In this modern-day world of consumers everyone is looking for a great deal. One method to get significant savings from your purchases is via Irs Form 1040 Recovery Rebate Credit Instructionss. Irs Form 1040 Recovery Rebate Credit Instructionss are a strategy for marketing that retailers and manufacturers use to offer customers a partial refund on purchases made after they've created them. In this post, we'll go deeper into the realm of Irs Form 1040 Recovery Rebate Credit Instructionss. We'll look at what they are their purpose, how they function and how you can maximise the savings you can make by using these cost-effective incentives.

Get Latest Irs Form 1040 Recovery Rebate Credit Instructions Below

Irs Form 1040 Recovery Rebate Credit Instructions

Irs Form 1040 Recovery Rebate Credit Instructions -

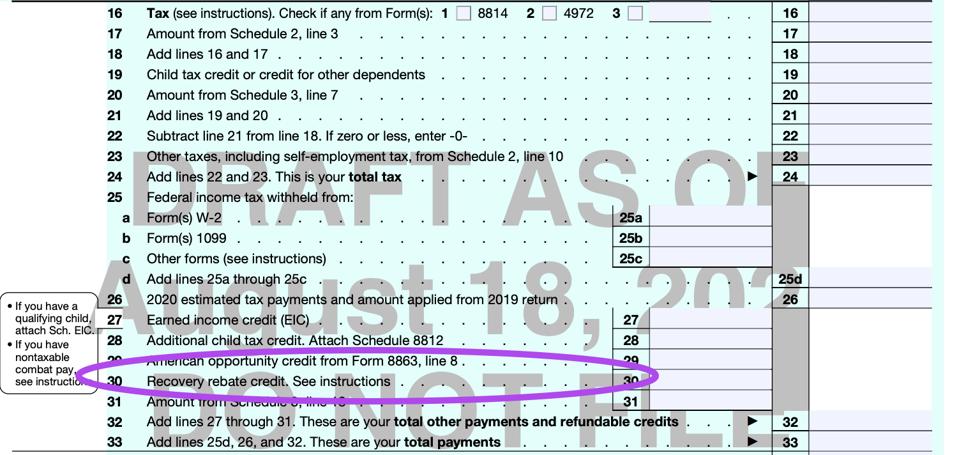

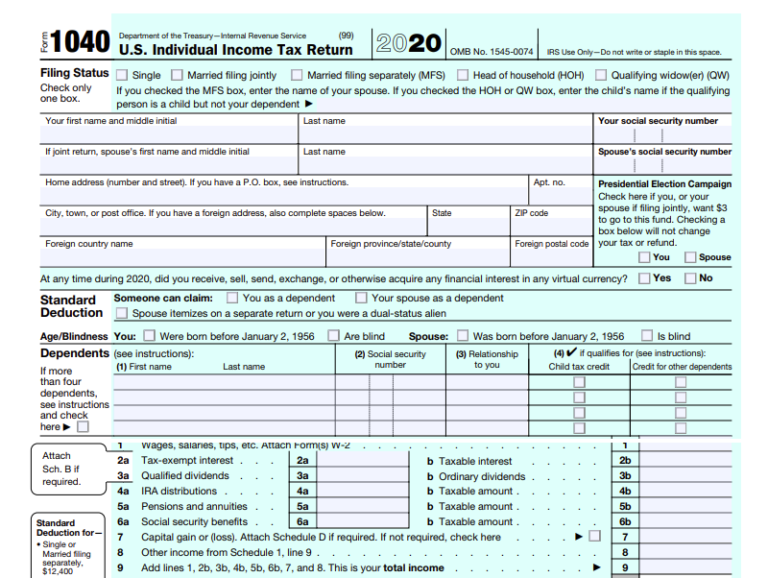

Line Instructions for Forms 1040 and 1040 SR Filing Status Name and Address Social Security Number SSN Dependents Qualifying Child for Child Tax Credit and

You will need the tax year s and amount s of the Economic Impact Payments you received to accurately calculate the Recovery Rebate Credit Enter the

A Irs Form 1040 Recovery Rebate Credit Instructions as it is understood in its simplest model, refers to a partial payment to a consumer after purchasing a certain product or service. It's a powerful instrument utilized by businesses to attract customers, increase sales, and market specific products.

Types of Irs Form 1040 Recovery Rebate Credit Instructions

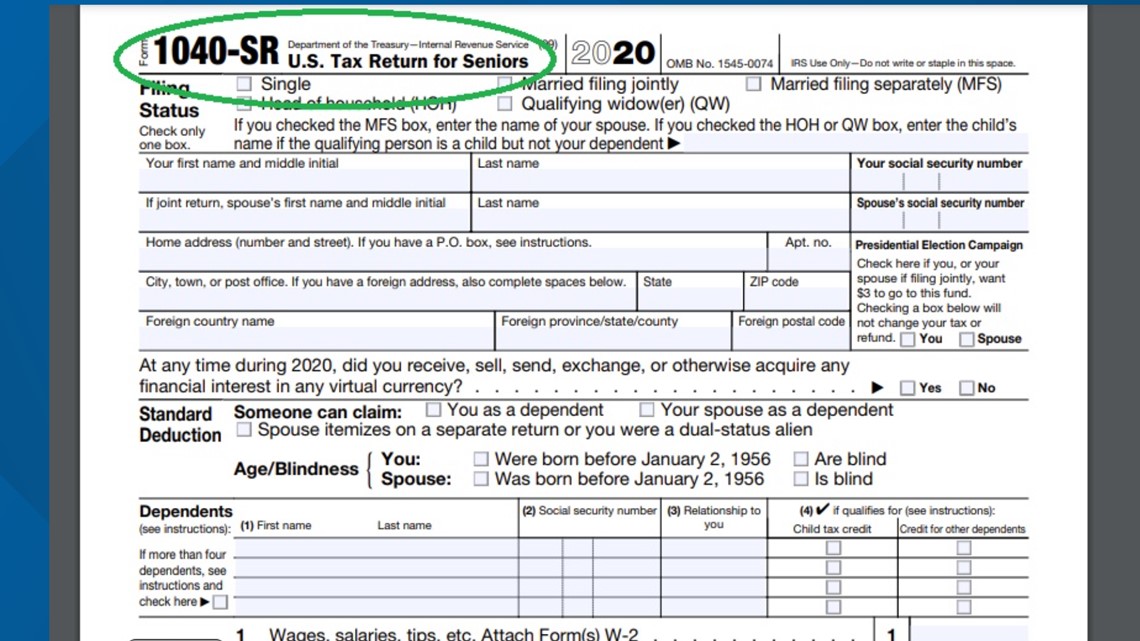

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

If you must file an amended return to claim the Recovery Rebate Credit use the worksheet on page 59 of the 2020 instructions for Form 1040 and Form 1040

If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form 1040 U S Individual Income Tax

Cash Irs Form 1040 Recovery Rebate Credit Instructions

Cash Irs Form 1040 Recovery Rebate Credit Instructions are a simple type of Irs Form 1040 Recovery Rebate Credit Instructions. The customer receives a particular amount of cash back after buying a product. These are typically applied to high-ticket items like electronics or appliances.

Mail-In Irs Form 1040 Recovery Rebate Credit Instructions

Customers who want to receive mail-in Irs Form 1040 Recovery Rebate Credit Instructions must send in proof of purchase in order to receive the money. They're more complicated, but they can provide huge savings.

Instant Irs Form 1040 Recovery Rebate Credit Instructions

Instant Irs Form 1040 Recovery Rebate Credit Instructions are credited at the points of sale. This reduces the price of your purchase instantly. Customers don't need to wait for their savings when they purchase this type of Irs Form 1040 Recovery Rebate Credit Instructions.

How Irs Form 1040 Recovery Rebate Credit Instructions Work

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim

The Irs Form 1040 Recovery Rebate Credit Instructions Process

The procedure typically consists of a few easy steps:

-

Buy the product: At first then, you buy the item the way you normally do.

-

Complete this Irs Form 1040 Recovery Rebate Credit Instructions request form. You'll need to provide some information like your name, address, and details about your purchase, in order in order to take advantage of your Irs Form 1040 Recovery Rebate Credit Instructions.

-

Send in the Irs Form 1040 Recovery Rebate Credit Instructions Based on the kind of Irs Form 1040 Recovery Rebate Credit Instructions you may have to fill out a paper form or make it available online.

-

Wait for the company's approval: They will review your submission to make sure that it's in accordance with the terms and conditions of the Irs Form 1040 Recovery Rebate Credit Instructions.

-

Get your Irs Form 1040 Recovery Rebate Credit Instructions After approval, you'll receive a refund using a check or prepaid card, or by another method that is specified in the offer.

Pros and Cons of Irs Form 1040 Recovery Rebate Credit Instructions

Advantages

-

Cost Savings The use of Irs Form 1040 Recovery Rebate Credit Instructions can greatly cut the price you pay for products.

-

Promotional Offers Incentivize customers to test new products or brands.

-

Accelerate Sales Reward programs can boost the company's sales as well as market share.

Disadvantages

-

Complexity Irs Form 1040 Recovery Rebate Credit Instructions that are mail-in, particularly the case of HTML0, can be a hassle and demanding.

-

Expiration Dates: Many Irs Form 1040 Recovery Rebate Credit Instructions have rigid deadlines to submit.

-

Risk of not receiving payment Some customers might not be able to receive their Irs Form 1040 Recovery Rebate Credit Instructions if they don't adhere to the rules precisely.

Download Irs Form 1040 Recovery Rebate Credit Instructions

Download Irs Form 1040 Recovery Rebate Credit Instructions

FAQs

1. Are Irs Form 1040 Recovery Rebate Credit Instructions equivalent to discounts? No, Irs Form 1040 Recovery Rebate Credit Instructions offer a partial refund upon purchase, and discounts are a reduction of the purchase price at moment of sale.

2. Can I use multiple Irs Form 1040 Recovery Rebate Credit Instructions on the same product The answer is dependent on the terms in the Irs Form 1040 Recovery Rebate Credit Instructions offer and also the item's quality and eligibility. Certain companies might permit it, and some don't.

3. How long does it take to receive an Irs Form 1040 Recovery Rebate Credit Instructions? The period can vary, but typically it will be anywhere from a few weeks up to a few months to receive your Irs Form 1040 Recovery Rebate Credit Instructions.

4. Do I need to pay taxes of Irs Form 1040 Recovery Rebate Credit Instructions quantities? the majority of situations, Irs Form 1040 Recovery Rebate Credit Instructions amounts are not considered to be taxable income.

5. Should I be able to trust Irs Form 1040 Recovery Rebate Credit Instructions offers from brands that aren't well-known It is essential to investigate and verify that the brand providing the Irs Form 1040 Recovery Rebate Credit Instructions is reputable before making an investment.

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

How Do I Claim The Recovery Rebate Credit On My Ta

Check more sample of Irs Form 1040 Recovery Rebate Credit Instructions below

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

1040 Recovery Rebate Credit Drake20

Solved Recovery Rebate Credit Error On 1040 Instructions

The Recovery Rebate Credit Get Your Full Stimulus Check Payment With

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

https://www.irs.gov/newsroom/recovery-rebate-credit

You will need the tax year s and amount s of the Economic Impact Payments you received to accurately calculate the Recovery Rebate Credit Enter the

https://www.irs.gov/newsroom/2021-recovery-rebate...

Below are frequently asked questions about the 2021 Recovery Rebate Credit separated by topic Please do not call the IRS Topic A General Information

You will need the tax year s and amount s of the Economic Impact Payments you received to accurately calculate the Recovery Rebate Credit Enter the

Below are frequently asked questions about the 2021 Recovery Rebate Credit separated by topic Please do not call the IRS Topic A General Information

The Recovery Rebate Credit Get Your Full Stimulus Check Payment With

1040 Recovery Rebate Credit Drake20

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

How To Claim The Stimulus Money On Your Tax Return Wltx

How To Claim The Stimulus Money On Your Tax Return Wltx

Tax Time Guide Didn t Get Economic Impact Payments Check Eligibility