Today, in a world that is driven by the consumer we all love a good bargain. One way to score substantial savings on your purchases can be achieved through 2023 Tax Form 1040 Recovery Rebate Credits. 2023 Tax Form 1040 Recovery Rebate Credits are a method of marketing employed by retailers and manufacturers in order to offer customers a small refund on purchases made after they have completed them. In this article, we'll investigate the world of 2023 Tax Form 1040 Recovery Rebate Credits, examining the nature of them and how they operate, and how you can maximise your savings through these efficient incentives.

Get Latest 2023 Tax Form 1040 Recovery Rebate Credit Below

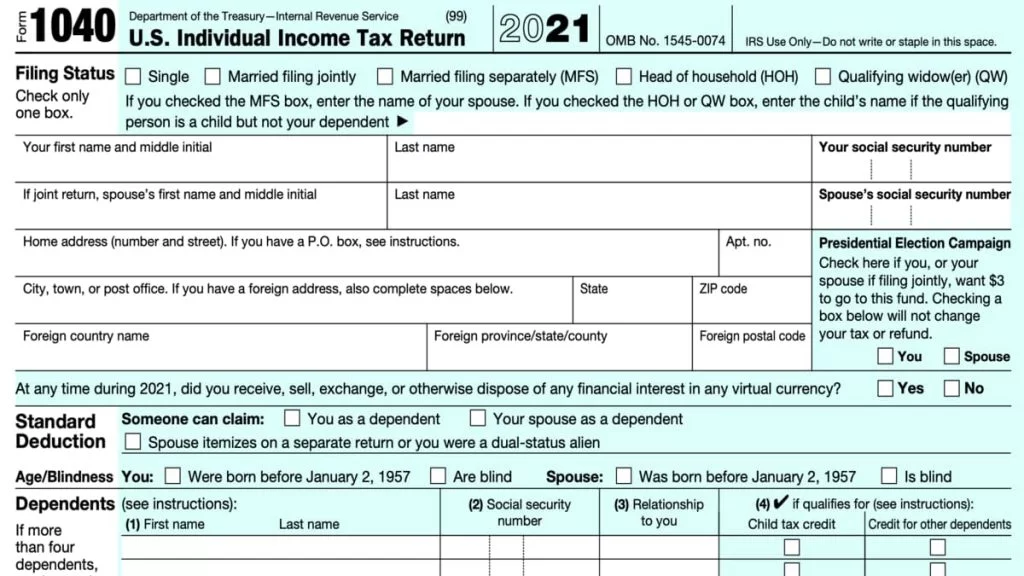

2023 Tax Form 1040 Recovery Rebate Credit

2023 Tax Form 1040 Recovery Rebate Credit -

Web 24 Aug 2023 nbsp 0183 32 Processing of Recovery Rebate Credit Claims During the 2022 Filing Season Background The American Rescue Plan Act of 2021 ARPA signed into law on

Web 11 Mai 2023 nbsp 0183 32 Recovery Rebate credits are distributed to taxpayers eligible for them in advance This means that if you owe an amount of tax that is higher in 2020 than in

A 2023 Tax Form 1040 Recovery Rebate Credit is, in its most basic definition, is a refund offered to a customer after having purchased a item or service. It's a highly effective tool used by businesses to attract buyers, increase sales and advertise specific products.

Types of 2023 Tax Form 1040 Recovery Rebate Credit

IRS Form 1040 Individual Income Tax Return 2022 NerdWallet Recovery

IRS Form 1040 Individual Income Tax Return 2022 NerdWallet Recovery

Web The 2021 Child Tax Credit is up to 3 600 for each qualifying child Eligible families including families in Puerto Rico can claim the credit through April 15 2025 by filing a

Web 13 Jan 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

Cash 2023 Tax Form 1040 Recovery Rebate Credit

Cash 2023 Tax Form 1040 Recovery Rebate Credit can be the simplest type of 2023 Tax Form 1040 Recovery Rebate Credit. The customer receives a particular amount of money back after buying a product. These are typically for more expensive items such electronics or appliances.

Mail-In 2023 Tax Form 1040 Recovery Rebate Credit

Mail-in 2023 Tax Form 1040 Recovery Rebate Credit require that customers present documents of purchase to claim the refund. They're somewhat more involved, but can result in huge savings.

Instant 2023 Tax Form 1040 Recovery Rebate Credit

Instant 2023 Tax Form 1040 Recovery Rebate Credit are applied at point of sale, and can reduce your purchase cost instantly. Customers don't have to wait around for savings with this type.

How 2023 Tax Form 1040 Recovery Rebate Credit Work

Form It 2023 Income Allocation And Apportionment Printable Pdf Download

Form It 2023 Income Allocation And Apportionment Printable Pdf Download

Web Updated for filing 2021 tax returns What is the Recovery Rebate Credit The Recovery Rebate Credit makes it possible for any eligible individual who did not receive an

The 2023 Tax Form 1040 Recovery Rebate Credit Process

The process usually involves a few simple steps:

-

Purchase the product: Then you purchase the product just as you would ordinarily.

-

Complete your 2023 Tax Form 1040 Recovery Rebate Credit paper: You'll have to supply some details including your name, address, and the purchase details, in order to apply for your 2023 Tax Form 1040 Recovery Rebate Credit.

-

To submit the 2023 Tax Form 1040 Recovery Rebate Credit: Depending on the nature of 2023 Tax Form 1040 Recovery Rebate Credit you might need to submit a form by mail or send it via the internet.

-

Wait for approval: The company will review your submission for compliance with reimbursement's terms and condition.

-

Redeem your 2023 Tax Form 1040 Recovery Rebate Credit Once you've received your approval, you'll receive a refund in the form of a check, prepaid card, or a different procedure specified by the deal.

Pros and Cons of 2023 Tax Form 1040 Recovery Rebate Credit

Advantages

-

Cost Savings Rewards can drastically reduce the cost for an item.

-

Promotional Deals These deals encourage customers to try new items or brands.

-

increase sales The benefits of a 2023 Tax Form 1040 Recovery Rebate Credit can improve the sales of a business and increase its market share.

Disadvantages

-

Complexity Reward mail-ins particularly the case of HTML0, can be a hassle and lengthy.

-

Deadlines for Expiration A lot of 2023 Tax Form 1040 Recovery Rebate Credit have extremely strict deadlines to submit.

-

Risk of not receiving payment Some customers might not receive 2023 Tax Form 1040 Recovery Rebate Credit if they don't follow the regulations exactly.

Download 2023 Tax Form 1040 Recovery Rebate Credit

Download 2023 Tax Form 1040 Recovery Rebate Credit

FAQs

1. Are 2023 Tax Form 1040 Recovery Rebate Credit the same as discounts? No, they are an amount of money that is refunded after the purchase, and discounts are a reduction of your purchase cost at point of sale.

2. Do I have to use multiple 2023 Tax Form 1040 Recovery Rebate Credit for the same product? It depends on the conditions of the 2023 Tax Form 1040 Recovery Rebate Credit offers and the product's acceptance. Certain companies might allow it, while others won't.

3. What is the time frame to receive an 2023 Tax Form 1040 Recovery Rebate Credit? The length of time varies, but it can take anywhere from a couple of weeks to a few months to get your 2023 Tax Form 1040 Recovery Rebate Credit.

4. Do I have to pay taxes when I receive 2023 Tax Form 1040 Recovery Rebate Credit amounts? In most instances, 2023 Tax Form 1040 Recovery Rebate Credit amounts are not considered taxable income.

5. Should I be able to trust 2023 Tax Form 1040 Recovery Rebate Credit deals from lesser-known brands You must research and make sure that the company which is providing the 2023 Tax Form 1040 Recovery Rebate Credit is credible prior to making an acquisition.

What Is The Recovery Rebate Credit CD Tax Financial

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

Check more sample of 2023 Tax Form 1040 Recovery Rebate Credit below

Form 1040 SE 2023

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Recovery Rebate Credit Irs Form Recovery Rebate

1040 EF Message 0006 Recovery Rebate Credit Drake20

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

2022 Form 1040 Recovery Rebate Credit Worksheet Recovery Rebate

https://www.recoveryrebate.net/recovery-rebate-credit-on-your-2023-tax...

Web 11 Mai 2023 nbsp 0183 32 Recovery Rebate credits are distributed to taxpayers eligible for them in advance This means that if you owe an amount of tax that is higher in 2020 than in

https://www.greenbacktaxservices.com/blog/recovery-rebate-credit

Web 8 M 228 rz 2022 nbsp 0183 32 Who Is Eligible to Claim the Recovery Rebate Credit When considering the Recovery Rebate Credit the first question to answer is who was eligible for the

Web 11 Mai 2023 nbsp 0183 32 Recovery Rebate credits are distributed to taxpayers eligible for them in advance This means that if you owe an amount of tax that is higher in 2020 than in

Web 8 M 228 rz 2022 nbsp 0183 32 Who Is Eligible to Claim the Recovery Rebate Credit When considering the Recovery Rebate Credit the first question to answer is who was eligible for the

1040 EF Message 0006 Recovery Rebate Credit Drake20

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

2022 Form 1040 Recovery Rebate Credit Worksheet Recovery Rebate

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png)

Formulaire 1040 SR Les Personnes g es Re oivent Un Nouveau

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Massachusetts Agi Worksheet Speed Test Site

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Massachusetts Agi Worksheet Speed Test Site

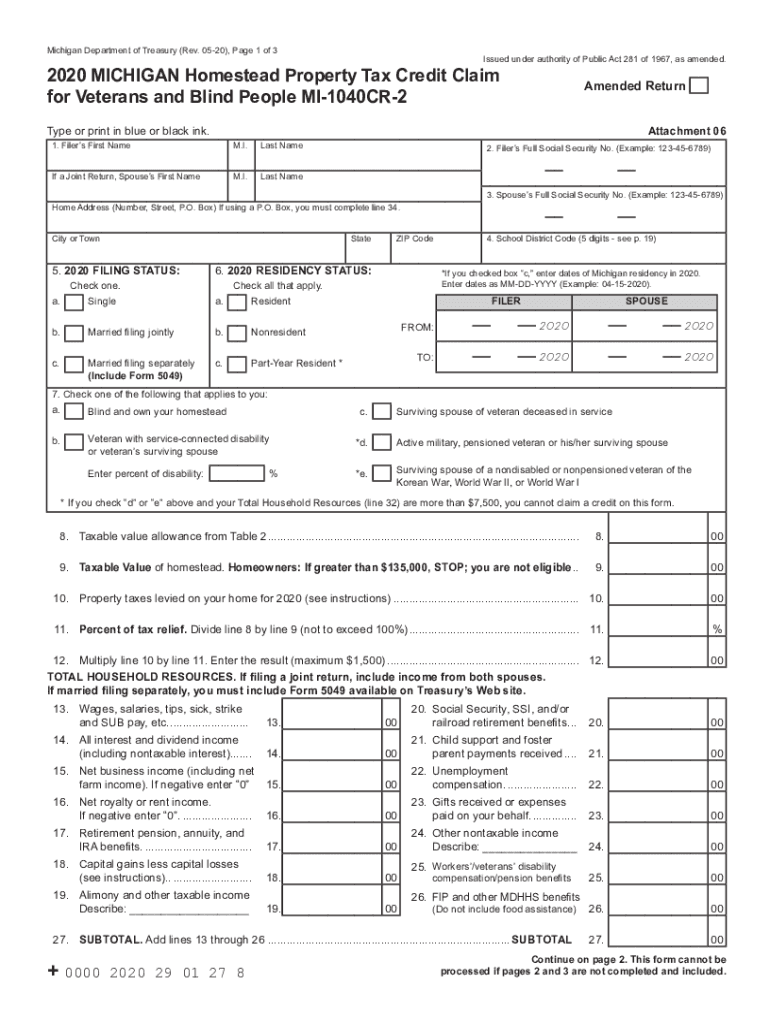

Mi 1040cr 2 Fill Out Sign Online DocHub