In this modern-day world of consumers, everyone loves a good deal. One way to gain substantial savings in your purchase is through Fuel Tax Rebate Forms. Fuel Tax Rebate Forms can be a way of marketing used by manufacturers and retailers to offer consumers a partial cash back on their purchases once they've bought them. In this article, we will take a look at the world that is Fuel Tax Rebate Forms and explore what they are and how they function, and how to maximize the savings you can make by using these cost-effective incentives.

Get Latest Fuel Tax Rebate Form Below

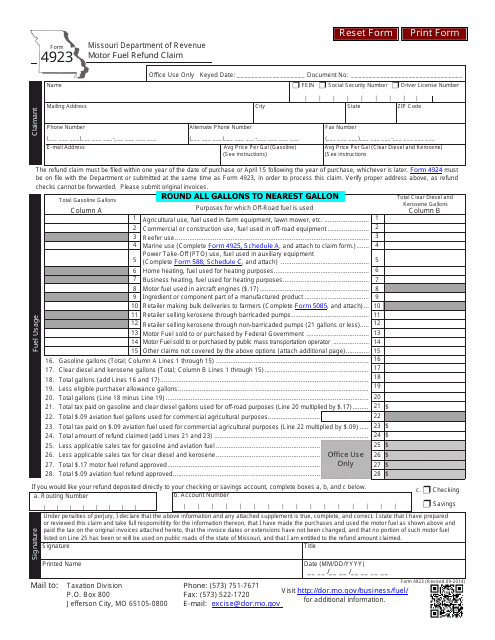

Fuel Tax Rebate Form

Fuel Tax Rebate Form -

Web Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits

Web You can claim tax relief on the money you ve spent on fuel and electricity for business trips in your company car Keep records to show the actual cost of the fuel If your employer

A Fuel Tax Rebate Form at its most basic definition, is a refund that a client receives after they've purchased a good or service. It's an effective way used by businesses to attract customers, increase sales and to promote certain products.

Types of Fuel Tax Rebate Form

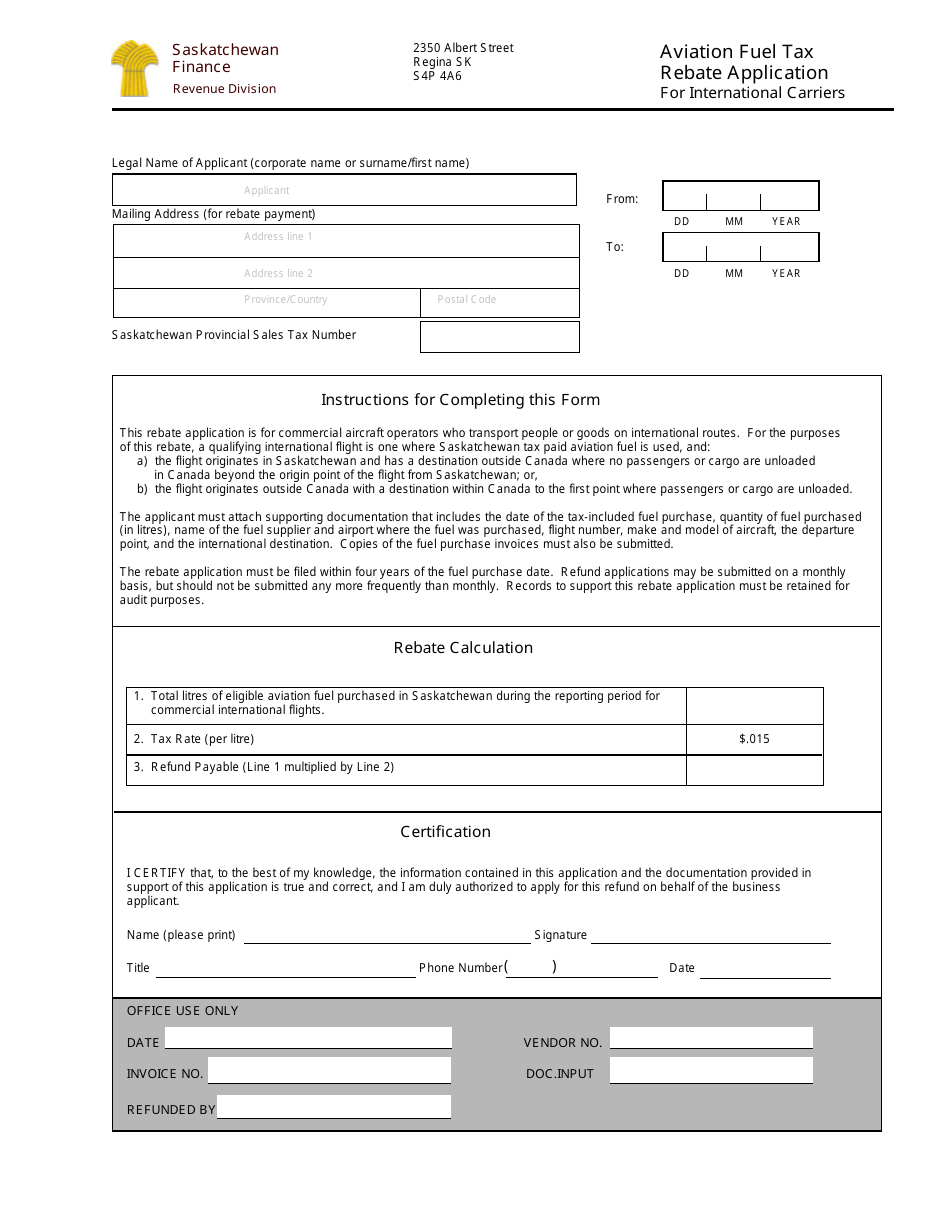

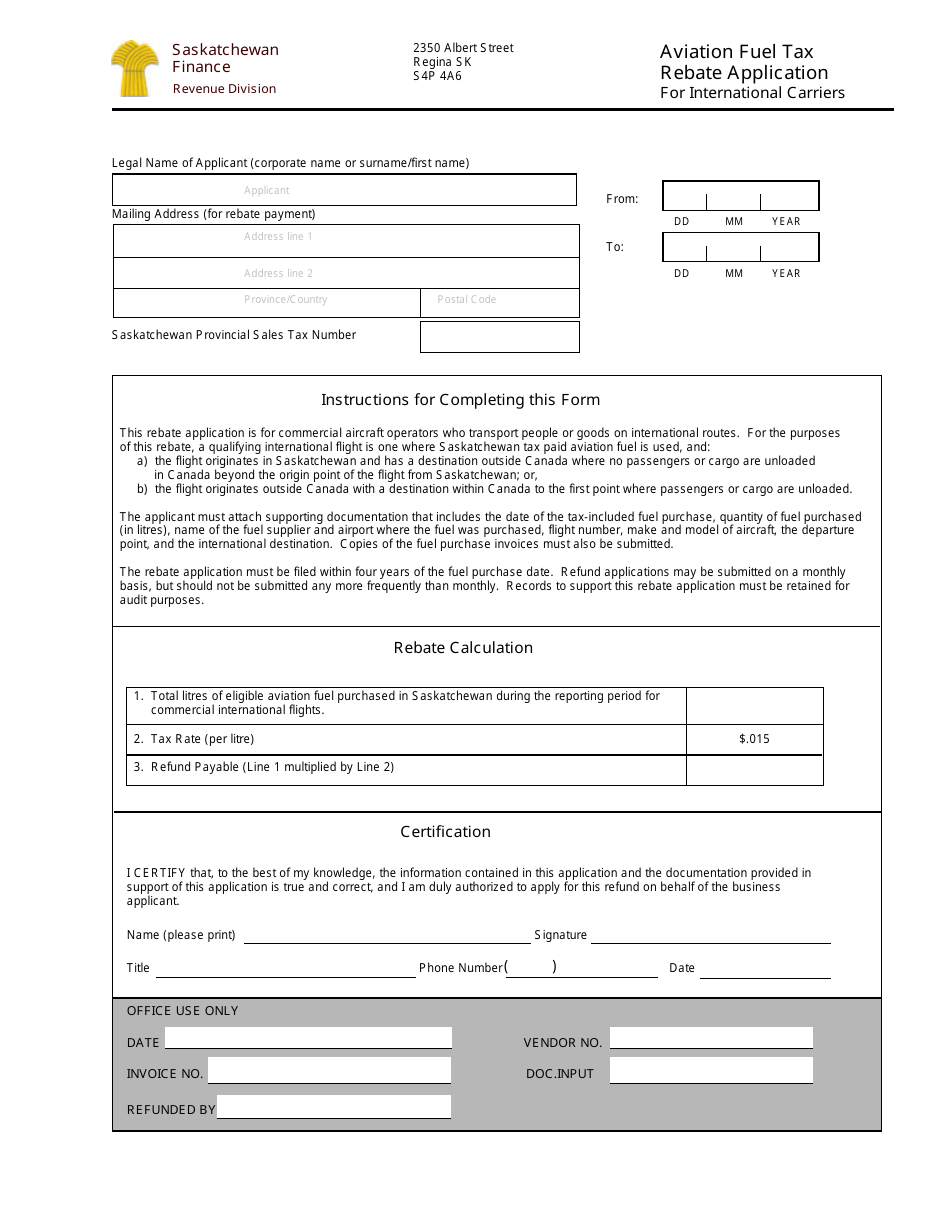

Saskatchewan Canada Aviation Fuel Tax Rebate Application For

Saskatchewan Canada Aviation Fuel Tax Rebate Application For

Web About Form 4136 Credit For Federal Tax Paid On Fuels Use Form 4136 to claim A credit for certain nontaxable uses or sales of fuel during your income tax year The

Web 25 avr 2014 nbsp 0183 32 Details To register to claim Fuel Duty relief when you sell unleaded petrol and diesel as road fuel and you re eligible for relief you can either use the online

Cash Fuel Tax Rebate Form

Cash Fuel Tax Rebate Form are probably the most simple type of Fuel Tax Rebate Form. Customers receive a specific amount back in cash after purchasing a item. These are typically for products that are expensive, such as electronics or appliances.

Mail-In Fuel Tax Rebate Form

Customers who want to receive mail-in Fuel Tax Rebate Form must submit the proof of purchase to be eligible for their refund. They're a bit more complicated, but they can provide significant savings.

Instant Fuel Tax Rebate Form

Instant Fuel Tax Rebate Form apply at the place of purchase, reducing the price of purchases immediately. Customers do not have to wait around for savings in this manner.

How Fuel Tax Rebate Form Work

National Fuel Printable Rebate Form Gas Rebates

National Fuel Printable Rebate Form Gas Rebates

Web Motor fuel tax and carbon tax forms The current version of each form is listed below If you need a tax return or refund form for a past reporting period review the previous

The Fuel Tax Rebate Form Process

The process typically comprises a few easy steps:

-

Purchase the product: Then then, you buy the item just as you would ordinarily.

-

Fill in your Fuel Tax Rebate Form Form: To claim the Fuel Tax Rebate Form you'll need to fill in some information including your name, address, as well as the details of your purchase to be eligible for a Fuel Tax Rebate Form.

-

To submit the Fuel Tax Rebate Form According to the type of Fuel Tax Rebate Form you could be required to send in a form, or upload it online.

-

Wait for approval: The business will review your submission to ensure it meets the Fuel Tax Rebate Form's terms and conditions.

-

Enjoy your Fuel Tax Rebate Form If it is approved, you'll receive a refund through a check, or a prepaid card, or another option specified by the offer.

Pros and Cons of Fuel Tax Rebate Form

Advantages

-

Cost savings A Fuel Tax Rebate Form can significantly cut the price you pay for a product.

-

Promotional Deals They encourage customers to explore new products or brands.

-

Help to Increase Sales A Fuel Tax Rebate Form program can boost companies' sales and market share.

Disadvantages

-

Complexity Reward mail-ins in particular could be cumbersome and demanding.

-

End Dates A majority of Fuel Tax Rebate Form have strict time limits for submission.

-

The risk of non-payment Customers may not be able to receive their Fuel Tax Rebate Form if they do not adhere to the guidelines exactly.

Download Fuel Tax Rebate Form

FAQs

1. Are Fuel Tax Rebate Form the same as discounts? No, Fuel Tax Rebate Form offer partial reimbursement after purchase, while discounts lower the cost of purchase at point of sale.

2. Are there multiple Fuel Tax Rebate Form I can get on the same item It is contingent on the conditions of the Fuel Tax Rebate Form offers and the product's acceptance. Certain companies might permit this, whereas others will not.

3. How long does it take to receive a Fuel Tax Rebate Form? The length of time will differ, but can take several weeks to a few months to receive your Fuel Tax Rebate Form.

4. Do I have to pay taxes regarding Fuel Tax Rebate Form quantities? most circumstances, Fuel Tax Rebate Form amounts are not considered taxable income.

5. Can I trust Fuel Tax Rebate Form deals from lesser-known brands It's crucial to research and confirm that the brand giving the Fuel Tax Rebate Form is legitimate prior to making any purchase.

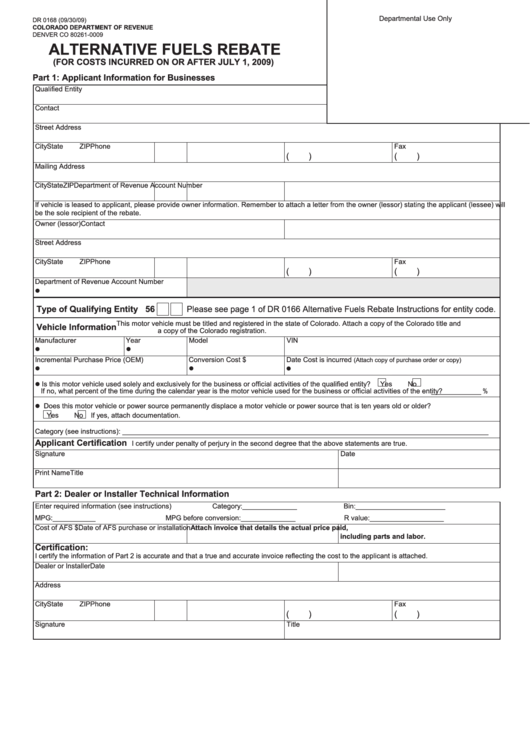

Form Dr 0168 Alternative Fuels Rebate 2009 Printable Pdf Download

REV 643 Motor Fuels Tax Reimbursement Claim Form In Truck

Check more sample of Fuel Tax Rebate Form below

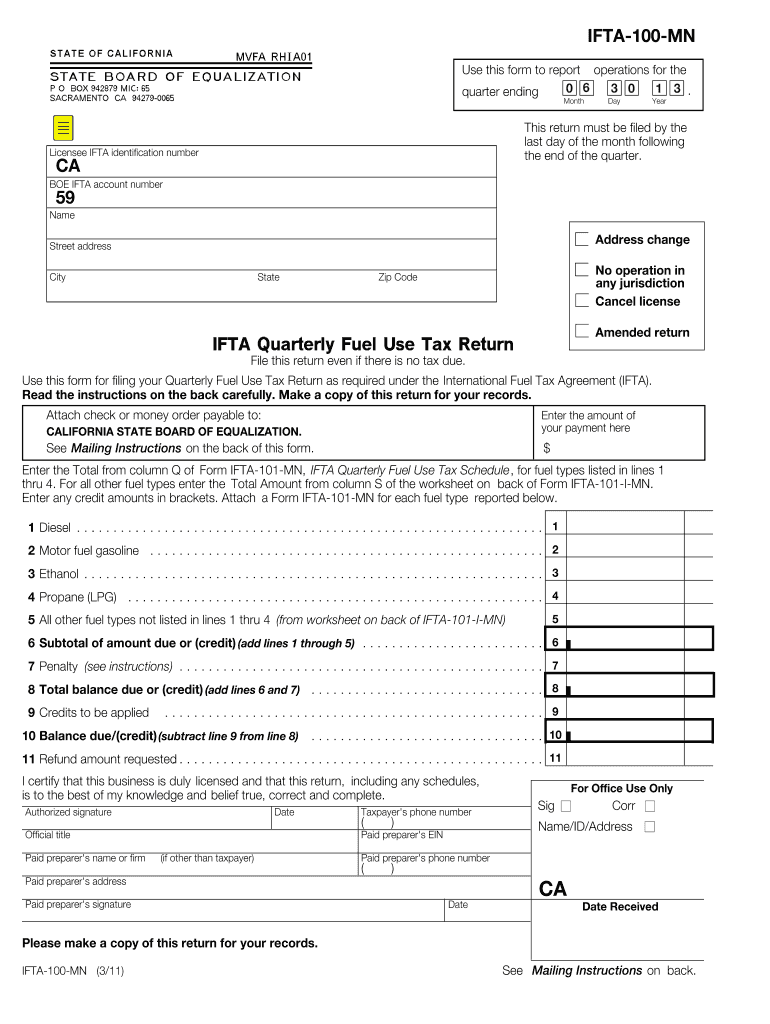

2019 California Ifta Quarterly Fuel Use Tax Schedule Form Fill Out

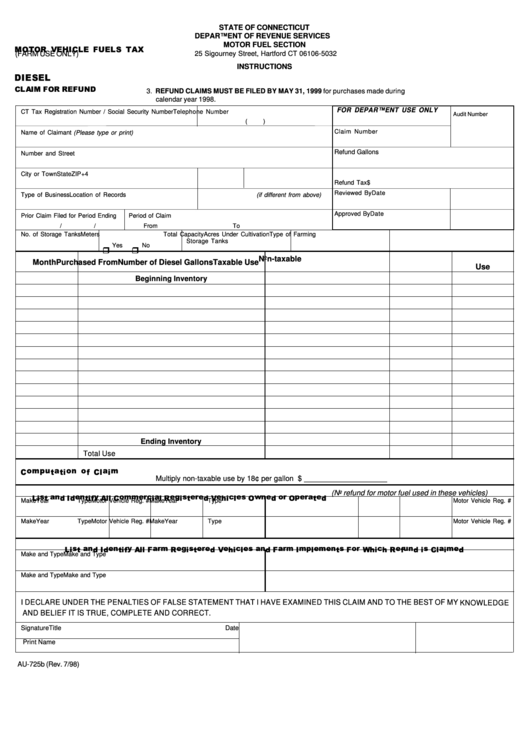

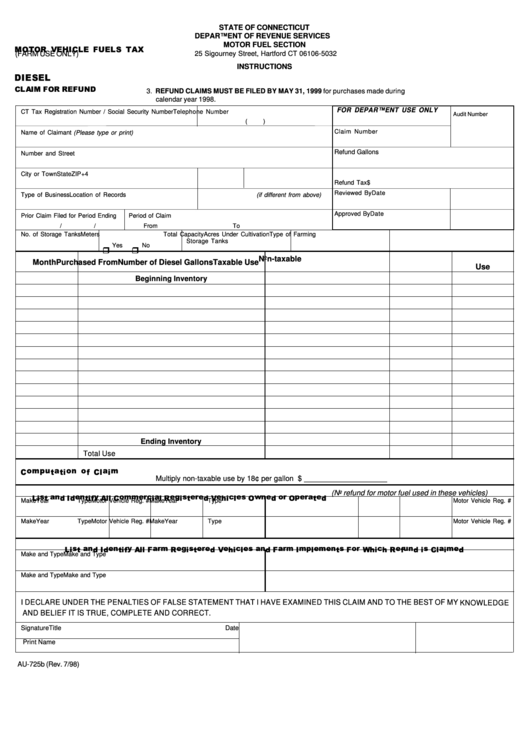

Fillable Form Au 725b Motor Vehicle Fuels Tax Farm Use Only

Intensive Weblog Diaporama

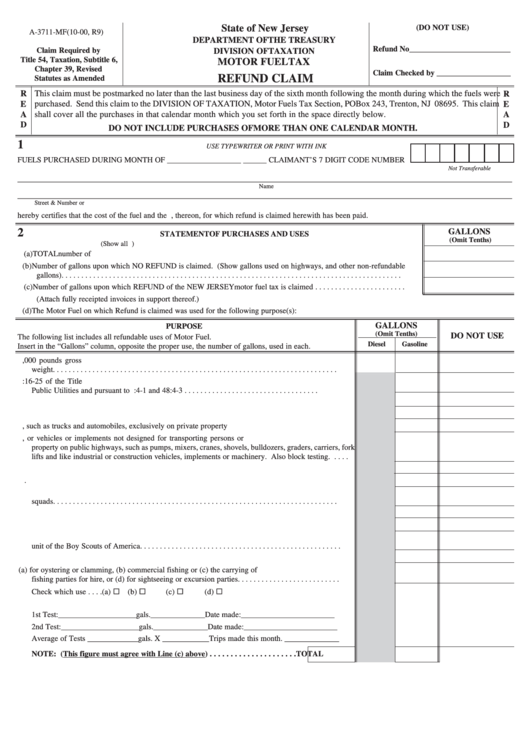

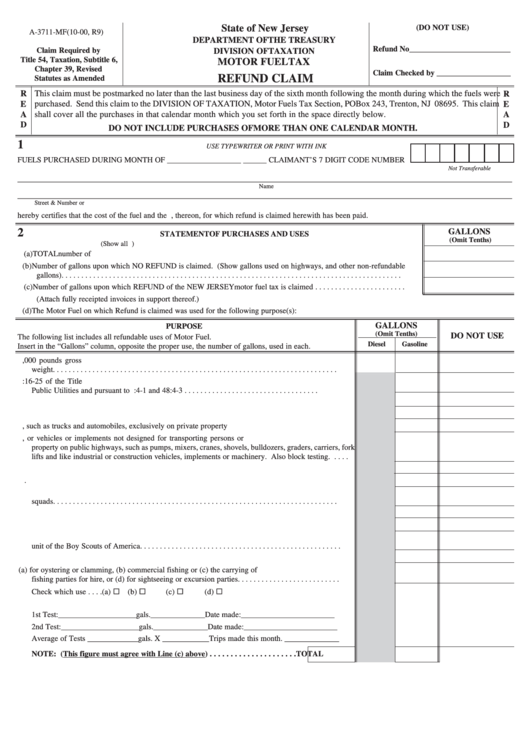

Fillable Form A 3711 Mf Motor Fuel Tax Refund Claim Printable Pdf

Missouri Gas Tax Refund Form Veche info 28

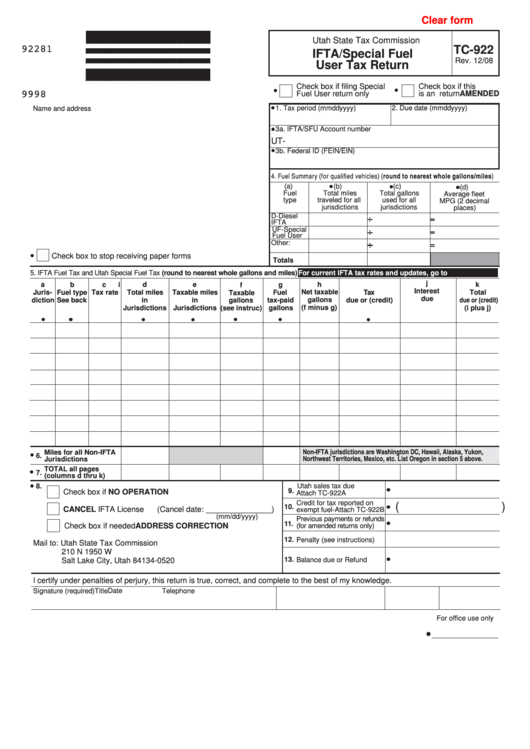

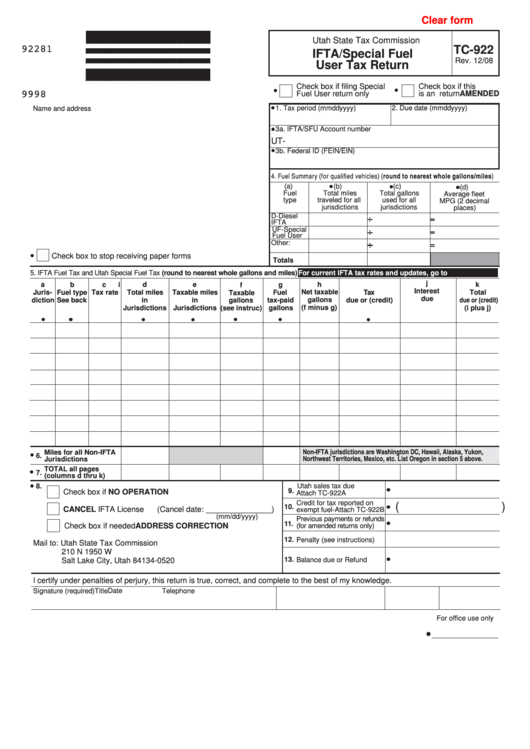

Fillable Ifta special Fuel User Tax Return Printable Pdf Download

https://www.gov.uk/tax-relief-for-employees/vehicles-you-use-for-work

Web You can claim tax relief on the money you ve spent on fuel and electricity for business trips in your company car Keep records to show the actual cost of the fuel If your employer

https://www.irs.gov/pub/irs-pdf/f4136.pdf

Web Credit for Federal Tax Paid on Fuels Go to www irs gov Form4136 for instructions and the latest information OMB No 1545 0162 2022 Attachment Sequence No 23 Name as

Web You can claim tax relief on the money you ve spent on fuel and electricity for business trips in your company car Keep records to show the actual cost of the fuel If your employer

Web Credit for Federal Tax Paid on Fuels Go to www irs gov Form4136 for instructions and the latest information OMB No 1545 0162 2022 Attachment Sequence No 23 Name as

Fillable Form A 3711 Mf Motor Fuel Tax Refund Claim Printable Pdf

Fillable Form Au 725b Motor Vehicle Fuels Tax Farm Use Only

Missouri Gas Tax Refund Form Veche info 28

Fillable Ifta special Fuel User Tax Return Printable Pdf Download

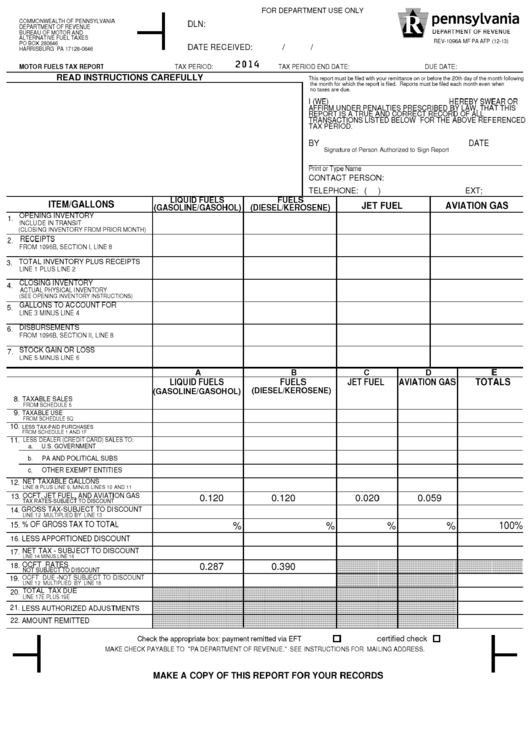

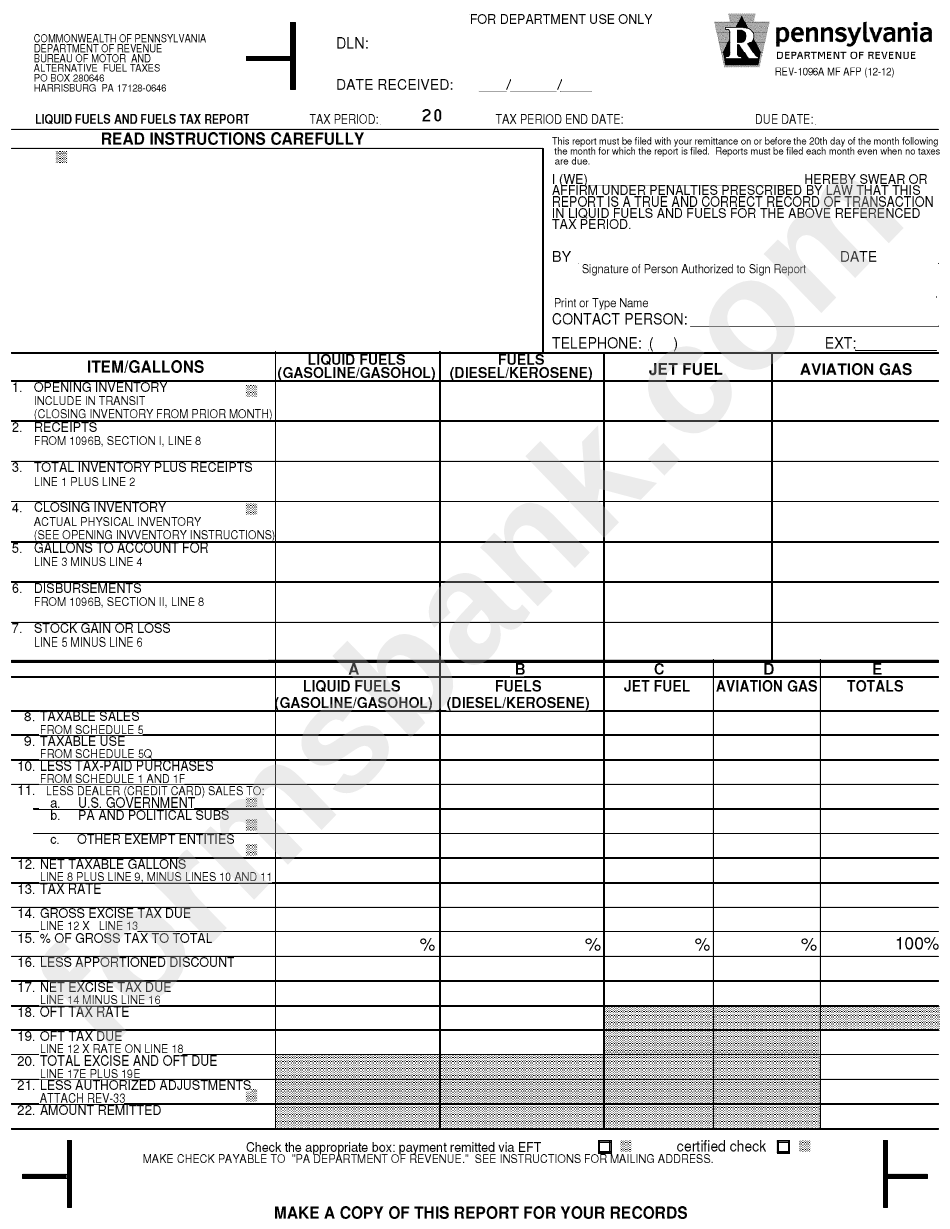

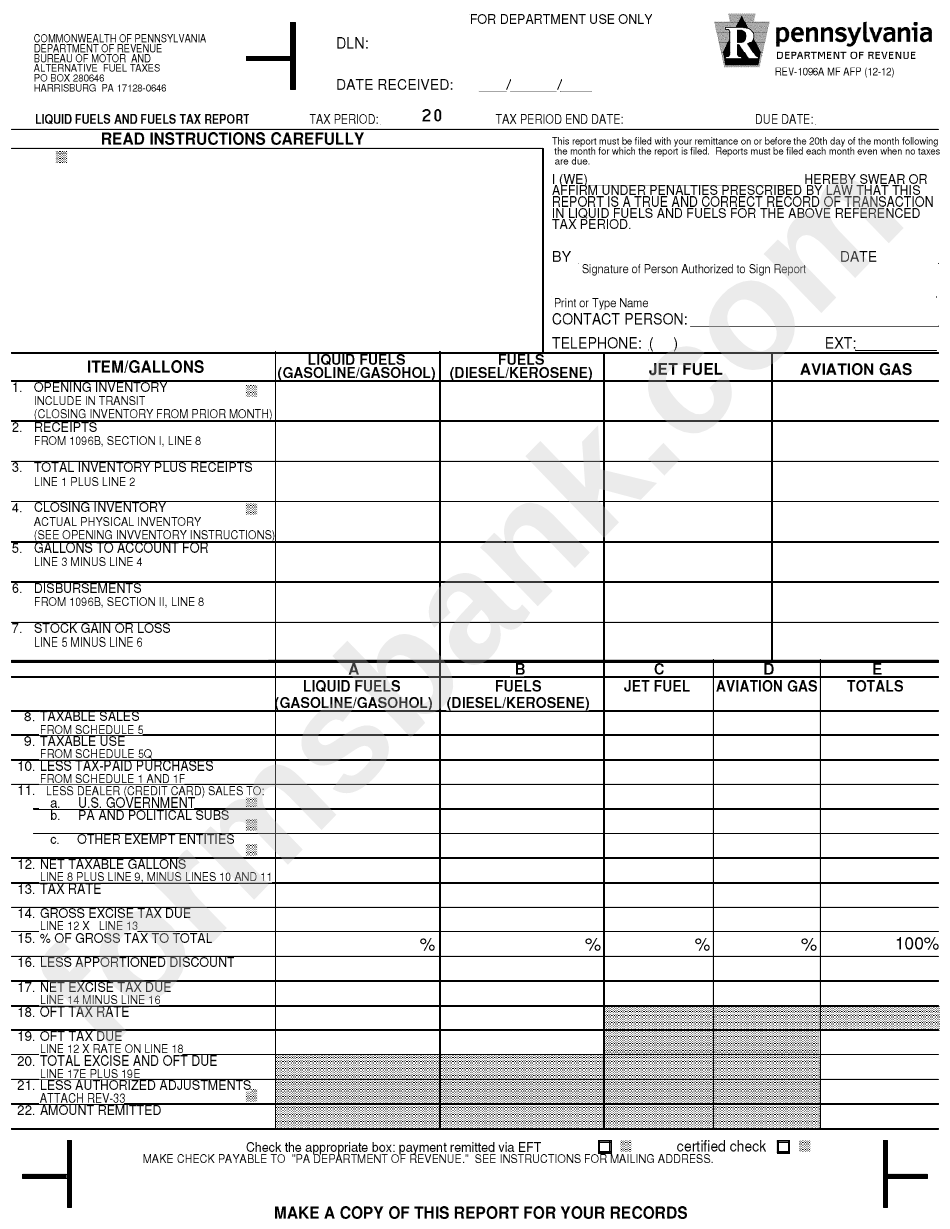

Form Rev 1096a Motor Fuels Tax Report 2014 Printable Pdf Download

Liquid Fuels And Fuels Tax Report Form Printable Pdf Download

Liquid Fuels And Fuels Tax Report Form Printable Pdf Download

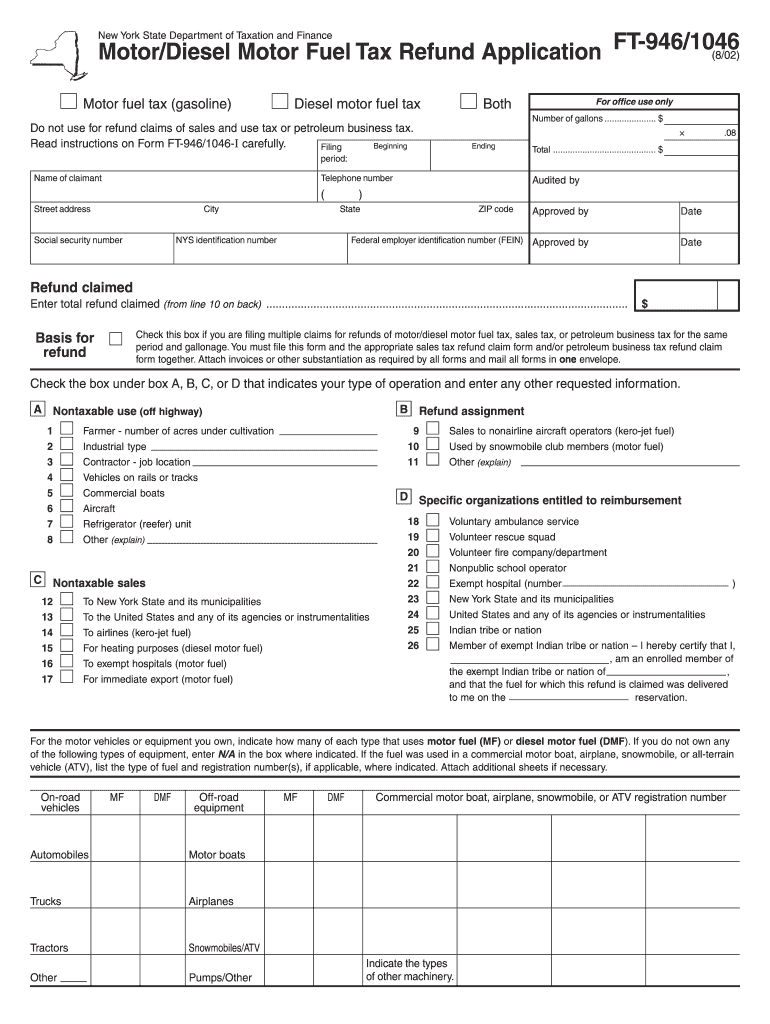

New York Motordiesel Fuel Tax Refund Application Form Fill Out And