In our modern, consumer-driven society every person loves a great bargain. One way to gain substantial savings on your purchases is to use 2023 Form 1040 Line 30 Recovery Rebate Credits. The use of 2023 Form 1040 Line 30 Recovery Rebate Credits is a method used by manufacturers and retailers in order to offer customers a small payment on their purchases, after they've purchased them. In this post, we'll look into the world of 2023 Form 1040 Line 30 Recovery Rebate Credits, examining the nature of them and how they function, and how you can maximise your savings by taking advantage of these cost-effective incentives.

Get Latest 2023 Form 1040 Line 30 Recovery Rebate Credit Below

2023 Form 1040 Line 30 Recovery Rebate Credit

2023 Form 1040 Line 30 Recovery Rebate Credit -

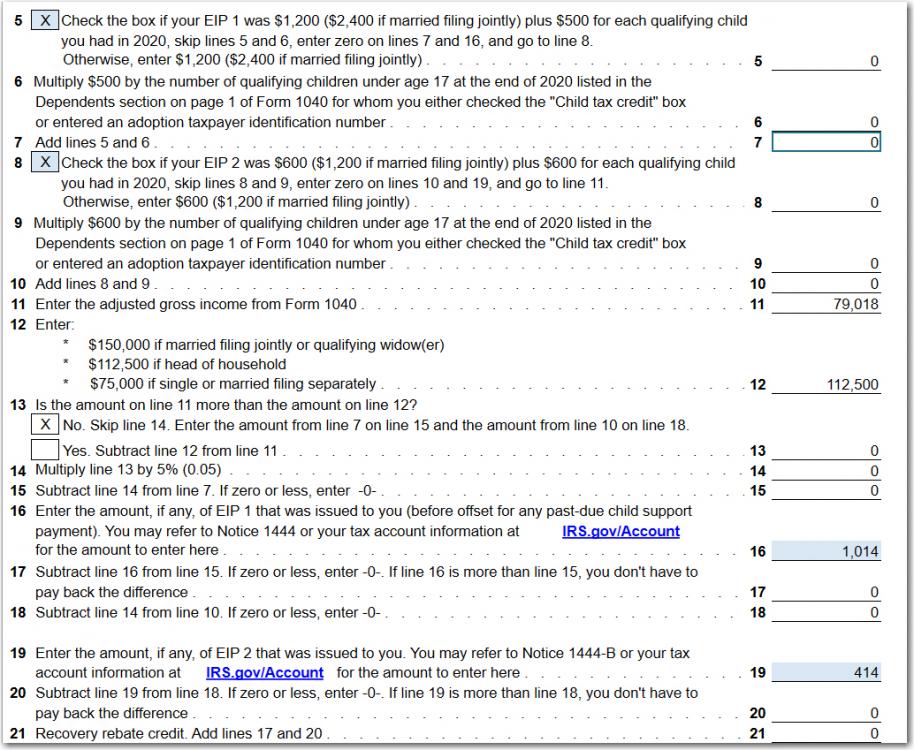

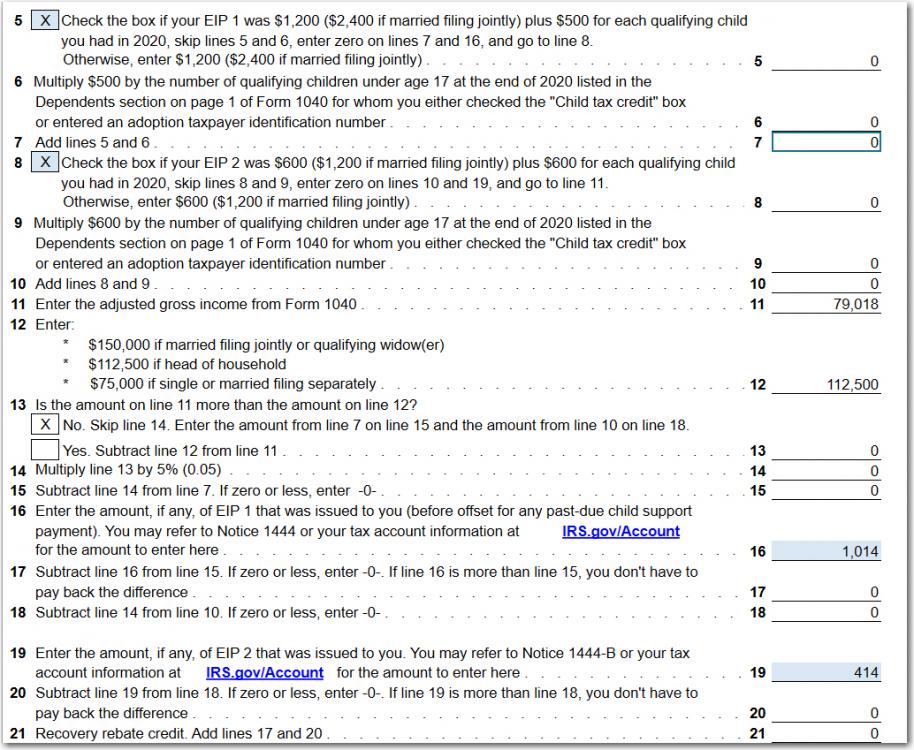

Web 13 Jan 2022 nbsp 0183 32 If you entered an amount greater than 0 on line 30 and made a mistake on the amount the IRS will calculate the correct amount of the Recovery Rebate Credit

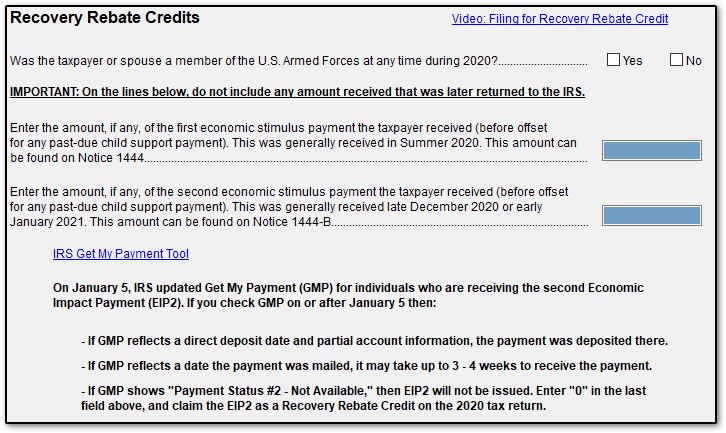

Web 13 Jan 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

A 2023 Form 1040 Line 30 Recovery Rebate Credit as it is understood in its simplest format, is a refund that a client receives when they purchase a product or service. This is a potent tool employed by companies to attract buyers, increase sales as well as promote particular products.

Types of 2023 Form 1040 Line 30 Recovery Rebate Credit

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

Web 12 Okt 2022 nbsp 0183 32 What s the Recovery Rebate Credit Kiplinger If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on your 2021

Web 13 Jan 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Cash 2023 Form 1040 Line 30 Recovery Rebate Credit

Cash 2023 Form 1040 Line 30 Recovery Rebate Credit are by far the easiest type of 2023 Form 1040 Line 30 Recovery Rebate Credit. Customers are given a certain amount of money after purchasing a product. This is often for big-ticket items, like electronics and appliances.

Mail-In 2023 Form 1040 Line 30 Recovery Rebate Credit

Mail-in 2023 Form 1040 Line 30 Recovery Rebate Credit demand that customers submit documents of purchase to claim their money back. They are a bit more complicated, but they can provide huge savings.

Instant 2023 Form 1040 Line 30 Recovery Rebate Credit

Instant 2023 Form 1040 Line 30 Recovery Rebate Credit are credited at the points of sale. This reduces the purchase price immediately. Customers don't need to wait for savings with this type.

How 2023 Form 1040 Line 30 Recovery Rebate Credit Work

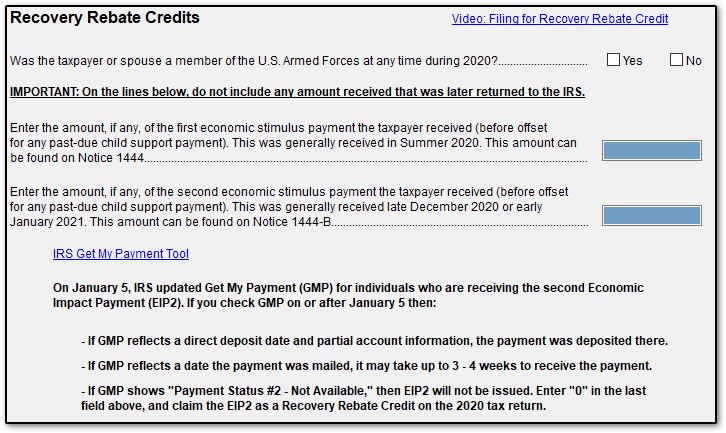

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Web To claim the Recovery Rebate Credit on your 2023 tax return complete the Recovery Rebate Credit Worksheet and enter the amount from Line 5 of the worksheet on Line 30 of Form 1040 or 1040 SR Will the

The 2023 Form 1040 Line 30 Recovery Rebate Credit Process

The process generally involves a few simple steps:

-

When you buy the product make sure you purchase the product like you normally do.

-

Complete this 2023 Form 1040 Line 30 Recovery Rebate Credit application: In order to claim your 2023 Form 1040 Line 30 Recovery Rebate Credit, you'll have to give some specific information including your name, address along with the purchase details, in order to take advantage of your 2023 Form 1040 Line 30 Recovery Rebate Credit.

-

Send in the 2023 Form 1040 Line 30 Recovery Rebate Credit: Depending on the kind of 2023 Form 1040 Line 30 Recovery Rebate Credit you may have to fill out a form and mail it in or make it available online.

-

Wait for approval: The business will evaluate your claim and ensure that it's compliant with 2023 Form 1040 Line 30 Recovery Rebate Credit's terms and conditions.

-

Take advantage of your 2023 Form 1040 Line 30 Recovery Rebate Credit After you've been approved, you'll receive your money back, either by check, prepaid card or through a different procedure specified by the deal.

Pros and Cons of 2023 Form 1040 Line 30 Recovery Rebate Credit

Advantages

-

Cost Savings The use of 2023 Form 1040 Line 30 Recovery Rebate Credit can greatly reduce the price you pay for the product.

-

Promotional Deals Customers are enticed to explore new products or brands.

-

Enhance Sales 2023 Form 1040 Line 30 Recovery Rebate Credit are a great way to boost sales for a company and also increase market share.

Disadvantages

-

Complexity mail-in 2023 Form 1040 Line 30 Recovery Rebate Credit particularly may be lengthy and long-winded.

-

The Expiration Dates: Many 2023 Form 1040 Line 30 Recovery Rebate Credit have the strictest deadlines for submission.

-

The risk of non-payment: Some customers may not get their 2023 Form 1040 Line 30 Recovery Rebate Credit if they don't comply with the rules exactly.

Download 2023 Form 1040 Line 30 Recovery Rebate Credit

Download 2023 Form 1040 Line 30 Recovery Rebate Credit

FAQs

1. Are 2023 Form 1040 Line 30 Recovery Rebate Credit the same as discounts? No, 2023 Form 1040 Line 30 Recovery Rebate Credit involve an amount of money that is refunded after the purchase, while discounts reduce costs at moment of sale.

2. Can I make use of multiple 2023 Form 1040 Line 30 Recovery Rebate Credit on the same item What is the best way to do it? It's contingent on terms on the 2023 Form 1040 Line 30 Recovery Rebate Credit deals and product's suitability. Some companies will allow it, while other companies won't.

3. How long does it take to get the 2023 Form 1040 Line 30 Recovery Rebate Credit What is the timeframe? will vary, but it may take a couple of weeks or a several months to receive a 2023 Form 1040 Line 30 Recovery Rebate Credit.

4. Do I have to pay tax upon 2023 Form 1040 Line 30 Recovery Rebate Credit quantities? most situations, 2023 Form 1040 Line 30 Recovery Rebate Credit amounts are not considered to be taxable income.

5. Do I have confidence in 2023 Form 1040 Line 30 Recovery Rebate Credit deals from lesser-known brands It is essential to investigate and verify that the brand that is offering the 2023 Form 1040 Line 30 Recovery Rebate Credit is legitimate prior to making an acquisition.

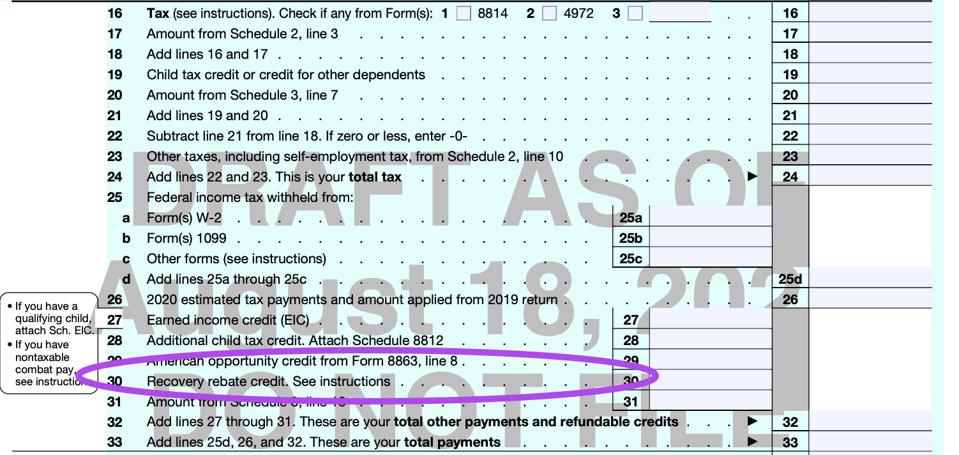

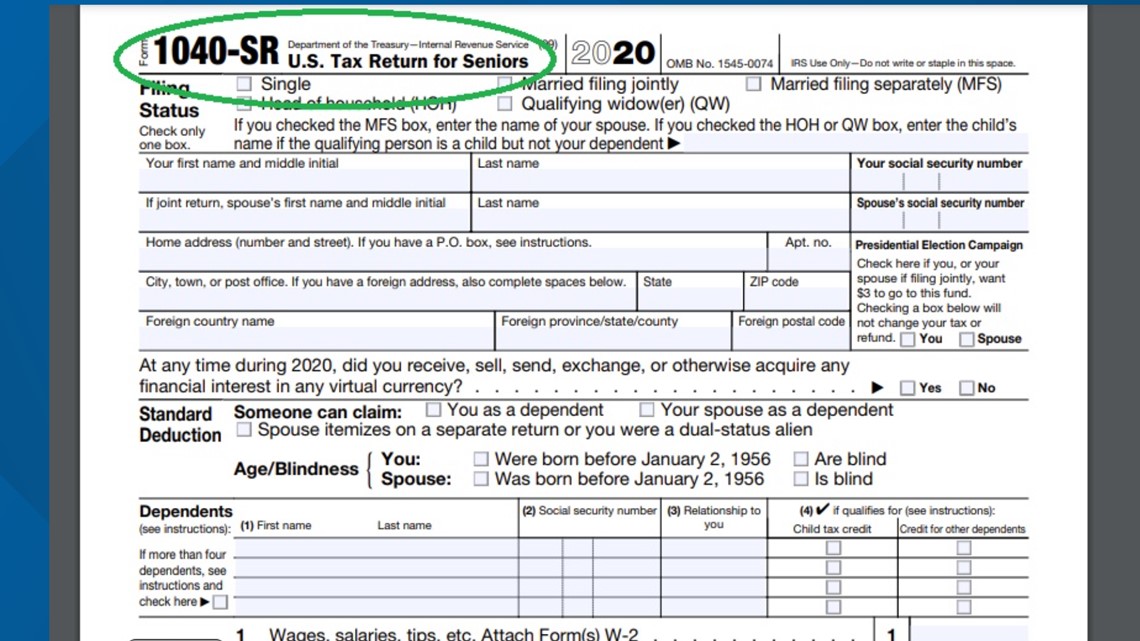

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

Recovery Rebate Credit Irs Form Recovery Rebate

Check more sample of 2023 Form 1040 Line 30 Recovery Rebate Credit below

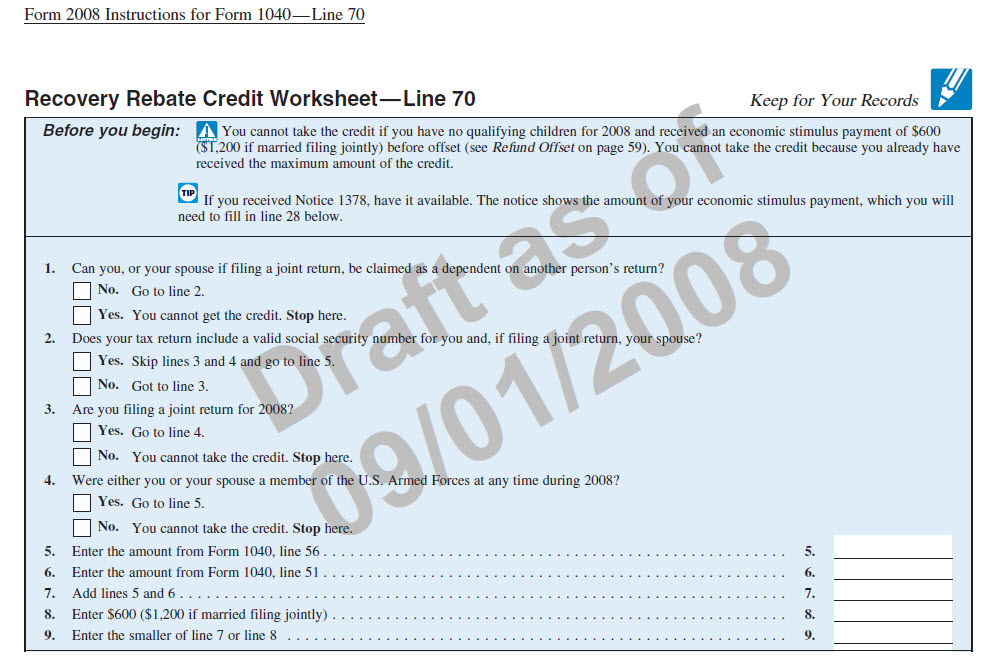

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

How To Claim The Stimulus Money On Your Tax Return Wltx

1040 Recovery Rebate Credit Drake20

1040 EF Message 0006 Recovery Rebate Credit Drake20

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

What Is The Recovery Rebate Credit CD Tax Financial

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 Jan 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

https://proconnect.intuit.com/support/en-us/help-article/tax-credits...

Web 5 Dez 2022 nbsp 0183 32 The Recovery Rebate Credit amount is figured just like the third economic impact stimulus payment except that it uses your client s tax year 2021 information to

Web 13 Jan 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

Web 5 Dez 2022 nbsp 0183 32 The Recovery Rebate Credit amount is figured just like the third economic impact stimulus payment except that it uses your client s tax year 2021 information to

1040 EF Message 0006 Recovery Rebate Credit Drake20

How To Claim The Stimulus Money On Your Tax Return Wltx

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

What Is The Recovery Rebate Credit CD Tax Financial

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Massachusetts Agi Worksheet Speed Test Site

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Massachusetts Agi Worksheet Speed Test Site

Recovery Rebate Credit Form 1040 Recovery Rebate