In our modern, consumer-driven society we all love a good deal. One method of gaining substantial savings in your purchase is through 1040x Form Recovery Rebate Credits. 1040x Form Recovery Rebate Credits are marketing strategies that retailers and manufacturers use to offer consumers a partial refund for their purchases after they have made them. In this post, we'll take a look at the world that is 1040x Form Recovery Rebate Credits, looking at the nature of them as well as how they work and ways you can increase your savings using these low-cost incentives.

Get Latest 1040x Form Recovery Rebate Credit Below

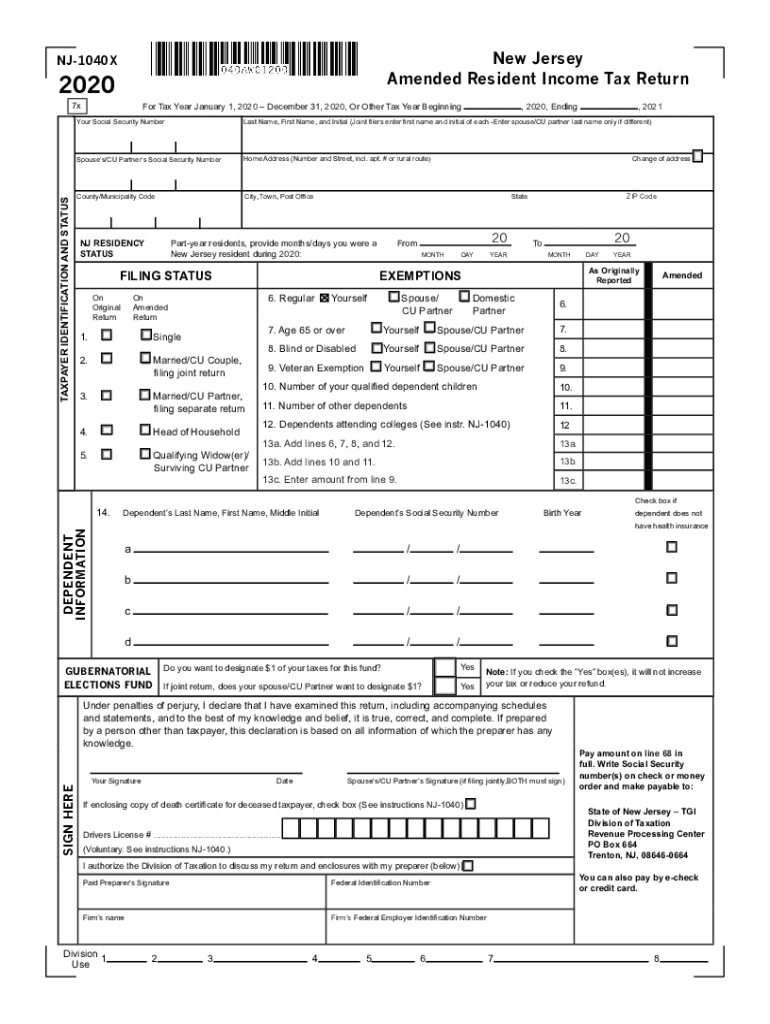

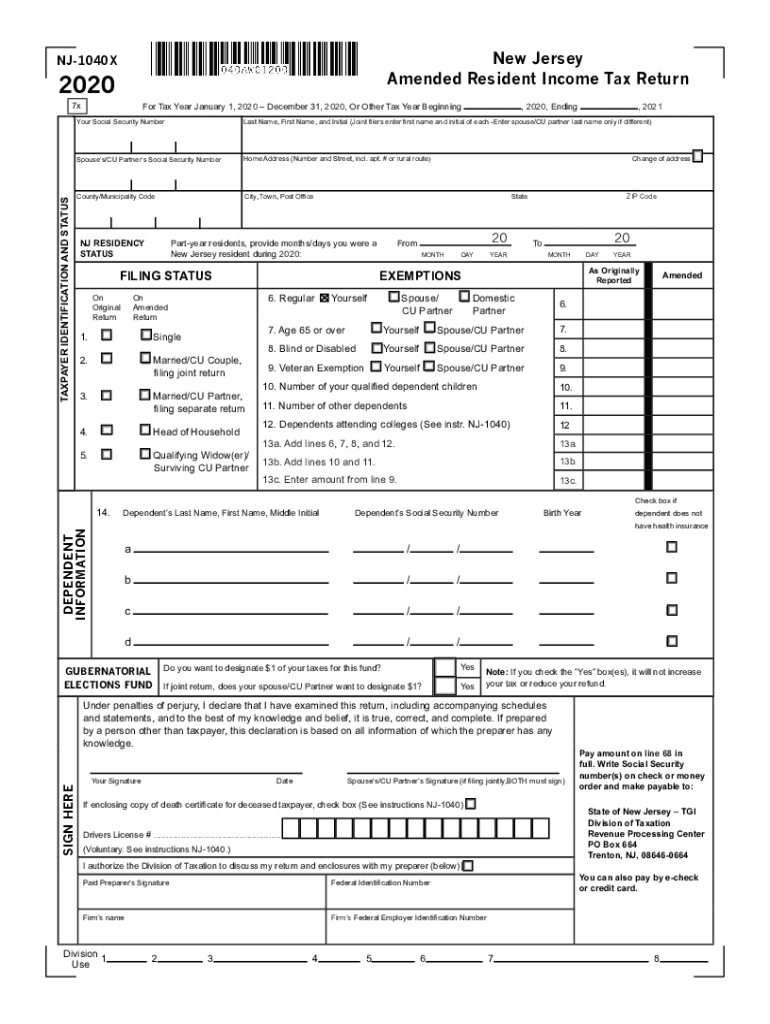

1040x Form Recovery Rebate Credit

1040x Form Recovery Rebate Credit -

Web 10 d 233 c 2021 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the Form 1040 and Form 1040 SR instructions PDF can help determine if you are eligible for the credit The fastest way

Web 26 mars 2021 nbsp 0183 32 If you did not receive your first and or second stimulus payment or if the amount received is not correct you can claim it on your 2020 tax return as the Recovery

A 1040x Form Recovery Rebate Credit at its most basic definition, is a reimbursement to a buyer following the purchase of a product or service. It's an effective method employed by companies to draw clients, increase sales as well as promote particular products.

Types of 1040x Form Recovery Rebate Credit

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

Web 20 d 233 c 2022 nbsp 0183 32 Enter the amount in your tax preparation software or in the Form 1040 Recovery Rebate Credit Worksheet to calculate your credit Having this information will

Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020

Cash 1040x Form Recovery Rebate Credit

Cash 1040x Form Recovery Rebate Credit are the simplest kind of 1040x Form Recovery Rebate Credit. Customers are given a certain amount of money back upon purchasing a particular item. This is often for big-ticket items, like electronics and appliances.

Mail-In 1040x Form Recovery Rebate Credit

Mail-in 1040x Form Recovery Rebate Credit require that customers provide evidence of purchase to get their money back. They are a bit more complicated, but they can provide huge savings.

Instant 1040x Form Recovery Rebate Credit

Instant 1040x Form Recovery Rebate Credit are made at the moment of sale, cutting the cost of purchase immediately. Customers don't have to wait for savings through this kind of offer.

How 1040x Form Recovery Rebate Credit Work

1040 Recovery Rebate Credit Drake20

1040 Recovery Rebate Credit Drake20

Web What is the Recovery Rebate Credit The Recovery Rebate Credit was added to 2020 individual tax returns in order to reconcile the Economic Impact stimulus Payments

The 1040x Form Recovery Rebate Credit Process

The process generally involves a few steps

-

You purchase the item: First purchase the product as you normally would.

-

Fill in this 1040x Form Recovery Rebate Credit forms: The 1040x Form Recovery Rebate Credit form will have to provide some data like your name, address, and purchase information, to be eligible for a 1040x Form Recovery Rebate Credit.

-

To submit the 1040x Form Recovery Rebate Credit: Depending on the type of 1040x Form Recovery Rebate Credit you will need to submit a claim form to the bank or upload it online.

-

Wait for approval: The business will review your submission for compliance with guidelines and conditions of the 1040x Form Recovery Rebate Credit.

-

Pay your 1040x Form Recovery Rebate Credit Once you've received your approval, you'll receive the refund via check, prepaid card or another option as per the terms of the offer.

Pros and Cons of 1040x Form Recovery Rebate Credit

Advantages

-

Cost savings A 1040x Form Recovery Rebate Credit can significantly reduce the cost for an item.

-

Promotional Offers Customers are enticed in trying new products or brands.

-

Increase Sales: 1040x Form Recovery Rebate Credit can boost the sales of a company as well as its market share.

Disadvantages

-

Complexity In particular, mail-in 1040x Form Recovery Rebate Credit in particular may be lengthy and lengthy.

-

Day of Expiration Many 1040x Form Recovery Rebate Credit impose the strictest deadlines for submission.

-

Risk of not receiving payment Certain customers could not receive their 1040x Form Recovery Rebate Credit if they don't adhere to the requirements exactly.

Download 1040x Form Recovery Rebate Credit

Download 1040x Form Recovery Rebate Credit

FAQs

1. Are 1040x Form Recovery Rebate Credit equivalent to discounts? Not necessarily, as 1040x Form Recovery Rebate Credit are only a partial reimbursement following the purchase, whereas discounts reduce your purchase cost at time of sale.

2. Do I have to use multiple 1040x Form Recovery Rebate Credit on the same item This is dependent on conditions applicable to 1040x Form Recovery Rebate Credit promotions and on the products qualification. Certain companies may permit the use of multiple 1040x Form Recovery Rebate Credit, whereas other won't.

3. What is the time frame to get the 1040x Form Recovery Rebate Credit? The length of time can vary, but typically it will take a couple of weeks or a couple of months for you to receive your 1040x Form Recovery Rebate Credit.

4. Do I need to pay taxes on 1040x Form Recovery Rebate Credit amounts? In most circumstances, 1040x Form Recovery Rebate Credit amounts are not considered to be taxable income.

5. Can I trust 1040x Form Recovery Rebate Credit offers from lesser-known brands Do I need to conduct a thorough research and verify that the brand giving the 1040x Form Recovery Rebate Credit is reliable prior to making purchases.

How Do I Claim The Recovery Rebate Credit On My Ta

How To Fill Out 1040x For Recovery Rebate Credit Recovery Rebate

Check more sample of 1040x Form Recovery Rebate Credit below

Federal Recovery Rebate Credit Recovery Rebate

Irs gov Recovery Rebate 1040 Recovery Rebate

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

2020 Form NJ DoT NJ 1040x Fill Online Printable Fillable Blank

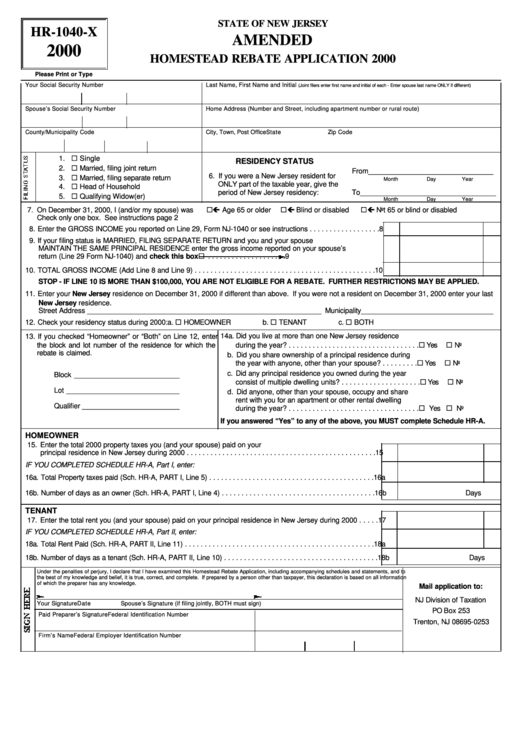

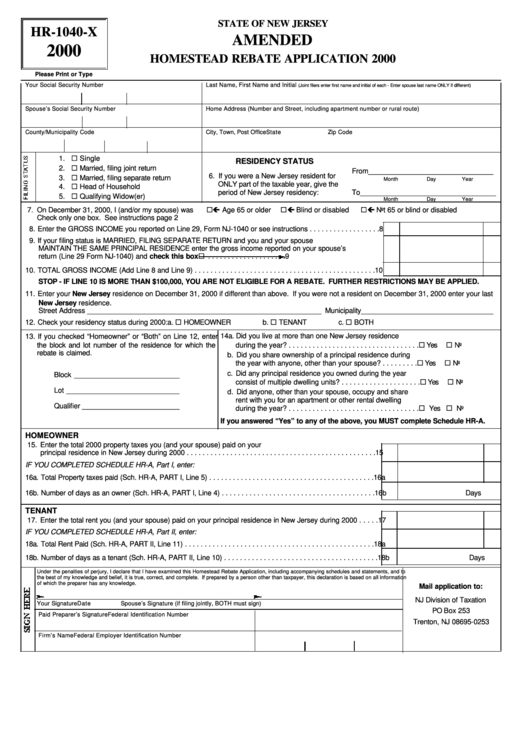

Fillable Form Hr 1040 X Amended Homestead Rebate Application 2000

Irs Form 1040x Fill Out Sign Online DocHub

https://ttlc.intuit.com/community/after-you-file/discussion/can-you...

Web 26 mars 2021 nbsp 0183 32 If you did not receive your first and or second stimulus payment or if the amount received is not correct you can claim it on your 2020 tax return as the Recovery

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-g...

Web 10 d 233 c 2021 nbsp 0183 32 If you must file an amended return to claim the Recovery Rebate Credit use the worksheet on page 59 of the 2020 instructions for Form 1040 and Form 1040 SR

Web 26 mars 2021 nbsp 0183 32 If you did not receive your first and or second stimulus payment or if the amount received is not correct you can claim it on your 2020 tax return as the Recovery

Web 10 d 233 c 2021 nbsp 0183 32 If you must file an amended return to claim the Recovery Rebate Credit use the worksheet on page 59 of the 2020 instructions for Form 1040 and Form 1040 SR

2020 Form NJ DoT NJ 1040x Fill Online Printable Fillable Blank

Irs gov Recovery Rebate 1040 Recovery Rebate

Fillable Form Hr 1040 X Amended Homestead Rebate Application 2000

Irs Form 1040x Fill Out Sign Online DocHub

1040 EF Message 0006 Recovery Rebate Credit Drake20

1040 Line 30 Recovery Rebate Credit Recovery Rebate

1040 Line 30 Recovery Rebate Credit Recovery Rebate

What Is The Recovery Rebate Credit CD Tax Financial