In our current world of high-end consumer goods every person loves a great bargain. One way to earn significant savings on your purchases is through Where To File For Homestead State Rebate On Fed Forms. Where To File For Homestead State Rebate On Fed Forms are a marketing strategy that retailers and manufacturers use to give customers a part cash back on their purchases once they have bought them. In this article, we will dive into the world Where To File For Homestead State Rebate On Fed Forms and explore what they are their purpose, how they function and ways you can increase your savings through these cost-effective incentives.

Get Latest Where To File For Homestead State Rebate On Fed Form Below

Where To File For Homestead State Rebate On Fed Form

Where To File For Homestead State Rebate On Fed Form -

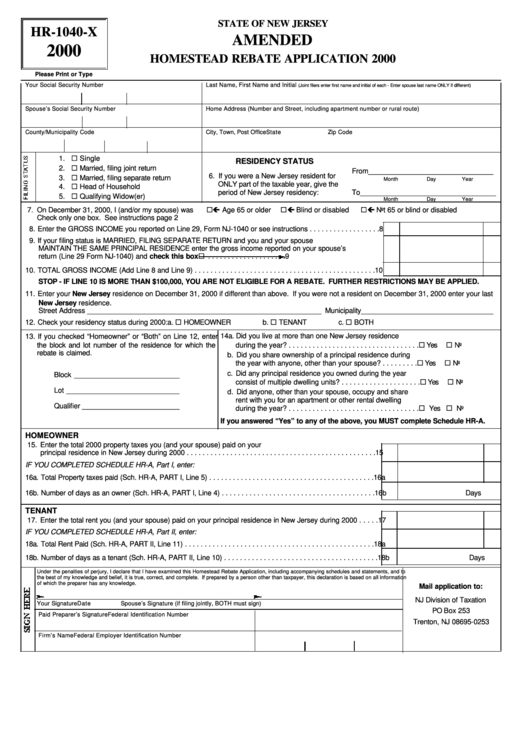

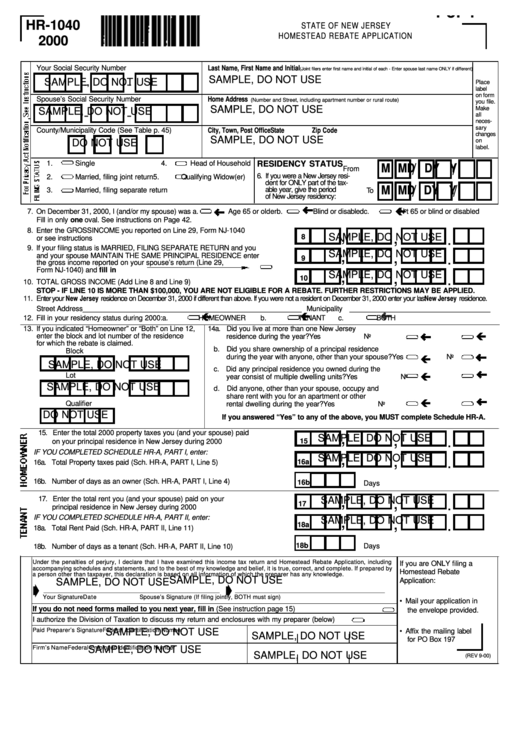

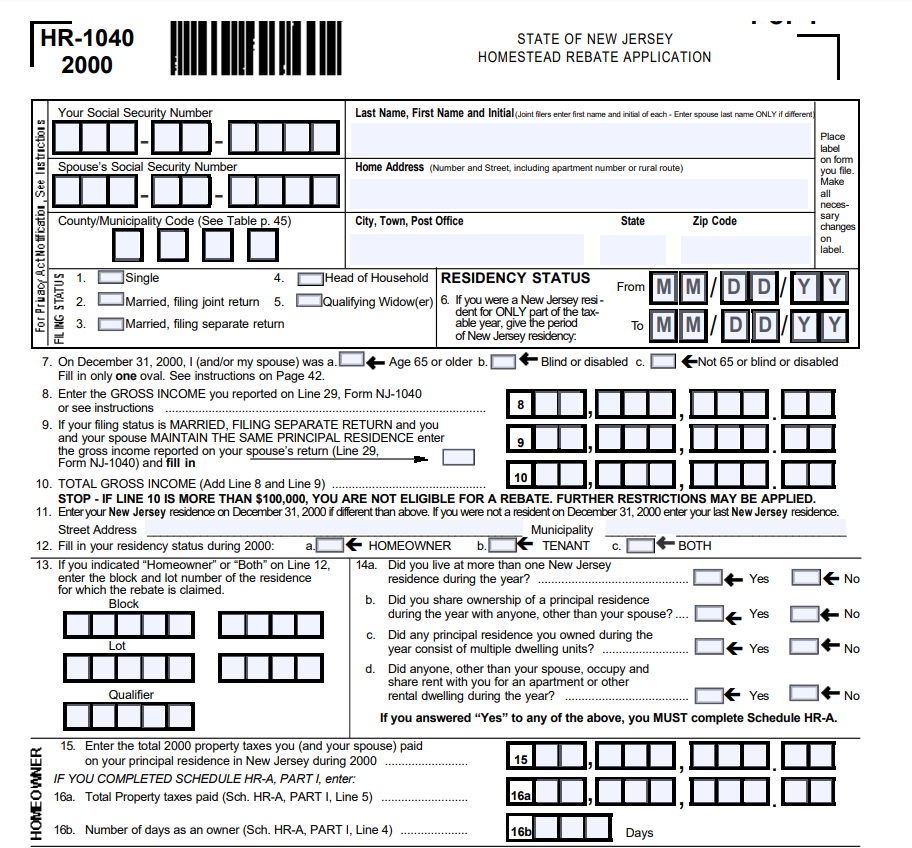

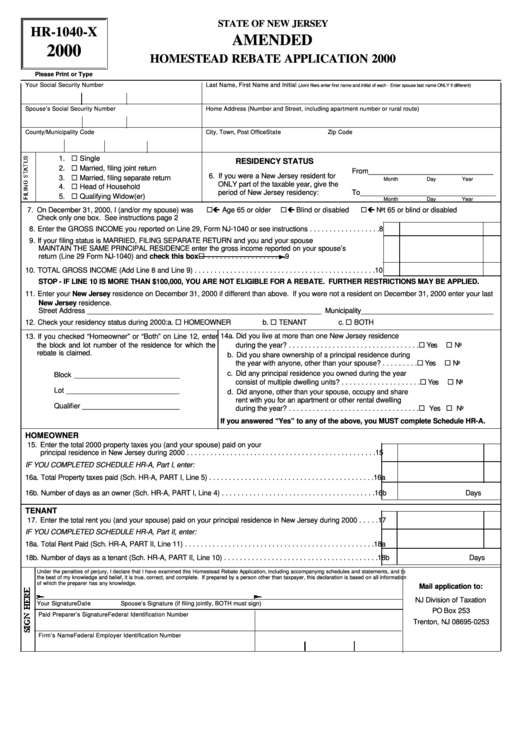

Web STATE OF NEW JERSEY HOMESTEAD REBATE APPLICATION Place label on form you file Make all neces sary changes on label 1 Single 4 Head of Household 2 Married

Web 4 M 228 rz 2019 nbsp 0183 32 If you received a rebate in the form of a credit to your property taxes then I would follow what you have done in the past and simply add up your tax payments and

A Where To File For Homestead State Rebate On Fed Form in its simplest version, is an ad-hoc return to the customer following the purchase of a product or service. It is a powerful tool that companies use to attract buyers, increase sales and promote specific products.

Types of Where To File For Homestead State Rebate On Fed Form

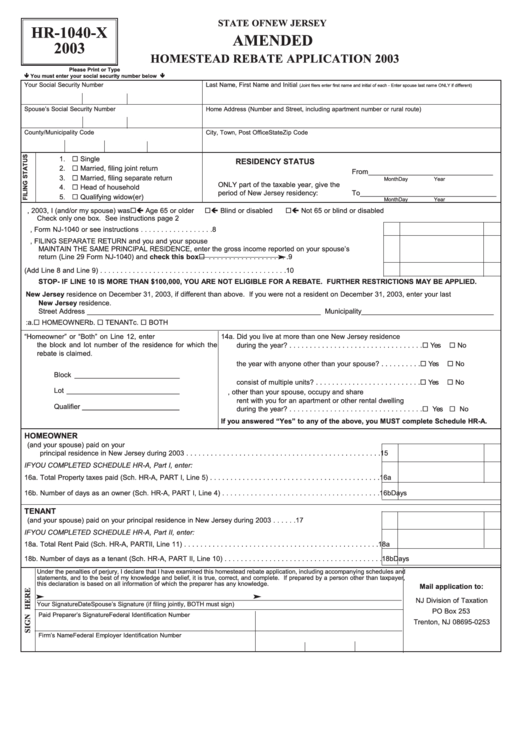

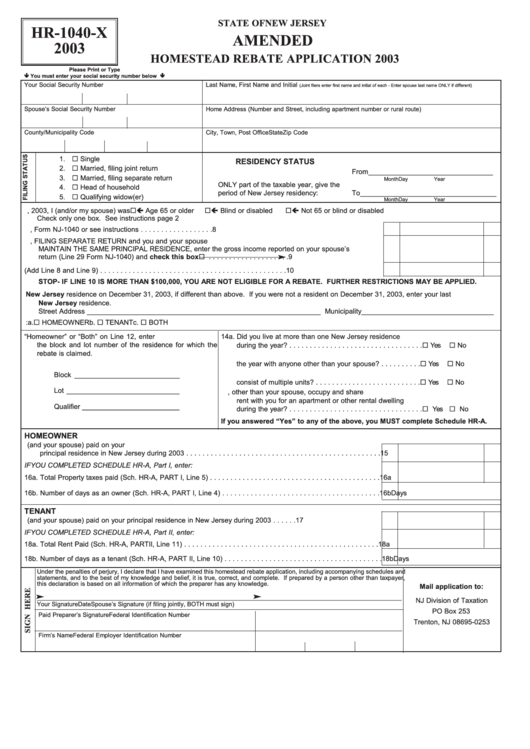

Fillable Form Hr 1040 X Amended Homestead Rebate Application 2003

Fillable Form Hr 1040 X Amended Homestead Rebate Application 2003

Web 14 Juli 2023 nbsp 0183 32 The Homestead Benefit program provides property tax relief to eligible homeowners For most homeowners the benefit is distributed to your municipality in the

Web 29 Sept 2022 nbsp 0183 32 File NJ Homestead Rebate Form Online A property tax credit known as the New Jersey homestead rebate is given to towns on behalf of homeowners who

Cash Where To File For Homestead State Rebate On Fed Form

Cash Where To File For Homestead State Rebate On Fed Form are by far the easiest type of Where To File For Homestead State Rebate On Fed Form. The customer receives a particular sum of money back when purchasing a particular item. These are usually used for more expensive items such electronics or appliances.

Mail-In Where To File For Homestead State Rebate On Fed Form

Mail-in Where To File For Homestead State Rebate On Fed Form require that customers send in evidence of purchase to get the refund. They're a little more involved but offer significant savings.

Instant Where To File For Homestead State Rebate On Fed Form

Instant Where To File For Homestead State Rebate On Fed Form are credited at the point of sale. They reduce the purchase price immediately. Customers do not have to wait for their savings by using this method.

How Where To File For Homestead State Rebate On Fed Form Work

SC Application For Homestead Exemption Fill And Sign Printable

SC Application For Homestead Exemption Fill And Sign Printable

Web File the signed application for exemption with the county property appraiser Date Signature property appraiser or deputy Date Entered by Date Penalties The property appraiser has

The Where To File For Homestead State Rebate On Fed Form Process

The process usually involves a handful of simple steps:

-

You purchase the item: First you purchase the item as you normally would.

-

Complete the Where To File For Homestead State Rebate On Fed Form questionnaire: you'll have submit some information including your name, address, and purchase details, in order to apply for your Where To File For Homestead State Rebate On Fed Form.

-

You must submit the Where To File For Homestead State Rebate On Fed Form: Depending on the type of Where To File For Homestead State Rebate On Fed Form you may have to send in a form, or upload it online.

-

Wait until the company approves: The company is going to review your entry to ensure it meets the terms and conditions of the Where To File For Homestead State Rebate On Fed Form.

-

Enjoy your Where To File For Homestead State Rebate On Fed Form Once it's approved, you'll receive the refund either by check, prepaid card, or other option as per the terms of the offer.

Pros and Cons of Where To File For Homestead State Rebate On Fed Form

Advantages

-

Cost savings Rewards can drastically reduce the price you pay for the item.

-

Promotional Deals They encourage customers to try new items or brands.

-

boost sales Reward programs can boost companies' sales and market share.

Disadvantages

-

Complexity In particular, mail-in Where To File For Homestead State Rebate On Fed Form in particular they can be time-consuming and tedious.

-

Expiration Dates Many Where To File For Homestead State Rebate On Fed Form have certain deadlines for submitting.

-

Risk of Not Being Paid Certain customers could not receive their refunds if they don't observe the rules precisely.

Download Where To File For Homestead State Rebate On Fed Form

Download Where To File For Homestead State Rebate On Fed Form

FAQs

1. Are Where To File For Homestead State Rebate On Fed Form similar to discounts? No, Where To File For Homestead State Rebate On Fed Form involve partial reimbursement after purchase, but discounts can reduce the price of the purchase at the point of sale.

2. Are there any Where To File For Homestead State Rebate On Fed Form that I can use on the same item This depends on the conditions that apply to the Where To File For Homestead State Rebate On Fed Form offered and product's ability to qualify. Certain companies may allow this, whereas others will not.

3. What is the time frame to receive the Where To File For Homestead State Rebate On Fed Form? The period is variable, however it can take anywhere from a few weeks to a few months before you receive your Where To File For Homestead State Rebate On Fed Form.

4. Do I need to pay tax of Where To File For Homestead State Rebate On Fed Form amounts? In the majority of situations, Where To File For Homestead State Rebate On Fed Form amounts are not considered taxable income.

5. Do I have confidence in Where To File For Homestead State Rebate On Fed Form offers from lesser-known brands Consider doing some research and make sure that the company giving the Where To File For Homestead State Rebate On Fed Form is legitimate prior to making a purchase.

Form Hr 1040 Sample Homestead Rebate Application 2000 Printable Pdf

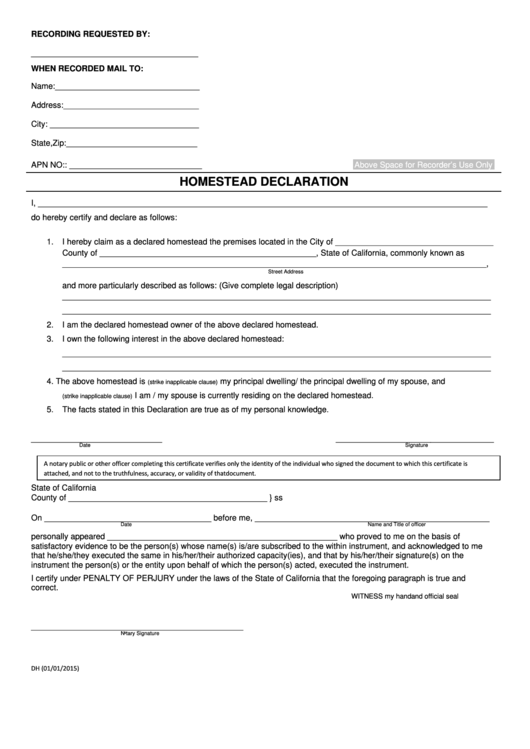

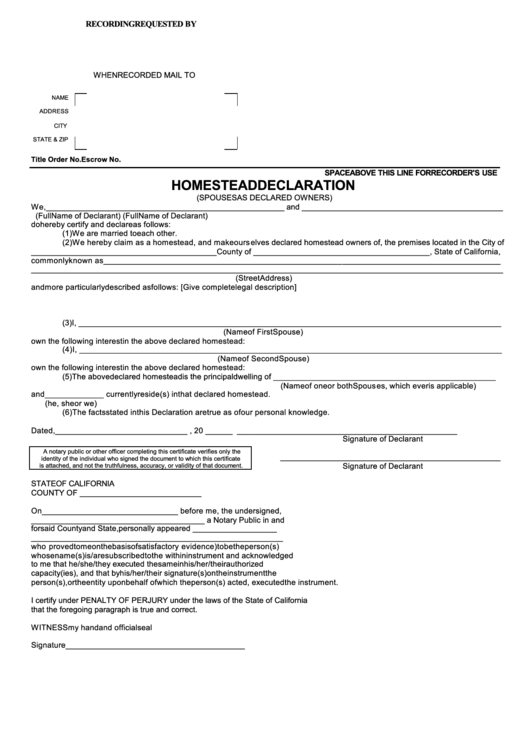

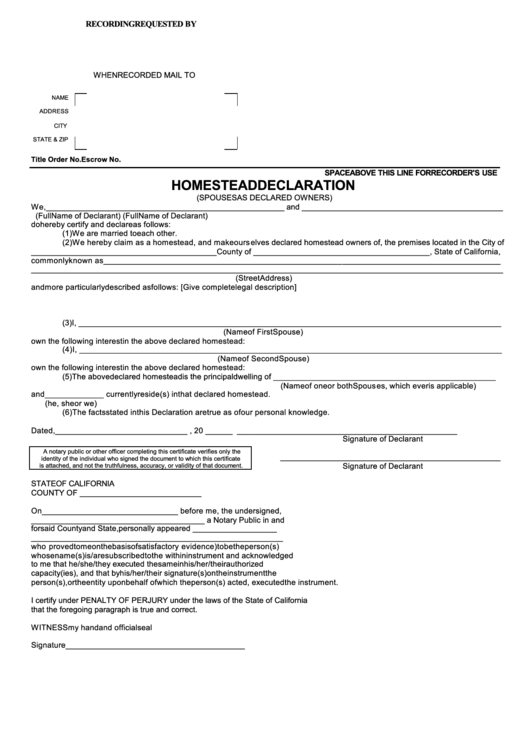

Fillable Homestead Declaration State Of California 2015 Printable

Check more sample of Where To File For Homestead State Rebate On Fed Form below

File Nj Homestead Rebate Form Online Check Status Printable Rebate Form

Fillable Homestead Declaration Form State Of California Printable Pdf

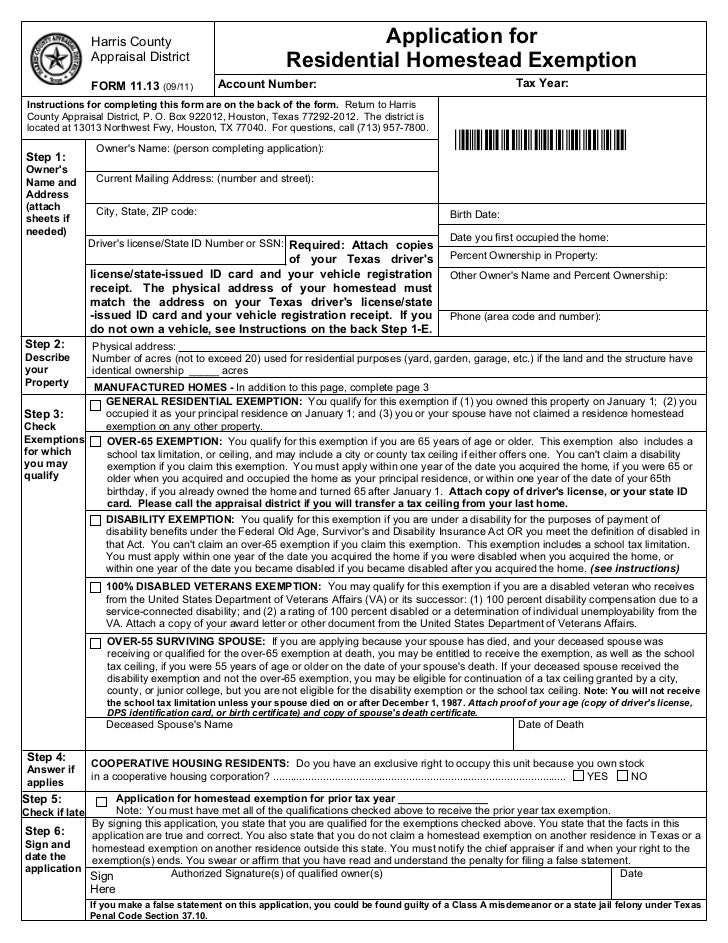

Homestead Exemption Form

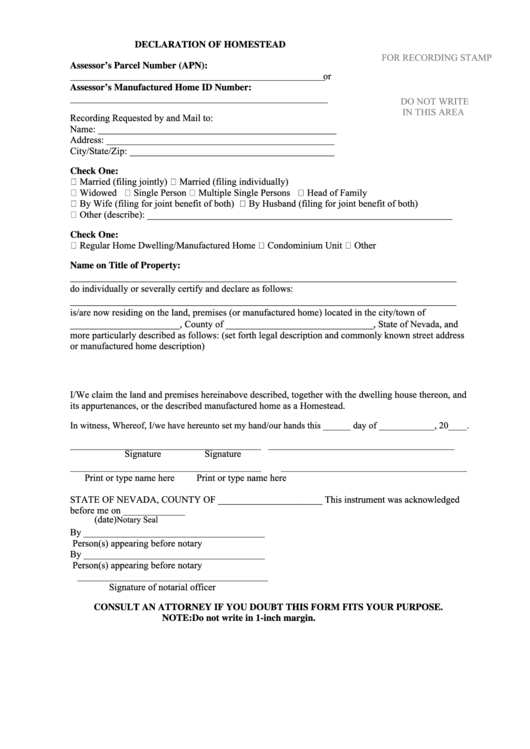

Fillable Declaration Of Homestead Form Printable Pdf Download

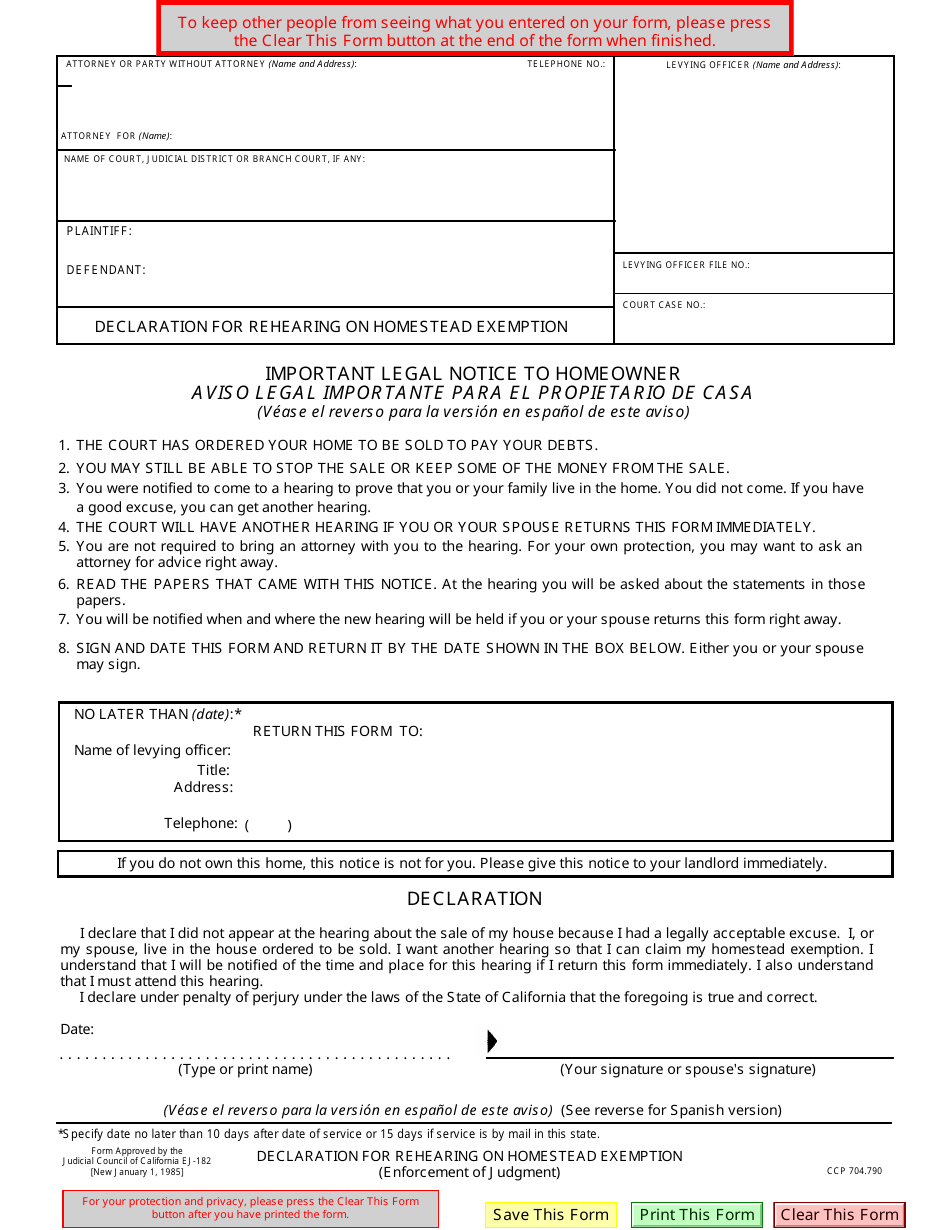

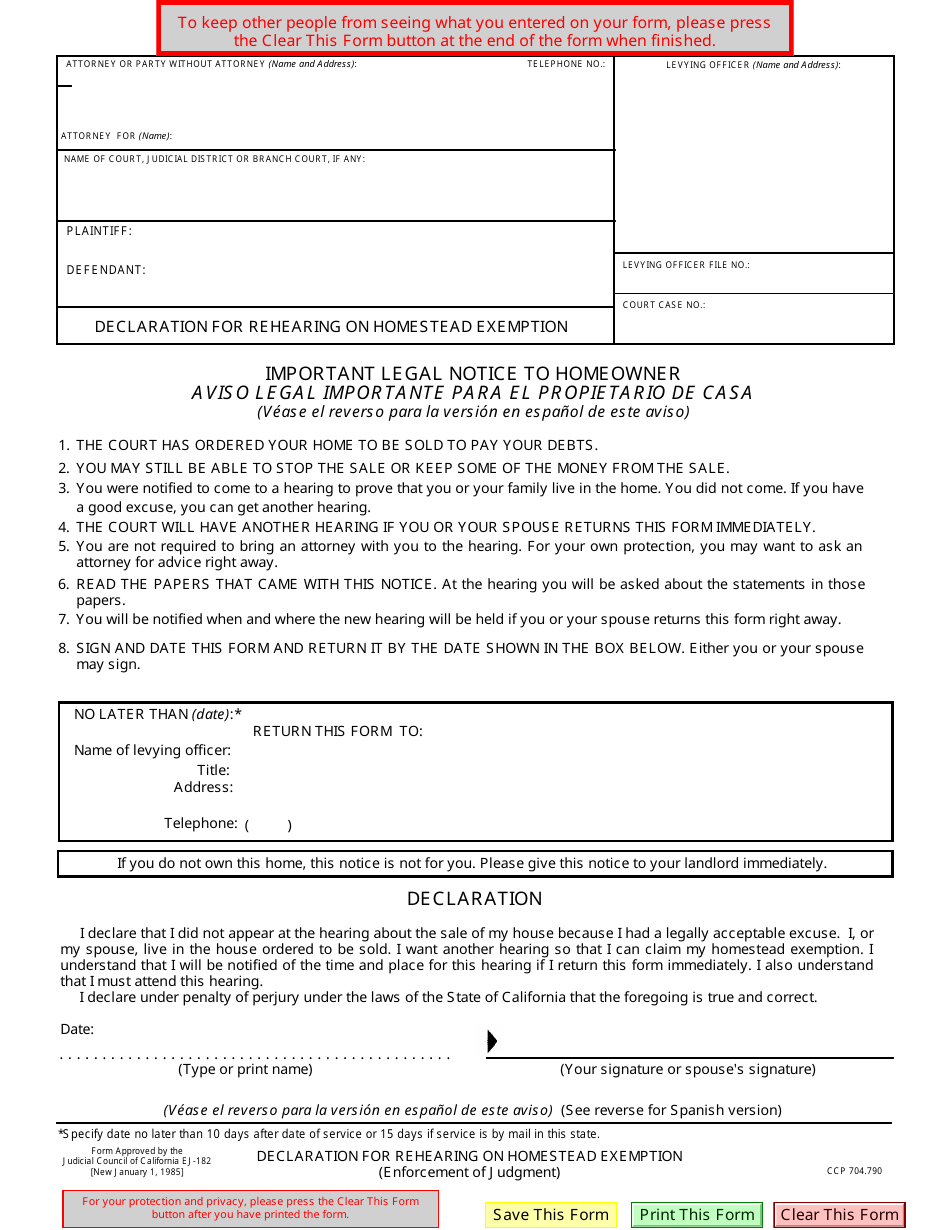

Form EJ 182 Download Fillable PDF Or Fill Online Declaration For

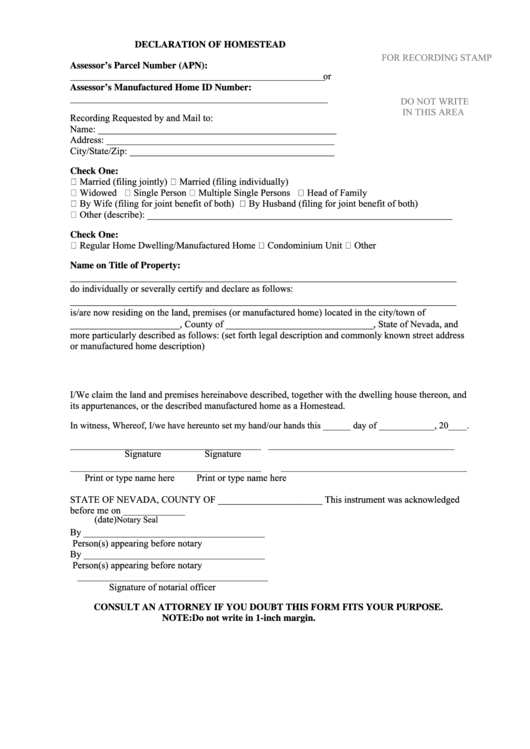

How To Fill Out Nevada Homestead Form Fill Out Sign Online DocHub

https://www.nj.com/entertainment/2019/03/how-does-my-homestead-rebate...

Web 4 M 228 rz 2019 nbsp 0183 32 If you received a rebate in the form of a credit to your property taxes then I would follow what you have done in the past and simply add up your tax payments and

https://www.irs.gov/instructions/i8898

Web You made a designation of homestead property or otherwise filed or recorded a declaration concerning property under a state homestead exemption law You applied for or took a

Web 4 M 228 rz 2019 nbsp 0183 32 If you received a rebate in the form of a credit to your property taxes then I would follow what you have done in the past and simply add up your tax payments and

Web You made a designation of homestead property or otherwise filed or recorded a declaration concerning property under a state homestead exemption law You applied for or took a

Fillable Declaration Of Homestead Form Printable Pdf Download

Fillable Homestead Declaration Form State Of California Printable Pdf

Form EJ 182 Download Fillable PDF Or Fill Online Declaration For

How To Fill Out Nevada Homestead Form Fill Out Sign Online DocHub

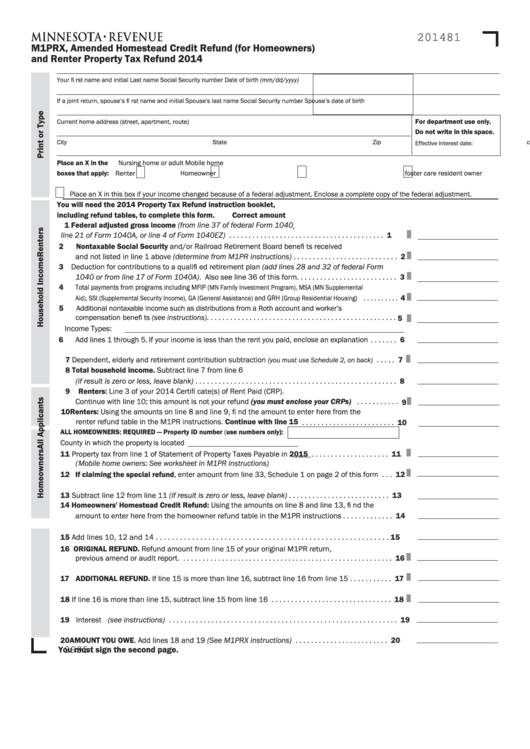

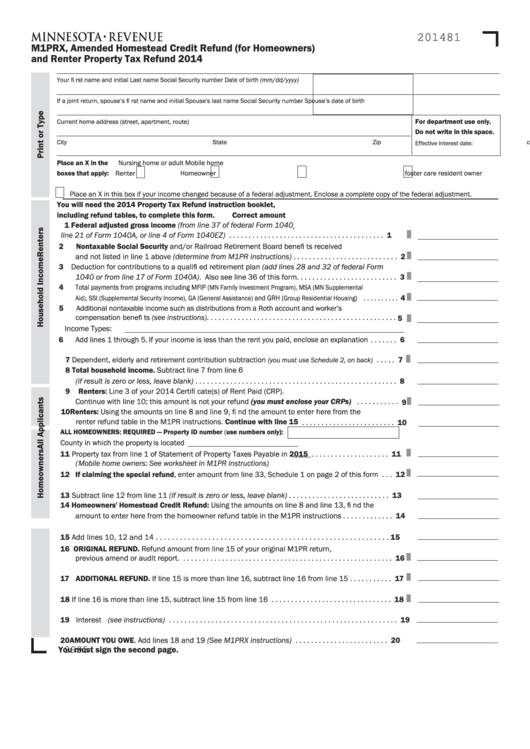

Fillable Form M1pr Homestead Credit Refund For Homeowners And

Fillable Form M1prx Minnesota Amended Homestead Credit Refund For

Fillable Form M1prx Minnesota Amended Homestead Credit Refund For

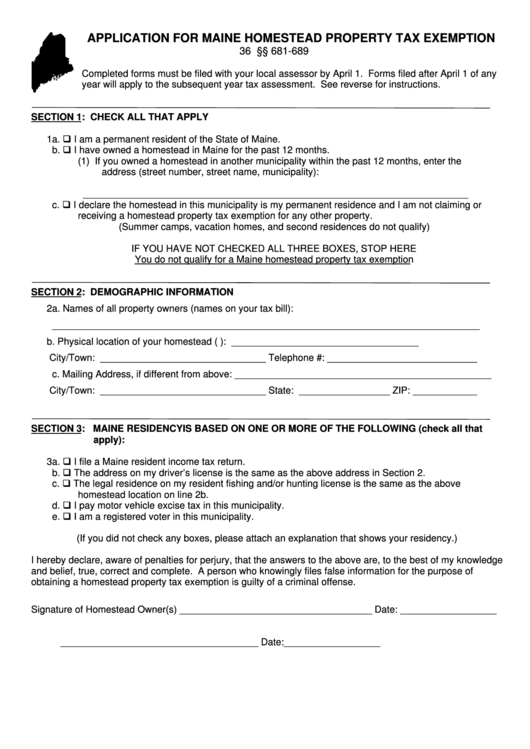

Fillable Application Form For Maine Homestead Property Tax Exemption