In today's world of consumerism everyone is looking for a great bargain. One of the ways to enjoy substantial savings on your purchases can be achieved through Irs Credit Rebate Forms. Irs Credit Rebate Forms can be a way of marketing that retailers and manufacturers use to offer customers a payment on their purchases, after they have taken them. In this article, we'll look into the world of Irs Credit Rebate Forms. We'll explore what they are about, how they work, and how to maximize your savings through these efficient incentives.

Get Latest Irs Credit Rebate Form Below

Irs Credit Rebate Form

Irs Credit Rebate Form -

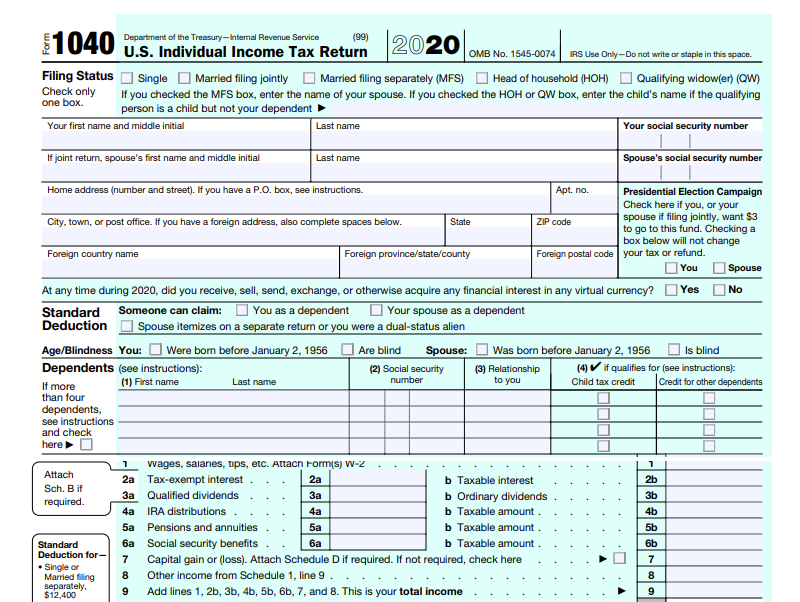

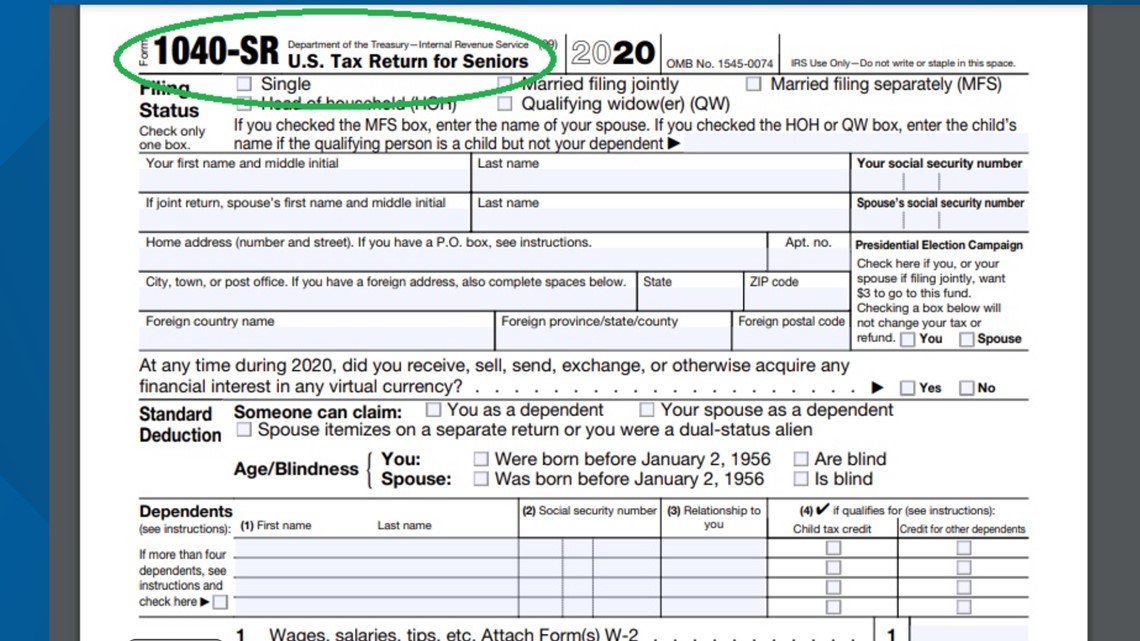

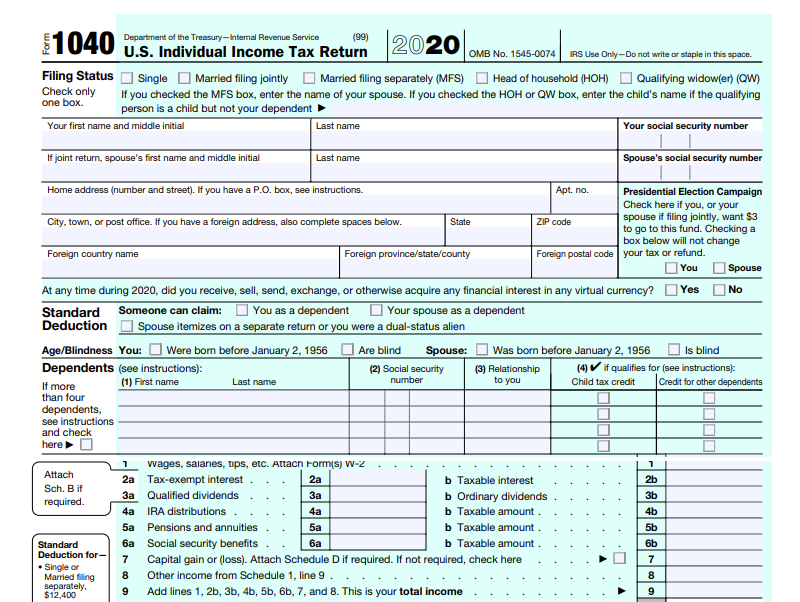

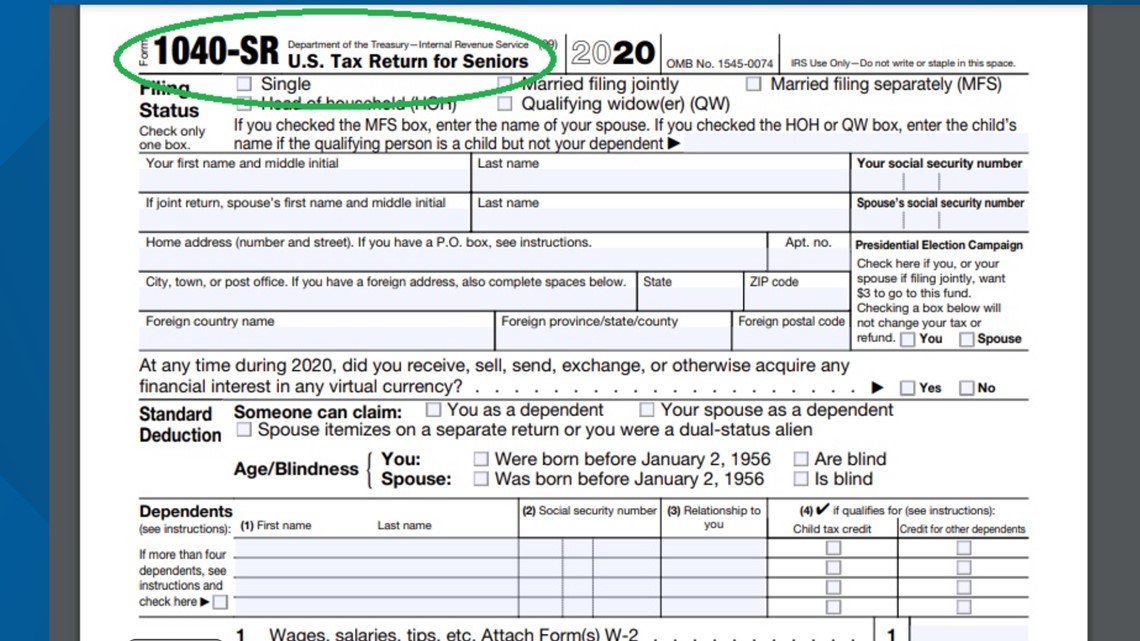

A3 You must file a 2020 tax return to claim a Recovery Rebate Credit even if you don t usually file a tax return The Recovery Rebate Credit Worksheet in the 2020 Form 1040 and Form 1040 SR instructions PDF can help determine if you are eligible for the credit The fastest way to get your tax refund is to have it direct deposited

The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your 2021 Recovery Rebate Credit will reduce any tax you owe for

A Irs Credit Rebate Form the simplest definition, is a cash refund provided to customers when they purchase a product or service. It's a highly effective tool used by companies to attract customers, increase sales and promote specific products.

Types of Irs Credit Rebate Form

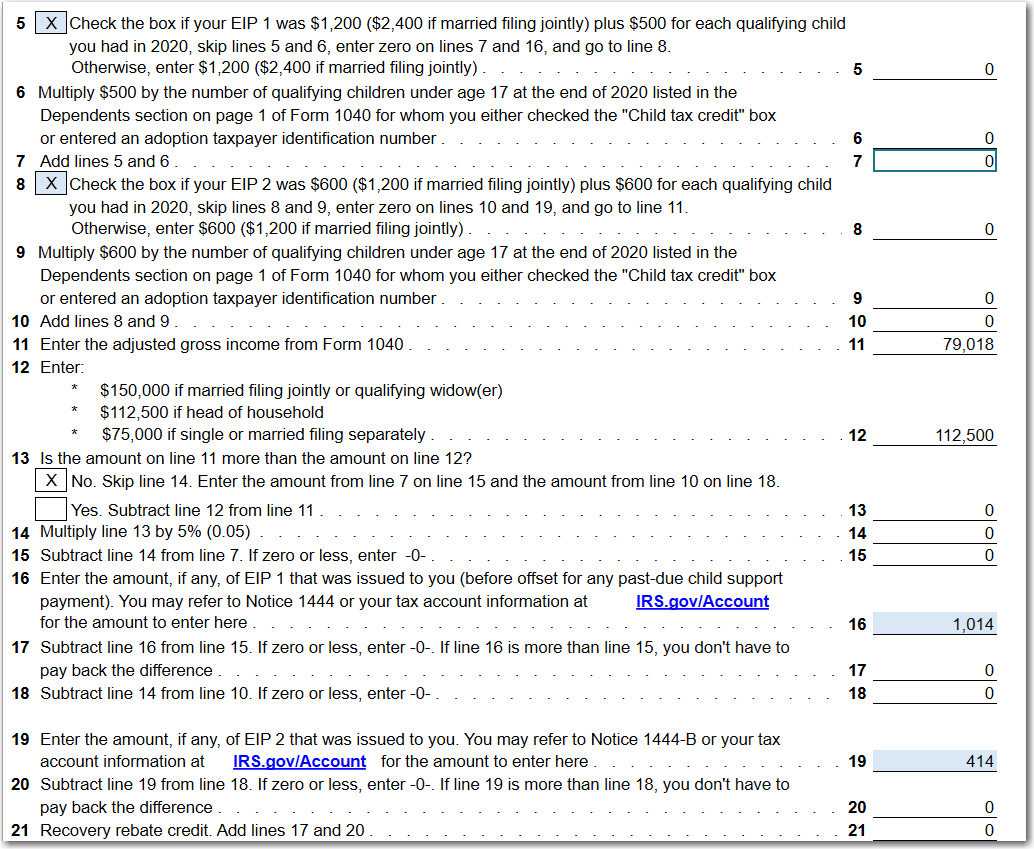

Recovery Rebate Credit 2020 Calculator KwameDawson

Recovery Rebate Credit 2020 Calculator KwameDawson

The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible for the credit If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

If you re eligible to claim the 2020 Recovery Rebate Credit you must file a tax return by May 17 2024 to claim the credit If you re eligible to claim the 2021 Recovery Rebate credit you must file a tax return by April 15 2025 to claim the credit

Cash Irs Credit Rebate Form

Cash Irs Credit Rebate Form are a simple type of Irs Credit Rebate Form. The customer receives a particular amount of money after buying a product. These are typically for the most expensive products like electronics or appliances.

Mail-In Irs Credit Rebate Form

Mail-in Irs Credit Rebate Form require the customer to present an evidence of purchase for the money. They're a little more involved but can offer significant savings.

Instant Irs Credit Rebate Form

Instant Irs Credit Rebate Form are made at the points of sale. This reduces your purchase cost instantly. Customers don't have to wait long for savings with this type.

How Irs Credit Rebate Form Work

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020 The initial stimulus payment provided up to 1 200 per qualifying adult and up to 500 per qualifying dependent Most of these payments went out to recipients in mid 2020

The Irs Credit Rebate Form Process

It usually consists of a few easy steps:

-

Buy the product: At first then, you buy the item the way you normally do.

-

Complete the Irs Credit Rebate Form paper: You'll need to fill in some information, such as your name, address and details about your purchase, in order to make a claim for your Irs Credit Rebate Form.

-

Send in the Irs Credit Rebate Form In accordance with the kind of Irs Credit Rebate Form there may be a requirement to send in a form, or send it via the internet.

-

Wait for approval: The business will review your submission to confirm that it complies with the requirements of the Irs Credit Rebate Form.

-

You will receive your Irs Credit Rebate Form If it is approved, you'll get your refund, via check, prepaid card, or any other way specified in the offer.

Pros and Cons of Irs Credit Rebate Form

Advantages

-

Cost savings Irs Credit Rebate Form could significantly decrease the price for an item.

-

Promotional Deals Customers are enticed to try out new products or brands.

-

Accelerate Sales A Irs Credit Rebate Form program can boost companies' sales and market share.

Disadvantages

-

Complexity: Mail-in Irs Credit Rebate Form, particularly may be lengthy and lengthy.

-

Days of expiration Most Irs Credit Rebate Form come with extremely strict deadlines to submit.

-

The risk of non-payment Customers may not receive their Irs Credit Rebate Form if they don't adhere to the requirements exactly.

Download Irs Credit Rebate Form

Download Irs Credit Rebate Form

FAQs

1. Are Irs Credit Rebate Form the same as discounts? No, Irs Credit Rebate Form offer a partial refund upon purchase whereas discounts will reduce the purchase price at moment of sale.

2. Are there Irs Credit Rebate Form that can be used on the same item What is the best way to do it? It's contingent on conditions and conditions of Irs Credit Rebate Form offers and the product's acceptance. Certain companies may allow it, while others won't.

3. What is the time frame to receive a Irs Credit Rebate Form? The period varies, but it can take several weeks to a few months before you receive your Irs Credit Rebate Form.

4. Do I have to pay tax on Irs Credit Rebate Form montants? the majority of circumstances, Irs Credit Rebate Form amounts are not considered taxable income.

5. Should I be able to trust Irs Credit Rebate Form offers from lesser-known brands It's crucial to research to ensure that the name offering the Irs Credit Rebate Form is trustworthy prior to making an purchase.

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

Check more sample of Irs Credit Rebate Form below

What Is The Recovery Rebate Credit CD Tax Financial

Tax Time Guide Didn t Get Economic Impact Payments Check Eligibility

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

How To Calculate Form 8962 Printable Form Templates And Letter

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

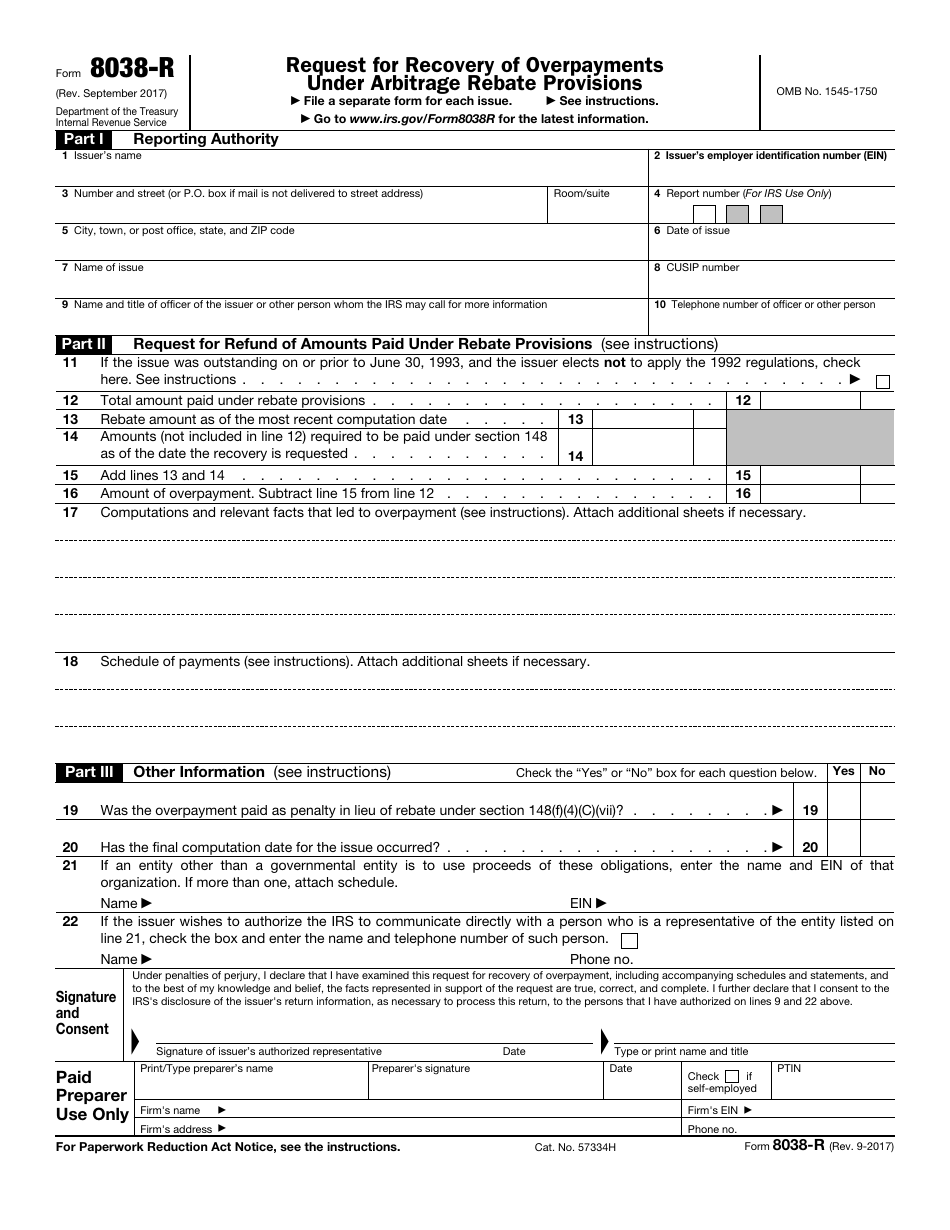

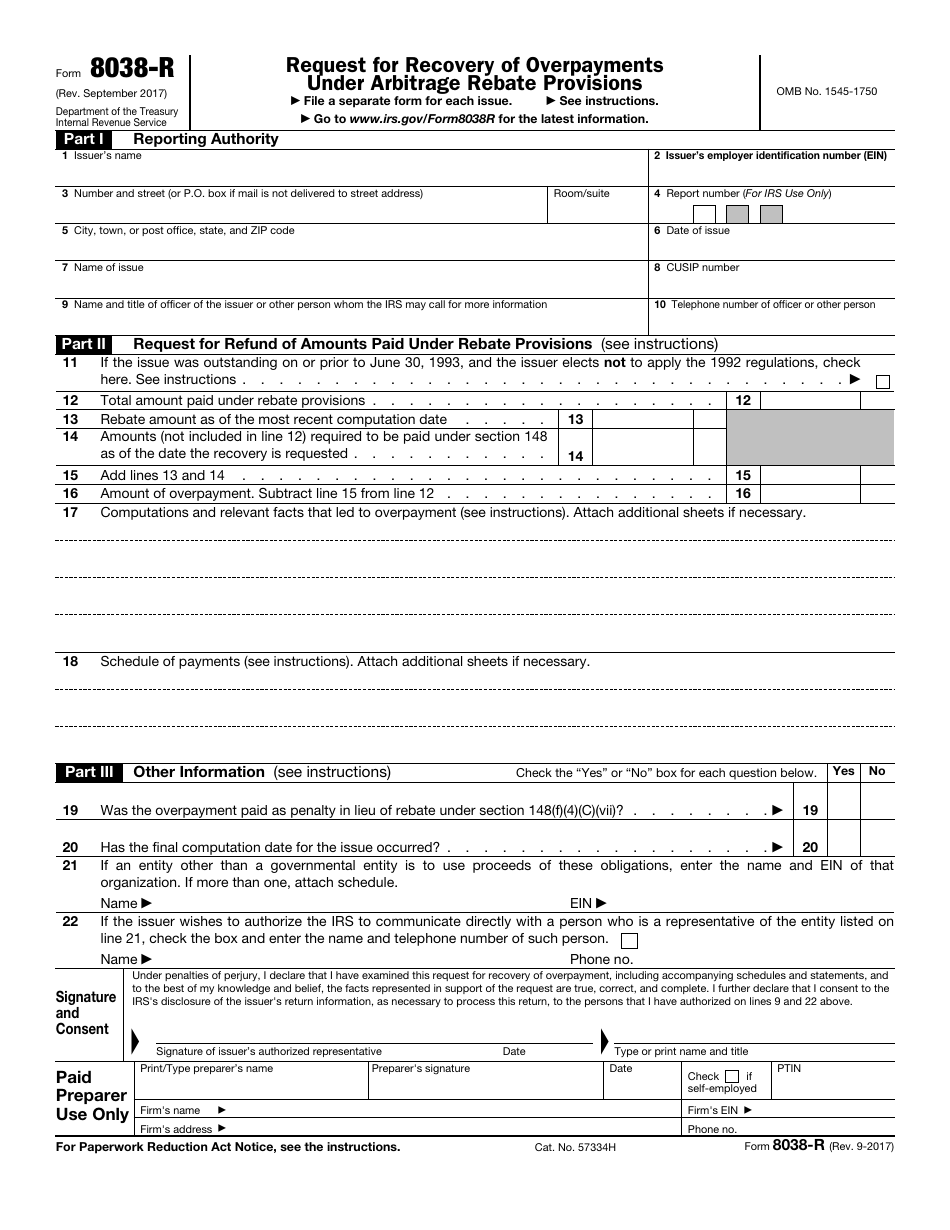

IRS Form 8038 R Download Fillable PDF Or Fill Online Request For

Do You Have To Claim Ssi On Your Taxes

https://www.irs.gov/newsroom/2021-recovery-rebate...

The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your 2021 Recovery Rebate Credit will reduce any tax you owe for

https://www.irs.gov/coronavirus/coronavirus-tax...

2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When your Third Economic Impact Payment is scheduled find when and how we sent your Payment Where s My Refund An online tool that will track your tax refund Online Payment Agreements Apply for a payment plan to pay your balance over time

The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your 2021 Recovery Rebate Credit will reduce any tax you owe for

2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When your Third Economic Impact Payment is scheduled find when and how we sent your Payment Where s My Refund An online tool that will track your tax refund Online Payment Agreements Apply for a payment plan to pay your balance over time

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

How To Calculate Form 8962 Printable Form Templates And Letter

Tax Time Guide Didn t Get Economic Impact Payments Check Eligibility

IRS Form 8038 R Download Fillable PDF Or Fill Online Request For

Do You Have To Claim Ssi On Your Taxes

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Free File 1040 Form 2021 Recovery Rebate

Free File 1040 Form 2021 Recovery Rebate

2022 Irs Recovery Rebate Credit Worksheet Rebate2022