In our modern, consumer-driven society everyone is looking for a great bargain. One option to obtain substantial savings on your purchases is by using Income Criteria For Pa Property Tax Rebate Forms. Income Criteria For Pa Property Tax Rebate Forms are a strategy for marketing that retailers and manufacturers use to provide customers with a partial reimbursement on their purchases following the time they have taken them. In this post, we'll look into the world of Income Criteria For Pa Property Tax Rebate Forms. We'll discuss the nature of them and how they function, and the best way to increase your savings through these cost-effective incentives.

Get Latest Income Criteria For Pa Property Tax Rebate Form Below

Income Criteria For Pa Property Tax Rebate Form

Income Criteria For Pa Property Tax Rebate Form -

Web PENNSYLVANIA DEPARTMENT OF REVENUE PROPERTY TAX RENT REBATE PROGRAM The Property Tax Rent Rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18

Web 2022 Property Tax Rent Rebate applications must be postmarked by December 31 2023 to be considered myPATH allows claimants of the Property Tax Rent Rebate Program to file their applications online Learn more about the online filing features for the Property

A Income Criteria For Pa Property Tax Rebate Form in its most basic definition, is a cash refund provided to customers after they've bought a product or service. It's a very effective technique that businesses use to draw buyers, increase sales or promote a specific product.

Types of Income Criteria For Pa Property Tax Rebate Form

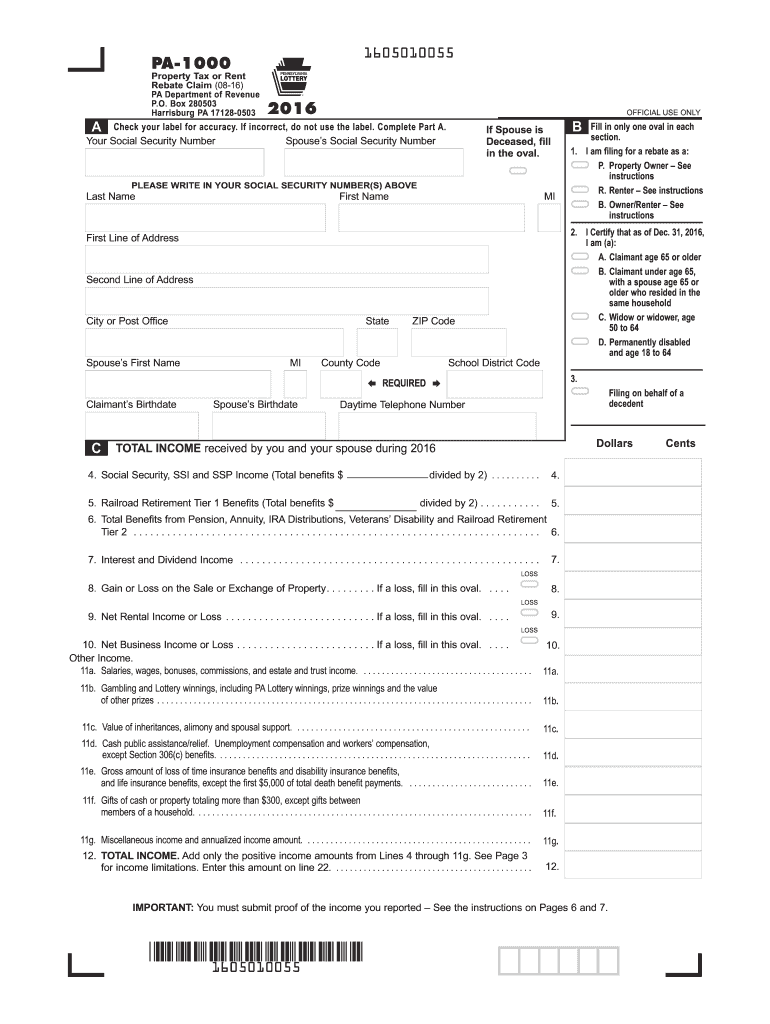

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

Web Eligibility Criteria Applicants of the Property Tax Rent Rebate program must still fall under one of the previous four categories to qualify That means the program will continue to benefit eligible Pennsylvanians age 65 and older widows and widowers age 50 and

Web INCOME LEVEL Maximum Rebate 0 to 8 000 650 8 001 to 15 000 500 Enter the amount from Line 13 of the claim form on this line and circle the corresponding Maximum Rebate amount for your income level Owners use Table A and Renters use Table B 23

Cash Income Criteria For Pa Property Tax Rebate Form

Cash Income Criteria For Pa Property Tax Rebate Form are the simplest type of Income Criteria For Pa Property Tax Rebate Form. Customers receive a specific amount of money back upon buying a product. These are typically for high-ticket items like electronics or appliances.

Mail-In Income Criteria For Pa Property Tax Rebate Form

Mail-in Income Criteria For Pa Property Tax Rebate Form demand that customers present the proof of purchase to be eligible for the money. They're more complicated, but they can provide substantial savings.

Instant Income Criteria For Pa Property Tax Rebate Form

Instant Income Criteria For Pa Property Tax Rebate Form apply at the moment of sale, cutting prices immediately. Customers don't have to wait until they can save when they purchase this type of Income Criteria For Pa Property Tax Rebate Form.

How Income Criteria For Pa Property Tax Rebate Form Work

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

Web 4 ao 251 t 2023 nbsp 0183 32 The lowest income households will be eligible for rebates of 1 000 up from 650 the previous maximum The law also resolves the mismatch between state and federal law that fueled the program s waning usage The federal government adjusts

The Income Criteria For Pa Property Tax Rebate Form Process

The process typically comprises a handful of simple steps:

-

When you buy the product purchase the product like you would normally.

-

Complete the Income Criteria For Pa Property Tax Rebate Form application: In order to claim your Income Criteria For Pa Property Tax Rebate Form, you'll have submit some information including your name, address and purchase information, in order to get your Income Criteria For Pa Property Tax Rebate Form.

-

To submit the Income Criteria For Pa Property Tax Rebate Form In accordance with the type of Income Criteria For Pa Property Tax Rebate Form you will need to mail a Income Criteria For Pa Property Tax Rebate Form form in or make it available online.

-

Wait until the company approves: The company will review your request to confirm that it complies with the Income Criteria For Pa Property Tax Rebate Form's terms and conditions.

-

Enjoy your Income Criteria For Pa Property Tax Rebate Form If it is approved, you'll receive the refund whether via check, credit card or through a different method as specified by the offer.

Pros and Cons of Income Criteria For Pa Property Tax Rebate Form

Advantages

-

Cost Savings The use of Income Criteria For Pa Property Tax Rebate Form can greatly decrease the price for a product.

-

Promotional Deals They encourage customers in trying new products or brands.

-

Help to Increase Sales A Income Criteria For Pa Property Tax Rebate Form program can boost the sales of a business and increase its market share.

Disadvantages

-

Complexity Pay-in Income Criteria For Pa Property Tax Rebate Form via mail, particularly is a time-consuming process and costly.

-

Expiration Dates Many Income Criteria For Pa Property Tax Rebate Form have extremely strict deadlines to submit.

-

The risk of non-payment Customers may not receive Income Criteria For Pa Property Tax Rebate Form if they don't observe the rules exactly.

Download Income Criteria For Pa Property Tax Rebate Form

Download Income Criteria For Pa Property Tax Rebate Form

FAQs

1. Are Income Criteria For Pa Property Tax Rebate Form equivalent to discounts? No, the Income Criteria For Pa Property Tax Rebate Form will be a partial refund after the purchase, whereas discounts cut their price at time of sale.

2. Can I use multiple Income Criteria For Pa Property Tax Rebate Form for the same product? It depends on the terms applicable to Income Criteria For Pa Property Tax Rebate Form promotions and on the products qualification. Certain companies allow it, but others won't.

3. How long will it take to get an Income Criteria For Pa Property Tax Rebate Form What is the timeframe? is different, but it could be anywhere from a few weeks up to a couple of months before you get your Income Criteria For Pa Property Tax Rebate Form.

4. Do I have to pay taxes in relation to Income Criteria For Pa Property Tax Rebate Form amount? the majority of cases, Income Criteria For Pa Property Tax Rebate Form amounts are not considered to be taxable income.

5. Should I be able to trust Income Criteria For Pa Property Tax Rebate Form offers from brands that aren't well-known Do I need to conduct a thorough research and verify that the brand offering the Income Criteria For Pa Property Tax Rebate Form is reputable before making an investment.

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

PA 1000 2014 Property Tax Or Rent Rebate Claim Free Download

Check more sample of Income Criteria For Pa Property Tax Rebate Form below

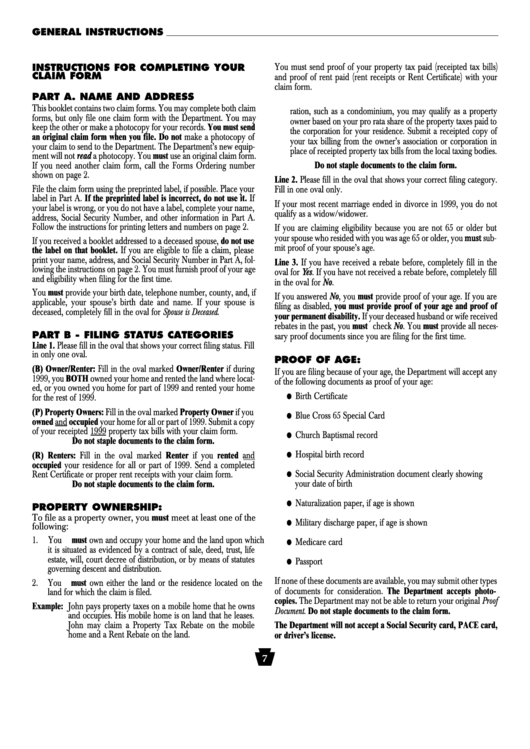

Form Pa 1000 Instructions For Completing Your Claim Form Property

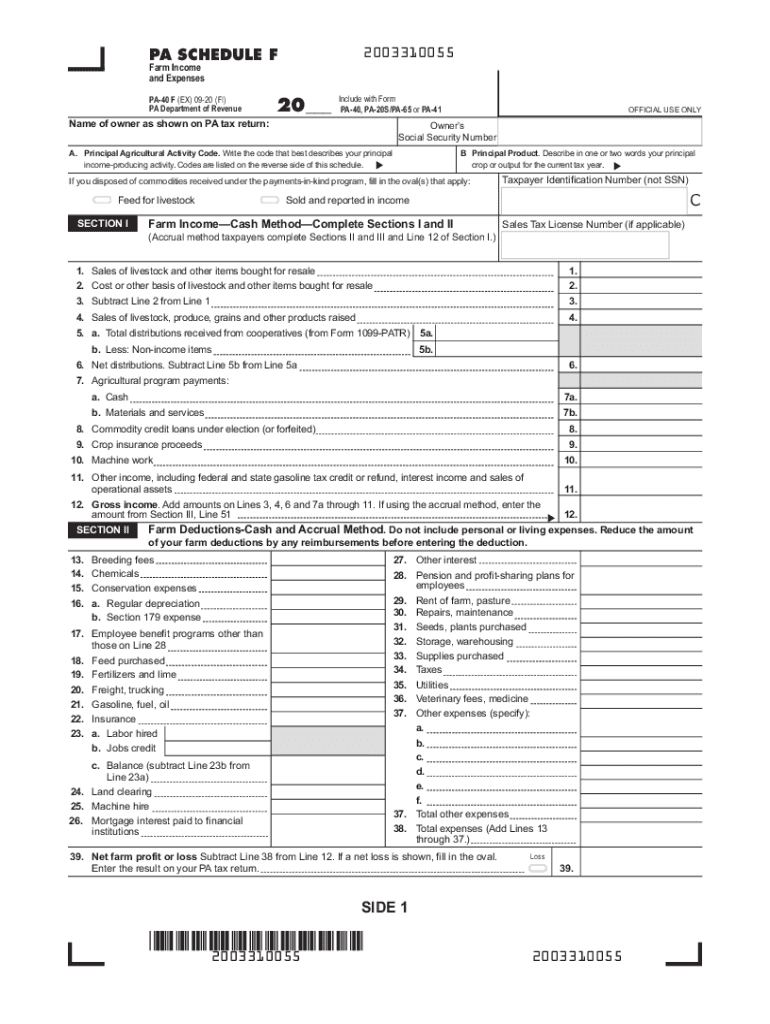

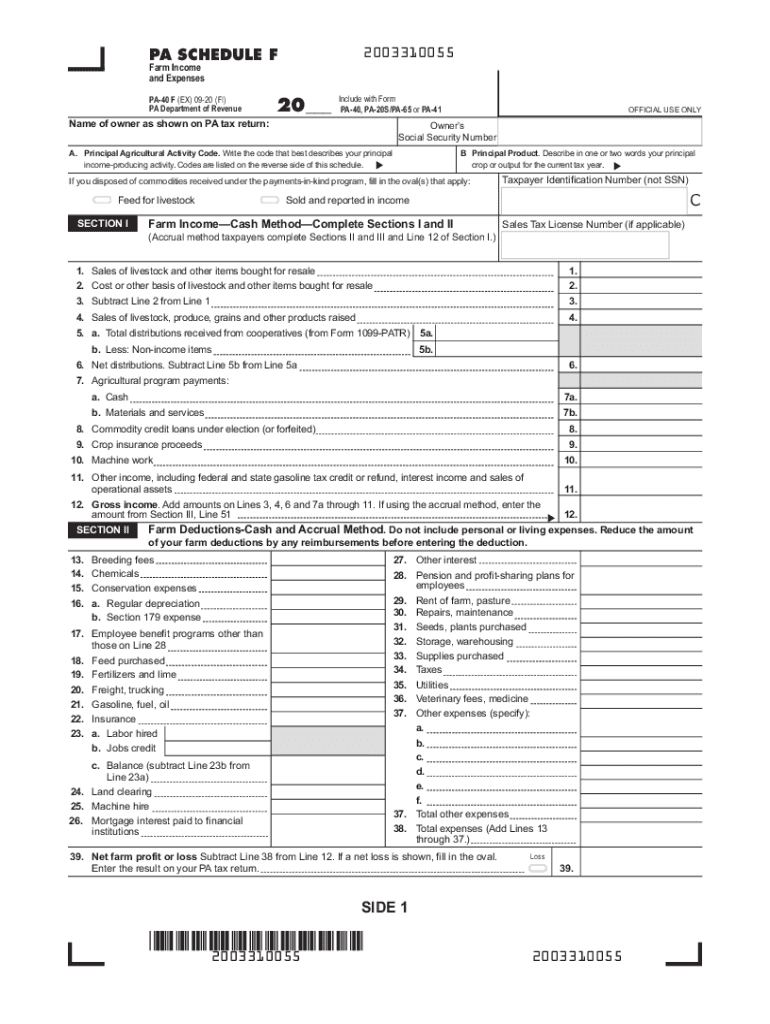

Pa 40 F Fill Online Printable Fillable Blank PdfFiller

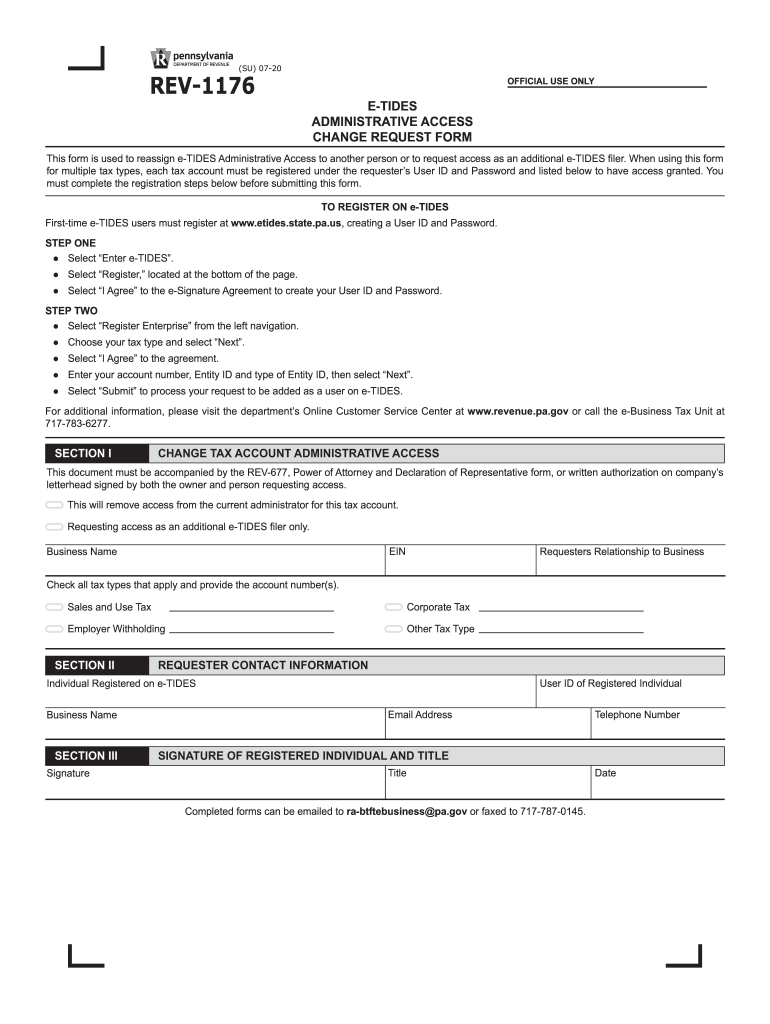

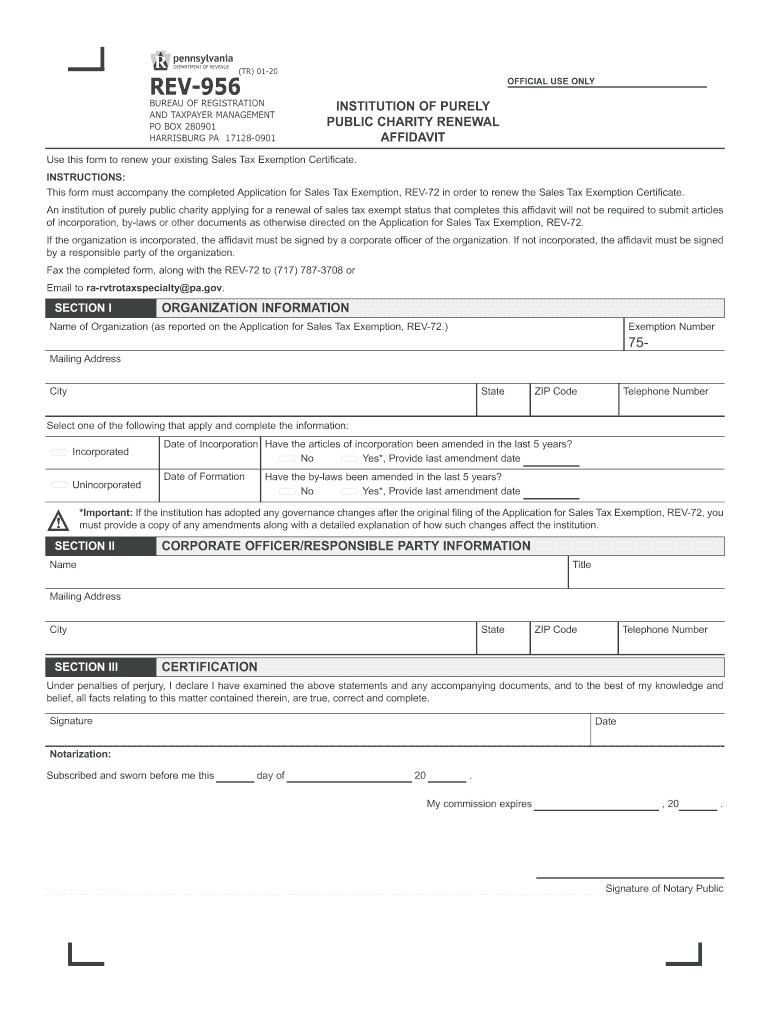

2020 2023 Form PA REV 1176 Fill Online Printable Fillable Blank

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

Property Tax Rebate Application Printable Pdf Download

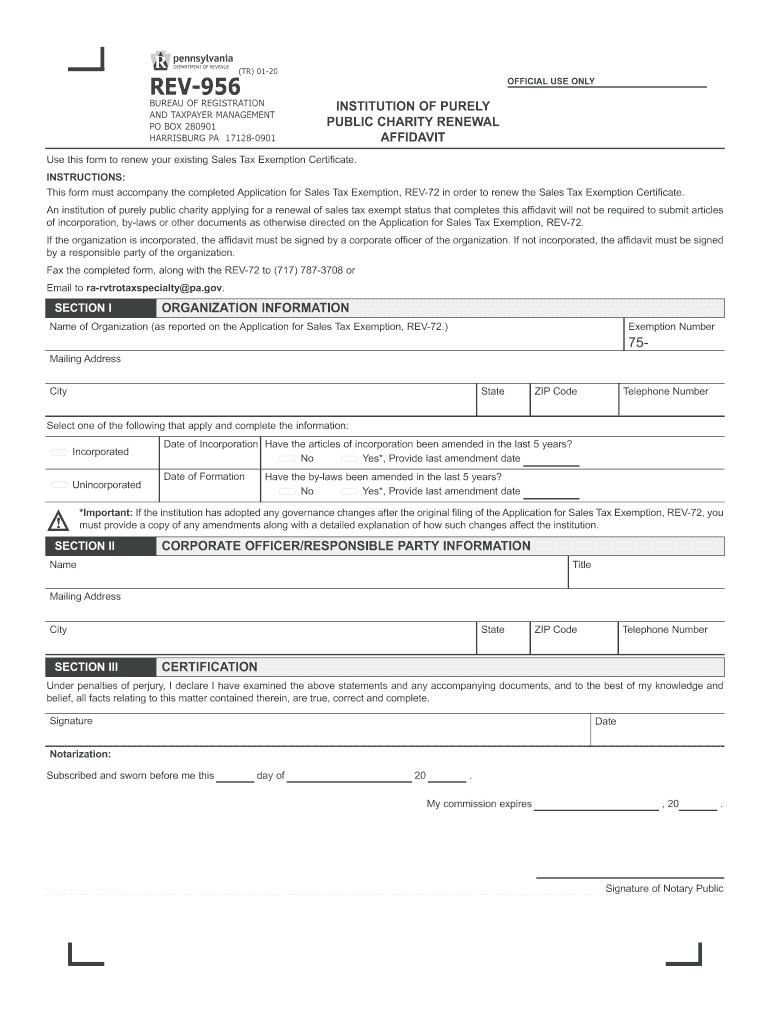

2020 2022 Form PA REV 956 Fill Online Printable Fillable Blank

https://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/P…

Web 2022 Property Tax Rent Rebate applications must be postmarked by December 31 2023 to be considered myPATH allows claimants of the Property Tax Rent Rebate Program to file their applications online Learn more about the online filing features for the Property

https://www.revenue.pa.gov/IncentivesCreditsPrograms...

Web Property Tax Rent Rebate Program The rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 and older The income limit is 35 000 a year for homeowners and 15 000 annually

Web 2022 Property Tax Rent Rebate applications must be postmarked by December 31 2023 to be considered myPATH allows claimants of the Property Tax Rent Rebate Program to file their applications online Learn more about the online filing features for the Property

Web Property Tax Rent Rebate Program The rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 and older The income limit is 35 000 a year for homeowners and 15 000 annually

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

Pa 40 F Fill Online Printable Fillable Blank PdfFiller

Property Tax Rebate Application Printable Pdf Download

2020 2022 Form PA REV 956 Fill Online Printable Fillable Blank

Fillable Pa 40 Fill Out Sign Online DocHub

PA Rent Rebate Form Printable Rebate Form

PA Rent Rebate Form Printable Rebate Form

Pa Rent Rebate Form 2020 Fill Online Printable Fillable Blank