In this modern-day world of consumers, everyone loves a good bargain. One of the ways to enjoy significant savings on your purchases can be achieved through Chevy Volt Tax Rebate Forms. Chevy Volt Tax Rebate Forms are a method of marketing employed by retailers and manufacturers to offer customers a partial discount on purchases they made after they've done so. In this article, we'll examine the subject of Chevy Volt Tax Rebate Forms, looking at what they are what they are, how they function, and how you can make the most of your savings with these cost-effective incentives.

Get Latest Chevy Volt Tax Rebate Form Below

Chevy Volt Tax Rebate Form

Chevy Volt Tax Rebate Form -

Web 1 nov 2022 nbsp 0183 32 GM plans to launch 30 new EVs by 2030 and within two years from now anticipates having at least six under the MSRP threshold depending on their

Web 19 ao 251 t 2022 nbsp 0183 32 The U S Department of Energy s website currently lists 21 vehicles that are eligible for the full 7 500 tax credit with models like the Chevy Bolt EV Bolt EUV

A Chevy Volt Tax Rebate Form at its most basic version, is an ad-hoc refund offered to a customer after they've bought a product or service. It's a highly effective tool employed by companies to draw customers, increase sales and market specific products.

Types of Chevy Volt Tax Rebate Form

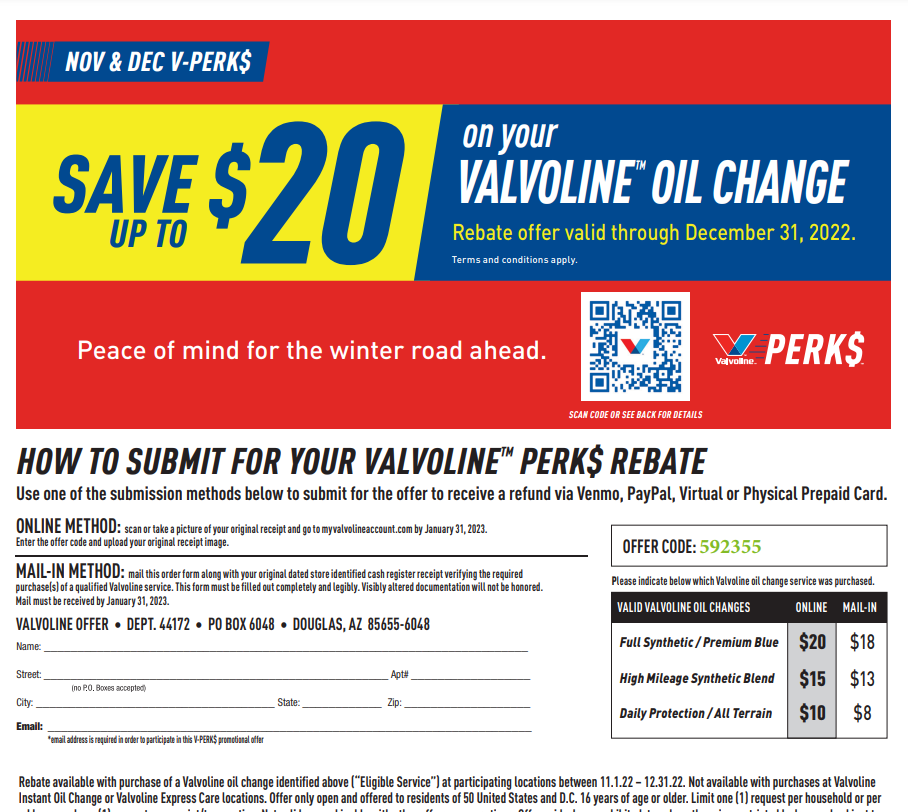

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

Web 15 avr 2023 nbsp 0183 32 A 7 500 tax credit for purchasers of new electric vehicles is changing again after the U S unveiled new guidelines that will impact the list of car models that qualify Scott Olson Getty Images

Web 16 ao 251 t 2022 nbsp 0183 32 If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal

Cash Chevy Volt Tax Rebate Form

Cash Chevy Volt Tax Rebate Form are a simple type of Chevy Volt Tax Rebate Form. The customer receives a particular amount back in cash after purchasing a item. These are usually used for the most expensive products like electronics or appliances.

Mail-In Chevy Volt Tax Rebate Form

Mail-in Chevy Volt Tax Rebate Form demand that customers send in the proof of purchase in order to receive their money back. They're somewhat more involved, however they can yield significant savings.

Instant Chevy Volt Tax Rebate Form

Instant Chevy Volt Tax Rebate Form are applied at the points of sale. This reduces the purchase cost immediately. Customers don't have to wait until they can save with this type.

How Chevy Volt Tax Rebate Form Work

P G And E Ev Rebate Printable Rebate Form

P G And E Ev Rebate Printable Rebate Form

Web 1 janv 2023 nbsp 0183 32 Federal Tax Credit Up To 4 000 Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a

The Chevy Volt Tax Rebate Form Process

The process generally involves a few steps

-

Purchase the product: First, you buy the product just like you normally would.

-

Fill in the Chevy Volt Tax Rebate Form forms: The Chevy Volt Tax Rebate Form form will have to provide some information including your address, name, and information about the purchase in order to receive your Chevy Volt Tax Rebate Form.

-

To submit the Chevy Volt Tax Rebate Form Based on the kind of Chevy Volt Tax Rebate Form the recipient may be required to submit a form by mail or make it available online.

-

Wait for approval: The company will review your submission for compliance with guidelines and conditions of the Chevy Volt Tax Rebate Form.

-

Redeem your Chevy Volt Tax Rebate Form Once it's approved, you'll receive a refund either through check, prepaid card, or through another way specified in the offer.

Pros and Cons of Chevy Volt Tax Rebate Form

Advantages

-

Cost savings Chevy Volt Tax Rebate Form could significantly decrease the price for the product.

-

Promotional Deals Customers are enticed in trying new products or brands.

-

Enhance Sales Reward programs can boost the sales of a company as well as its market share.

Disadvantages

-

Complexity Pay-in Chevy Volt Tax Rebate Form via mail, particularly could be cumbersome and costly.

-

Days of expiration Many Chevy Volt Tax Rebate Form have very strict deadlines for filing.

-

Risk of Not Being Paid Customers may not get their Chevy Volt Tax Rebate Form if they do not adhere to the guidelines precisely.

Download Chevy Volt Tax Rebate Form

Download Chevy Volt Tax Rebate Form

FAQs

1. Are Chevy Volt Tax Rebate Form equivalent to discounts? No, Chevy Volt Tax Rebate Form require an amount of money that is refunded after the purchase, whereas discounts decrease the purchase price at the point of sale.

2. Are there Chevy Volt Tax Rebate Form that can be used on the same product What is the best way to do it? It's contingent on terms and conditions of Chevy Volt Tax Rebate Form promotions and on the products qualification. Certain businesses may allow this, whereas others will not.

3. How long will it take to receive an Chevy Volt Tax Rebate Form? The amount of time will differ, but can take anywhere from a couple of weeks to a few months for you to receive your Chevy Volt Tax Rebate Form.

4. Do I need to pay taxes when I receive Chevy Volt Tax Rebate Form the amount? most circumstances, Chevy Volt Tax Rebate Form amounts are not considered to be taxable income.

5. Should I be able to trust Chevy Volt Tax Rebate Form deals from lesser-known brands Do I need to conduct a thorough research and make sure that the company providing the Chevy Volt Tax Rebate Form is trustworthy prior to making purchases.

Valvoline Rebate Forms Printable Rebate Form

Top Mass Save Rebate Form Templates Free To Download In PDF Format

Check more sample of Chevy Volt Tax Rebate Form below

Kingston Progressive ELECTRIC CAR REBATE

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

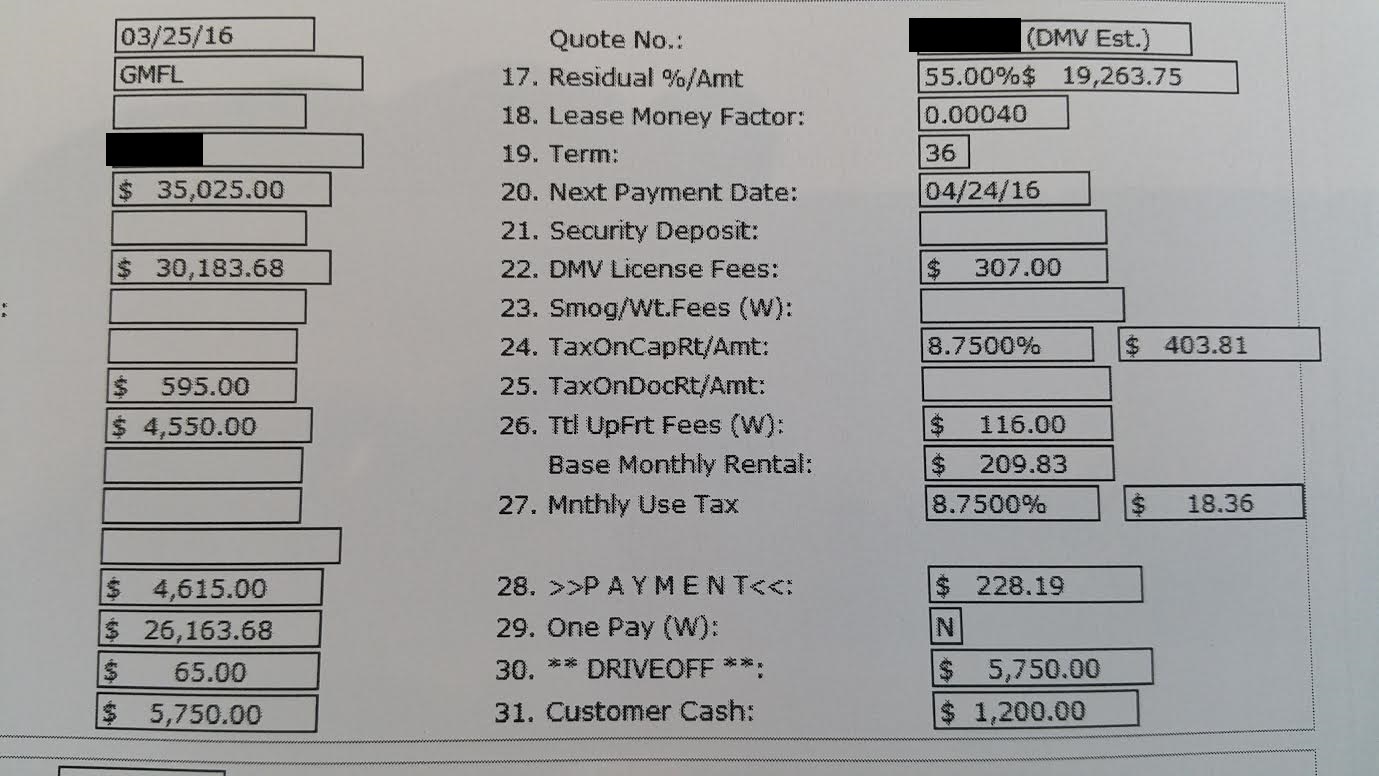

2016 2017 Volt Getting Dealership To Rebate Federal Tax Credit Ask

2023 Tax Credit Form Did You Get One When You Purchased Your Bolt

PA Property Tax Rebate Forms Printable Rebate Form

Carbon Tax Rebate 2022 Printable Rebate Form

https://gmauthority.com/blog/2022/08/gm-vehicles-would-be-eligible-for...

Web 19 ao 251 t 2022 nbsp 0183 32 The U S Department of Energy s website currently lists 21 vehicles that are eligible for the full 7 500 tax credit with models like the Chevy Bolt EV Bolt EUV

https://www.irs.gov/credits-deductions/credits-for-new-electric...

Web The maximum credit is 7 500 It is nonrefundable so you can t get back more on the credit than you owe in taxes You can t apply any excess credit to future tax years Find

Web 19 ao 251 t 2022 nbsp 0183 32 The U S Department of Energy s website currently lists 21 vehicles that are eligible for the full 7 500 tax credit with models like the Chevy Bolt EV Bolt EUV

Web The maximum credit is 7 500 It is nonrefundable so you can t get back more on the credit than you owe in taxes You can t apply any excess credit to future tax years Find

2023 Tax Credit Form Did You Get One When You Purchased Your Bolt

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

PA Property Tax Rebate Forms Printable Rebate Form

Carbon Tax Rebate 2022 Printable Rebate Form

Ouc Energy Rebates Fill Online Printable Fillable Blank PdfFiller

Tax Application Fill Online Printable Fillable Blank PdfFiller

Tax Application Fill Online Printable Fillable Blank PdfFiller

Printable Old Style Rebate Form Printable Forms Free Online