In this day and age of consuming everyone is looking for a great bargain. One way to score substantial savings on your purchases is by using Federal Solar Rebate Forms. Federal Solar Rebate Forms are a strategy for marketing that retailers and manufacturers use to offer customers a partial return on their purchases once they have completed them. In this post, we'll go deeper into the realm of Federal Solar Rebate Forms, exploring what they are, how they work, and how you can maximise the savings you can make by using these cost-effective incentives.

Get Latest Federal Solar Rebate Form Below

Federal Solar Rebate Form

Federal Solar Rebate Form -

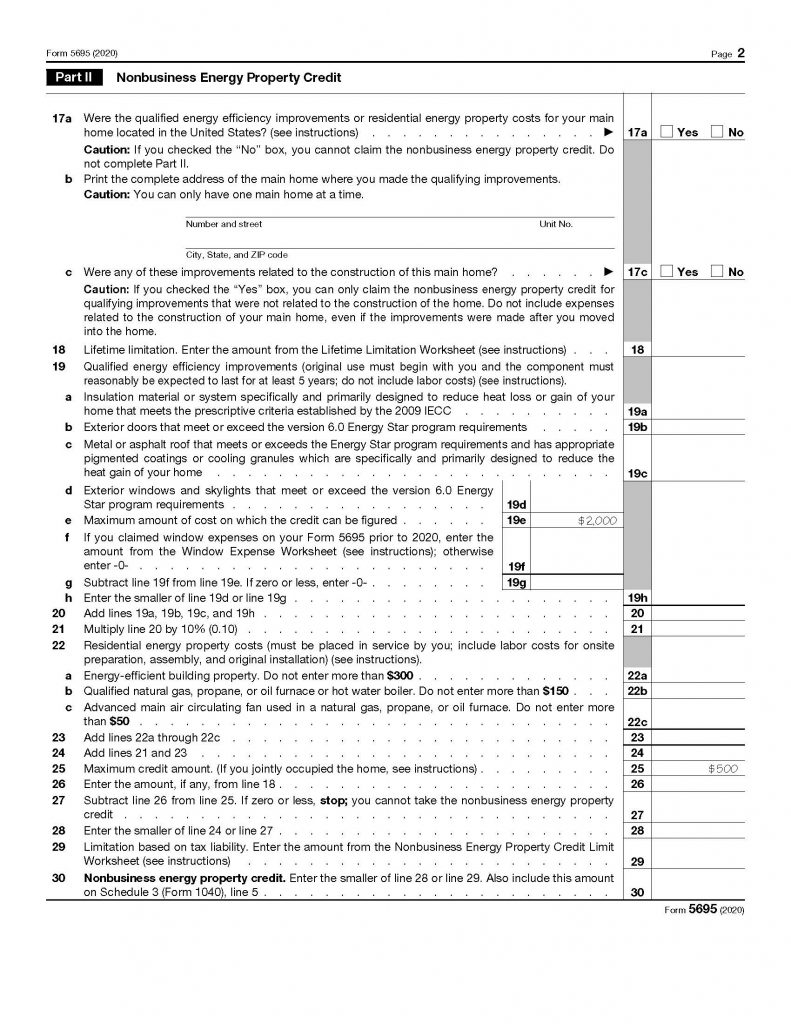

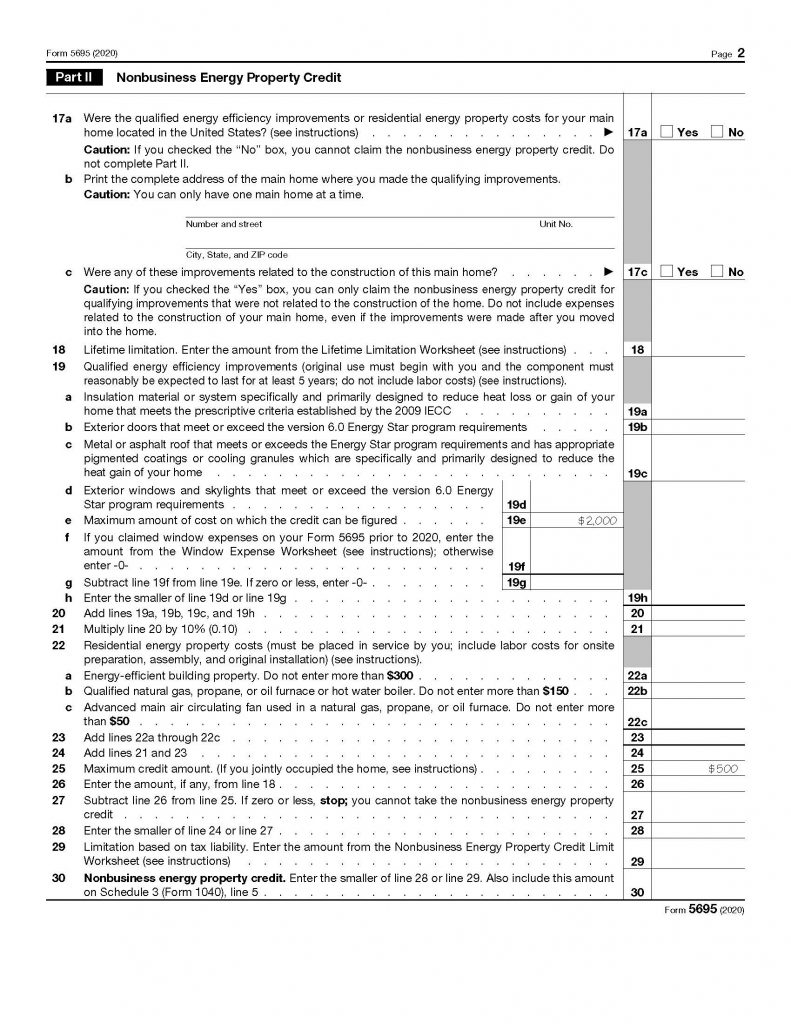

Web 17 f 233 vr 2023 nbsp 0183 32 The residential energy credits are The nonbusiness energy property credit and The residential energy efficient property credit Current Revision Form 5695 PDF Instructions for Form 5695 Print Version PDF Recent Developments None at this time

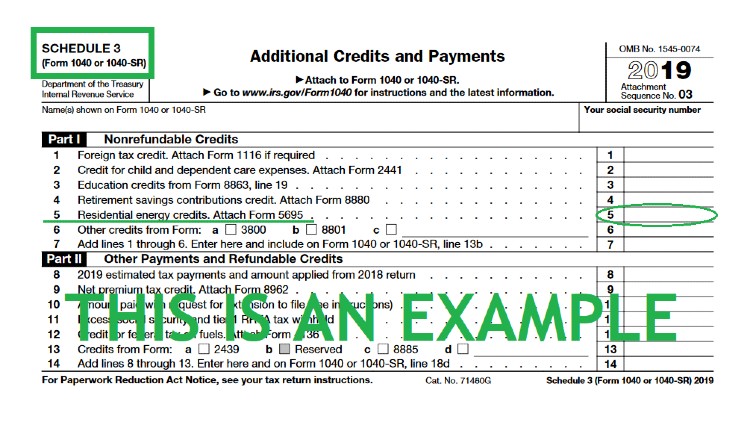

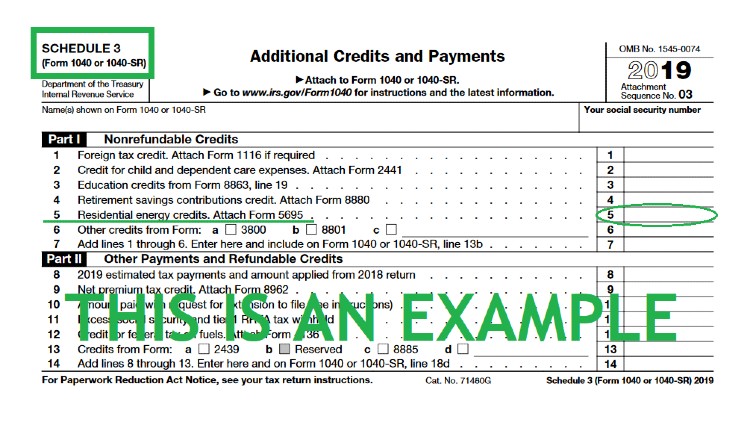

Web How do I claim the federal solar tax credit After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to your federal tax return Form 1040 or Form 1040NR Instructions on filling out the form

A Federal Solar Rebate Form, in its simplest model, refers to a partial cash refund provided to customers when they purchase a product or service. It's a powerful instrument used by businesses to attract customers, boost sales, and market specific products.

Types of Federal Solar Rebate Form

How To Claim The Federal Solar Tax Credit SAVKAT Inc

How To Claim The Federal Solar Tax Credit SAVKAT Inc

Web 8 sept 2022 nbsp 0183 32 The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar Investment Tax Credit ITC

Web 8 oct 2021 nbsp 0183 32 The IRS has not yet released their revised Form 5695 so our example below uses 2021 s version and 26 tax credit amount One of the biggest immediate benefits of installing a solar electric system is that it

Cash Federal Solar Rebate Form

Cash Federal Solar Rebate Form are the most basic kind of Federal Solar Rebate Form. Clients receive a predetermined amount of money back after purchasing a item. These are typically applied to expensive items such as electronics or appliances.

Mail-In Federal Solar Rebate Form

Mail-in Federal Solar Rebate Form demand that customers present the proof of purchase to be eligible for the refund. They're somewhat more involved, but offer substantial savings.

Instant Federal Solar Rebate Form

Instant Federal Solar Rebate Form are credited at the moment of sale, cutting the price instantly. Customers don't have to wait for their savings when they purchase this type of Federal Solar Rebate Form.

How Federal Solar Rebate Form Work

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar

Web 26 juil 2023 nbsp 0183 32 Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit

The Federal Solar Rebate Form Process

The process typically comprises a few simple steps:

-

You purchase the item: First, you buy the product just like you normally would.

-

Fill in this Federal Solar Rebate Form questionnaire: you'll need submit some information, such as your name, address, and purchase details, to be eligible for a Federal Solar Rebate Form.

-

Make sure you submit the Federal Solar Rebate Form: Depending on the kind of Federal Solar Rebate Form you could be required to either mail in a request form or send it via the internet.

-

Wait until the company approves: The company will review your submission to verify that it is compliant with the Federal Solar Rebate Form's terms and conditions.

-

Receive your Federal Solar Rebate Form After you've been approved, you'll be able to receive your reimbursement, through a check, or a prepaid card or through a different option specified by the offer.

Pros and Cons of Federal Solar Rebate Form

Advantages

-

Cost savings Federal Solar Rebate Form can substantially cut the price you pay for an item.

-

Promotional Deals Incentivize customers to try out new products or brands.

-

Increase Sales Federal Solar Rebate Form can help boost sales for a company and also increase market share.

Disadvantages

-

Complexity Mail-in Federal Solar Rebate Form in particular are often time-consuming and costly.

-

Day of Expiration Many Federal Solar Rebate Form impose certain deadlines for submitting.

-

Risque of Non-Payment: Some customers may lose their Federal Solar Rebate Form in the event that they don't follow the regulations precisely.

Download Federal Solar Rebate Form

Download Federal Solar Rebate Form

FAQs

1. Are Federal Solar Rebate Form the same as discounts? No, Federal Solar Rebate Form offer only a partial reimbursement following the purchase, and discounts are a reduction of costs at point of sale.

2. Do I have to use multiple Federal Solar Rebate Form on the same item This depends on the conditions for the Federal Solar Rebate Form deals and product's qualification. Certain companies allow it, and some don't.

3. How long will it take to receive the Federal Solar Rebate Form? The period will vary, but it may take a couple of weeks or a few months before you receive your Federal Solar Rebate Form.

4. Do I have to pay tax regarding Federal Solar Rebate Form sums? the majority of instances, Federal Solar Rebate Form amounts are not considered to be taxable income.

5. Can I trust Federal Solar Rebate Form offers from brands that aren't well-known it is crucial to conduct research and verify that the organization giving the Federal Solar Rebate Form is legitimate prior to making an investment.

How To Claim The Solar Investment Tax Credit YSG Solar YSG Solar

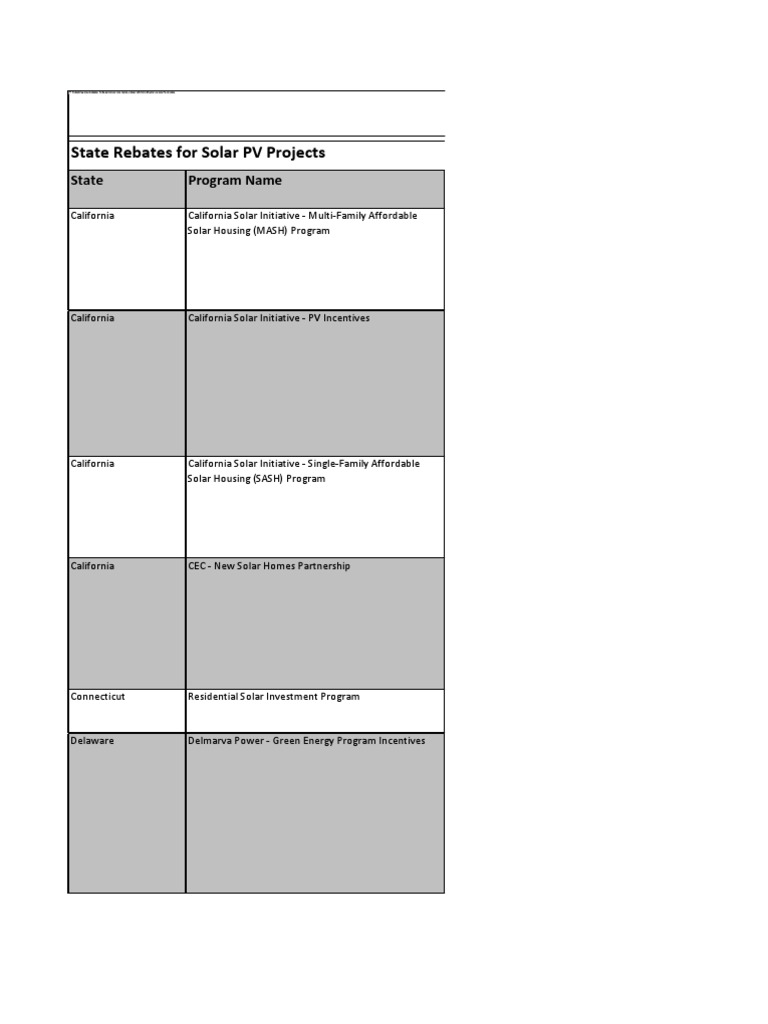

States Rebates For Solar PV Projects Photovoltaic System Renewable

Check more sample of Federal Solar Rebate Form below

How To Claim The Solar Tax Credit Using IRS Form 5695

Filing For The Solar Tax Credit Wells Solar

Federal State Local Rebates Are Available Now Home Solar Rebate

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

Reports Of Unfair Early FPL Solar Rebate Applications Florida Solar

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit...

Web How do I claim the federal solar tax credit After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to your federal tax return Form 1040 or Form 1040NR Instructions on filling out the form

https://www.energy.gov/sites/default/files/2021/02/f82/Guide …

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this

Web How do I claim the federal solar tax credit After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to your federal tax return Form 1040 or Form 1040NR Instructions on filling out the form

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

Filing For The Solar Tax Credit Wells Solar

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

Reports Of Unfair Early FPL Solar Rebate Applications Florida Solar

Application Form Residential Solar Electric Rebate United Power

Puget Sound Solar LLC

Puget Sound Solar LLC

How Does The Federal Solar Tax Credit Work