In this day and age of consuming everybody loves a good deal. One option to obtain substantial savings in your purchase is through Nb Property Tax Rebate For Low Income Forms. Nb Property Tax Rebate For Low Income Forms can be a way of marketing used by manufacturers and retailers to offer consumers a partial discount on purchases they made after they have completed them. In this article, we will go deeper into the realm of Nb Property Tax Rebate For Low Income Forms, exploring the nature of them as well as how they work and how you can maximize your savings by taking advantage of these cost-effective incentives.

Get Latest Nb Property Tax Rebate For Low Income Form Below

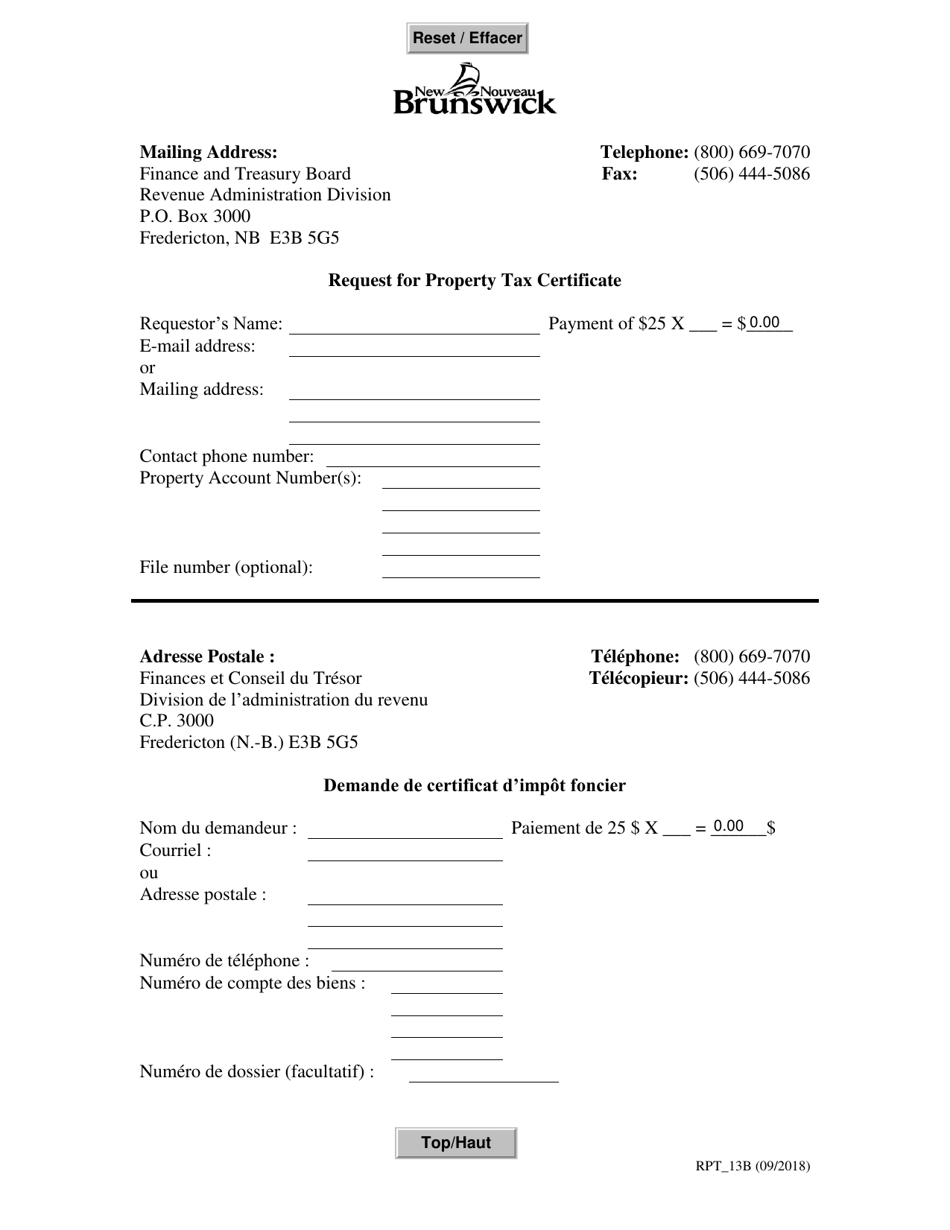

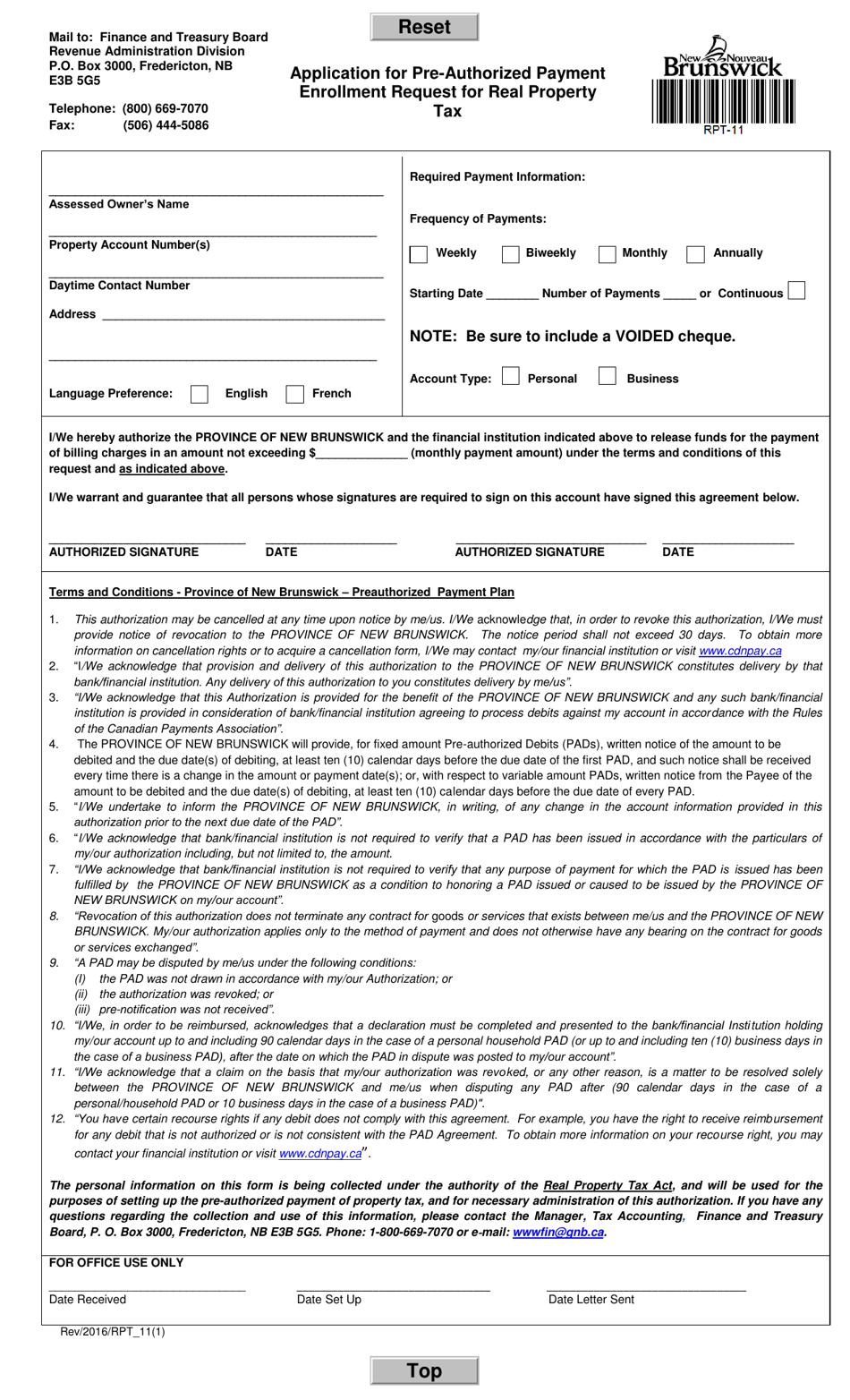

Nb Property Tax Rebate For Low Income Form

Nb Property Tax Rebate For Low Income Form -

Web A 400 benefit under the Low Income Senior s Benefit To assist low income seniors in New Brunswick the government offers a 400 annual benefit to qualifying applicants

Web Not For Profit Organizations Assessment Reduction Program To receive a reduction in the value of the property For Developers Housing Development Incentive Program For the

A Nb Property Tax Rebate For Low Income Form or Nb Property Tax Rebate For Low Income Form, in its most basic form, is a return to the customer after having purchased a item or service. It's an effective method used by businesses to attract customers, increase sales, and to promote certain products.

Types of Nb Property Tax Rebate For Low Income Form

South Brunswick Property Tax Propertyvc

South Brunswick Property Tax Propertyvc

Web Full Tax Credit If you own and maintain your property as your principal residence for the full year with the exception of vacations and holidays you may be eligible for a full tax

Web 12 mars 2010 nbsp 0183 32 The low income property tax allowance which has not been adjusted since 1995 previously offered a 200 benefit to households with total taxable incomes up to 20 000 The changes take

Cash Nb Property Tax Rebate For Low Income Form

Cash Nb Property Tax Rebate For Low Income Form are the most basic kind of Nb Property Tax Rebate For Low Income Form. Customers are given a certain amount of cash back after purchasing a item. These are typically for high-ticket items like electronics or appliances.

Mail-In Nb Property Tax Rebate For Low Income Form

Mail-in Nb Property Tax Rebate For Low Income Form require consumers to submit their proof of purchase before receiving their money back. They're a little more involved, however they can yield significant savings.

Instant Nb Property Tax Rebate For Low Income Form

Instant Nb Property Tax Rebate For Low Income Form are applied at the point of sale and reduce the price instantly. Customers do not have to wait long for savings in this manner.

How Nb Property Tax Rebate For Low Income Form Work

Rebate Form Download Printable PDF Templateroller

Rebate Form Download Printable PDF Templateroller

Web 21 juin 2021 nbsp 0183 32 Low income families can now apply for the Canada New Brunswick Housing Benefit and receive on average between 300 and 475 monthly Social Sharing The

The Nb Property Tax Rebate For Low Income Form Process

It usually consists of a number of easy steps:

-

When you buy the product make sure you purchase the product just like you normally would.

-

Fill out the Nb Property Tax Rebate For Low Income Form questionnaire: you'll need be able to provide a few details, such as your name, address, along with the purchase details, to take advantage of your Nb Property Tax Rebate For Low Income Form.

-

Send in the Nb Property Tax Rebate For Low Income Form In accordance with the type of Nb Property Tax Rebate For Low Income Form it is possible that you need to either mail in a request form or make it available online.

-

Wait for approval: The business will look over your submission to verify that it is compliant with the refund's conditions and terms.

-

Redeem your Nb Property Tax Rebate For Low Income Form Once it's approved, you'll receive the refund through a check, or a prepaid card, or another procedure specified by the deal.

Pros and Cons of Nb Property Tax Rebate For Low Income Form

Advantages

-

Cost Savings The use of Nb Property Tax Rebate For Low Income Form can greatly reduce the price you pay for an item.

-

Promotional Deals they encourage their customers to try new items or brands.

-

Improve Sales Nb Property Tax Rebate For Low Income Form are a great way to boost an organization's sales and market share.

Disadvantages

-

Complexity In particular, mail-in Nb Property Tax Rebate For Low Income Form particularly are often time-consuming and time-consuming.

-

The Expiration Dates Many Nb Property Tax Rebate For Low Income Form have rigid deadlines to submit.

-

Risk of Non-Payment Customers may have their Nb Property Tax Rebate For Low Income Form delayed if they don't comply with the rules precisely.

Download Nb Property Tax Rebate For Low Income Form

Download Nb Property Tax Rebate For Low Income Form

FAQs

1. Are Nb Property Tax Rebate For Low Income Form the same as discounts? No, Nb Property Tax Rebate For Low Income Form require one-third of the amount refunded following purchase, while discounts lower your purchase cost at point of sale.

2. Can I get multiple Nb Property Tax Rebate For Low Income Form for the same product This depends on the conditions applicable to Nb Property Tax Rebate For Low Income Form offered and product's eligibility. Certain companies might allow it, and some don't.

3. How long will it take to get an Nb Property Tax Rebate For Low Income Form? The period will differ, but can be from several weeks to couple of months for you to receive your Nb Property Tax Rebate For Low Income Form.

4. Do I have to pay taxes with respect to Nb Property Tax Rebate For Low Income Form amounts? In the majority of instances, Nb Property Tax Rebate For Low Income Form amounts are not considered to be taxable income.

5. Should I be able to trust Nb Property Tax Rebate For Low Income Form deals from lesser-known brands It's crucial to research and confirm that the brand providing the Nb Property Tax Rebate For Low Income Form is reputable prior to making a purchase.

South Brunswick Property Tax Propertyvc

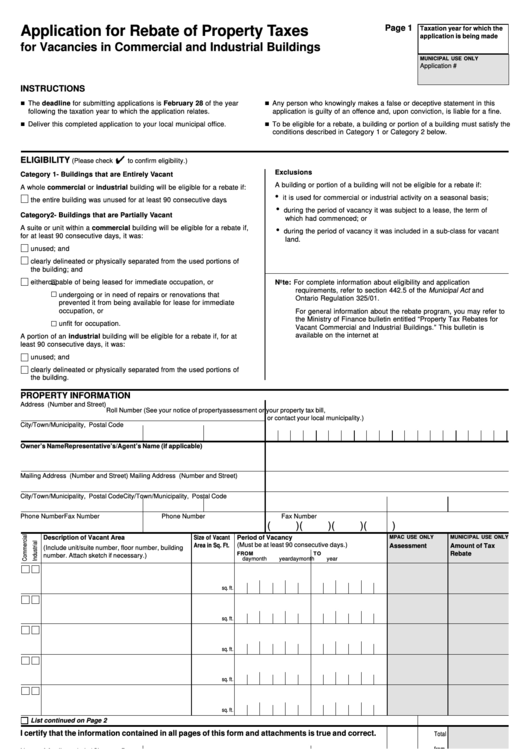

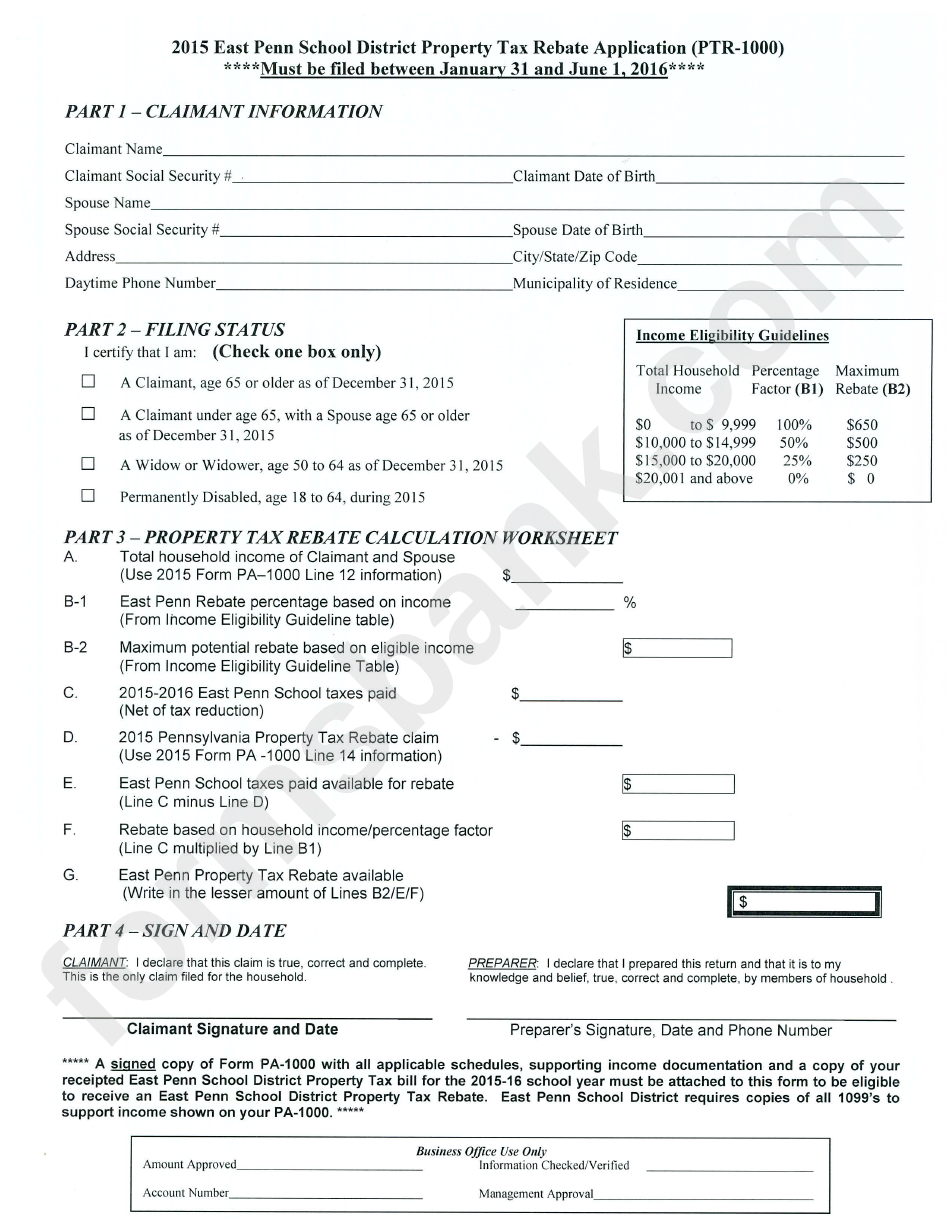

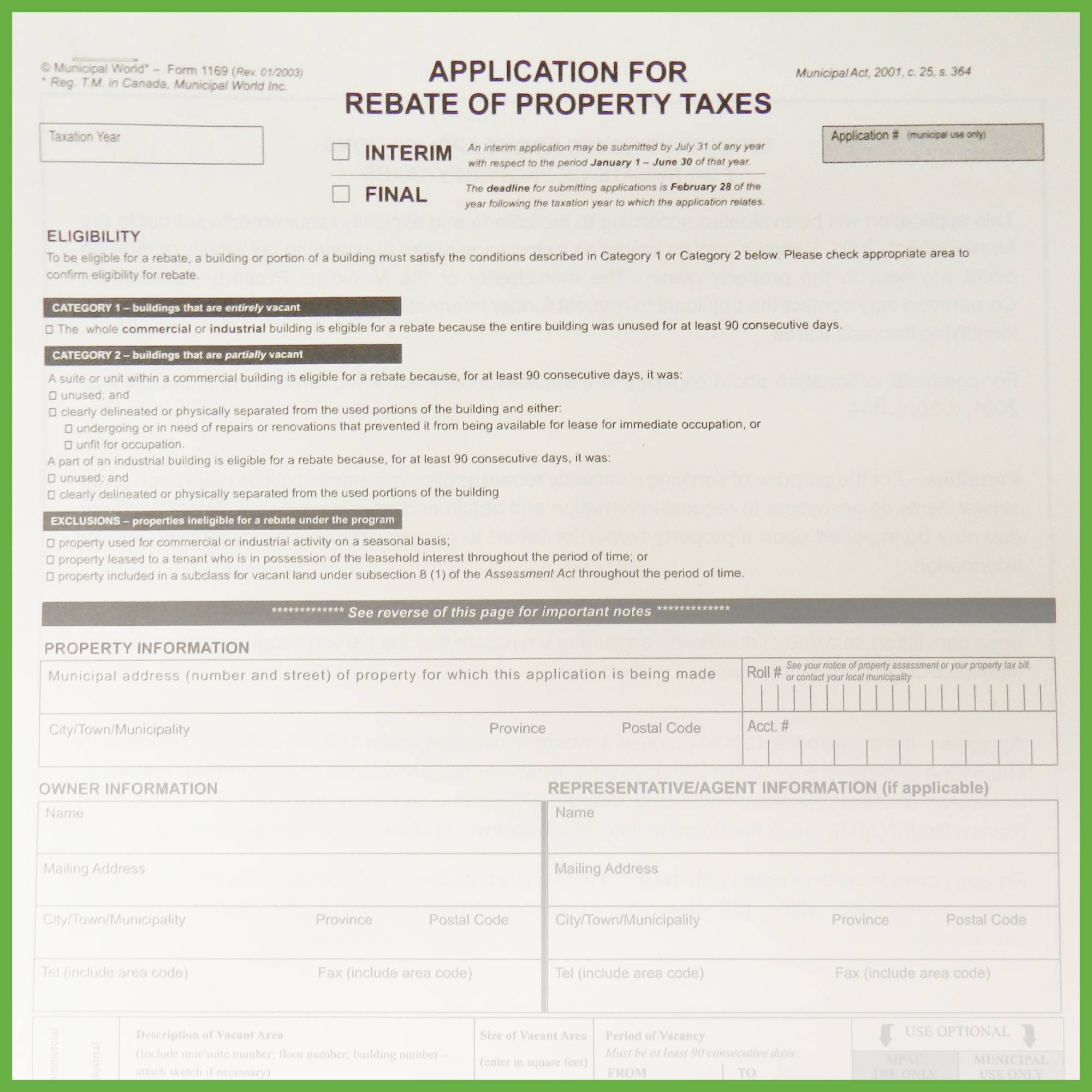

Application For Rebate Of Property Taxes Printable Pdf Download

Check more sample of Nb Property Tax Rebate For Low Income Form below

PA Property Tax Rebate Forms Printable Rebate Form

Tulsa Sales Tax Rebate Form Fill Online Printable Fillable Blank

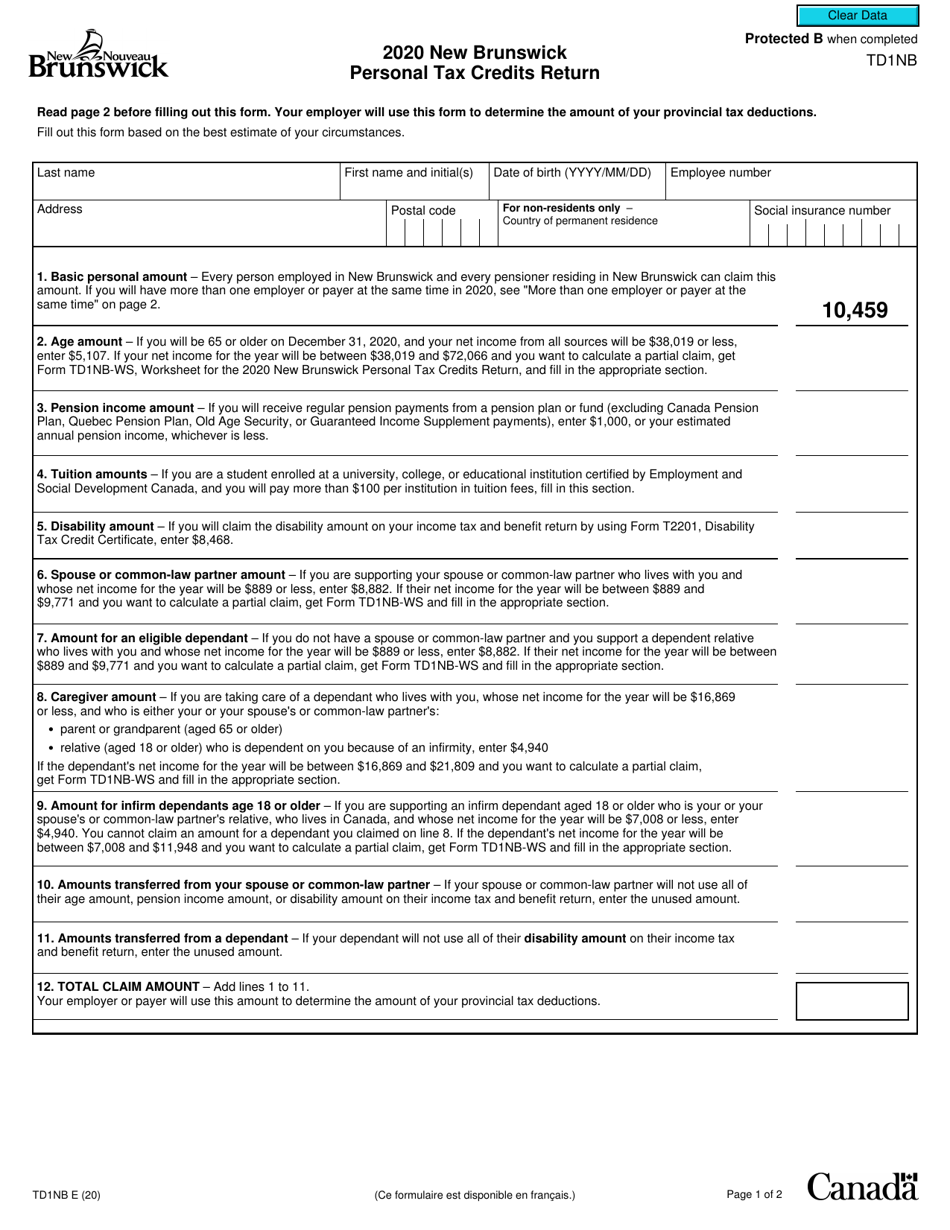

Form TD1NB Download Fillable PDF Or Fill Online New Brunswick Personal

Minneaots Income Tax Form M1prx Fill Out Sign Online DocHub

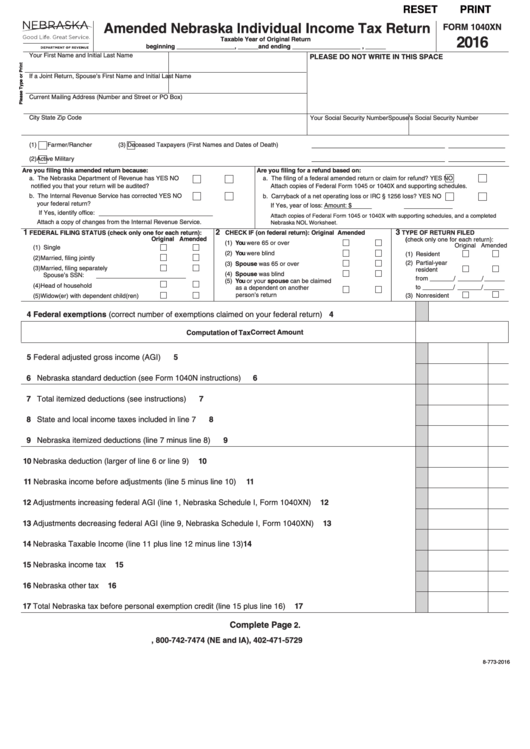

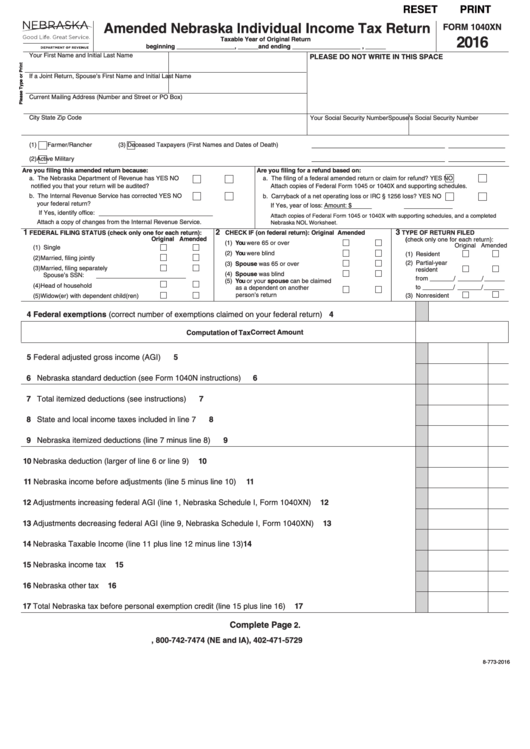

Fillable Nebraska State Income Tax Forms Printable Forms Free Online

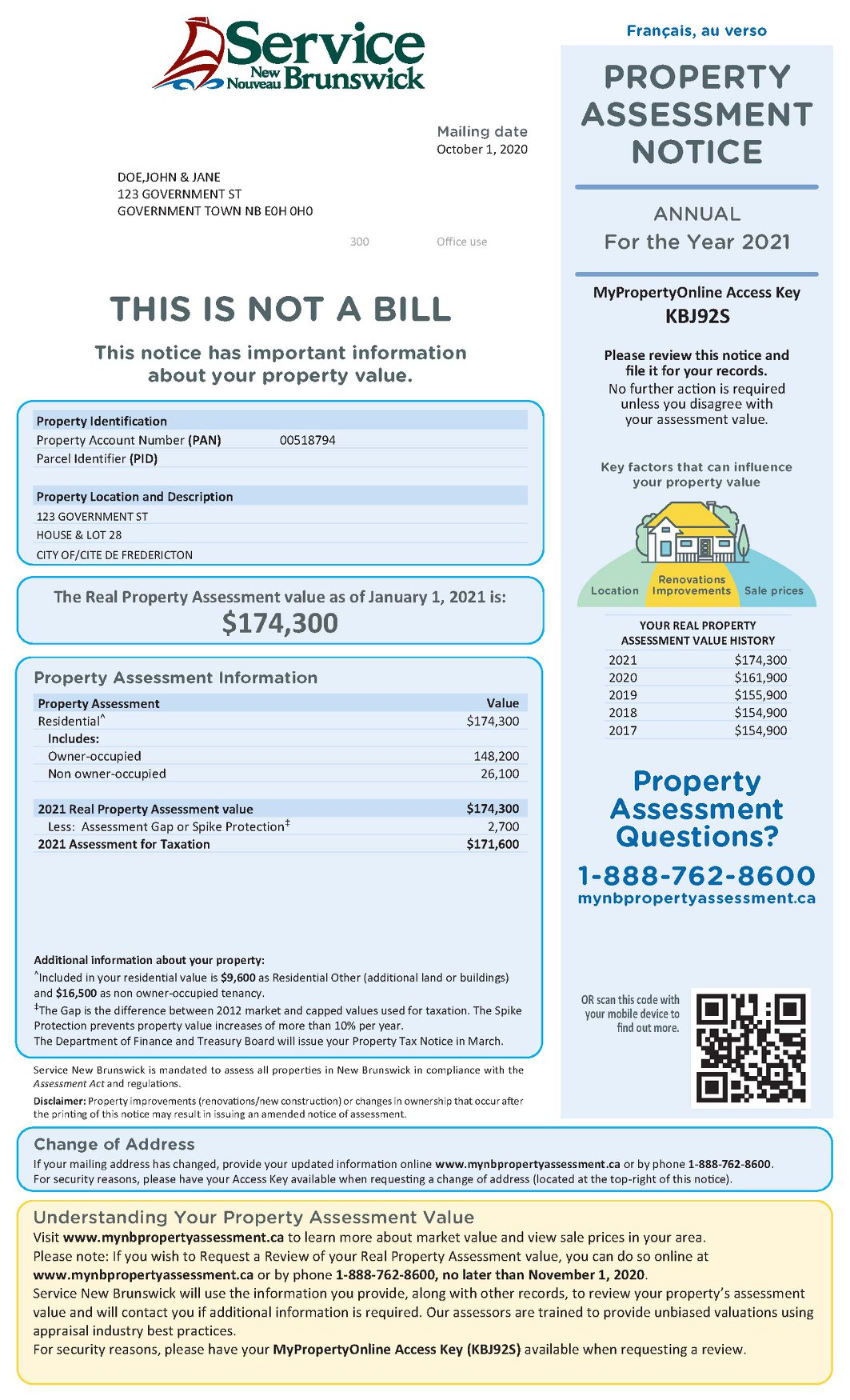

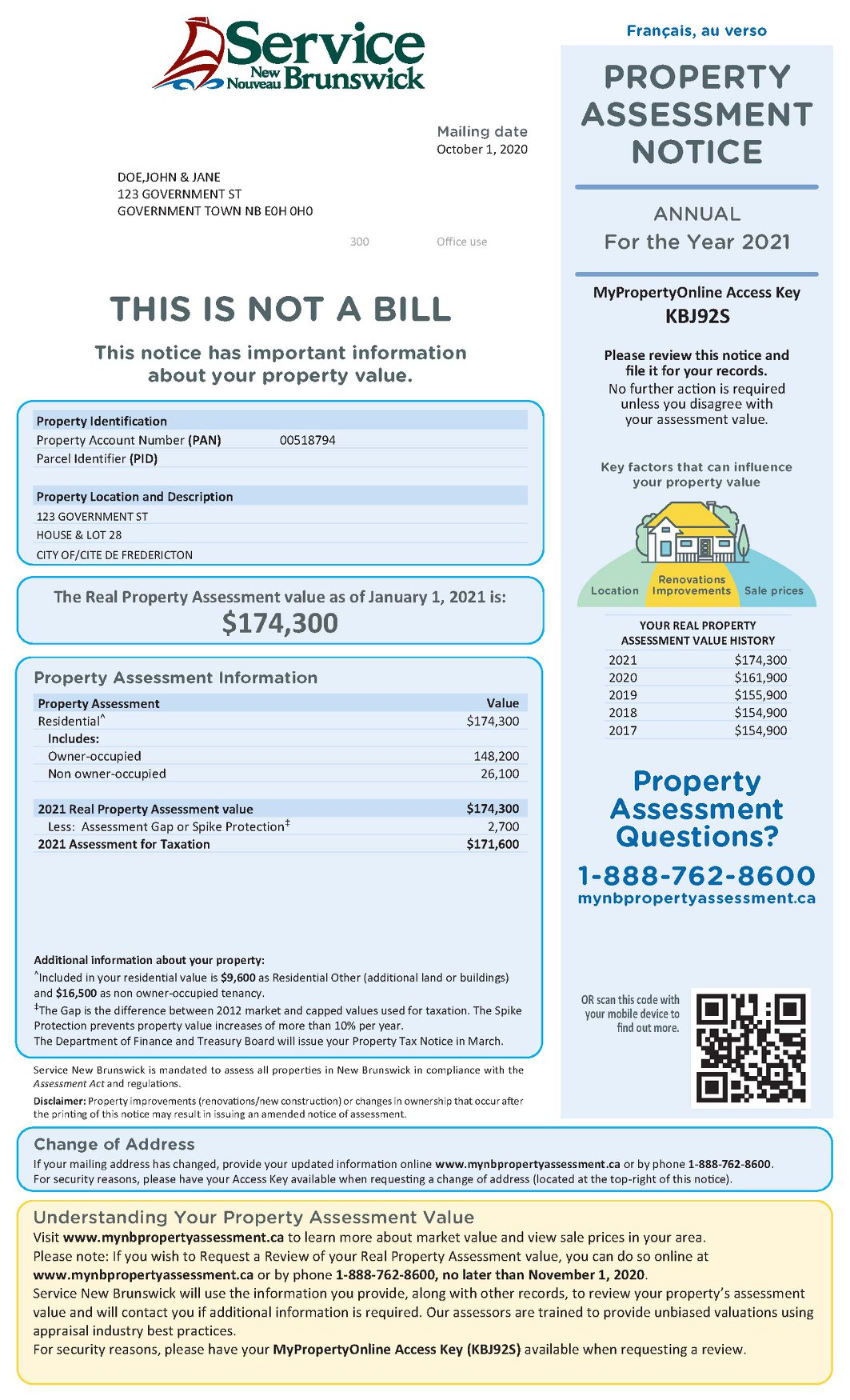

New Brunswick Property Assessments Are Here Blog 103 9 MAX FM

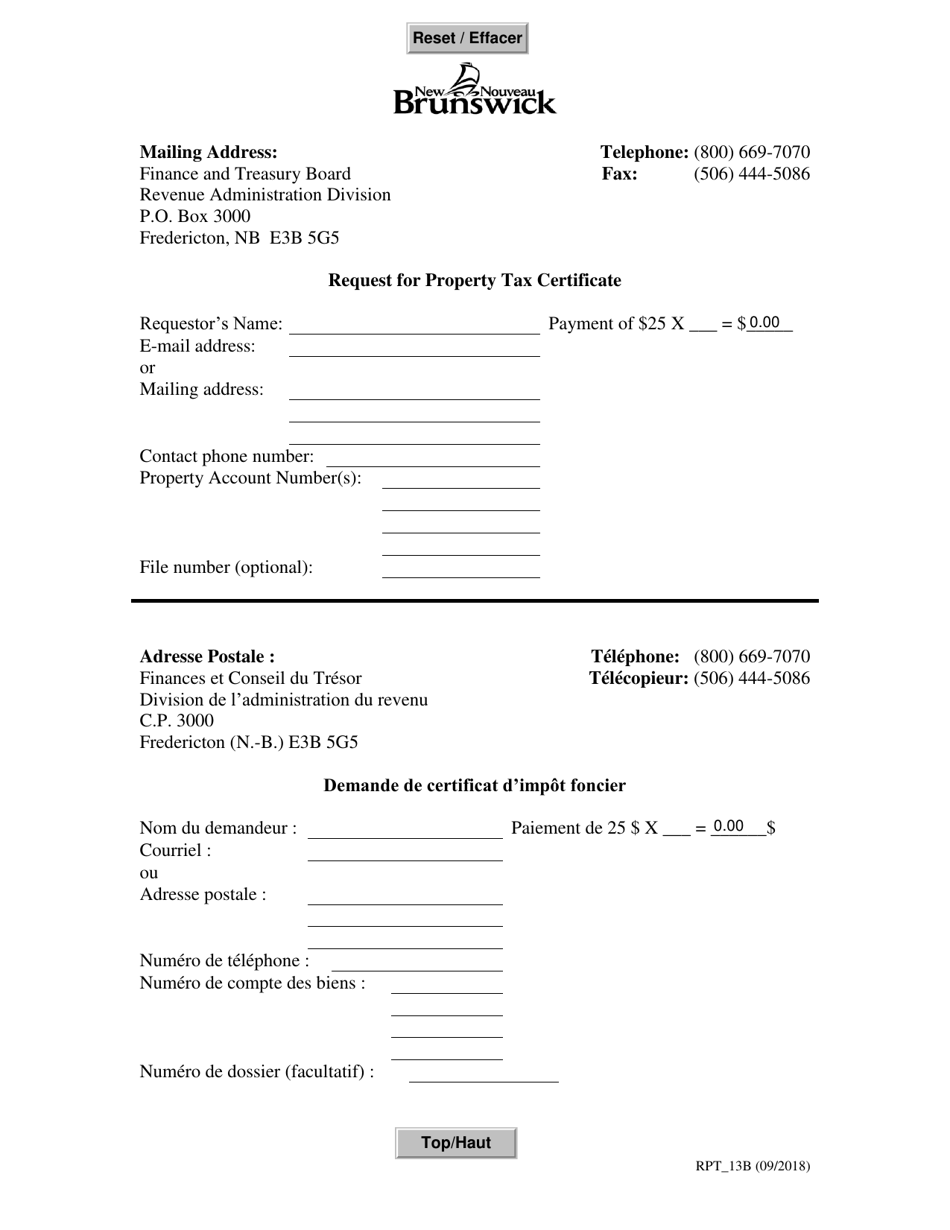

https://www2.gnb.ca/content/snb/en/sites/property-assessment/apply.html

Web Not For Profit Organizations Assessment Reduction Program To receive a reduction in the value of the property For Developers Housing Development Incentive Program For the

https://www2.gnb.ca/content/gnb/en/departments/finance/taxes/other.html

Web Between 22 001 and 25 000 you are eligible for up to a 200 rebate Between 25 001 and 30 000 you are eligible for up to a 100 rebate For more information about the

Web Not For Profit Organizations Assessment Reduction Program To receive a reduction in the value of the property For Developers Housing Development Incentive Program For the

Web Between 22 001 and 25 000 you are eligible for up to a 200 rebate Between 25 001 and 30 000 you are eligible for up to a 100 rebate For more information about the

Minneaots Income Tax Form M1prx Fill Out Sign Online DocHub

Tulsa Sales Tax Rebate Form Fill Online Printable Fillable Blank

Fillable Nebraska State Income Tax Forms Printable Forms Free Online

New Brunswick Property Assessments Are Here Blog 103 9 MAX FM

Application For Rebate Of Property Tax 2 Pages Verification Sheet

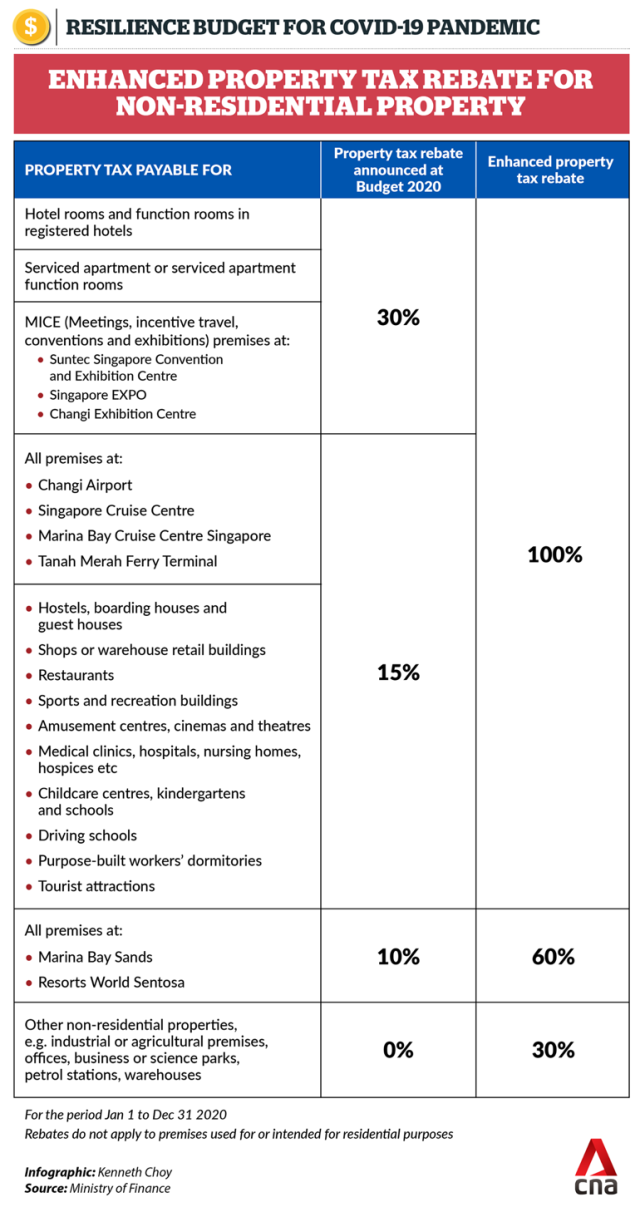

Covid 19 Property Tax Rebate To Help Individuals Business

Covid 19 Property Tax Rebate To Help Individuals Business

T1159 Fill Out Sign Online DocHub