In the modern world of consumerization everybody loves a good bargain. One method of gaining substantial savings on your purchases is to use Tulsa County Sales Tax Rebate Forms. Tulsa County Sales Tax Rebate Forms are a method of marketing employed by retailers and manufacturers in order to offer customers a small return on their purchases once they've bought them. In this post, we'll explore the world of Tulsa County Sales Tax Rebate Forms. We will explore the nature of them, how they work, and how to maximize your savings through these cost-effective incentives.

Get Latest Tulsa County Sales Tax Rebate Form Below

Tulsa County Sales Tax Rebate Form

Tulsa County Sales Tax Rebate Form -

Web Create a free account set a strong password and go through email verification to start working on your forms Add a document Click on New Document and choose the file importing option upload Tulsa sales tax

Web City of Tulsa Attn Sales Tax Rebate P O Box 1499 Tulsa OK 74101 1499 or drop off at City Hall Cashier s Office PLEASE PRINT or TYPE CLEARLY DEADLINE FOR

A Tulsa County Sales Tax Rebate Form in its most basic definition, is a cash refund provided to customers following the purchase of a product or service. It's an effective method used by businesses to attract buyers, increase sales and also to advertise certain products.

Types of Tulsa County Sales Tax Rebate Form

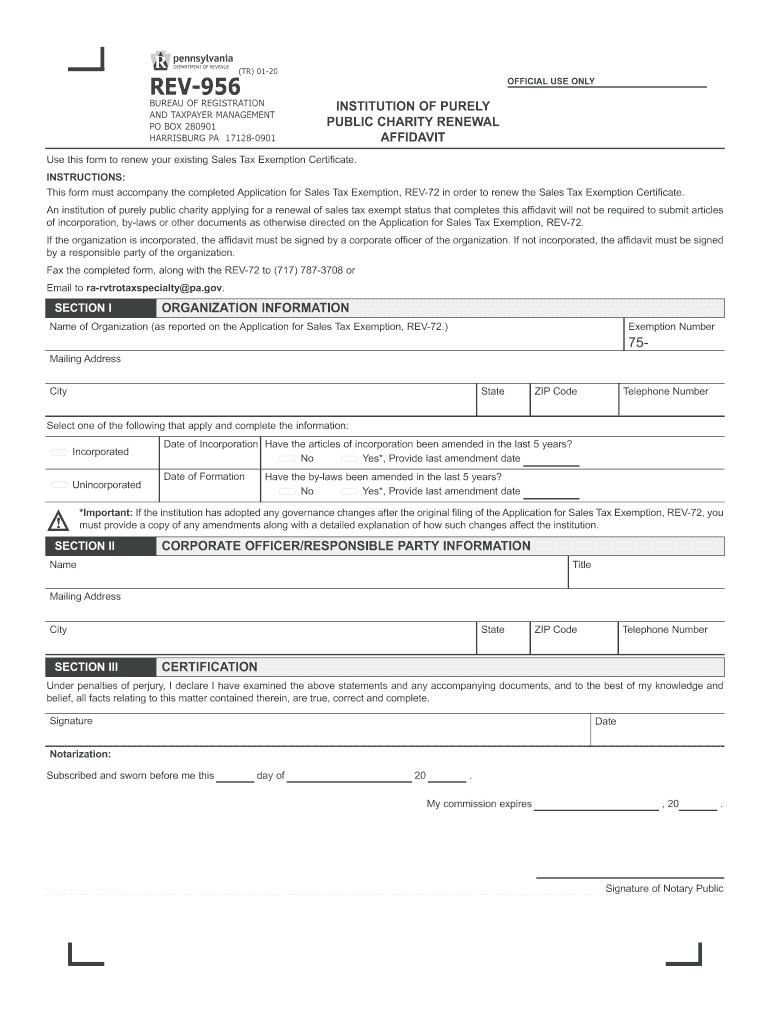

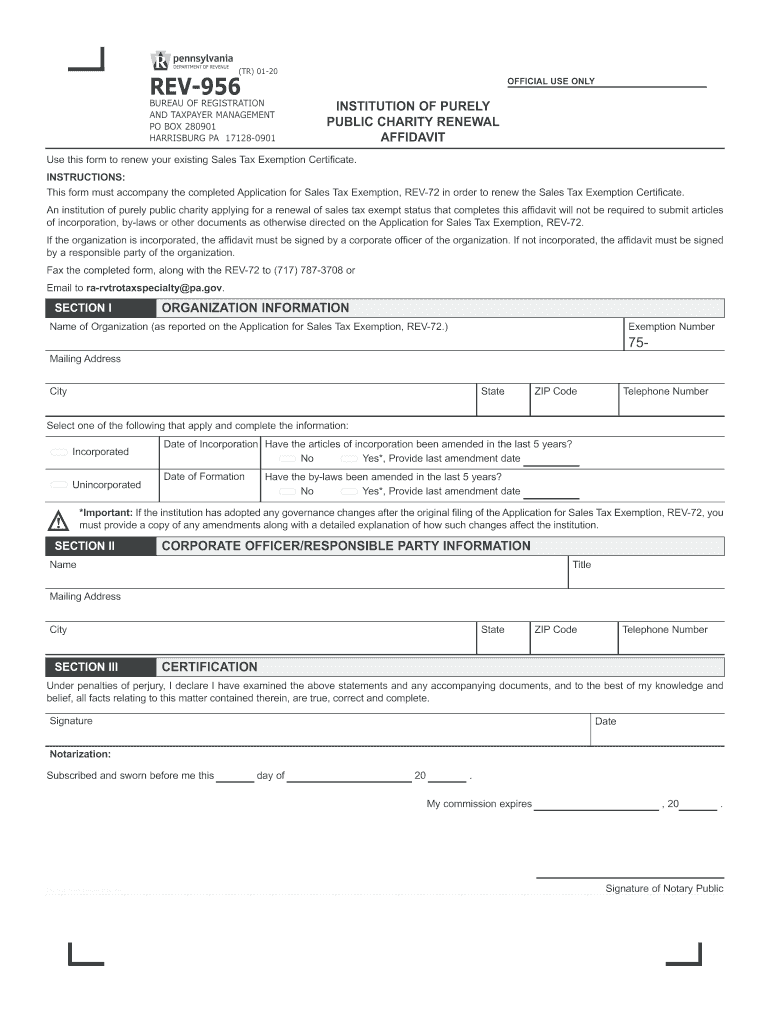

2020 2023 Form PA REV 956 Fill Online Printable Fillable Blank

2020 2023 Form PA REV 956 Fill Online Printable Fillable Blank

Web The Tulsa County Assessor is responsible for placing a Fair Cash Value Market on property as of the tax date January 1 of each year in Tulsa County

Web Application for Vision 2025 Sales Tax Rebate Please mail form to J Dennis Seller Tulsa County Treasurer ATTN Sales Tax Rebate 500 S Denver Ave Rm 323 Tulsa OK

Cash Tulsa County Sales Tax Rebate Form

Cash Tulsa County Sales Tax Rebate Form are the simplest kind of Tulsa County Sales Tax Rebate Form. Clients receive a predetermined amount of money in return for purchasing a product. They are typically used to purchase more expensive items such electronics or appliances.

Mail-In Tulsa County Sales Tax Rebate Form

Mail-in Tulsa County Sales Tax Rebate Form require the customer to present evidence of purchase to get their money back. They're somewhat longer-lasting, however they offer huge savings.

Instant Tulsa County Sales Tax Rebate Form

Instant Tulsa County Sales Tax Rebate Form will be applied at point of sale, which reduces the price of your purchase instantly. Customers don't need to wait for savings in this manner.

How Tulsa County Sales Tax Rebate Form Work

Rebate Form Download Printable PDF Templateroller

Rebate Form Download Printable PDF Templateroller

Web Tulsa County Headquarters 218 W 6th St Tulsa OK 74119 1004 918 596 5000

The Tulsa County Sales Tax Rebate Form Process

The process usually involves a few simple steps:

-

Purchase the product: First you buy the product just like you normally would.

-

Complete your Tulsa County Sales Tax Rebate Form template: You'll need to give some specific information including your address, name, and purchase details to be eligible for a Tulsa County Sales Tax Rebate Form.

-

In order to submit the Tulsa County Sales Tax Rebate Form In accordance with the nature of Tulsa County Sales Tax Rebate Form it is possible that you need to mail in a form or submit it online.

-

Wait until the company approves: The company will go through your application to confirm that it complies with the Tulsa County Sales Tax Rebate Form's terms and conditions.

-

Enjoy your Tulsa County Sales Tax Rebate Form After approval, you'll be able to receive your reimbursement, in the form of a check, prepaid card or through a different way specified in the offer.

Pros and Cons of Tulsa County Sales Tax Rebate Form

Advantages

-

Cost savings Rewards can drastically cut the price you pay for a product.

-

Promotional Offers they encourage their customers to experiment with new products, or brands.

-

Improve Sales Tulsa County Sales Tax Rebate Form are a great way to boost the company's sales as well as market share.

Disadvantages

-

Complexity The mail-in Tulsa County Sales Tax Rebate Form particularly is a time-consuming process and lengthy.

-

Days of expiration Most Tulsa County Sales Tax Rebate Form come with rigid deadlines to submit.

-

Risque of Non-Payment Some customers might not be able to receive their Tulsa County Sales Tax Rebate Form if they don't adhere to the requirements exactly.

Download Tulsa County Sales Tax Rebate Form

Download Tulsa County Sales Tax Rebate Form

FAQs

1. Are Tulsa County Sales Tax Rebate Form the same as discounts? No, Tulsa County Sales Tax Rebate Form require a partial refund after the purchase, and discounts are a reduction of prices at point of sale.

2. Are multiple Tulsa County Sales Tax Rebate Form available on the same item It's contingent upon the terms for the Tulsa County Sales Tax Rebate Form provides and the particular product's acceptance. Some companies will allow the use of multiple Tulsa County Sales Tax Rebate Form, whereas other won't.

3. How long will it take to get a Tulsa County Sales Tax Rebate Form? The period is different, but it could be from several weeks to couple of months before you get your Tulsa County Sales Tax Rebate Form.

4. Do I need to pay tax of Tulsa County Sales Tax Rebate Form montants? the majority of situations, Tulsa County Sales Tax Rebate Form amounts are not considered to be taxable income.

5. Do I have confidence in Tulsa County Sales Tax Rebate Form deals from lesser-known brands It is essential to investigate and ensure that the brand providing the Tulsa County Sales Tax Rebate Form is reputable before making an purchase.

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19

PA Property Tax Rebate Forms Printable Rebate Form

Check more sample of Tulsa County Sales Tax Rebate Form below

Council Tax Rebate Form 2023 Printable Rebate Form

Illinois Tax Rebate Tracker Rebate2022

Midland County Leaders Deny Bass Pro Shops Sales Tax Rebate

Rent Rebate Tax Form Missouri Printable Rebate Form

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://formspal.com/pdf-forms/other/application-for-sales-t…

Web City of Tulsa Attn Sales Tax Rebate P O Box 1499 Tulsa OK 74101 1499 or drop off at City Hall Cashier s Office PLEASE PRINT or TYPE CLEARLY DEADLINE FOR

https://www.signnow.com/fill-and-sign-pdf-for…

Web Tulsa Sales Tax Rebate Form Get started with a tulsa sales tax 0 complete it in a few clicks and submit it securely

Web City of Tulsa Attn Sales Tax Rebate P O Box 1499 Tulsa OK 74101 1499 or drop off at City Hall Cashier s Office PLEASE PRINT or TYPE CLEARLY DEADLINE FOR

Web Tulsa Sales Tax Rebate Form Get started with a tulsa sales tax 0 complete it in a few clicks and submit it securely

Rent Rebate Tax Form Missouri Printable Rebate Form

Illinois Tax Rebate Tracker Rebate2022

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Georgia Income Tax Rebate 2023 Printable Rebate Form

Request To Rebate Sales Taxes To Lake County Businesses Doesn t Gain

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

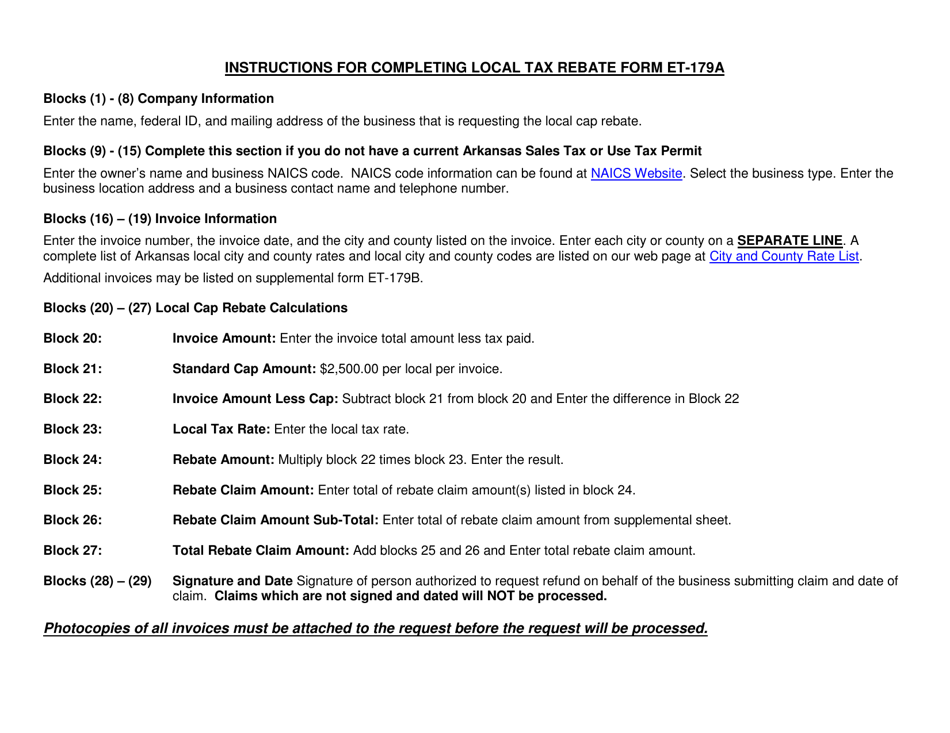

Form ET 179A Fill Out Sign Online And Download Fillable PDF