In the modern world of consumerization everybody loves a good deal. One method to get substantial savings on your purchases is to use Nhs Tax Rebate Forms. Nhs Tax Rebate Forms are a method of marketing employed by retailers and manufacturers in order to offer customers a small cash back on their purchases once they have placed them. In this post, we'll delve into the world of Nhs Tax Rebate Forms and explore what they are, how they work, and ways to maximize the savings you can make by using these cost-effective incentives.

Get Latest Nhs Tax Rebate Form Below

Nhs Tax Rebate Form

Nhs Tax Rebate Form -

Web 15 ao 251 t 2014 nbsp 0183 32 Details If you ve paid too much tax and want to claim back the over payment use form R38 You can also use this form to authorise a representative to get the

Web 19 d 233 c 2016 nbsp 0183 32 HMRC no longer processes requests for tax and National Insurance contributions refunds relating to NHS WATS courses You should not process any refund

A Nhs Tax Rebate Form as it is understood in its simplest definition, is a return to the customer when they purchase a product or service. It is a powerful tool utilized by businesses to attract customers, increase sales, and advertise specific products.

Types of Nhs Tax Rebate Form

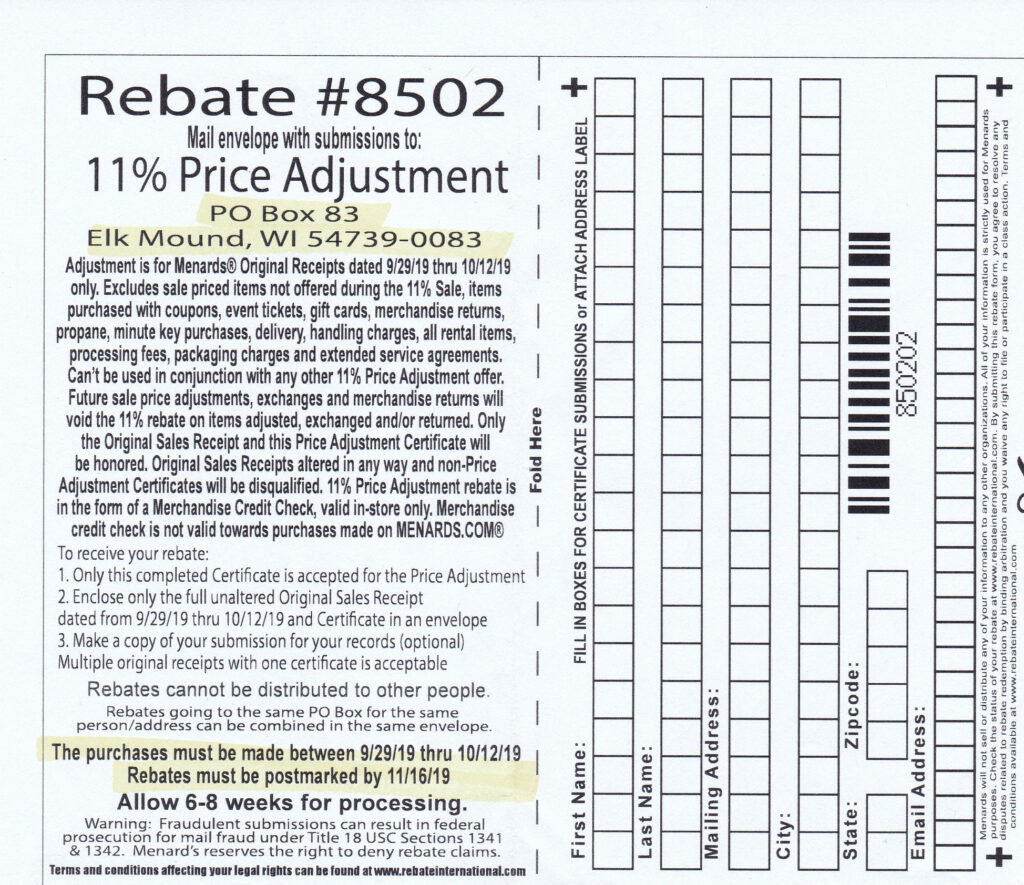

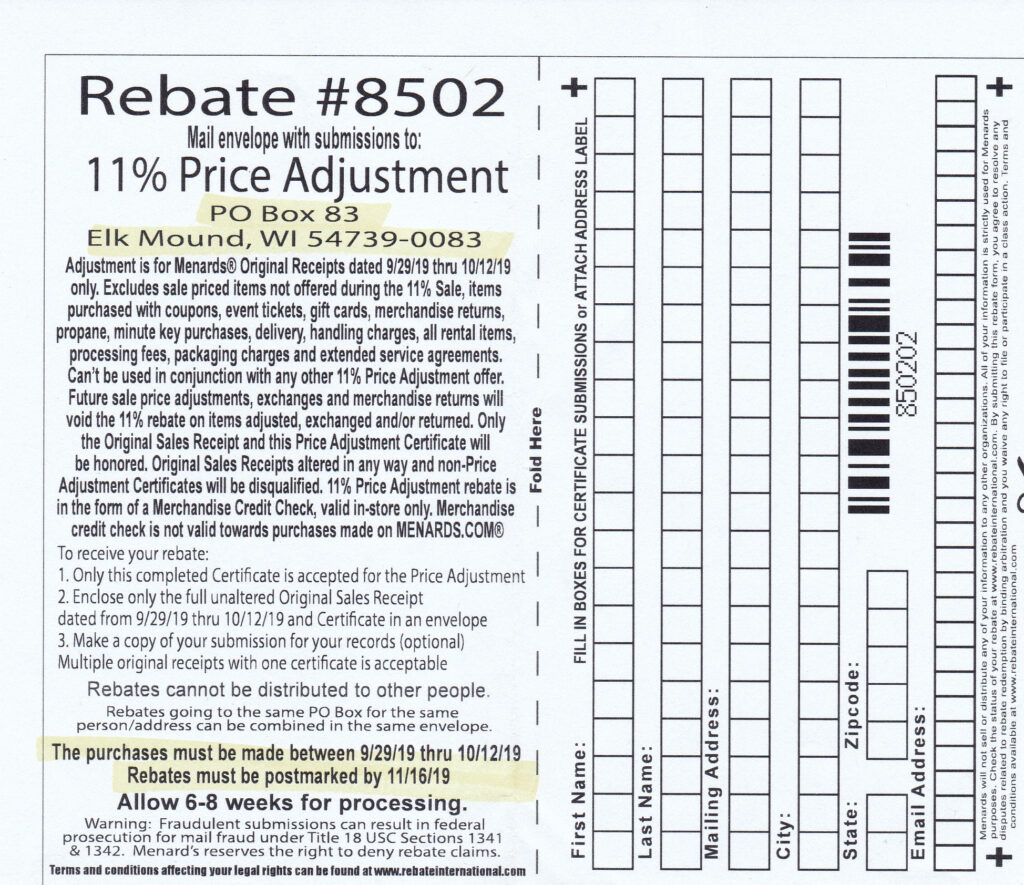

Menards Rebate Form 6564 MenardsRebate Form

Menards Rebate Form 6564 MenardsRebate Form

Web Healthcare Worker Tax Rebate Guide Private sector and NHS healthcare professionals qualify for a Healthcare Worker Tax Rebate We ll make sure you get yours Whatever

Web 84 lignes nbsp 0183 32 1 janv 2015 nbsp 0183 32 Income Tax Guidance Check how much tax relief you can claim for uniforms work clothing and tools Use this list to check if you can claim a fixed amount

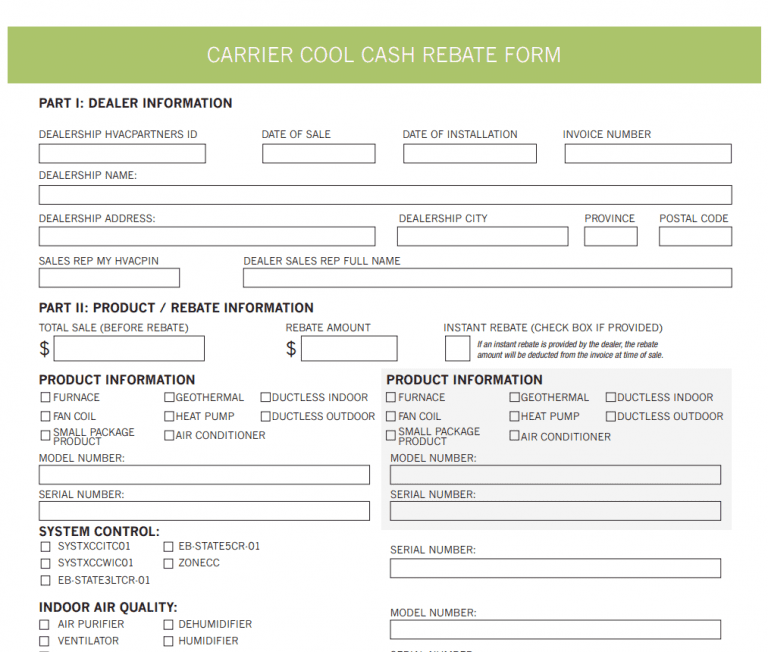

Cash Nhs Tax Rebate Form

Cash Nhs Tax Rebate Form are the most straightforward kind of Nhs Tax Rebate Form. Customers receive a specific amount of money after buying a product. These are typically applied to large-ticket items such as electronics and appliances.

Mail-In Nhs Tax Rebate Form

Mail-in Nhs Tax Rebate Form require consumers to present evidence of purchase to get their reimbursement. They're a bit more involved but can offer significant savings.

Instant Nhs Tax Rebate Form

Instant Nhs Tax Rebate Form are applied at the point of sale. They reduce the purchase price immediately. Customers do not have to wait around for savings through this kind of offer.

How Nhs Tax Rebate Form Work

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

Web 12 avr 2019 nbsp 0183 32 How to make your claim Making backdated work expense claims What are Tax Deductible Expenses If you are employed by the NHS and pay for work expenses

The Nhs Tax Rebate Form Process

The procedure usually involves a handful of simple steps:

-

Purchase the item: First you buy the product as you normally would.

-

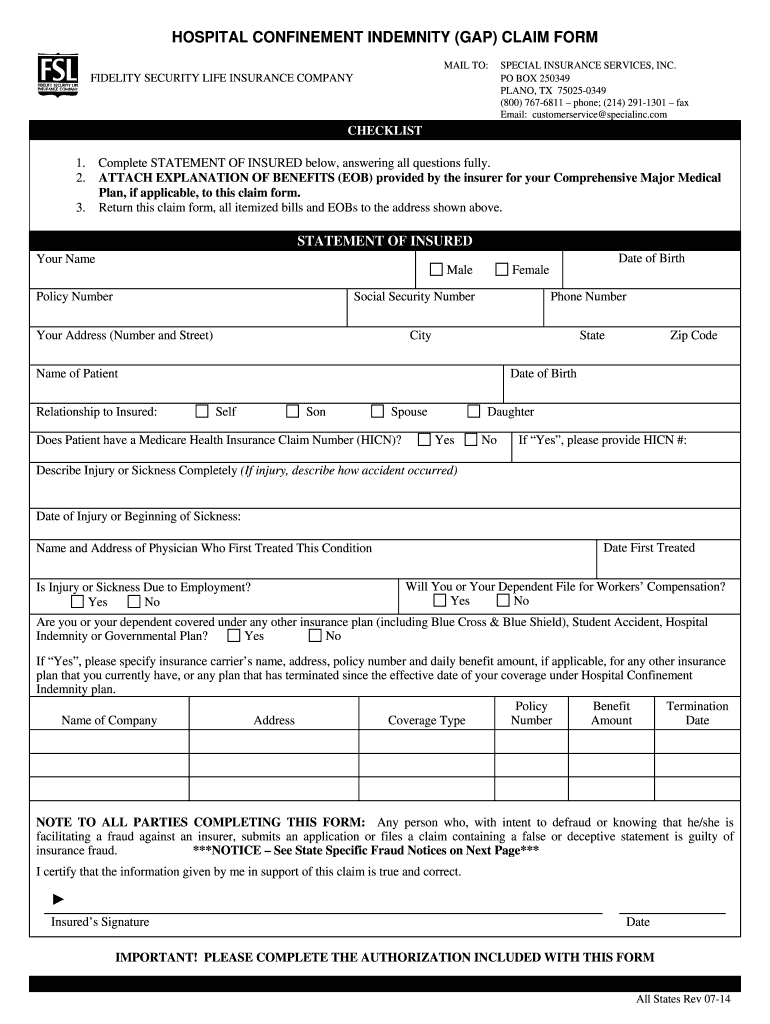

Fill out this Nhs Tax Rebate Form Form: To claim the Nhs Tax Rebate Form you'll need be able to provide a few details including your address, name, as well as the details of your purchase to apply for your Nhs Tax Rebate Form.

-

In order to submit the Nhs Tax Rebate Form The Nhs Tax Rebate Form must be submitted in accordance with the kind of Nhs Tax Rebate Form you might need to send in a form, or send it via the internet.

-

Wait for approval: The business will evaluate your claim to make sure that it's in accordance with the requirements of the Nhs Tax Rebate Form.

-

Pay your Nhs Tax Rebate Form After approval, you'll get your refund, whether via check, credit card, or another method as specified by the offer.

Pros and Cons of Nhs Tax Rebate Form

Advantages

-

Cost savings: Nhs Tax Rebate Form can significantly decrease the price for an item.

-

Promotional Deals: They encourage customers to try new products or brands.

-

Boost Sales Nhs Tax Rebate Form can help boost the company's sales as well as market share.

Disadvantages

-

Complexity: Mail-in Nhs Tax Rebate Form, particularly is a time-consuming process and demanding.

-

Days of expiration Some Nhs Tax Rebate Form have certain deadlines for submitting.

-

Risk of Not Being Paid Certain customers could not get their Nhs Tax Rebate Form if they do not follow the rules exactly.

Download Nhs Tax Rebate Form

FAQs

1. Are Nhs Tax Rebate Form similar to discounts? Not necessarily, as Nhs Tax Rebate Form are only a partial reimbursement following the purchase, whereas discounts decrease the price of the purchase at the time of sale.

2. Are there multiple Nhs Tax Rebate Form I can get on the same item The answer is dependent on the conditions and conditions of Nhs Tax Rebate Form offers and the product's admissibility. Certain businesses may allow it, and some don't.

3. How long will it take to get a Nhs Tax Rebate Form? The period will differ, but can take anywhere from a couple of weeks to a couple of months before you get your Nhs Tax Rebate Form.

4. Do I need to pay tax on Nhs Tax Rebate Form values? the majority of instances, Nhs Tax Rebate Form amounts are not considered taxable income.

5. Do I have confidence in Nhs Tax Rebate Form offers from lesser-known brands It's important to do your research and confirm that the company that is offering the Nhs Tax Rebate Form is reputable prior making the purchase.

Supplier Rebate Agreement Template

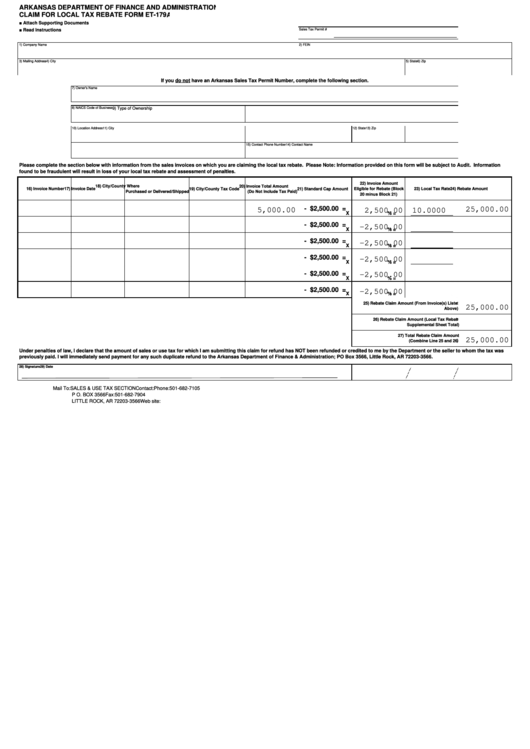

Fillable Form Et 179a Claim For Local Tax Rebate Printable Pdf Download

Check more sample of Nhs Tax Rebate Form below

Government Rebate Program Fill Out Sign Online DocHub

How To Fill Out Form To Get Stimulus Check Printable Rebate Form

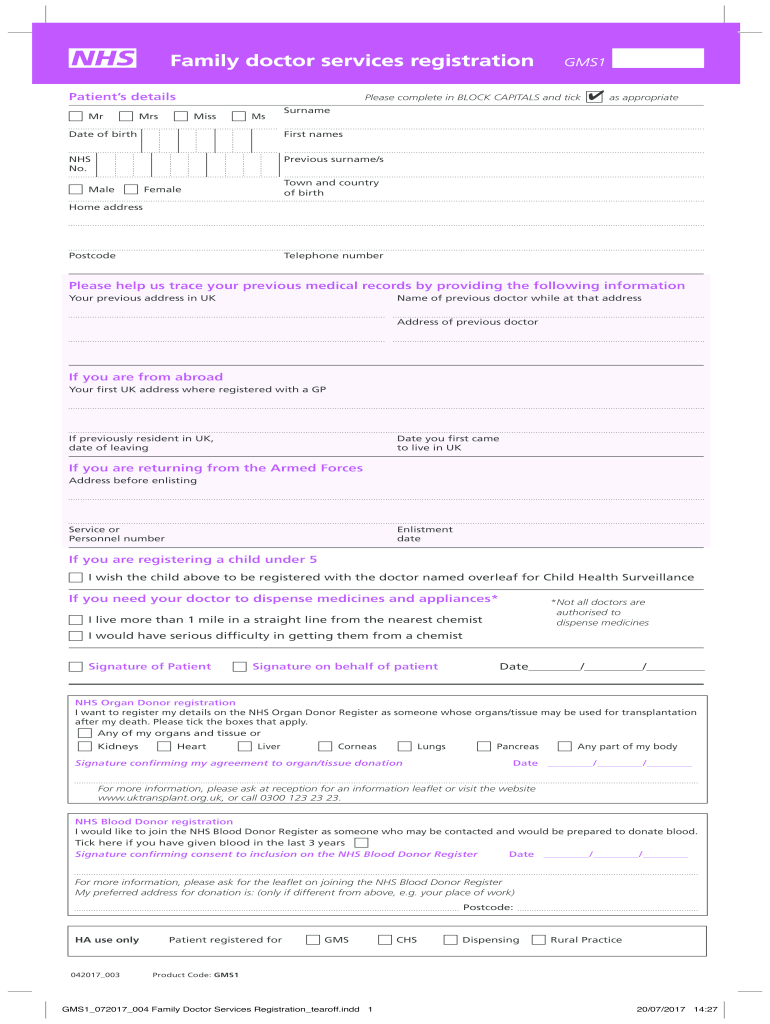

2017 Form UK NHS GMS1 Fill Online Printable Fillable Blank PdfFiller

Tulsa Sales Tax Rebate Form Fill Out Sign Online DocHub

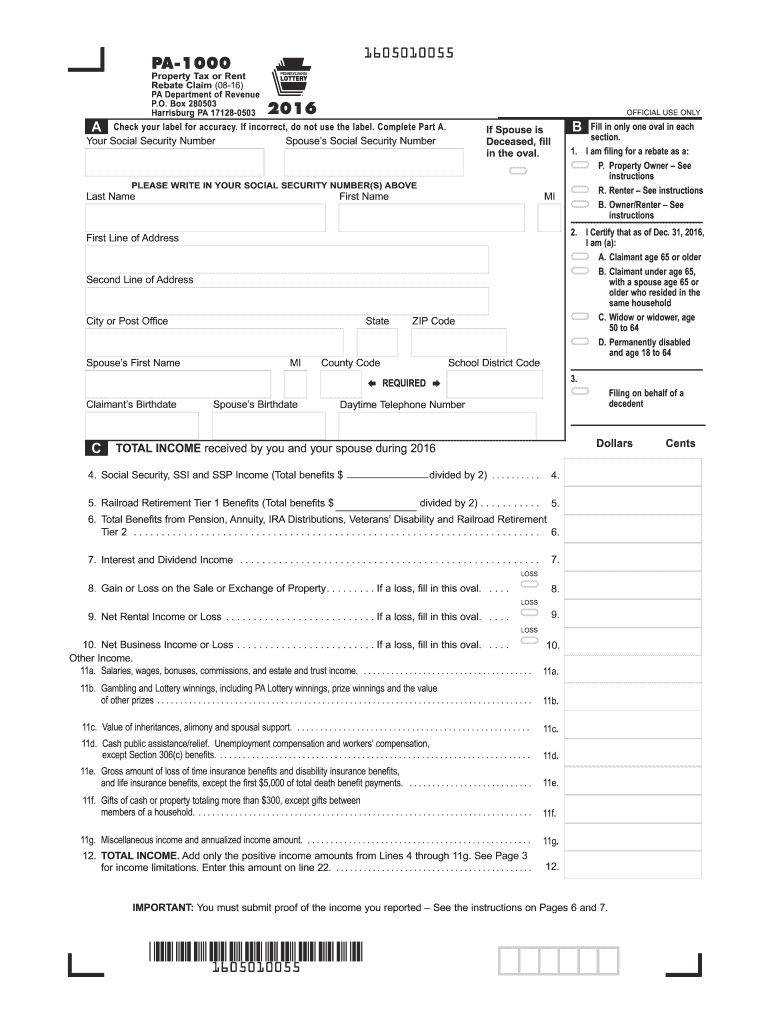

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

https://www.gov.uk/guidance/widening-access-training-scheme-refunds...

Web 19 d 233 c 2016 nbsp 0183 32 HMRC no longer processes requests for tax and National Insurance contributions refunds relating to NHS WATS courses You should not process any refund

https://www.unison.org.uk/news/article/2022/07/tax-relief-for-nhs...

Web 21 juil 2022 nbsp 0183 32 Make sure you don t lose out Resources to help members get tax relief Tax Relief FAQs Tax Relief Claim Form Tax Relief Leaflet and Claim Form Find out

Web 19 d 233 c 2016 nbsp 0183 32 HMRC no longer processes requests for tax and National Insurance contributions refunds relating to NHS WATS courses You should not process any refund

Web 21 juil 2022 nbsp 0183 32 Make sure you don t lose out Resources to help members get tax relief Tax Relief FAQs Tax Relief Claim Form Tax Relief Leaflet and Claim Form Find out

Tulsa Sales Tax Rebate Form Fill Out Sign Online DocHub

How To Fill Out Form To Get Stimulus Check Printable Rebate Form

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

Carrier Rebates 2022 Printable Rebate Form

Fillable Pa 40 Fill Out Sign Online DocHub

Fillable Pa 40 Fill Out Sign Online DocHub

Combined Insurance Printable Claim Forms Printable Forms Free Online