In this modern-day world of consumers everyone is looking for a great deal. One way to score significant savings for your purchases is through 1040 Form Recovery Rebate Credit Instructionss. 1040 Form Recovery Rebate Credit Instructionss are a method of marketing employed by retailers and manufacturers to give customers a part reimbursement on their purchases following the time they've done so. In this article, we will go deeper into the realm of 1040 Form Recovery Rebate Credit Instructionss. We will explore what they are and how they work and how you can maximize your savings through these cost-effective incentives.

Get Latest 1040 Form Recovery Rebate Credit Instructions Below

1040 Form Recovery Rebate Credit Instructions

1040 Form Recovery Rebate Credit Instructions - Irs Form 1040 Line 30 Recovery Rebate Credit Instructions

Web 17 Feb 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible for the credit If your

Web 20 Dez 2022 nbsp 0183 32 Enter the amount in your tax preparation software or in the Form 1040 Recovery Rebate Credit Worksheet to calculate your credit Having this information

A 1040 Form Recovery Rebate Credit Instructions, in its simplest version, is an ad-hoc payment to a consumer who has purchased a particular product or service. It's a powerful instrument used by businesses to attract clients, increase sales and also to advertise certain products.

Types of 1040 Form Recovery Rebate Credit Instructions

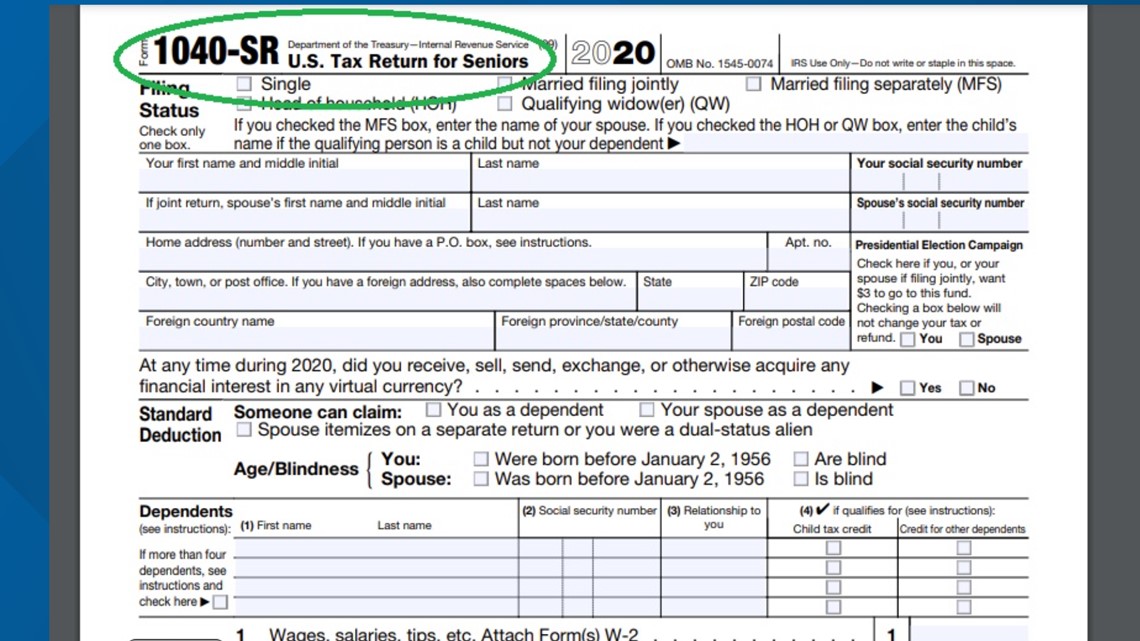

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Web 10 Dez 2021 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2020 Form 1040 and Form 1040 SR instructions PDF can help determine if you are eligible for the credit See the

Web 10 Dez 2021 nbsp 0183 32 Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form 1040 and Form 1040 SR Instructions PDF Enter the

Cash 1040 Form Recovery Rebate Credit Instructions

Cash 1040 Form Recovery Rebate Credit Instructions are a simple type of 1040 Form Recovery Rebate Credit Instructions. The customer receives a particular amount of money back upon purchasing a product. This is often for big-ticket items, like electronics and appliances.

Mail-In 1040 Form Recovery Rebate Credit Instructions

Mail-in 1040 Form Recovery Rebate Credit Instructions require that customers provide proof of purchase to receive the refund. They're a bit more involved, however they can yield huge savings.

Instant 1040 Form Recovery Rebate Credit Instructions

Instant 1040 Form Recovery Rebate Credit Instructions are applied at point of sale and reduce the price of purchases immediately. Customers don't have to wait long for savings in this manner.

How 1040 Form Recovery Rebate Credit Instructions Work

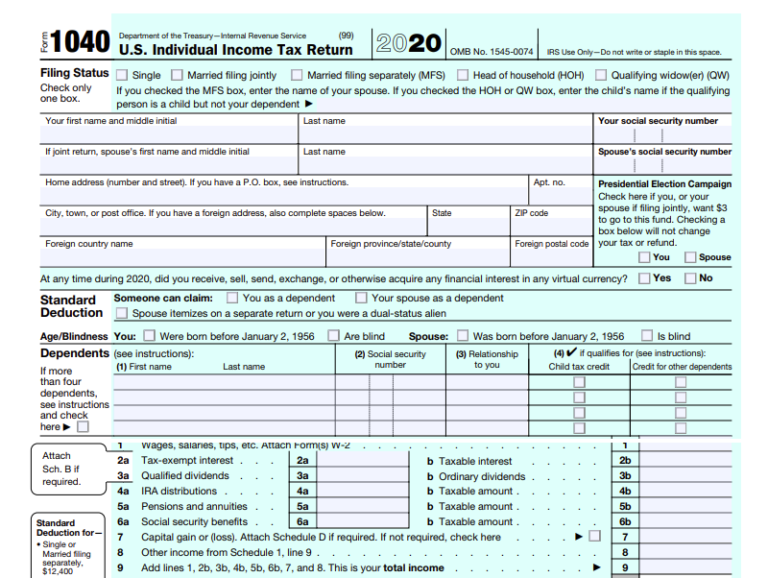

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

Web 10 Dez 2021 nbsp 0183 32 If you must file an amended return to claim the Recovery Rebate Credit use the worksheet on page 59 of the 2020 instructions for Form 1040 and Form 1040

The 1040 Form Recovery Rebate Credit Instructions Process

The process generally involves a few simple steps:

-

Purchase the item: First, you purchase the item in the same way you would normally.

-

Fill out the 1040 Form Recovery Rebate Credit Instructions paper: You'll need to provide some data like your address, name, as well as the details of your purchase to receive your 1040 Form Recovery Rebate Credit Instructions.

-

To submit the 1040 Form Recovery Rebate Credit Instructions The 1040 Form Recovery Rebate Credit Instructions must be submitted in accordance with the kind of 1040 Form Recovery Rebate Credit Instructions the recipient may be required to either mail in a request form or send it via the internet.

-

Wait for the company's approval: They will review your request to make sure it is in line with the guidelines and conditions of the 1040 Form Recovery Rebate Credit Instructions.

-

Get your 1040 Form Recovery Rebate Credit Instructions Once you've received your approval, you'll get your refund, via check, prepaid card, or a different option as per the terms of the offer.

Pros and Cons of 1040 Form Recovery Rebate Credit Instructions

Advantages

-

Cost Savings 1040 Form Recovery Rebate Credit Instructions can substantially cut the price you pay for the product.

-

Promotional Offers They encourage customers to explore new products or brands.

-

Increase Sales The benefits of a 1040 Form Recovery Rebate Credit Instructions can improve sales for a company and also increase market share.

Disadvantages

-

Complexity The mail-in 1040 Form Recovery Rebate Credit Instructions in particular, can be cumbersome and lengthy.

-

Time Limits for 1040 Form Recovery Rebate Credit Instructions Some 1040 Form Recovery Rebate Credit Instructions have strict time limits for submission.

-

Risk of not receiving payment Some customers might not get their 1040 Form Recovery Rebate Credit Instructions if they don't adhere to the rules precisely.

Download 1040 Form Recovery Rebate Credit Instructions

Download 1040 Form Recovery Rebate Credit Instructions

FAQs

1. Are 1040 Form Recovery Rebate Credit Instructions the same as discounts? No, 1040 Form Recovery Rebate Credit Instructions require a partial refund after the purchase, and discounts are a reduction of costs at moment of sale.

2. Do I have to use multiple 1040 Form Recovery Rebate Credit Instructions on the same product It's dependent on the terms that apply to the 1040 Form Recovery Rebate Credit Instructions incentives and the specific product's qualification. Some companies may allow it, while others won't.

3. What is the time frame to receive the 1040 Form Recovery Rebate Credit Instructions? The time frame differs, but it can last from a few weeks until a few months for you to receive your 1040 Form Recovery Rebate Credit Instructions.

4. Do I need to pay taxes of 1040 Form Recovery Rebate Credit Instructions values? the majority of situations, 1040 Form Recovery Rebate Credit Instructions amounts are not considered to be taxable income.

5. Do I have confidence in 1040 Form Recovery Rebate Credit Instructions offers from brands that aren't well-known Consider doing some research and confirm that the company which is providing the 1040 Form Recovery Rebate Credit Instructions is reliable prior to making an purchase.

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

1040 EF Message 0006 Recovery Rebate Credit Drake20

Check more sample of 1040 Form Recovery Rebate Credit Instructions below

1040 Recovery Rebate Credit Drake20

How Do I Claim The Recovery Rebate Credit On My Ta

Solved Recovery Rebate Credit Error On 1040 Instructions

1040Nr Fill Out And Sign Printable PDF Template SignNow Recovery Rebate

1040 Recovery Rebate Credit Worksheet

The Recovery Rebate Credit Get Your Full Stimulus Check Payment With

https://www.irs.gov/newsroom/recovery-rebate-credit

Web 20 Dez 2022 nbsp 0183 32 Enter the amount in your tax preparation software or in the Form 1040 Recovery Rebate Credit Worksheet to calculate your credit Having this information

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-f...

Web 13 Apr 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible for the credit Your

Web 20 Dez 2022 nbsp 0183 32 Enter the amount in your tax preparation software or in the Form 1040 Recovery Rebate Credit Worksheet to calculate your credit Having this information

Web 13 Apr 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible for the credit Your

1040Nr Fill Out And Sign Printable PDF Template SignNow Recovery Rebate

How Do I Claim The Recovery Rebate Credit On My Ta

1040 Recovery Rebate Credit Worksheet

The Recovery Rebate Credit Get Your Full Stimulus Check Payment With

Tax Time Guide Didn t Get Economic Impact Payments Check Eligibility

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

How To Claim The Stimulus Money On Your Tax Return Wltx