In this day and age of consuming every person loves a great deal. One method of gaining substantial savings on your purchases is through Recovery Rebate Credit On A 2023 Form 1040s. Recovery Rebate Credit On A 2023 Form 1040s are a strategy for marketing used by manufacturers and retailers to give customers a part discount on purchases they made after they have created them. In this post, we'll explore the world of Recovery Rebate Credit On A 2023 Form 1040s, exploring the nature of them, how they work, and the best way to increase the savings you can make by using these cost-effective incentives.

Get Latest Recovery Rebate Credit On A 2023 Form 1040 Below

Recovery Rebate Credit On A 2023 Form 1040

Recovery Rebate Credit On A 2023 Form 1040 -

Verkko 13 huhtik 2022 nbsp 0183 32 Below are frequently asked questions about the 2021 Recovery Rebate Credit separated by topic Please do not call the IRS Topic A General Information Topic B Claiming the Recovery Rebate Credit if you aren t required to file a 2021 tax return Topic C Eligibility for claiming a Recovery Rebate Credit on a 2021

Verkko IR 2023 217 Nov 17 2023 The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before it s too late

A Recovery Rebate Credit On A 2023 Form 1040 the simplest description, is a refund given to a client who has purchased a particular product or service. It's a powerful method for businesses to entice customers, increase sales or promote a specific product.

Types of Recovery Rebate Credit On A 2023 Form 1040

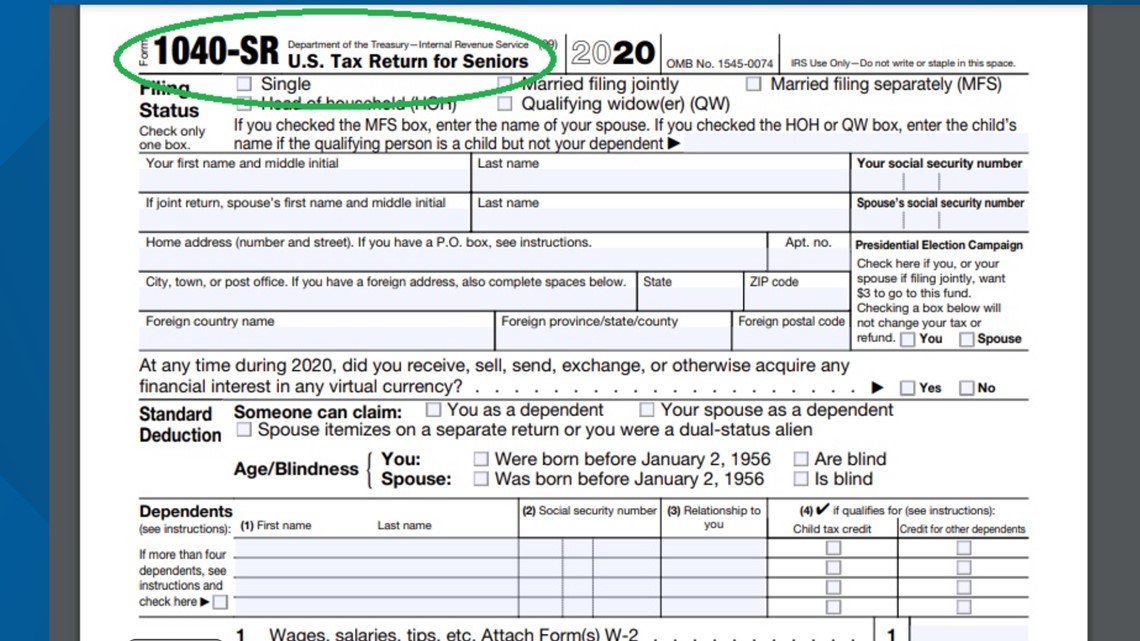

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

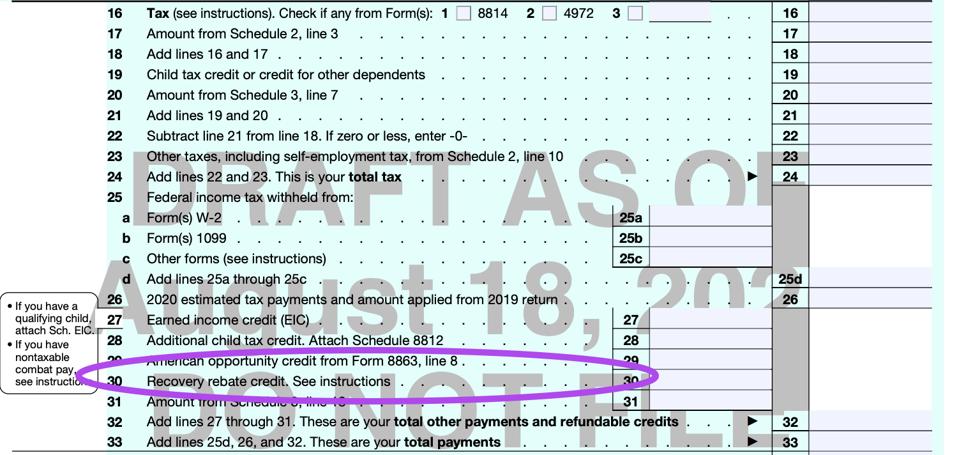

Verkko 10 jouluk 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form 1040 and Form 1040 SR Instructions PDF Enter the computed amount from the worksheet onto line 30 Recovery Rebate Credit of your 2020 Form 1040 or 2020

Verkko 25 helmik 2021 nbsp 0183 32 The recovery rebate credit should be included when you file your 2020 tax return When you work with a tax pro or file with H amp R Block Online we ll get you your maximum refund guaranteed Want to find

Cash Recovery Rebate Credit On A 2023 Form 1040

Cash Recovery Rebate Credit On A 2023 Form 1040 are by far the easiest type of Recovery Rebate Credit On A 2023 Form 1040. Customers receive a specified amount of money back after purchasing a particular item. They are typically used to purchase high-ticket items like electronics or appliances.

Mail-In Recovery Rebate Credit On A 2023 Form 1040

Customers who want to receive mail-in Recovery Rebate Credit On A 2023 Form 1040 must provide the proof of purchase to be eligible for their refund. They're a little more involved, but can result in significant savings.

Instant Recovery Rebate Credit On A 2023 Form 1040

Instant Recovery Rebate Credit On A 2023 Form 1040 can be applied at the point of sale, and can reduce your purchase cost instantly. Customers don't need to wait around for savings when they purchase this type of Recovery Rebate Credit On A 2023 Form 1040.

How Recovery Rebate Credit On A 2023 Form 1040 Work

What Is The Recovery Rebate Credit CD Tax Financial

What Is The Recovery Rebate Credit CD Tax Financial

Verkko 13 tammik 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and the amount to enter on line 30 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund

The Recovery Rebate Credit On A 2023 Form 1040 Process

The procedure typically consists of a few simple steps

-

Purchase the item: First you purchase the item the way you normally do.

-

Complete your Recovery Rebate Credit On A 2023 Form 1040 application: In order to claim your Recovery Rebate Credit On A 2023 Form 1040, you'll have to give some specific information including your address, name, and details about your purchase, in order in order to be eligible for a Recovery Rebate Credit On A 2023 Form 1040.

-

In order to submit the Recovery Rebate Credit On A 2023 Form 1040 If you want to submit the Recovery Rebate Credit On A 2023 Form 1040, based on the kind of Recovery Rebate Credit On A 2023 Form 1040 it is possible that you need to mail in a form or send it via the internet.

-

Wait until the company approves: The company will go through your application to determine if it's in compliance with the terms and conditions of the Recovery Rebate Credit On A 2023 Form 1040.

-

Redeem your Recovery Rebate Credit On A 2023 Form 1040 After approval, you'll be able to receive your reimbursement, through a check, or a prepaid card or through a different option specified by the offer.

Pros and Cons of Recovery Rebate Credit On A 2023 Form 1040

Advantages

-

Cost savings Rewards can drastically lower the cost you pay for an item.

-

Promotional Offers The aim is to encourage customers to try new items or brands.

-

increase sales Recovery Rebate Credit On A 2023 Form 1040 are a great way to boost the company's sales as well as market share.

Disadvantages

-

Complexity In particular, mail-in Recovery Rebate Credit On A 2023 Form 1040 particularly is a time-consuming process and demanding.

-

The Expiration Dates Many Recovery Rebate Credit On A 2023 Form 1040 are subject to rigid deadlines to submit.

-

A risk of not being paid Some customers might not receive their refunds if they don't follow the regulations precisely.

Download Recovery Rebate Credit On A 2023 Form 1040

Download Recovery Rebate Credit On A 2023 Form 1040

FAQs

1. Are Recovery Rebate Credit On A 2023 Form 1040 equivalent to discounts? Not at all, Recovery Rebate Credit On A 2023 Form 1040 provide some form of refund following the purchase, and discounts are a reduction of prices at time of sale.

2. Are multiple Recovery Rebate Credit On A 2023 Form 1040 available on the same item This is dependent on terms that apply to the Recovery Rebate Credit On A 2023 Form 1040 incentives and the specific product's quality and eligibility. Certain companies might permit it, and some don't.

3. How long does it take to get an Recovery Rebate Credit On A 2023 Form 1040 What is the timeframe? differs, but could last from a few weeks until a couple of months before you get your Recovery Rebate Credit On A 2023 Form 1040.

4. Do I need to pay tax with respect to Recovery Rebate Credit On A 2023 Form 1040 funds? the majority of cases, Recovery Rebate Credit On A 2023 Form 1040 amounts are not considered to be taxable income.

5. Can I trust Recovery Rebate Credit On A 2023 Form 1040 offers from lesser-known brands Do I need to conduct a thorough research and make sure that the company giving the Recovery Rebate Credit On A 2023 Form 1040 is legitimate prior to making any purchase.

Recovery Rebate Credit Form 1040 Recovery Rebate

2022 Form 1040 Recovery Rebate Credit Worksheet Recovery Rebate

Check more sample of Recovery Rebate Credit On A 2023 Form 1040 below

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

How To Claim The Stimulus Money On Your Tax Return 13newsnow

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

Massachusetts Agi Worksheet Speed Test Site

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

The Recovery Rebate Credit Calculator ShauntelRaya

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://www.irs.gov/newsroom/irs-reminds-eligible-2020-and-2021-non...

Verkko IR 2023 217 Nov 17 2023 The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before it s too late

https://1040abroad.com/blog/dont-miss-out-a-guide-to-recovery-rebate...

Verkko Feb 3 2023 If you re one of the many U S expats who are owed stimulus money you can still claim it through Recovery Rebate Credit As the matter of fact 2023 is the last year to get all the stimulus checks you might have missed It will either boost the amount of your tax refund or reduce the taxes you owe to the IRS Either way you win

Verkko IR 2023 217 Nov 17 2023 The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before it s too late

Verkko Feb 3 2023 If you re one of the many U S expats who are owed stimulus money you can still claim it through Recovery Rebate Credit As the matter of fact 2023 is the last year to get all the stimulus checks you might have missed It will either boost the amount of your tax refund or reduce the taxes you owe to the IRS Either way you win

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Massachusetts Agi Worksheet Speed Test Site

How To Claim The Stimulus Money On Your Tax Return 13newsnow

The Recovery Rebate Credit Calculator ShauntelRaya

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

Recovery Rebate Credit 2023 Eligibility Calculator How To Claim

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

1040 Form Pdf Fillable Printable Forms Free Online