In today's world of consumerism we all love a good bargain. One way to score substantial savings from your purchases is via What Are Tax Rebatess. What Are Tax Rebatess can be a way of marketing that retailers and manufacturers use to offer consumers a partial payment on their purchases, after they've made them. In this article, we will dive into the world What Are Tax Rebatess and explore what they are and how they work and how you can make the most of the savings you can make by using these cost-effective incentives.

Get Latest What Are Tax Rebates Below

What Are Tax Rebates

What Are Tax Rebates - What Are Tax Rebates, What Are Tax Rebates South Africa, What Are The Tax Rebates For 2023, What Are Tax Credits, What Are Tax Returns, What Are Tax Deductions, What Are Tax Breaks, What Are Tax Exemptions, What Are Tax Incentives, What Are Tax Credits Ireland

A reduction in the amount of tax that has to be paid on something They are negotiating a property tax rebate for elderly home owners Definition of tax rebate

What is a Tax Rebate A tax rebate is a tax refund claimed by the employees and self employed persons if they have more as tax returns At the end of the financial year you can calculate the tax returns and allowances It will help you discover the areas where you can claim a tax refund from the HMRC

A What Are Tax Rebates in its most basic definition, is a refund offered to a customer after they've purchased a good or service. It's a powerful instrument employed by companies to draw clients, increase sales or promote a specific product.

Types of What Are Tax Rebates

Export Tax Rebates In China China Briefing News

Export Tax Rebates In China China Briefing News

A rebate is an amount by which SARS reduces the actual taxes owing depending on certain circumstances SARS will calculate the amount of tax that you owe to them based on your income and expenses throughout the year then if certain conditions apply they ll reduce the amount due The most common rebate in tax terms is for age

A tax refund or tax rebate is a payment to the taxpayer due to the taxpayer having paid more tax than they owed By country United States According to the Internal Revenue Service 77 of tax returns filed in 2004 resulted in a refund check with the average refund check being 2 100 1 In 2011 the average tax refund was 2 913

Cash What Are Tax Rebates

Cash What Are Tax Rebates are a simple kind of What Are Tax Rebates. The customer receives a particular amount of cash back after purchasing a product. These are typically applied to expensive items such as electronics or appliances.

Mail-In What Are Tax Rebates

Mail-in What Are Tax Rebates are based on the requirement that customers provide proof of purchase in order to receive the refund. They're more involved, however they can yield substantial savings.

Instant What Are Tax Rebates

Instant What Are Tax Rebates are applied at the moment of sale, cutting the price of your purchase instantly. Customers do not have to wait for their savings through this kind of offer.

How What Are Tax Rebates Work

Tax Rebates For 84 Companies Financial Tribune

Tax Rebates For 84 Companies Financial Tribune

Tax rebates are free to claim via HMRC and the process is relatively simple but some firms are charging between a quarter and half of the final tax payment received in return for their

The What Are Tax Rebates Process

The process typically involves a couple of steps that are easy to follow:

-

Buy the product: At first you purchase the item just like you normally would.

-

Fill in the What Are Tax Rebates paper: You'll need to supply some details, such as your name, address and details about your purchase, in order to make a claim for your What Are Tax Rebates.

-

In order to submit the What Are Tax Rebates It is dependent on the kind of What Are Tax Rebates there may be a requirement to mail in a form or make it available online.

-

Wait until the company approves: The company will look over your submission to ensure it meets the rules and regulations of the What Are Tax Rebates.

-

Accept your What Are Tax Rebates After you've been approved, you'll get your refund, whether by check, prepaid card or another method that is specified in the offer.

Pros and Cons of What Are Tax Rebates

Advantages

-

Cost savings What Are Tax Rebates can substantially reduce the cost for an item.

-

Promotional Offers: They encourage customers to try out new products or brands.

-

Help to Increase Sales: What Are Tax Rebates can boost the sales of a business and increase its market share.

Disadvantages

-

Complexity The mail-in What Are Tax Rebates particularly is a time-consuming process and take a long time to complete.

-

Expiration Dates Some What Are Tax Rebates have rigid deadlines to submit.

-

Risk of not receiving payment Some customers might have their What Are Tax Rebates delayed if they do not follow the rules precisely.

Download What Are Tax Rebates

FAQs

1. Are What Are Tax Rebates the same as discounts? No, What Are Tax Rebates offer a partial refund after the purchase, whereas discounts reduce your purchase cost at time of sale.

2. Can I make use of multiple What Are Tax Rebates for the same product This depends on the terms in the What Are Tax Rebates is offered as well as the merchandise's qualification. Certain companies may permit it, and some don't.

3. What is the time frame to receive an What Are Tax Rebates? The period is variable, however it can take a couple of weeks or a few months for you to receive your What Are Tax Rebates.

4. Do I need to pay taxes when I receive What Are Tax Rebates values? most cases, What Are Tax Rebates amounts are not considered to be taxable income.

5. Do I have confidence in What Are Tax Rebates offers from brands that aren't well-known It's crucial to research and confirm that the brand giving the What Are Tax Rebates is trustworthy prior to making purchases.

Tax Credits Save You More Than Deductions Here Are The Best Ones

Tax Rebates Made Simple YouTube

Check more sample of What Are Tax Rebates below

Online Tax Rebates Claim Instantly FREE Quick Estimate

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

Tax Rebates CBM Training

Tax Rebates For Solar Power Ineffective For Low income Americans But

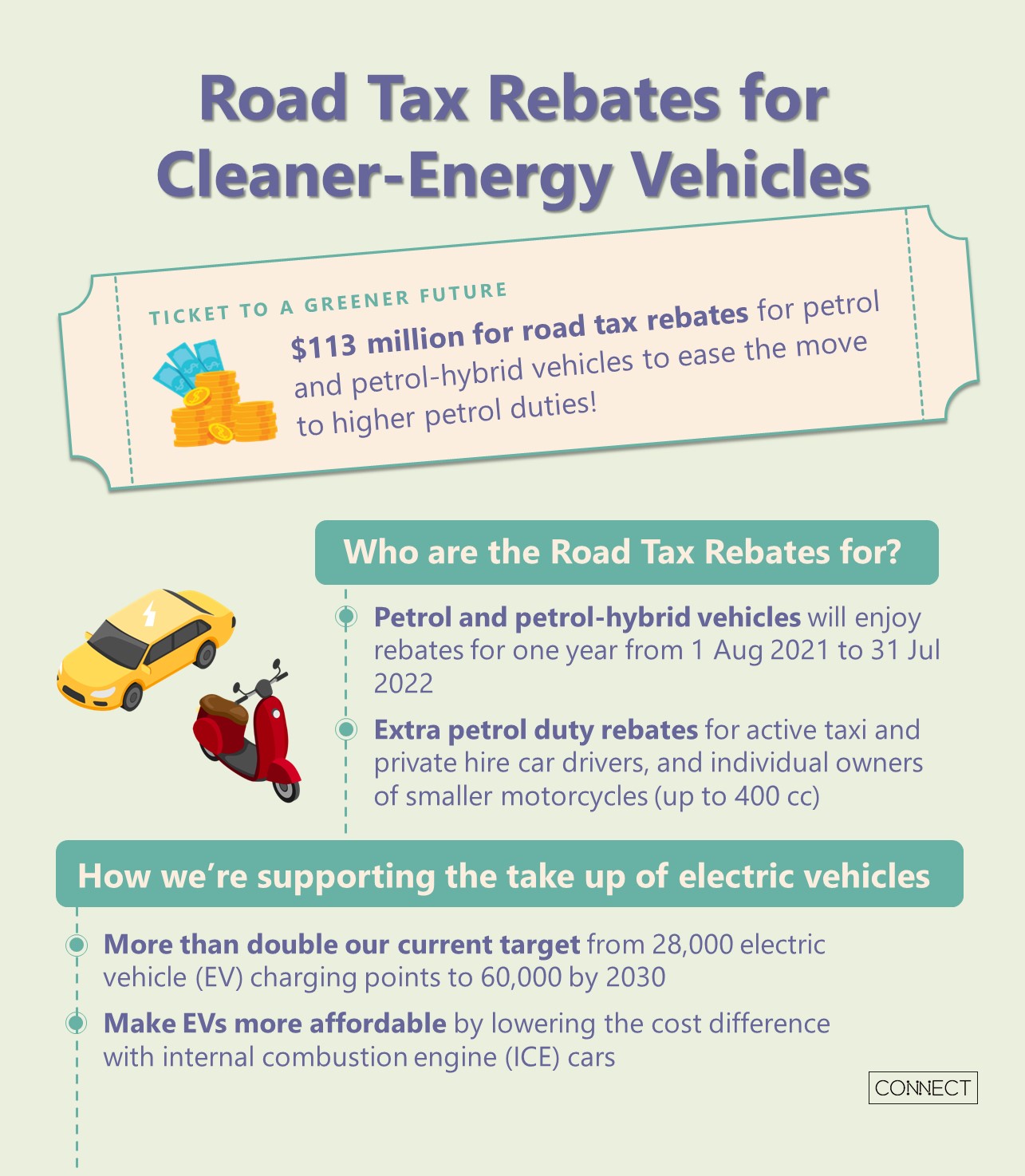

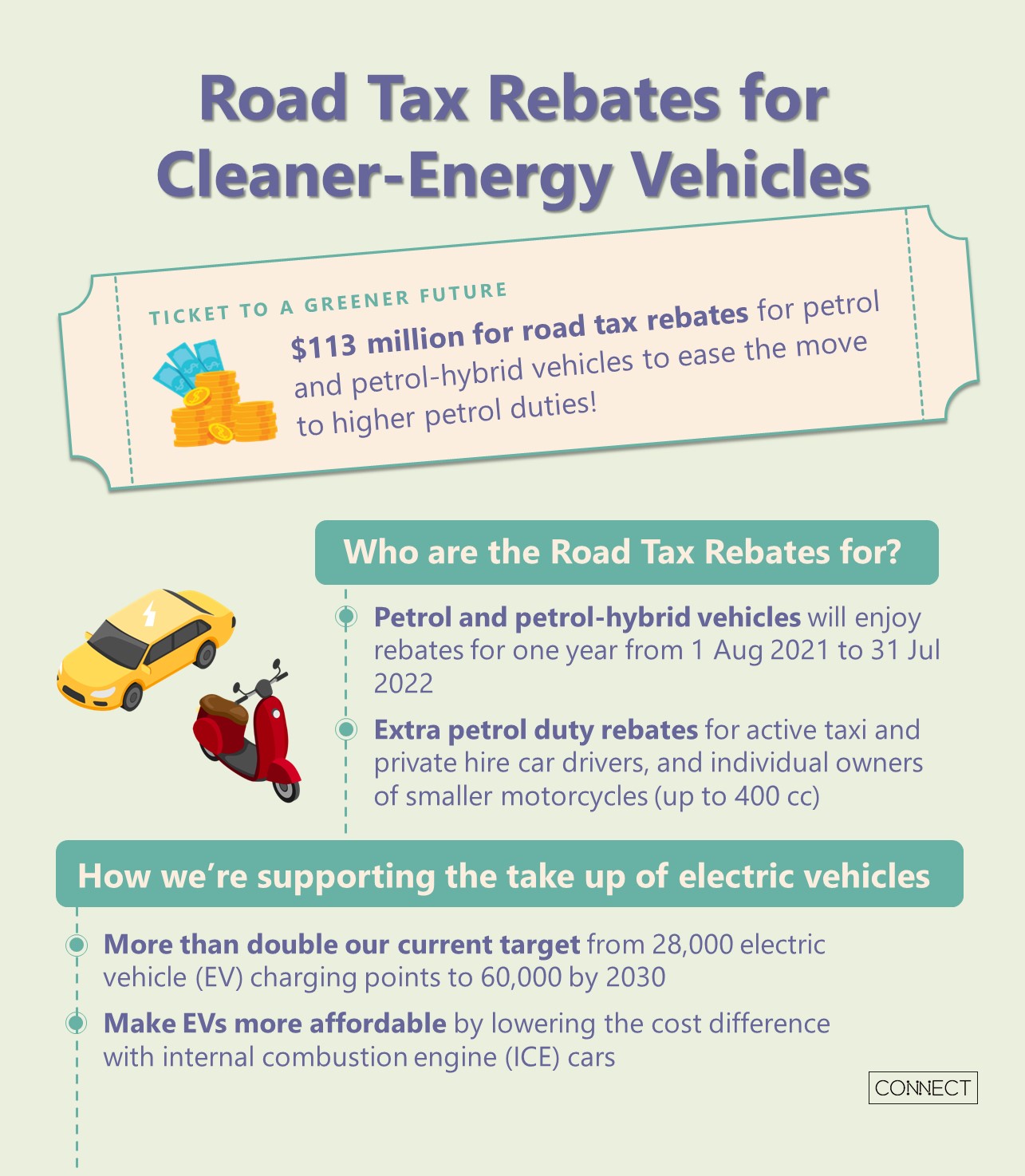

LTA Latest Happenings More Road Tax Rebates For A Greener Future

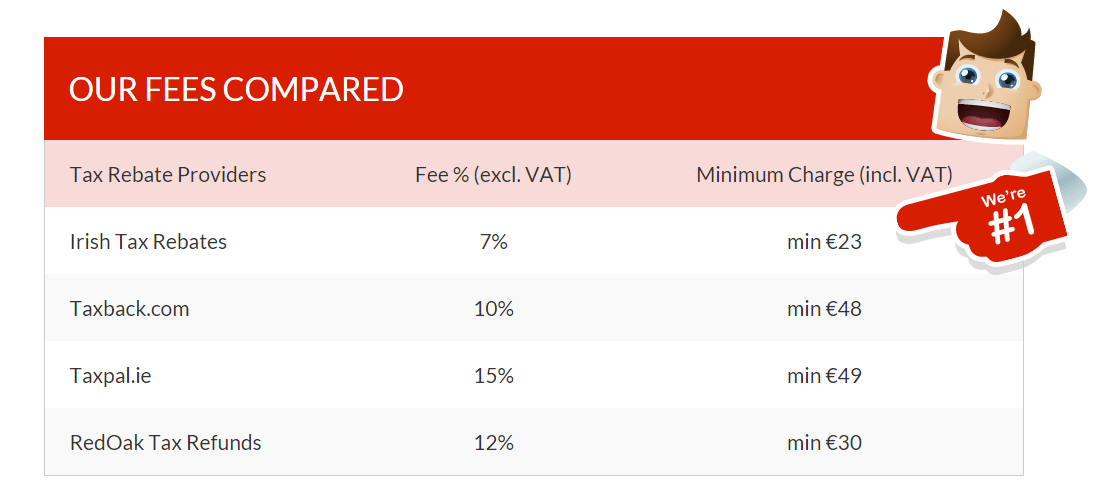

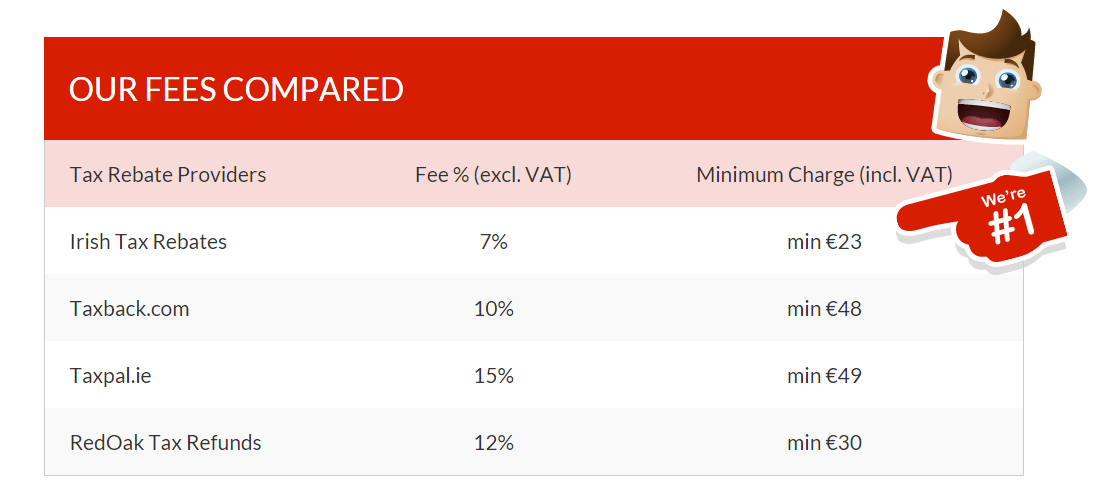

Why You Should Use A Tax Expert To Claim Tax Back Irish Tax Rebates

https://www.accountingfirms.co.uk/blog/what-is-a-tax-rebate

What is a Tax Rebate A tax rebate is a tax refund claimed by the employees and self employed persons if they have more as tax returns At the end of the financial year you can calculate the tax returns and allowances It will help you discover the areas where you can claim a tax refund from the HMRC

https://www.investopedia.com/terms/r/rebate.asp

Broadly speaking a rebate is a sum of money that is credited or returned to a customer on completion of a transaction A rebate may offer cashback on the purchase

What is a Tax Rebate A tax rebate is a tax refund claimed by the employees and self employed persons if they have more as tax returns At the end of the financial year you can calculate the tax returns and allowances It will help you discover the areas where you can claim a tax refund from the HMRC

Broadly speaking a rebate is a sum of money that is credited or returned to a customer on completion of a transaction A rebate may offer cashback on the purchase

Tax Rebates For Solar Power Ineffective For Low income Americans But

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

LTA Latest Happenings More Road Tax Rebates For A Greener Future

Why You Should Use A Tax Expert To Claim Tax Back Irish Tax Rebates

Congress Unveils Deal For Tax Rebates

2022 State Of Illinois Tax Rebates Scheffel Boyle

2022 State Of Illinois Tax Rebates Scheffel Boyle

Tax Rebates 2022 IRS To Send Up To 750 To Each Eligible Taxpayer In