In the modern world of consumerization we all love a good deal. One way to gain substantial savings in your purchase is through Recovery Rebate Credit 2023 Tax Return Forms. Recovery Rebate Credit 2023 Tax Return Forms are a strategy for marketing employed by retailers and manufacturers to offer customers a refund on their purchases after they've completed them. In this article, we will look into the world of Recovery Rebate Credit 2023 Tax Return Forms. We'll discuss the nature of them and how they operate, and how you can maximize the savings you can make by using these cost-effective incentives.

Get Latest Recovery Rebate Credit 2023 Tax Return Form Below

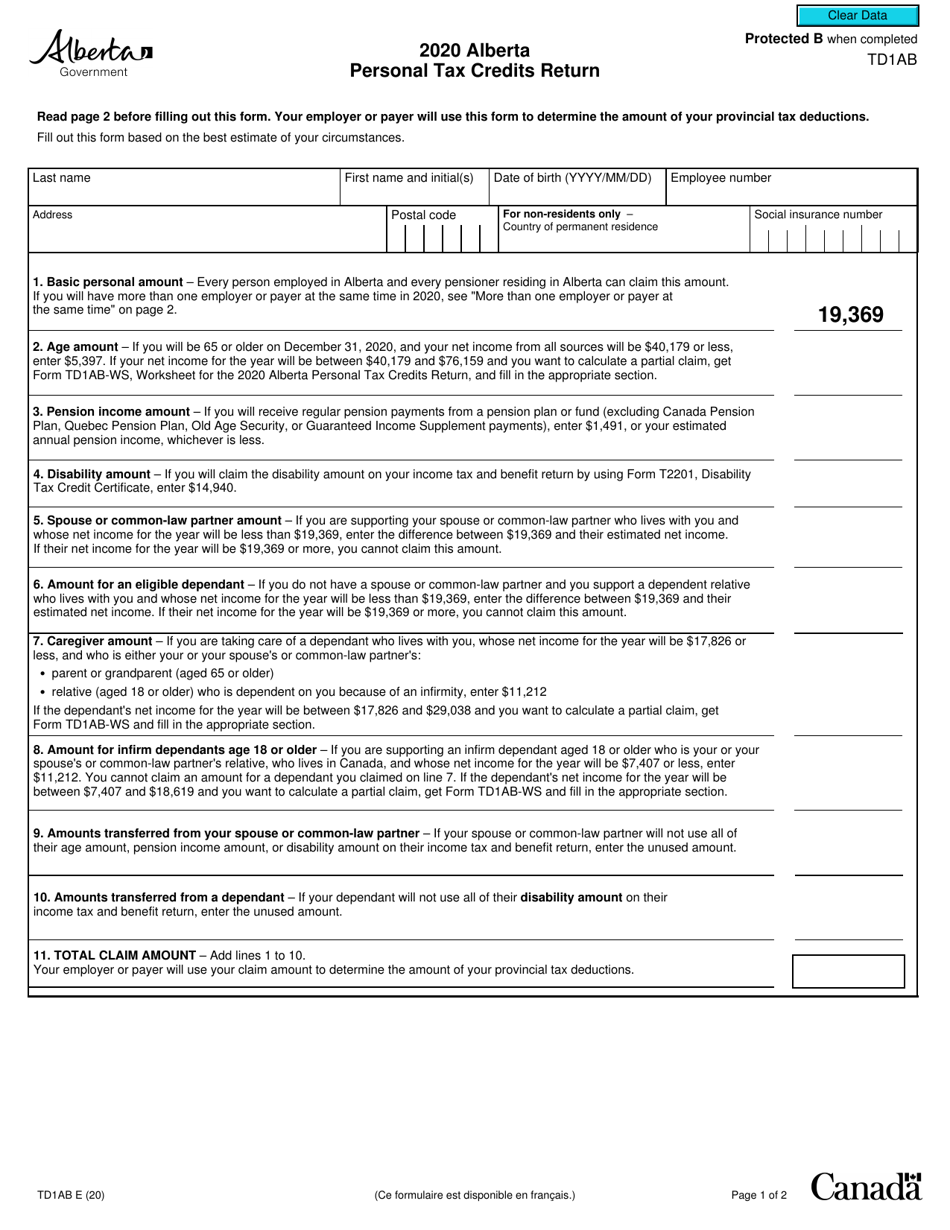

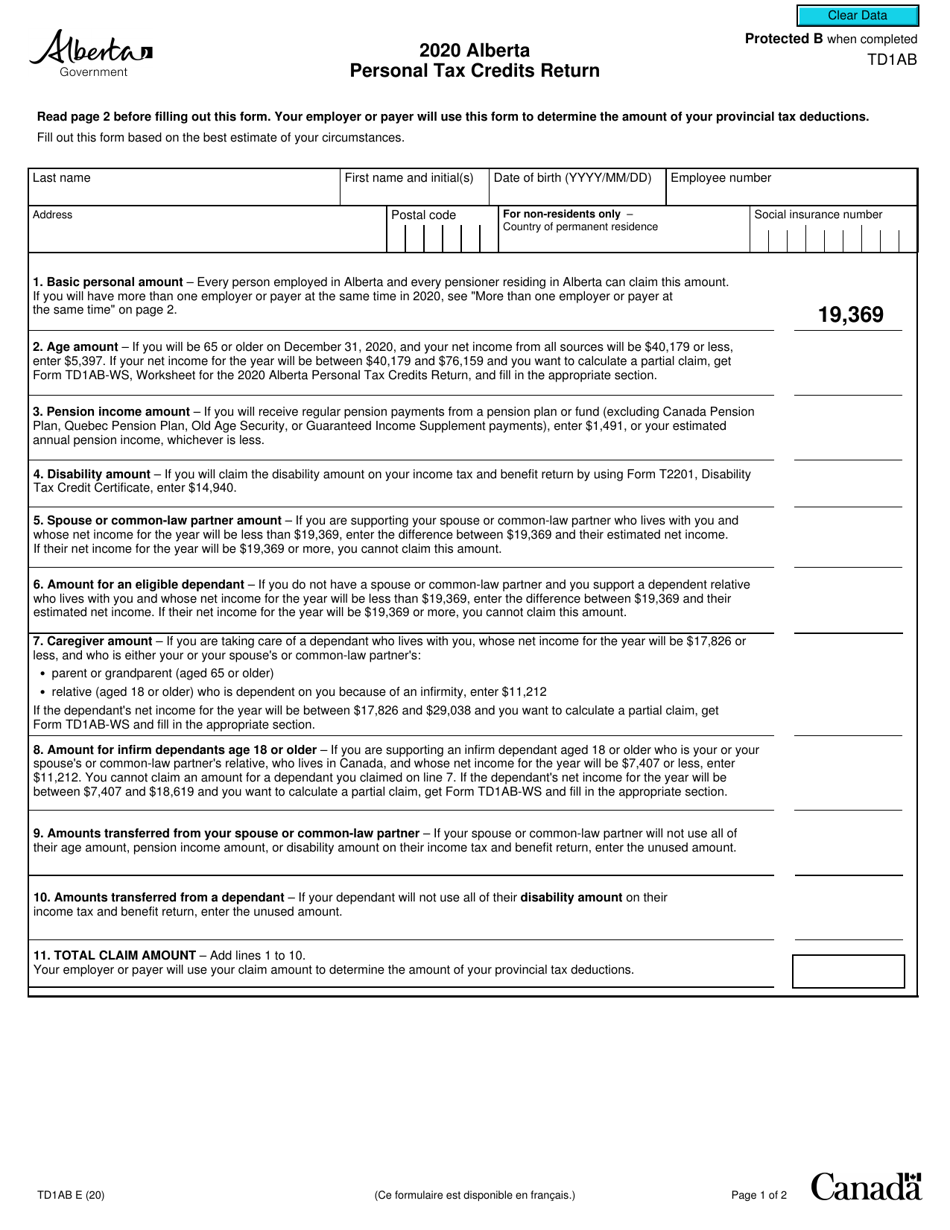

Recovery Rebate Credit 2023 Tax Return Form

Recovery Rebate Credit 2023 Tax Return Form -

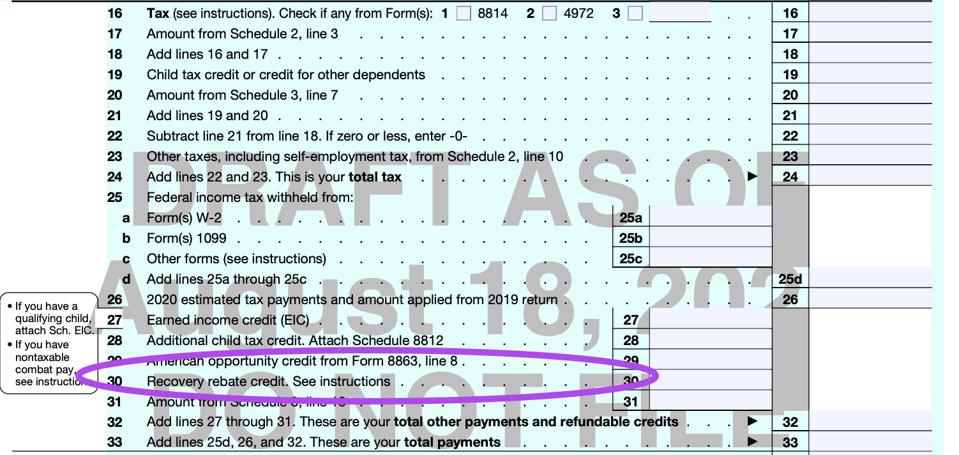

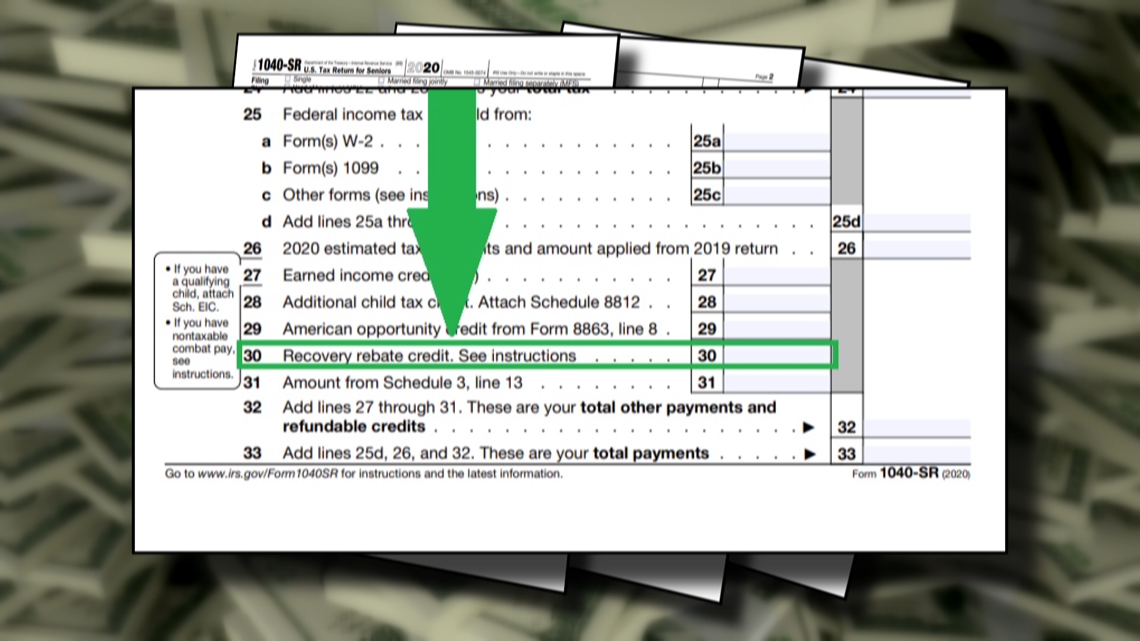

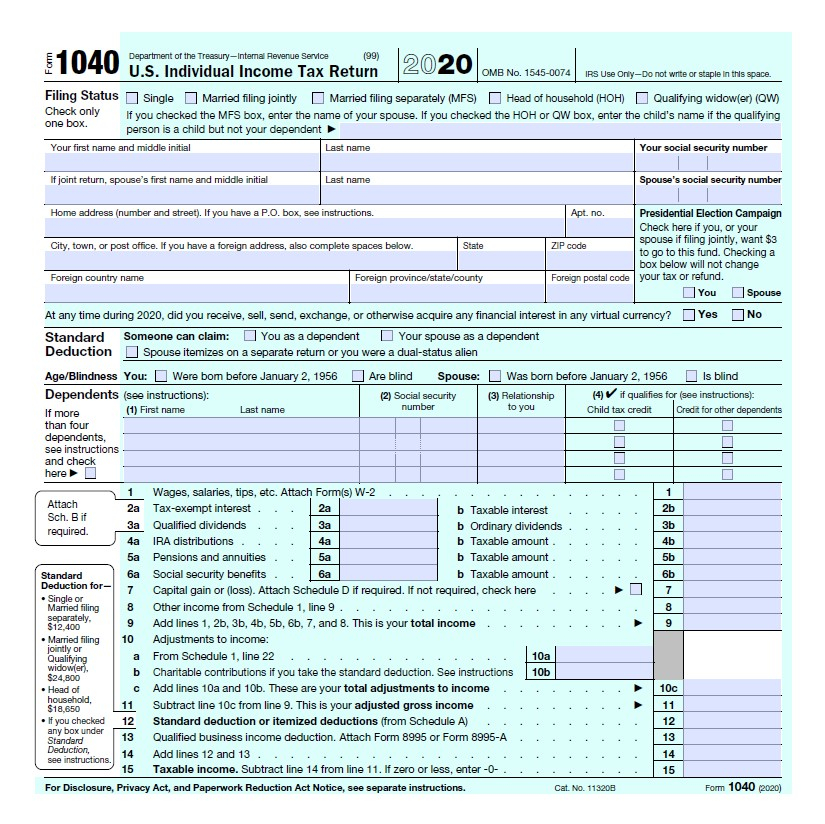

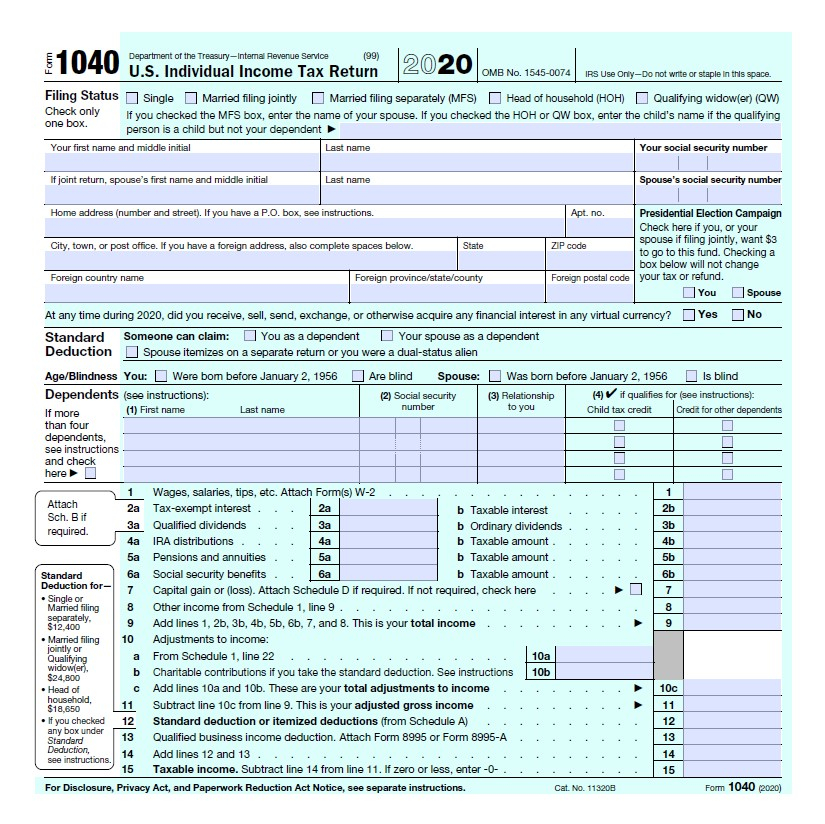

Both Form 1040 and Form 1040 SR included a line specifically for the Recovery Rebate Credit If you received a Recovery Rebate Credit it would have either increased the amount of

Page Last Reviewed or Updated 17 Nov 2023 IR 2023 217 Nov 17 2023 The Internal Revenue Service is reminding those who may be entitled to the

A Recovery Rebate Credit 2023 Tax Return Form or Recovery Rebate Credit 2023 Tax Return Form, in its most basic version, is an ad-hoc return to the customer after purchasing a certain product or service. This is a potent tool that companies use to attract buyers, increase sales and to promote certain products.

Types of Recovery Rebate Credit 2023 Tax Return Form

The Recovery Rebate Credit Calculator ShauntelRaya

The Recovery Rebate Credit Calculator ShauntelRaya

However since the stimulus payments were made in 2020 and 2021 the Recovery Rebate Credit must be claimed on your tax returns for those two years

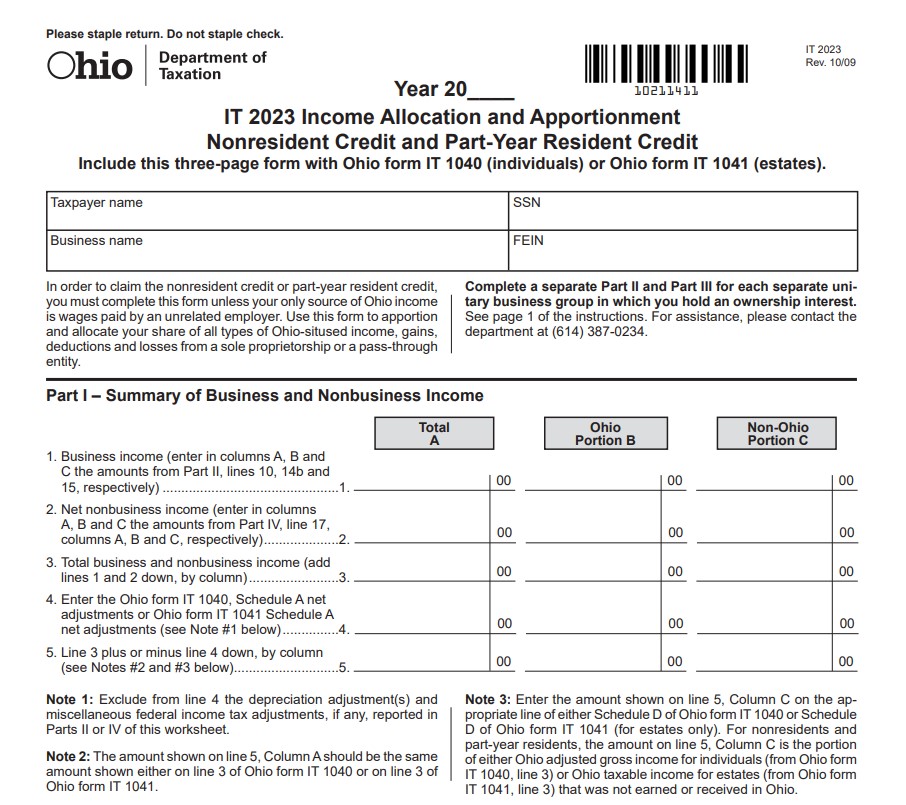

How To Claim the Recovery Rebate Credit on a Tax Return You will need to file your recovery rebate worksheet along with your 2020 or 2021 federal tax return

Cash Recovery Rebate Credit 2023 Tax Return Form

Cash Recovery Rebate Credit 2023 Tax Return Form are probably the most simple type of Recovery Rebate Credit 2023 Tax Return Form. Customers are given a certain amount of money after purchasing a product. This is often for the most expensive products like electronics or appliances.

Mail-In Recovery Rebate Credit 2023 Tax Return Form

Mail-in Recovery Rebate Credit 2023 Tax Return Form need customers to provide documents of purchase to claim their refund. They're more involved but offer significant savings.

Instant Recovery Rebate Credit 2023 Tax Return Form

Instant Recovery Rebate Credit 2023 Tax Return Form apply at the place of purchase, reducing prices immediately. Customers don't need to wait for their savings in this manner.

How Recovery Rebate Credit 2023 Tax Return Form Work

What Is The Recovery Rebate Credit CD Tax Financial

What Is The Recovery Rebate Credit CD Tax Financial

Who Is Eligible to Claim the Recovery Rebate Credit When considering the Recovery Rebate Credit the first question to answer is who was eligible for the

The Recovery Rebate Credit 2023 Tax Return Form Process

The process typically comprises a number of easy steps:

-

Purchase the item: First, you buy the product just as you would ordinarily.

-

Complete your Recovery Rebate Credit 2023 Tax Return Form template: You'll need to provide some data, such as your name, address and the purchase details, in order in order to claim your Recovery Rebate Credit 2023 Tax Return Form.

-

To submit the Recovery Rebate Credit 2023 Tax Return Form If you want to submit the Recovery Rebate Credit 2023 Tax Return Form, based on the type of Recovery Rebate Credit 2023 Tax Return Form, you may need to send in a form, or submit it online.

-

Wait for the company's approval: They is going to review your entry for compliance with reimbursement's terms and condition.

-

Redeem your Recovery Rebate Credit 2023 Tax Return Form When it's approved you'll receive the refund whether by check, prepaid card, or other option as per the terms of the offer.

Pros and Cons of Recovery Rebate Credit 2023 Tax Return Form

Advantages

-

Cost Savings Recovery Rebate Credit 2023 Tax Return Form could significantly decrease the price for a product.

-

Promotional Offers These deals encourage customers to try out new products or brands.

-

Improve Sales Recovery Rebate Credit 2023 Tax Return Form can help boost the sales of a business and increase its market share.

Disadvantages

-

Complexity The mail-in Recovery Rebate Credit 2023 Tax Return Form in particular they can be time-consuming and costly.

-

Extension Dates Many Recovery Rebate Credit 2023 Tax Return Form have extremely strict deadlines to submit.

-

The risk of non-payment: Some customers may lose their Recovery Rebate Credit 2023 Tax Return Form in the event that they don't follow the rules precisely.

Download Recovery Rebate Credit 2023 Tax Return Form

Download Recovery Rebate Credit 2023 Tax Return Form

FAQs

1. Are Recovery Rebate Credit 2023 Tax Return Form the same as discounts? No, Recovery Rebate Credit 2023 Tax Return Form are a partial refund after the purchase, whereas discounts cut the cost of purchase at point of sale.

2. Are there multiple Recovery Rebate Credit 2023 Tax Return Form I can get on the same product The answer is dependent on the terms that apply to the Recovery Rebate Credit 2023 Tax Return Form promotions and on the products acceptance. Certain businesses may allow this, whereas others will not.

3. How long will it take to receive an Recovery Rebate Credit 2023 Tax Return Form? The time frame can vary, but typically it will take a couple of weeks or a few months to receive your Recovery Rebate Credit 2023 Tax Return Form.

4. Do I have to pay taxes regarding Recovery Rebate Credit 2023 Tax Return Form values? most situations, Recovery Rebate Credit 2023 Tax Return Form amounts are not considered taxable income.

5. Should I be able to trust Recovery Rebate Credit 2023 Tax Return Form offers from lesser-known brands Consider doing some research and ensure that the brand giving the Recovery Rebate Credit 2023 Tax Return Form has a good reputation prior to making a purchase.

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

Check more sample of Recovery Rebate Credit 2023 Tax Return Form below

IT S NOT TOO LATE Claim A Recovery Rebate Credit To Get Your

What Is A Recovery Rebate Credit 2022 Rebate2022

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

How Do I Claim My Recovery Rebate Credit 2022 Leia Aqui How To Get

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

https://www.irs.gov/newsroom/irs-reminds-eligible...

Page Last Reviewed or Updated 17 Nov 2023 IR 2023 217 Nov 17 2023 The Internal Revenue Service is reminding those who may be entitled to the

https://www.irs.gov/newsroom/2021-recovery-rebate...

The only way to get a Recovery Rebate Credit is to file a 2021 tax return even if you are otherwise not required to file a tax return The fastest and most accurate

Page Last Reviewed or Updated 17 Nov 2023 IR 2023 217 Nov 17 2023 The Internal Revenue Service is reminding those who may be entitled to the

The only way to get a Recovery Rebate Credit is to file a 2021 tax return even if you are otherwise not required to file a tax return The fastest and most accurate

How Do I Claim My Recovery Rebate Credit 2022 Leia Aqui How To Get

What Is A Recovery Rebate Credit 2022 Rebate2022

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Aep Ohio Rebates 2023 Printable Rebate Form

Certificate Of Rent Paid 2014 Eligibility Requirements And Refund

Certificate Of Rent Paid 2014 Eligibility Requirements And Refund

The 600 Stimulus Could Affect Your Upcoming Tax Refund NBC2 News