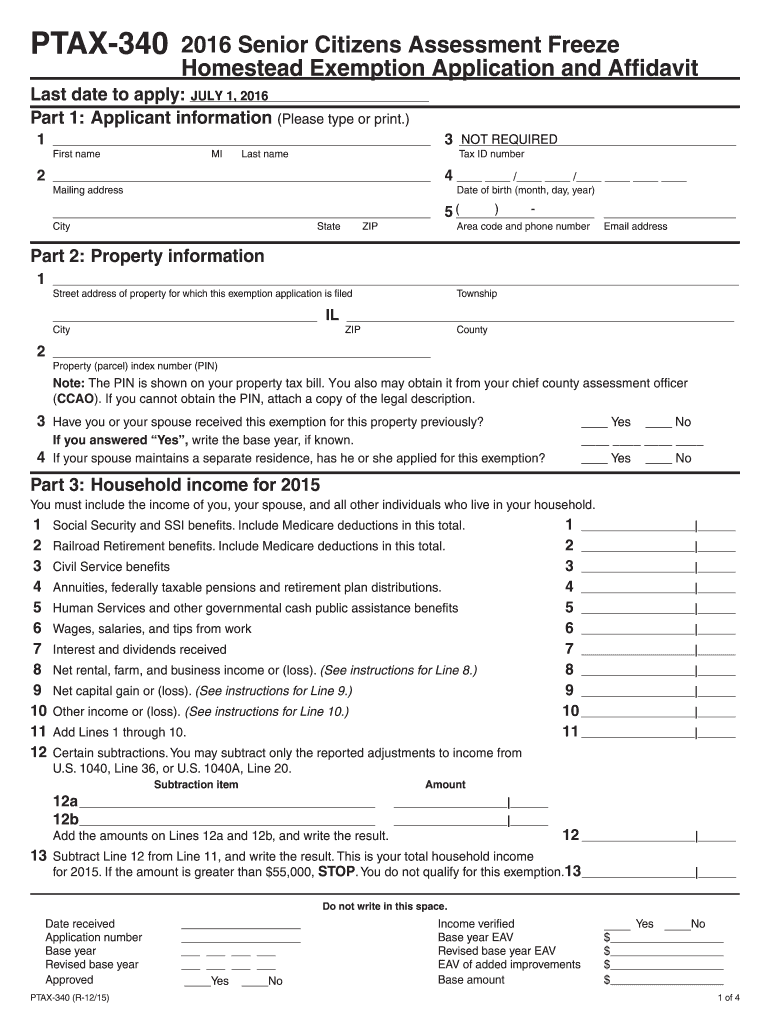

Top 47 Imagen Cook County Senior Citizen Exemption Ecover mx

Top 47 Imagen Cook County Senior Citizen Exemption Ecover mx

Web The section 8 timetable would not exist without our partner landlords The Housing Choice Voucher Program and its landlords help families afford decent stable housing avoid

The Mchenry County Real Estate Tax Rebate Form Process

The procedure typically consists of a few steps

-

Buy the product: Firstly purchase the product like you would normally.

-

Complete your Mchenry County Real Estate Tax Rebate Form template: You'll have to provide some data like your address, name, and the purchase details, in order to receive your Mchenry County Real Estate Tax Rebate Form.

-

Send in the Mchenry County Real Estate Tax Rebate Form If you want to submit the Mchenry County Real Estate Tax Rebate Form, based on the kind of Mchenry County Real Estate Tax Rebate Form the recipient may be required to submit a claim form to the bank or make it available online.

-

Wait for approval: The company will scrutinize your submission for compliance with reimbursement's terms and condition.

-

Pay your Mchenry County Real Estate Tax Rebate Form Once it's approved, the amount you receive will be using a check or prepaid card or through a different option that's specified in the offer.

Pros and Cons of Mchenry County Real Estate Tax Rebate Form

Advantages

-

Cost savings Mchenry County Real Estate Tax Rebate Form are a great way to cut the price you pay for an item.

-

Promotional Deals These deals encourage customers to try new products or brands.

-

Boost Sales Mchenry County Real Estate Tax Rebate Form can enhance the company's sales as well as market share.

Disadvantages

-

Complexity Reward mail-ins in particular difficult and lengthy.

-

The Expiration Dates Many Mchenry County Real Estate Tax Rebate Form have strict time limits for submission.

-

Risk of not receiving payment Customers may lose their Mchenry County Real Estate Tax Rebate Form in the event that they don't follow the rules precisely.

Download Mchenry County Real Estate Tax Rebate Form

Download Mchenry County Real Estate Tax Rebate Form

FAQs

1. Are Mchenry County Real Estate Tax Rebate Form similar to discounts? No, Mchenry County Real Estate Tax Rebate Form involve a partial refund after purchase, whereas discounts cut costs at time of sale.

2. Are there multiple Mchenry County Real Estate Tax Rebate Form I can get on the same item? It depends on the terms in the Mchenry County Real Estate Tax Rebate Form incentives and the specific product's qualification. Certain companies might permit it, but some will not.

3. How long does it take to get an Mchenry County Real Estate Tax Rebate Form What is the timeframe? differs, but it can take anywhere from a few weeks to a couple of months for you to receive your Mchenry County Real Estate Tax Rebate Form.

4. Do I need to pay taxes of Mchenry County Real Estate Tax Rebate Form montants? the majority of cases, Mchenry County Real Estate Tax Rebate Form amounts are not considered taxable income.

5. Do I have confidence in Mchenry County Real Estate Tax Rebate Form offers from lesser-known brands Consider doing some research and confirm that the company that is offering the Mchenry County Real Estate Tax Rebate Form has a good reputation prior to making an acquisition.

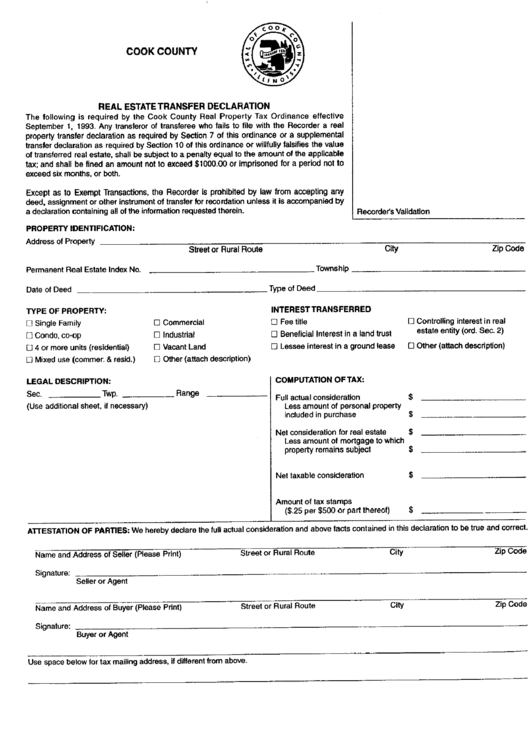

McHenry County Valley Hi Tax Rebate Program Miller Verchota CPAs

Property Tax Rebate Application Printable Pdf Download

Check more sample of Mchenry County Real Estate Tax Rebate Form below

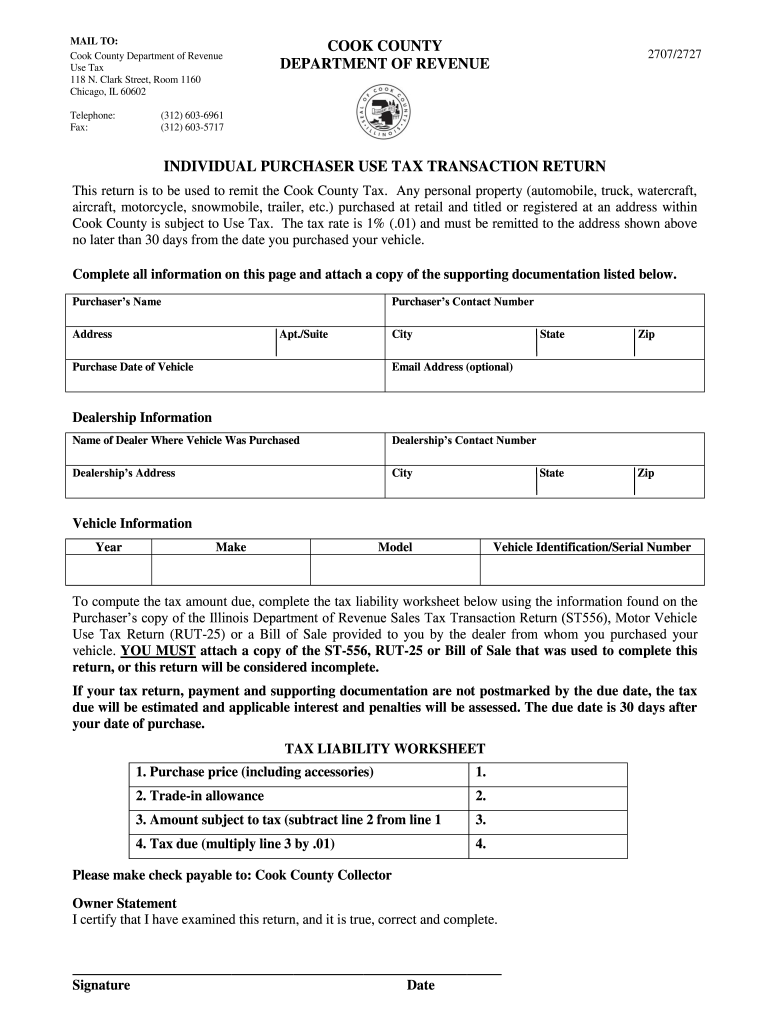

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

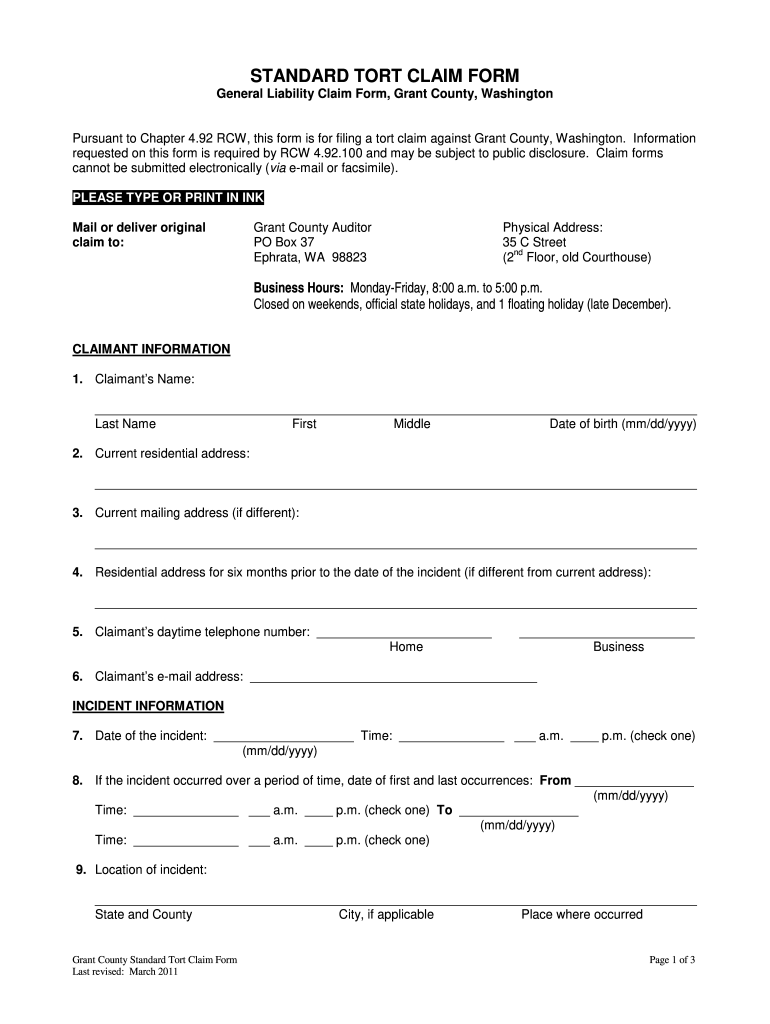

2011 Form WA DES Sf 210 Fill Online Printable Fillable Blank PdfFiller

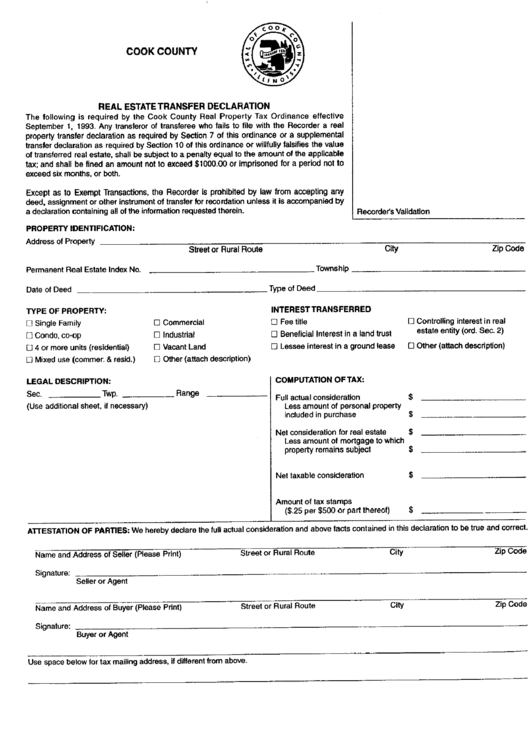

Real Estate Transfer Tax Pennsylvania At Jesse Frank Blog

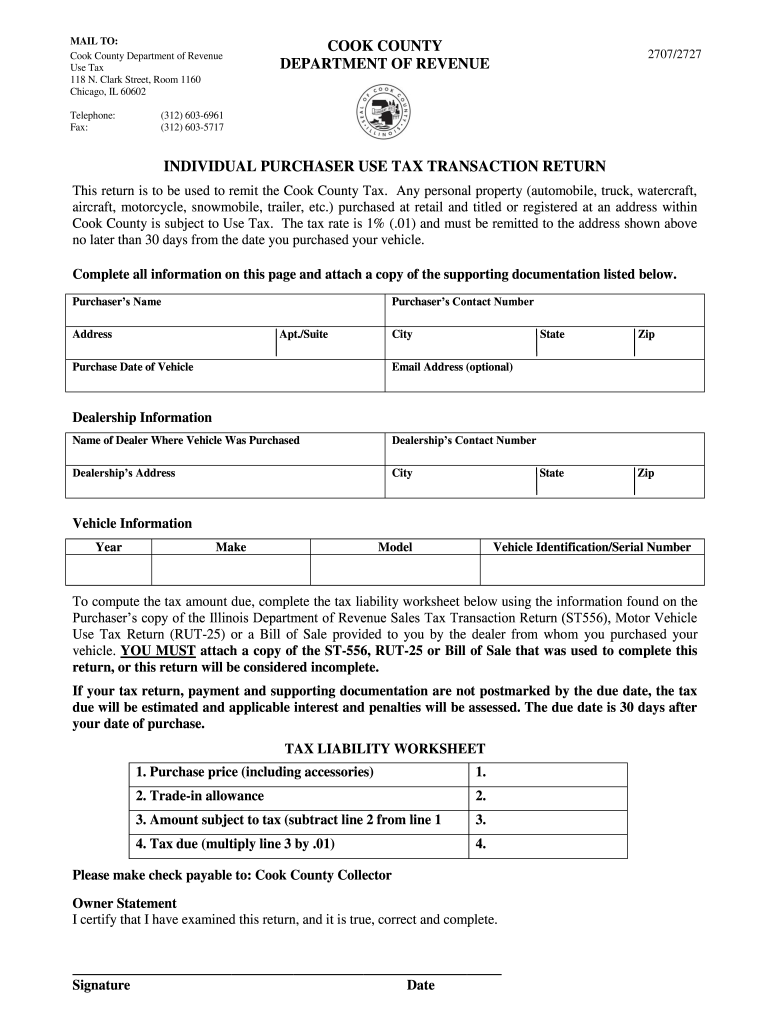

Ouc Rebates Pdf Fill Online Printable Fillable Blank PdfFiller

Nc Vehicle Property Tax Refund VEHICLE UOI

https://www.mchenrycountyil.gov/.../treasurer/reducing-your-tax-bill

Web Reduction in equalized assessed value up to 6 000 Available for all owner occupied residences No age requirement Check your last tax bill To add it contact your

https://www.mchenrytownship.com/wp-content/uploads/taxp…

Web Applicaon for the Senior Cizens Real Estate Tax Deferral Pro gram must be submied each year and involves compleng two forms which are available at the McHenry County

Web Reduction in equalized assessed value up to 6 000 Available for all owner occupied residences No age requirement Check your last tax bill To add it contact your

Web Applicaon for the Senior Cizens Real Estate Tax Deferral Pro gram must be submied each year and involves compleng two forms which are available at the McHenry County

Real Estate Transfer Tax Pennsylvania At Jesse Frank Blog

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Ouc Rebates Pdf Fill Online Printable Fillable Blank PdfFiller

Nc Vehicle Property Tax Refund VEHICLE UOI

Form 1041 Fill Out And Sign Printable PDF Template SignNow

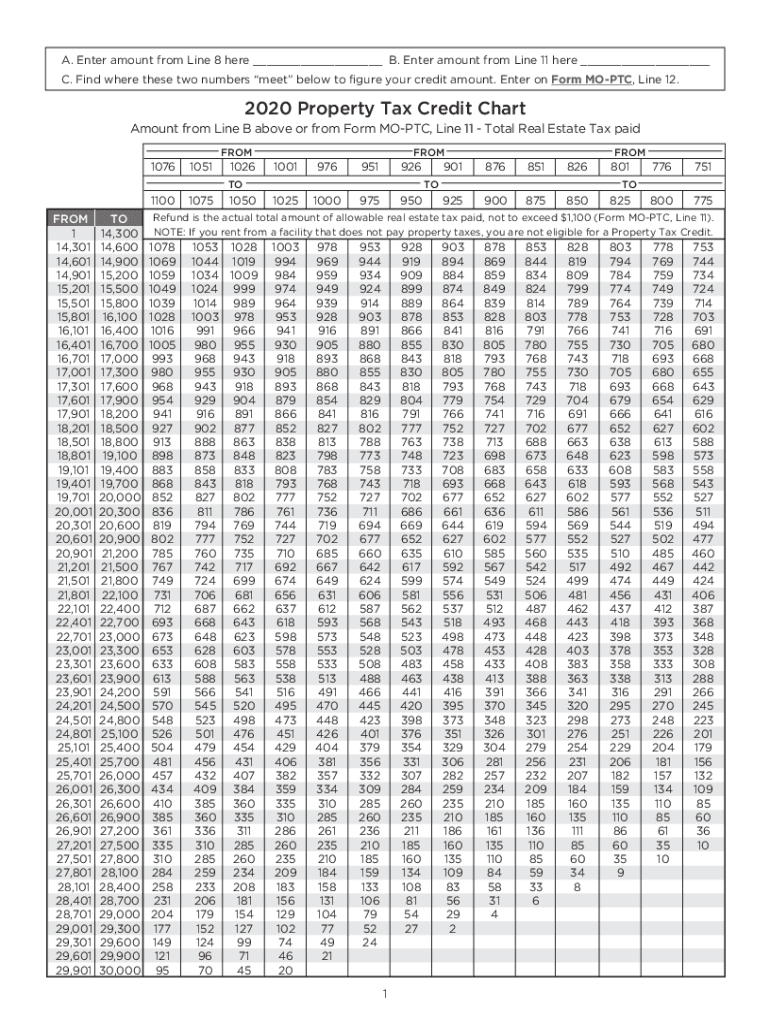

Rent Rebate Tax Form Missouri Printable Rebate Form

Rent Rebate Tax Form Missouri Printable Rebate Form

2020 Form MO MO PTC ChartFill Online Printable Fillable Blank