In the modern world of consumerization everyone is looking for a great bargain. One way to earn significant savings on your purchases is through Child Sales Tax Rebate Forms. The use of Child Sales Tax Rebate Forms is a method used by manufacturers and retailers to offer customers a return on their purchases once they have completed them. In this article, we will explore the world of Child Sales Tax Rebate Forms. We'll discuss what they are what they are, how they function, and ways to maximize your savings with these cost-effective incentives.

Get Latest Child Sales Tax Rebate Form Below

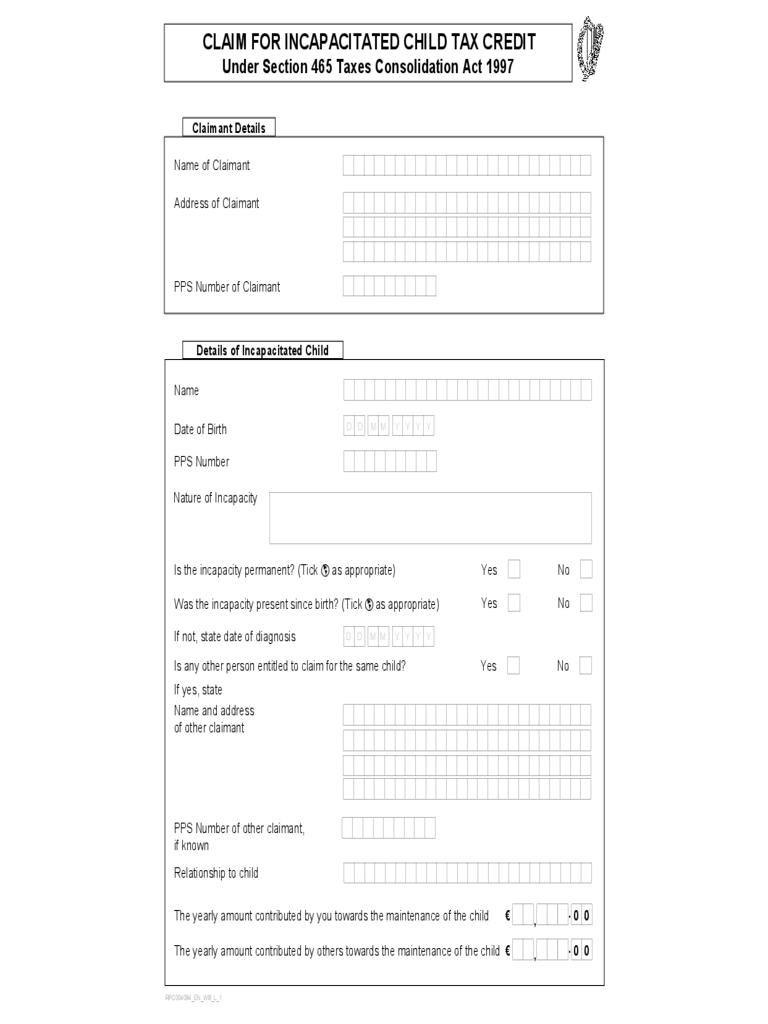

Child Sales Tax Rebate Form

Child Sales Tax Rebate Form -

Web 13 avr 2022 nbsp 0183 32 2021 Recovery Rebate Credit Questions and Answers These updated FAQs were released to the public in Fact Sheet 2022 27 PDF April 13 2022 If you didn t get

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your

A Child Sales Tax Rebate Form, in its simplest type, is a refund given to a client after they have purchased a product or service. This is a potent tool that businesses use to draw customers, boost sales, and also to advertise certain products.

Types of Child Sales Tax Rebate Form

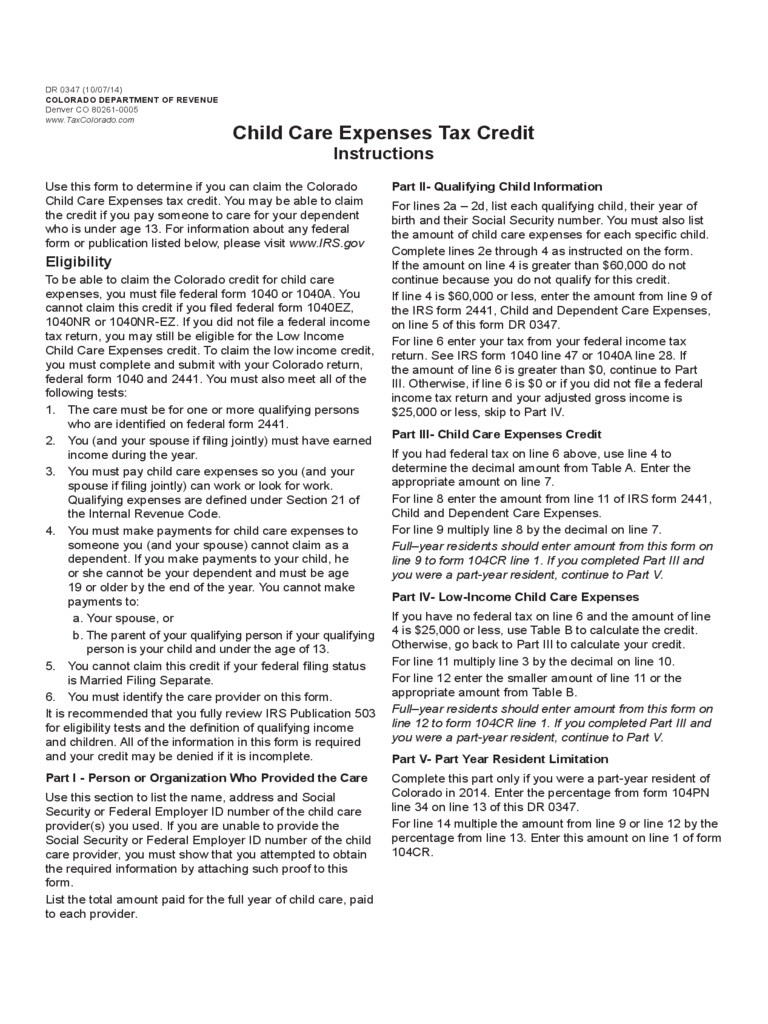

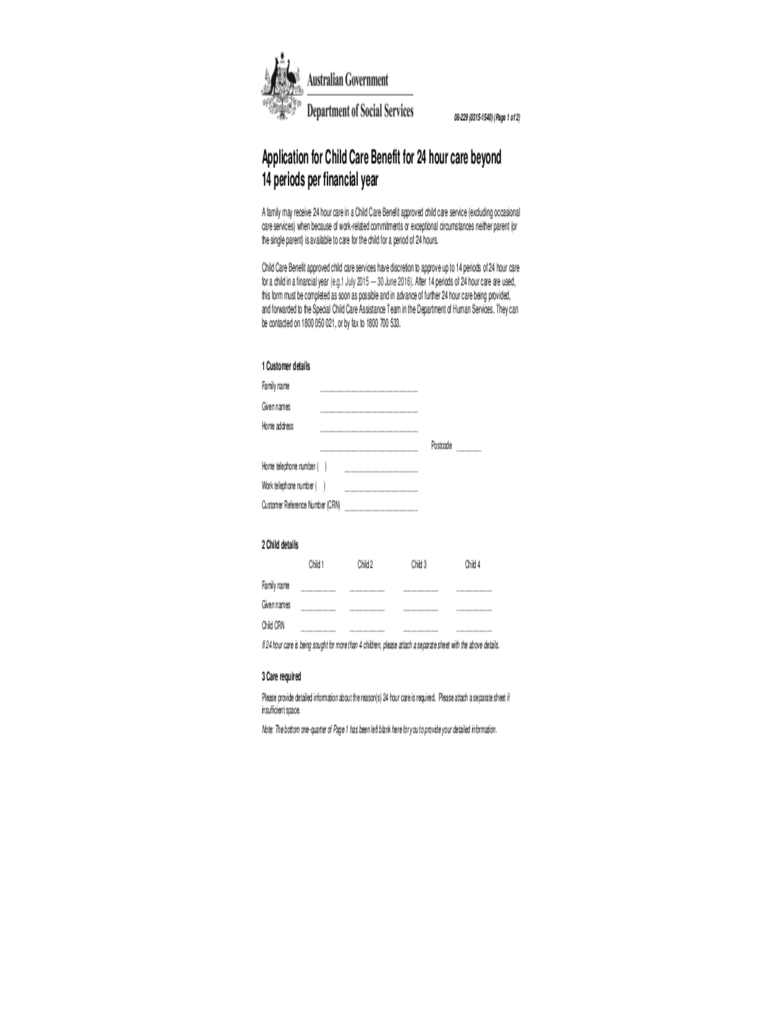

Child Care Rebate Application Form Edit Fill Sign Online Handypdf

Child Care Rebate Application Form Edit Fill Sign Online Handypdf

Web 1 oct 2017 nbsp 0183 32 How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per rebate

Web 10 mai 2018 nbsp 0183 32 Governor Walker and the State Legislature have determined that some of the surplus should be returned to taxpayers in the form of a Child Sales Tax Rebate It is a

Cash Child Sales Tax Rebate Form

Cash Child Sales Tax Rebate Form are the simplest kind of Child Sales Tax Rebate Form. Customers get a set amount of cash back after purchasing a particular item. These are usually used for the most expensive products like electronics or appliances.

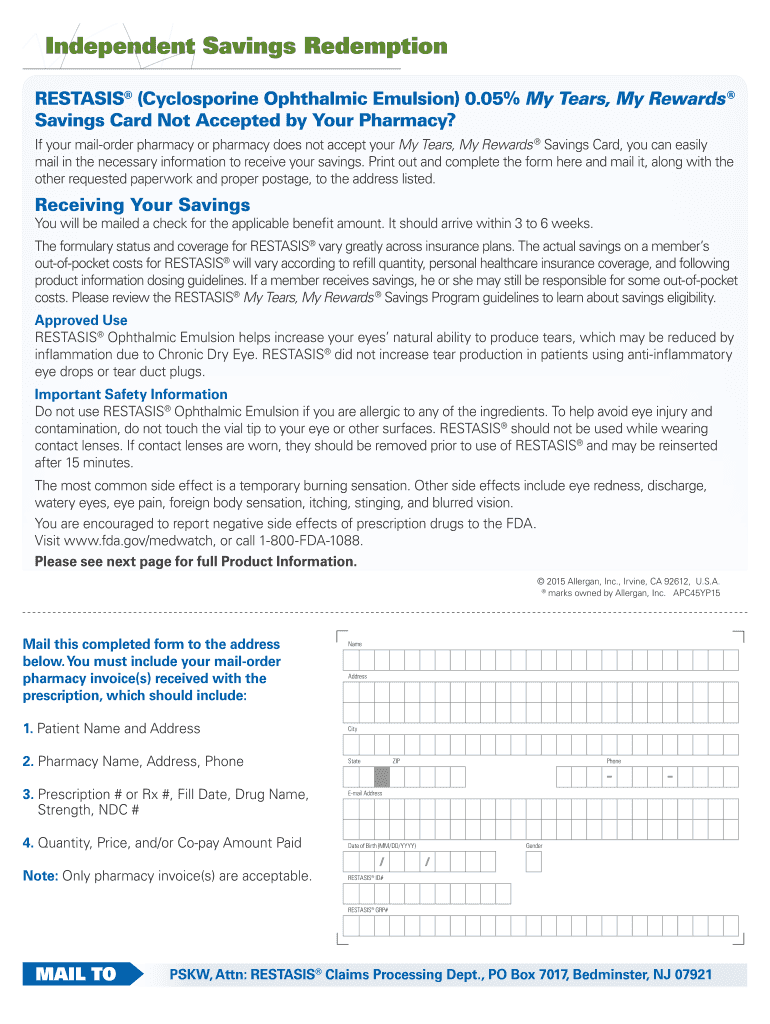

Mail-In Child Sales Tax Rebate Form

Mail-in Child Sales Tax Rebate Form require consumers to send in documents of purchase to claim their cash back. They're more involved, but offer substantial savings.

Instant Child Sales Tax Rebate Form

Instant Child Sales Tax Rebate Form apply at the point of sale, reducing the price of your purchase instantly. Customers do not have to wait until they can save through this kind of offer.

How Child Sales Tax Rebate Form Work

2022 Child Care Rebate Form Fillable Printable PDF Forms Handypdf

2022 Child Care Rebate Form Fillable Printable PDF Forms Handypdf

Web Starting with the return for the period ending January 2023 filed in February 2023 monthly and quarterly Sales and Use Tax filers will begin using the RI Division of Taxation s new

The Child Sales Tax Rebate Form Process

The process usually involves a couple of steps that are easy to follow:

-

When you buy the product then, you buy the item like you normally do.

-

Fill in your Child Sales Tax Rebate Form questionnaire: you'll have to fill in some information like your name, address, as well as the details of your purchase to make a claim for your Child Sales Tax Rebate Form.

-

Complete the Child Sales Tax Rebate Form In accordance with the type of Child Sales Tax Rebate Form you might need to send in a form, or submit it online.

-

Wait for approval: The company will look over your submission to determine if it's in compliance with the refund's conditions and terms.

-

You will receive your Child Sales Tax Rebate Form: Once approved, you'll receive a refund either by check, prepaid card, or by another option as per the terms of the offer.

Pros and Cons of Child Sales Tax Rebate Form

Advantages

-

Cost Savings The use of Child Sales Tax Rebate Form can greatly cut the price you pay for the item.

-

Promotional Deals These deals encourage customers to explore new products or brands.

-

Enhance Sales Child Sales Tax Rebate Form can help boost companies' sales and market share.

Disadvantages

-

Complexity Child Sales Tax Rebate Form that are mail-in, particularly they can be time-consuming and slow-going.

-

Extension Dates: Many Child Sales Tax Rebate Form have strict time limits for submission.

-

A risk of not being paid: Some customers may not receive Child Sales Tax Rebate Form if they don't follow the rules exactly.

Download Child Sales Tax Rebate Form

Download Child Sales Tax Rebate Form

FAQs

1. Are Child Sales Tax Rebate Form the same as discounts? No, Child Sales Tax Rebate Form involve only a partial reimbursement following the purchase, whereas discounts cut their price at time of sale.

2. Are there Child Sales Tax Rebate Form that can be used for the same product? It depends on the terms of Child Sales Tax Rebate Form offered and product's acceptance. Certain companies allow it, but some will not.

3. How long will it take to receive a Child Sales Tax Rebate Form? The amount of time varies, but it can take a couple of weeks or a couple of months to receive your Child Sales Tax Rebate Form.

4. Do I need to pay taxes on Child Sales Tax Rebate Form values? the majority of instances, Child Sales Tax Rebate Form amounts are not considered taxable income.

5. Do I have confidence in Child Sales Tax Rebate Form offers from lesser-known brands It is essential to investigate and make sure that the company which is providing the Child Sales Tax Rebate Form is trustworthy prior to making an investment.

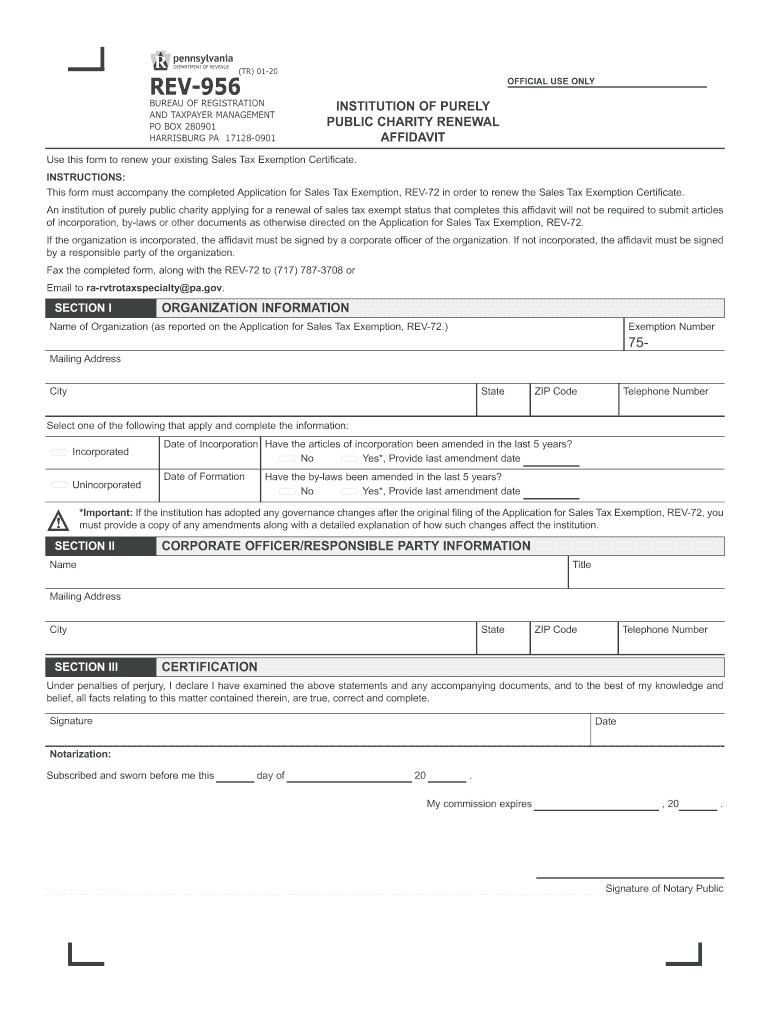

2020 2023 Form PA REV 956 Fill Online Printable Fillable Blank

Tulsa Sales Tax Rebate Form Fill Online Printable Fillable Blank

Check more sample of Child Sales Tax Rebate Form below

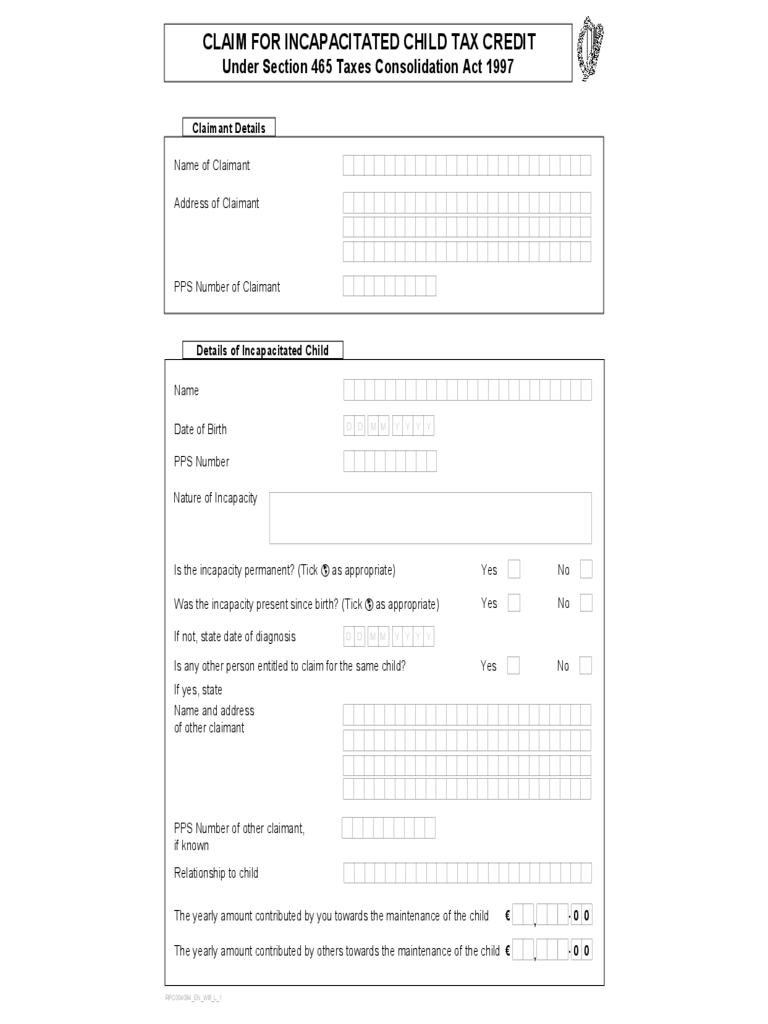

2022 Child Tax Credits Form Fillable Printable PDF Forms Handypdf

Child Tax Credits Calculator CALCULATORUK HJW

Supplier Rebate Agreement Template

HST Rebate Forms Ontario Printable Rebate Form

How Do I Claim The 600 Stimulus Payment For My Child That Was Born In 2020

PA Property Tax Rebate Forms Printable Rebate Form

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your

https://www.irs.gov/pub/taxpros/fs-2022-22.pdf

Web 25 mars 2022 nbsp 0183 32 eligible to receive a 2021 Recovery Rebate Credit of up to 1 400 for this child o All eligible parents of qualifying children born or welcomed through adoption or

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your

Web 25 mars 2022 nbsp 0183 32 eligible to receive a 2021 Recovery Rebate Credit of up to 1 400 for this child o All eligible parents of qualifying children born or welcomed through adoption or

HST Rebate Forms Ontario Printable Rebate Form

Child Tax Credits Calculator CALCULATORUK HJW

How Do I Claim The 600 Stimulus Payment For My Child That Was Born In 2020

PA Property Tax Rebate Forms Printable Rebate Form

P G Printable Rebate Form

2012 Form PA REV 72 Fill Online Printable Fillable Blank PdfFiller

2012 Form PA REV 72 Fill Online Printable Fillable Blank PdfFiller

Rebate Form Fill And Sign Printable Template Online US Legal Forms