In this day and age of consuming everyone appreciates a great deal. One method of gaining significant savings on your purchases is through Hmrc Mileage Tax Rebate Forms. The use of Hmrc Mileage Tax Rebate Forms is a method used by manufacturers and retailers in order to offer customers a small cash back on their purchases once they've created them. In this post, we'll examine the subject of Hmrc Mileage Tax Rebate Forms, exploring what they are and how they work and how to maximize the savings you can make by using these cost-effective incentives.

Get Latest Hmrc Mileage Tax Rebate Form Below

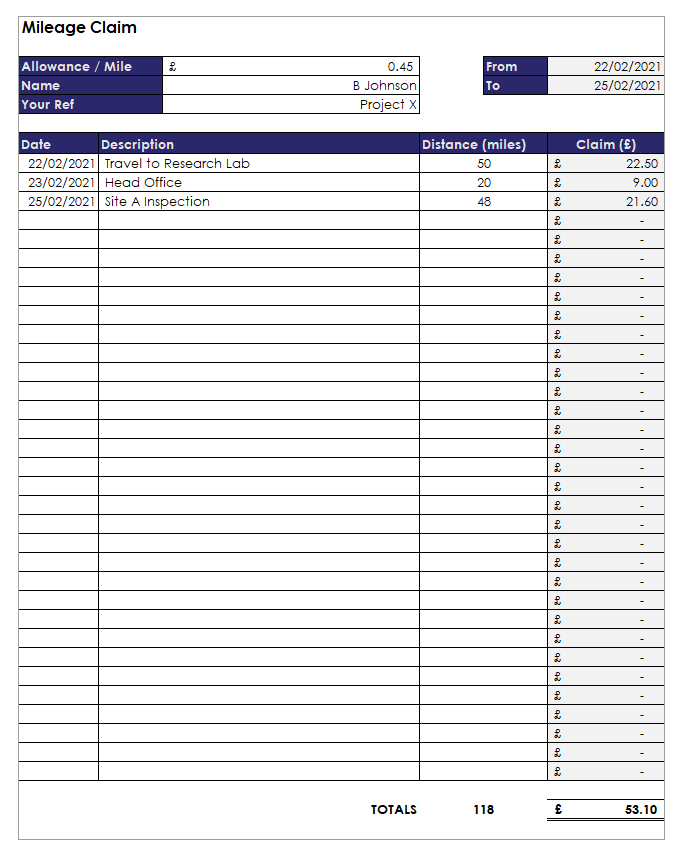

Hmrc Mileage Tax Rebate Form

Hmrc Mileage Tax Rebate Form - Hmrc Mileage Tax Relief Form, Hmrc Tax Return Mileage Allowance, Hmrc Mileage Claim Form, Hmrc Mileage Tax Relief, Hmrc Mileage Claims

Web Updated 5 April 2023 Approved mileage rates from tax year 2011 to 2012 to present date Passenger payments cars and vans 5p per passenger per business mile for carrying

Web 3 mars 2016 nbsp 0183 32 You must claim tax relief by post if you re claiming either on behalf of someone else for more than 5 jobs You ll need to submit a claim by post using HMRC s

A Hmrc Mileage Tax Rebate Form at its most basic form, is a partial reimbursement to a buyer following the purchase of a product or service. It's an effective way employed by companies to draw customers, increase sales and to promote certain products.

Types of Hmrc Mileage Tax Rebate Form

How To Claim The Work Mileage Tax Rebate Goselfemployed co

How To Claim The Work Mileage Tax Rebate Goselfemployed co

Web 15 ao 251 t 2014 nbsp 0183 32 If you ve paid too much tax and want to claim back the over payment use form R38 You can also use this form to authorise a representative to get the payment

Web 5 April 2023 See all updates Get emails about this page Documents Travel mileage and fuel rates and allowances HTML Details The attached document is classified by

Cash Hmrc Mileage Tax Rebate Form

Cash Hmrc Mileage Tax Rebate Form are the most basic kind of Hmrc Mileage Tax Rebate Form. Customers receive a specific amount of money back upon purchasing a item. These are often used for products that are expensive, such as electronics or appliances.

Mail-In Hmrc Mileage Tax Rebate Form

Customers who want to receive mail-in Hmrc Mileage Tax Rebate Form must send in proof of purchase to receive their reimbursement. They're a bit more involved but offer significant savings.

Instant Hmrc Mileage Tax Rebate Form

Instant Hmrc Mileage Tax Rebate Form can be applied at the moment of sale, cutting the price instantly. Customers don't have to wait long for savings with this type.

How Hmrc Mileage Tax Rebate Form Work

2016 Form UK HMRC SA102 Fill Online Printable Fillable Blank PdfFiller

2016 Form UK HMRC SA102 Fill Online Printable Fillable Blank PdfFiller

Web Mileage 163 4500 20 tax relief 163 900 In this example if you were paying tax at 20 your claim would be worth in the region of 163 900 If you are a higher rate taxpayer paying a

The Hmrc Mileage Tax Rebate Form Process

The procedure usually involves a few steps:

-

Buy the product: Firstly purchase the product like you normally do.

-

Complete this Hmrc Mileage Tax Rebate Form application: In order to claim your Hmrc Mileage Tax Rebate Form, you'll need submit some information including your name, address and details about your purchase, in order in order to receive your Hmrc Mileage Tax Rebate Form.

-

Complete the Hmrc Mileage Tax Rebate Form In accordance with the type of Hmrc Mileage Tax Rebate Form, you may need to send in a form, or submit it online.

-

Wait for approval: The business will review your request to confirm that it complies with the Hmrc Mileage Tax Rebate Form's terms and conditions.

-

Take advantage of your Hmrc Mileage Tax Rebate Form After being approved, you'll receive your money back, via check, prepaid card, or other method specified by the offer.

Pros and Cons of Hmrc Mileage Tax Rebate Form

Advantages

-

Cost Savings Rewards can drastically reduce the cost for the product.

-

Promotional Deals These promotions encourage consumers to try new products or brands.

-

boost sales The benefits of a Hmrc Mileage Tax Rebate Form can improve the sales of a business and increase its market share.

Disadvantages

-

Complexity The mail-in Hmrc Mileage Tax Rebate Form particularly are often time-consuming and tedious.

-

Expiration Dates: Many Hmrc Mileage Tax Rebate Form have certain deadlines for submitting.

-

Risk of not receiving payment: Some customers may not receive their Hmrc Mileage Tax Rebate Form if they don't adhere to the rules precisely.

Download Hmrc Mileage Tax Rebate Form

Download Hmrc Mileage Tax Rebate Form

FAQs

1. Are Hmrc Mileage Tax Rebate Form equivalent to discounts? No, they are a partial refund after purchase, while discounts reduce prices at moment of sale.

2. Do I have to use multiple Hmrc Mileage Tax Rebate Form on the same product It's contingent upon the terms of the Hmrc Mileage Tax Rebate Form offers and the product's quality and eligibility. Certain companies allow it, but others won't.

3. What is the time frame to get the Hmrc Mileage Tax Rebate Form? The duration differs, but it can last from a few weeks until a few months to receive your Hmrc Mileage Tax Rebate Form.

4. Do I need to pay tax regarding Hmrc Mileage Tax Rebate Form amounts? In the majority of instances, Hmrc Mileage Tax Rebate Form amounts are not considered taxable income.

5. Can I trust Hmrc Mileage Tax Rebate Form offers from lesser-known brands You must research and verify that the brand that is offering the Hmrc Mileage Tax Rebate Form is reputable prior to making a purchase.

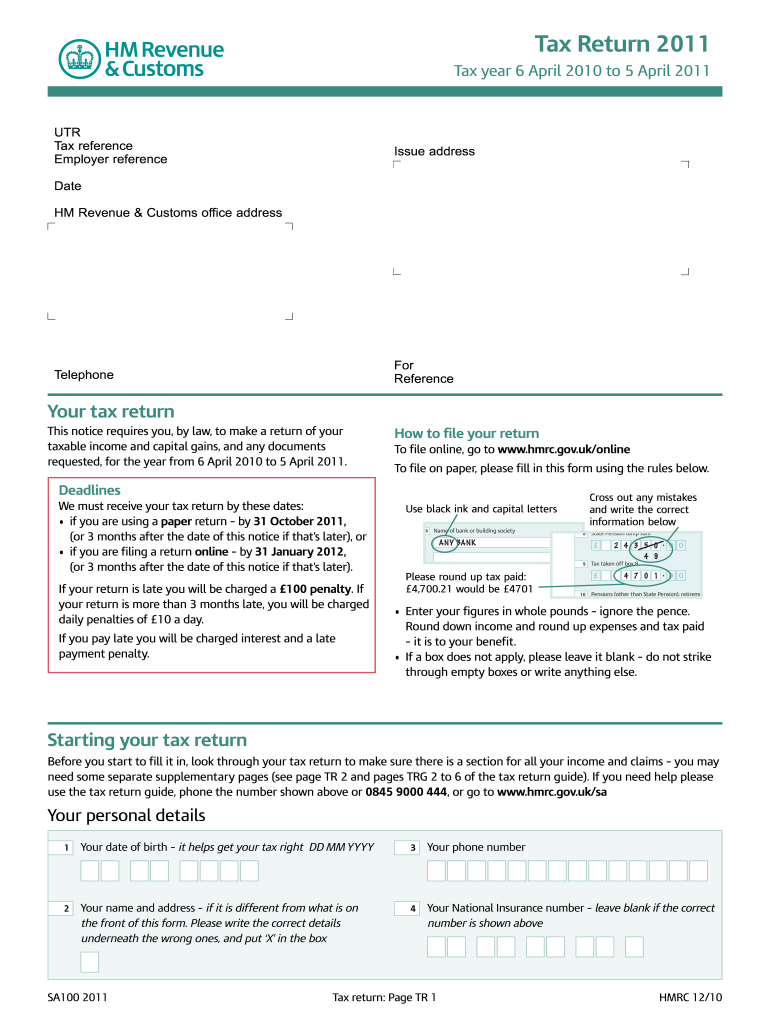

2011 Form UK HMRC P87 Fill Online Printable Fillable Blank PDFfiller

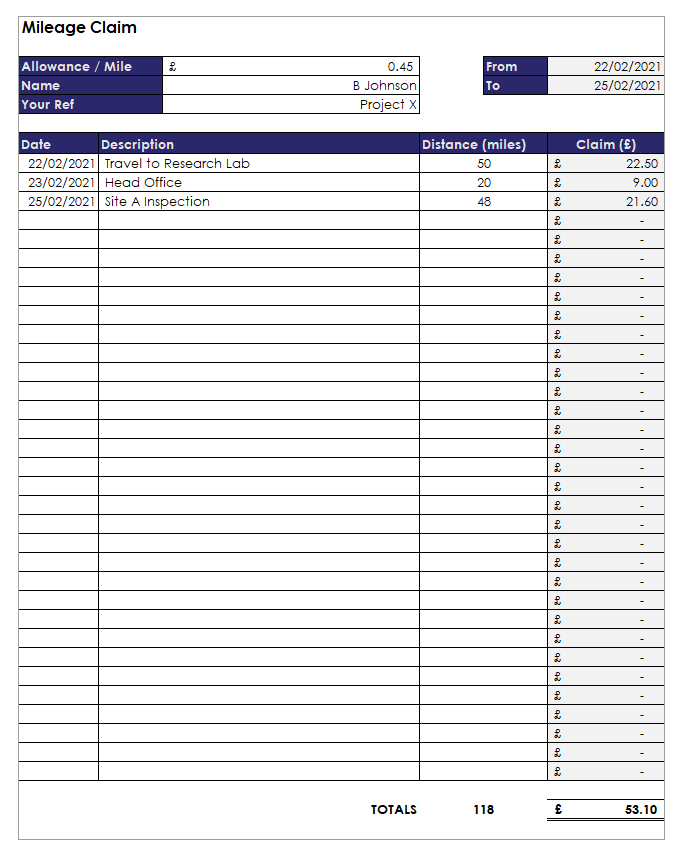

Hmrc Private Mileage Claim Form Erin Anderson s Template

Check more sample of Hmrc Mileage Tax Rebate Form below

Hmrc Private Mileage Claim Form Erin Anderson s Template

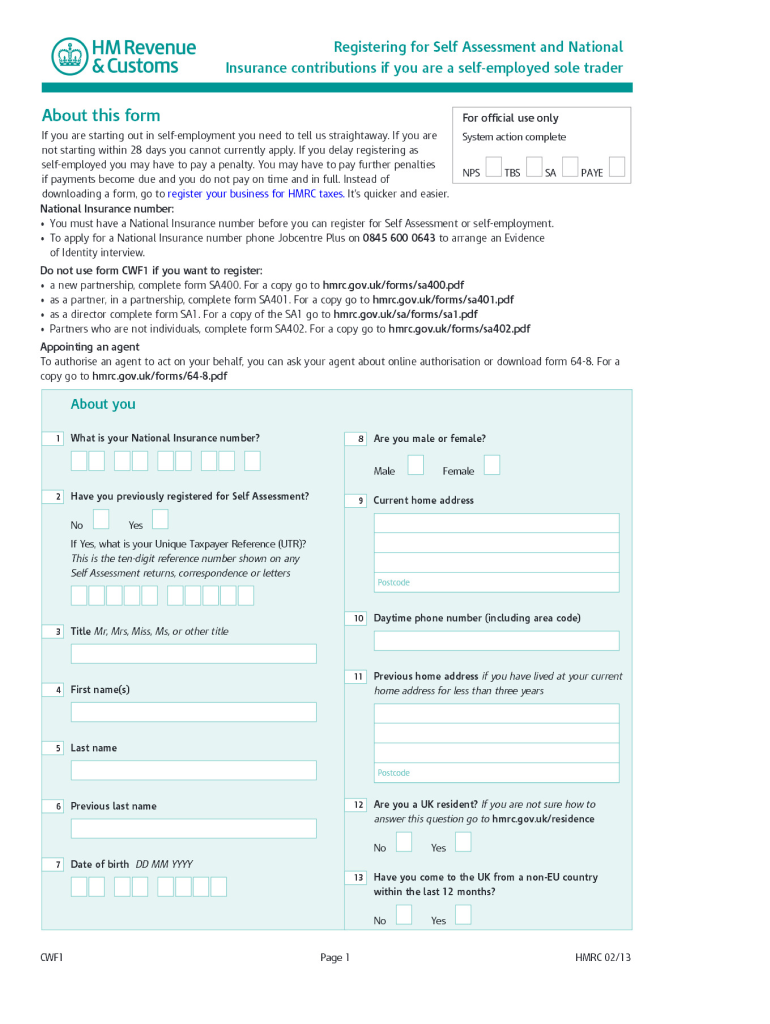

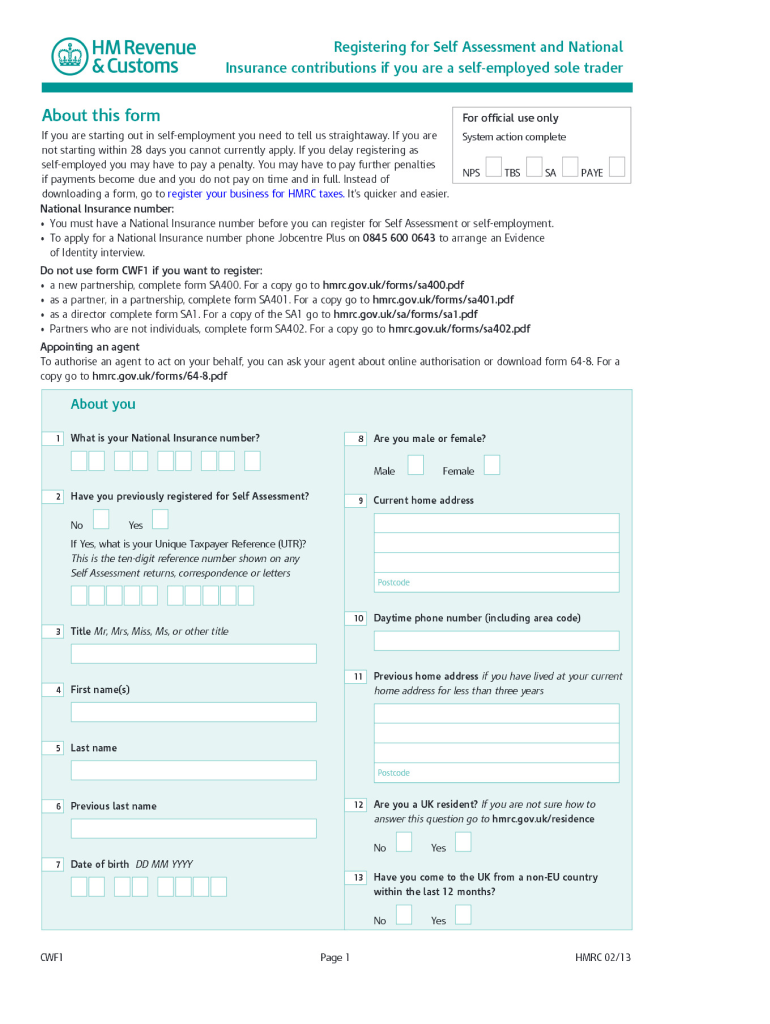

2013 2022 Form UK HMRC CWF1 Fill Online Printable Fillable Blank

2011 Form UK HMRC ChV1Fill Online Printable Fillable Blank PdfFiller

2013 2022 Form UK HMRC P85 Fill Online Printable Fillable Blank

Hmrc Private Mileage Claim Form Erin Anderson s Template

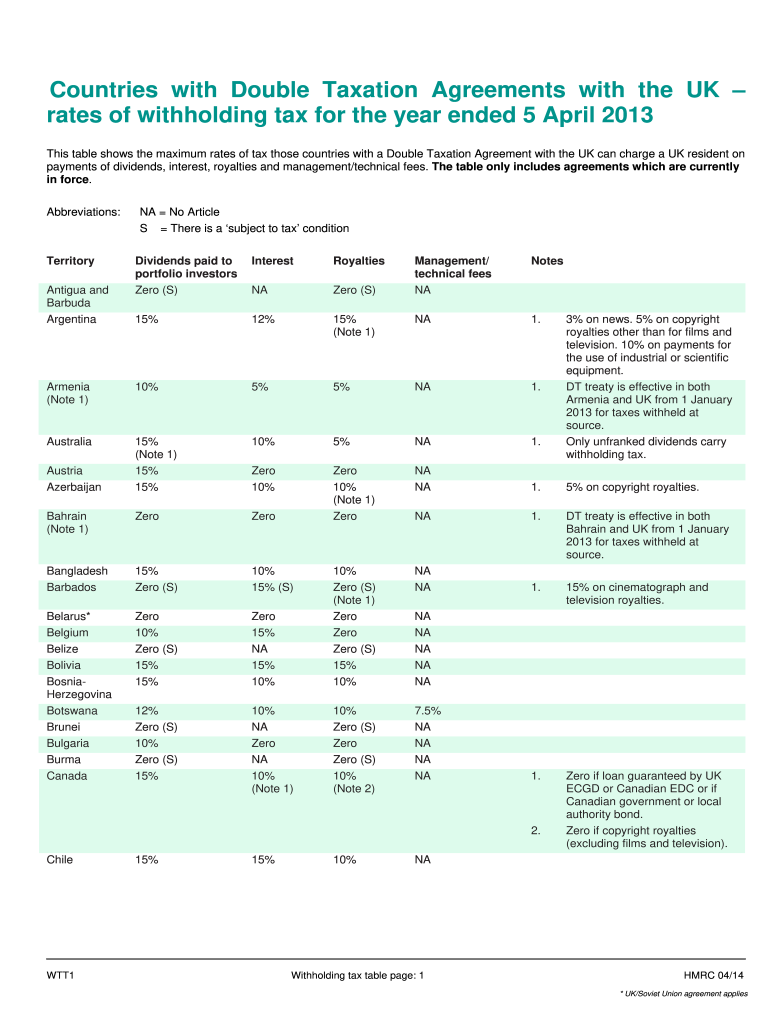

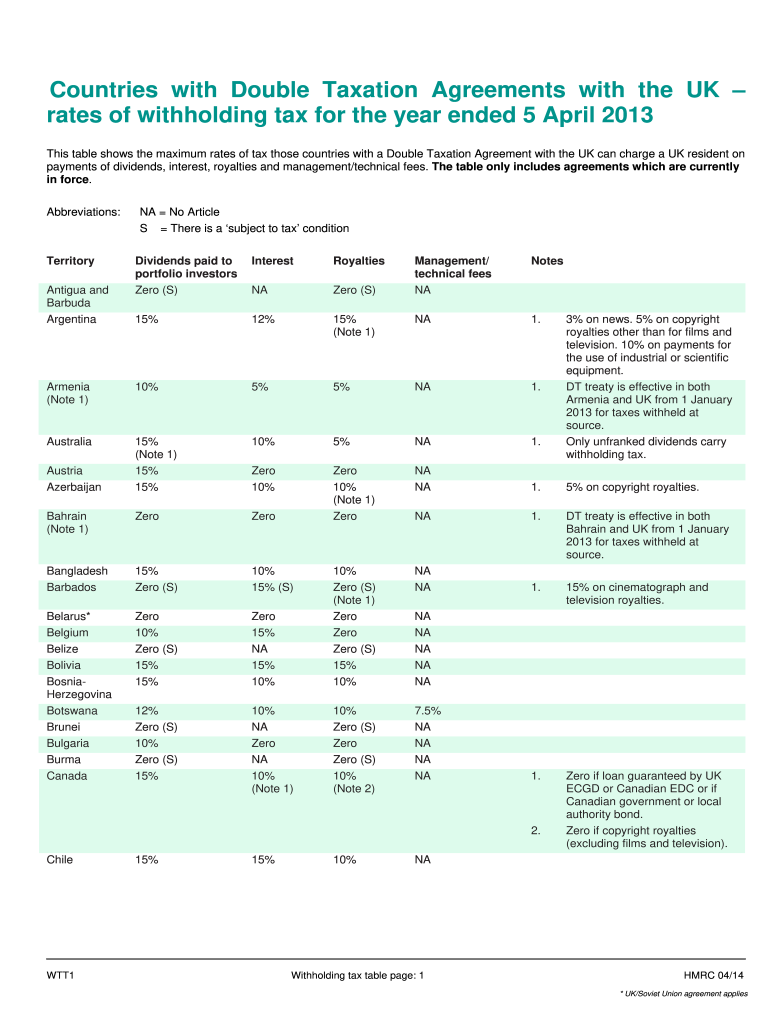

Hmrc Wtt1 Form Fill Out Sign Online DocHub

https://www.gov.uk/guidance/claim-income-tax-relief-for-your...

Web 3 mars 2016 nbsp 0183 32 You must claim tax relief by post if you re claiming either on behalf of someone else for more than 5 jobs You ll need to submit a claim by post using HMRC s

https://assets.publishing.service.gov.uk/government/uploads/…

Web The taxable amount Taxable payments from section 4 plus The amount at box K where more than zero is the excess over the tax free amounts for 2021 to 2022 Enter this

Web 3 mars 2016 nbsp 0183 32 You must claim tax relief by post if you re claiming either on behalf of someone else for more than 5 jobs You ll need to submit a claim by post using HMRC s

Web The taxable amount Taxable payments from section 4 plus The amount at box K where more than zero is the excess over the tax free amounts for 2021 to 2022 Enter this

2013 2022 Form UK HMRC P85 Fill Online Printable Fillable Blank

2013 2022 Form UK HMRC CWF1 Fill Online Printable Fillable Blank

Hmrc Private Mileage Claim Form Erin Anderson s Template

Hmrc Wtt1 Form Fill Out Sign Online DocHub

UK HMRC P46 2011 2022 Fill And Sign Printable Template Online US

It s Not A Tax Rebate It s An HMRC Phishing Scam IT Governance UK Blog

It s Not A Tax Rebate It s An HMRC Phishing Scam IT Governance UK Blog

UK HMRC SA100 2011 Fill And Sign Printable Template Online US Legal