In today's world of consumerism people love a good deal. One option to obtain substantial savings in your purchase is through Illinois Tax Rebatess. Illinois Tax Rebatess are a strategy for marketing that retailers and manufacturers use to offer customers a partial refund on their purchases after they've completed them. In this article, we will dive into the world Illinois Tax Rebatess. We'll discuss the nature of them what they are, how they function, and ways you can increase your savings using these low-cost incentives.

Get Latest Illinois Tax Rebates Below

Illinois Tax Rebates

Illinois Tax Rebates - Illinois Tax Rebates, Illinois Tax Rebates 2023, Illinois Tax Rebates Taxable, Illinois Tax Rebate Electric Car, Illinois Tax Rebate Program, Illinois Tax Refund, How Long To Get Illinois Tax Refund

Web 8 ao 251 t 2022 nbsp 0183 32 The property tax rebate amount your clients can receive is equal to the property tax credit they were qualified to claim on the 2021 IL 1040 with a maximum

Web By law Monday October 17 2022 was the last day to submit information to receive the Illinois Income Tax Rebate and Property Tax Rebate Public Act 102 0700 No filing

A Illinois Tax Rebates in its simplest description, is a reimbursement to a buyer after having purchased a item or service. It's an effective way used by businesses to attract customers, increase sales, and even promote certain products.

Types of Illinois Tax Rebates

2021 Illinois Property Tax Rebate Printable Rebate Form

2021 Illinois Property Tax Rebate Printable Rebate Form

Web 21 sept 2022 nbsp 0183 32 How Much Money Could You Get and Who Is Eligible There will be two rebates One is for income taxes and another for property taxes Income tax The income

Web 28 sept 2022 nbsp 0183 32 There will be two rebates One is for income taxes and another for property taxes Income tax The income tax rebate calls for a single person to receive 50 while

Cash Illinois Tax Rebates

Cash Illinois Tax Rebates are the simplest kind of Illinois Tax Rebates. Customers receive a certain amount of money back upon purchasing a item. They are typically used to purchase costly items like electronics or appliances.

Mail-In Illinois Tax Rebates

Mail-in Illinois Tax Rebates demand that customers provide an evidence of purchase for their cash back. They're a bit more complicated, but they can provide substantial savings.

Instant Illinois Tax Rebates

Instant Illinois Tax Rebates are applied at points of sale. This reduces the purchase cost immediately. Customers don't have to wait until they can save through this kind of offer.

How Illinois Tax Rebates Work

2022 State Of Illinois Tax Rebates EzTaxReturn Blog

2022 State Of Illinois Tax Rebates EzTaxReturn Blog

Web 5 mai 2023 nbsp 0183 32 How to Claim Illinois Tax Rebates a Step 1 Gather necessary documents W 2 forms or 1099s for income verification Proof of residency or business b Step 2

The Illinois Tax Rebates Process

The process typically comprises a number of easy steps:

-

Buy the product: At first you purchase the item like you would normally.

-

Complete the Illinois Tax Rebates paper: You'll have to fill in some information like your name, address, as well as the details of your purchase to submit your Illinois Tax Rebates.

-

You must submit the Illinois Tax Rebates It is dependent on the type of Illinois Tax Rebates you may have to fill out a paper form or make it available online.

-

Wait for approval: The company will look over your submission and ensure that it's compliant with requirements of the Illinois Tax Rebates.

-

Take advantage of your Illinois Tax Rebates If it is approved, you'll get your refund, whether by check, prepaid card, or any other way specified in the offer.

Pros and Cons of Illinois Tax Rebates

Advantages

-

Cost Savings Illinois Tax Rebates can dramatically reduce the cost for products.

-

Promotional Deals The aim is to encourage customers to try new products and brands.

-

Accelerate Sales The benefits of a Illinois Tax Rebates can improve the company's sales as well as market share.

Disadvantages

-

Complexity In particular, mail-in Illinois Tax Rebates in particular difficult and long-winded.

-

End Dates: Many Illinois Tax Rebates have the strictest deadlines for submission.

-

Risque of Non-Payment Customers may not get their Illinois Tax Rebates if they don't follow the rules precisely.

Download Illinois Tax Rebates

FAQs

1. Are Illinois Tax Rebates equivalent to discounts? No, the Illinois Tax Rebates will be a partial refund after purchase, whereas discounts cut your purchase cost at point of sale.

2. Can I make use of multiple Illinois Tax Rebates for the same product This depends on the terms for the Illinois Tax Rebates offers and the product's eligibility. Certain companies allow the use of multiple Illinois Tax Rebates, whereas other won't.

3. How long does it take to receive a Illinois Tax Rebates? The time frame differs, but could take anywhere from a couple of weeks to a few months to receive your Illinois Tax Rebates.

4. Do I need to pay taxes of Illinois Tax Rebates the amount? the majority of instances, Illinois Tax Rebates amounts are not considered to be taxable income.

5. Do I have confidence in Illinois Tax Rebates deals from lesser-known brands it is crucial to conduct research and confirm that the brand giving the Illinois Tax Rebates is trustworthy prior to making any purchase.

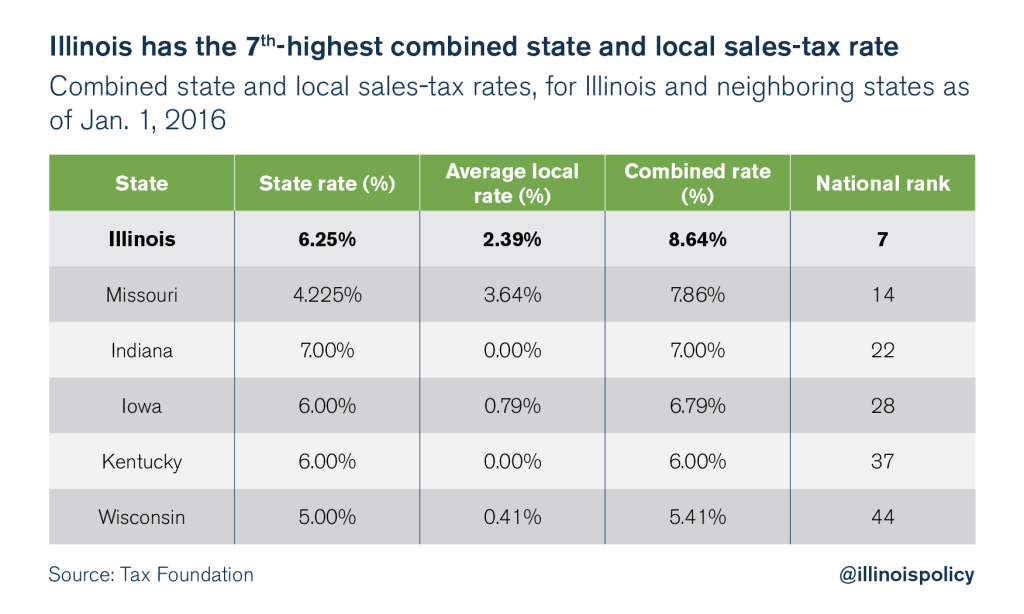

Illinois Is A High tax State Illinois Policy

Deadline To File For Illinois Tax Rebates Monday YouTube

Check more sample of Illinois Tax Rebates below

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

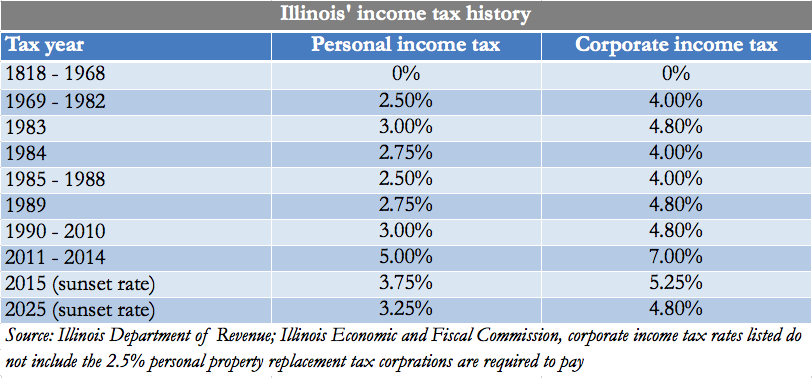

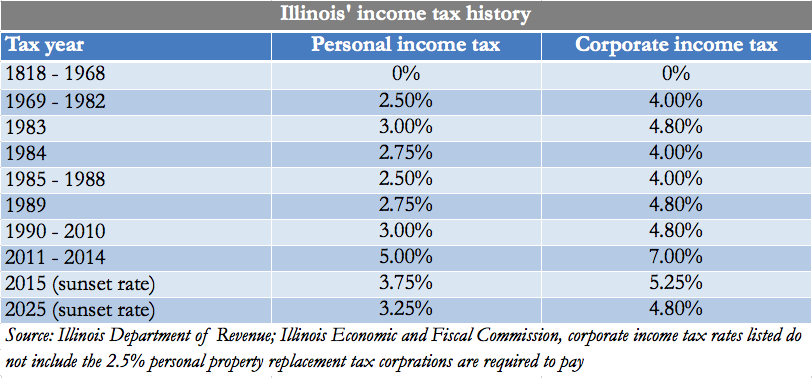

Illinois Has A Dirty Little Secret Buried In Its Tax History

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

No Those Illinois Tax Rebate Checks Aren t Bouncing WGN TV

Illinois Tax Rebates Are Coming In Time For The Election

https://tax.illinois.gov/programs/rebates/rebates-filing-guide.html

Web By law Monday October 17 2022 was the last day to submit information to receive the Illinois Income Tax Rebate and Property Tax Rebate Public Act 102 0700 No filing

https://www.kiplinger.com/taxes/illinois-tax-rebate-stimulus-checks

Web 8 d 233 c 2022 nbsp 0183 32 The size of your income tax rebate depends on your filing status and the number of dependents claimed on your 2021 Illinois tax return Each qualifying person

Web By law Monday October 17 2022 was the last day to submit information to receive the Illinois Income Tax Rebate and Property Tax Rebate Public Act 102 0700 No filing

Web 8 d 233 c 2022 nbsp 0183 32 The size of your income tax rebate depends on your filing status and the number of dependents claimed on your 2021 Illinois tax return Each qualifying person

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

Illinois Has A Dirty Little Secret Buried In Its Tax History

No Those Illinois Tax Rebate Checks Aren t Bouncing WGN TV

Illinois Tax Rebates Are Coming In Time For The Election

Three Chicago Fed Economists Say They Know How To Tax Illinoisans

Illinois Tax Rebate Tracker Rebate2022

Illinois Tax Rebate Tracker Rebate2022

Illinois Tax Tables Brokeasshome