In the modern world of consumerization we all love a good bargain. One of the ways to enjoy substantial savings on your purchases is to use Indiana Fuel Tax Rebate Form 1000as. Indiana Fuel Tax Rebate Form 1000as are a marketing strategy that retailers and manufacturers use to provide customers with a partial discount on purchases they made after they have made them. In this post, we'll examine the subject of Indiana Fuel Tax Rebate Form 1000as. We'll look at the nature of them their purpose, how they function and how you can maximize the savings you can make by using these cost-effective incentives.

Get Latest Indiana Fuel Tax Rebate Form 1000a Below

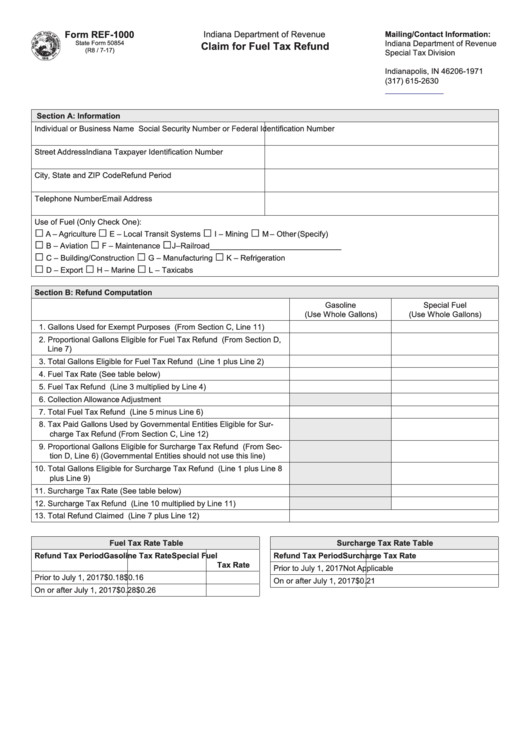

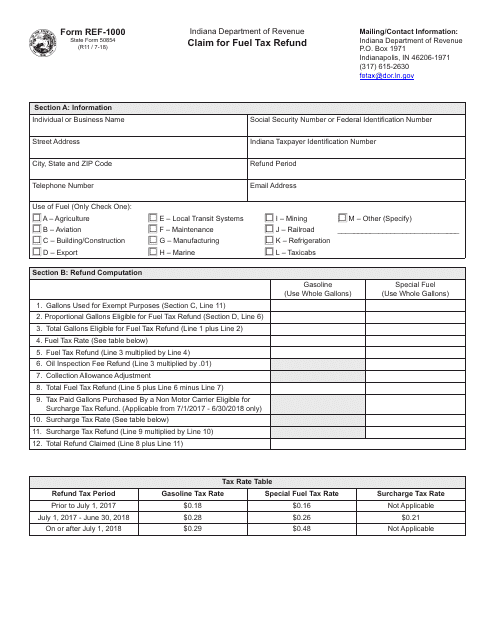

Indiana Fuel Tax Rebate Form 1000a

Indiana Fuel Tax Rebate Form 1000a -

Web 2022 Fuel Exemptions Yes Comments A separate claim for refund of INDIANA motor fuel tax is available through the INDIANA Department of Revenue for fuel not used to

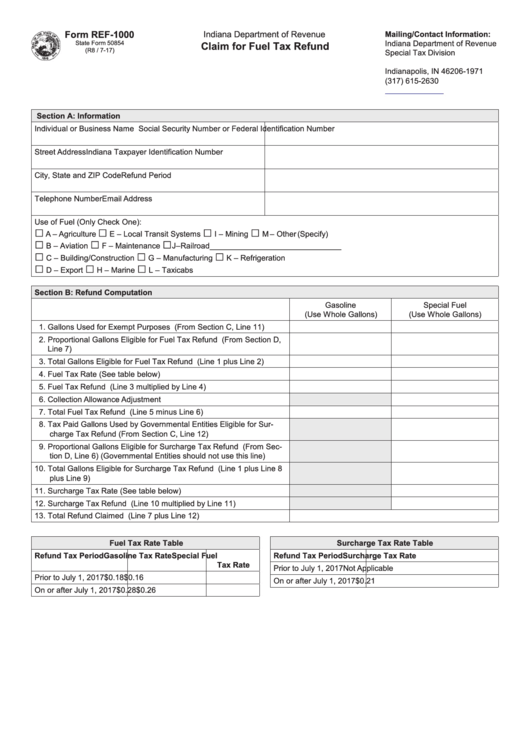

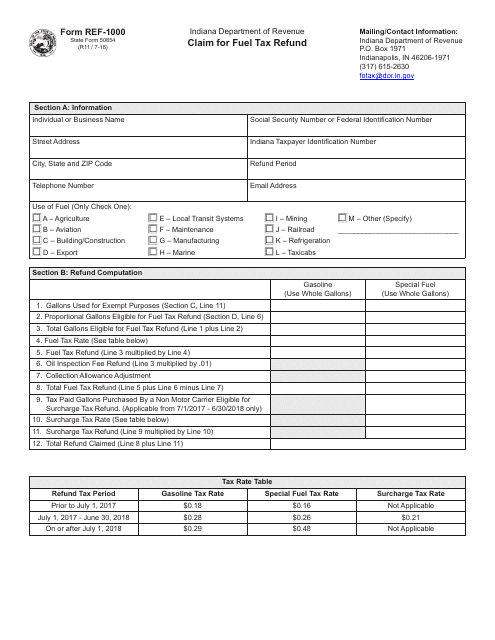

Web 1 juil 2019 nbsp 0183 32 The REF 1000 form is used to file for a refund of un dyed special fuel excise tax gasoline excise tax and oil inspection fee Who should file Anyone who purchased

A Indiana Fuel Tax Rebate Form 1000a at its most basic description, is a refund to a purchaser when they purchase a product or service. It is a powerful tool that companies use to attract clients, increase sales and advertise specific products.

Types of Indiana Fuel Tax Rebate Form 1000a

State Form 50854 REF 1000 Download Fillable PDF Or Fill Online Claim

State Form 50854 REF 1000 Download Fillable PDF Or Fill Online Claim

Web tax you are eligible for a refund of the Indiana special fuel tax You must provide proof of payment of the destination state tax to obtain the refund A wholesale distributor who is

Web MCFT Rate Effective July 1 2022 Effective July 1 2022 the rate of the MCFT is 0 55 per gallon of special fuel or alternative fuel and 0 33 per gallon of gasoline consumed by

Cash Indiana Fuel Tax Rebate Form 1000a

Cash Indiana Fuel Tax Rebate Form 1000a are probably the most simple kind of Indiana Fuel Tax Rebate Form 1000a. Customers receive a specified amount of money back after purchasing a item. This is often for products that are expensive, such as electronics or appliances.

Mail-In Indiana Fuel Tax Rebate Form 1000a

Mail-in Indiana Fuel Tax Rebate Form 1000a require consumers to submit their proof of purchase before receiving their cash back. They are a bit more involved, but can result in huge savings.

Instant Indiana Fuel Tax Rebate Form 1000a

Instant Indiana Fuel Tax Rebate Form 1000a can be applied at the point of sale, reducing the price instantly. Customers do not have to wait around for savings in this manner.

How Indiana Fuel Tax Rebate Form 1000a Work

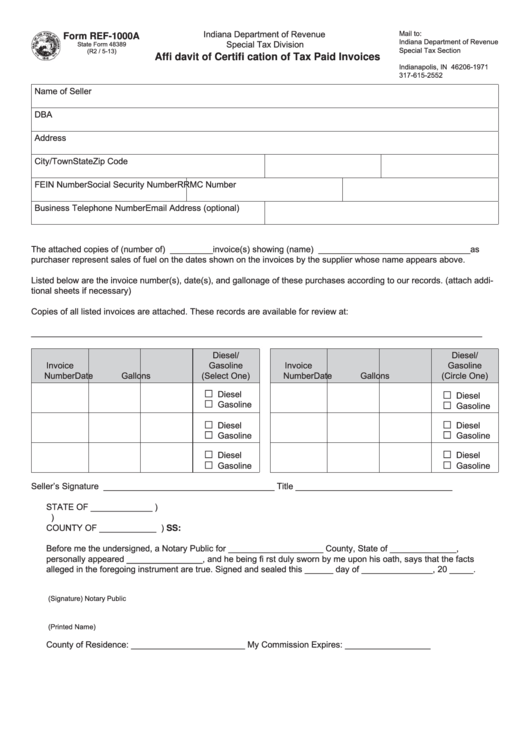

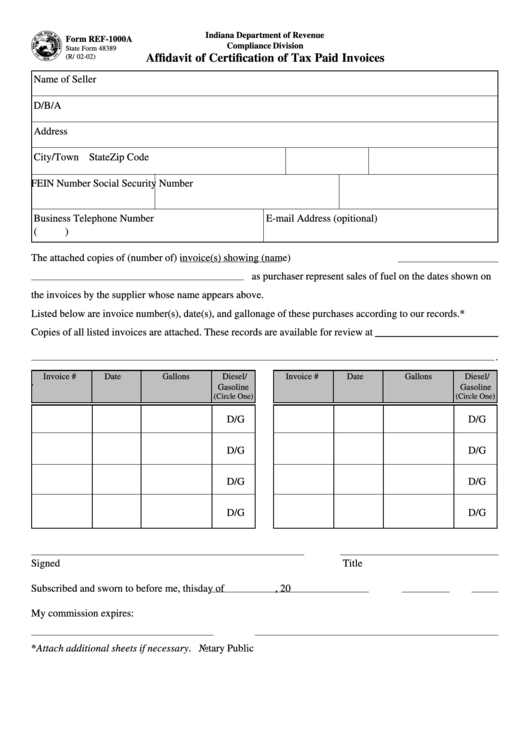

Fillable Form Ref 1000a Affidavit Form Of Certification Of Tax Paid

Fillable Form Ref 1000a Affidavit Form Of Certification Of Tax Paid

Web Carriers legally exempt from filing online will receive their quarterly fuel tax return by mail To file the quarterly tax return follow the detailed instructions below Step 1 Log into the

The Indiana Fuel Tax Rebate Form 1000a Process

The process generally involves a few easy steps:

-

Buy the product: At first you buy the product just as you would ordinarily.

-

Fill in the Indiana Fuel Tax Rebate Form 1000a form: You'll have to provide some data including your name, address and purchase details in order to submit your Indiana Fuel Tax Rebate Form 1000a.

-

Send in the Indiana Fuel Tax Rebate Form 1000a: Depending on the kind of Indiana Fuel Tax Rebate Form 1000a you could be required to submit a claim form to the bank or send it via the internet.

-

Wait for approval: The company will look over your submission to ensure it meets the refund's conditions and terms.

-

Get your Indiana Fuel Tax Rebate Form 1000a After being approved, you'll be able to receive your reimbursement, either through check, prepaid card, or through another procedure specified by the deal.

Pros and Cons of Indiana Fuel Tax Rebate Form 1000a

Advantages

-

Cost savings Indiana Fuel Tax Rebate Form 1000a can dramatically decrease the price for the product.

-

Promotional Deals they encourage their customers to try new products or brands.

-

Boost Sales Indiana Fuel Tax Rebate Form 1000a can help boost the sales of a business and increase its market share.

Disadvantages

-

Complexity Reward mail-ins in particular could be cumbersome and take a long time to complete.

-

Expiration Dates Many Indiana Fuel Tax Rebate Form 1000a are subject to specific deadlines for submission.

-

Risk of Not Being Paid Customers may not receive their Indiana Fuel Tax Rebate Form 1000a if they don't follow the regulations exactly.

Download Indiana Fuel Tax Rebate Form 1000a

Download Indiana Fuel Tax Rebate Form 1000a

FAQs

1. Are Indiana Fuel Tax Rebate Form 1000a similar to discounts? No, Indiana Fuel Tax Rebate Form 1000a involve a partial refund after purchase, whereas discounts cut the purchase price at the moment of sale.

2. Can I use multiple Indiana Fuel Tax Rebate Form 1000a on the same product It is contingent on the conditions on the Indiana Fuel Tax Rebate Form 1000a provides and the particular product's admissibility. Certain companies might allow it, and some don't.

3. How long will it take to get an Indiana Fuel Tax Rebate Form 1000a? The period differs, but it can take several weeks to a few months for you to receive your Indiana Fuel Tax Rebate Form 1000a.

4. Do I have to pay tax with respect to Indiana Fuel Tax Rebate Form 1000a montants? the majority of circumstances, Indiana Fuel Tax Rebate Form 1000a amounts are not considered taxable income.

5. Should I be able to trust Indiana Fuel Tax Rebate Form 1000a offers from lesser-known brands It's crucial to research and make sure that the company offering the Indiana Fuel Tax Rebate Form 1000a is reputable before making an acquisition.

Form Ref 1000a Affidavit Form For Certification Of Tax Paid Invoices

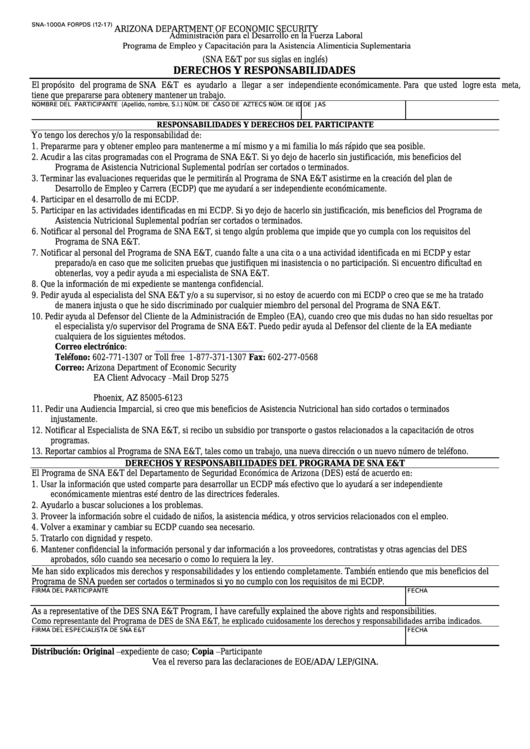

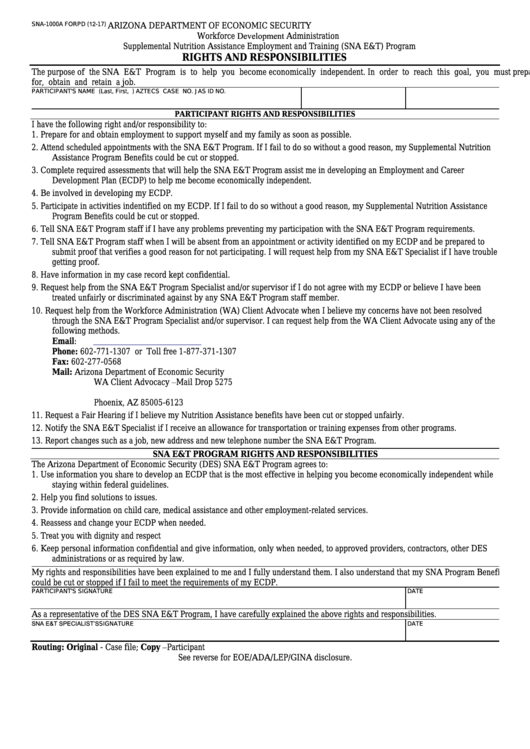

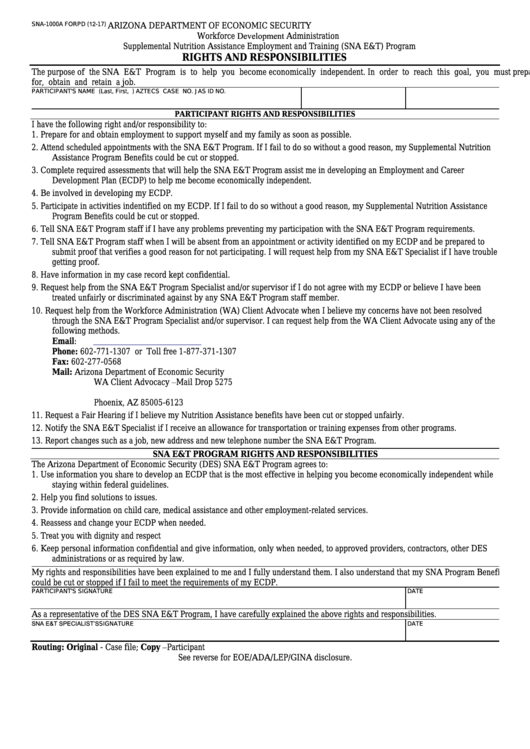

Fillable Form Sna 1000a Derechos Y Responsabilidades Printable Pdf

Check more sample of Indiana Fuel Tax Rebate Form 1000a below

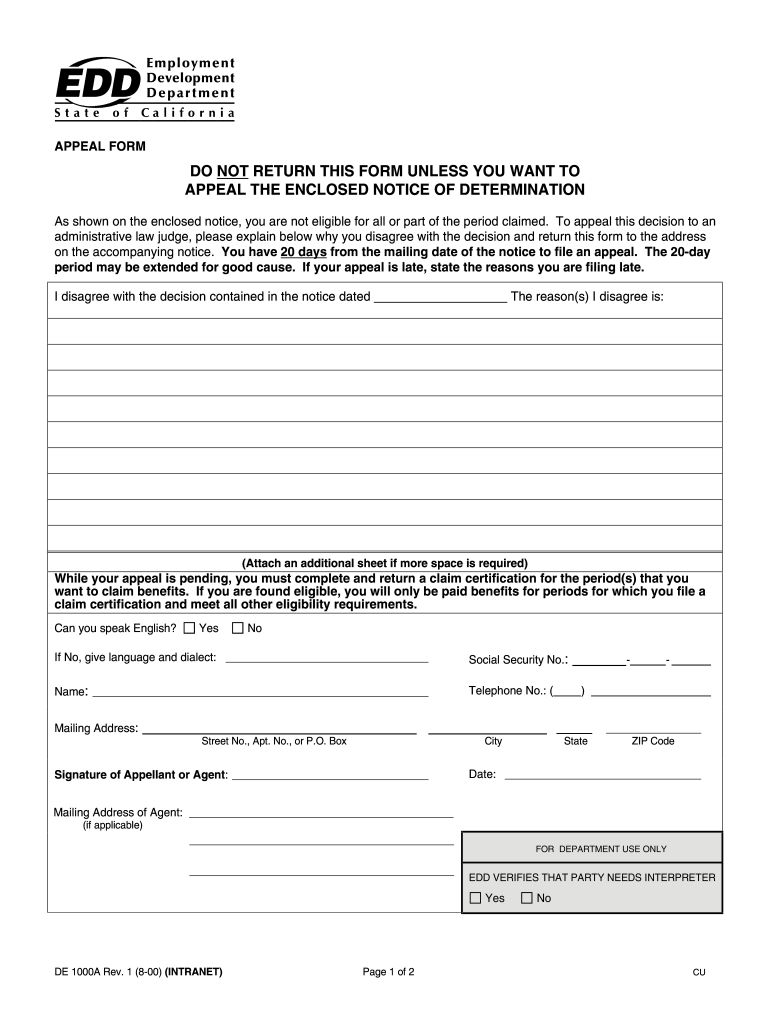

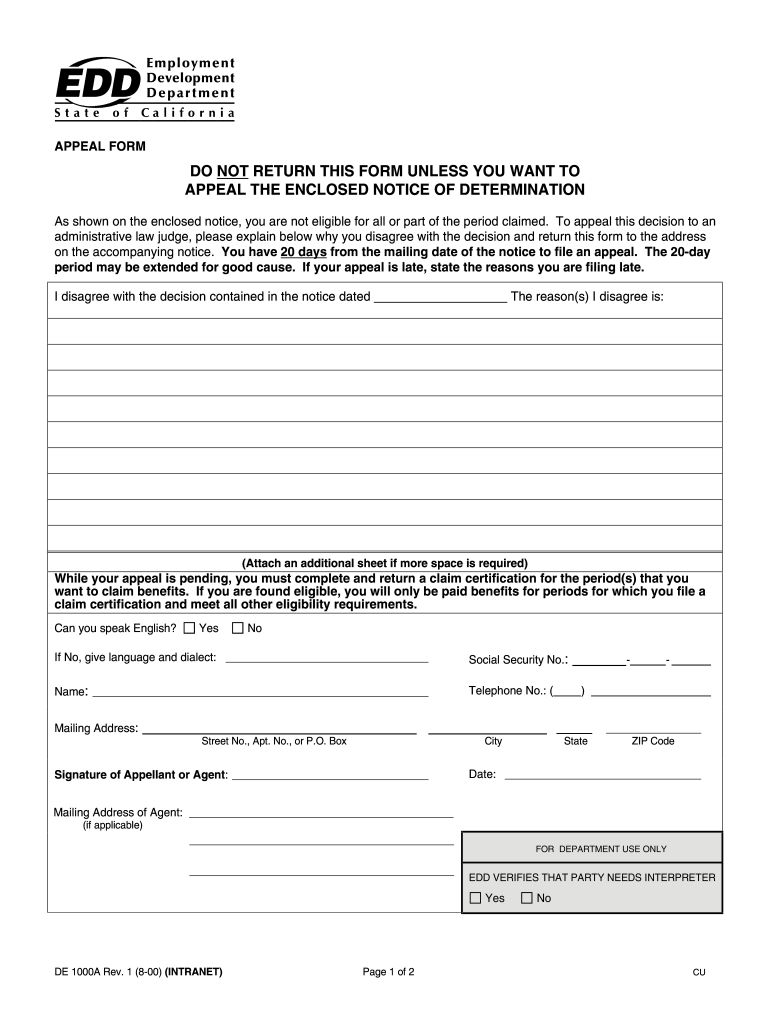

CA EDD DE 1000AA 2016 2022 Fill And Sign Printable Template Online

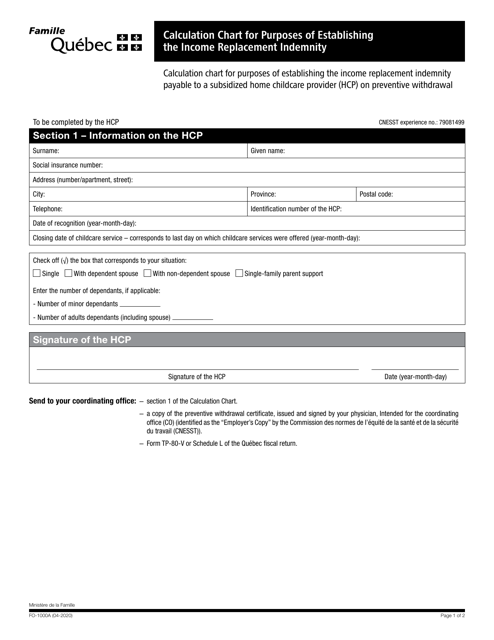

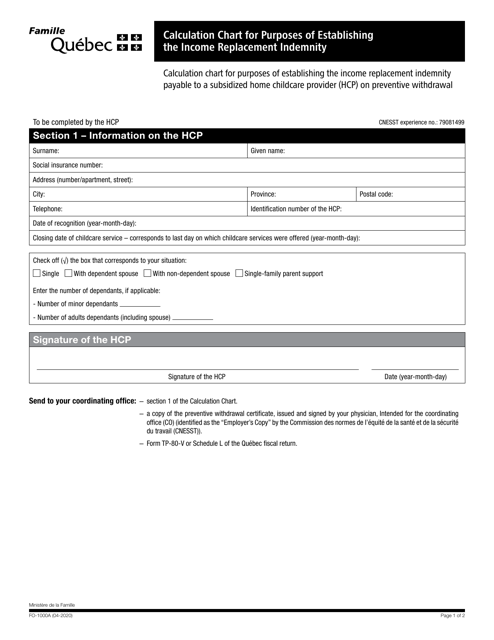

Form FO 1000A Download Fillable PDF Or Fill Online Calculation Chart

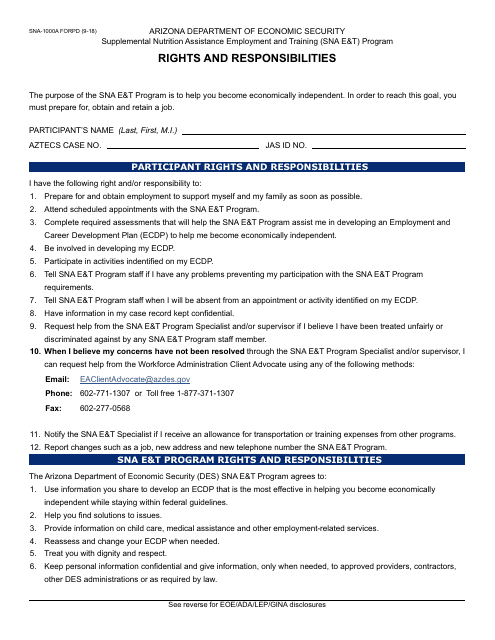

Form SNA 1000A FORPD Download Fillable PDF Or Fill Online Rights And

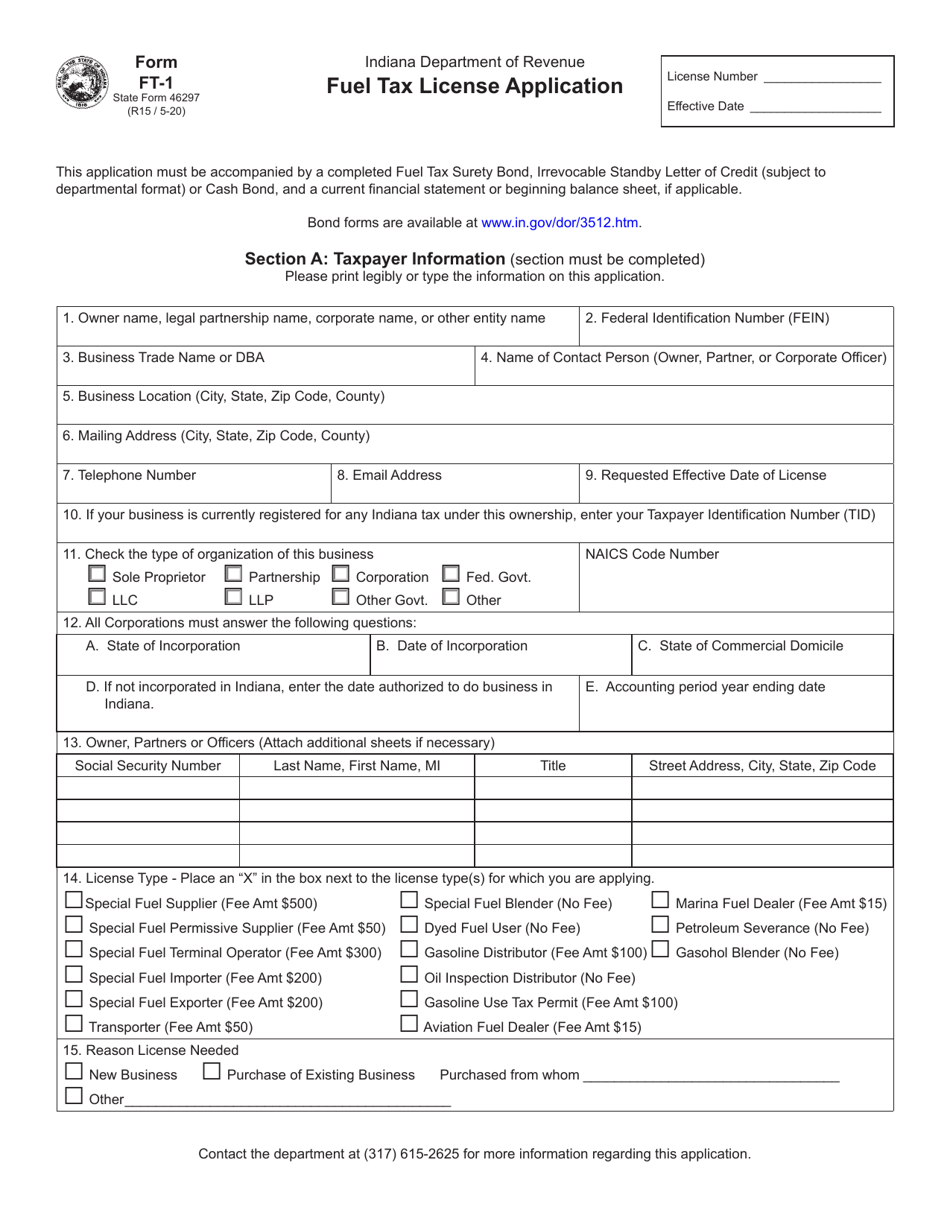

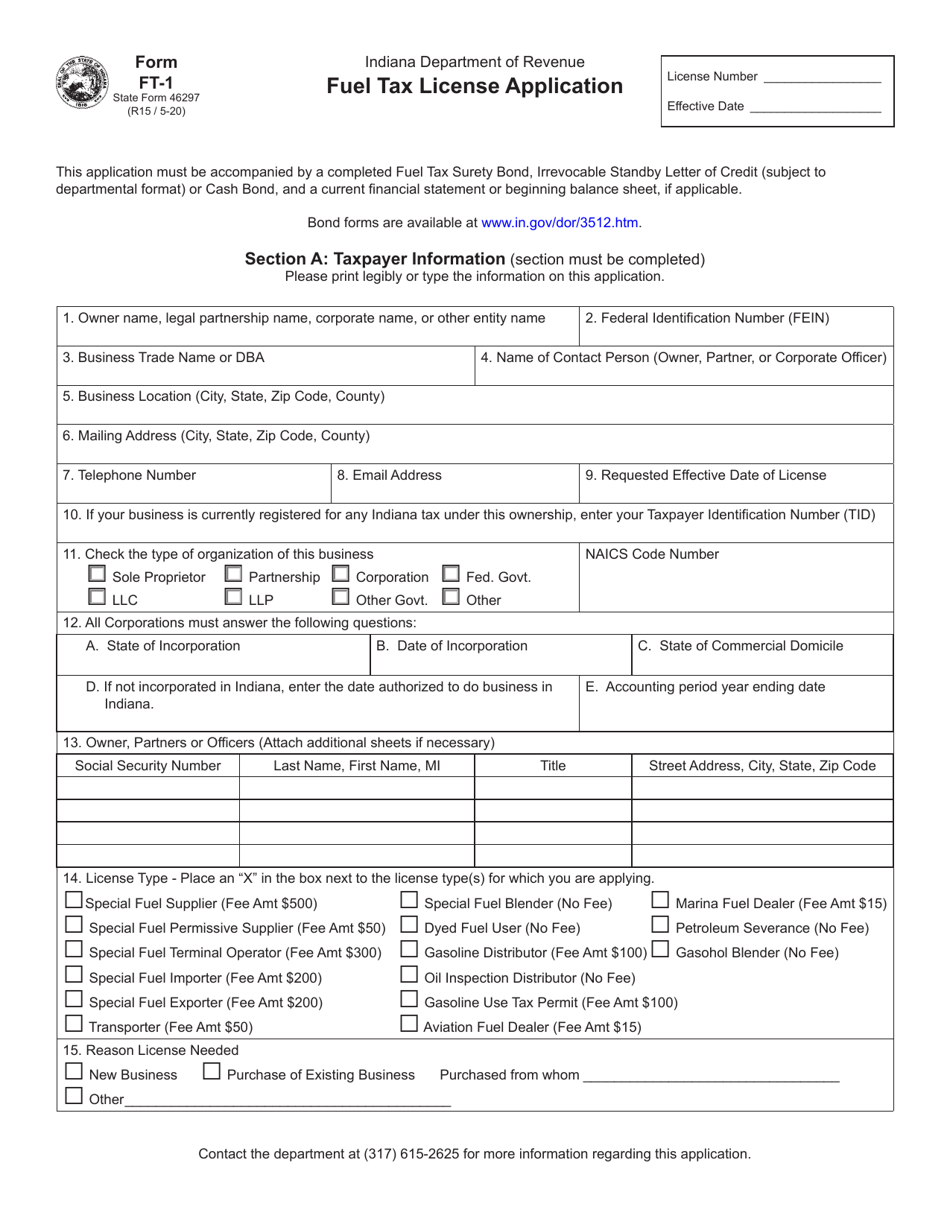

Form FT 1 State Form 46297 Download Fillable PDF Or Fill Online Fuel

Fillable Form Sna 1000a Rights And Responsibilities Printable Pdf

2000 Form CA EDD DE 1000AA Fill Online Printable Fillable Blank

https://forms.in.gov/Download.aspx?id=2808

Web 1 juil 2019 nbsp 0183 32 The REF 1000 form is used to file for a refund of un dyed special fuel excise tax gasoline excise tax and oil inspection fee Who should file Anyone who purchased

https://www.templateroller.com/group/6851/f…

Web 1 juin 2022 nbsp 0183 32 Download Fillable Form Ref 1000 state Form 50854 In Pdf The Latest Version Applicable For 2023 Fill Out The Claim For Fuel Tax

Web 1 juil 2019 nbsp 0183 32 The REF 1000 form is used to file for a refund of un dyed special fuel excise tax gasoline excise tax and oil inspection fee Who should file Anyone who purchased

Web 1 juin 2022 nbsp 0183 32 Download Fillable Form Ref 1000 state Form 50854 In Pdf The Latest Version Applicable For 2023 Fill Out The Claim For Fuel Tax

Form FT 1 State Form 46297 Download Fillable PDF Or Fill Online Fuel

Form FO 1000A Download Fillable PDF Or Fill Online Calculation Chart

Fillable Form Sna 1000a Rights And Responsibilities Printable Pdf

2000 Form CA EDD DE 1000AA Fill Online Printable Fillable Blank

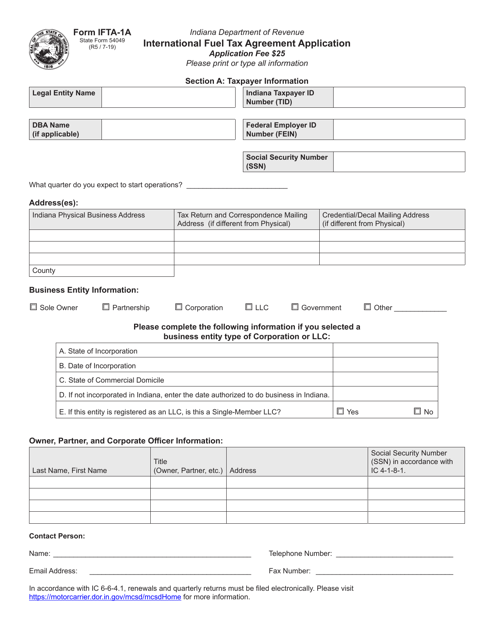

Form IFTA 1A State Form 54049 Download Fillable PDF Or Fill Online

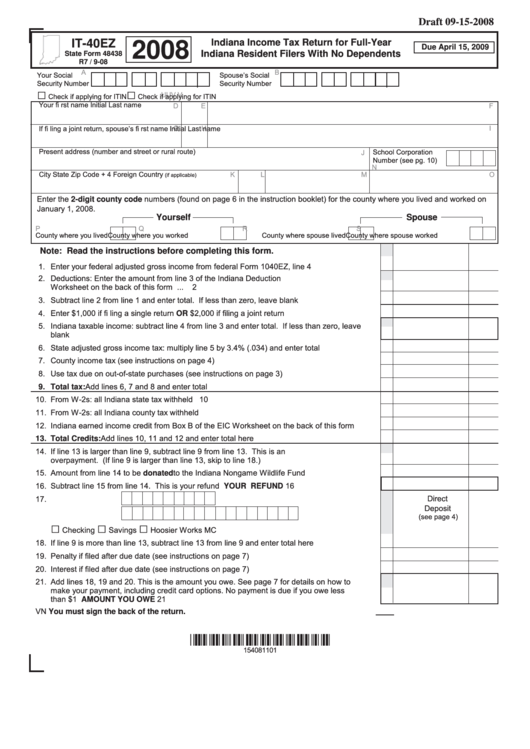

Form It 40ez Indiana Income Tax Return For Full Year Indiana Resident

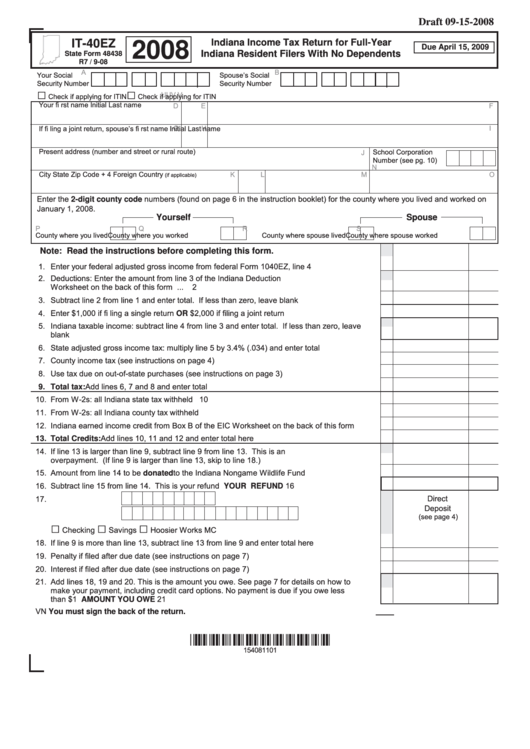

Form It 40ez Indiana Income Tax Return For Full Year Indiana Resident

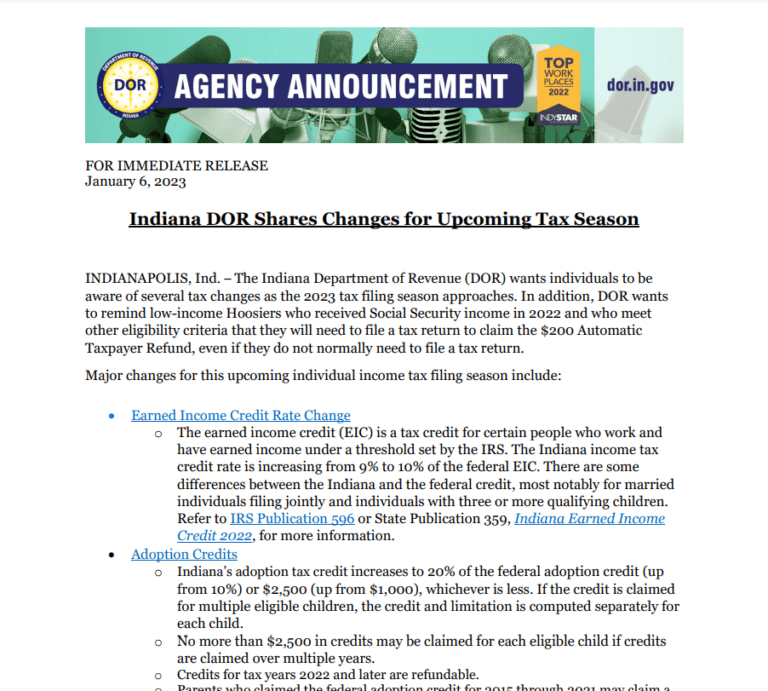

State Of Indiana Tax Rebate 2023 Printable Rebate Form