In today's consumer-driven world everyone appreciates a great deal. One option to obtain substantial savings when you shop is with 2023 Form 1040 Instructions Recovery Rebate Credits. 2023 Form 1040 Instructions Recovery Rebate Credits are a marketing strategy employed by retailers and manufacturers for offering customers a percentage reimbursement on their purchases following the time they have done so. In this article, we will dive into the world 2023 Form 1040 Instructions Recovery Rebate Credits and explore the nature of them, how they work, and how you can make the most of your savings using these low-cost incentives.

Get Latest 2023 Form 1040 Instructions Recovery Rebate Credit Below

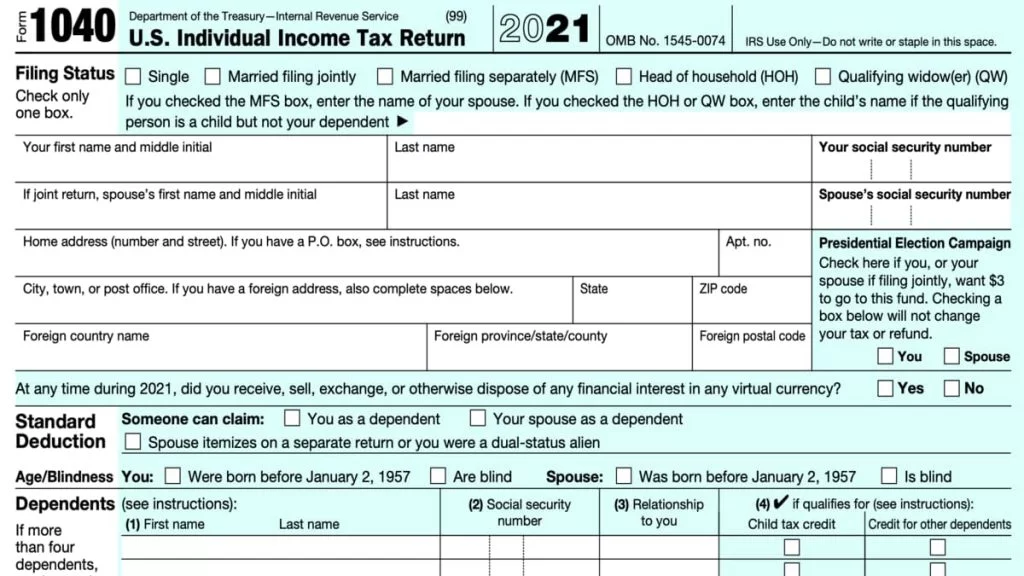

2023 Form 1040 Instructions Recovery Rebate Credit

2023 Form 1040 Instructions Recovery Rebate Credit -

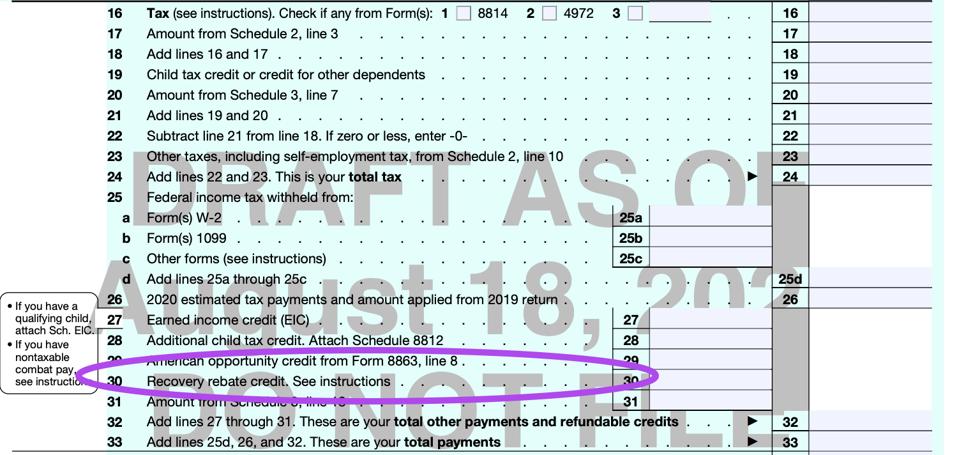

Web 13 Jan 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

Web 13 Apr 2022 nbsp 0183 32 The 2021 Recovery Rebate Credit can reduce any taxes owed or be included in the tax refund for the 2021 tax year Filers must ensure to not mix information

A 2023 Form 1040 Instructions Recovery Rebate Credit in its most basic form, is a partial refund offered to a customer after they've bought a product or service. It is a powerful tool that companies use to attract customers, increase sales, and promote specific products.

Types of 2023 Form 1040 Instructions Recovery Rebate Credit

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

Web 8 M 228 rz 2022 nbsp 0183 32 Who Is Eligible to Claim the Recovery Rebate Credit When considering the Recovery Rebate Credit the first question to answer is who was eligible for the

Web SCHEDULE 3 Form 1040 2022 Additional Credits and Payments Department of the Treasury Internal Revenue Service Attach to Form 1040 1040 SR or 1040 NR

Cash 2023 Form 1040 Instructions Recovery Rebate Credit

Cash 2023 Form 1040 Instructions Recovery Rebate Credit are probably the most simple kind of 2023 Form 1040 Instructions Recovery Rebate Credit. Customers receive a specific amount of money back upon buying a product. These are often used for big-ticket items, like electronics and appliances.

Mail-In 2023 Form 1040 Instructions Recovery Rebate Credit

Mail-in 2023 Form 1040 Instructions Recovery Rebate Credit require customers to send in proof of purchase to receive their refund. They're somewhat more complicated, but they can provide significant savings.

Instant 2023 Form 1040 Instructions Recovery Rebate Credit

Instant 2023 Form 1040 Instructions Recovery Rebate Credit are applied at the points of sale. This reduces the cost of purchase immediately. Customers don't need to wait until they can save when they purchase this type of 2023 Form 1040 Instructions Recovery Rebate Credit.

How 2023 Form 1040 Instructions Recovery Rebate Credit Work

Form 1040 SE 2023

Form 1040 SE 2023

Web 7 Dez 2022 nbsp 0183 32 The Recovery Rebate can be applied to federal income tax returns that are filed up to 2021 If you are married and have at minimum two children you may get up to

The 2023 Form 1040 Instructions Recovery Rebate Credit Process

The process typically comprises a few easy steps:

-

Then, you purchase the product purchase the product like you would normally.

-

Fill out the 2023 Form 1040 Instructions Recovery Rebate Credit forms: The 2023 Form 1040 Instructions Recovery Rebate Credit form will need to supply some details like your name, address, and purchase information, to apply for your 2023 Form 1040 Instructions Recovery Rebate Credit.

-

To submit the 2023 Form 1040 Instructions Recovery Rebate Credit Based on the type of 2023 Form 1040 Instructions Recovery Rebate Credit you will need to mail a 2023 Form 1040 Instructions Recovery Rebate Credit form in or send it via the internet.

-

Wait for approval: The company will go through your application to make sure it is in line with the requirements of the 2023 Form 1040 Instructions Recovery Rebate Credit.

-

Redeem your 2023 Form 1040 Instructions Recovery Rebate Credit After you've been approved, you'll receive your cash back whether via check, credit card, or by another method that is specified in the offer.

Pros and Cons of 2023 Form 1040 Instructions Recovery Rebate Credit

Advantages

-

Cost savings 2023 Form 1040 Instructions Recovery Rebate Credit can dramatically decrease the price for the product.

-

Promotional Offers The aim is to encourage customers in trying new products or brands.

-

Enhance Sales 2023 Form 1040 Instructions Recovery Rebate Credit can help boost the sales of a business and increase its market share.

Disadvantages

-

Complexity The mail-in 2023 Form 1040 Instructions Recovery Rebate Credit in particular they can be time-consuming and tedious.

-

Expiration Dates A majority of 2023 Form 1040 Instructions Recovery Rebate Credit have deadlines for submission.

-

Risque of Non-Payment Customers may not receive 2023 Form 1040 Instructions Recovery Rebate Credit if they don't follow the rules precisely.

Download 2023 Form 1040 Instructions Recovery Rebate Credit

Download 2023 Form 1040 Instructions Recovery Rebate Credit

FAQs

1. Are 2023 Form 1040 Instructions Recovery Rebate Credit the same as discounts? No, they are some form of refund following the purchase whereas discounts will reduce the cost of purchase at moment of sale.

2. Are there 2023 Form 1040 Instructions Recovery Rebate Credit that can be used on the same product It's contingent upon the conditions of the 2023 Form 1040 Instructions Recovery Rebate Credit provides and the particular product's admissibility. Certain companies allow it, while other companies won't.

3. How long will it take to receive the 2023 Form 1040 Instructions Recovery Rebate Credit? The length of time will vary, but it may take anywhere from a few weeks to a couple of months for you to receive your 2023 Form 1040 Instructions Recovery Rebate Credit.

4. Do I have to pay tax in relation to 2023 Form 1040 Instructions Recovery Rebate Credit montants? the majority of situations, 2023 Form 1040 Instructions Recovery Rebate Credit amounts are not considered to be taxable income.

5. Do I have confidence in 2023 Form 1040 Instructions Recovery Rebate Credit offers from lesser-known brands Consider doing some research and make sure that the company that is offering the 2023 Form 1040 Instructions Recovery Rebate Credit is trustworthy prior to making purchases.

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

1040 EF Message 0006 Recovery Rebate Credit Drake20

Check more sample of 2023 Form 1040 Instructions Recovery Rebate Credit below

Recovery Rebate Credit Irs Form Recovery Rebate

1040 Recovery Rebate Credit Drake20

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Form It 2023 Income Allocation And Apportionment Printable Pdf Download

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Solved Recovery Rebate Credit Error On 1040 Instructions

https://www.irs.gov/newsroom/irs-revises-further-frequently-asked...

Web 13 Apr 2022 nbsp 0183 32 The 2021 Recovery Rebate Credit can reduce any taxes owed or be included in the tax refund for the 2021 tax year Filers must ensure to not mix information

https://www.recoveryrebate.net/1040-instructions-2023-recovery-rebat…

Web 25 M 228 rz 2023 nbsp 0183 32 1040 Instructions 2023 Recovery Rebate Credit The Recovery Rebate allows taxpayers to receive a tax refund without having to modify the tax return This

Web 13 Apr 2022 nbsp 0183 32 The 2021 Recovery Rebate Credit can reduce any taxes owed or be included in the tax refund for the 2021 tax year Filers must ensure to not mix information

Web 25 M 228 rz 2023 nbsp 0183 32 1040 Instructions 2023 Recovery Rebate Credit The Recovery Rebate allows taxpayers to receive a tax refund without having to modify the tax return This

Form It 2023 Income Allocation And Apportionment Printable Pdf Download

1040 Recovery Rebate Credit Drake20

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Solved Recovery Rebate Credit Error On 1040 Instructions

2022 Form 1040 Recovery Rebate Credit Worksheet Recovery Rebate

Recovery Rebate Credit Form 1040 Recovery Rebate

Recovery Rebate Credit Form 1040 Recovery Rebate

2022 Form 1040 Schedule A Instructions