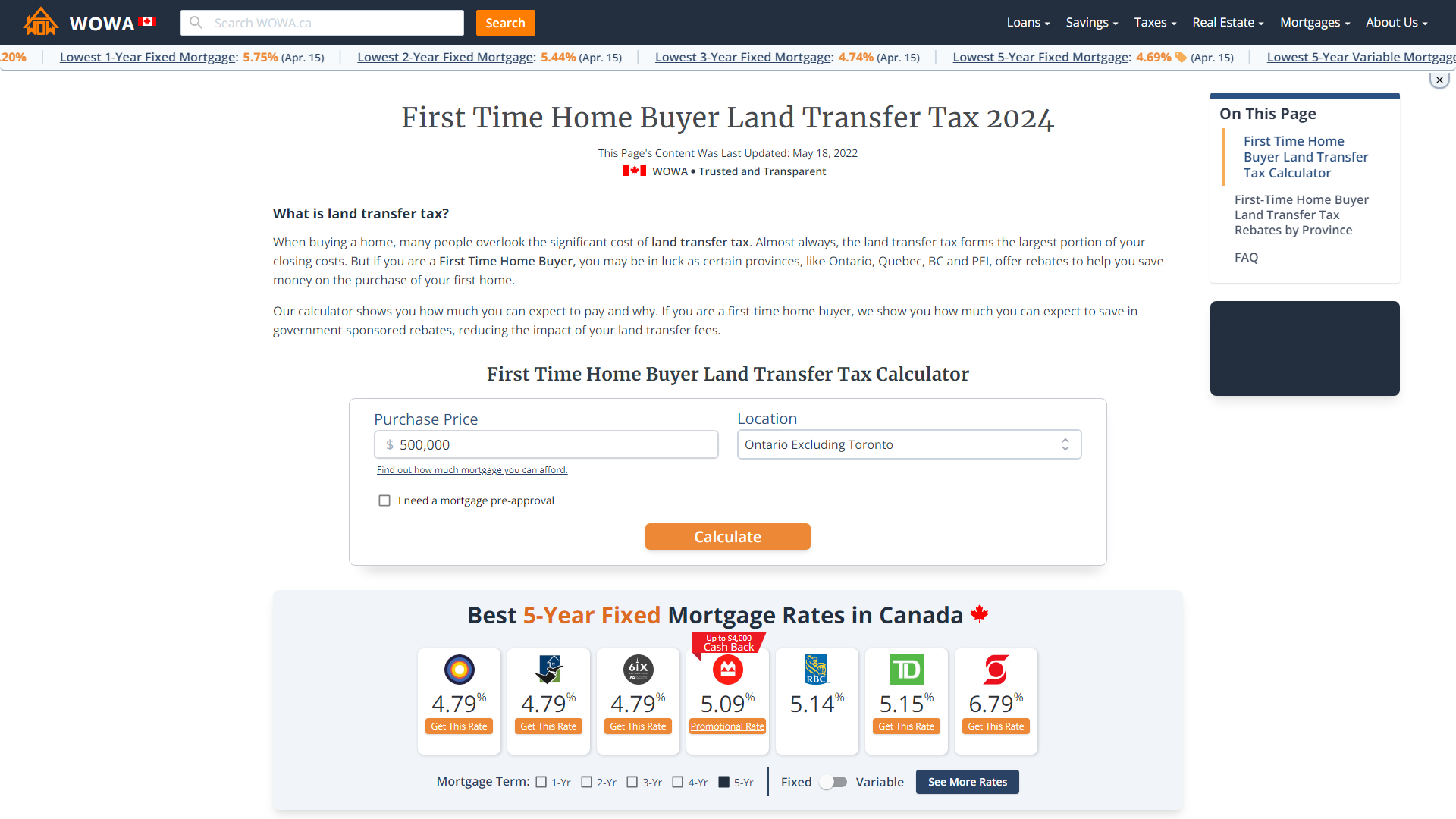

Today, in a world that is driven by the consumer everybody loves a good deal. One method to get significant savings on your purchases is by using First Time Home Buyer Land Transfer Tax Rebate Forms. The use of First Time Home Buyer Land Transfer Tax Rebate Forms is a method that retailers and manufacturers use to provide customers with a partial refund on purchases made after they've placed them. In this article, we will delve into the world of First Time Home Buyer Land Transfer Tax Rebate Forms. We'll look at what they are their purpose, how they function and how to maximize the savings you can make by using these cost-effective incentives.

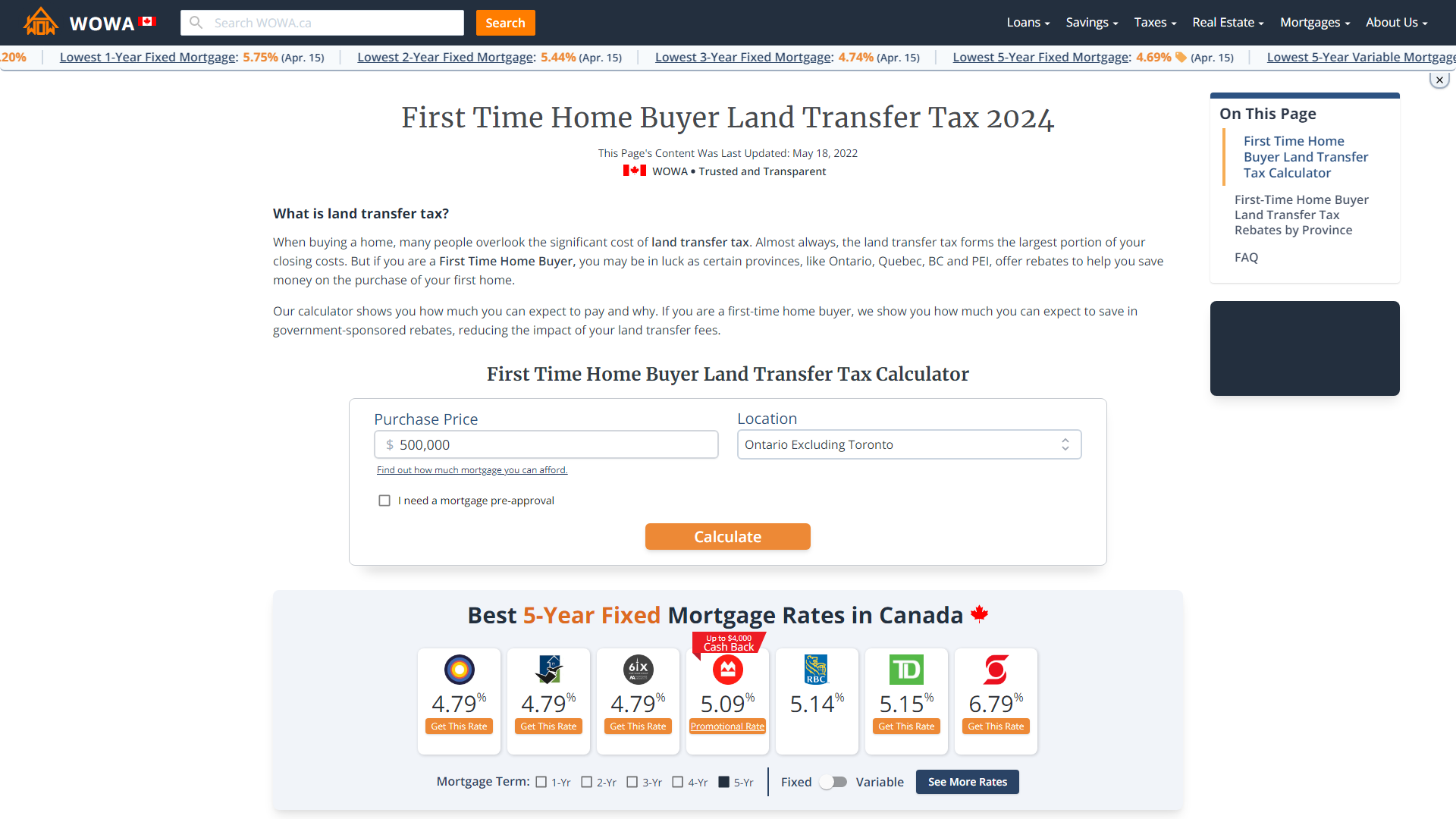

Get Latest First Time Home Buyer Land Transfer Tax Rebate Form Below

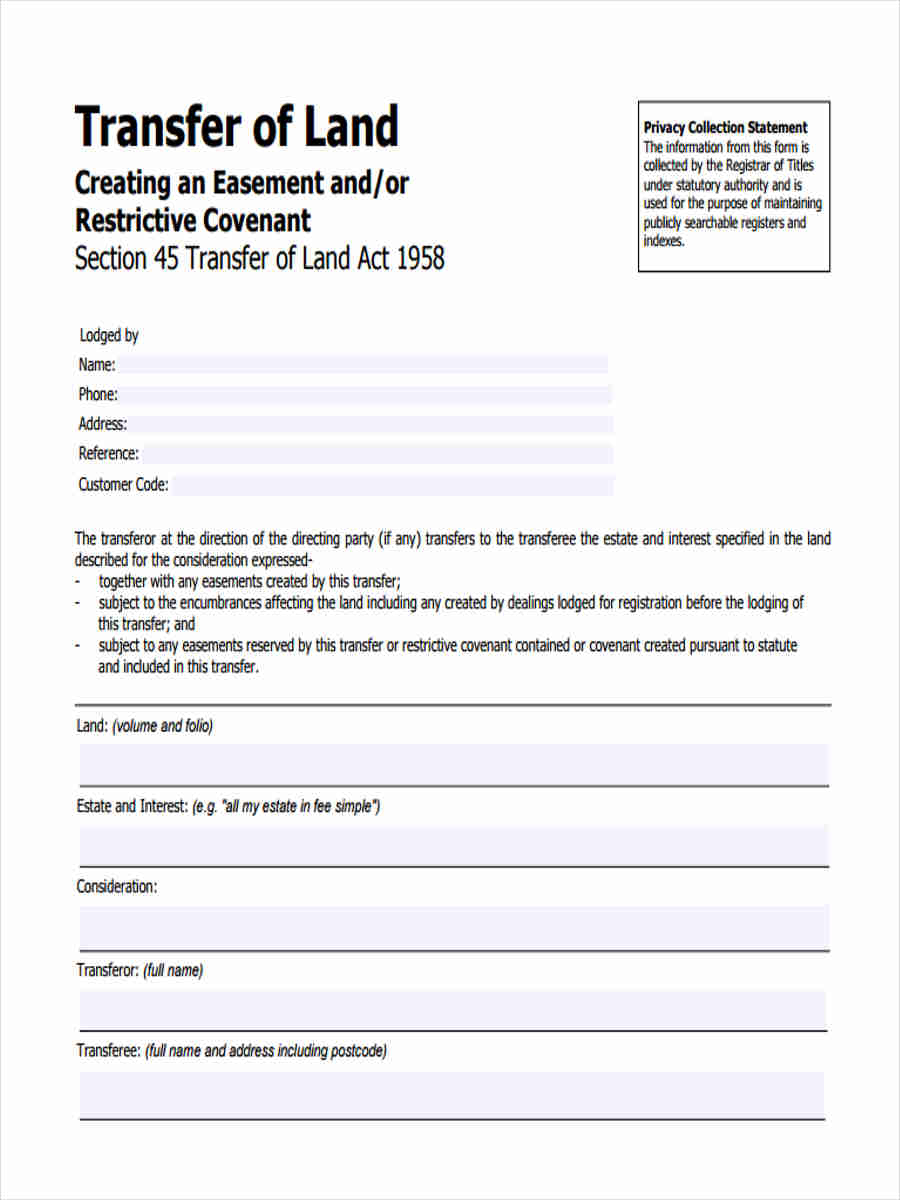

First Time Home Buyer Land Transfer Tax Rebate Form

First Time Home Buyer Land Transfer Tax Rebate Form -

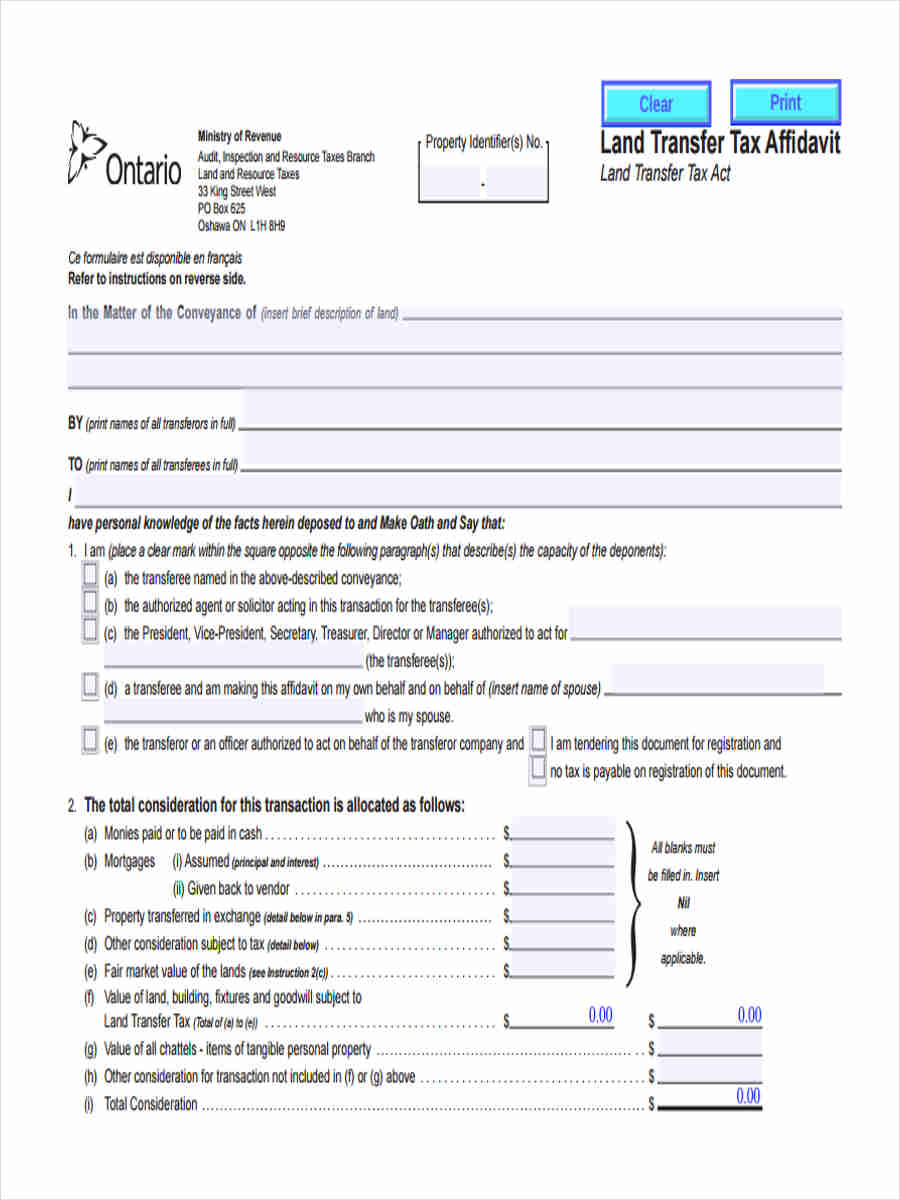

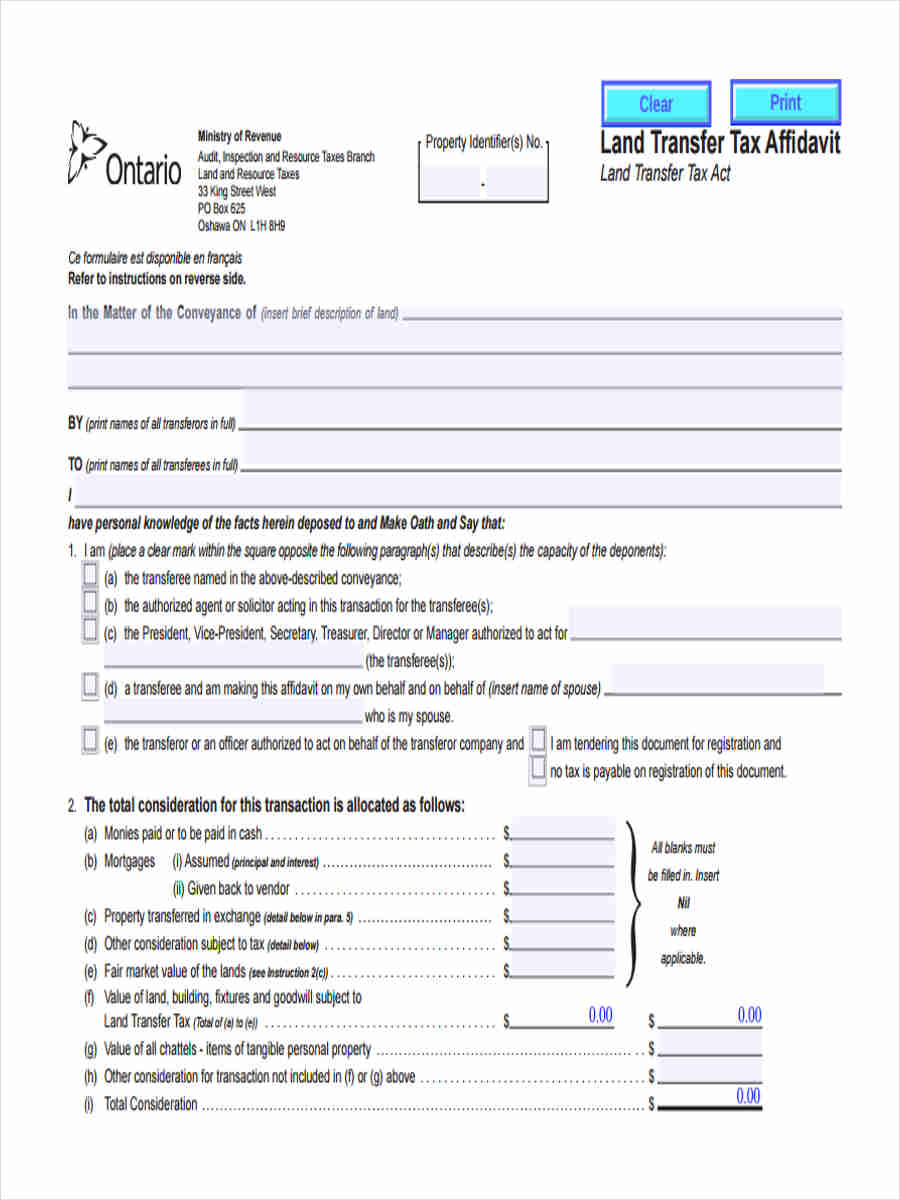

Web Title Ontario Land Transfer Tax Refund Affidavit For First Time Purchasers of Qualifying Home Land Transfer Tax Act Author Ministry of Finance

Web Form Number 013 0300 Title Ontario Land Transfer Tax Refund Affidavit for First Time Purchasers of Eligible Homes Description Allows taxpayers to manually claim the

A First Time Home Buyer Land Transfer Tax Rebate Form as it is understood in its simplest definition, is a refund offered to a customer following the purchase of a product or service. It's a powerful method used by companies to attract customers, increase sales and even promote certain products.

Types of First Time Home Buyer Land Transfer Tax Rebate Form

Stamp Duty Cut Off For First Time Buyers Jason Dunn Trending

Stamp Duty Cut Off For First Time Buyers Jason Dunn Trending

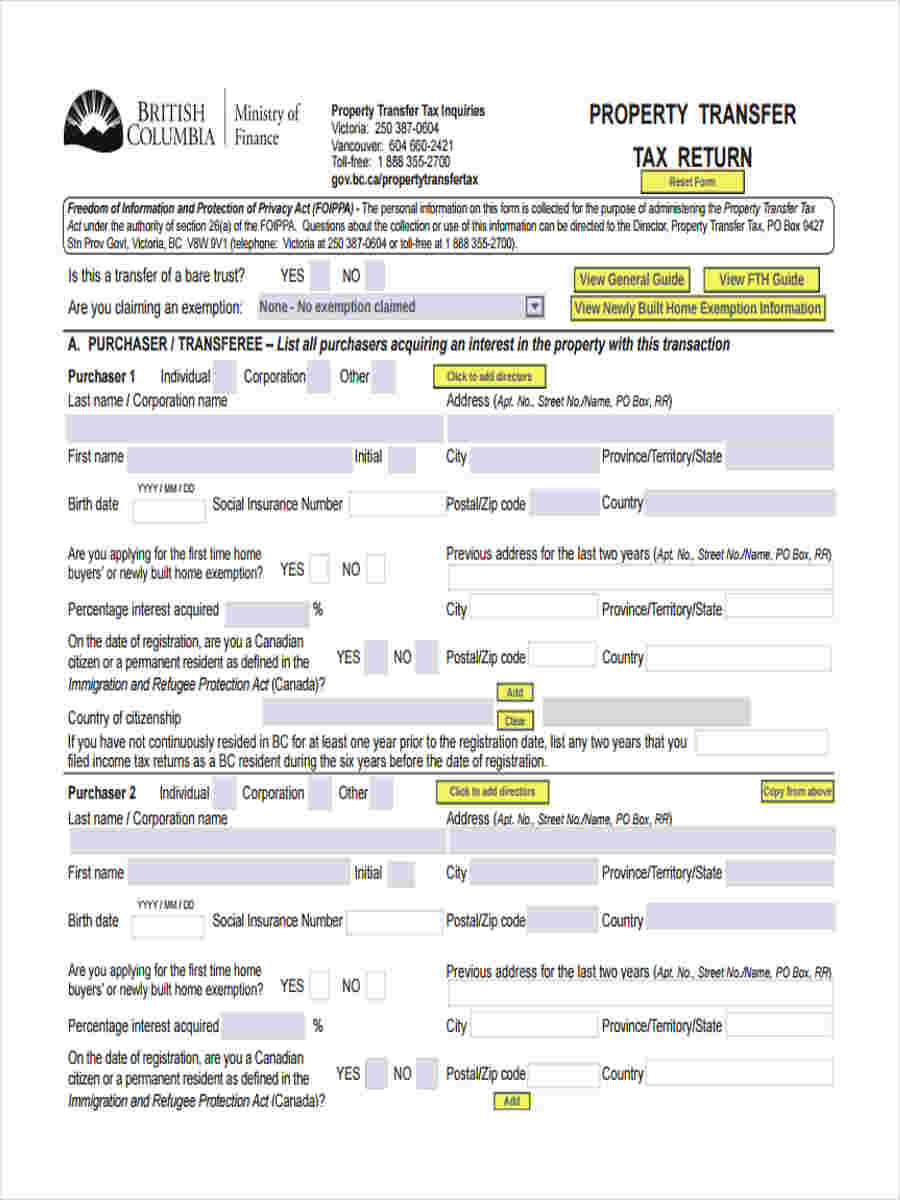

Web 19 mai 2022 nbsp 0183 32 If you are a first time home buyer British Columbia offers a land transfer tax refund of up to 8 000 for properties worth below 525 000 The refund covers the

Web Ontario Land Transfer Tax refund for first time home buyers now includes resale homes Teraview Home Newsletters Ontario Land Transfer Tax refund for first time home

Cash First Time Home Buyer Land Transfer Tax Rebate Form

Cash First Time Home Buyer Land Transfer Tax Rebate Form are the most straightforward type of First Time Home Buyer Land Transfer Tax Rebate Form. Customers receive a specified amount of money in return for purchasing a product. They are typically used to purchase more expensive items such electronics or appliances.

Mail-In First Time Home Buyer Land Transfer Tax Rebate Form

Mail-in First Time Home Buyer Land Transfer Tax Rebate Form demand that customers present the proof of purchase in order to receive the refund. They are a bit more involved, but can result in huge savings.

Instant First Time Home Buyer Land Transfer Tax Rebate Form

Instant First Time Home Buyer Land Transfer Tax Rebate Form are applied at the point of sale. They reduce your purchase cost instantly. Customers don't have to wait for their savings when they purchase this type of First Time Home Buyer Land Transfer Tax Rebate Form.

How First Time Home Buyer Land Transfer Tax Rebate Form Work

SDLT1 FORM DOWNLOAD

SDLT1 FORM DOWNLOAD

Web 19 mai 2020 nbsp 0183 32 The minimum down payment required is 5 for homes less than 500 000 10 for the amount above 500 000 and below 1 000 000 And you are a permanent resident of Canada How much can I qualify

The First Time Home Buyer Land Transfer Tax Rebate Form Process

The process typically involves few easy steps:

-

When you buy the product make sure you purchase the product like you normally do.

-

Fill in your First Time Home Buyer Land Transfer Tax Rebate Form forms: The First Time Home Buyer Land Transfer Tax Rebate Form form will have to provide some data, such as your address, name, along with the purchase details, in order to receive your First Time Home Buyer Land Transfer Tax Rebate Form.

-

Submit the First Time Home Buyer Land Transfer Tax Rebate Form: Depending on the kind of First Time Home Buyer Land Transfer Tax Rebate Form you may have to fill out a paper form or submit it online.

-

Wait for the company's approval: They will review your request for compliance with First Time Home Buyer Land Transfer Tax Rebate Form's terms and conditions.

-

Redeem your First Time Home Buyer Land Transfer Tax Rebate Form Once you've received your approval, you'll get your refund, either through check, prepaid card, or by another method as specified by the offer.

Pros and Cons of First Time Home Buyer Land Transfer Tax Rebate Form

Advantages

-

Cost Savings First Time Home Buyer Land Transfer Tax Rebate Form could significantly lower the cost you pay for a product.

-

Promotional Deals they encourage their customers to test new products or brands.

-

Boost Sales First Time Home Buyer Land Transfer Tax Rebate Form can help boost the company's sales as well as market share.

Disadvantages

-

Complexity Pay-in First Time Home Buyer Land Transfer Tax Rebate Form via mail, in particular the case of HTML0, can be a hassle and slow-going.

-

Deadlines for Expiration A majority of First Time Home Buyer Land Transfer Tax Rebate Form have certain deadlines for submitting.

-

Risque of Non-Payment Some customers might not receive their First Time Home Buyer Land Transfer Tax Rebate Form if they don't follow the regulations precisely.

Download First Time Home Buyer Land Transfer Tax Rebate Form

Download First Time Home Buyer Land Transfer Tax Rebate Form

FAQs

1. Are First Time Home Buyer Land Transfer Tax Rebate Form similar to discounts? No, First Time Home Buyer Land Transfer Tax Rebate Form involve one-third of the amount refunded following purchase, while discounts reduce the price of the purchase at the moment of sale.

2. Are there multiple First Time Home Buyer Land Transfer Tax Rebate Form I can get on the same item? It depends on the conditions on the First Time Home Buyer Land Transfer Tax Rebate Form is offered as well as the merchandise's admissibility. Certain companies allow it, while some won't.

3. How long will it take to get the First Time Home Buyer Land Transfer Tax Rebate Form What is the timeframe? varies, but it can take several weeks to a couple of months to receive your First Time Home Buyer Land Transfer Tax Rebate Form.

4. Do I have to pay taxes of First Time Home Buyer Land Transfer Tax Rebate Form sums? most circumstances, First Time Home Buyer Land Transfer Tax Rebate Form amounts are not considered taxable income.

5. Do I have confidence in First Time Home Buyer Land Transfer Tax Rebate Form offers from brands that aren't well-known It's crucial to research and confirm that the brand providing the First Time Home Buyer Land Transfer Tax Rebate Form is credible prior to making the purchase.

Land Transfer Tax Rebate Rental Property PropertyRebate

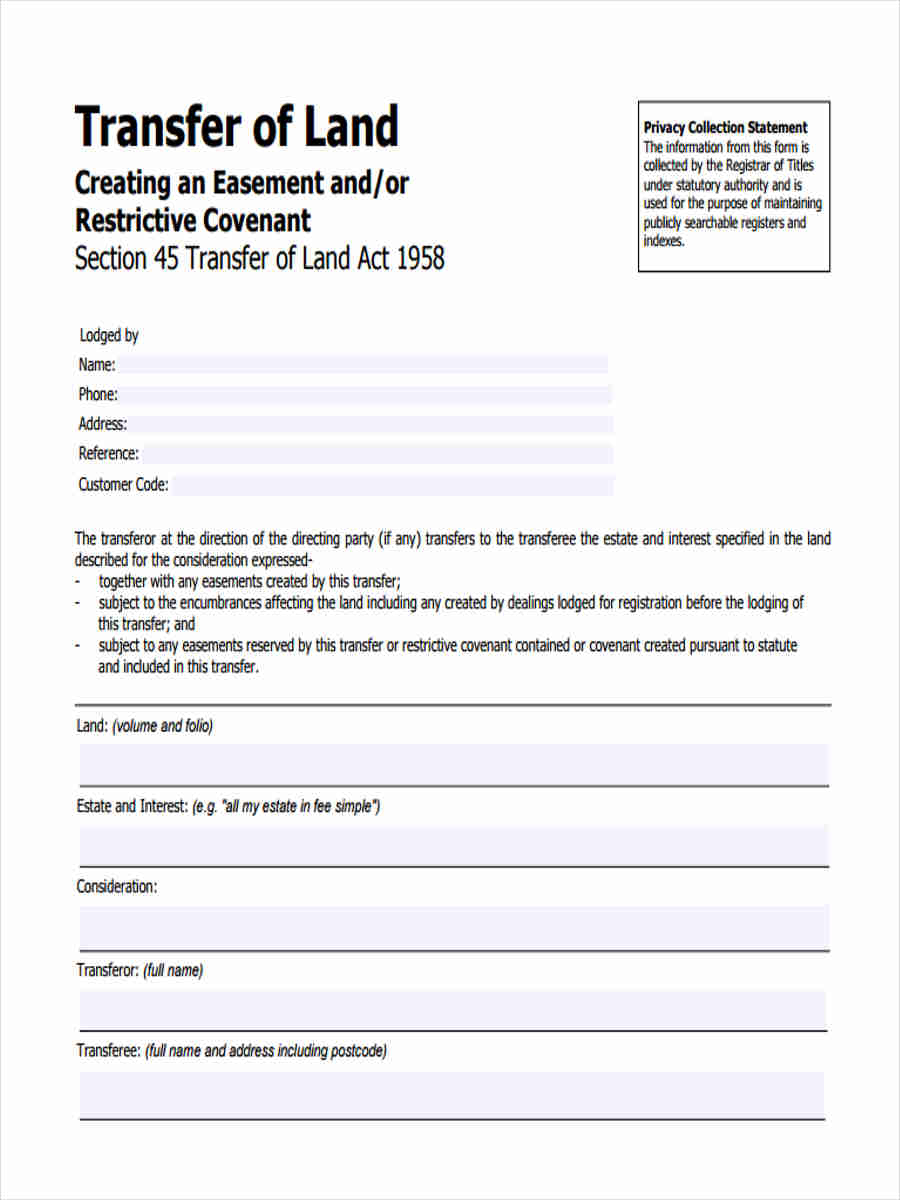

FREE 6 Land Transfer Form Samples In PDF MS Word

Check more sample of First Time Home Buyer Land Transfer Tax Rebate Form below

Property Tax Rebate Application Printable Pdf Download

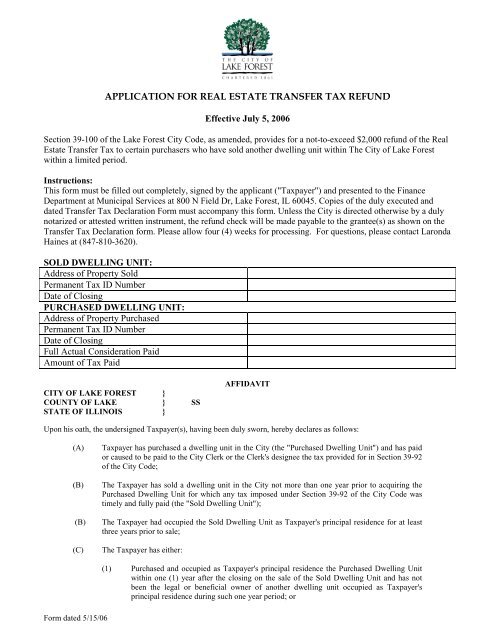

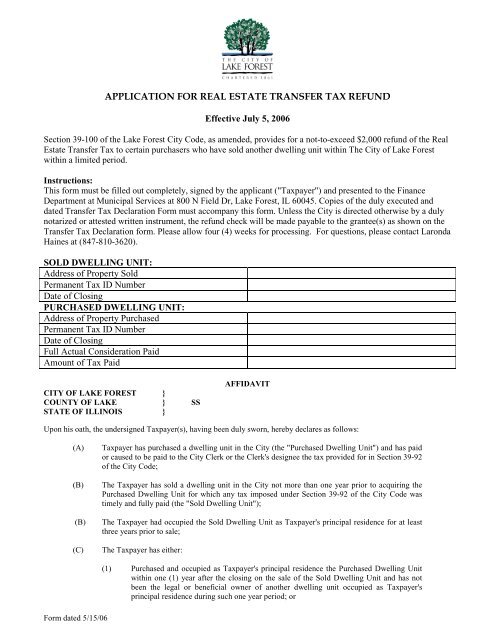

Real Estate Transfer Tax Rebate Form City Of Lake Forest

Land Transfer Form Fill Online Printable Fillable Blank PdfFiller

FREE 6 Land Transfer Form Samples In PDF MS Word

Land Transfer Tax Rebates Amit Patel Real Estate HomeLife Miracle

FREE 6 Land Transfer Form Samples In PDF MS Word

https://forms.mgcs.gov.on.ca/en/dataset/013-0300

Web Form Number 013 0300 Title Ontario Land Transfer Tax Refund Affidavit for First Time Purchasers of Eligible Homes Description Allows taxpayers to manually claim the

https://www.canadalife.com/.../land-transfer-tax-rebates.html

Web December 2021 15 min read What is a land transfer tax LTT rebate How do you qualify for a land transfer tax rebate Claiming a land tax rebate Other programs and

Web Form Number 013 0300 Title Ontario Land Transfer Tax Refund Affidavit for First Time Purchasers of Eligible Homes Description Allows taxpayers to manually claim the

Web December 2021 15 min read What is a land transfer tax LTT rebate How do you qualify for a land transfer tax rebate Claiming a land tax rebate Other programs and

FREE 6 Land Transfer Form Samples In PDF MS Word

Real Estate Transfer Tax Rebate Form City Of Lake Forest

Land Transfer Tax Rebates Amit Patel Real Estate HomeLife Miracle

FREE 6 Land Transfer Form Samples In PDF MS Word

Foreign Buyers Only Account For 5 Metro Vancouver Real Estate Sales

Supplier Rebate Agreement Template

Supplier Rebate Agreement Template

Property Transfer Tax And The First Time Home Buyers Program