In today's consumer-driven world people love a good bargain. One method to get substantial savings on your purchases can be achieved through Federal Government Solar Rebate Formss. Federal Government Solar Rebate Formss are a strategy for marketing employed by retailers and manufacturers for offering customers a percentage discount on purchases they made after they have placed them. In this article, we'll explore the world of Federal Government Solar Rebate Formss. We'll look at the nature of them as well as how they work and how you can maximize the value of these incentives.

Get Latest Federal Government Solar Rebate Forms Below

Federal Government Solar Rebate Forms

Federal Government Solar Rebate Forms -

Web 8 sept 2022 nbsp 0183 32 Federal Solar Tax Credit Resources The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar

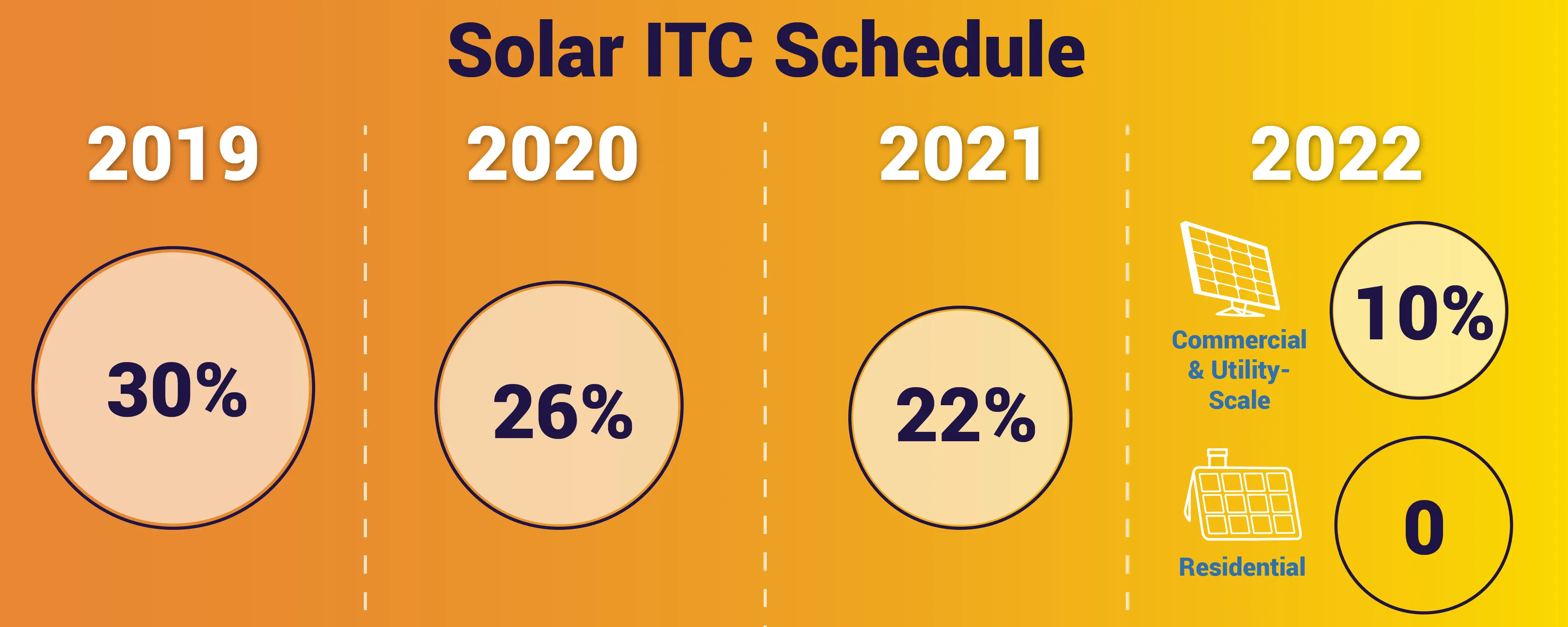

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

A Federal Government Solar Rebate Forms in its simplest definition, is a payment to a consumer after they've bought a product or service. It's an effective way utilized by businesses to attract customers, boost sales, and advertise specific products.

Types of Federal Government Solar Rebate Forms

Federal State Local Rebates Are Available Now Home Solar Rebate

Federal State Local Rebates Are Available Now Home Solar Rebate

Web The following expenses are included Solar PV panels or PV cells used to power an attic fan but not the fan itself Contractor labor costs for onsite preparation assembly or

Web 26 juil 2023 nbsp 0183 32 Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in

Cash Federal Government Solar Rebate Forms

Cash Federal Government Solar Rebate Forms are probably the most simple type of Federal Government Solar Rebate Forms. Customers receive a specified amount of money back after purchasing a item. This is often for high-ticket items like electronics or appliances.

Mail-In Federal Government Solar Rebate Forms

Mail-in Federal Government Solar Rebate Forms require consumers to present the proof of purchase to be eligible for their refund. They are a bit more involved, however they can yield significant savings.

Instant Federal Government Solar Rebate Forms

Instant Federal Government Solar Rebate Forms are applied at the point of sale and reduce your purchase cost instantly. Customers don't need to wait around for savings with this type.

How Federal Government Solar Rebate Forms Work

Solar Rebates Benefit SOLARInstallGURU Advantages Of Solar Energy Blog

Solar Rebates Benefit SOLARInstallGURU Advantages Of Solar Energy Blog

Web Energy gov Tax Credits Rebates amp Savings Please visit the Database of State Incentives for Renewables amp Efficiency website DSIRE for the latest state and federal incentives

The Federal Government Solar Rebate Forms Process

The procedure typically consists of a number of easy steps:

-

When you buy the product then, you buy the item exactly as you would normally.

-

Complete the Federal Government Solar Rebate Forms template: You'll have submit some information including your name, address, along with the purchase details, to be eligible for a Federal Government Solar Rebate Forms.

-

You must submit the Federal Government Solar Rebate Forms It is dependent on the type of Federal Government Solar Rebate Forms there may be a requirement to mail a Federal Government Solar Rebate Forms form in or upload it online.

-

Wait for the company's approval: They will examine your application to make sure it is in line with the Federal Government Solar Rebate Forms's terms and conditions.

-

Accept your Federal Government Solar Rebate Forms Once you've received your approval, you'll receive the refund in the form of a check, prepaid card, or other procedure specified by the deal.

Pros and Cons of Federal Government Solar Rebate Forms

Advantages

-

Cost Savings Federal Government Solar Rebate Forms could significantly cut the price you pay for a product.

-

Promotional Offers: They encourage customers to try new products and brands.

-

Increase Sales The benefits of a Federal Government Solar Rebate Forms can improve an organization's sales and market share.

Disadvantages

-

Complexity: Mail-in Federal Government Solar Rebate Forms, particularly are often time-consuming and time-consuming.

-

Day of Expiration A lot of Federal Government Solar Rebate Forms have certain deadlines for submitting.

-

Risk of Non-Payment Customers may have their Federal Government Solar Rebate Forms delayed if they do not follow the rules precisely.

Download Federal Government Solar Rebate Forms

Download Federal Government Solar Rebate Forms

FAQs

1. Are Federal Government Solar Rebate Forms equivalent to discounts? Not necessarily, as Federal Government Solar Rebate Forms are a partial refund after purchase whereas discounts will reduce their price at time of sale.

2. Can I use multiple Federal Government Solar Rebate Forms on the same item? It depends on the terms applicable to Federal Government Solar Rebate Forms incentives and the specific product's ability to qualify. Certain companies may allow the use of multiple Federal Government Solar Rebate Forms, whereas other won't.

3. How long will it take to get an Federal Government Solar Rebate Forms? The period can vary, but typically it will take anywhere from a couple of weeks to a couple of months for you to receive your Federal Government Solar Rebate Forms.

4. Do I need to pay tax when I receive Federal Government Solar Rebate Forms values? the majority of circumstances, Federal Government Solar Rebate Forms amounts are not considered to be taxable income.

5. Should I be able to trust Federal Government Solar Rebate Forms offers from brands that aren't well-known Do I need to conduct a thorough research and ensure that the business which is providing the Federal Government Solar Rebate Forms has a good reputation prior to making an investment.

Federal Government Solar Tax Credit KnowYourGovernment

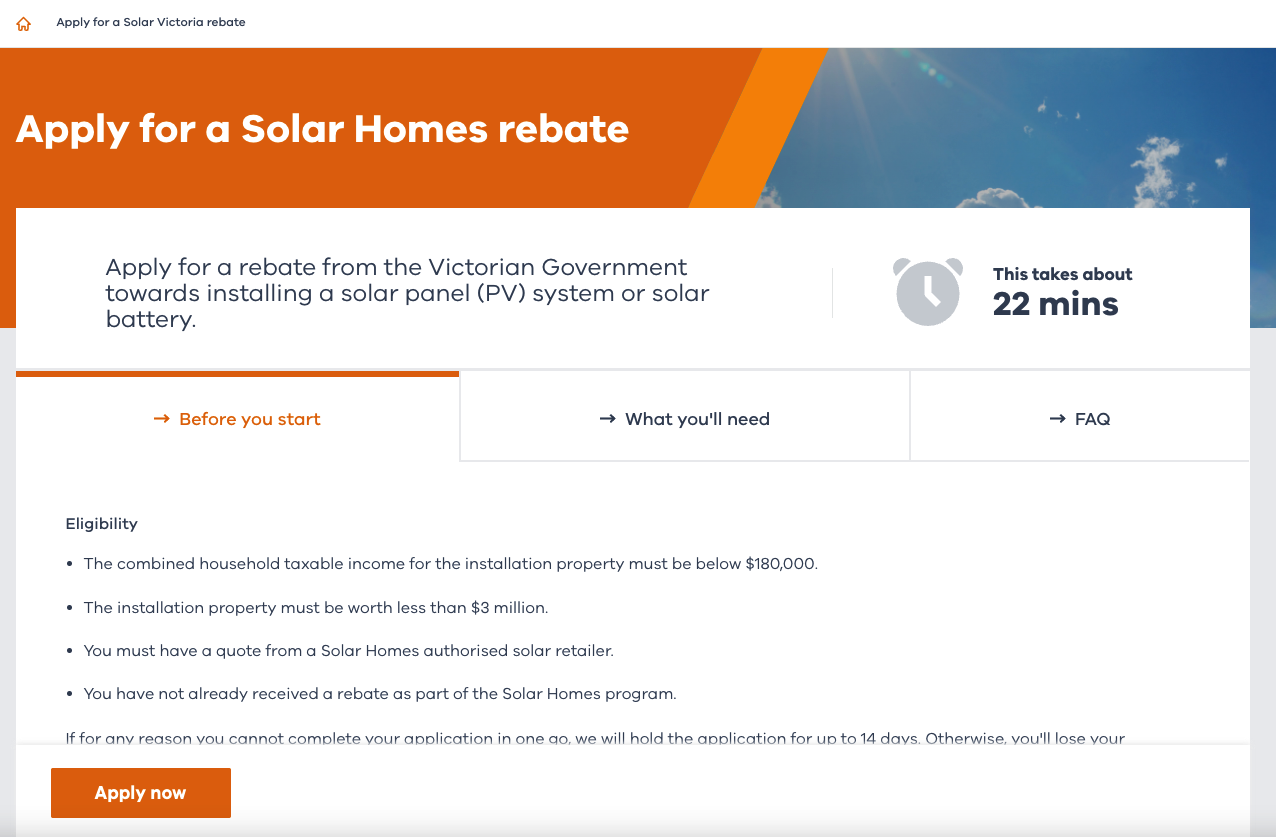

Solar Rebate Victoria 2022 Printable Rebate Form

Check more sample of Federal Government Solar Rebate Forms below

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

How To Claim The Solar Investment Tax Credit YSG Solar YSG Solar

2020 Guide To Oregon Solar Incentives Rebates Tax Credits More

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit...

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

https://www.energy.gov/sites/default/files/2021/02/f82/Guide …

Web For example if your solar PV system was installed before December 31 2022 cost 18 000 and your utility gave you a one time rebate of 1 000 for installing the system

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

Web For example if your solar PV system was installed before December 31 2022 cost 18 000 and your utility gave you a one time rebate of 1 000 for installing the system

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

How To Claim The Solar Investment Tax Credit YSG Solar YSG Solar

2020 Guide To Oregon Solar Incentives Rebates Tax Credits More

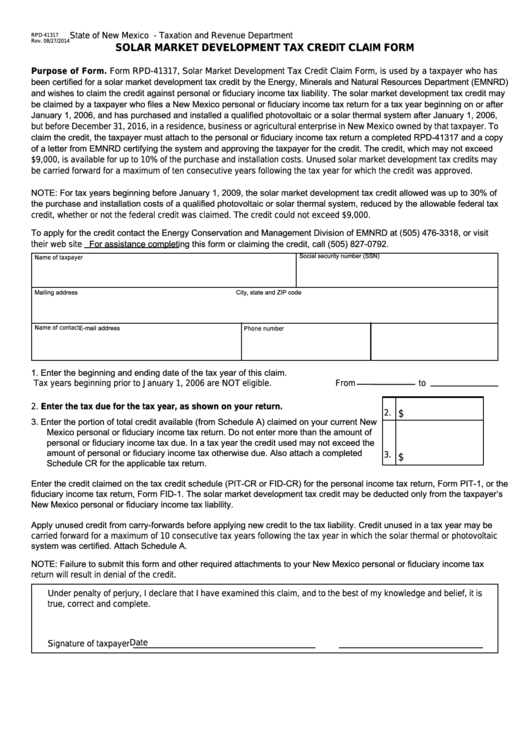

Fillable Form Rpd 41317 New Mexico Solar Market Development Tax

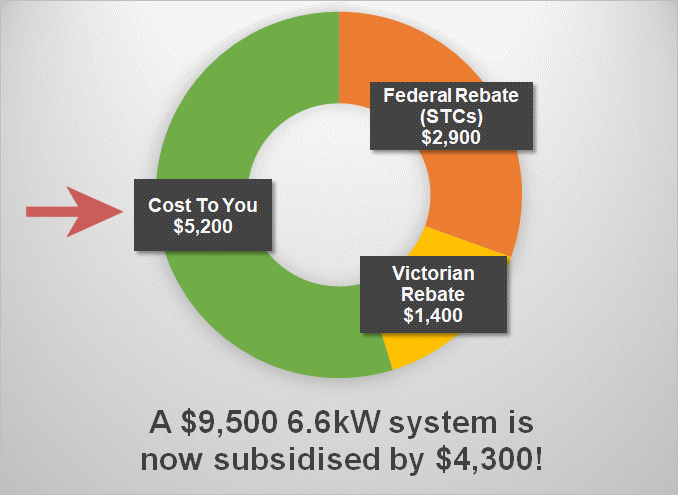

Latest Solar Rebates And Payments

Latest Solar Rebates And Payments

Victorian Solar Rebate Explained SolarQuotes