In today's consumer-driven world people love a good deal. One method to get substantial savings on your purchases is to use File Recovery Rebate Forms. File Recovery Rebate Forms are a method of marketing that retailers and manufacturers use in order to offer customers a small cash back on their purchases once they have created them. In this post, we'll go deeper into the realm of File Recovery Rebate Forms. We'll explore what they are and how they operate, and ways you can increase the savings you can make by using these cost-effective incentives.

Get Latest File Recovery Rebate Form Below

File Recovery Rebate Form

File Recovery Rebate Form -

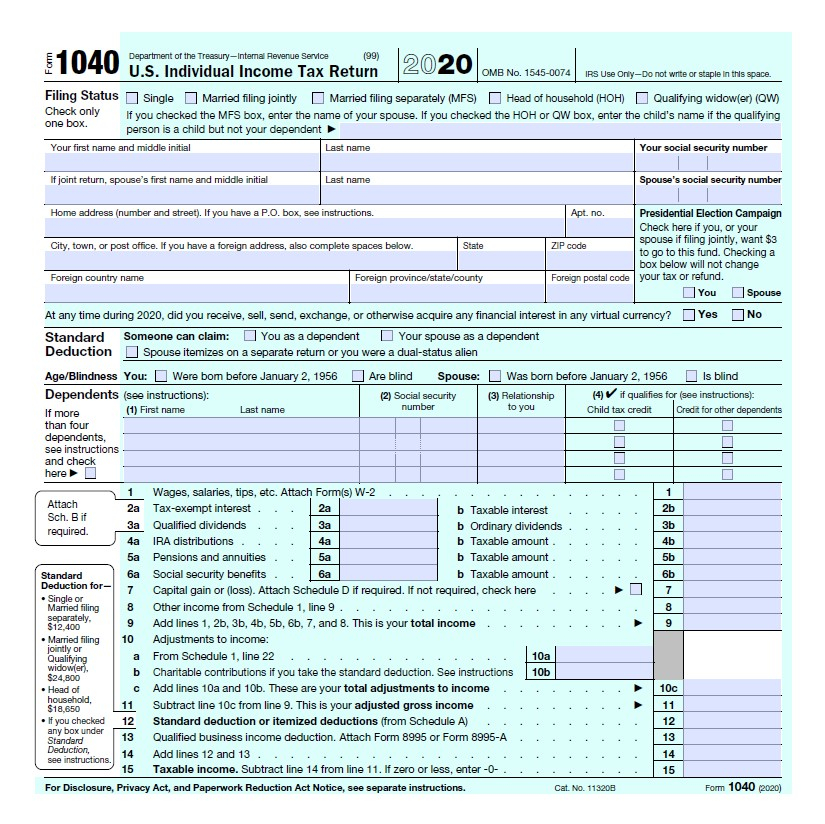

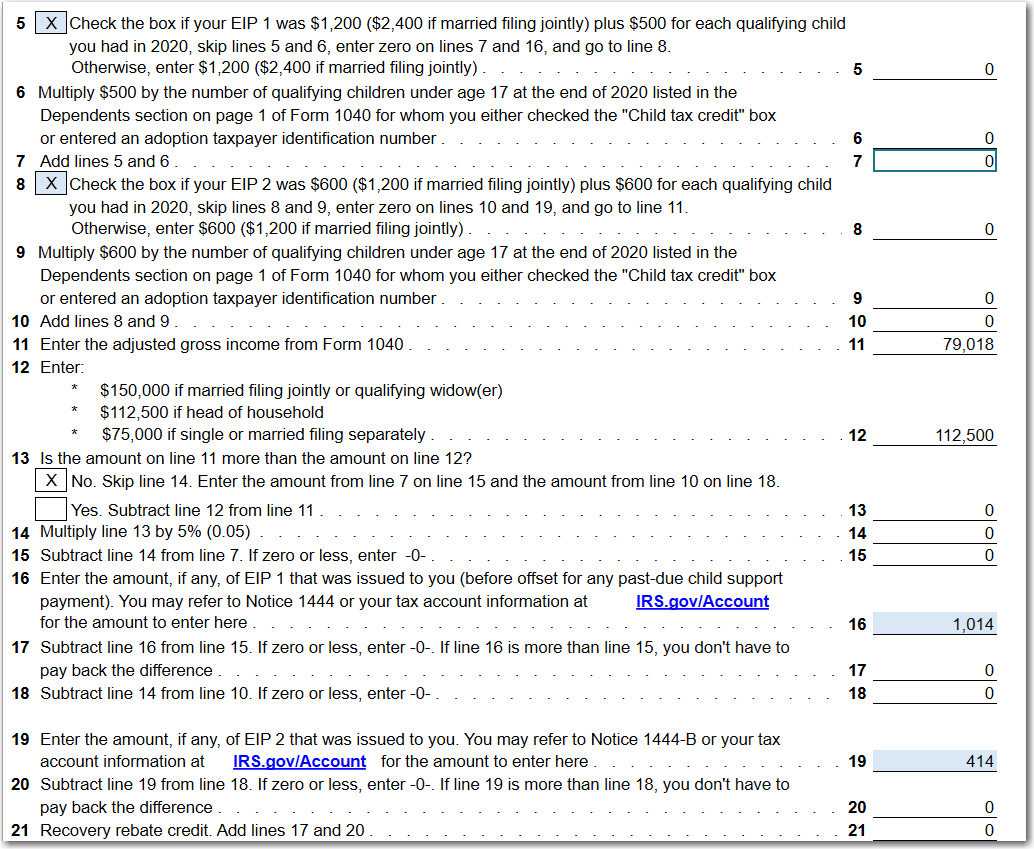

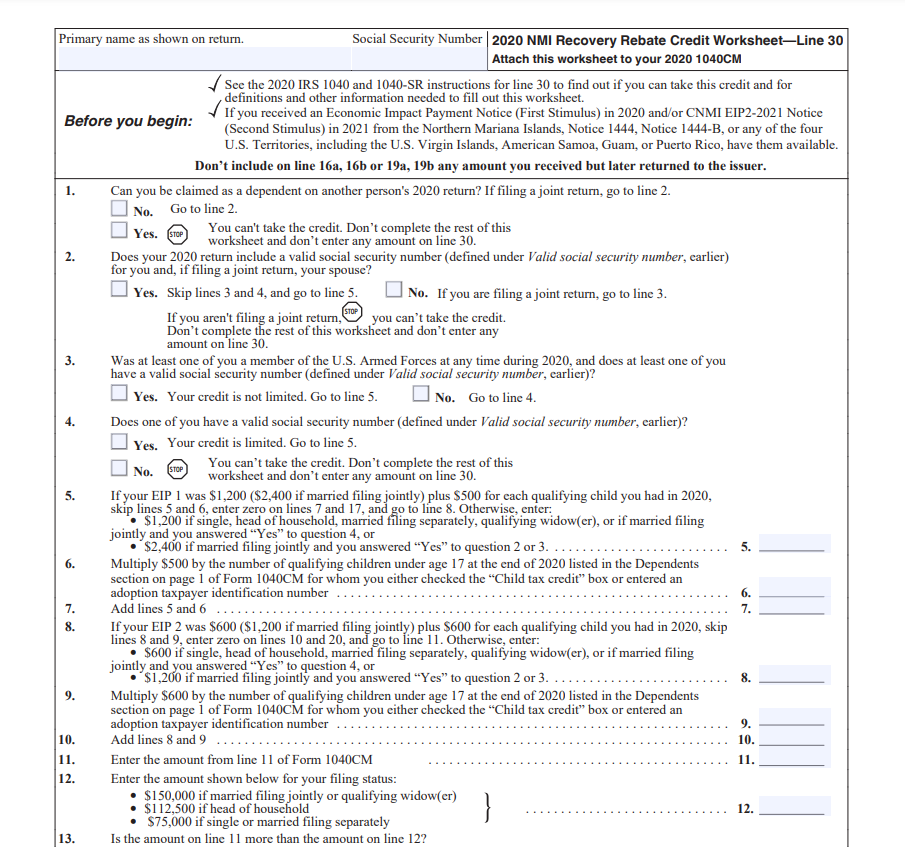

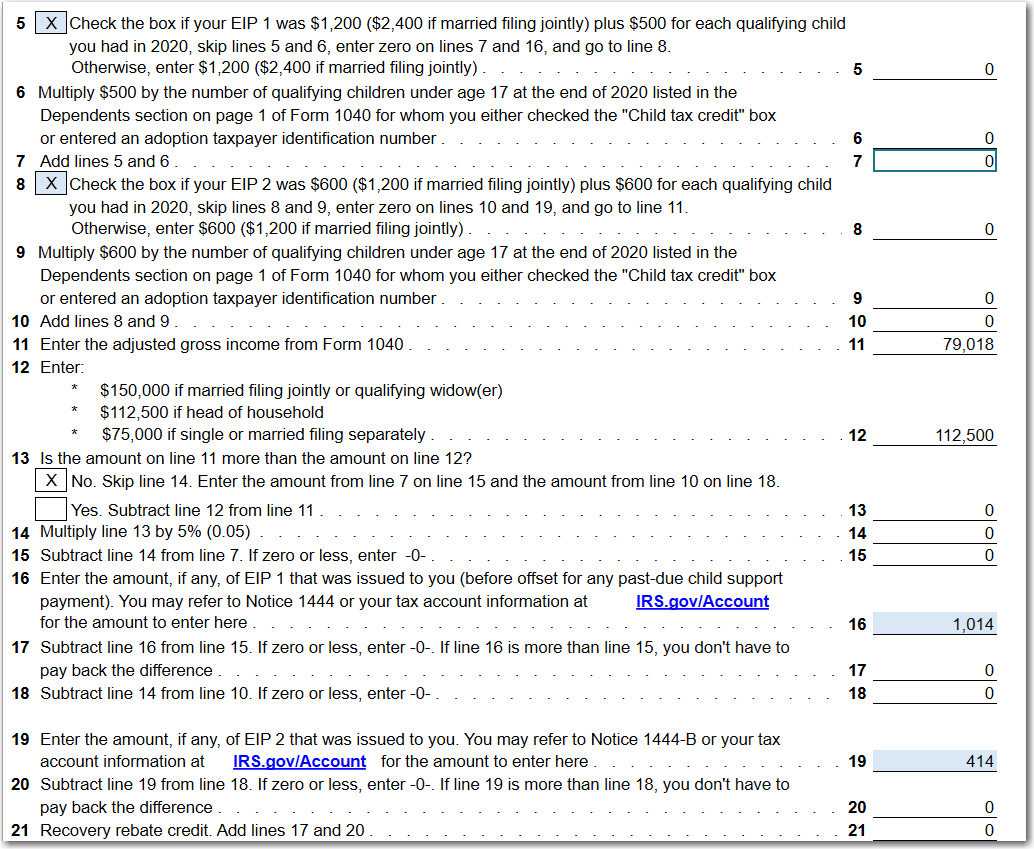

Web 10 d 233 c 2021 nbsp 0183 32 You must file a 2020 tax return to claim a Recovery Rebate Credit even if you don t usually file a tax return The Recovery Rebate Credit Worksheet in the 2020

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

A File Recovery Rebate Form in its simplest definition, is a refund given to a client after purchasing a certain product or service. It is a powerful tool for businesses to entice customers, boost sales, and also to advertise certain products.

Types of File Recovery Rebate Form

What Does It Mean To Claim The Recovery Rebate Credit Leia Aqui Who

What Does It Mean To Claim The Recovery Rebate Credit Leia Aqui Who

Web 10 d 233 c 2021 nbsp 0183 32 If you re eligible for the Recovery Rebate Credit you ll need to file a 2020 tax return to claim the credit even if you don t usually file a tax return This credit is

Web 10 d 233 c 2021 nbsp 0183 32 Enter the amount on the Refundable Credits section of the 1040 X and include quot Recovery Rebate Credit quot in the Explanation of Changes section If you filed

Cash File Recovery Rebate Form

Cash File Recovery Rebate Form are the most basic type of File Recovery Rebate Form. Customers receive a specific amount of money after purchasing a item. They are typically used to purchase big-ticket items, like electronics and appliances.

Mail-In File Recovery Rebate Form

Mail-in File Recovery Rebate Form are based on the requirement that customers present proof of purchase to receive their cash back. They're a bit more involved, however they can yield substantial savings.

Instant File Recovery Rebate Form

Instant File Recovery Rebate Form apply at the point of sale. They reduce the purchase price immediately. Customers do not have to wait for their savings when they purchase this type of File Recovery Rebate Form.

How File Recovery Rebate Form Work

IRS CP 11R Recovery Rebate Credit Balance Due

IRS CP 11R Recovery Rebate Credit Balance Due

Web When you file your 2021 tax return you can use the Recovery Rebate Credit RRC to claim any missing amounts from the third EIP Do I qualify for the Recovery Rebate

The File Recovery Rebate Form Process

The process generally involves a few simple steps

-

Then, you purchase the product then, you buy the item just like you normally would.

-

Fill in the File Recovery Rebate Form template: You'll need to provide some information, such as your name, address, and purchase details, to apply for your File Recovery Rebate Form.

-

Send in the File Recovery Rebate Form: Depending on the nature of File Recovery Rebate Form you might need to mail a File Recovery Rebate Form form in or make it available online.

-

Wait for approval: The company will examine your application to make sure that it's in accordance with the refund's conditions and terms.

-

Accept your File Recovery Rebate Form After being approved, you'll receive your money back, using a check or prepaid card or another option specified by the offer.

Pros and Cons of File Recovery Rebate Form

Advantages

-

Cost savings File Recovery Rebate Form could significantly reduce the cost for the item.

-

Promotional Offers The aim is to encourage customers to try new products and brands.

-

Improve Sales The benefits of a File Recovery Rebate Form can improve sales for a company and also increase market share.

Disadvantages

-

Complexity: Mail-in File Recovery Rebate Form, in particular may be lengthy and demanding.

-

Extension Dates Many File Recovery Rebate Form impose the strictest deadlines for submission.

-

A risk of not being paid: Some customers may have their File Recovery Rebate Form delayed if they don't follow the regulations precisely.

Download File Recovery Rebate Form

Download File Recovery Rebate Form

FAQs

1. Are File Recovery Rebate Form similar to discounts? Not at all, File Recovery Rebate Form provide only a partial reimbursement following the purchase, while discounts reduce the cost of purchase at point of sale.

2. Are there any File Recovery Rebate Form that I can use on the same product This depends on the conditions for the File Recovery Rebate Form promotions and on the products qualification. Certain companies allow this, whereas others will not.

3. How long will it take to receive an File Recovery Rebate Form? The timing will vary, but it may last from a few weeks until a couple of months to receive your File Recovery Rebate Form.

4. Do I have to pay tax with respect to File Recovery Rebate Form funds? the majority of situations, File Recovery Rebate Form amounts are not considered to be taxable income.

5. Do I have confidence in File Recovery Rebate Form offers from brands that aren't well-known? It's essential to research and confirm that the company which is providing the File Recovery Rebate Form is reputable prior to making purchases.

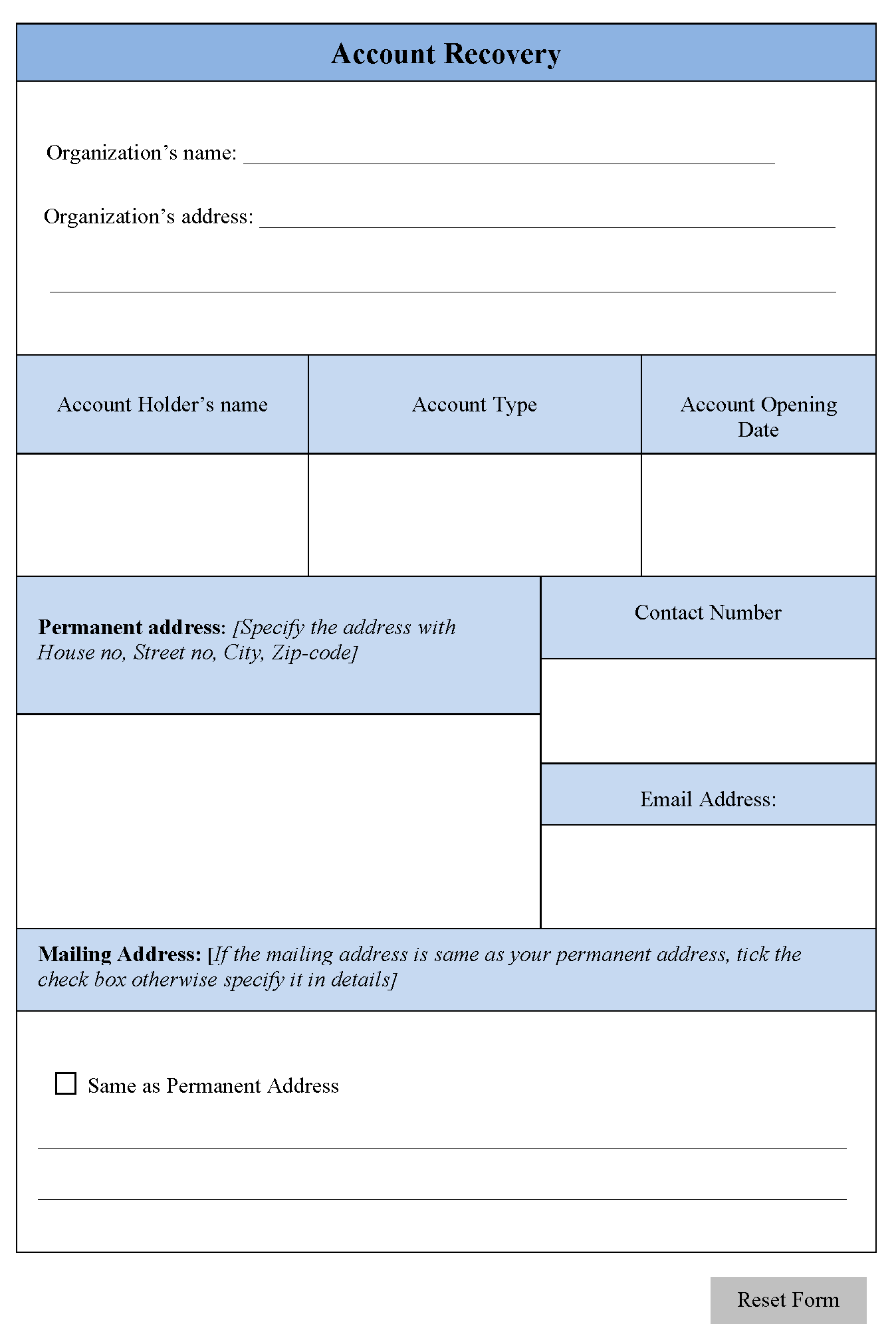

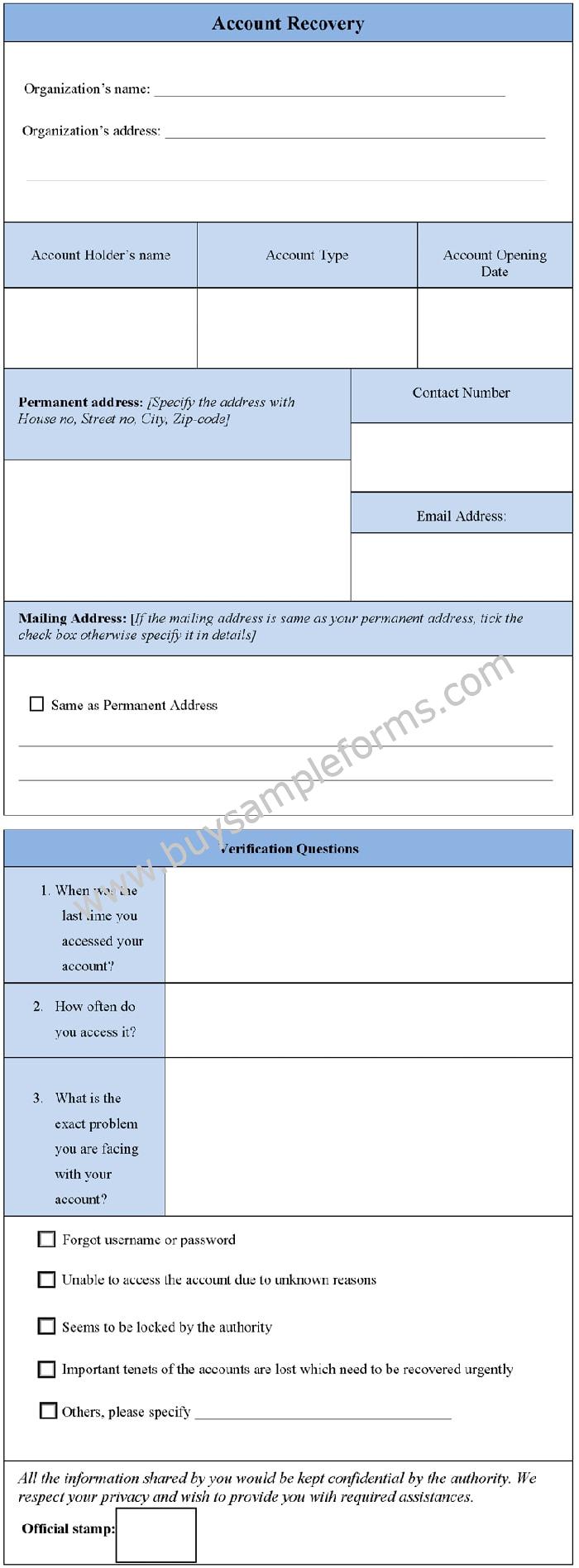

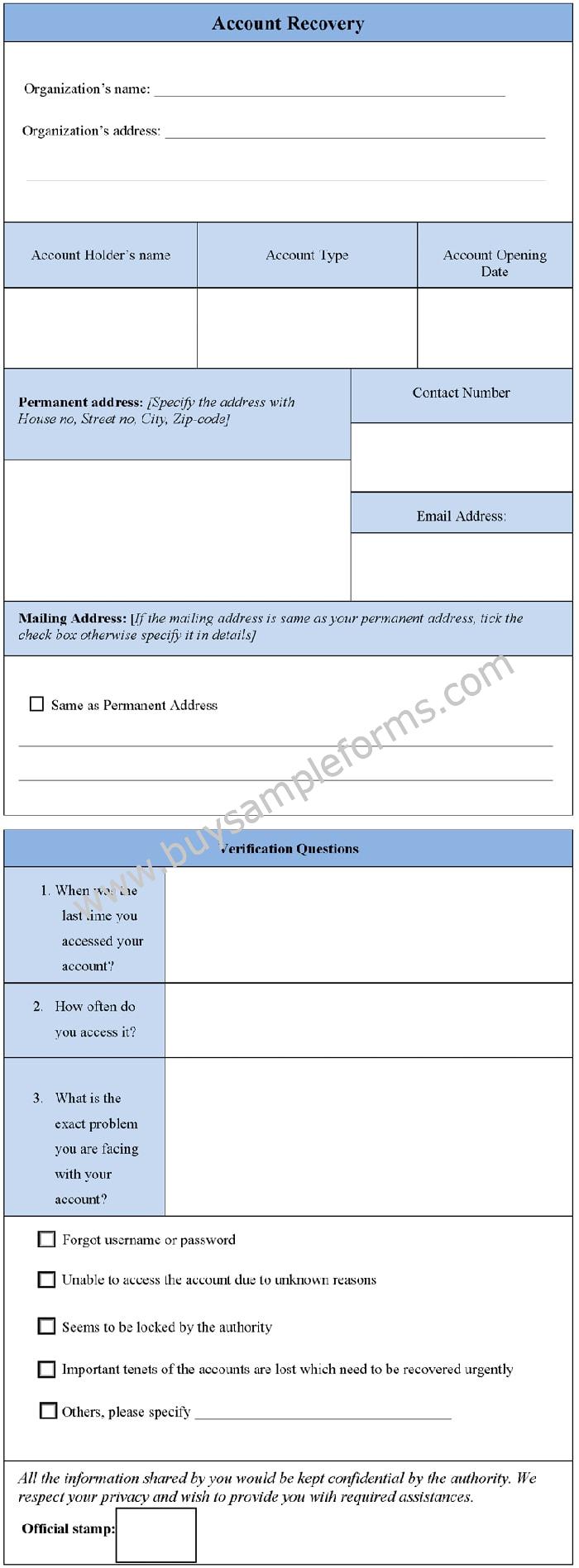

Account Recovery Form Editable Forms

How Do I Claim The Recovery Rebate Credit On My Ta

Check more sample of File Recovery Rebate Form below

What Is A Recovery Rebate Credit 2022 Rebate2022

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Rebate Form Download Printable PDF Templateroller

What Is The Recovery Rebate Credit CD Tax Financial

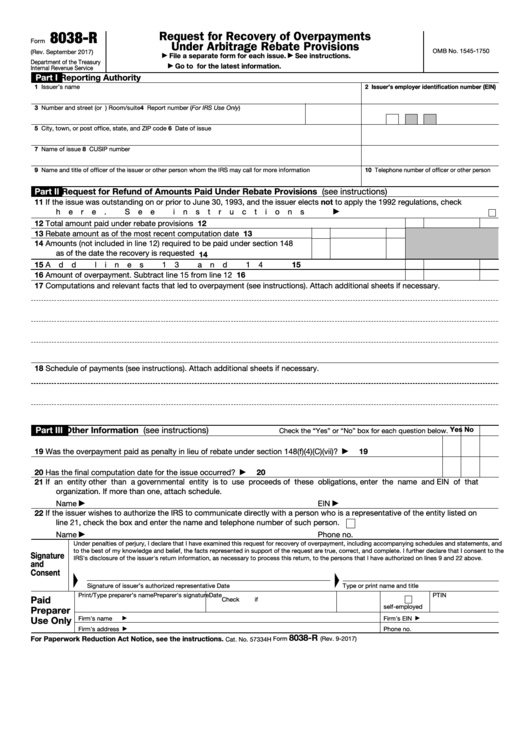

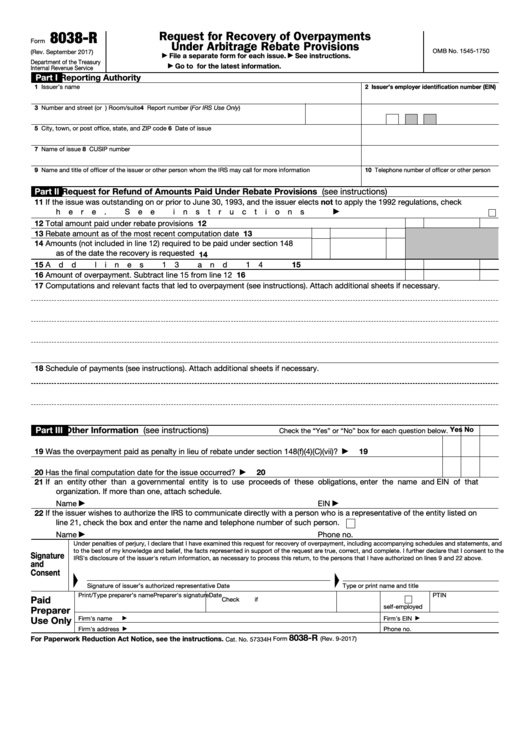

Fillable Form 8038 R Request For Recovery Of Overpayments Under

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-and...

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-b...

Web 13 janv 2022 nbsp 0183 32 No matter how you file you will need to do the following to claim the 2021 Recovery Rebate Credit Compute the 2021 Recovery Rebate Credit amount using tax

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 13 janv 2022 nbsp 0183 32 No matter how you file you will need to do the following to claim the 2021 Recovery Rebate Credit Compute the 2021 Recovery Rebate Credit amount using tax

Rebate Form Download Printable PDF Templateroller

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

What Is The Recovery Rebate Credit CD Tax Financial

Fillable Form 8038 R Request For Recovery Of Overpayments Under

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Sample Account Recovery Form Template In Word Format

Sample Account Recovery Form Template In Word Format

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter