In our current world of high-end consumer goods people love a good deal. One way to score substantial savings for your purchases is through Federal Ev Rebate Tax Forms. Federal Ev Rebate Tax Forms are an effective marketing tactic employed by retailers and manufacturers to offer customers a partial refund on purchases made after they've completed them. In this article, we'll dive into the world Federal Ev Rebate Tax Forms. We'll look at what they are and how they operate, and the best way to increase your savings with these cost-effective incentives.

Get Latest Federal Ev Rebate Tax Form Below

Federal Ev Rebate Tax Form

Federal Ev Rebate Tax Form - Federal Ev Tax Rebate Form, Federal Ev Charger Tax Credit Form, Federal Ev Tax Credit 2022 Form, Is There A Federal Ev Tax Credit, Federal Ev Rebate Eligibility, How To Claim Federal Ev Tax Credit, How Does The Federal Ev Tax Credit Work

Web 5 sept 2023 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

A Federal Ev Rebate Tax Form at its most basic model, refers to a partial payment to a consumer after having purchased a item or service. It's an effective method used by companies to attract customers, boost sales, and to promote certain products.

Types of Federal Ev Rebate Tax Form

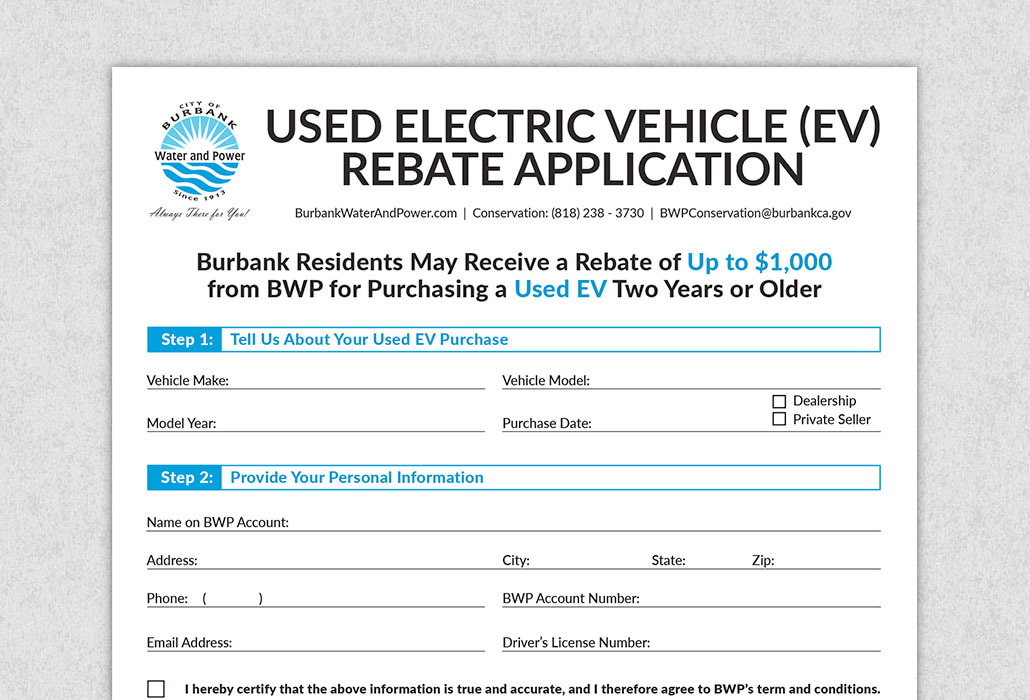

Used Electric Vehicle Rebate

Used Electric Vehicle Rebate

Web 18 avr 2023 nbsp 0183 32 Electric Vehicle EV and Fuel Cell Electric Vehicle FCEV Tax Credit The Inflation Reduction Act of 2022 Public Law 117 169 amended the Qualified Plug in

Web 5 sept 2023 nbsp 0183 32 Here s what you should know A new federal EV tax credit for 2023 is here thanks to the Inflation Reduction Act IRA massive tax and climate legislation

Cash Federal Ev Rebate Tax Form

Cash Federal Ev Rebate Tax Form are the most basic type of Federal Ev Rebate Tax Form. Customers receive a specific amount of money when purchasing a item. These are typically applied to products that are expensive, such as electronics or appliances.

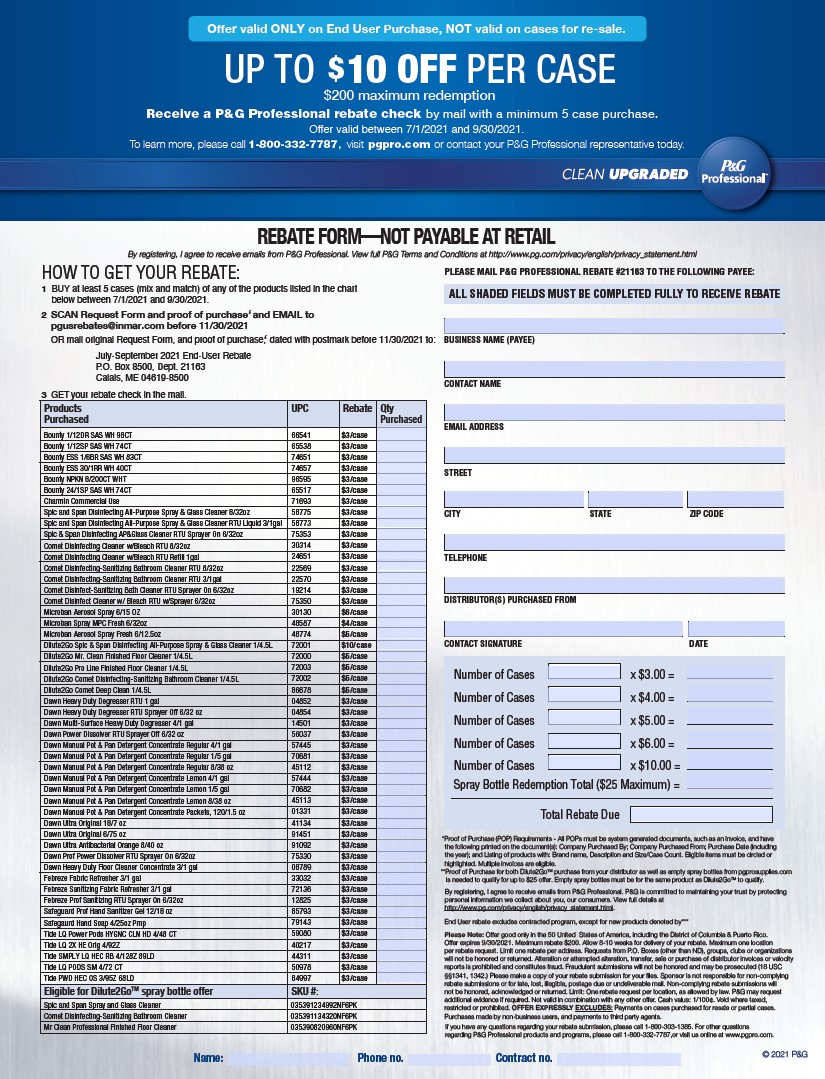

Mail-In Federal Ev Rebate Tax Form

Mail-in Federal Ev Rebate Tax Form require that customers present evidence of purchase to get the money. They're more involved but can offer significant savings.

Instant Federal Ev Rebate Tax Form

Instant Federal Ev Rebate Tax Form are applied at the point of sale and reduce your purchase cost instantly. Customers don't have to wait around for savings when they purchase this type of Federal Ev Rebate Tax Form.

How Federal Ev Rebate Tax Form Work

Federal EV 7500 Rebate For F 150 Lightning F150gen14 2021

Federal EV 7500 Rebate For F 150 Lightning F150gen14 2021

Web Pre Owned Plug in and Fuel Cell Electric Vehicles Purchased in or after 2023 Get a credit of up to 4 000 for used vehicles purchased from a dealer for 25 000 or less The

The Federal Ev Rebate Tax Form Process

The process typically involves a few simple steps

-

When you buy the product make sure you purchase the product as you normally would.

-

Complete your Federal Ev Rebate Tax Form forms: The Federal Ev Rebate Tax Form form will have provide certain information like your address, name, and information about the purchase to be eligible for a Federal Ev Rebate Tax Form.

-

You must submit the Federal Ev Rebate Tax Form The Federal Ev Rebate Tax Form must be submitted in accordance with the type of Federal Ev Rebate Tax Form you could be required to submit a claim form to the bank or send it via the internet.

-

Wait for the company's approval: They will look over your submission and ensure that it's compliant with rules and regulations of the Federal Ev Rebate Tax Form.

-

Receive your Federal Ev Rebate Tax Form After approval, you'll receive the refund whether by check, prepaid card, or any other procedure specified by the deal.

Pros and Cons of Federal Ev Rebate Tax Form

Advantages

-

Cost Savings Federal Ev Rebate Tax Form could significantly reduce the cost for a product.

-

Promotional Deals The aim is to encourage customers to test new products or brands.

-

Increase Sales Federal Ev Rebate Tax Form are a great way to boost the sales of a business and increase its market share.

Disadvantages

-

Complexity: Mail-in Federal Ev Rebate Tax Form, particularly, can be cumbersome and take a long time to complete.

-

End Dates Many Federal Ev Rebate Tax Form are subject to extremely strict deadlines to submit.

-

Risk of Non-Payment Some customers might not receive Federal Ev Rebate Tax Form if they don't follow the rules precisely.

Download Federal Ev Rebate Tax Form

Download Federal Ev Rebate Tax Form

FAQs

1. Are Federal Ev Rebate Tax Form equivalent to discounts? No, the Federal Ev Rebate Tax Form will be only a partial reimbursement following the purchase, whereas discounts cut the purchase price at the moment of sale.

2. Are there multiple Federal Ev Rebate Tax Form I can get on the same product What is the best way to do it? It's contingent on terms of Federal Ev Rebate Tax Form offers and the product's quality and eligibility. Certain businesses may allow it, while others won't.

3. How long does it take to get a Federal Ev Rebate Tax Form? The period differs, but it can take anywhere from a couple of weeks to a several months to receive a Federal Ev Rebate Tax Form.

4. Do I have to pay taxes on Federal Ev Rebate Tax Form amounts? In most situations, Federal Ev Rebate Tax Form amounts are not considered taxable income.

5. Should I be able to trust Federal Ev Rebate Tax Form offers from lesser-known brands It is essential to investigate and confirm that the company providing the Federal Ev Rebate Tax Form is legitimate prior to making an acquisition.

Property Tax Rebate Application Printable Pdf Download

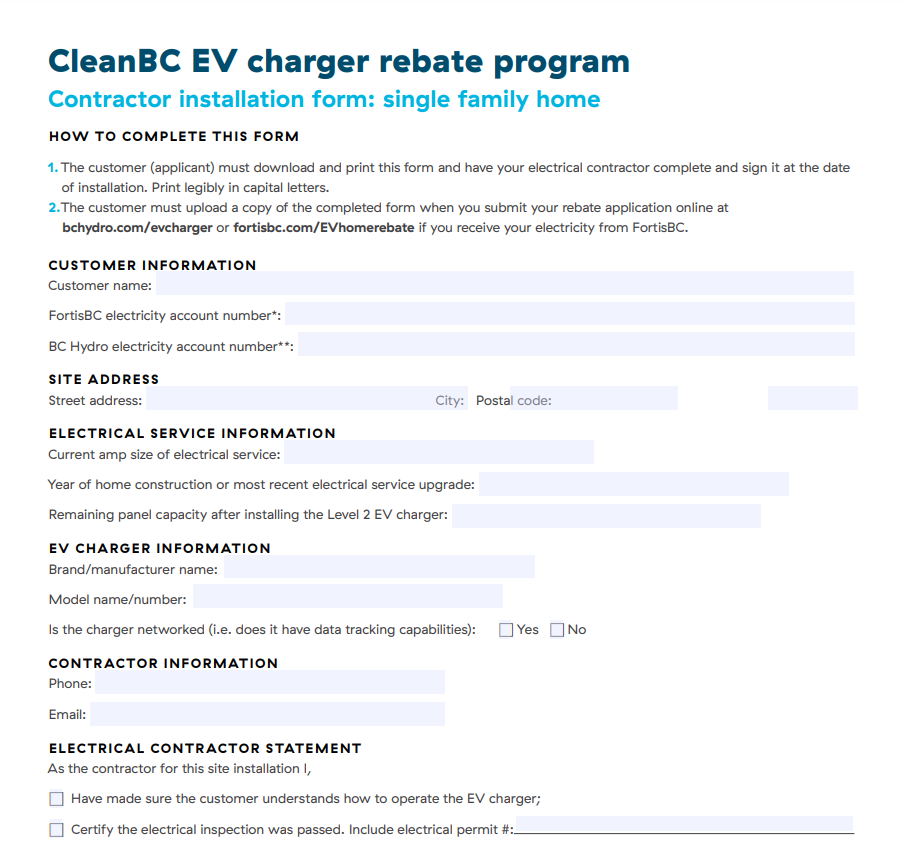

Ontario Ev Charger Rebate Form By State Printable Rebate Form

Check more sample of Federal Ev Rebate Tax Form below

Ok Natural Gas Rebate Energy Fill Online Printable Fillable Blank

California s EV Rebate Changes A Good Model For The Federal EV Tax

Top 19 Mor ev Application Form En Iyi 2022

Ev Federal Tax Credit Form FederalProTalk

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

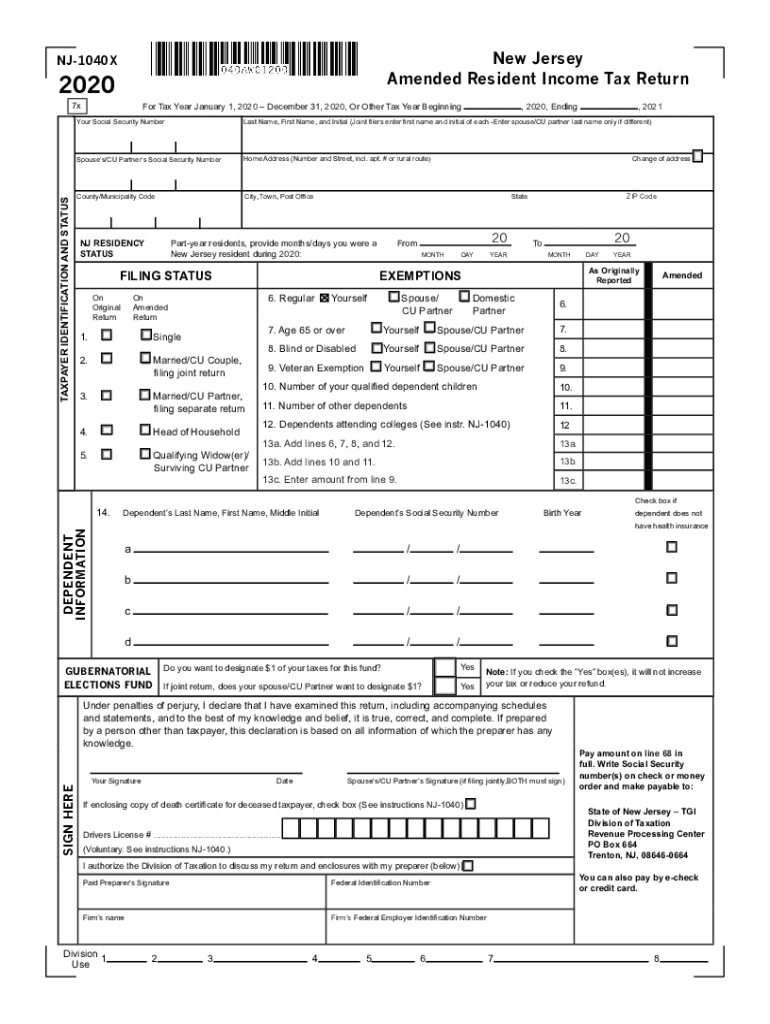

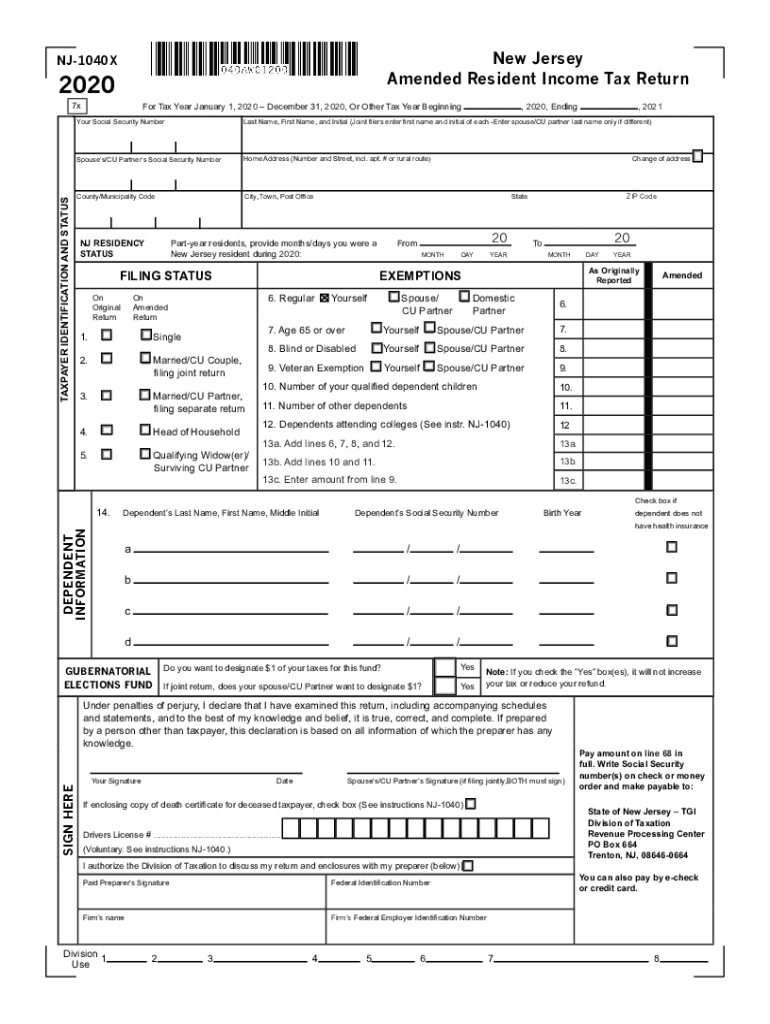

2020 Form NJ DoT NJ 1040x Fill Online Printable Fillable Blank

https://www.irs.gov/credits-deductions/credits-for-new-electric...

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

https://www.irs.gov/credits-deductions/used-clean-vehicle-credit

Web Used Clean Vehicle Credit Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Web Used Clean Vehicle Credit Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you

Ev Federal Tax Credit Form FederalProTalk

California s EV Rebate Changes A Good Model For The Federal EV Tax

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

2020 Form NJ DoT NJ 1040x Fill Online Printable Fillable Blank

Filing Tax Returns EV Credits Tesla Motors Club

Ev Car Tax Rebate Calculator 2022 Carrebate

Ev Car Tax Rebate Calculator 2022 Carrebate

Latina Mcneal