In our modern, consumer-driven society we all love a good bargain. One of the ways to enjoy substantial savings on your purchases is by using If You Lose Your Homestead Rebate Forms. If You Lose Your Homestead Rebate Forms are a strategy for marketing that retailers and manufacturers use to offer customers a partial return on their purchases once they've completed them. In this article, we will dive into the world If You Lose Your Homestead Rebate Forms. We will explore the nature of them, how they work, and ways to maximize your savings through these efficient incentives.

Get Latest If You Lose Your Homestead Rebate Form Below

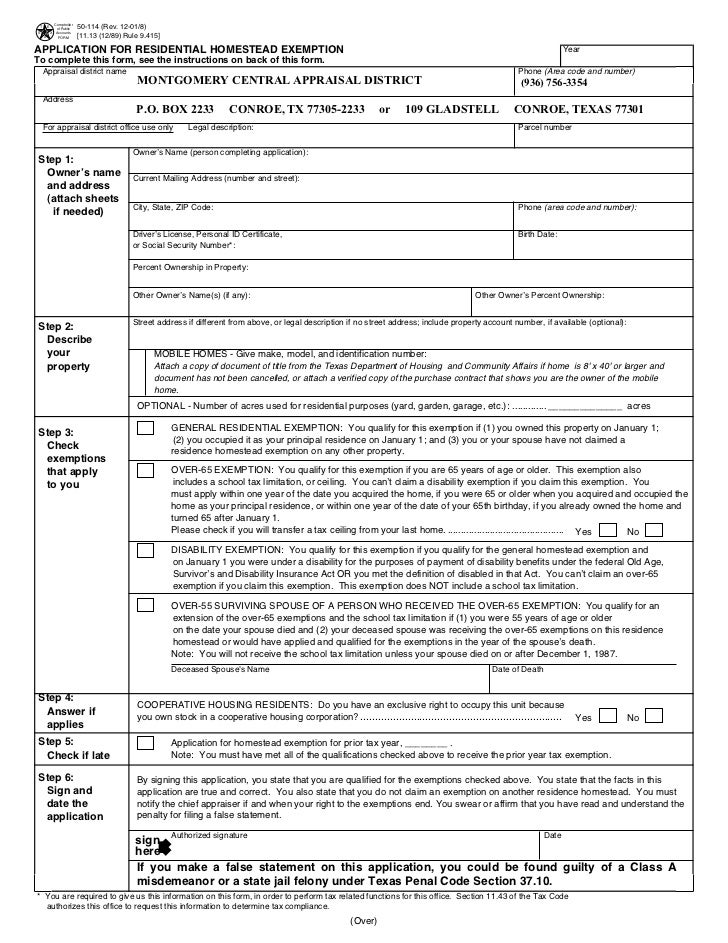

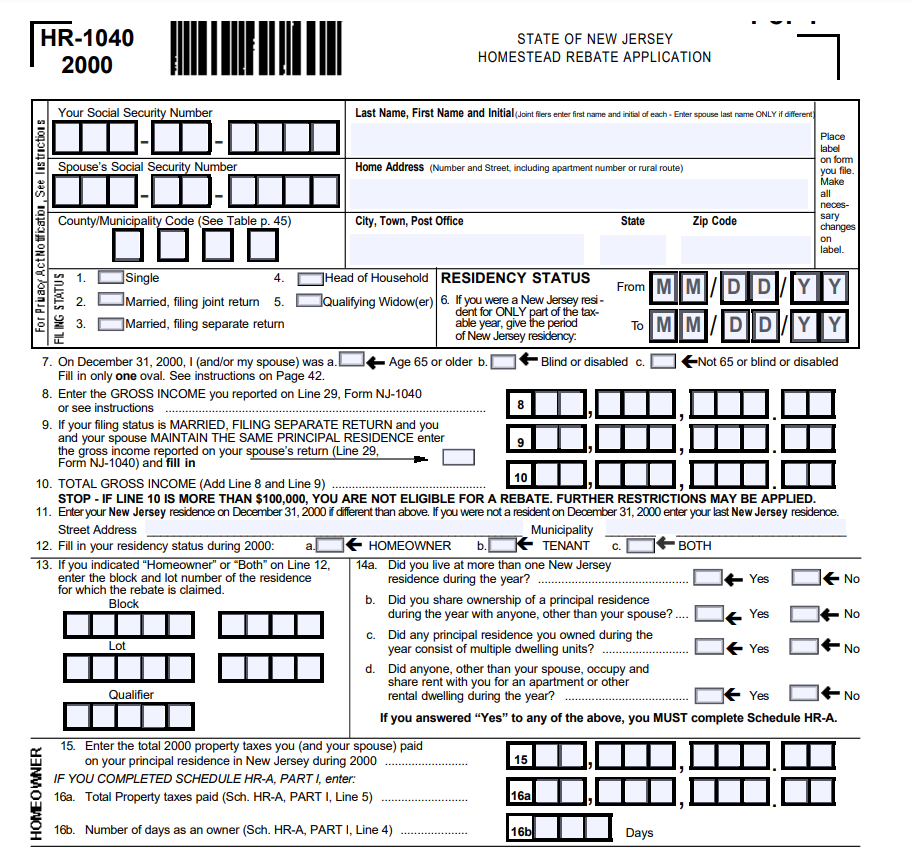

If You Lose Your Homestead Rebate Form

If You Lose Your Homestead Rebate Form -

Web 7 juin 2019 nbsp 0183 32 You file a homestead exemption with your county tax assessor and it reduces the amount of property tax you have to pay Filing the homestead exemption will have

Web 6 d 233 c 2021 nbsp 0183 32 Homestead exemption most commonly refers to an exemption a homeowner claims to lower their property taxes The homestead tax exemption lowers the taxable

A If You Lose Your Homestead Rebate Form or If You Lose Your Homestead Rebate Form, in its most basic model, refers to a partial return to the customer after purchasing a certain product or service. It's an effective method employed by companies to attract buyers, increase sales and also to advertise certain products.

Types of If You Lose Your Homestead Rebate Form

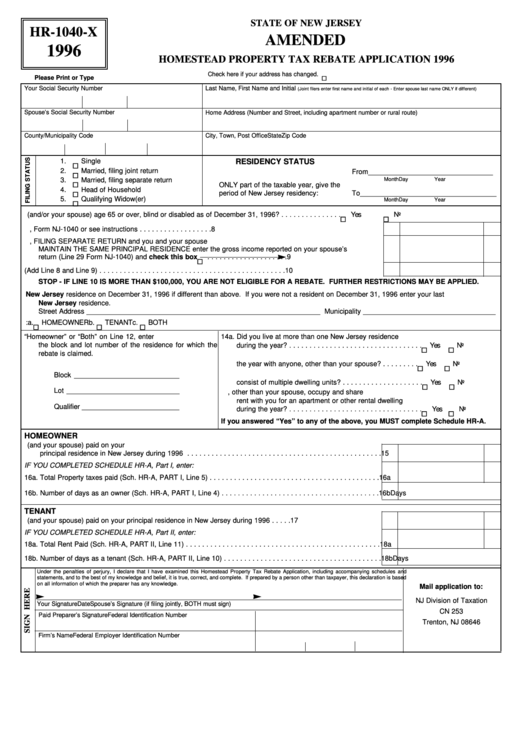

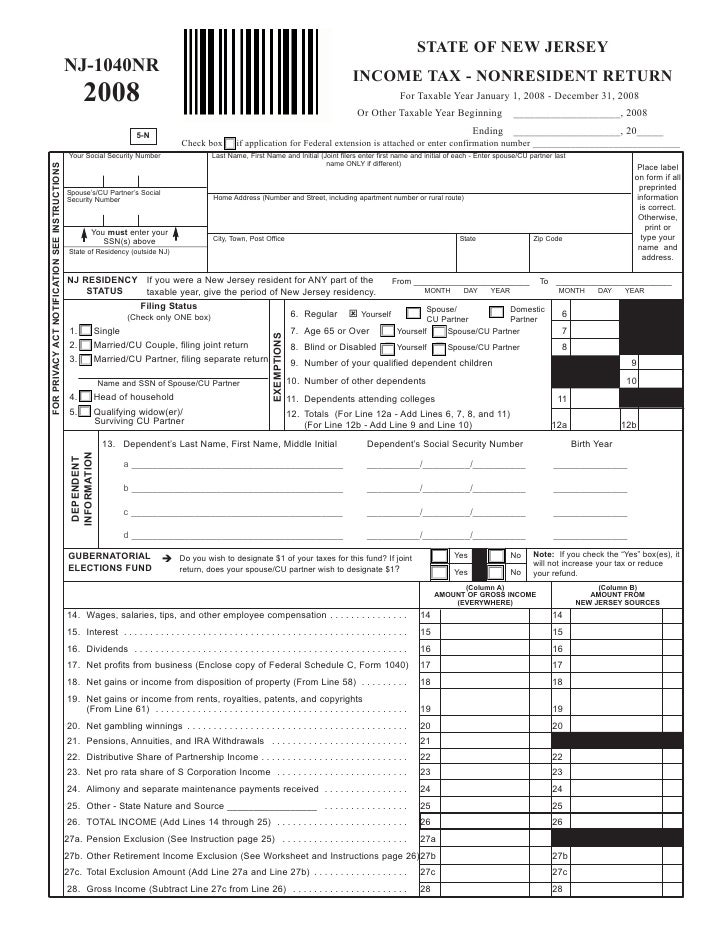

NJ Homestead Printable Rebate Form

NJ Homestead Printable Rebate Form

Web After subtracting the school operating tax from your property tax bill you can claim 90 of the remaining property tax for the credit How to compute your homestead property tax

Web Form 2105 Michigan Homestead Property Tax Credits for Separated or Divorced Taxpayers Form 5049 Worksheet for Married Filing Separately and Divorced or

Cash If You Lose Your Homestead Rebate Form

Cash If You Lose Your Homestead Rebate Form are by far the easiest type of If You Lose Your Homestead Rebate Form. Customers receive a certain amount of cash back after purchasing a item. This is often for more expensive items such electronics or appliances.

Mail-In If You Lose Your Homestead Rebate Form

Mail-in If You Lose Your Homestead Rebate Form require customers to submit their proof of purchase before receiving the money. They're more involved, however they can yield significant savings.

Instant If You Lose Your Homestead Rebate Form

Instant If You Lose Your Homestead Rebate Form are applied at the points of sale. This reduces prices immediately. Customers don't have to wait until they can save in this manner.

How If You Lose Your Homestead Rebate Form Work

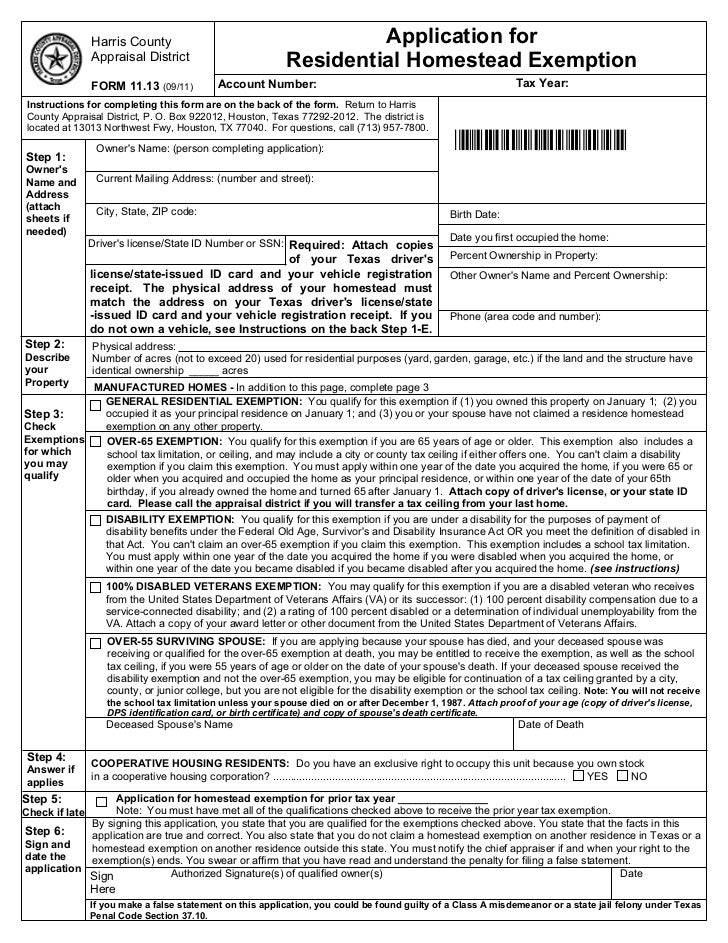

Fillable Application For Homestead Exemption Template Printable Pdf

Fillable Application For Homestead Exemption Template Printable Pdf

Web You may qualify for a homestead property tax credit if all of the following apply Your homestead is in Michigan You were a resident of Michigan for at least six months

The If You Lose Your Homestead Rebate Form Process

The procedure usually involves a few simple steps:

-

Then, you purchase the product purchase the product the way you normally do.

-

Complete the If You Lose Your Homestead Rebate Form paper: You'll need to supply some details including your name, address and details about your purchase, in order to submit your If You Lose Your Homestead Rebate Form.

-

In order to submit the If You Lose Your Homestead Rebate Form It is dependent on the kind of If You Lose Your Homestead Rebate Form you may have to send in a form, or send it via the internet.

-

Wait for approval: The company will review your request to make sure it is in line with the If You Lose Your Homestead Rebate Form's terms and conditions.

-

Take advantage of your If You Lose Your Homestead Rebate Form When it's approved you'll receive your cash back whether via check, credit card, or any other method that is specified in the offer.

Pros and Cons of If You Lose Your Homestead Rebate Form

Advantages

-

Cost savings If You Lose Your Homestead Rebate Form are a great way to reduce the price you pay for an item.

-

Promotional Offers they encourage their customers to experiment with new products, or brands.

-

Improve Sales The benefits of a If You Lose Your Homestead Rebate Form can improve the sales of a business and increase its market share.

Disadvantages

-

Complexity If You Lose Your Homestead Rebate Form that are mail-in, in particular could be cumbersome and long-winded.

-

End Dates Many If You Lose Your Homestead Rebate Form are subject to specific deadlines for submission.

-

The risk of non-payment Customers may lose their If You Lose Your Homestead Rebate Form in the event that they don't follow the rules precisely.

Download If You Lose Your Homestead Rebate Form

Download If You Lose Your Homestead Rebate Form

FAQs

1. Are If You Lose Your Homestead Rebate Form the same as discounts? No, If You Lose Your Homestead Rebate Form require some form of refund following the purchase, while discounts reduce the price of the purchase at the time of sale.

2. Are there If You Lose Your Homestead Rebate Form that can be used on the same item? It depends on the conditions on the If You Lose Your Homestead Rebate Form offers and the product's eligibility. Certain companies may allow it, but others won't.

3. What is the time frame to get an If You Lose Your Homestead Rebate Form What is the timeframe? differs, but could last from a few weeks until a few months for you to receive your If You Lose Your Homestead Rebate Form.

4. Do I need to pay tax upon If You Lose Your Homestead Rebate Form the amount? most situations, If You Lose Your Homestead Rebate Form amounts are not considered taxable income.

5. Can I trust If You Lose Your Homestead Rebate Form deals from lesser-known brands It's crucial to research and verify that the brand offering the If You Lose Your Homestead Rebate Form is reputable prior to making an acquisition.

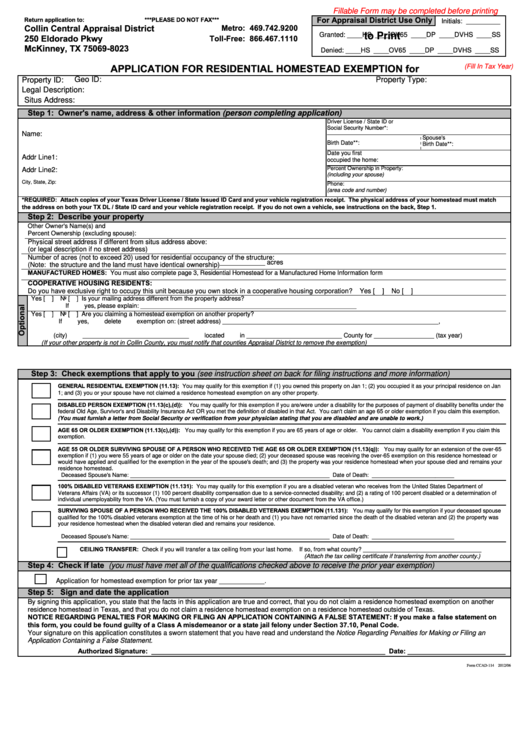

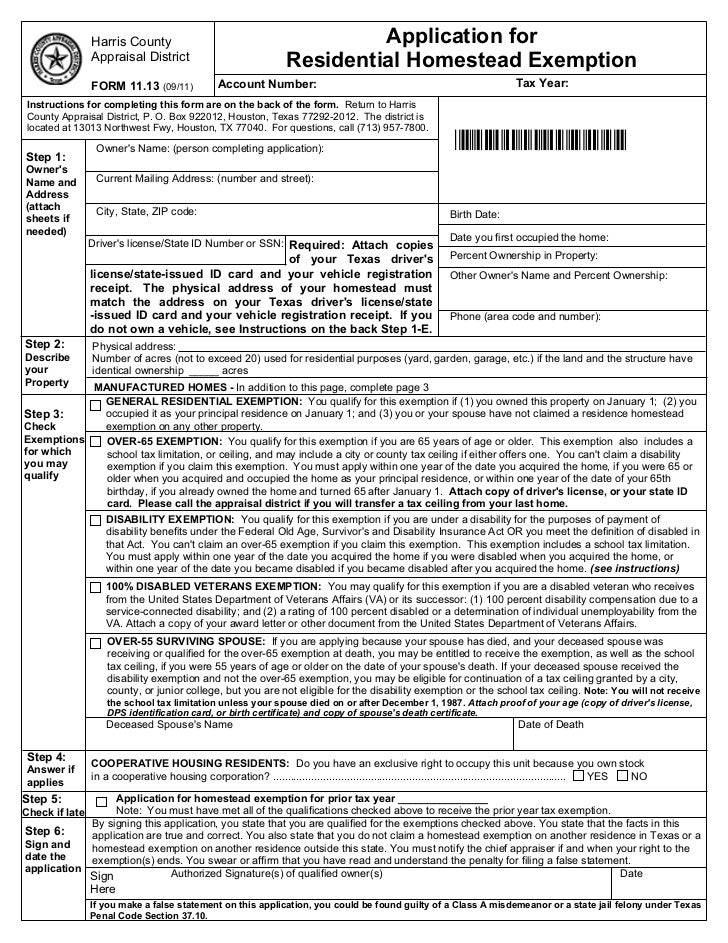

Application For Residential Homestead Exemption Form Printable Pdf Download

Homestead Exemption Application Montgomery County TX

Check more sample of If You Lose Your Homestead Rebate Form below

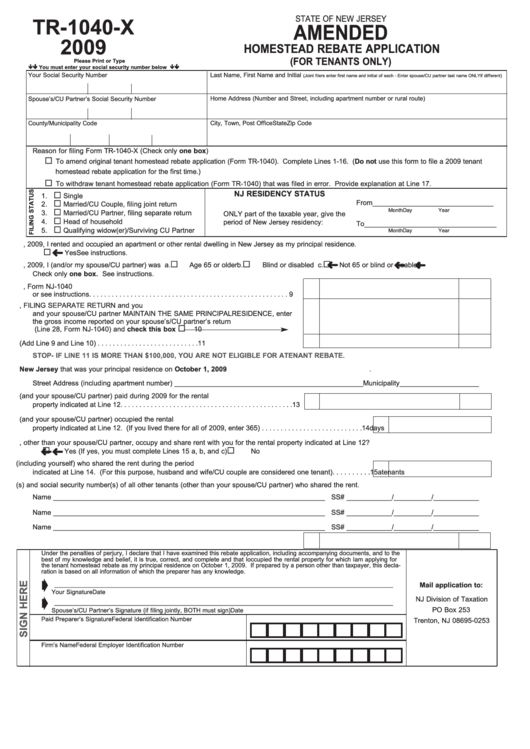

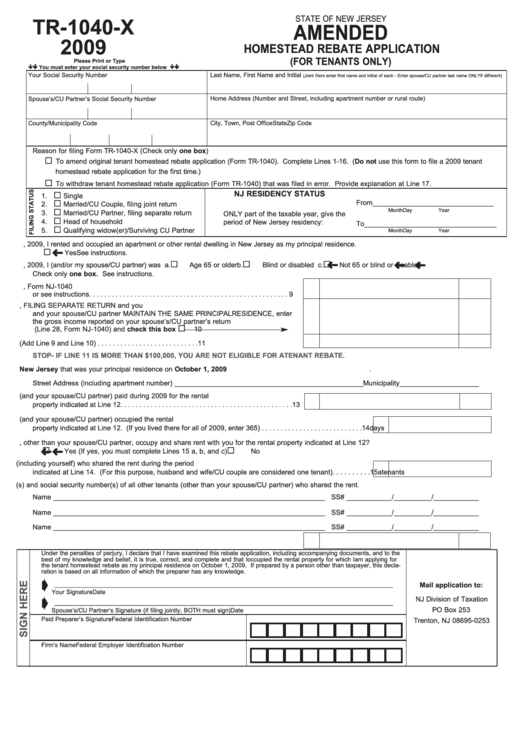

Fillable Form Hr 1040 X Amended Homestead Property Tax Rebate

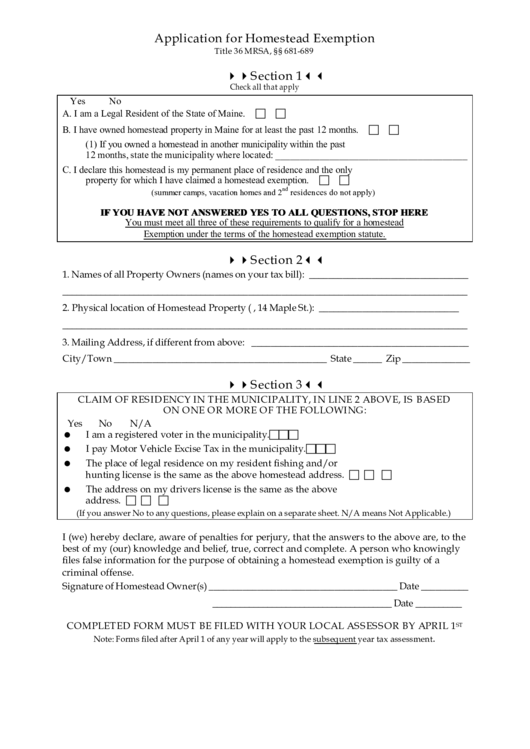

Homestead Exemption Form

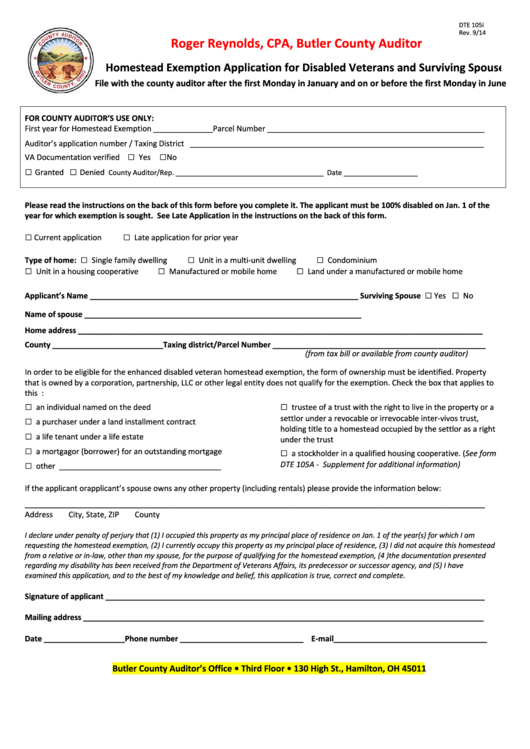

Fillable Form Dte 105i Homestead Exemption Application For Disabled

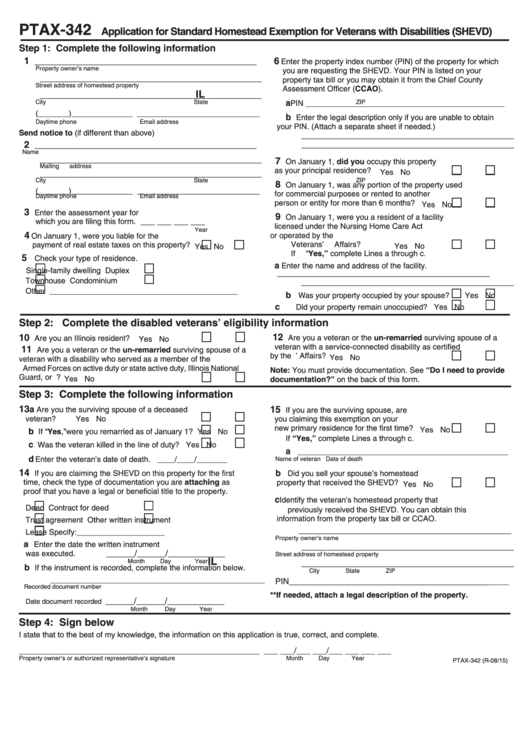

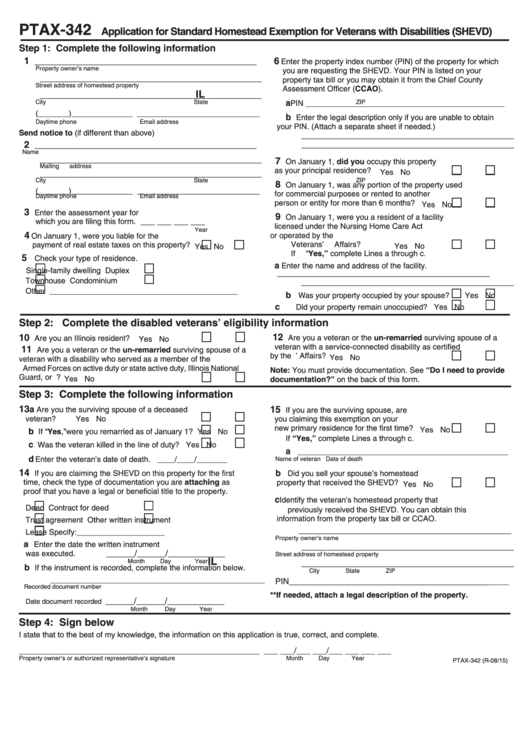

Ptax 342 Form Application For Standard Homestead Exemption For

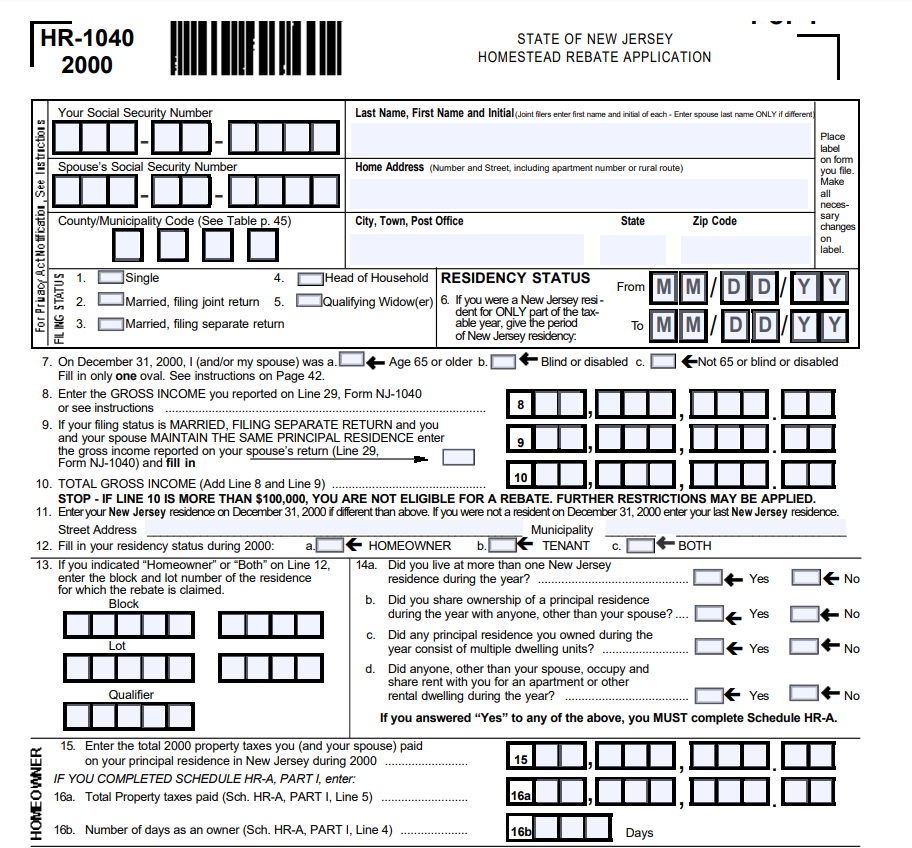

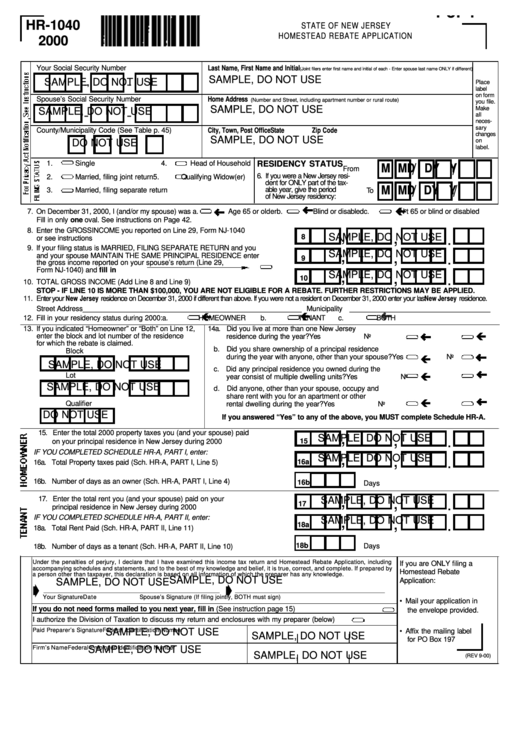

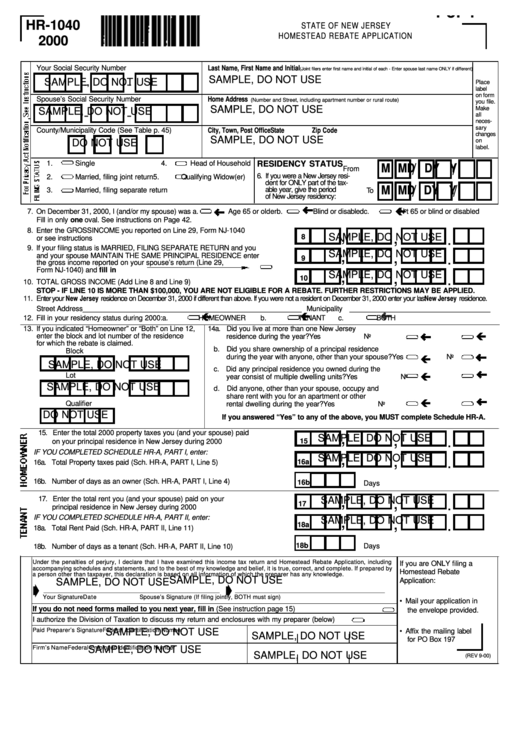

Form Hr 1040 Sample Homestead Rebate Application 2000 Printable Pdf

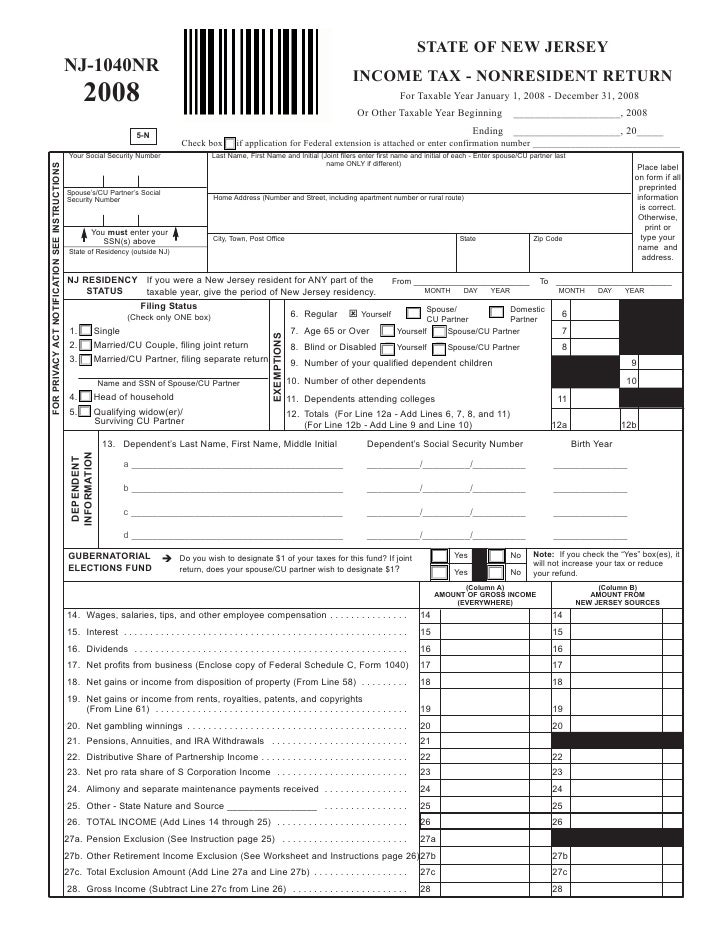

Tenant Homestead Rebate Instructions

https://www.policygenius.com/estate-planning/homestead-exemption

Web 6 d 233 c 2021 nbsp 0183 32 Homestead exemption most commonly refers to an exemption a homeowner claims to lower their property taxes The homestead tax exemption lowers the taxable

https://smartasset.com/taxes/what-is-a-home…

Web 16 oct 2016 nbsp 0183 32 Homestead tax exemptions shelter a certain dollar amount or percentage of home value from property taxes They re called

Web 6 d 233 c 2021 nbsp 0183 32 Homestead exemption most commonly refers to an exemption a homeowner claims to lower their property taxes The homestead tax exemption lowers the taxable

Web 16 oct 2016 nbsp 0183 32 Homestead tax exemptions shelter a certain dollar amount or percentage of home value from property taxes They re called

Ptax 342 Form Application For Standard Homestead Exemption For

Homestead Exemption Form

Form Hr 1040 Sample Homestead Rebate Application 2000 Printable Pdf

Tenant Homestead Rebate Instructions

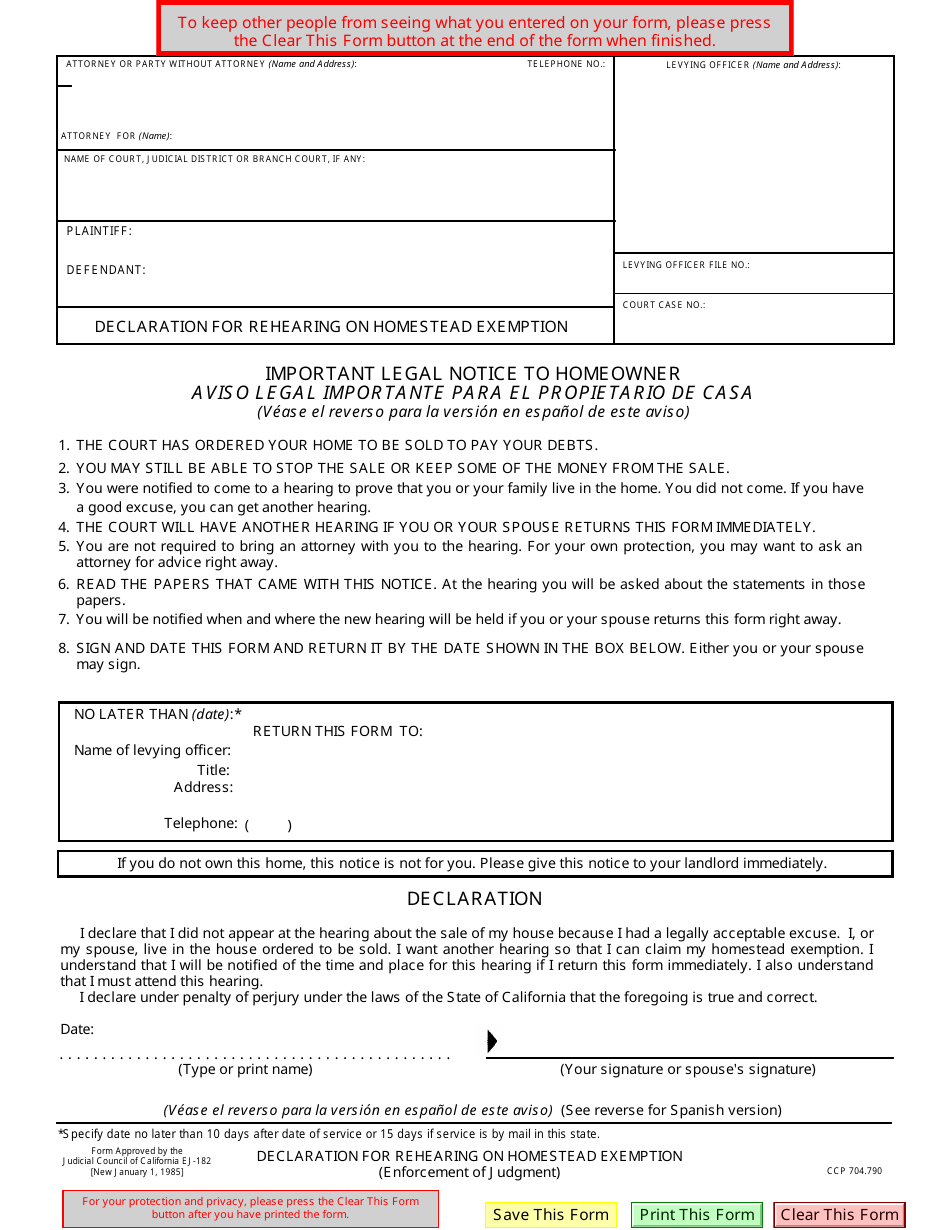

Form EJ 182 Download Fillable PDF Or Fill Online Declaration For

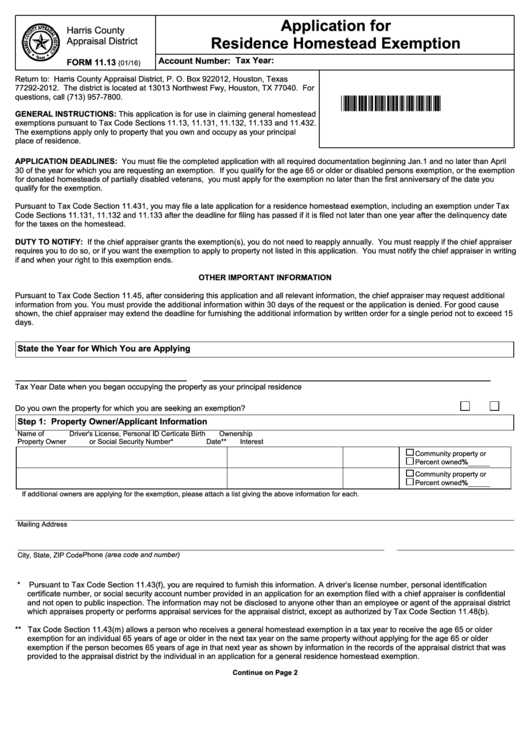

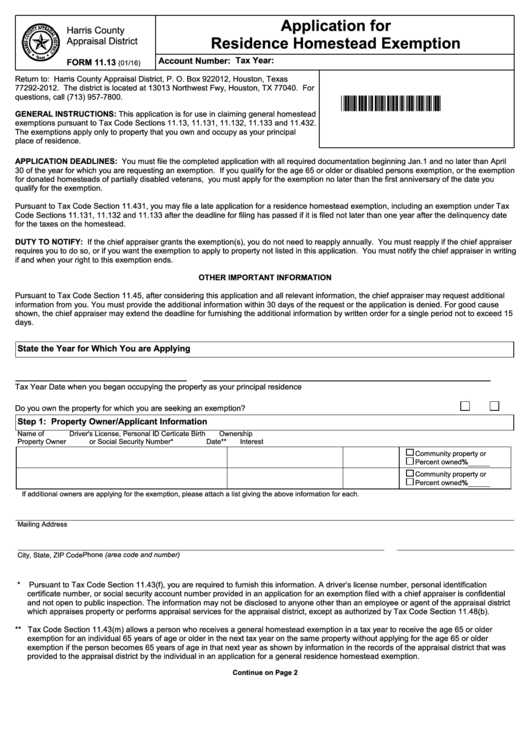

Application For Residence Homestead Exemption Harris County Appraisal

Application For Residence Homestead Exemption Harris County Appraisal

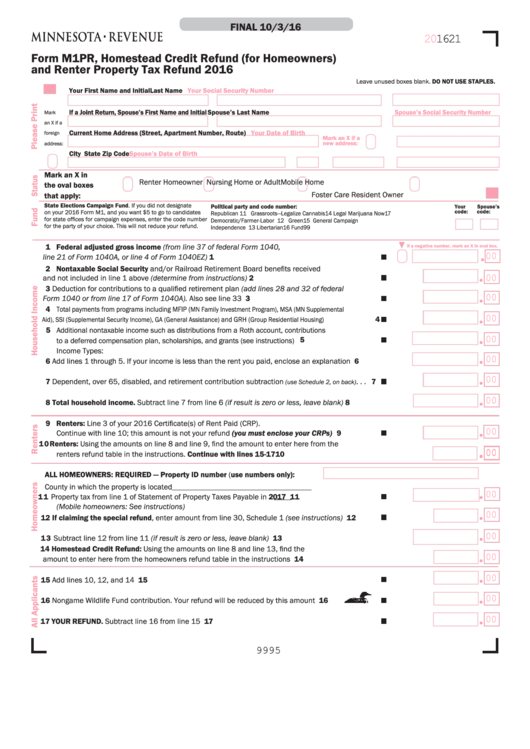

Form M1pr Homestead Credit Refund For Homeowners Printable Pdf Download