In today's world of consumerism, everyone loves a good deal. One method of gaining significant savings when you shop is with Irs Stimulus Rebate Forms. Irs Stimulus Rebate Forms are an effective marketing tactic employed by retailers and manufacturers to offer consumers a partial payment on their purchases, after they have bought them. In this article, we'll examine the subject of Irs Stimulus Rebate Forms. We'll look at what they are and how they operate, and the best way to increase your savings through these cost-effective incentives.

Get Latest Irs Stimulus Rebate Form Below

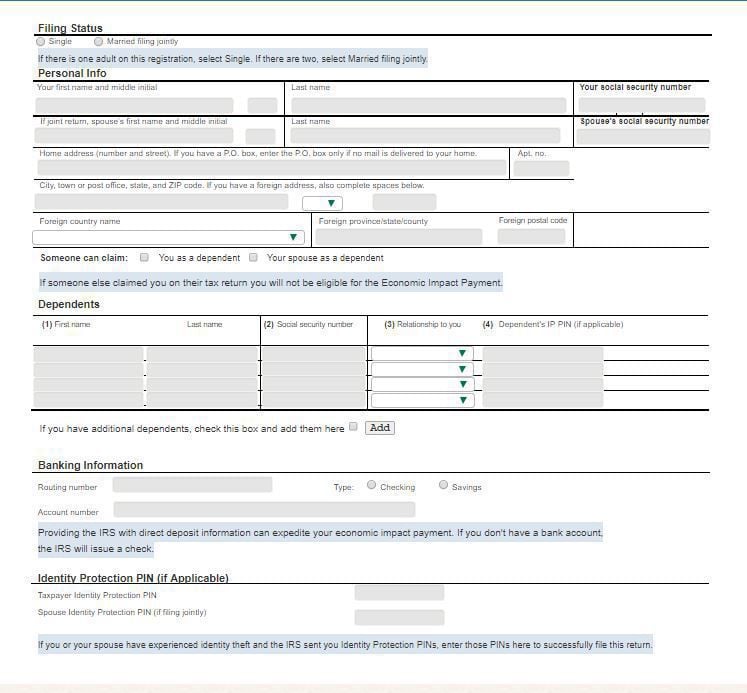

Irs Stimulus Rebate Form

Irs Stimulus Rebate Form - Irs Stimulus Refund Form, Irs Stimulus Payments Claim Form

Web 10 Dez 2021 nbsp 0183 32 A3 You must file a 2020 tax return to claim a Recovery Rebate Credit even if you don t usually file a tax return The Recovery Rebate Credit Worksheet in the 2020

Web 15 M 228 rz 2023 nbsp 0183 32 Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the

A Irs Stimulus Rebate Form, in its simplest model, refers to a partial reimbursement to a buyer after having purchased a item or service. It's a powerful instrument that companies use to attract buyers, increase sales or promote a specific product.

Types of Irs Stimulus Rebate Form

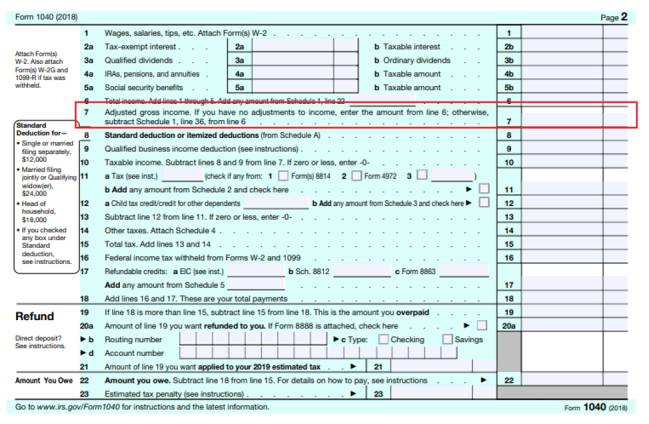

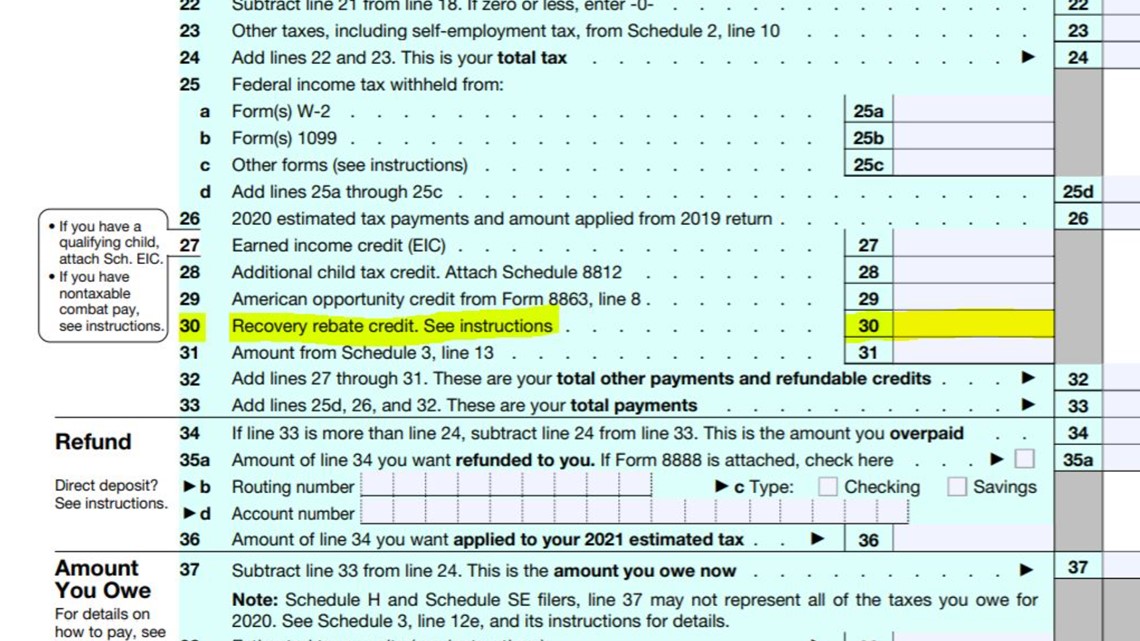

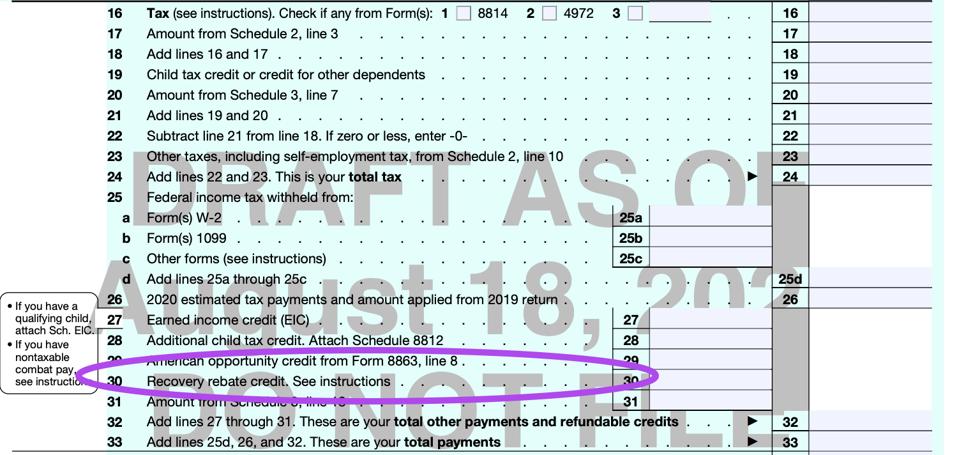

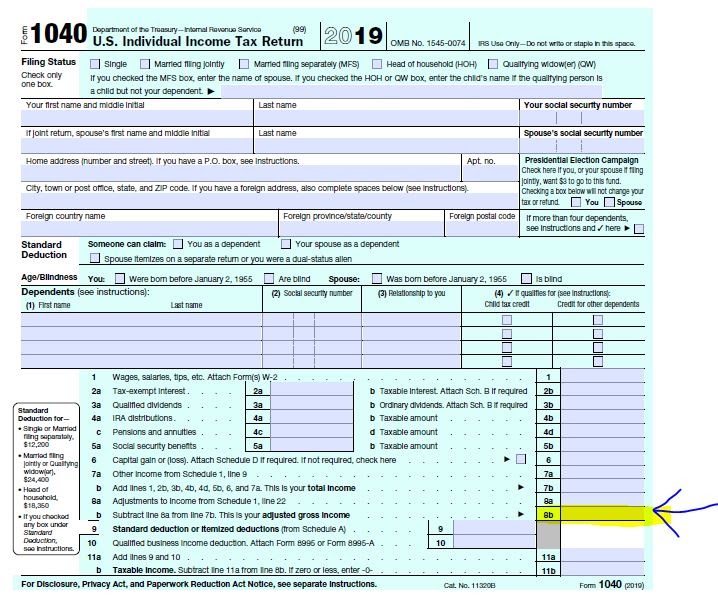

IRS Releases Draft Form 1040 Here s What s New For 2020

IRS Releases Draft Form 1040 Here s What s New For 2020

Web The IRS has issued all first second and third Economic Impact Payments Most eligible people already received their Economic Impact Payments People who are missing

Web See the special section on IRS gov about claiming the Recovery Rebate Credit if you aren t required to file a tax return Learn more at 2020 Recovery Rebate Credit Frequently

Cash Irs Stimulus Rebate Form

Cash Irs Stimulus Rebate Form are a simple type of Irs Stimulus Rebate Form. Customers get a set amount of money when purchasing a product. They are typically used to purchase large-ticket items such as electronics and appliances.

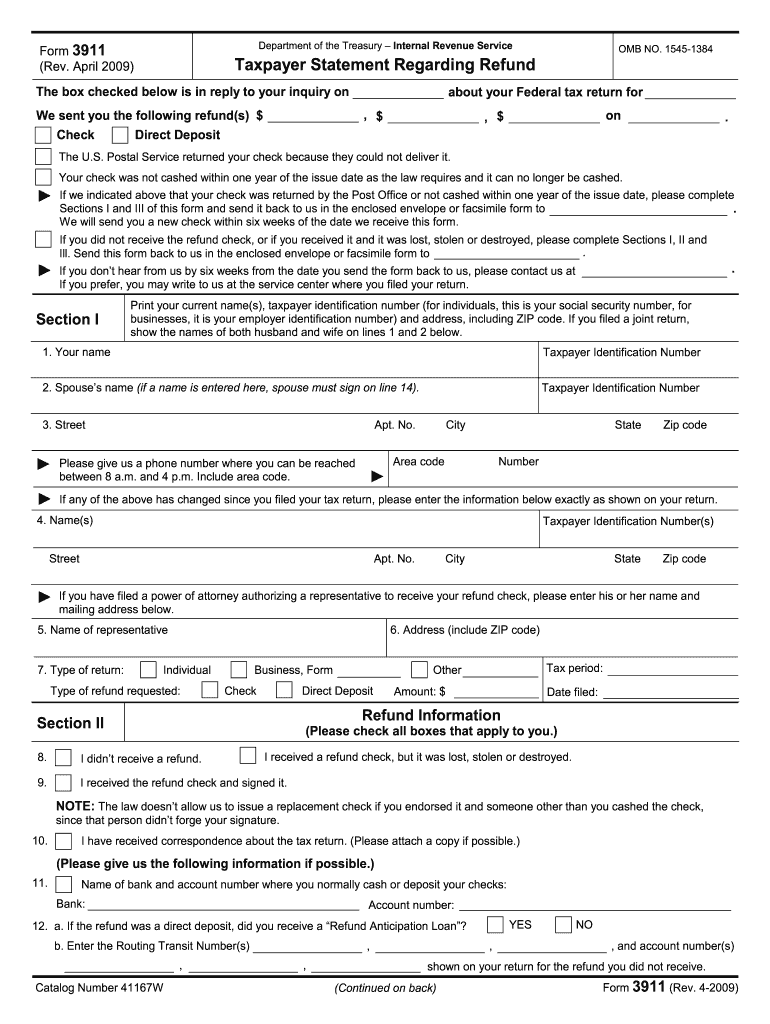

Mail-In Irs Stimulus Rebate Form

Mail-in Irs Stimulus Rebate Form require consumers to provide evidence of purchase to get the refund. They're a bit more involved but can offer substantial savings.

Instant Irs Stimulus Rebate Form

Instant Irs Stimulus Rebate Form are made at the point of sale and reduce the purchase cost immediately. Customers don't need to wait long for savings in this manner.

How Irs Stimulus Rebate Form Work

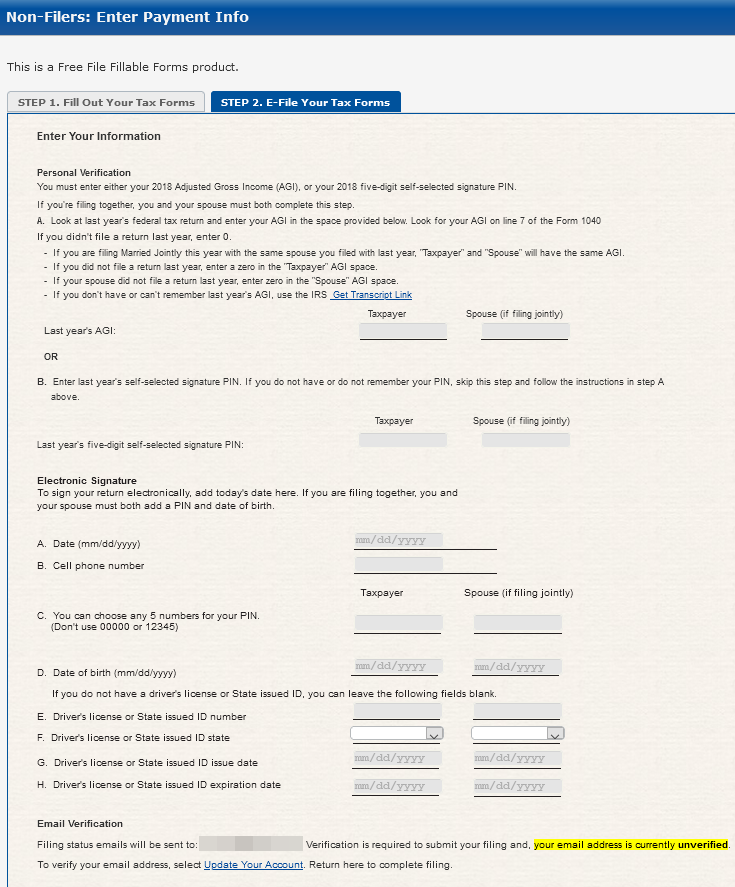

Legal Structure Free Fillable Forms Stimulus Check

Legal Structure Free Fillable Forms Stimulus Check

Web The Coronavirus Aid Relief and Economic Security CARES Act established Internal Revenue Code IRC section 6428 2020 Recovery Rebates for Individuals which can

The Irs Stimulus Rebate Form Process

The procedure usually involves a number of easy steps:

-

Purchase the product: First purchase the product exactly as you would normally.

-

Fill out your Irs Stimulus Rebate Form paper: You'll have submit some information including your name, address and purchase information, to submit your Irs Stimulus Rebate Form.

-

Send in the Irs Stimulus Rebate Form It is dependent on the kind of Irs Stimulus Rebate Form you might need to submit a claim form to the bank or upload it online.

-

Wait for the company's approval: They will examine your application to ensure it meets the Irs Stimulus Rebate Form's terms and conditions.

-

You will receive your Irs Stimulus Rebate Form Once it's approved, you'll receive your money back, either by check, prepaid card, or other option that's specified in the offer.

Pros and Cons of Irs Stimulus Rebate Form

Advantages

-

Cost Savings The use of Irs Stimulus Rebate Form can greatly reduce the price you pay for the item.

-

Promotional Offers they encourage their customers to try new products or brands.

-

Accelerate Sales Reward programs can boost the sales of a company as well as its market share.

Disadvantages

-

Complexity Mail-in Irs Stimulus Rebate Form in particular the case of HTML0, can be a hassle and take a long time to complete.

-

Expiration Dates Many Irs Stimulus Rebate Form impose strict time limits for submission.

-

A risk of not being paid Customers may miss out on Irs Stimulus Rebate Form because they don't comply with the rules precisely.

Download Irs Stimulus Rebate Form

Download Irs Stimulus Rebate Form

FAQs

1. Are Irs Stimulus Rebate Form equivalent to discounts? Not necessarily, as Irs Stimulus Rebate Form are one-third of the amount refunded following purchase whereas discounts will reduce their price at moment of sale.

2. Can I use multiple Irs Stimulus Rebate Form on the same product What is the best way to do it? It's contingent on terms on the Irs Stimulus Rebate Form offers and the product's suitability. Certain companies may permit it, while others won't.

3. What is the time frame to receive an Irs Stimulus Rebate Form? The amount of time will differ, but can take several weeks to a few months before you receive your Irs Stimulus Rebate Form.

4. Do I need to pay taxes regarding Irs Stimulus Rebate Form sums? the majority of situations, Irs Stimulus Rebate Form amounts are not considered taxable income.

5. Do I have confidence in Irs Stimulus Rebate Form offers from lesser-known brands Do I need to conduct a thorough research and confirm that the company offering the Irs Stimulus Rebate Form is trustworthy prior to making an acquisition.

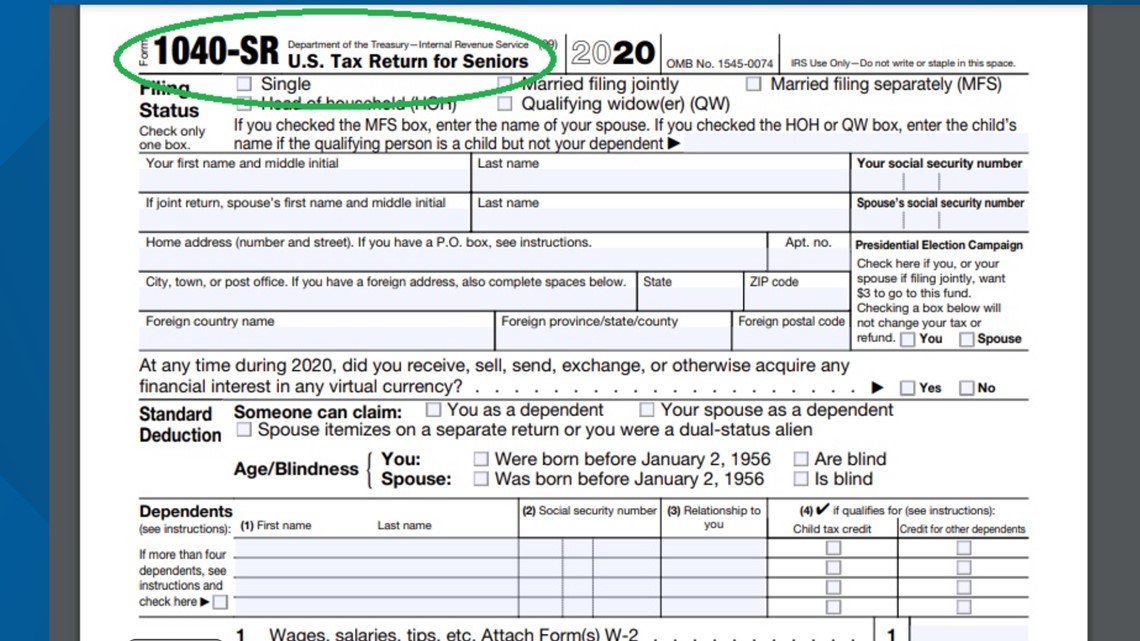

If You re Getting An Error On The IRS s Coronavirus Stimulus Website

New IRS Site Could Make It Easy For Thieves To Intercept Some Stimulus

Check more sample of Irs Stimulus Rebate Form below

How Do I Claim The 600 Stimulus Payment For My Child That Was Born In 2020

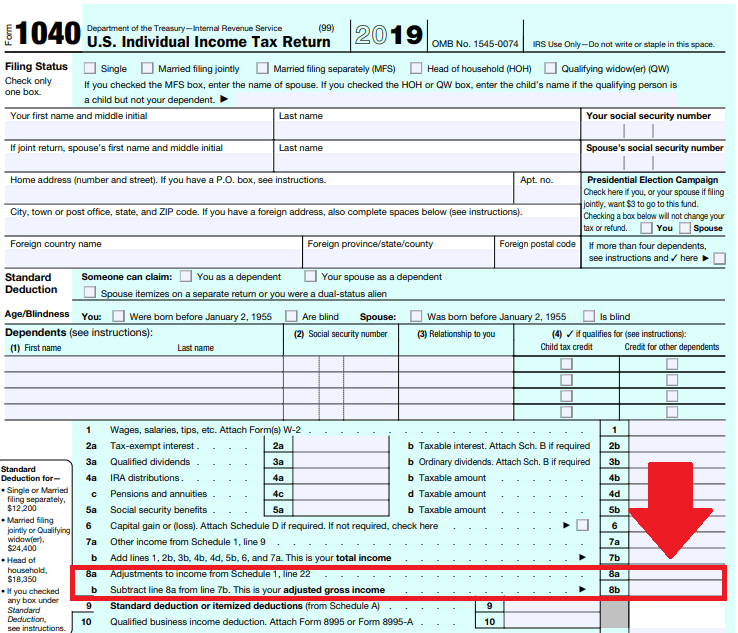

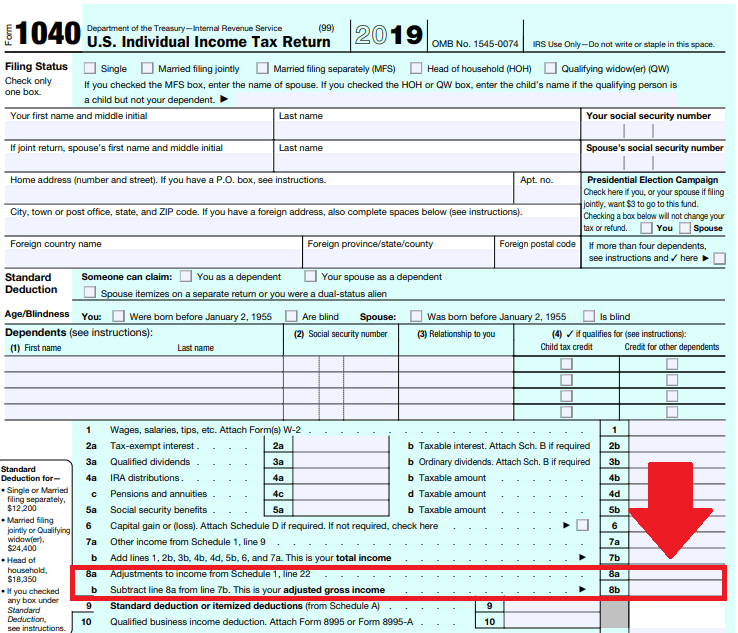

Second Stimulus Check What Is My AGI And Where Can I Find It AS

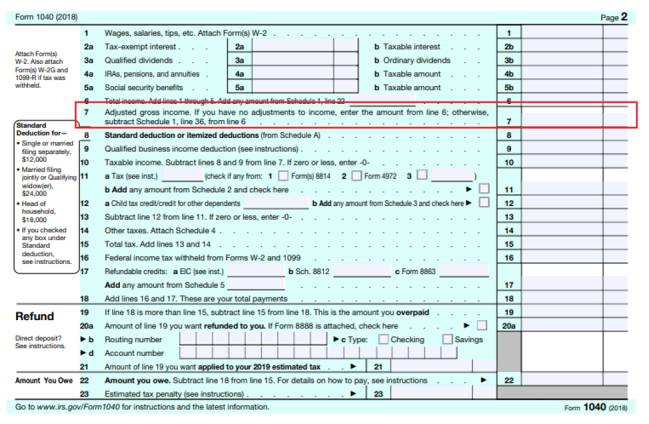

Didn t Get Your Stimulus Check Claim It As An Income Tax Credit

Stimulus Check 2021 Tracker Irs Irs Stimulus Check Schedule 2020

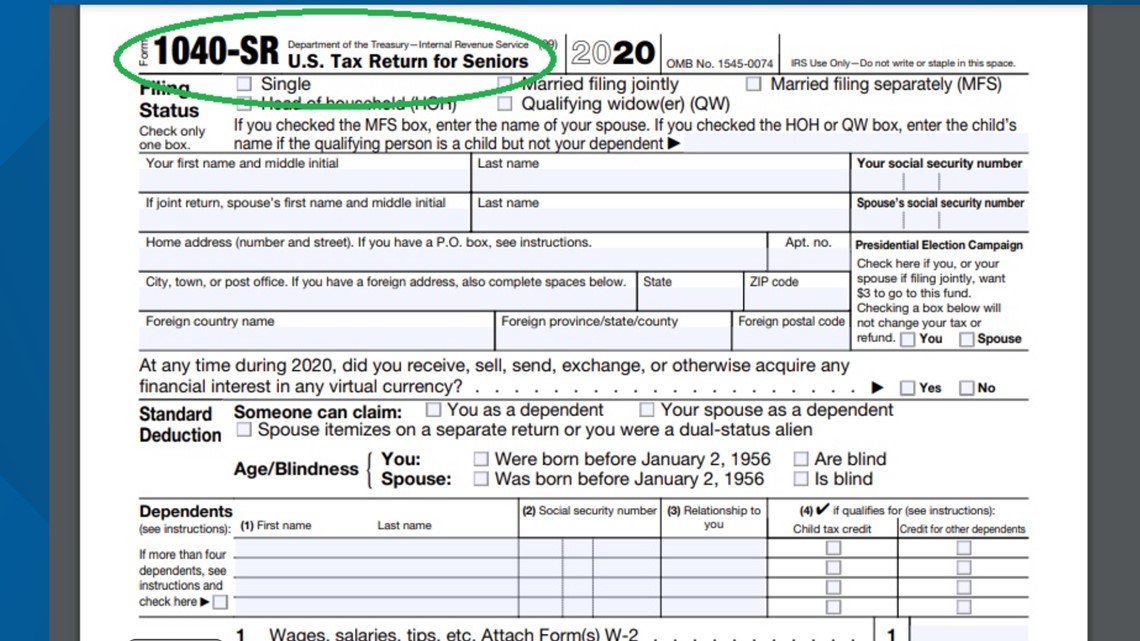

How To Claim The Stimulus Money On Your Tax Return 13newsnow

4 4 Stimulus Calculator And Everything You Need To Know About The New

https://www.irs.gov/coronavirus/economic-impact-payments

Web 15 M 228 rz 2023 nbsp 0183 32 Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 Jan 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 15 M 228 rz 2023 nbsp 0183 32 Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the

Web 13 Jan 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Stimulus Check 2021 Tracker Irs Irs Stimulus Check Schedule 2020

Second Stimulus Check What Is My AGI And Where Can I Find It AS

How To Claim The Stimulus Money On Your Tax Return 13newsnow

4 4 Stimulus Calculator And Everything You Need To Know About The New

Stimulus HomeUnemployed

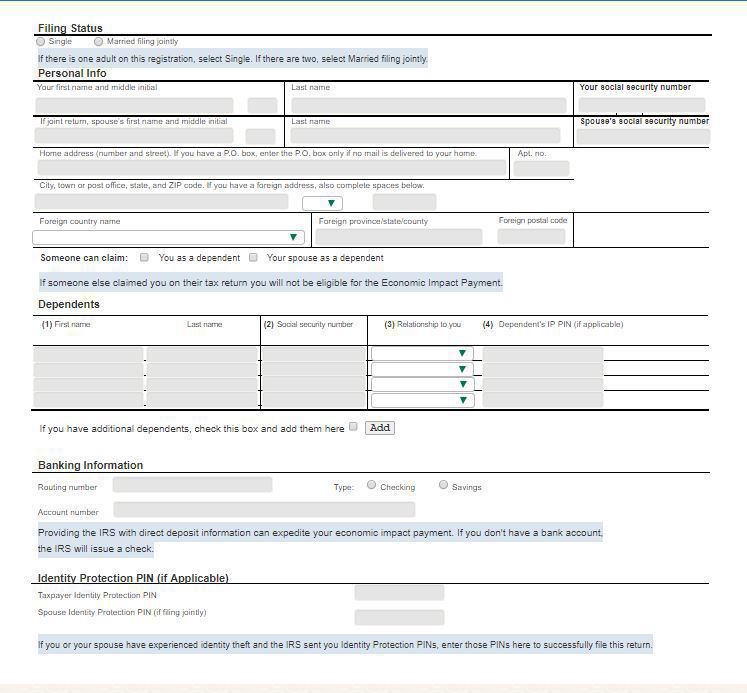

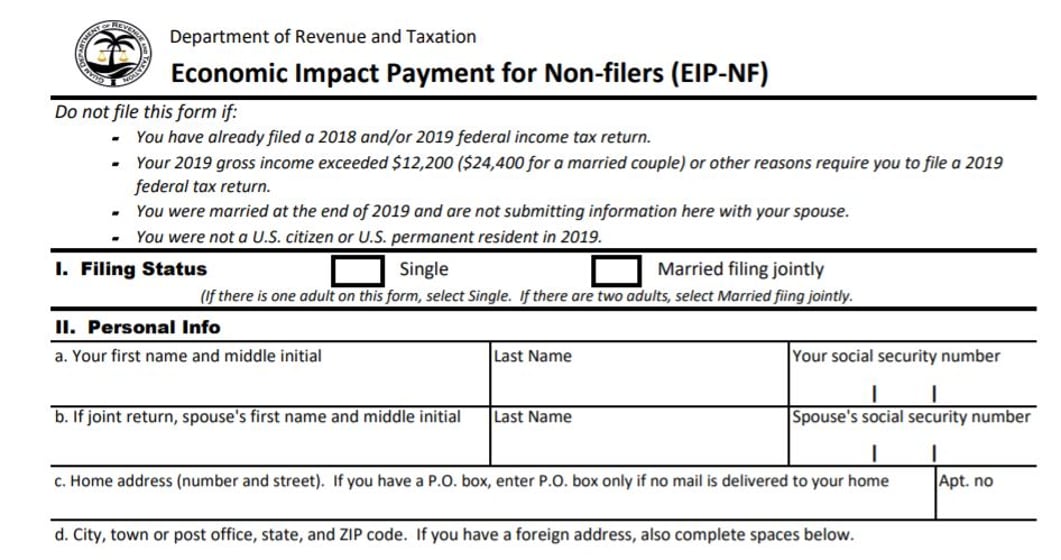

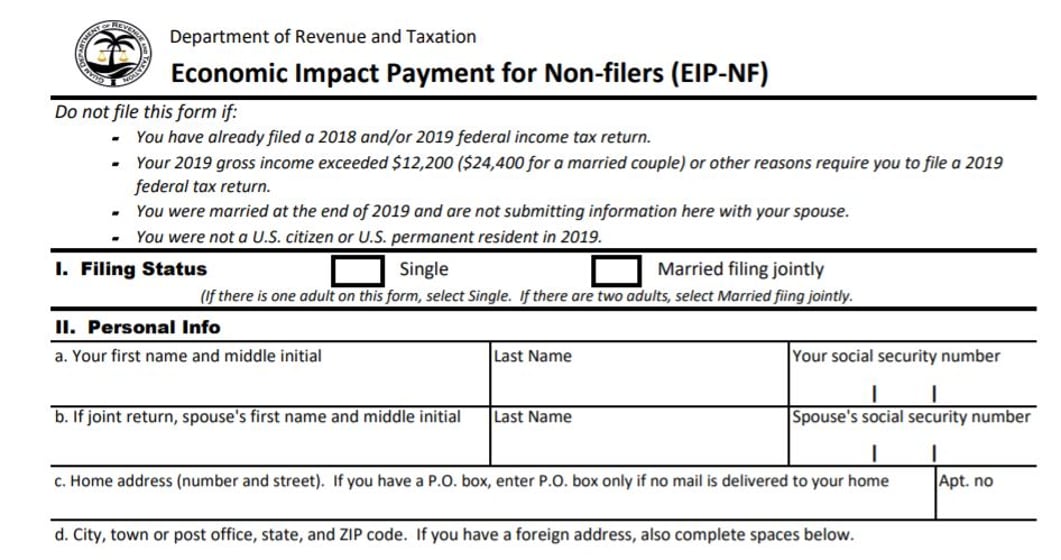

Downloadable Economic Impact Payment For Non Filers Form KUAM

Downloadable Economic Impact Payment For Non Filers Form KUAM

Irs Non Filers Printable Stimulus Form