Today, in a world that is driven by the consumer people love a good deal. One method of gaining significant savings on your purchases is by using Gst Hst Rebate Form Line 111s. Gst Hst Rebate Form Line 111s are a method of marketing that retailers and manufacturers use in order to offer customers a small discount on purchases they made after they have created them. In this article, we will dive into the world Gst Hst Rebate Form Line 111s. We will explore what they are their purpose, how they function and the best way to increase your savings using these low-cost incentives.

Get Latest Gst Hst Rebate Form Line 111 Below

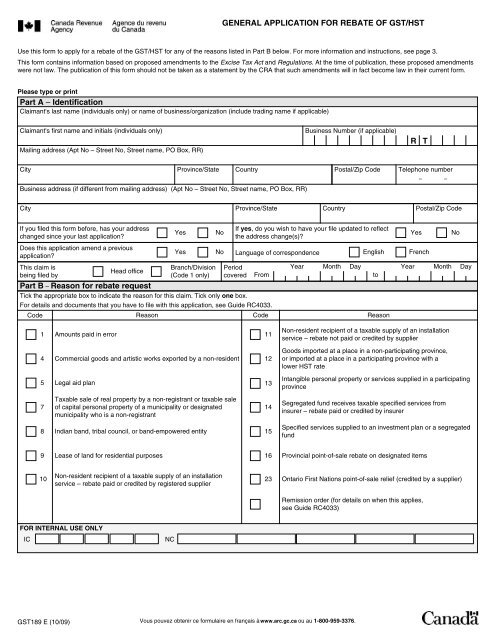

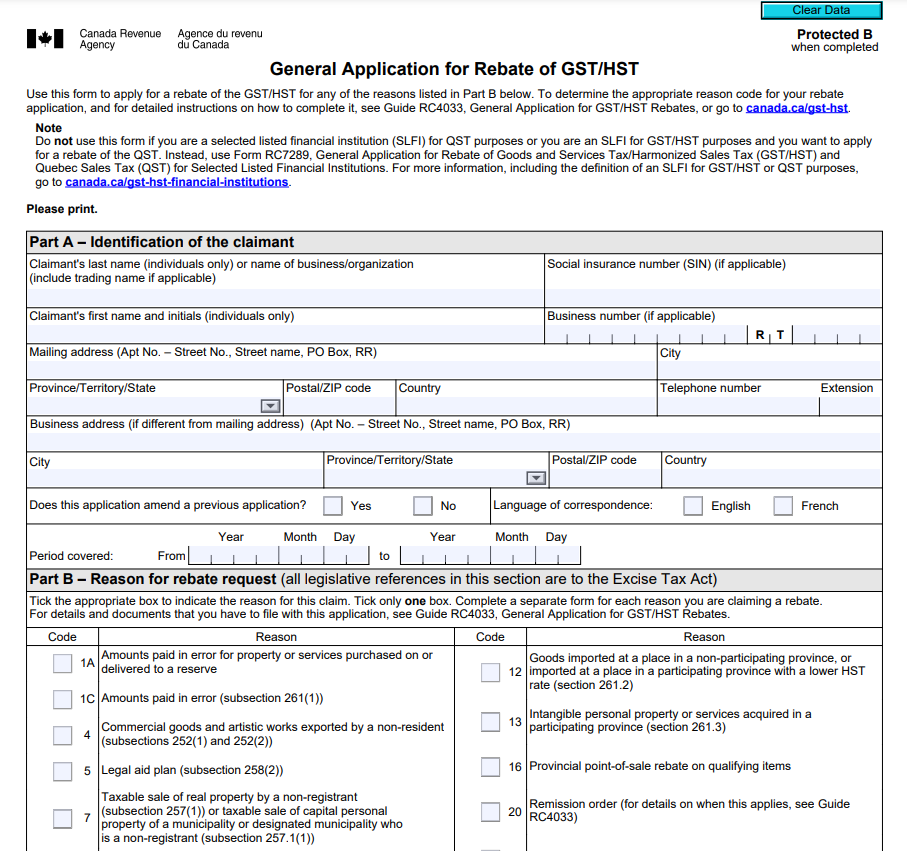

Gst Hst Rebate Form Line 111

Gst Hst Rebate Form Line 111 -

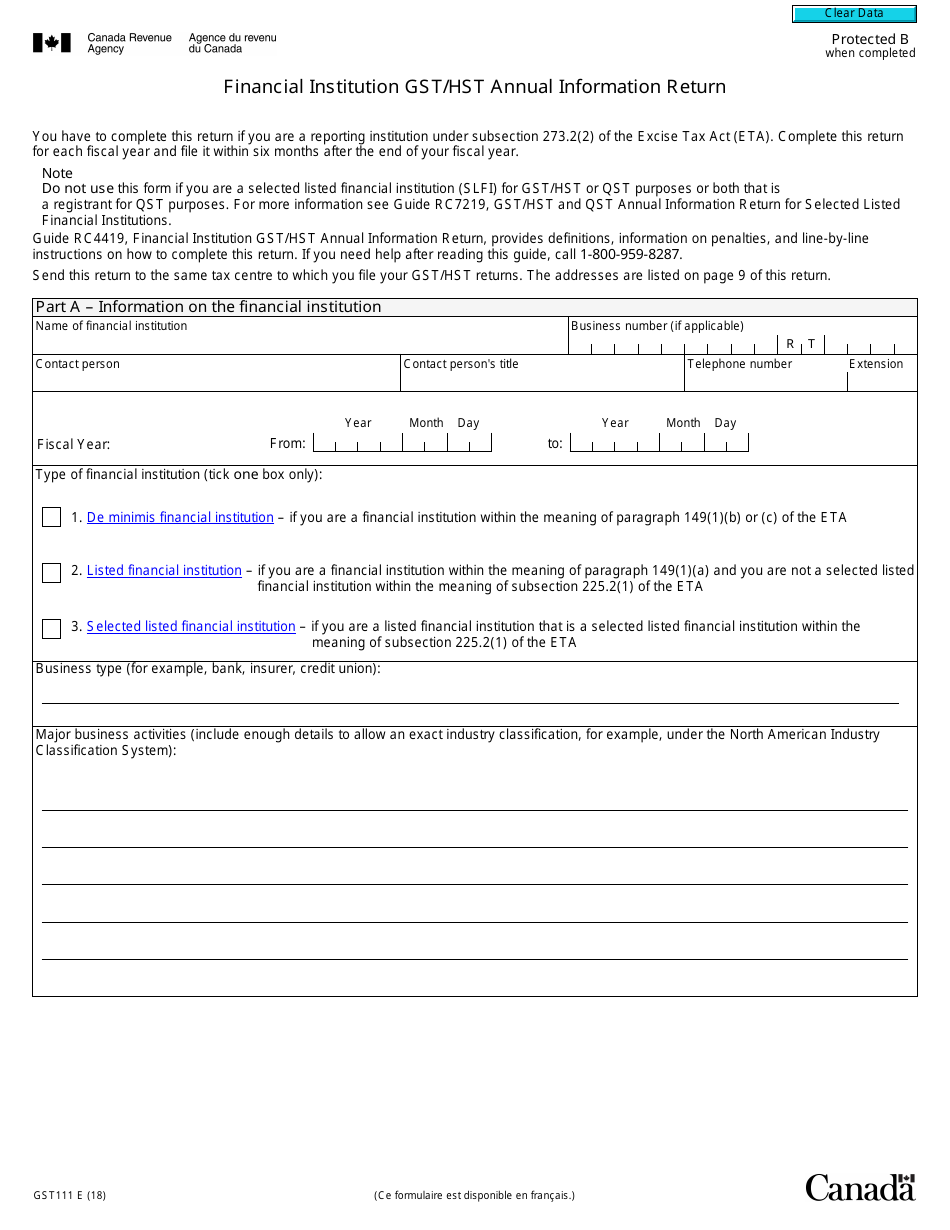

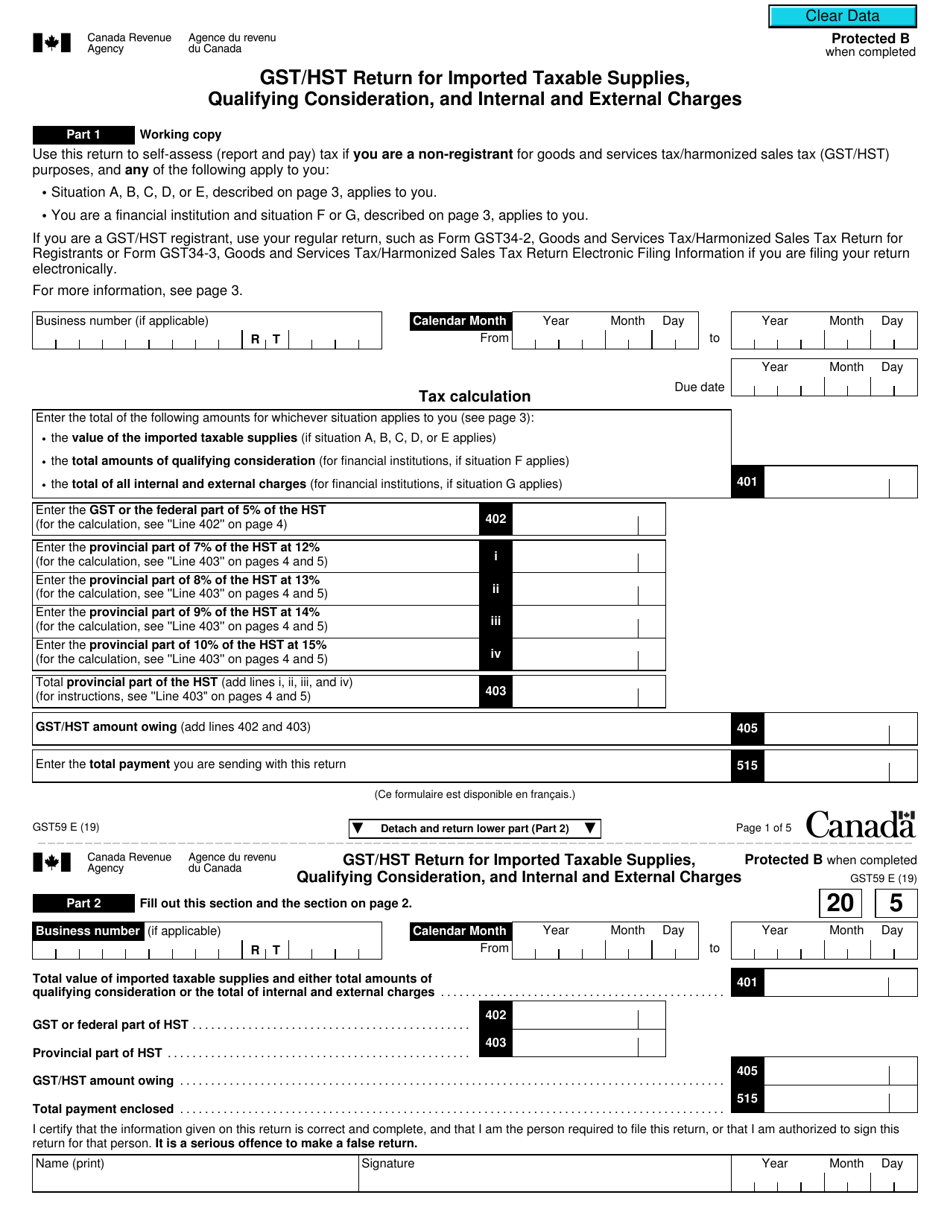

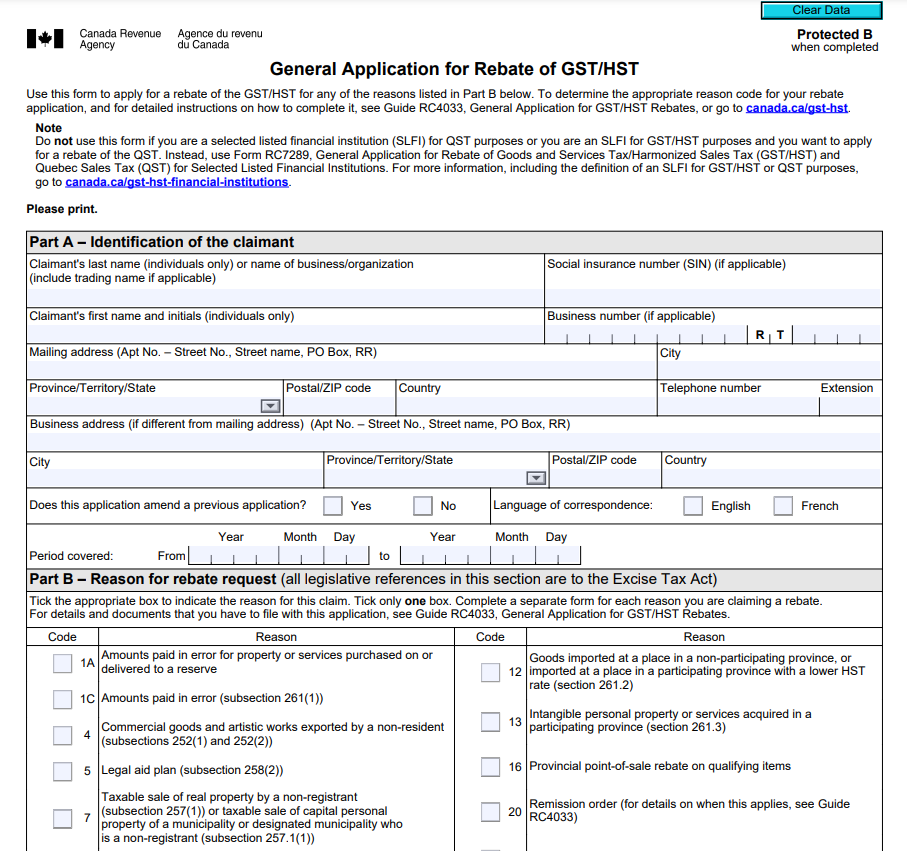

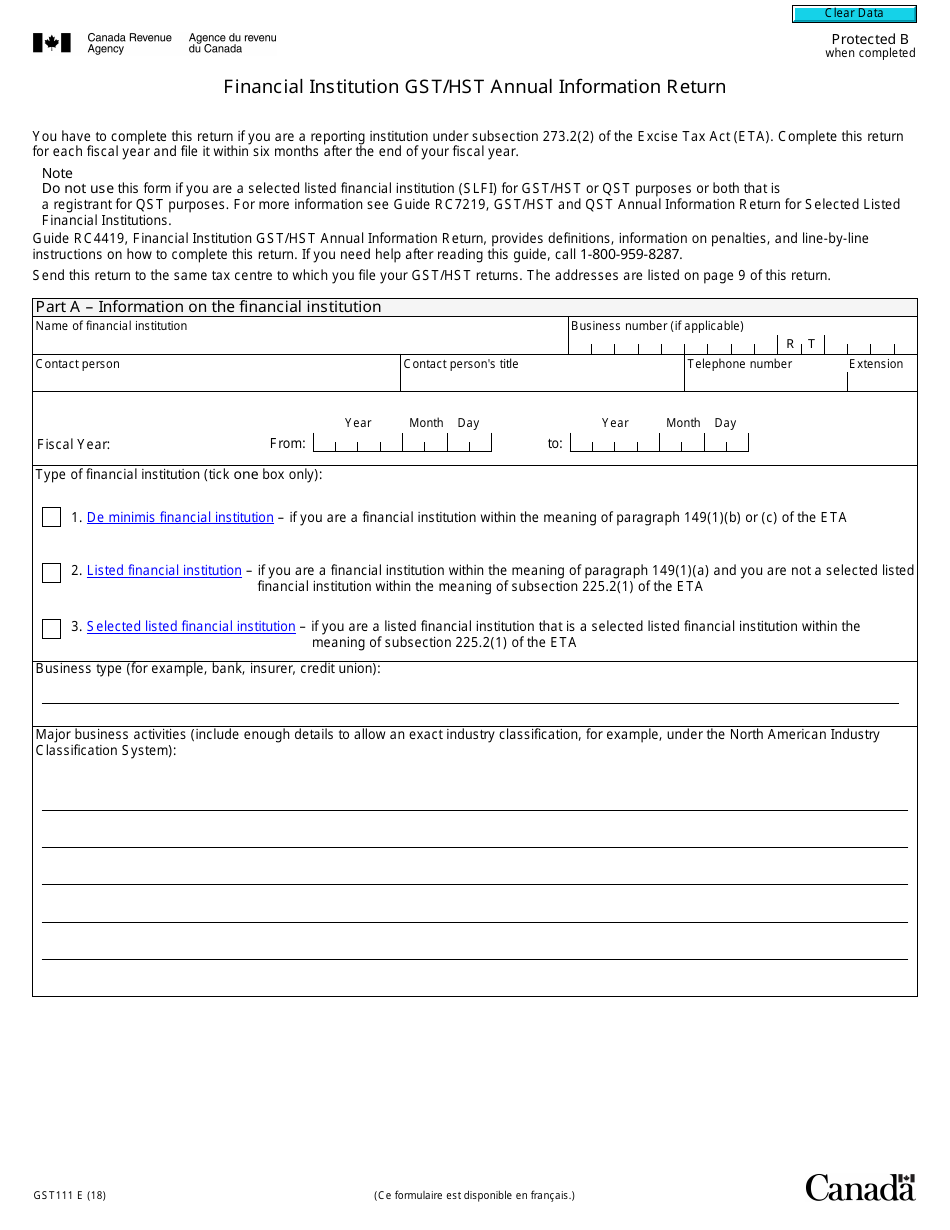

Web 1 avr 2022 nbsp 0183 32 The following is a list of new or revised excise and GST HST forms and publications GST HST forms GST111 Financial Institution GST HST Annual

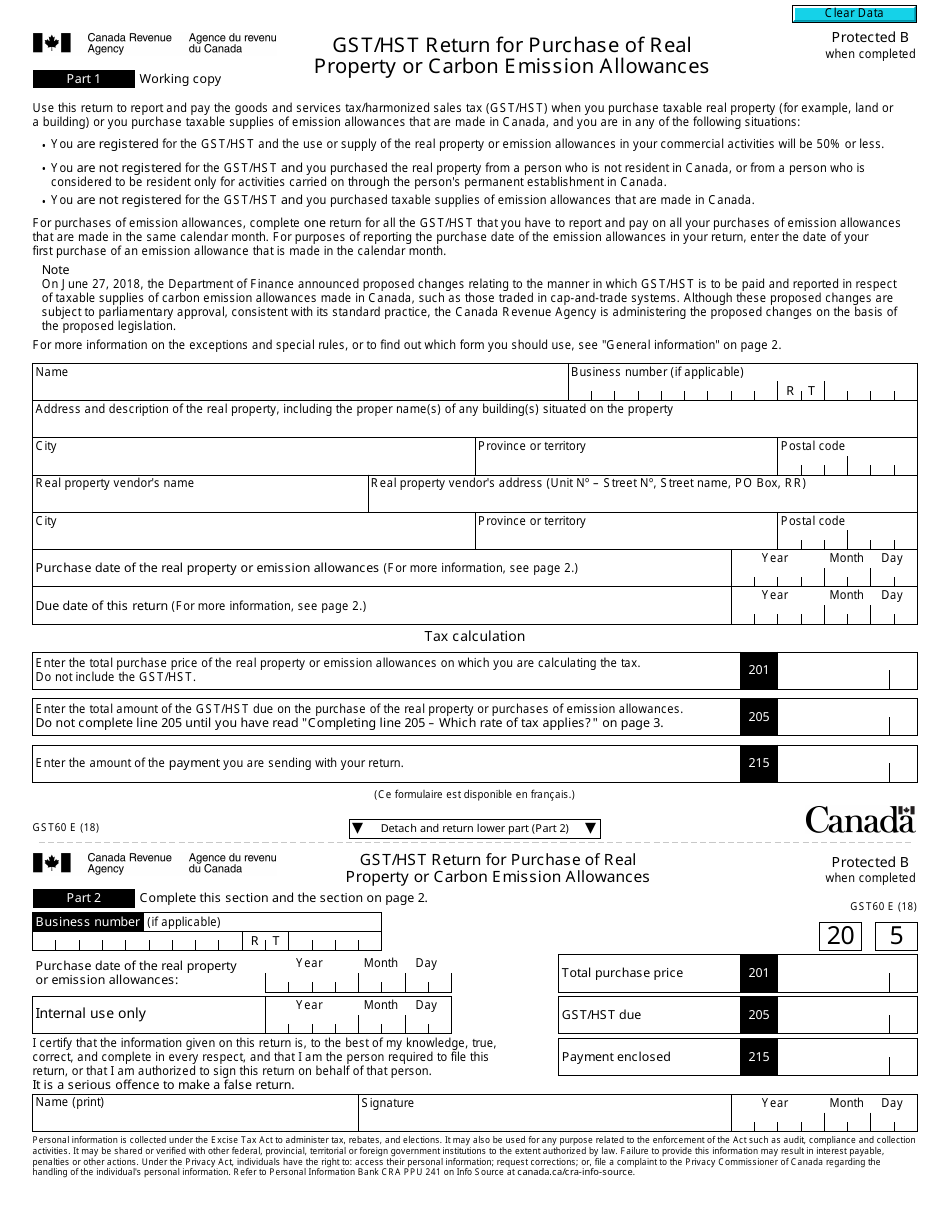

Web 1 oct 2017 nbsp 0183 32 The netting of the HST amount to 5 or having the price include HST at a net rate of 5 is only permitted on the invoice while the GST HST return must show tax at

A Gst Hst Rebate Form Line 111 in its simplest format, is a refund that a client receives after purchasing a certain product or service. It is a powerful tool used by businesses to attract customers, increase sales or promote a specific product.

Types of Gst Hst Rebate Form Line 111

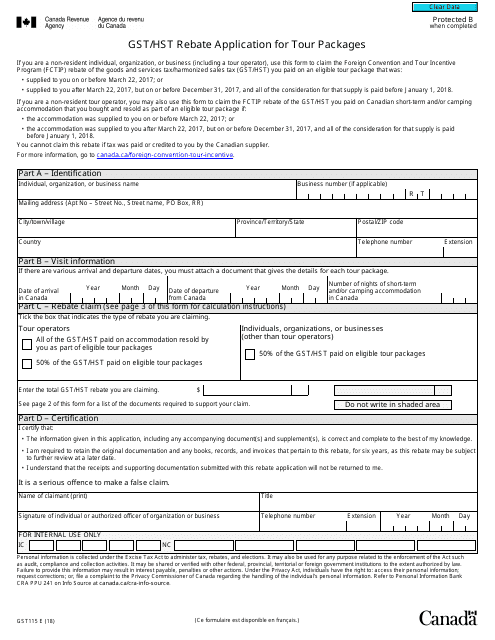

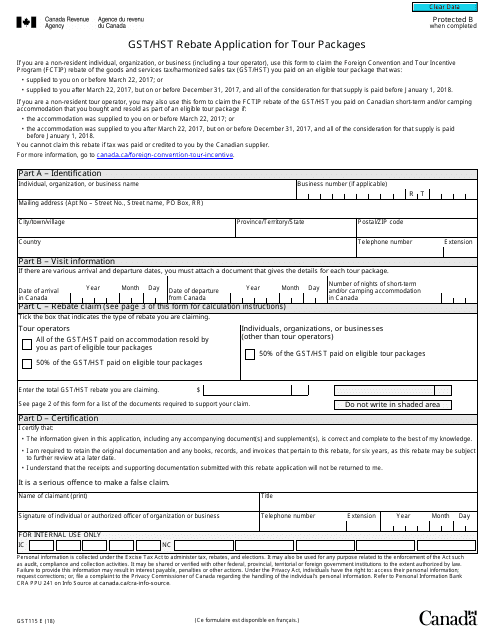

Form GST115 Fill Out Sign Online And Download Fillable PDF Canada

Form GST115 Fill Out Sign Online And Download Fillable PDF Canada

Web 17 mai 2021 nbsp 0183 32 You can file returns with a rebate amount on line 111 using GST HST TELEFILE However you must still mail the rebate application form s to the applicable

Web Line 111 Certain rebates can reduce or offset your amount owing Those rebate forms contain a question asking if you want to claim the rebate amount on line 111 of your

Cash Gst Hst Rebate Form Line 111

Cash Gst Hst Rebate Form Line 111 are the simplest type of Gst Hst Rebate Form Line 111. Customers are given a certain amount of money after purchasing a product. They are typically used to purchase the most expensive products like electronics or appliances.

Mail-In Gst Hst Rebate Form Line 111

Mail-in Gst Hst Rebate Form Line 111 require that customers send in the proof of purchase to be eligible for their money back. They're more involved, but offer huge savings.

Instant Gst Hst Rebate Form Line 111

Instant Gst Hst Rebate Form Line 111 are made at the place of purchase, reducing the cost of purchase immediately. Customers do not have to wait for their savings in this manner.

How Gst Hst Rebate Form Line 111 Work

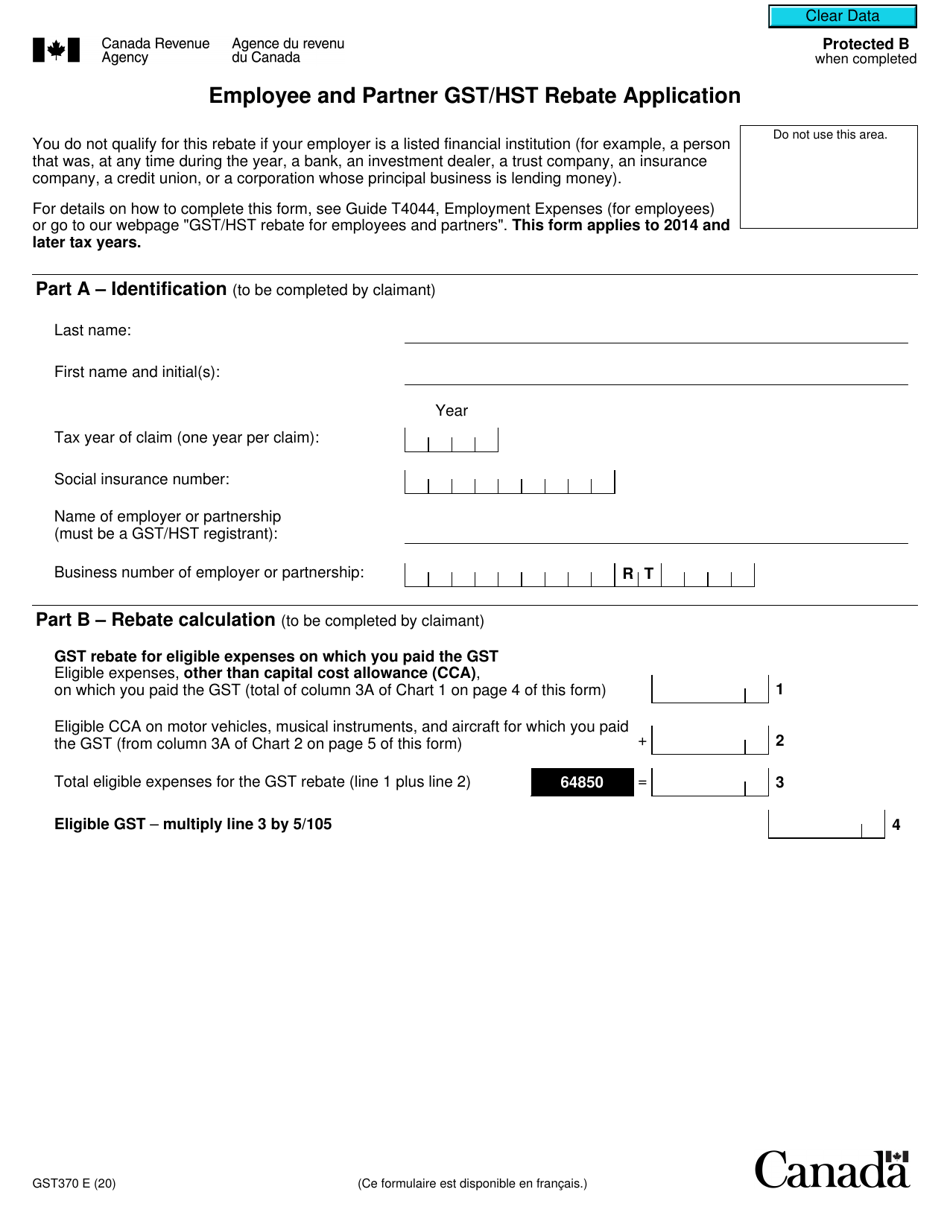

Form GST370 Download Fillable PDF Or Fill Online Employee And Partner

Form GST370 Download Fillable PDF Or Fill Online Employee And Partner

Web rental property rebate as an adjustment on line 111 of your GST HST return or on line 1301 of Schedule A of your GST HST NETFILE return enter the reporting period in which you

The Gst Hst Rebate Form Line 111 Process

The procedure usually involves a few steps:

-

Buy the product: At first make sure you purchase the product as you normally would.

-

Fill in this Gst Hst Rebate Form Line 111 application: In order to claim your Gst Hst Rebate Form Line 111, you'll have provide certain information including your address, name, and purchase information, in order to get your Gst Hst Rebate Form Line 111.

-

Make sure you submit the Gst Hst Rebate Form Line 111 It is dependent on the type of Gst Hst Rebate Form Line 111 the recipient may be required to submit a form by mail or make it available online.

-

Wait until the company approves: The company will evaluate your claim to confirm that it complies with the requirements of the Gst Hst Rebate Form Line 111.

-

Enjoy your Gst Hst Rebate Form Line 111 Once it's approved, you'll be able to receive your reimbursement, in the form of a check, prepaid card, or a different method that is specified in the offer.

Pros and Cons of Gst Hst Rebate Form Line 111

Advantages

-

Cost Savings Rewards can drastically lower the cost you pay for the product.

-

Promotional Deals they encourage their customers to test new products or brands.

-

Improve Sales Gst Hst Rebate Form Line 111 can increase an organization's sales and market share.

Disadvantages

-

Complexity In particular, mail-in Gst Hst Rebate Form Line 111 particularly may be lengthy and lengthy.

-

End Dates Most Gst Hst Rebate Form Line 111 come with extremely strict deadlines to submit.

-

Risk of Not Being Paid: Some customers may not receive Gst Hst Rebate Form Line 111 if they don't comply with the rules precisely.

Download Gst Hst Rebate Form Line 111

Download Gst Hst Rebate Form Line 111

FAQs

1. Are Gst Hst Rebate Form Line 111 equivalent to discounts? No, Gst Hst Rebate Form Line 111 involve one-third of the amount refunded following purchase whereas discounts will reduce their price at point of sale.

2. Do I have to use multiple Gst Hst Rebate Form Line 111 for the same product? It depends on the conditions of Gst Hst Rebate Form Line 111 incentives and the specific product's quality and eligibility. Certain companies may allow it, but others won't.

3. How long does it take to receive an Gst Hst Rebate Form Line 111? The amount of time is variable, however it can last from a few weeks until a few months for you to receive your Gst Hst Rebate Form Line 111.

4. Do I need to pay taxes upon Gst Hst Rebate Form Line 111 quantities? the majority of situations, Gst Hst Rebate Form Line 111 amounts are not considered taxable income.

5. Do I have confidence in Gst Hst Rebate Form Line 111 offers from brands that aren't well-known It's crucial to research and make sure that the company giving the Gst Hst Rebate Form Line 111 is reputable before making an purchase.

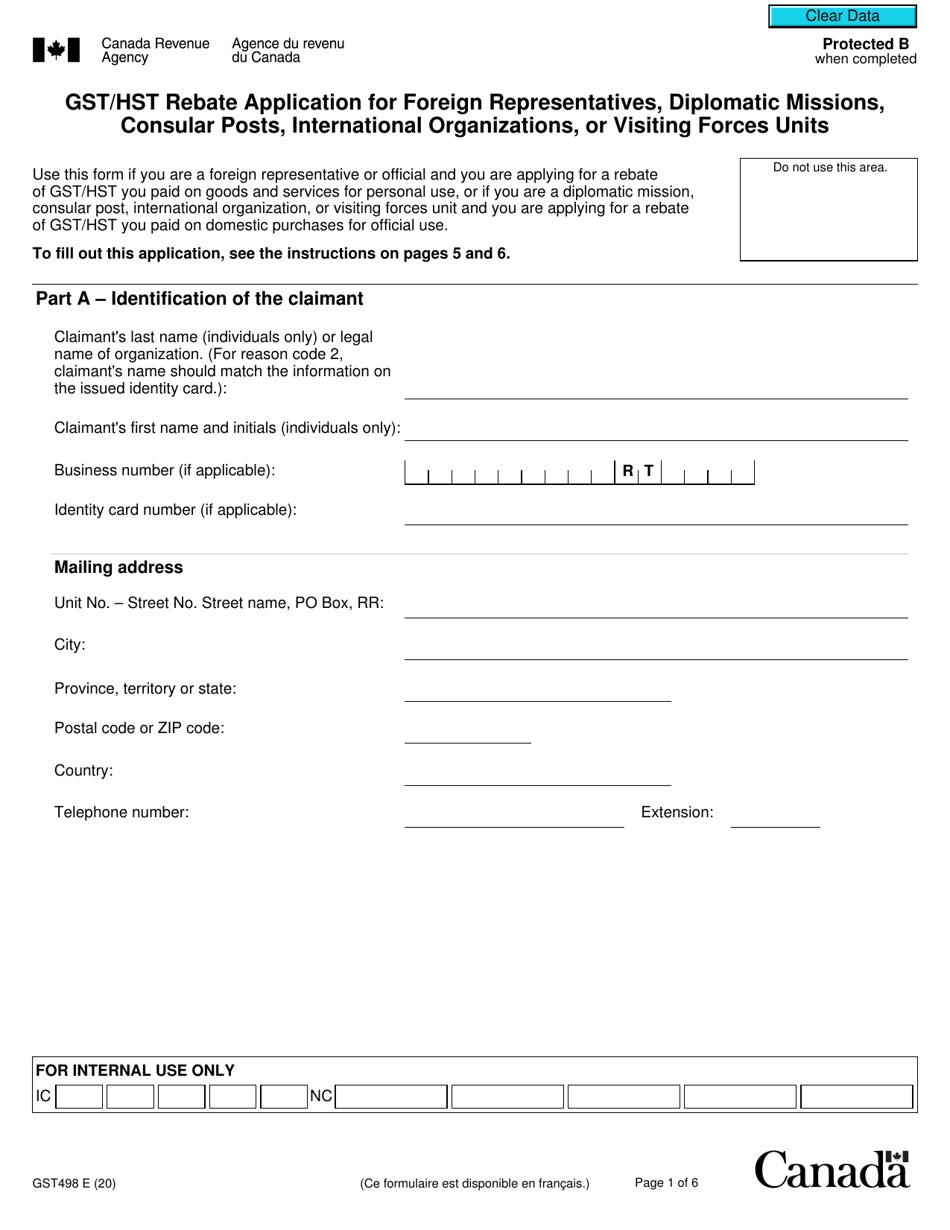

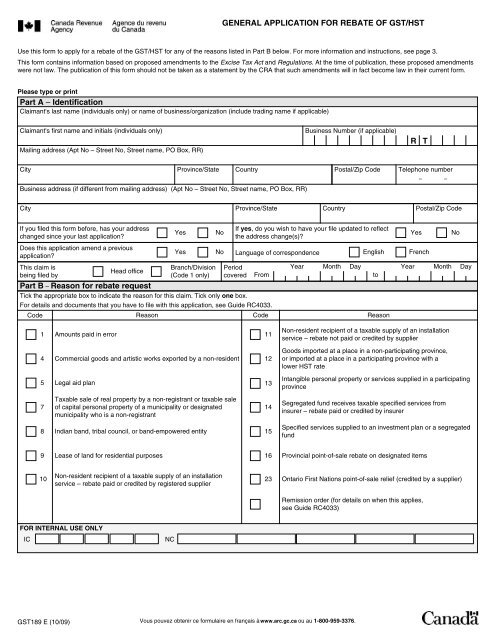

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

Business Gst Remittance Form Santos Czerwinski s Template

Check more sample of Gst Hst Rebate Form Line 111 below

Gst Fillable Form Printable Forms Free Online

Gst191 Fillable Form Printable Forms Free Online

Gst Fillable Form Printable Forms Free Online

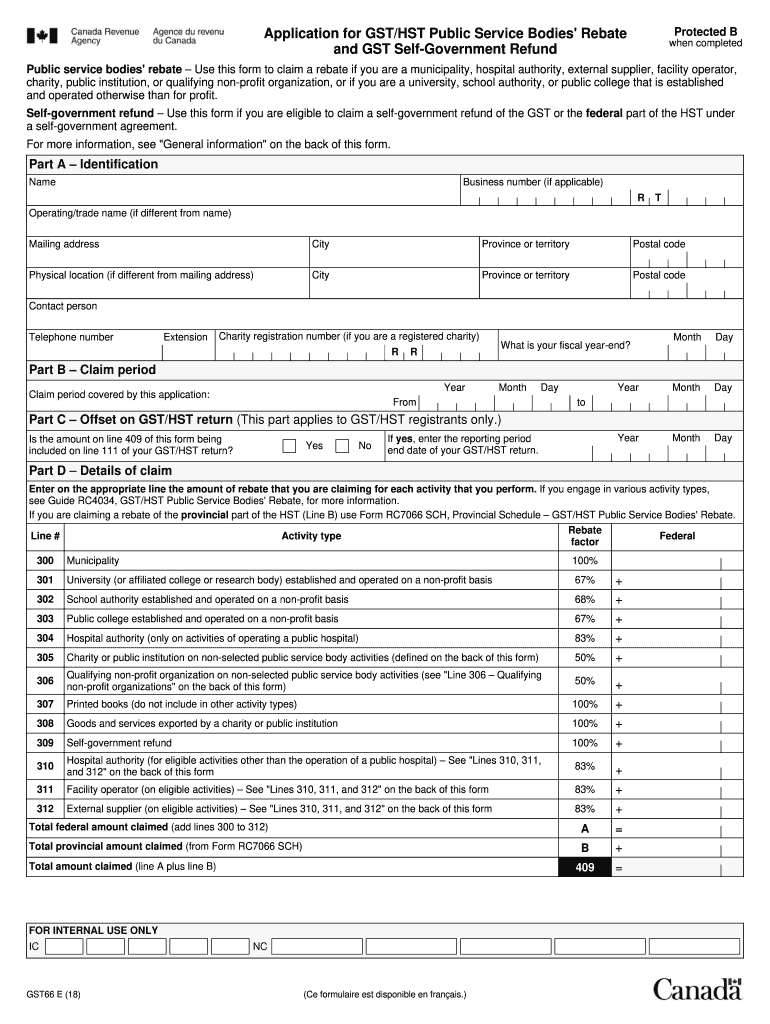

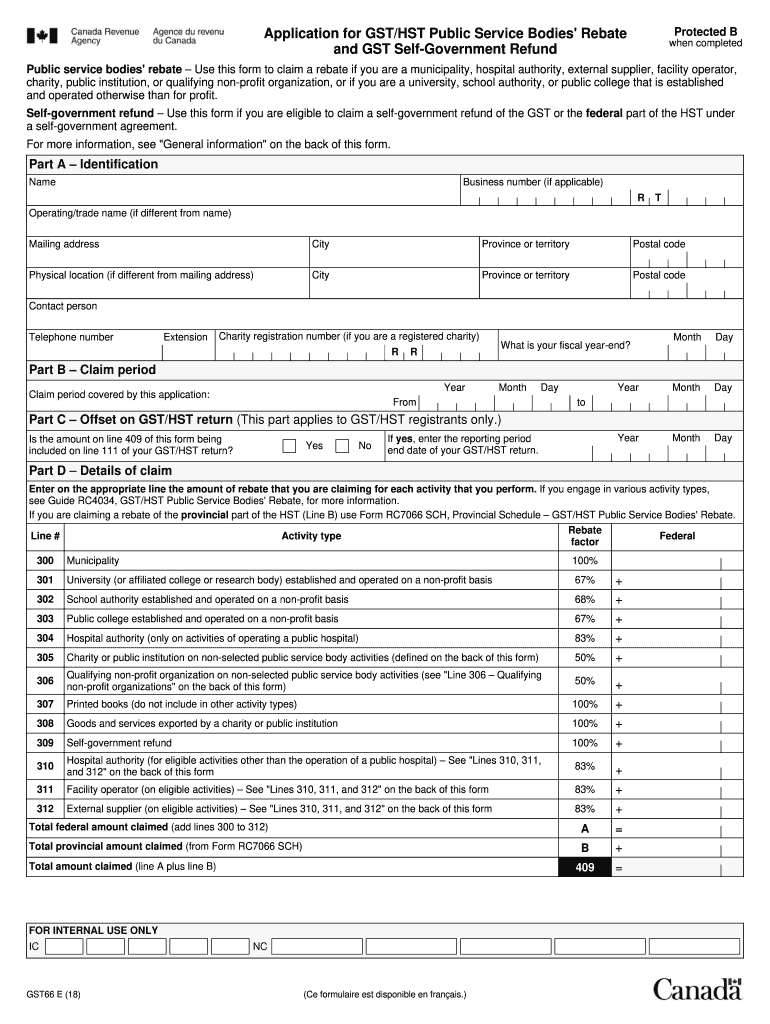

Gst66 E Fill Out Sign Online DocHub

GST HST Rebate Form Asset Services Inc

How To Fill Out Hst Rebate Form By State Printable Rebate Form

https://www.canada.ca/.../gst-hst-rebates/application.html

Web 1 oct 2017 nbsp 0183 32 The netting of the HST amount to 5 or having the price include HST at a net rate of 5 is only permitted on the invoice while the GST HST return must show tax at

https://www.canada.ca/.../rc4033/general-application-gst-hst-rebates.html

Web To do this enter the amount of your rebate on line 111 of Form GST62 The amount you will have to remit is equal to the amount on line 109 less the amount on line 111 File

Web 1 oct 2017 nbsp 0183 32 The netting of the HST amount to 5 or having the price include HST at a net rate of 5 is only permitted on the invoice while the GST HST return must show tax at

Web To do this enter the amount of your rebate on line 111 of Form GST62 The amount you will have to remit is equal to the amount on line 109 less the amount on line 111 File

Gst66 E Fill Out Sign Online DocHub

Gst191 Fillable Form Printable Forms Free Online

GST HST Rebate Form Asset Services Inc

How To Fill Out Hst Rebate Form By State Printable Rebate Form

Changes To The GST HST Return DJB Chartered Professional Accountants

Gst Hst New Housing Rebate Application For Owner Built Houses

Gst Hst New Housing Rebate Application For Owner Built Houses

Gst Hst New Residential Rental Property Rebate Application Guide