In our current world of high-end consumer goods everyone is looking for a great bargain. One method to get substantial savings when you shop is with Irs 1040 Form Recovery Rebate Credits. They are a form of marketing employed by retailers and manufacturers in order to offer customers a small refund on their purchases after they've created them. In this post, we'll dive into the world Irs 1040 Form Recovery Rebate Credits, looking at what they are about, how they work, and how to maximize the savings you can make by using these cost-effective incentives.

Get Latest Irs 1040 Form Recovery Rebate Credit Below

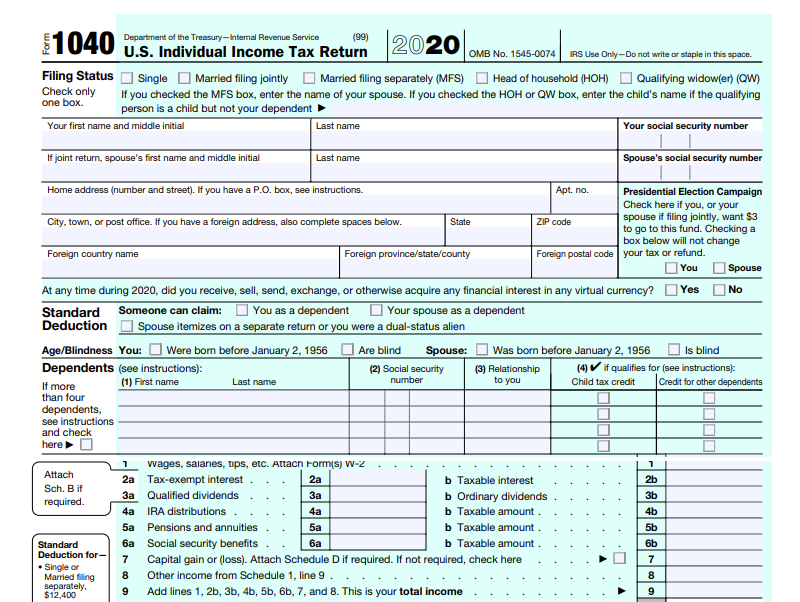

Irs 1040 Form Recovery Rebate Credit

Irs 1040 Form Recovery Rebate Credit -

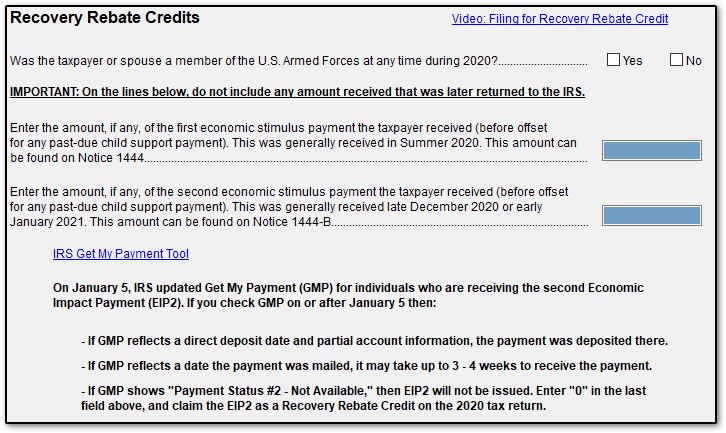

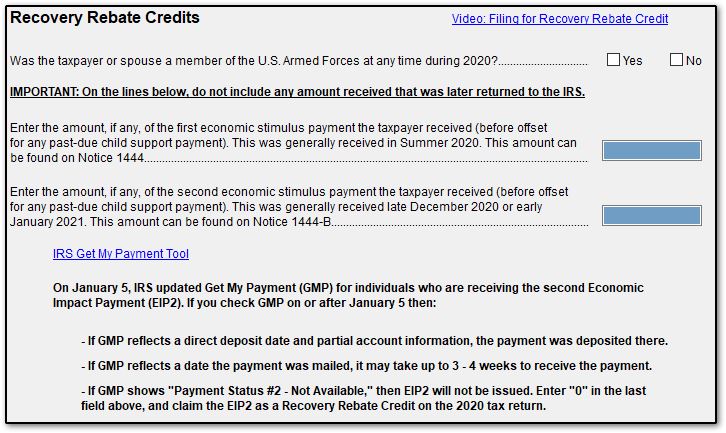

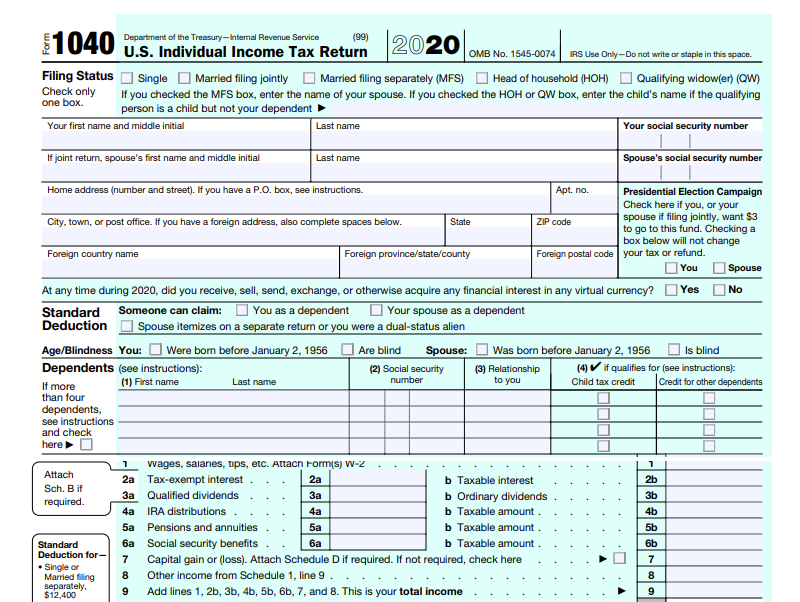

Web 10 Dez 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020

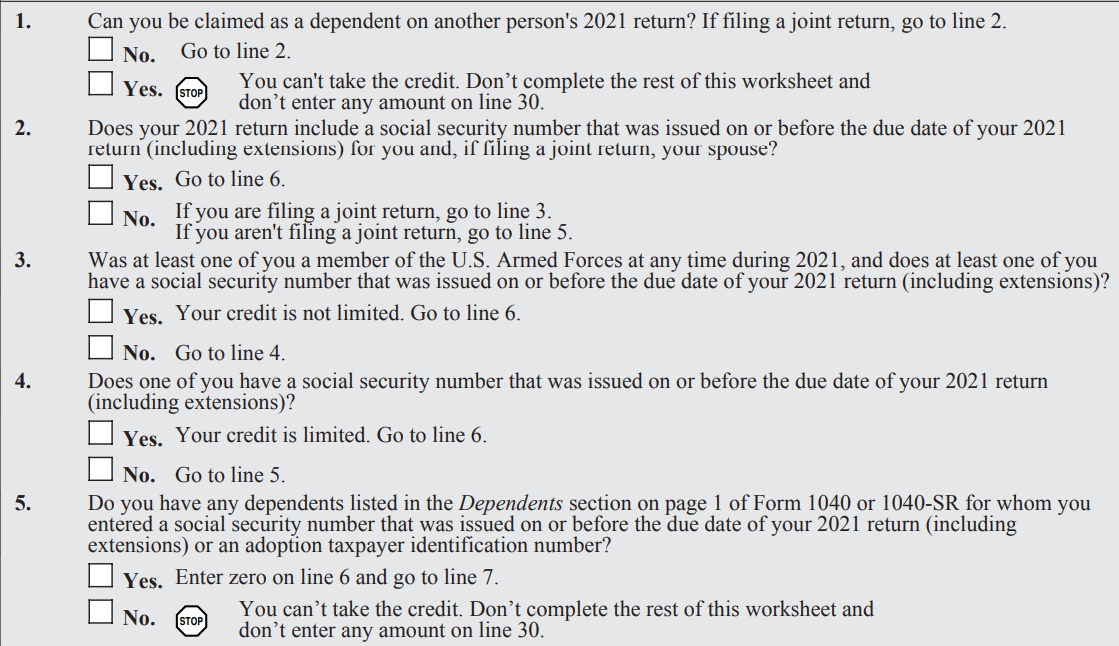

Web 13 Jan 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your

A Irs 1040 Form Recovery Rebate Credit as it is understood in its simplest description, is a return to the customer after having purchased a item or service. It's a very effective technique employed by companies to attract customers, boost sales, and promote specific products.

Types of Irs 1040 Form Recovery Rebate Credit

1040 EF Message 0006 Recovery Rebate Credit Drake20

1040 EF Message 0006 Recovery Rebate Credit Drake20

Web 13 Apr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Web 13 Jan 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Cash Irs 1040 Form Recovery Rebate Credit

Cash Irs 1040 Form Recovery Rebate Credit can be the simplest type of Irs 1040 Form Recovery Rebate Credit. Customers are given a certain amount of money in return for purchasing a particular item. This is often for products that are expensive, such as electronics or appliances.

Mail-In Irs 1040 Form Recovery Rebate Credit

Mail-in Irs 1040 Form Recovery Rebate Credit require the customer to provide an evidence of purchase for the money. They're more involved but can offer huge savings.

Instant Irs 1040 Form Recovery Rebate Credit

Instant Irs 1040 Form Recovery Rebate Credit apply at the point of sale, reducing the purchase price immediately. Customers don't have to wait until they can save by using this method.

How Irs 1040 Form Recovery Rebate Credit Work

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form

The Irs 1040 Form Recovery Rebate Credit Process

It usually consists of a few steps

-

When you buy the product you buy the product the way you normally do.

-

Fill in the Irs 1040 Form Recovery Rebate Credit forms: The Irs 1040 Form Recovery Rebate Credit form will need to give some specific information like your name, address, and the purchase details, in order in order to make a claim for your Irs 1040 Form Recovery Rebate Credit.

-

To submit the Irs 1040 Form Recovery Rebate Credit According to the nature of Irs 1040 Form Recovery Rebate Credit there may be a requirement to either mail in a request form or upload it online.

-

Wait for approval: The business will review your request to make sure that it's in accordance with the terms and conditions of the Irs 1040 Form Recovery Rebate Credit.

-

Get your Irs 1040 Form Recovery Rebate Credit After approval, you'll be able to receive your reimbursement, via check, prepaid card or through a different method as specified by the offer.

Pros and Cons of Irs 1040 Form Recovery Rebate Credit

Advantages

-

Cost savings Irs 1040 Form Recovery Rebate Credit can dramatically reduce the price you pay for an item.

-

Promotional Offers They encourage customers to try out new products or brands.

-

Help to Increase Sales Irs 1040 Form Recovery Rebate Credit can help boost a company's sales and market share.

Disadvantages

-

Complexity: Mail-in Irs 1040 Form Recovery Rebate Credit, in particular, can be cumbersome and long-winded.

-

End Dates Most Irs 1040 Form Recovery Rebate Credit come with the strictest deadlines for submission.

-

Risk of Non-Payment Customers may lose their Irs 1040 Form Recovery Rebate Credit in the event that they don't adhere to the requirements exactly.

Download Irs 1040 Form Recovery Rebate Credit

Download Irs 1040 Form Recovery Rebate Credit

FAQs

1. Are Irs 1040 Form Recovery Rebate Credit equivalent to discounts? No, Irs 1040 Form Recovery Rebate Credit are an amount of money that is refunded after the purchase, whereas discounts cut the cost of purchase at time of sale.

2. Are there any Irs 1040 Form Recovery Rebate Credit that I can use on the same product It's contingent upon the conditions of the Irs 1040 Form Recovery Rebate Credit offers and the product's suitability. Certain companies allow it, but some will not.

3. What is the time frame to get the Irs 1040 Form Recovery Rebate Credit What is the timeframe? is different, but it could take anywhere from a few weeks to a couple of months before you get your Irs 1040 Form Recovery Rebate Credit.

4. Do I need to pay taxes for Irs 1040 Form Recovery Rebate Credit amount? the majority of instances, Irs 1040 Form Recovery Rebate Credit amounts are not considered to be taxable income.

5. Should I be able to trust Irs 1040 Form Recovery Rebate Credit deals from lesser-known brands You must research and ensure that the business giving the Irs 1040 Form Recovery Rebate Credit is credible prior to making an acquisition.

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

What Is The Recovery Rebate Credit CD Tax Financial

Check more sample of Irs 1040 Form Recovery Rebate Credit below

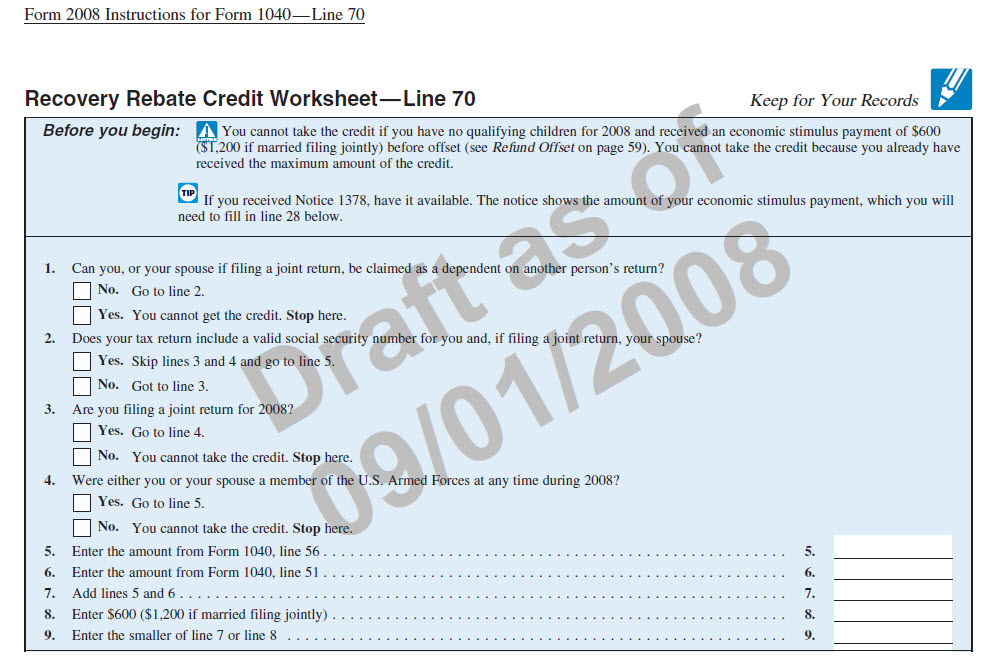

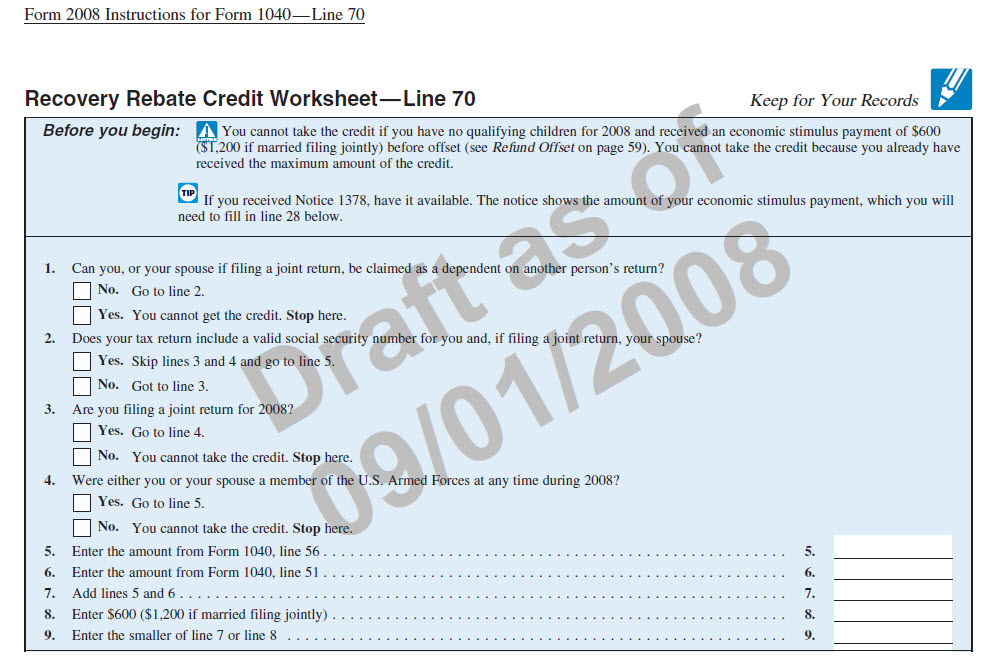

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

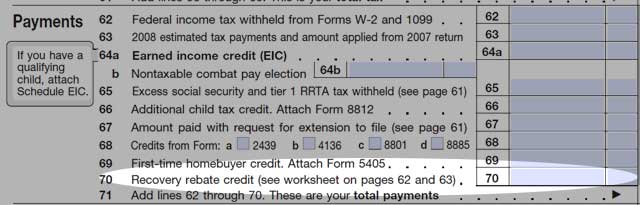

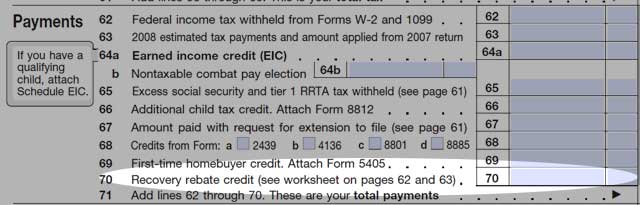

1040 Recovery Rebate Credit Drake20

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Tax Time Guide Didn t Get Economic Impact Payments Check Eligibility

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 Jan 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-h...

Web 13 Jan 2022 nbsp 0183 32 If you need to file an amended return even if you don t usually file taxes to claim the 2021 Recovery Rebate Credit use the worksheet in the 2021 instructions

Web 13 Jan 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your

Web 13 Jan 2022 nbsp 0183 32 If you need to file an amended return even if you don t usually file taxes to claim the 2021 Recovery Rebate Credit use the worksheet in the 2021 instructions

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

1040 Recovery Rebate Credit Drake20

Tax Time Guide Didn t Get Economic Impact Payments Check Eligibility

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

1040 Recovery Rebate Credit Worksheet

Solved Recovery Rebate Credit Error On 1040 Instructions

Solved Recovery Rebate Credit Error On 1040 Instructions

The Recovery Rebate Credit Calculator ShauntelRaya