Today, in a world that is driven by the consumer everyone appreciates a great deal. One way to make significant savings on your purchases is by using Recovery Rebate Credit Turbotax Forms. Recovery Rebate Credit Turbotax Forms can be a way of marketing employed by retailers and manufacturers for offering customers a percentage payment on their purchases, after they've done so. In this post, we'll take a look at the world that is Recovery Rebate Credit Turbotax Forms, examining the nature of them and how they operate, as well as ways to maximize the value of these incentives.

Get Latest Recovery Rebate Credit Turbotax Form Below

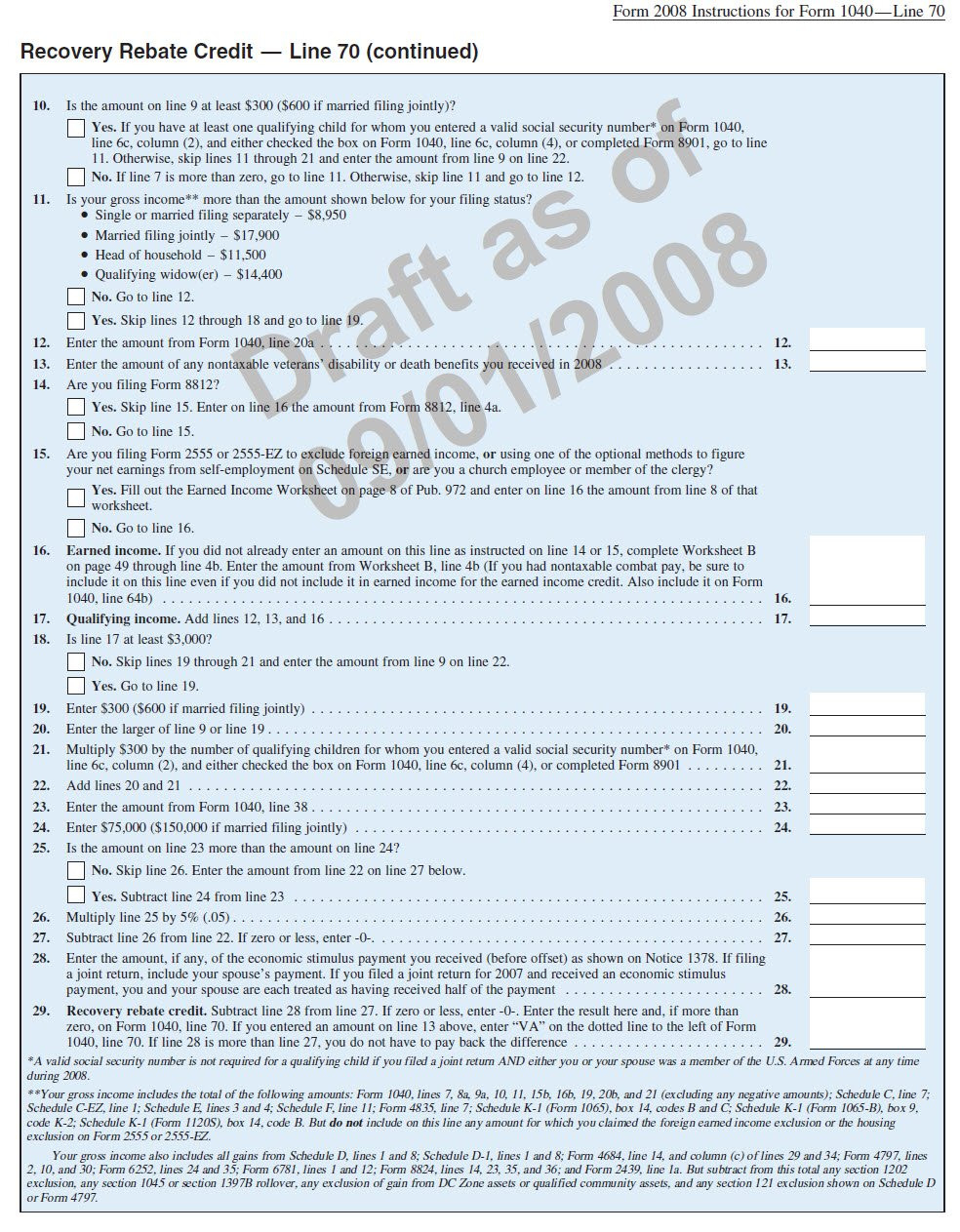

Recovery Rebate Credit Turbotax Form

Recovery Rebate Credit Turbotax Form -

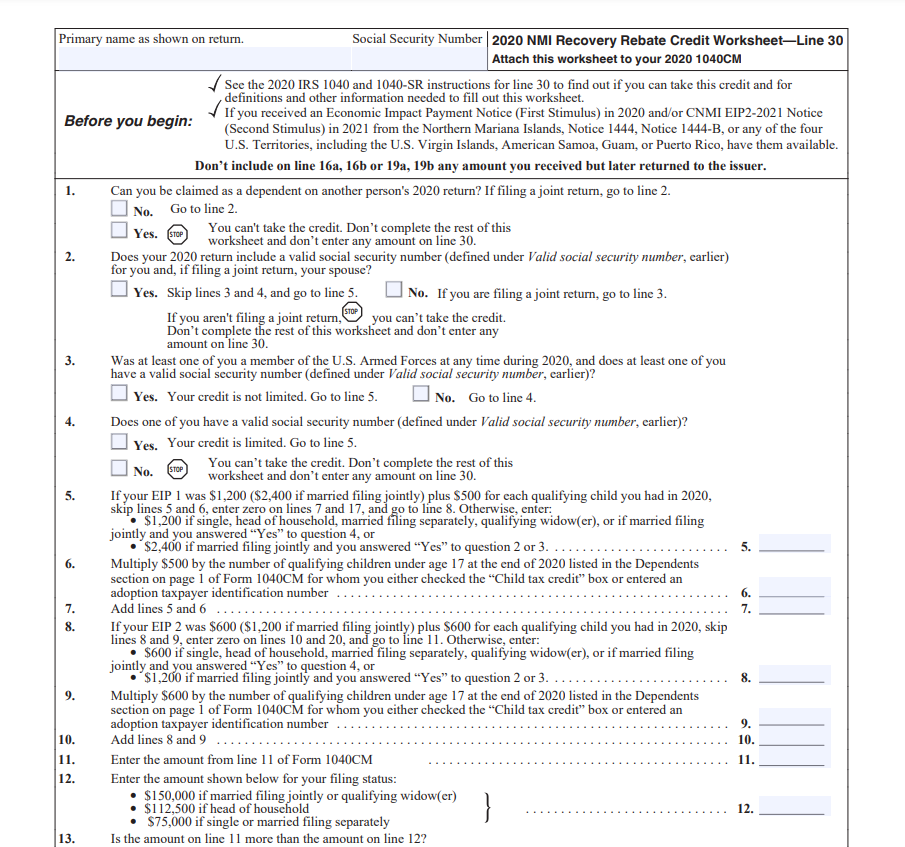

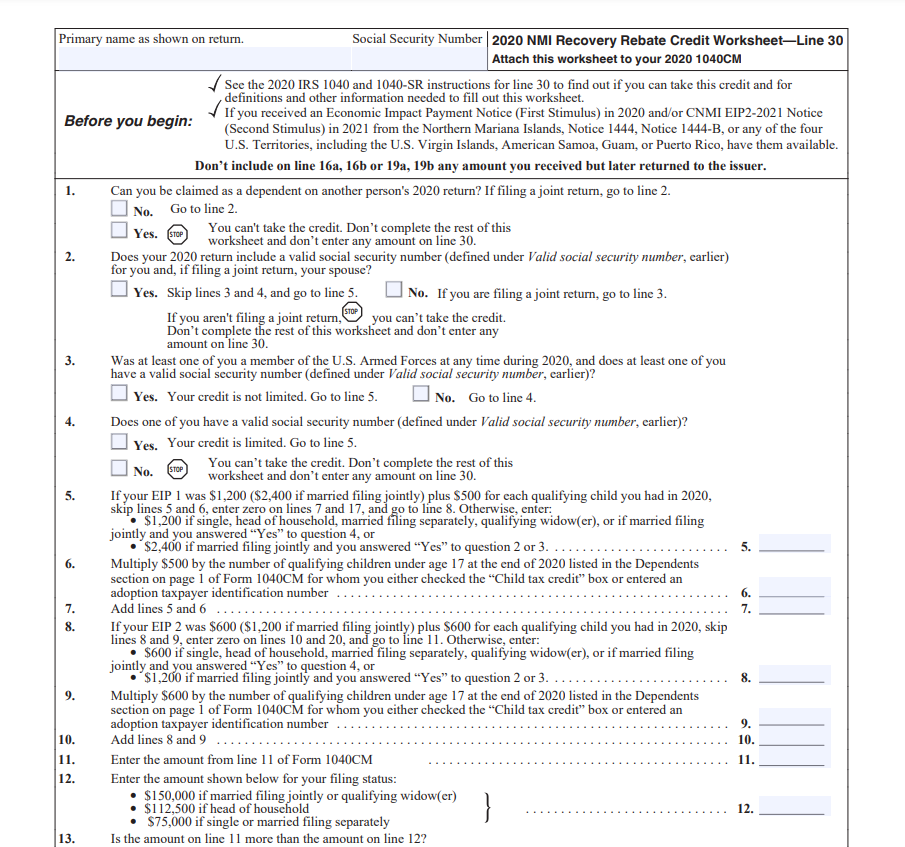

Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form

Web 1 d 233 c 2022 nbsp 0183 32 What is the 2020 Recovery Rebate Credit The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of

A Recovery Rebate Credit Turbotax Form in its simplest form, is a reimbursement to a buyer after having purchased a item or service. It's an effective way for businesses to entice customers, increase sales or promote a specific product.

Types of Recovery Rebate Credit Turbotax Form

How Do I Claim The Recovery Rebate Credit On My Ta

How Do I Claim The Recovery Rebate Credit On My Ta

Web Didn t get your stimulus Here s how to claim it on your tax return using TurboTax Follow these steps to claim the Recovery Rebate Credit on your 2020 Form 1040 Step 1 Get

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Cash Recovery Rebate Credit Turbotax Form

Cash Recovery Rebate Credit Turbotax Form are the most straightforward kind of Recovery Rebate Credit Turbotax Form. Customers are given a certain amount of money after purchasing a particular item. These are usually used for big-ticket items, like electronics and appliances.

Mail-In Recovery Rebate Credit Turbotax Form

Mail-in Recovery Rebate Credit Turbotax Form demand that customers present evidence of purchase to get their money back. They're more involved, however they can yield significant savings.

Instant Recovery Rebate Credit Turbotax Form

Instant Recovery Rebate Credit Turbotax Form are applied at the point of sale, reducing the price instantly. Customers do not have to wait around for savings when they purchase this type of Recovery Rebate Credit Turbotax Form.

How Recovery Rebate Credit Turbotax Form Work

Track Your Recovery Rebate With This Worksheet Style Worksheets

Track Your Recovery Rebate With This Worksheet Style Worksheets

Web 29 janv 2021 nbsp 0183 32 1 Best answer Yes you can claim the Recovery Rebate when you file your 2020 tax return When you are inside your tax return click on Federal on the left menu

The Recovery Rebate Credit Turbotax Form Process

The process typically comprises a handful of simple steps:

-

When you buy the product, you buy the product like you normally do.

-

Complete the Recovery Rebate Credit Turbotax Form questionnaire: you'll have to supply some details, such as your name, address, and the purchase details, in order to submit your Recovery Rebate Credit Turbotax Form.

-

Send in the Recovery Rebate Credit Turbotax Form If you want to submit the Recovery Rebate Credit Turbotax Form, based on the kind of Recovery Rebate Credit Turbotax Form the recipient may be required to mail in a form or upload it online.

-

Wait for approval: The business will scrutinize your submission and ensure that it's compliant with reimbursement's terms and condition.

-

Pay your Recovery Rebate Credit Turbotax Form Once it's approved, you'll receive a refund through a check, or a prepaid card, or another method specified by the offer.

Pros and Cons of Recovery Rebate Credit Turbotax Form

Advantages

-

Cost Savings Recovery Rebate Credit Turbotax Form could significantly decrease the price for products.

-

Promotional Deals They encourage customers to try new items or brands.

-

boost sales The benefits of a Recovery Rebate Credit Turbotax Form can improve the company's sales as well as market share.

Disadvantages

-

Complexity In particular, mail-in Recovery Rebate Credit Turbotax Form in particular the case of HTML0, can be a hassle and tedious.

-

Time Limits for Recovery Rebate Credit Turbotax Form Many Recovery Rebate Credit Turbotax Form are subject to extremely strict deadlines to submit.

-

A risk of not being paid: Some customers may not be able to receive their Recovery Rebate Credit Turbotax Form if they do not adhere to the guidelines exactly.

Download Recovery Rebate Credit Turbotax Form

Download Recovery Rebate Credit Turbotax Form

FAQs

1. Are Recovery Rebate Credit Turbotax Form equivalent to discounts? No, they are an amount of money that is refunded after the purchase, whereas discounts cut costs at time of sale.

2. Are there multiple Recovery Rebate Credit Turbotax Form I can get for the same product This is dependent on terms and conditions of Recovery Rebate Credit Turbotax Form offered and product's potential eligibility. Some companies may allow it, but some will not.

3. How long will it take to get a Recovery Rebate Credit Turbotax Form? The period differs, but could be anywhere from a few weeks up to a few months for you to receive your Recovery Rebate Credit Turbotax Form.

4. Do I have to pay tax with respect to Recovery Rebate Credit Turbotax Form values? most situations, Recovery Rebate Credit Turbotax Form amounts are not considered taxable income.

5. Should I be able to trust Recovery Rebate Credit Turbotax Form offers from brands that aren't well-known? It's essential to research and verify that the brand providing the Recovery Rebate Credit Turbotax Form has a good reputation prior to making the purchase.

Fill Free Fillable TheTaxBook PDF Forms Recovery Rebate

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Check more sample of Recovery Rebate Credit Turbotax Form below

Taxes Recovery Rebate Credit Recovery Rebate

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

35 What If Worksheet Turbotax Worksheet Source 2021 Recovery Rebate

Recovery Credit Printable Rebate Form

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

1040 Line 30 Recovery Rebate Credit Recovery Rebate

https://turbotax.intuit.com/tax-tips/tax-relief/w…

Web 1 d 233 c 2022 nbsp 0183 32 What is the 2020 Recovery Rebate Credit The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 1 d 233 c 2022 nbsp 0183 32 What is the 2020 Recovery Rebate Credit The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Recovery Credit Printable Rebate Form

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

1040 Line 30 Recovery Rebate Credit Recovery Rebate

Recovery Rebate Credit Worksheet Tax Guru Kertetter Letter Db

How To Claim Stimulus Check 2021 Turbotax It S Not Too Late Claim A

How To Claim Stimulus Check 2021 Turbotax It S Not Too Late Claim A

Recovery Rebate Credit Stimulus Check 2022 Turbotax Recovery Rebate