In our modern, consumer-driven society, everyone loves a good deal. One way to make substantial savings for your purchases is through Energy Tax Rebates. Energy Tax Rebates are a strategy for marketing employed by retailers and manufacturers to provide customers with a portion of a return on their purchases once they've completed them. In this post, we'll dive into the world Energy Tax Rebates, examining what they are as well as how they work and how you can maximise the value of these incentives.

Get Latest Energy Tax Rebate Below

Energy Tax Rebate

Energy Tax Rebate - Energy Tax Rebate 2023, Energy Tax Rebates, Energy Tax Credit 2023, Energy Tax Credit 2022, Energy Tax Credit, Energy Tax Credits Inflation Reduction Act, Energy Tax Credit 2023 For Windows, Energy Tax Credit Ontario, Energy Tax Credit Form, Energy Tax Credit 2023 Air Conditioner

Web Department of Energy Energy gov Tax Credits Rebates amp Savings Please visit the Database of State Incentives for Renewables amp Efficiency website DSIRE for the latest

Web 11 mars 2019 nbsp 0183 32 Depuis le 1 er janvier 2014 une TVA de 20 s applique sur le montant des consommations du client et sur les autres taxes CSPE TCFE Les taxes sur la

A Energy Tax Rebate the simplest type, is a reimbursement to a buyer after purchasing a certain product or service. It's a powerful method that businesses use to draw buyers, increase sales and to promote certain products.

Types of Energy Tax Rebate

Council Tax Rebate Epping Forest District Council

Council Tax Rebate Epping Forest District Council

Web 1 janv 2023 nbsp 0183 32 Clean Vehicle Credits If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can

Web 3 f 233 vr 2022 nbsp 0183 32 The rebate on energy bills will provide around 28 million households with an upfront discount on their bills worth 163 200 and suppliers will apply the discount to

Cash Energy Tax Rebate

Cash Energy Tax Rebate are the most straightforward type of Energy Tax Rebate. Clients receive a predetermined amount back in cash after purchasing a product. These are often used for more expensive items such electronics or appliances.

Mail-In Energy Tax Rebate

Mail-in Energy Tax Rebate are based on the requirement that customers present proof of purchase to receive their refund. They're a little more complicated but could provide huge savings.

Instant Energy Tax Rebate

Instant Energy Tax Rebate are applied at place of purchase, reducing prices immediately. Customers don't need to wait for savings by using this method.

How Energy Tax Rebate Work

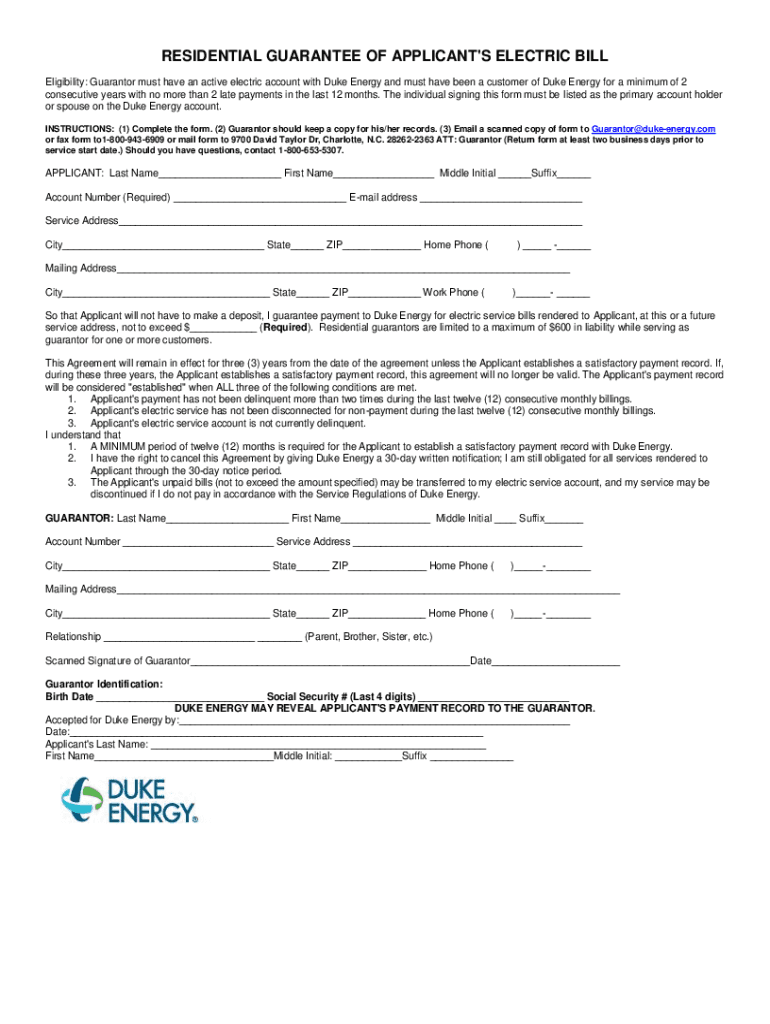

Duke Energy Bill Template Form The Form In Seconds Fill Out And Sign

Duke Energy Bill Template Form The Form In Seconds Fill Out And Sign

Web 4 mars 2023 nbsp 0183 32 EV tax credits and rebates across America Federal Plug in Electric Drive Vehicle Credit 7 500 tax credit on qualifying purchases Used Clean Vehicle Credit

The Energy Tax Rebate Process

The process usually involves a few easy steps:

-

Then, you purchase the product you buy the product as you normally would.

-

Fill out the Energy Tax Rebate questionnaire: you'll need to provide some information, such as your name, address, along with the purchase details, to get your Energy Tax Rebate.

-

You must submit the Energy Tax Rebate It is dependent on the kind of Energy Tax Rebate you could be required to submit a claim form to the bank or make it available online.

-

Wait for approval: The business will go through your application to ensure it meets the refund's conditions and terms.

-

Pay your Energy Tax Rebate If it is approved, you'll receive your cash back either through check, prepaid card or through a different option that's specified in the offer.

Pros and Cons of Energy Tax Rebate

Advantages

-

Cost Savings Rewards can drastically cut the price you pay for an item.

-

Promotional Offers: They encourage customers to try new products and brands.

-

Accelerate Sales Energy Tax Rebate can enhance sales for a company and also increase market share.

Disadvantages

-

Complexity Reward mail-ins particularly are often time-consuming and long-winded.

-

Days of expiration Most Energy Tax Rebate come with extremely strict deadlines to submit.

-

Risk of not receiving payment: Some customers may not receive their Energy Tax Rebate if they don't follow the regulations precisely.

Download Energy Tax Rebate

FAQs

1. Are Energy Tax Rebate the same as discounts? No, the Energy Tax Rebate will be an amount of money that is refunded after the purchase, whereas discounts decrease the purchase price at time of sale.

2. Can I use multiple Energy Tax Rebate on the same item This depends on the terms of Energy Tax Rebate deals and product's admissibility. Certain businesses may allow it, while others won't.

3. How long will it take to receive an Energy Tax Rebate? The amount of time varies, but it can take anywhere from a few weeks to a couple of months before you get your Energy Tax Rebate.

4. Do I have to pay tax on Energy Tax Rebate values? most situations, Energy Tax Rebate amounts are not considered to be taxable income.

5. Can I trust Energy Tax Rebate offers from lesser-known brands It's crucial to research and make sure that the company that is offering the Energy Tax Rebate is credible prior to making a purchase.

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie

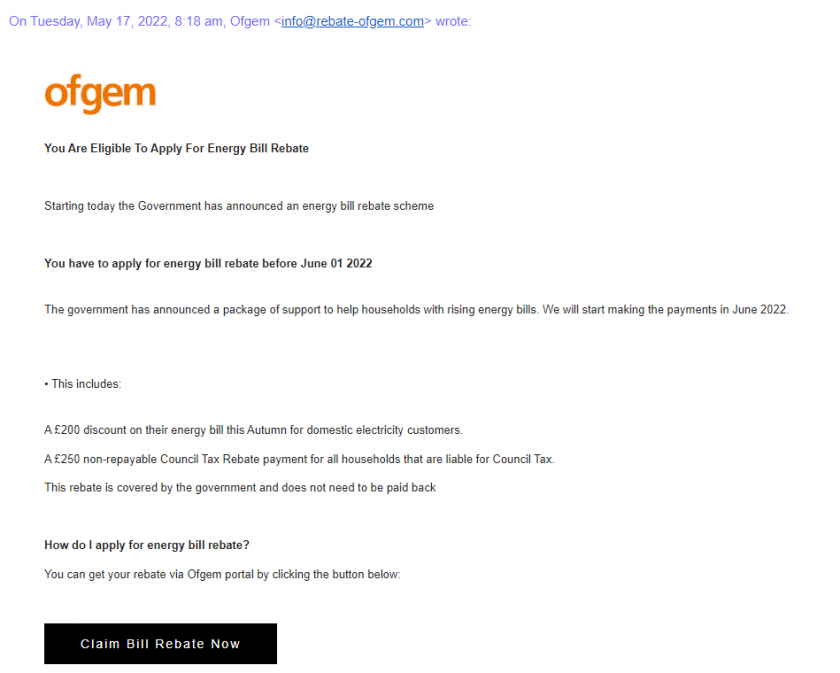

Scam Ofgem Email Is Luring Victims With Fake Energy Refunds Warns Which

Check more sample of Energy Tax Rebate below

Energy Efficient Rebates Tax Incentives For MA Homeowners

First Payments Of 150 Energy Rebate Made To Worcester Council Tax

Speed Up Your 150 Energy Bill Rebate By Setting Up Direct Debit

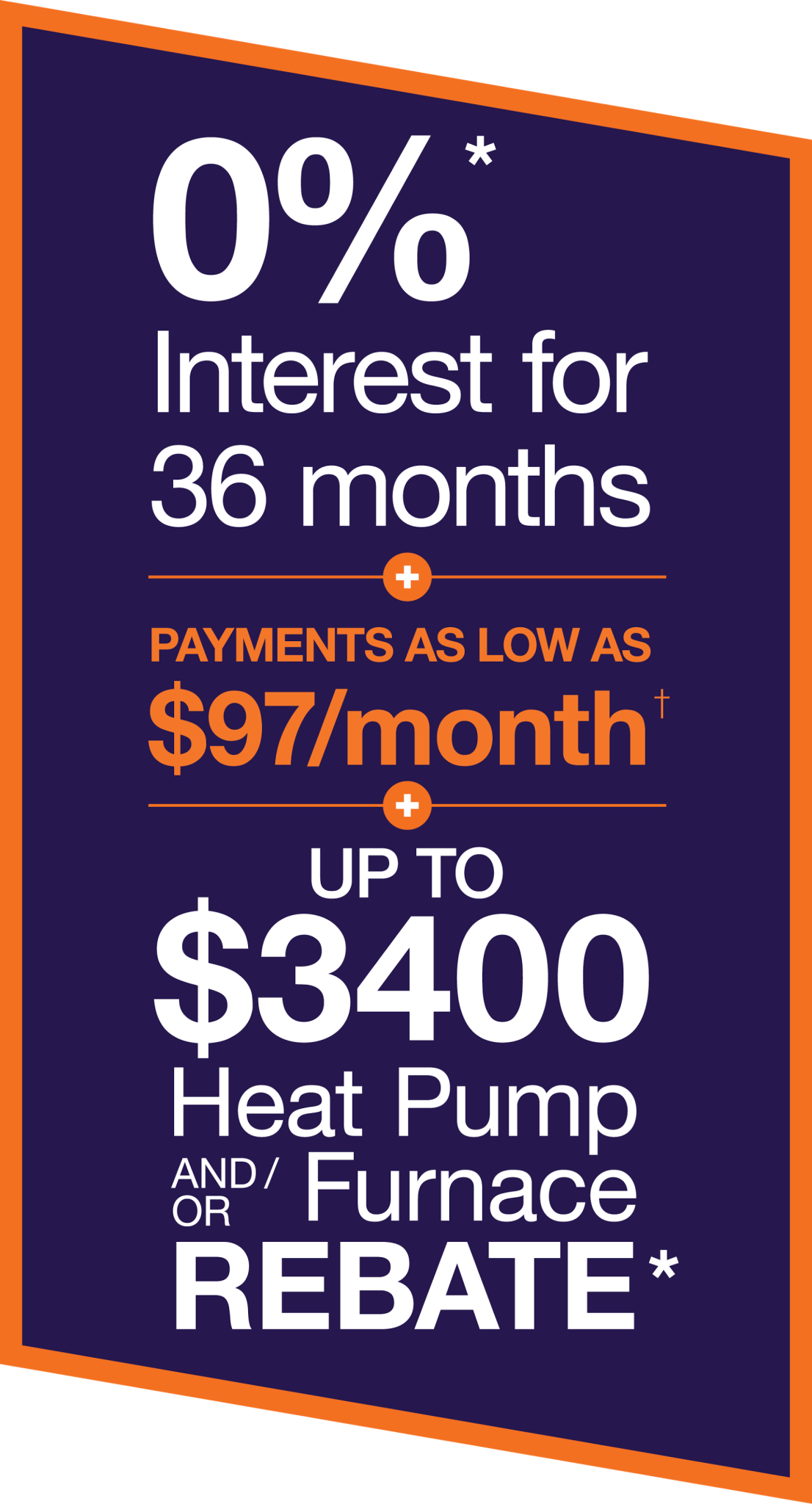

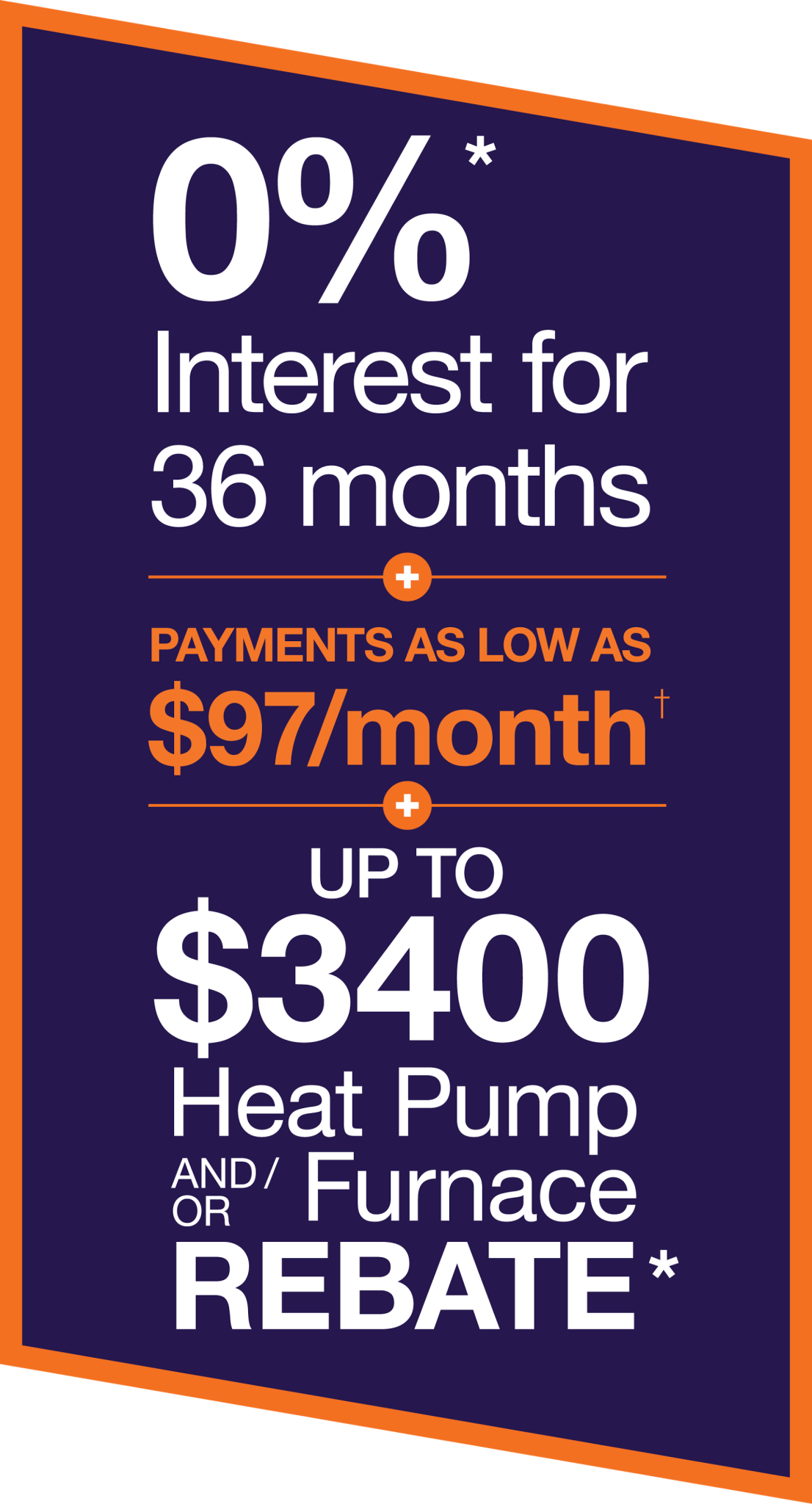

3400 Rebate Offer Coastal Energy

PM Trudeau Ministers To Announce Carbon Tax Rebate Plan CTV News

2023 Residential Clean Energy Credit Guide ReVision Energy

https://particuliers.engie.fr/conseils/guides-pratiques/comprendre/...

Web 11 mars 2019 nbsp 0183 32 Depuis le 1 er janvier 2014 une TVA de 20 s applique sur le montant des consommations du client et sur les autres taxes CSPE TCFE Les taxes sur la

https://www.energystar.gov/about/federal_tax…

Web 30 d 233 c 2022 nbsp 0183 32 Information updated 12 30 2022 The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower Americans to make homes and buildings more energy efficient to help

Web 11 mars 2019 nbsp 0183 32 Depuis le 1 er janvier 2014 une TVA de 20 s applique sur le montant des consommations du client et sur les autres taxes CSPE TCFE Les taxes sur la

Web 30 d 233 c 2022 nbsp 0183 32 Information updated 12 30 2022 The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower Americans to make homes and buildings more energy efficient to help

3400 Rebate Offer Coastal Energy

First Payments Of 150 Energy Rebate Made To Worcester Council Tax

PM Trudeau Ministers To Announce Carbon Tax Rebate Plan CTV News

2023 Residential Clean Energy Credit Guide ReVision Energy

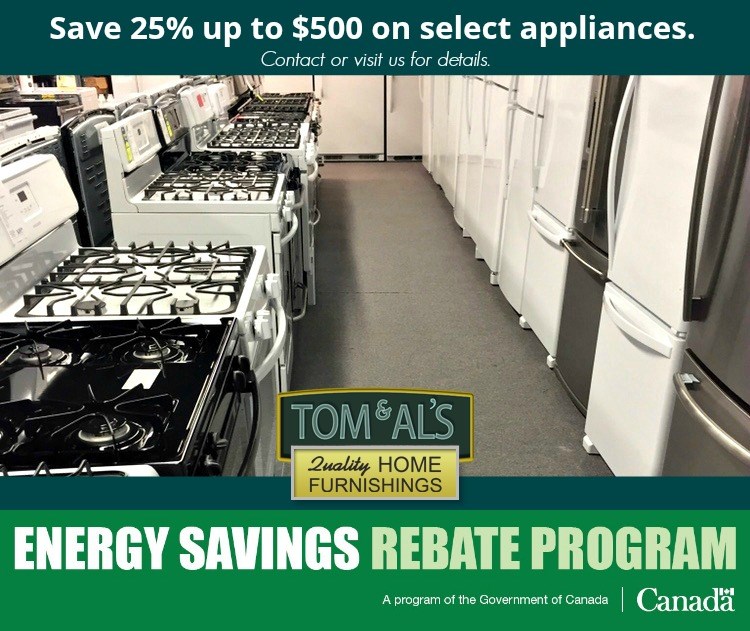

Energy Savings Rebate Program

Be Green Save Find Energy Tax Credits Rebates The Savvy Age

Be Green Save Find Energy Tax Credits Rebates The Savvy Age

HVAC Rebates And Special Offers HB McClure Company