Today, in a world that is driven by the consumer every person loves a great deal. One way to make substantial savings on your purchases is through Rebate Of The 5 Gst New Home Form Canadas. The use of Rebate Of The 5 Gst New Home Form Canadas is a method employed by retailers and manufacturers to offer customers a return on their purchases once they have completed them. In this article, we'll look into the world of Rebate Of The 5 Gst New Home Form Canadas. We'll explore what they are as well as how they work and how you can make the most of your savings via these cost-effective incentives.

Get Latest Rebate Of The 5 Gst New Home Form Canada Below

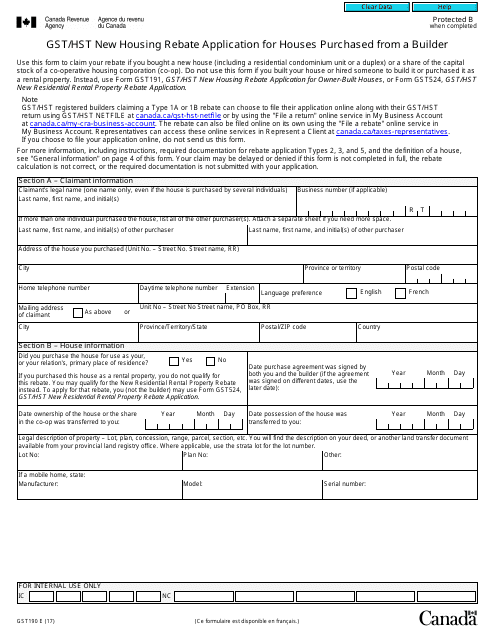

Rebate Of The 5 Gst New Home Form Canada

Rebate Of The 5 Gst New Home Form Canada -

Web 500 000 purchase price x 13 HST in ON HST on new home purchase 65 000 Now there s one of two ways you ll have to pay this with cash on closing day or

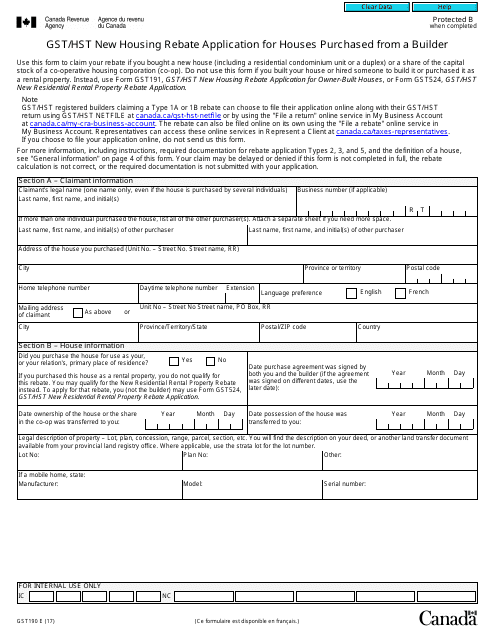

Web You have to fill out this form first It will help you determine the amount of the GST HST you paid during the construction and it will help determine if you qualify for the rebate You

A Rebate Of The 5 Gst New Home Form Canada as it is understood in its simplest type, is a return to the customer after having purchased a item or service. It's a very effective technique for businesses to entice clients, increase sales and even promote certain products.

Types of Rebate Of The 5 Gst New Home Form Canada

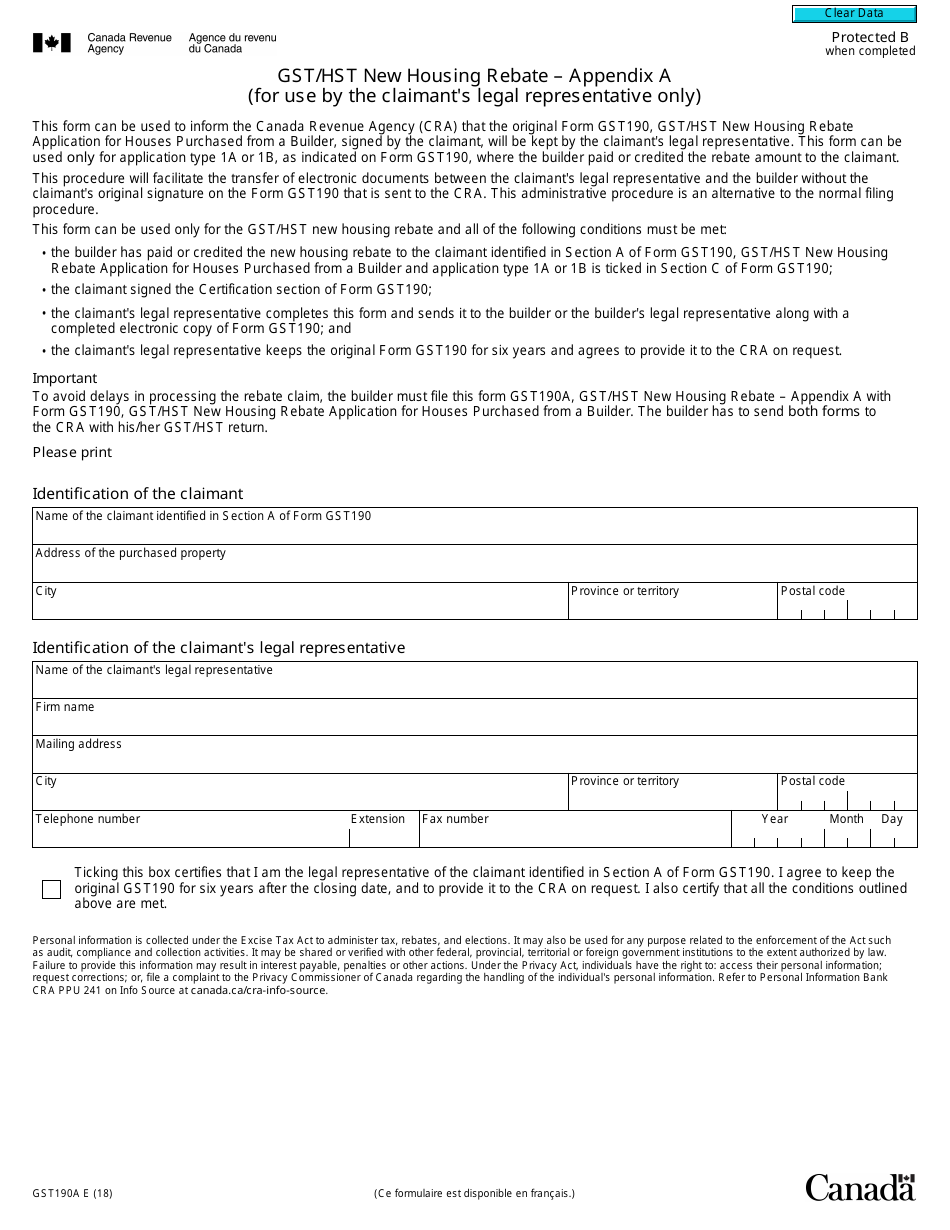

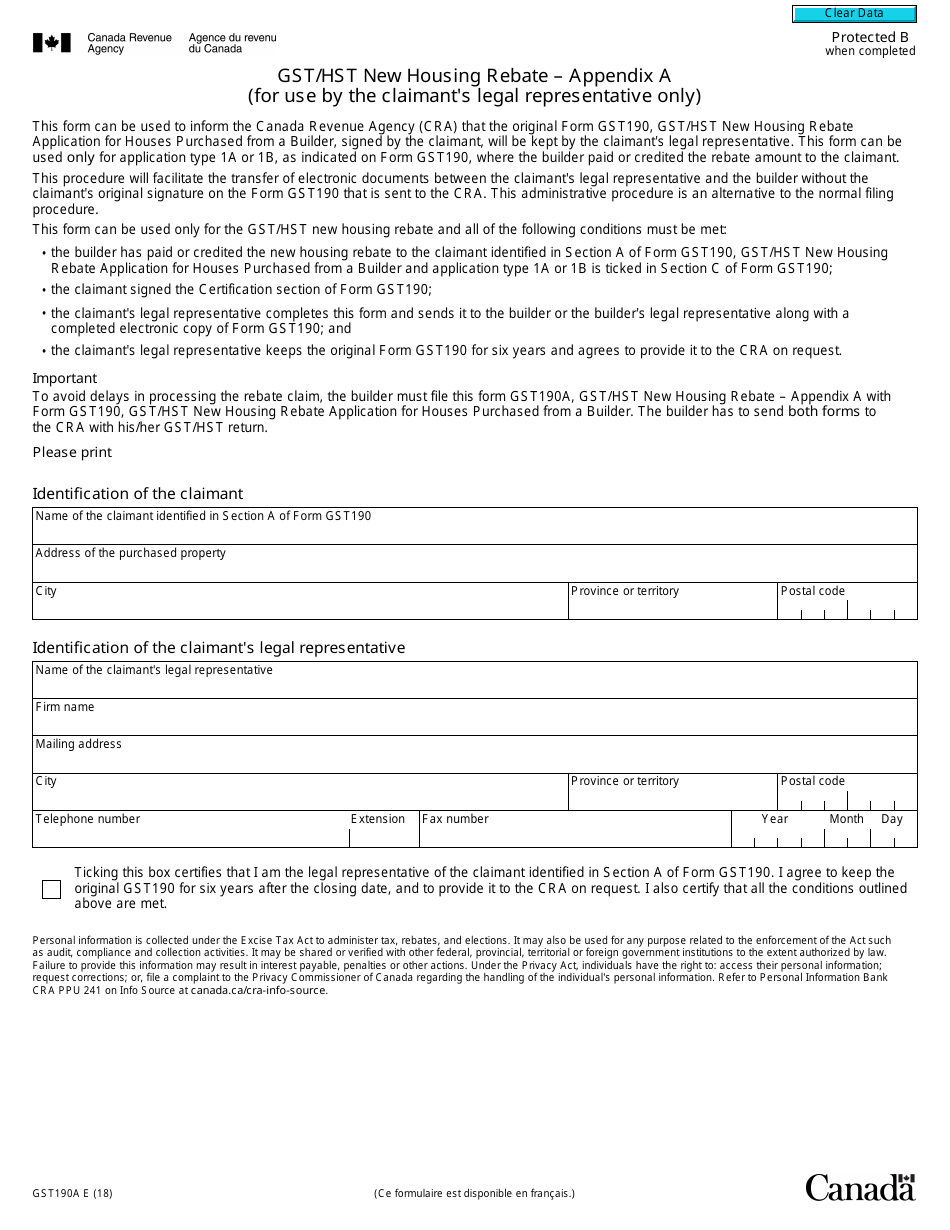

Form GST190A Schedule A Download Fillable PDF Or Fill Online Gst Hst

Form GST190A Schedule A Download Fillable PDF Or Fill Online Gst Hst

Web Fill out Form GST524 GST HST New Residential Rental Property Rebate Application and Form GST525 Supplement to the New Residential Rental Property Rebate Application

Web 27 Sept 2023 nbsp 0183 32 The existing GST rental rebate has a phase out for qualifying residential units valued between 350k and 450k with no rebate available for units valued at

Cash Rebate Of The 5 Gst New Home Form Canada

Cash Rebate Of The 5 Gst New Home Form Canada are probably the most simple kind of Rebate Of The 5 Gst New Home Form Canada. Clients receive a predetermined amount of money after purchasing a particular item. These are typically for big-ticket items, like electronics and appliances.

Mail-In Rebate Of The 5 Gst New Home Form Canada

Mail-in Rebate Of The 5 Gst New Home Form Canada need customers to send in the proof of purchase to be eligible for their money back. They're a bit more complicated but could provide huge savings.

Instant Rebate Of The 5 Gst New Home Form Canada

Instant Rebate Of The 5 Gst New Home Form Canada are applied at the place of purchase, reducing the purchase price immediately. Customers don't need to wait for savings through this kind of offer.

How Rebate Of The 5 Gst New Home Form Canada Work

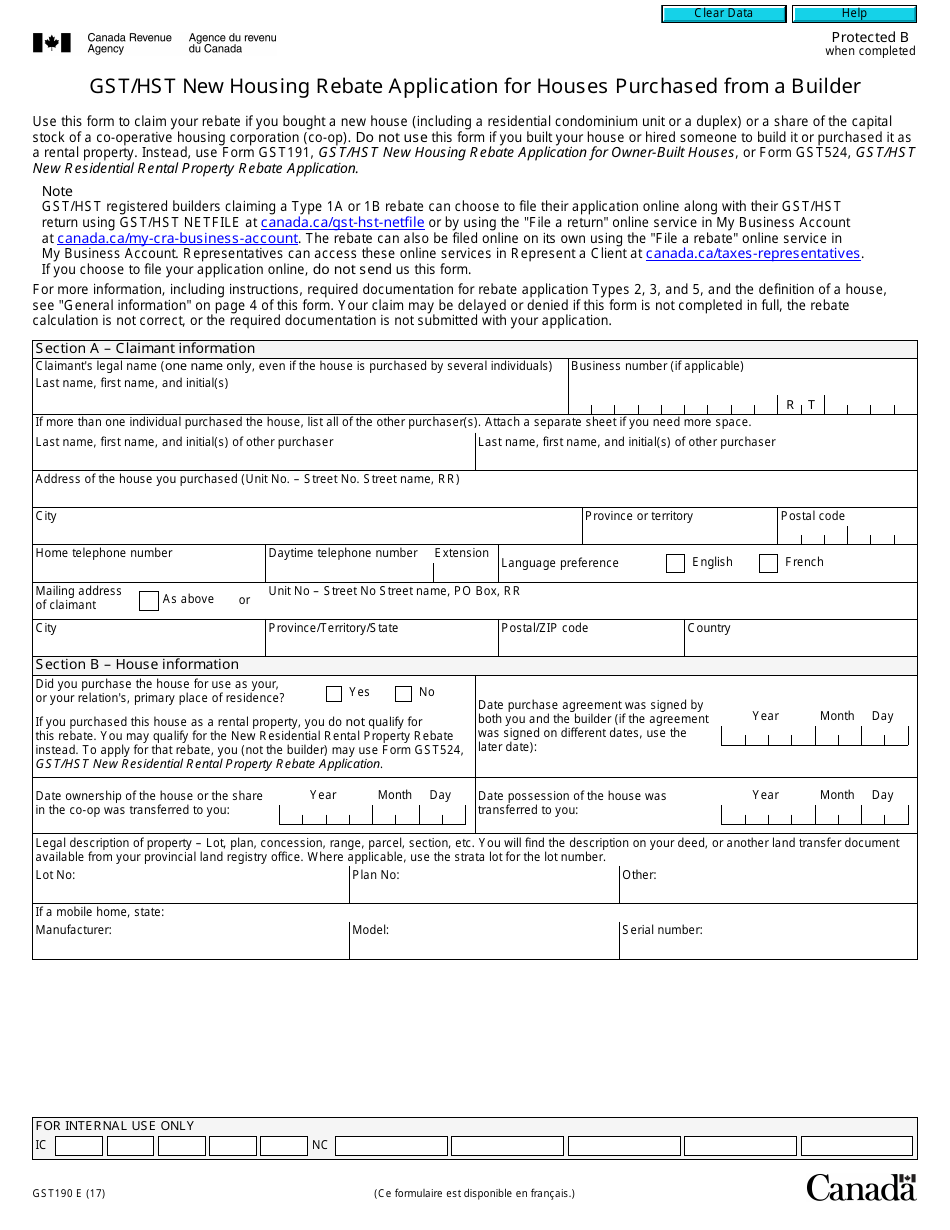

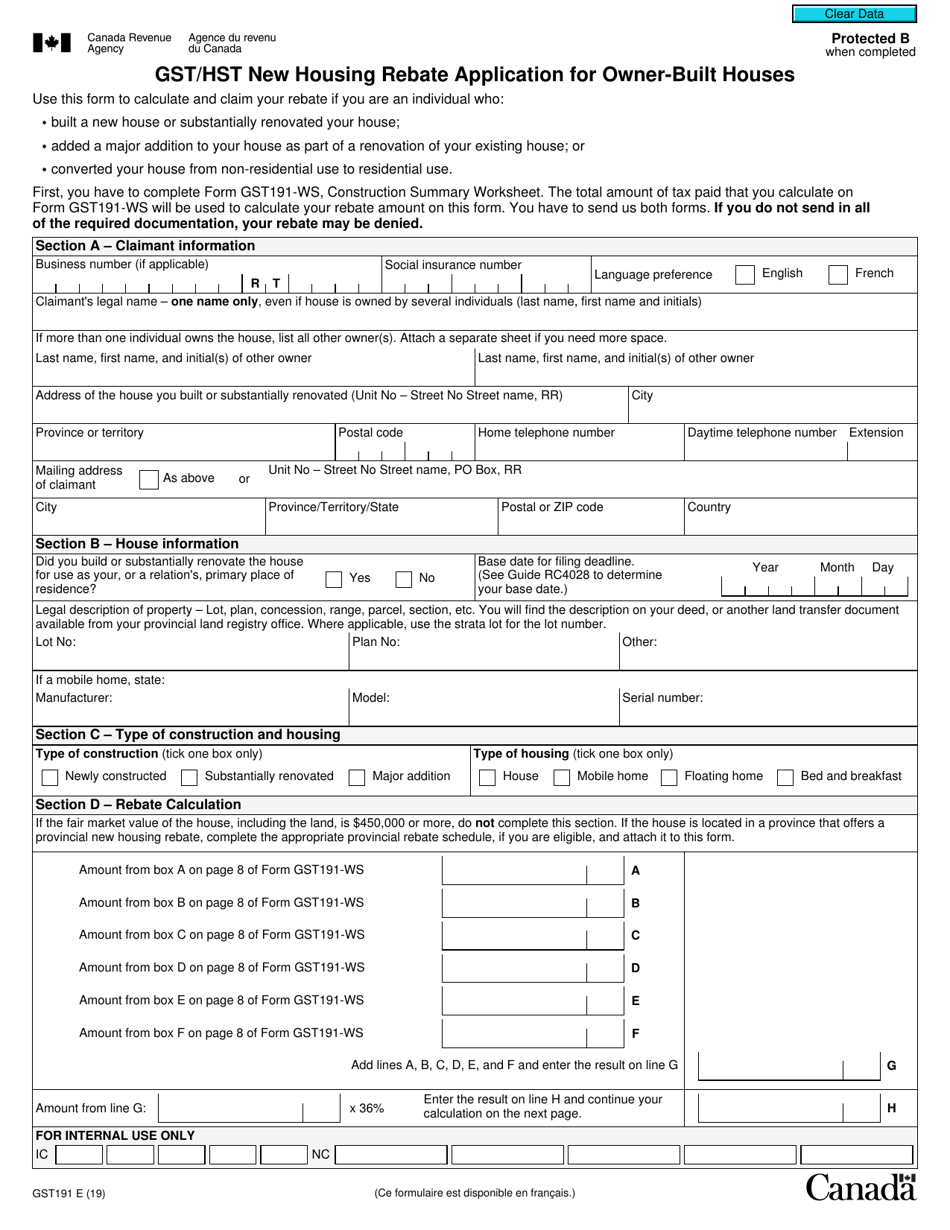

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

Web 26 Aug 2021 nbsp 0183 32 The CRA s HST GST new housing rebate allows Canadian homeowners to recuperate a portion of the GST or the federal part of the HST paid if their house is

The Rebate Of The 5 Gst New Home Form Canada Process

The procedure usually involves a few steps

-

Buy the product: Firstly, you purchase the item just as you would ordinarily.

-

Complete your Rebate Of The 5 Gst New Home Form Canada Form: To claim the Rebate Of The 5 Gst New Home Form Canada you'll have to provide some data, such as your name, address, and purchase information, to apply for your Rebate Of The 5 Gst New Home Form Canada.

-

Submit the Rebate Of The 5 Gst New Home Form Canada Based on the type of Rebate Of The 5 Gst New Home Form Canada you could be required to fill out a paper form or make it available online.

-

Wait for approval: The business will review your submission to ensure it meets the Rebate Of The 5 Gst New Home Form Canada's terms and conditions.

-

Redeem your Rebate Of The 5 Gst New Home Form Canada Once it's approved, you'll receive a refund either through check, prepaid card or through a different way specified in the offer.

Pros and Cons of Rebate Of The 5 Gst New Home Form Canada

Advantages

-

Cost savings Rebate Of The 5 Gst New Home Form Canada can dramatically reduce the cost for the product.

-

Promotional Offers they encourage their customers to try new items or brands.

-

increase sales Rebate Of The 5 Gst New Home Form Canada are a great way to boost the company's sales as well as market share.

Disadvantages

-

Complexity The mail-in Rebate Of The 5 Gst New Home Form Canada in particular are often time-consuming and take a long time to complete.

-

Time Limits for Rebate Of The 5 Gst New Home Form Canada Many Rebate Of The 5 Gst New Home Form Canada impose very strict deadlines for filing.

-

A risk of not being paid Some customers might not be able to receive their Rebate Of The 5 Gst New Home Form Canada if they don't follow the rules exactly.

Download Rebate Of The 5 Gst New Home Form Canada

Download Rebate Of The 5 Gst New Home Form Canada

FAQs

1. Are Rebate Of The 5 Gst New Home Form Canada equivalent to discounts? No, they are a partial refund after purchase, whereas discounts decrease the cost of purchase at moment of sale.

2. Are there any Rebate Of The 5 Gst New Home Form Canada that I can use on the same product This is dependent on terms for the Rebate Of The 5 Gst New Home Form Canada promotions and on the products qualification. Some companies may allow it, while some won't.

3. What is the time frame to receive a Rebate Of The 5 Gst New Home Form Canada? The time frame varies, but it can take a couple of weeks or a few months to get your Rebate Of The 5 Gst New Home Form Canada.

4. Do I need to pay taxes on Rebate Of The 5 Gst New Home Form Canada sums? the majority of situations, Rebate Of The 5 Gst New Home Form Canada amounts are not considered taxable income.

5. Can I trust Rebate Of The 5 Gst New Home Form Canada offers from lesser-known brands It is essential to investigate and ensure that the brand that is offering the Rebate Of The 5 Gst New Home Form Canada has a good reputation prior to making the purchase.

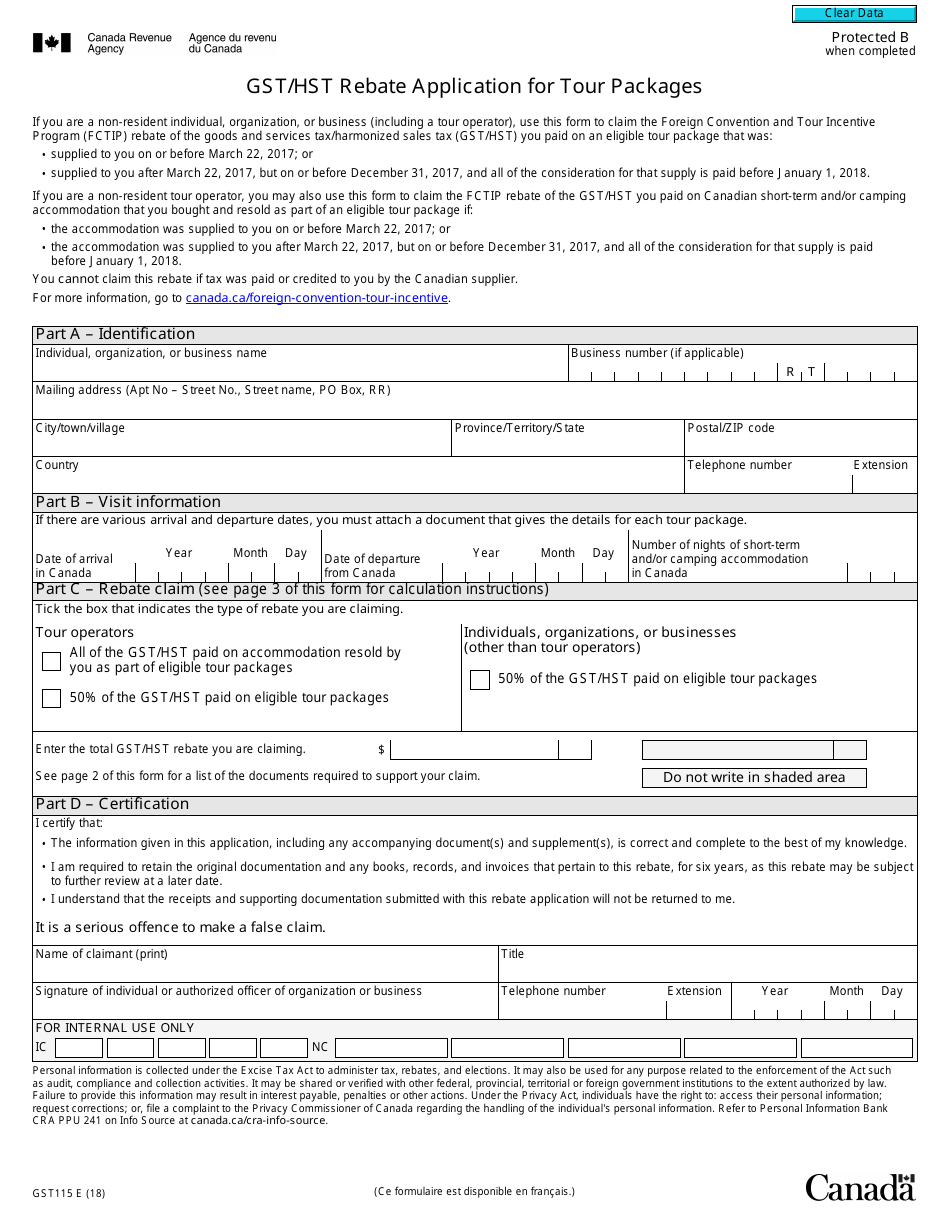

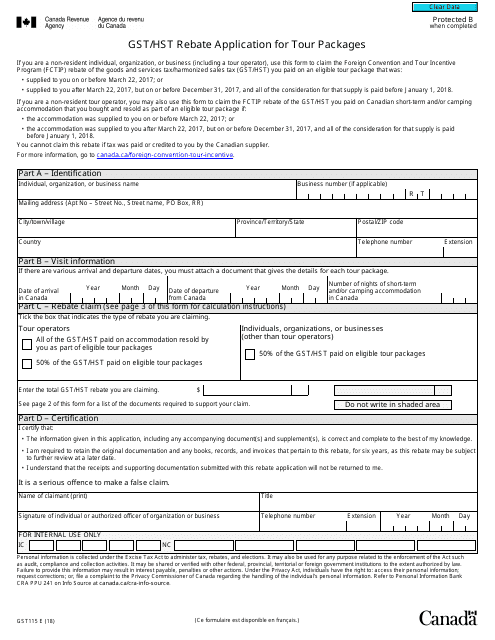

Form GST115 Download Fillable PDF Or Fill Online Gst Hst Rebate

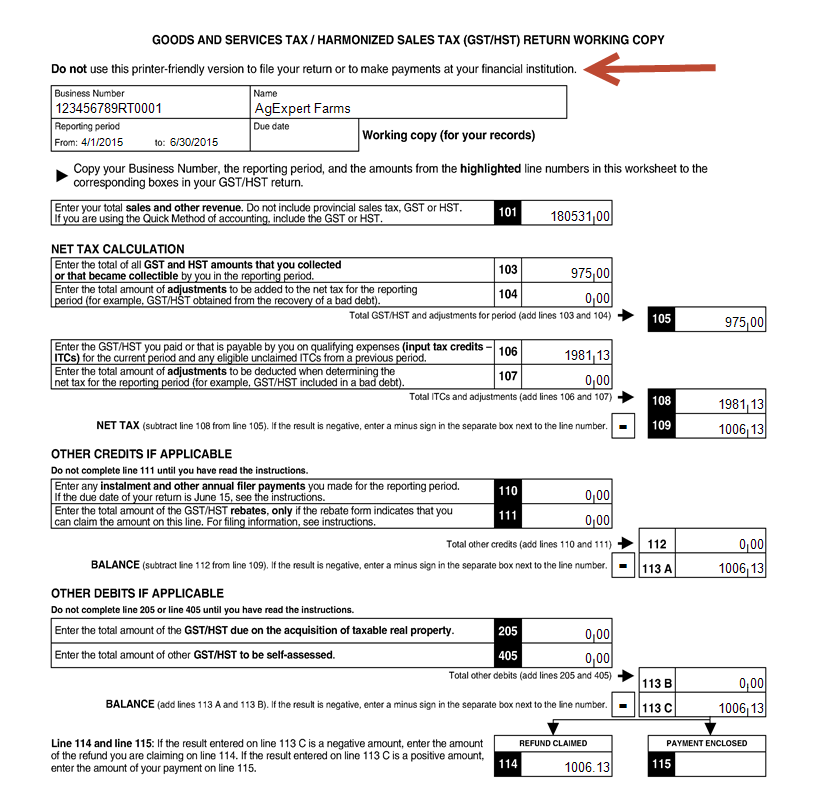

What s New FCC AgExpert Community

Check more sample of Rebate Of The 5 Gst New Home Form Canada below

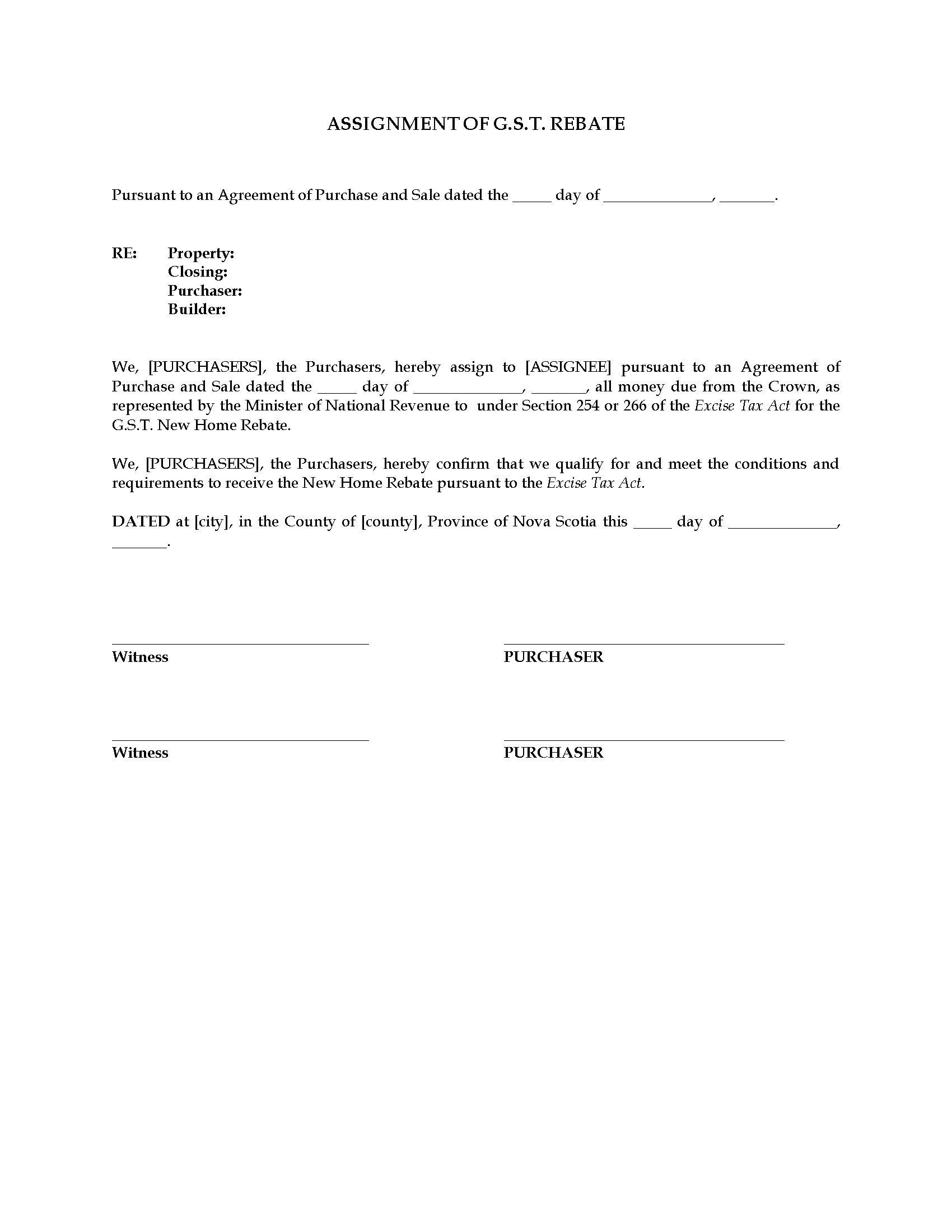

Canada Assignment Of GST New Home Rebate Legal Forms And Business

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

Form GST115 Download Fillable PDF Or Fill Online Gst Hst Rebate

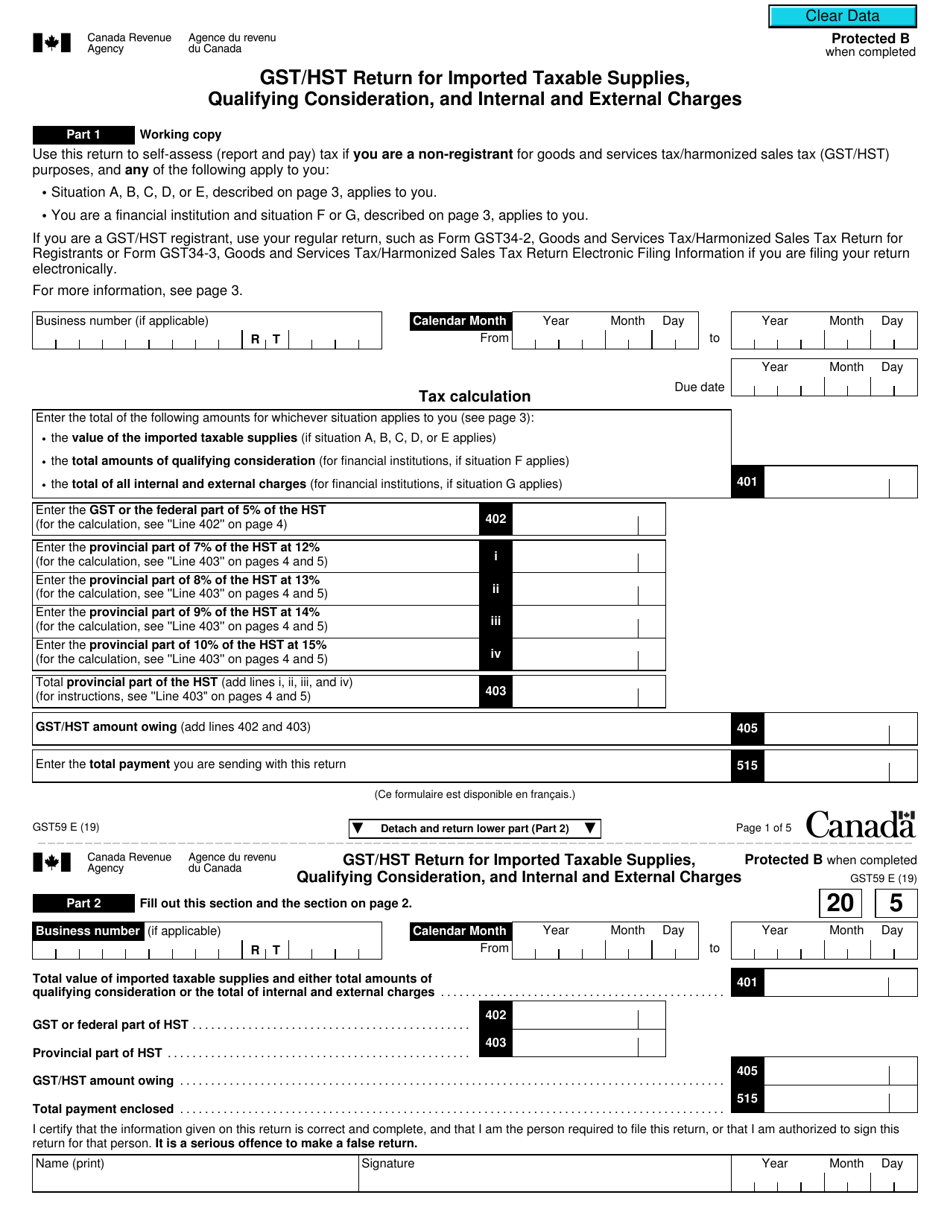

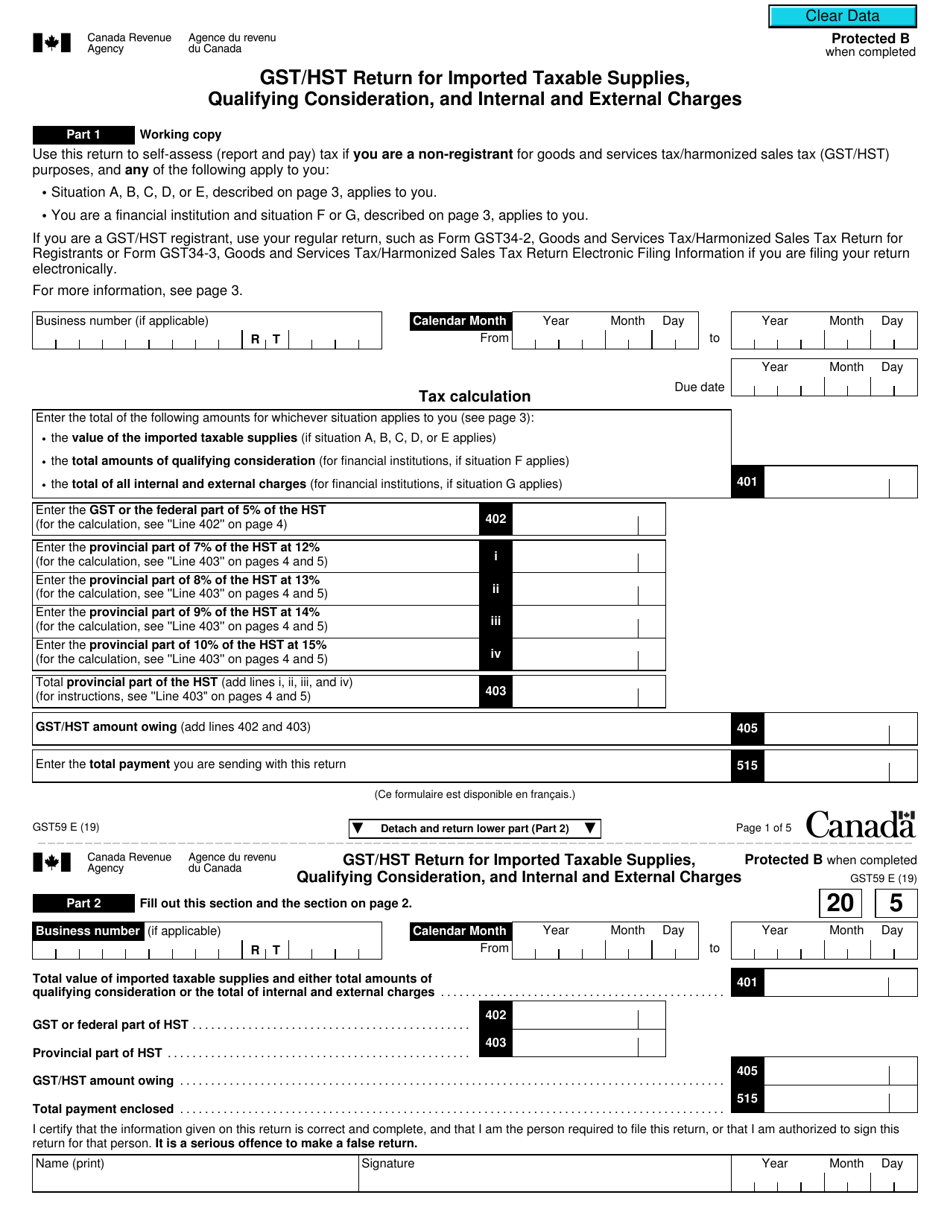

Form GST59 Download Fillable PDF Or Fill Online Gst Hst Return For

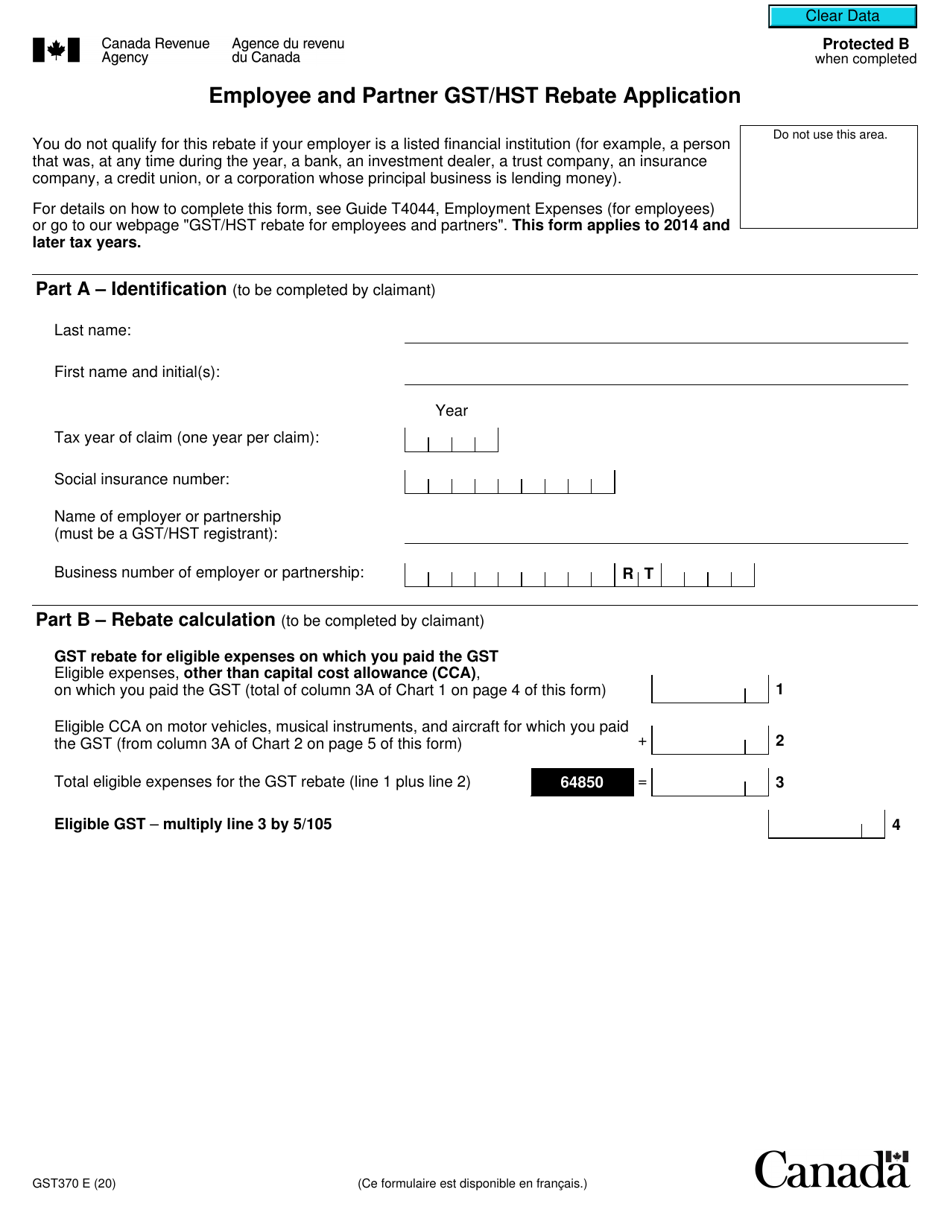

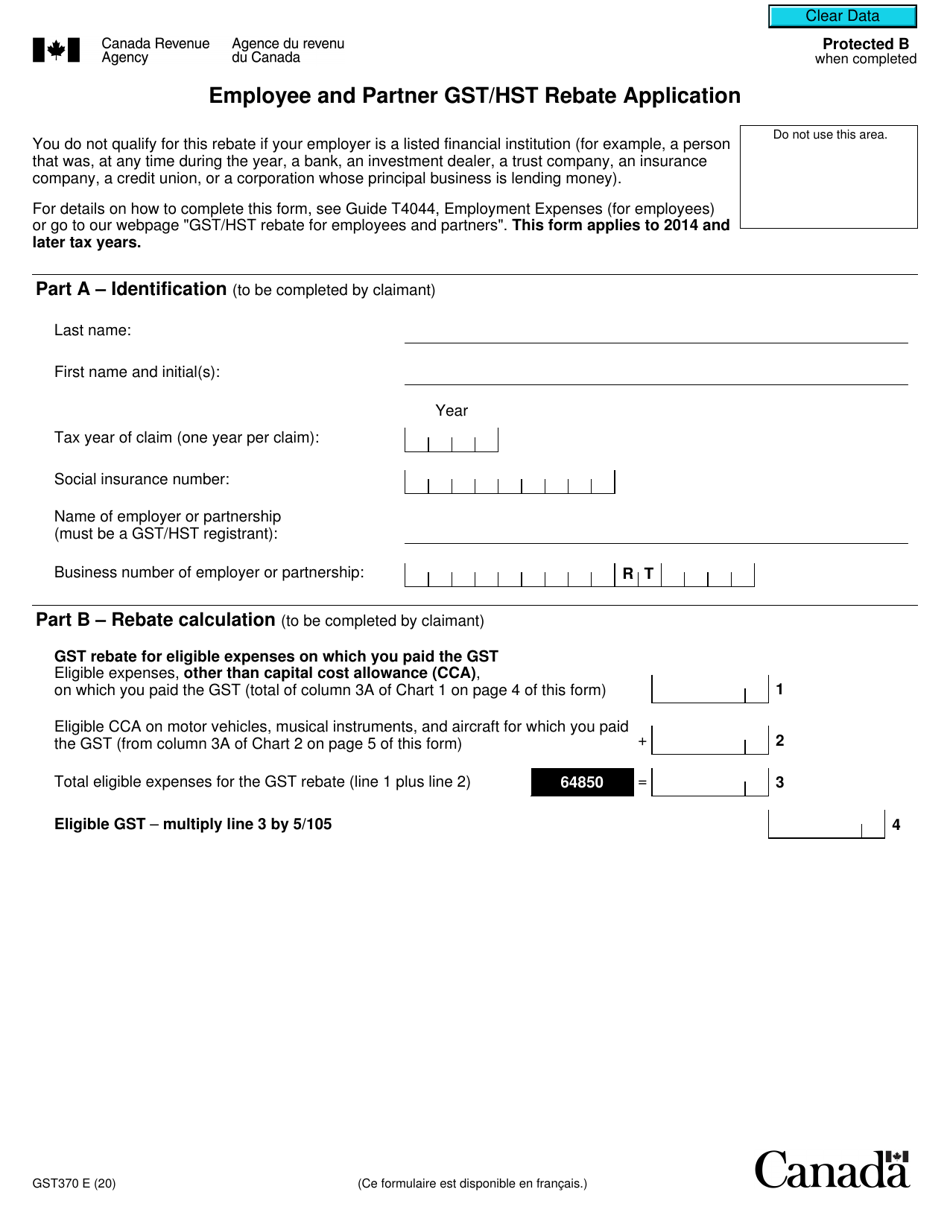

Form GST370 Download Fillable PDF Or Fill Online Employee And Partner

Cra Business Gst Return Form Charles Leal s Template

https://www.canada.ca/en/revenue-agency/services/forms-publications...

Web You have to fill out this form first It will help you determine the amount of the GST HST you paid during the construction and it will help determine if you qualify for the rebate You

https://wowa.ca/calculators/gst-hst-rebate-new-home-canada

Web 26 Okt 2022 nbsp 0183 32 The amount of federal rebate you can receive for the GST Portion is 36 of the GST tax amount up to a maximum of 6 300 and disappears entirely once the home

Web You have to fill out this form first It will help you determine the amount of the GST HST you paid during the construction and it will help determine if you qualify for the rebate You

Web 26 Okt 2022 nbsp 0183 32 The amount of federal rebate you can receive for the GST Portion is 36 of the GST tax amount up to a maximum of 6 300 and disappears entirely once the home

Form GST59 Download Fillable PDF Or Fill Online Gst Hst Return For

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

Form GST370 Download Fillable PDF Or Fill Online Employee And Partner

Cra Business Gst Return Form Charles Leal s Template

How To Complete A Canadian GST Return with Pictures WikiHow

Realised Exchange Rate Differences The Exempt Supplies Solarsys

Realised Exchange Rate Differences The Exempt Supplies Solarsys

GST HST New Housing Rebate Agence Du Revenu Du Canada