In the modern world of consumerization everybody loves a good bargain. One method of gaining substantial savings in your purchase is through Tesla Tax Rebate Forms. Tesla Tax Rebate Forms can be a way of marketing used by manufacturers and retailers to give customers a part refund on their purchases after they have taken them. In this post, we'll look into the world of Tesla Tax Rebate Forms. We'll look at what they are, how they work, and how you can maximize your savings through these efficient incentives.

Get Latest Tesla Tax Rebate Form Below

Tesla Tax Rebate Form

Tesla Tax Rebate Form - Tesla Tax Rebate Form, Tesla Tax Credit Form, Tesla Tax Credit Form 2022, Tesla Tax Credit 2023 Form, Tesla Ev Tax Credit Form, Tesla Charger Tax Credit Form, Is There A Tax Rebate For Tesla, How Does Tesla Tax Rebate Work, Does Tesla Get Tax Credit

Web 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The maximum credit is 7 500 It is nonrefundable so

Web Several government entities and local utilities offer electric vehicle and solar incentives for customers often taking the form of a rebate or a tax credit Rebates can be claimed at

A Tesla Tax Rebate Form or Tesla Tax Rebate Form, in its most basic format, is a refund offered to a customer when they purchase a product or service. This is a potent tool employed by companies to draw buyers, increase sales and to promote certain products.

Types of Tesla Tax Rebate Form

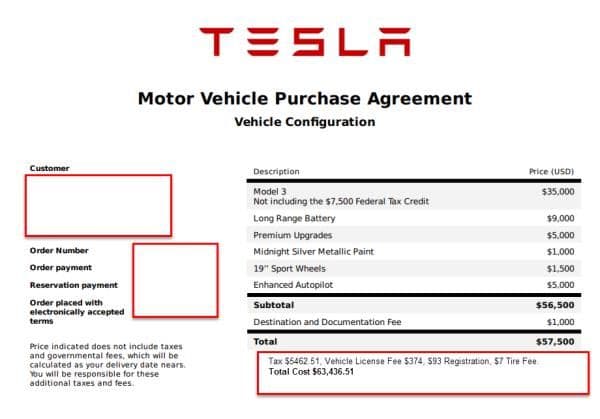

Is This A Good Deal For Tesla Model 3 Ask The Hackrs Leasehackr Forum

Is This A Good Deal For Tesla Model 3 Ask The Hackrs Leasehackr Forum

Web Up to 7 500 total In general the minimum credit will be 3 751 2 500 3 times 417 the credit amount for a vehicle with the minimum 7 kilowatt hours of battery capacity For

Web 7 janv 2023 nbsp 0183 32 For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some vehicles and only some buyers are eligible Justin

Cash Tesla Tax Rebate Form

Cash Tesla Tax Rebate Form are the simplest kind of Tesla Tax Rebate Form. The customer receives a particular amount of money back after purchasing a particular item. These are typically for high-ticket items like electronics or appliances.

Mail-In Tesla Tax Rebate Form

Mail-in Tesla Tax Rebate Form require that customers present the proof of purchase in order to receive their refund. They're a little more involved, however they can yield substantial savings.

Instant Tesla Tax Rebate Form

Instant Tesla Tax Rebate Form are credited at the place of purchase, reducing the cost of purchase immediately. Customers don't need to wait around for savings in this manner.

How Tesla Tax Rebate Form Work

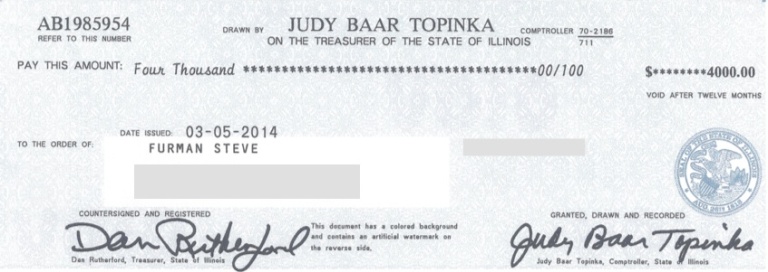

Filing Tax Returns EV Credits Tesla Motors Club

Filing Tax Returns EV Credits Tesla Motors Club

Web 13 janv 2023 nbsp 0183 32 As car prices soared during 2022 baseline models of Tesla vehicles suddenly fell in step with their competition s pricing The baseline Model 3 costs 43 990 or 36 490 with the tax rebate

The Tesla Tax Rebate Form Process

The process typically involves a few simple steps:

-

Purchase the item: First, you purchase the item in the same way you would normally.

-

Fill out the Tesla Tax Rebate Form questionnaire: you'll need to fill in some information including your name, address and purchase information, to get your Tesla Tax Rebate Form.

-

Complete the Tesla Tax Rebate Form The Tesla Tax Rebate Form must be submitted in accordance with the kind of Tesla Tax Rebate Form, you may need to mail a Tesla Tax Rebate Form form in or upload it online.

-

Wait until the company approves: The company will examine your application to ensure it meets the Tesla Tax Rebate Form's terms and conditions.

-

Take advantage of your Tesla Tax Rebate Form After you've been approved, you'll be able to receive your reimbursement, through a check, or a prepaid card, or a different procedure specified by the deal.

Pros and Cons of Tesla Tax Rebate Form

Advantages

-

Cost savings: Tesla Tax Rebate Form can significantly reduce the cost for an item.

-

Promotional Deals The aim is to encourage customers to explore new products or brands.

-

Help to Increase Sales Tesla Tax Rebate Form can increase the sales of a company as well as its market share.

Disadvantages

-

Complexity Pay-in Tesla Tax Rebate Form via mail, particularly they can be time-consuming and take a long time to complete.

-

Deadlines for Expiration Most Tesla Tax Rebate Form come with extremely strict deadlines to submit.

-

The risk of non-payment Customers may not receive their Tesla Tax Rebate Form if they don't adhere to the rules precisely.

Download Tesla Tax Rebate Form

Download Tesla Tax Rebate Form

FAQs

1. Are Tesla Tax Rebate Form the same as discounts? No, Tesla Tax Rebate Form offer one-third of the amount refunded following purchase, while discounts lower your purchase cost at moment of sale.

2. Are multiple Tesla Tax Rebate Form available on the same product It's contingent upon the terms that apply to the Tesla Tax Rebate Form is offered as well as the merchandise's qualification. Some companies may allow this, whereas others will not.

3. What is the time frame to get an Tesla Tax Rebate Form? The duration will vary, but it may take several weeks to a several months to receive a Tesla Tax Rebate Form.

4. Do I need to pay tax with respect to Tesla Tax Rebate Form quantities? most instances, Tesla Tax Rebate Form amounts are not considered to be taxable income.

5. Should I be able to trust Tesla Tax Rebate Form deals from lesser-known brands It is essential to investigate and ensure that the brand offering the Tesla Tax Rebate Form is legitimate prior to making a purchase.

Tesla Model 3s Commanding Surprisingly Small Premium On New used Market

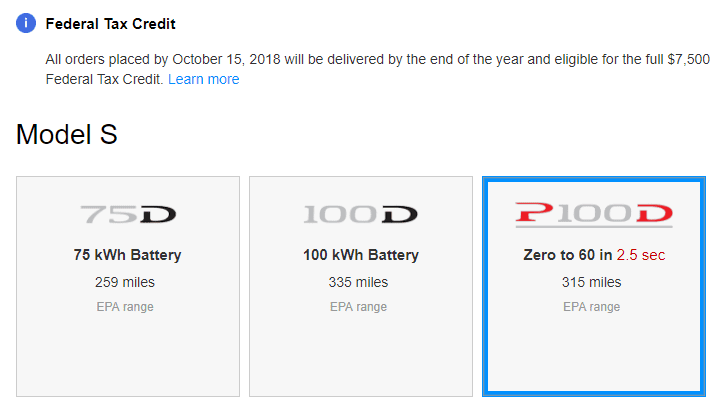

Tax Deductions For Tesla Incentives Rebates And Credits

Check more sample of Tesla Tax Rebate Form below

Tesla Tax Time

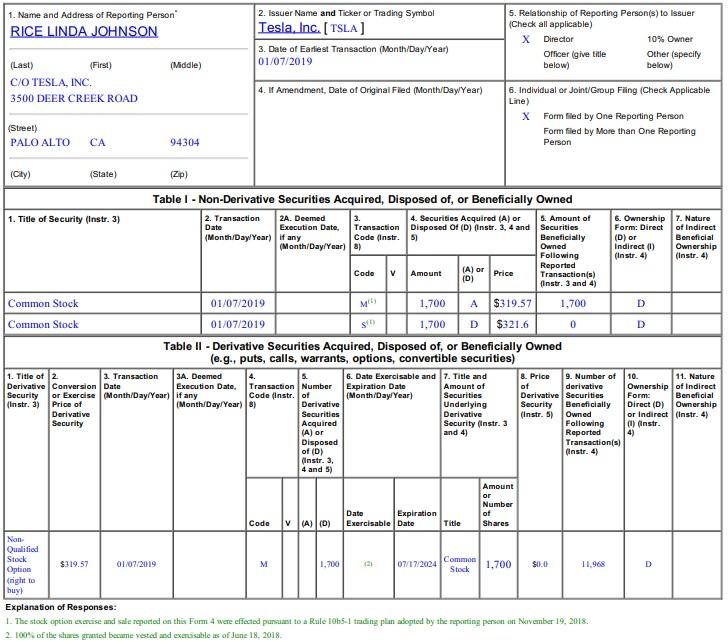

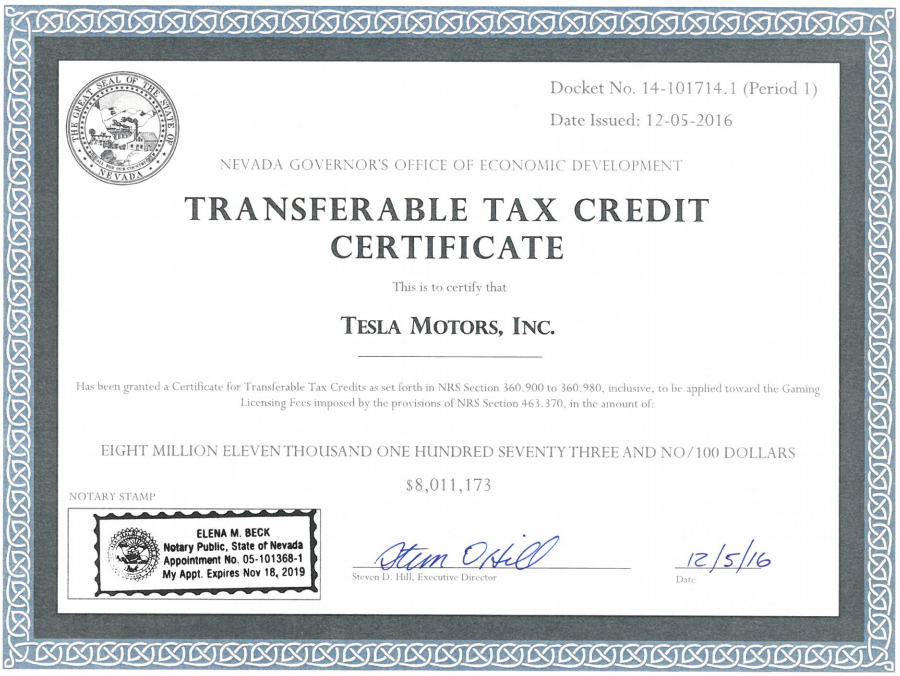

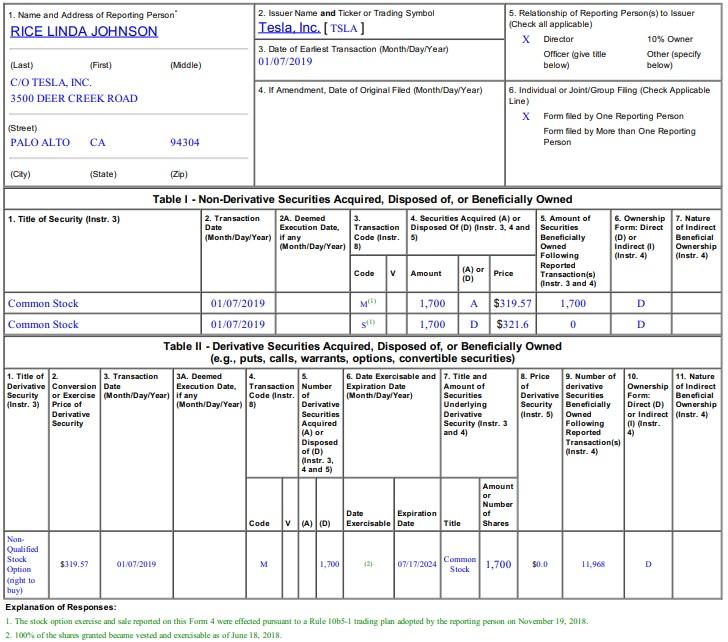

Tesla Receives 8 Million In Tax Credit For The Gigafactory After

Fillable Pa 40 Fill Out Sign Online DocHub

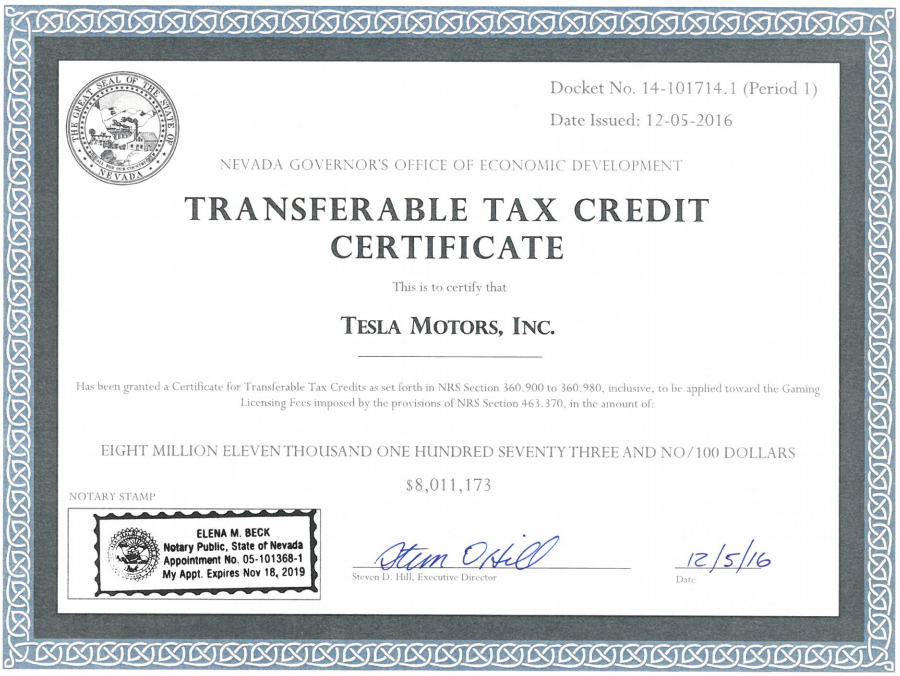

The Tesla EV Tax Credit

.jpg)

Government Rebate Program Fill Out Sign Online DocHub

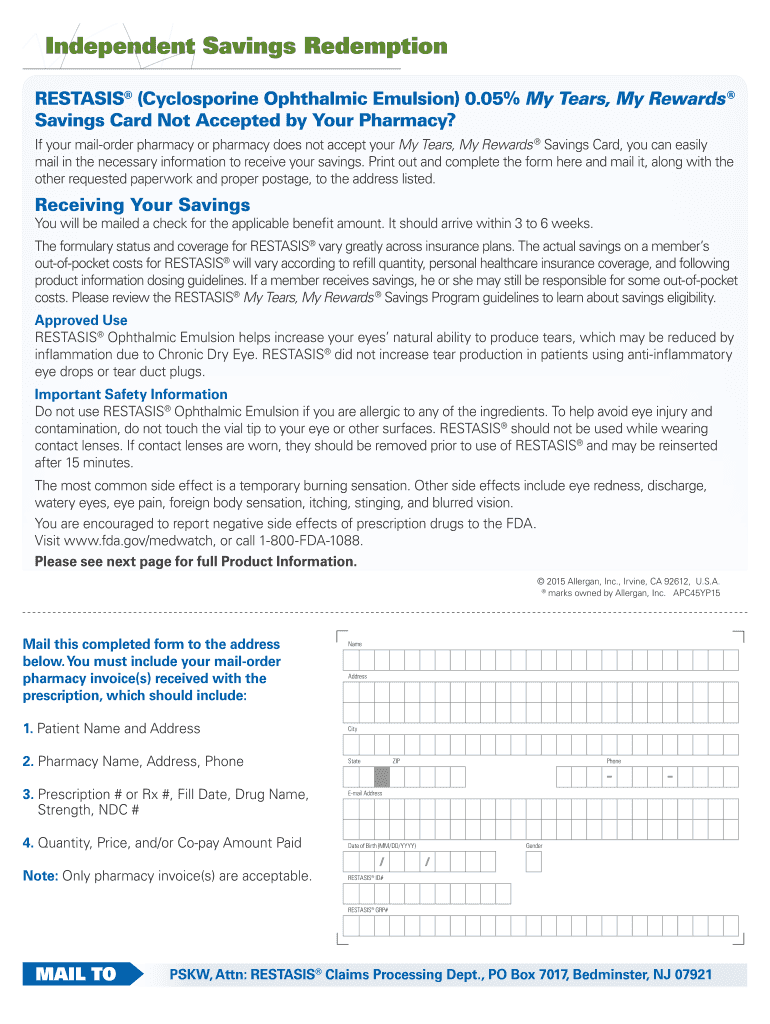

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

https://www.tesla.com/support/incentives

Web Several government entities and local utilities offer electric vehicle and solar incentives for customers often taking the form of a rebate or a tax credit Rebates can be claimed at

https://www.irs.gov/pub/irs-pdf/f8936.pdf

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled

Web Several government entities and local utilities offer electric vehicle and solar incentives for customers often taking the form of a rebate or a tax credit Rebates can be claimed at

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled

.jpg)

The Tesla EV Tax Credit

Tesla Receives 8 Million In Tax Credit For The Gigafactory After

Government Rebate Program Fill Out Sign Online DocHub

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

This Week In Tesla News October 2018 Week 2 EVBite

P G And E Ev Rebate Printable Rebate Form

P G And E Ev Rebate Printable Rebate Form

Restasis Claim Form Fill Online Printable Fillable Blank PdfFiller