In the modern world of consumerization everybody loves a good bargain. One way to gain substantial savings on your purchases is through Irs Ev Rebate Forms. The use of Irs Ev Rebate Forms is a method used by manufacturers and retailers to provide customers with a portion of a return on their purchases once they've taken them. In this article, we'll examine the subject of Irs Ev Rebate Forms. We will explore what they are and how they operate, as well as ways to maximize your savings using these low-cost incentives.

Get Latest Irs Ev Rebate Form Below

Irs Ev Rebate Form

Irs Ev Rebate Form - Irs Ev Rebate Form, Irs Ev Tax Credit Form 2022, How To Claim Ev Rebate, How To Get The Rebate Tax Credit, What Is Rebate Tax Credit

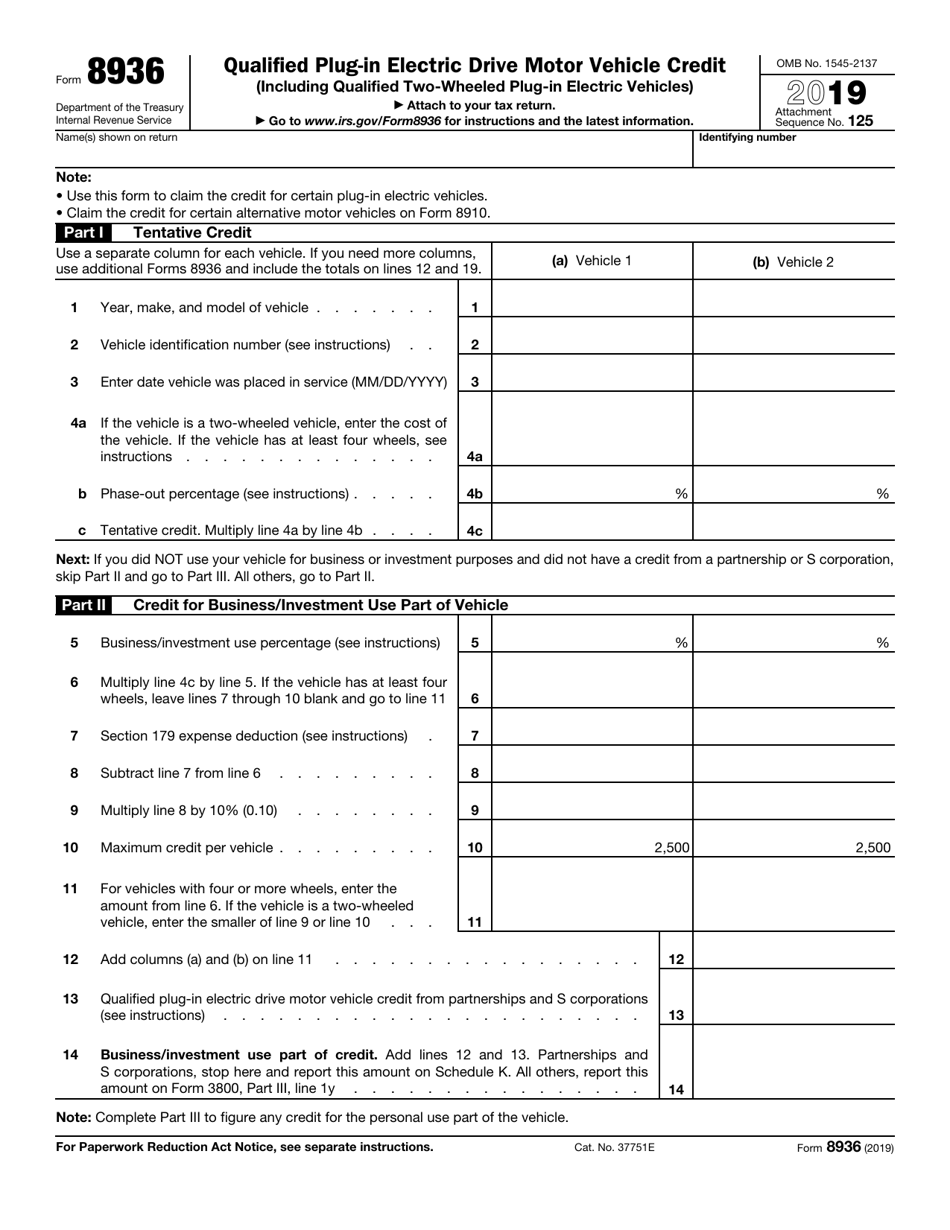

Use Form 8936 to claim either the Qualified Plug In Electric Drive Motor Vehicle Credit or the new Clean Vehicle Credit The Qualified Plug In Electric Drive Motor Vehicle Credit and the new Clean Vehicle Credit are each worth up to 7 500

Find information on credits for used clean vehicles qualified commercial clean vehicles and new plug in EVs purchased before 2023 Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV

A Irs Ev Rebate Form in its most basic format, is a reimbursement to a buyer when they purchase a product or service. It's a highly effective tool employed by companies to attract customers, increase sales or promote a specific product.

Types of Irs Ev Rebate Form

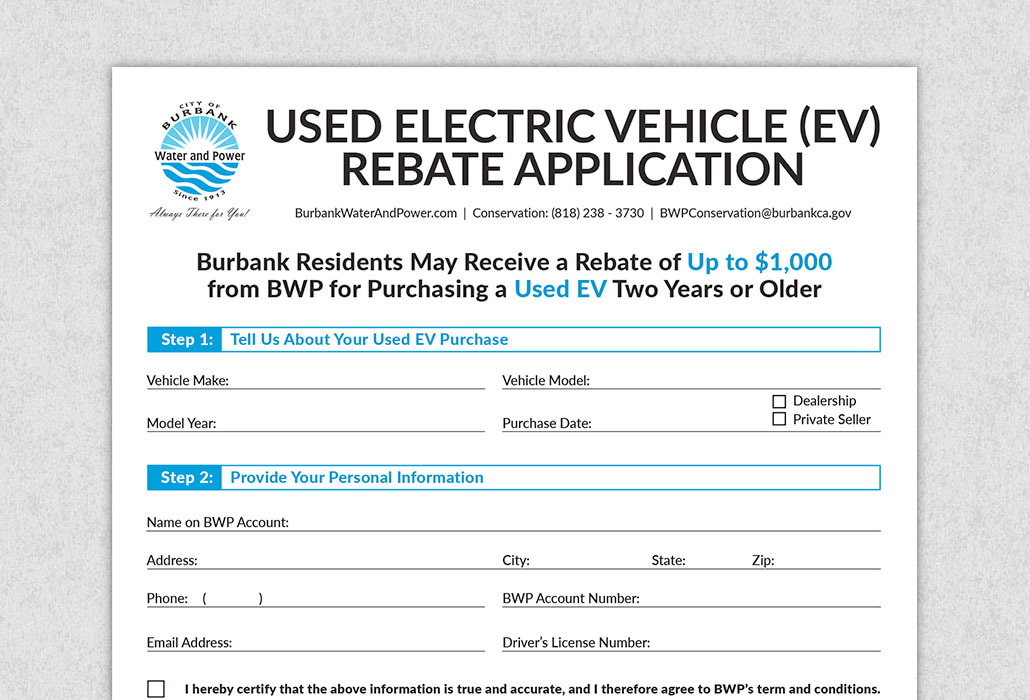

Used Electric Vehicle Rebate

Used Electric Vehicle Rebate

Clean Vehicle Tax Credits We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new clean vehicle Looking to claim a credit for a new clean vehicle you already bought

Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 The availability of the credit will depend on several factors including the vehicle s MSRP its final assembly location battery component and or critical

Cash Irs Ev Rebate Form

Cash Irs Ev Rebate Form is the most basic type of Irs Ev Rebate Form. Customers are offered a certain amount of money when buying a product. These are typically for the most expensive products like electronics or appliances.

Mail-In Irs Ev Rebate Form

Mail-in Irs Ev Rebate Form require consumers to send in an evidence of purchase for the refund. They're more involved, but offer substantial savings.

Instant Irs Ev Rebate Form

Instant Irs Ev Rebate Form are applied right at the point of sale and reduce prices immediately. Customers don't have to wait long for savings in this manner.

How Irs Ev Rebate Form Work

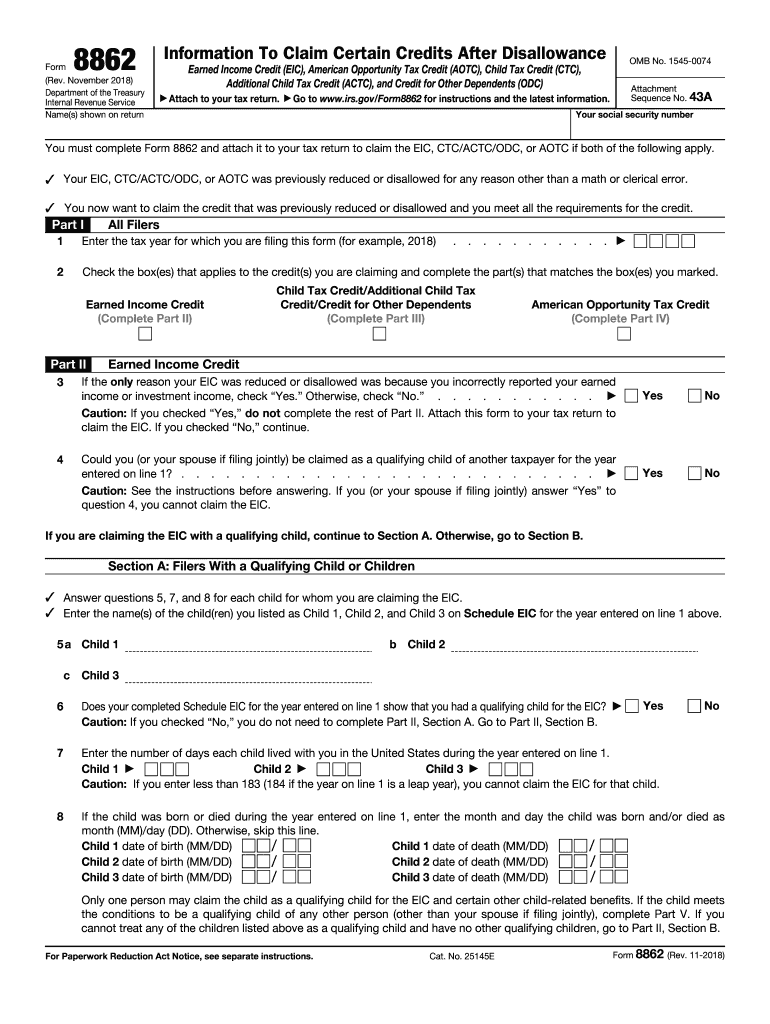

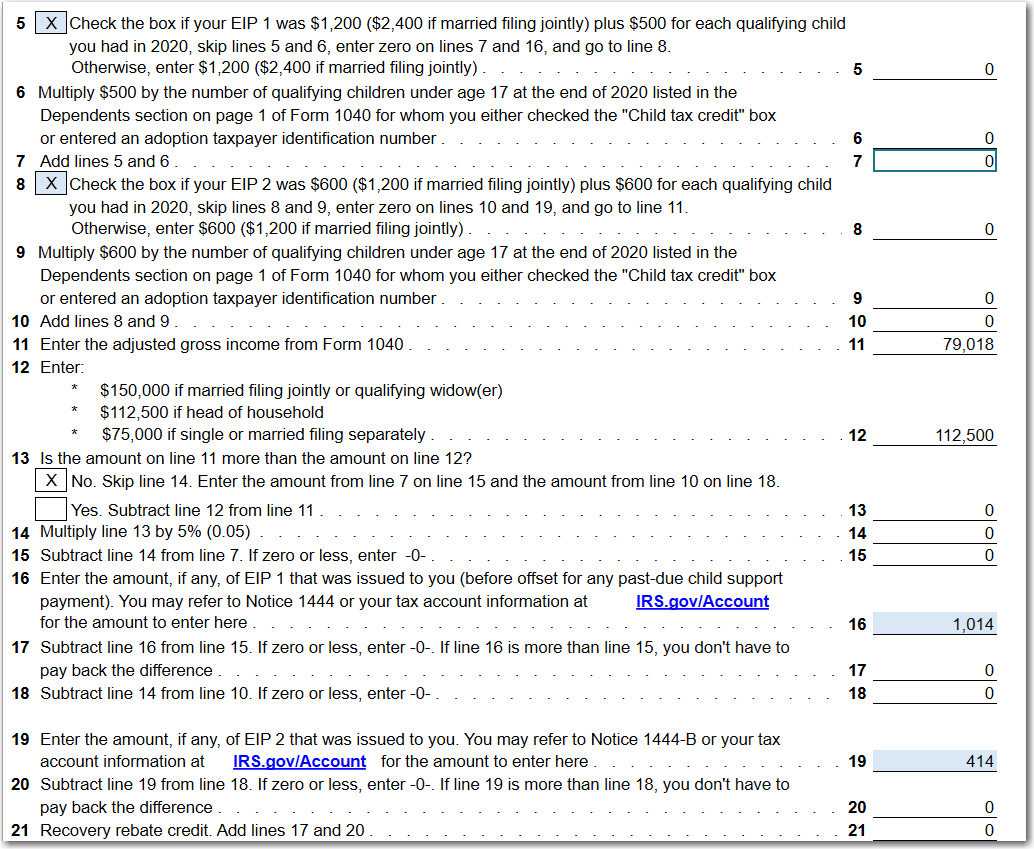

IRS CP 12R Recovery Rebate Credit Overpayment

IRS CP 12R Recovery Rebate Credit Overpayment

To assist consumers identifying eligible vehicles the Department of Transportation and Department of Energy published new resources today to help those interested in claiming tax credits for an electric vehicle purchased after the Inflation Reduction Act s enactment on August 16 2022

The Irs Ev Rebate Form Process

The process usually involves a number of easy steps:

-

Purchase the product: First, you purchase the item like you would normally.

-

Fill out your Irs Ev Rebate Form Form: To claim the Irs Ev Rebate Form you'll have to supply some details, such as your address, name, and purchase details, in order to be eligible for a Irs Ev Rebate Form.

-

You must submit the Irs Ev Rebate Form depending on the kind of Irs Ev Rebate Form you might need to fill out a form and mail it in or submit it online.

-

Wait for approval: The business will look over your submission to make sure that it's in accordance with the Irs Ev Rebate Form's terms and conditions.

-

You will receive your Irs Ev Rebate Form Once you've received your approval, you'll get your refund, whether via check, credit card or through a different way specified in the offer.

Pros and Cons of Irs Ev Rebate Form

Advantages

-

Cost savings Irs Ev Rebate Form are a great way to reduce the cost for the item.

-

Promotional Offers they encourage their customers to try new products and brands.

-

Increase Sales Irs Ev Rebate Form are a great way to boost the sales of a business and increase its market share.

Disadvantages

-

Complexity Reward mail-ins in particular is a time-consuming process and demanding.

-

Days of expiration A majority of Irs Ev Rebate Form have rigid deadlines to submit.

-

Risk of not receiving payment Some customers might not get their Irs Ev Rebate Form if they don't comply with the rules exactly.

Download Irs Ev Rebate Form

FAQs

1. Are Irs Ev Rebate Form equivalent to discounts? Not at all, Irs Ev Rebate Form provide a partial refund after purchase whereas discounts will reduce the cost of purchase at point of sale.

2. Can I get multiple Irs Ev Rebate Form for the same product? It depends on the terms and conditions of Irs Ev Rebate Form offered and product's eligibility. Certain companies might allow it, while some won't.

3. How long will it take to get the Irs Ev Rebate Form? The timing will differ, but can last from a few weeks until a couple of months before you get your Irs Ev Rebate Form.

4. Do I need to pay tax for Irs Ev Rebate Form amounts? In the majority of situations, Irs Ev Rebate Form amounts are not considered taxable income.

5. Should I be able to trust Irs Ev Rebate Form deals from lesser-known brands You must research and ensure that the business which is providing the Irs Ev Rebate Form is legitimate prior to making purchases.

IRS CP 11R Recovery Rebate Credit Balance Due

Have A New Electric Car Don t Forget To Claim Your Tax Credit Turbo Tax

Check more sample of Irs Ev Rebate Form below

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

How Do I Claim The Recovery Rebate Credit On My Ta

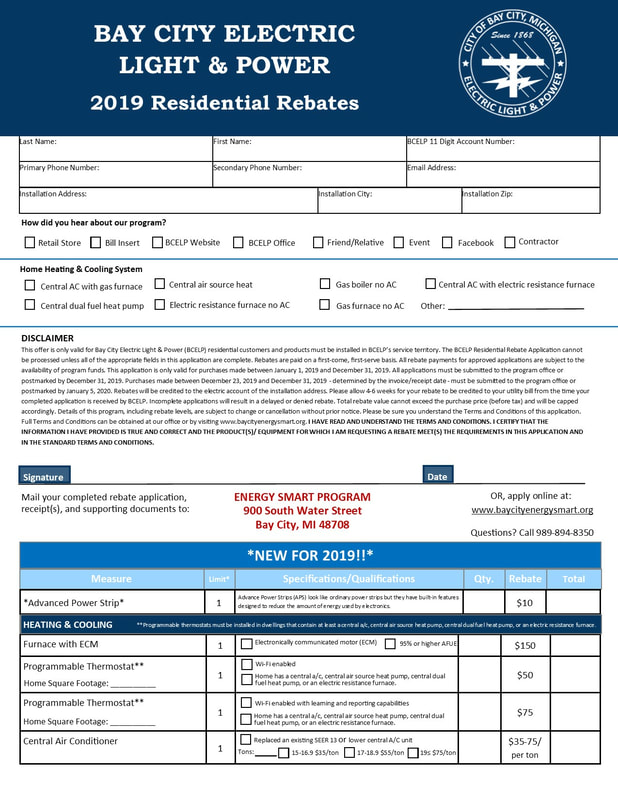

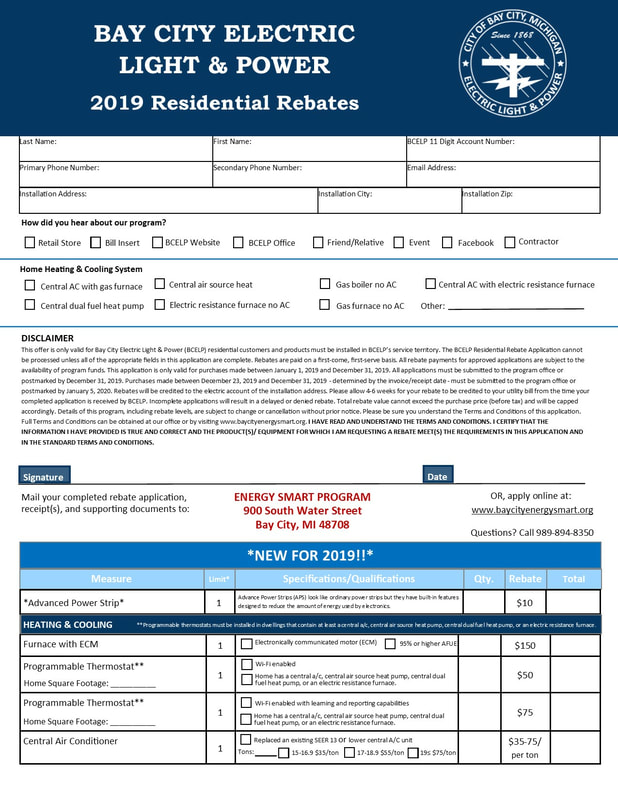

Rebates For Your Home BAY CITY ELECTRIC LIGHT POWER ENERGY SMART

2021 Rent Rebate Form Fillable Printable PDF Forms Handypdf

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

https://www.irs.gov/credits-deductions/credits-for...

Find information on credits for used clean vehicles qualified commercial clean vehicles and new plug in EVs purchased before 2023 Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV

https://www.irs.gov/pub/irs-pdf/f8936.pdf

Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles and New Clean Vehicles Attach to your tax return

Find information on credits for used clean vehicles qualified commercial clean vehicles and new plug in EVs purchased before 2023 Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV

Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles and New Clean Vehicles Attach to your tax return

Rebates For Your Home BAY CITY ELECTRIC LIGHT POWER ENERGY SMART

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

2021 Rent Rebate Form Fillable Printable PDF Forms Handypdf

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

IRS Form 8936 Download Fillable PDF Or Fill Online Qualified Plug In

Application Form Residential Solar Electric Rebate United Power

Application Form Residential Solar Electric Rebate United Power

Supplier Rebate Agreement Template