In today's consumer-driven world, everyone loves a good deal. One way to make significant savings in your purchase is through Tax Rebates For Pellet Stovess. The use of Tax Rebates For Pellet Stovess is a method used by manufacturers and retailers to offer consumers a partial refund on their purchases after they've purchased them. In this article, we'll go deeper into the realm of Tax Rebates For Pellet Stovess. We'll explore the nature of them and how they function, and the best way to increase your savings using these low-cost incentives.

Get Latest Tax Rebates For Pellet Stoves Below

Tax Rebates For Pellet Stoves

Tax Rebates For Pellet Stoves -

Web 26 oct 2021 nbsp 0183 32 How Do I Claim The Biomass Stove Tax Credit What If I Purchase a Heating Appliance for a Secondary Home Heating Wood Pellets Available From

Web Le montant du cr 233 dit d imp 244 t 2020 pour un po 234 le 224 granul 233 s Depuis le 1 er janvier 2020 le cr 233 dit d imp 244 t n est plus calcul 233 sur base du prix du po 234 le 224 granul 233 s 30 du montant

A Tax Rebates For Pellet Stoves the simplest description, is a reimbursement to a buyer who has purchased a particular product or service. It is a powerful tool used by companies to attract customers, increase sales as well as promote particular products.

Types of Tax Rebates For Pellet Stoves

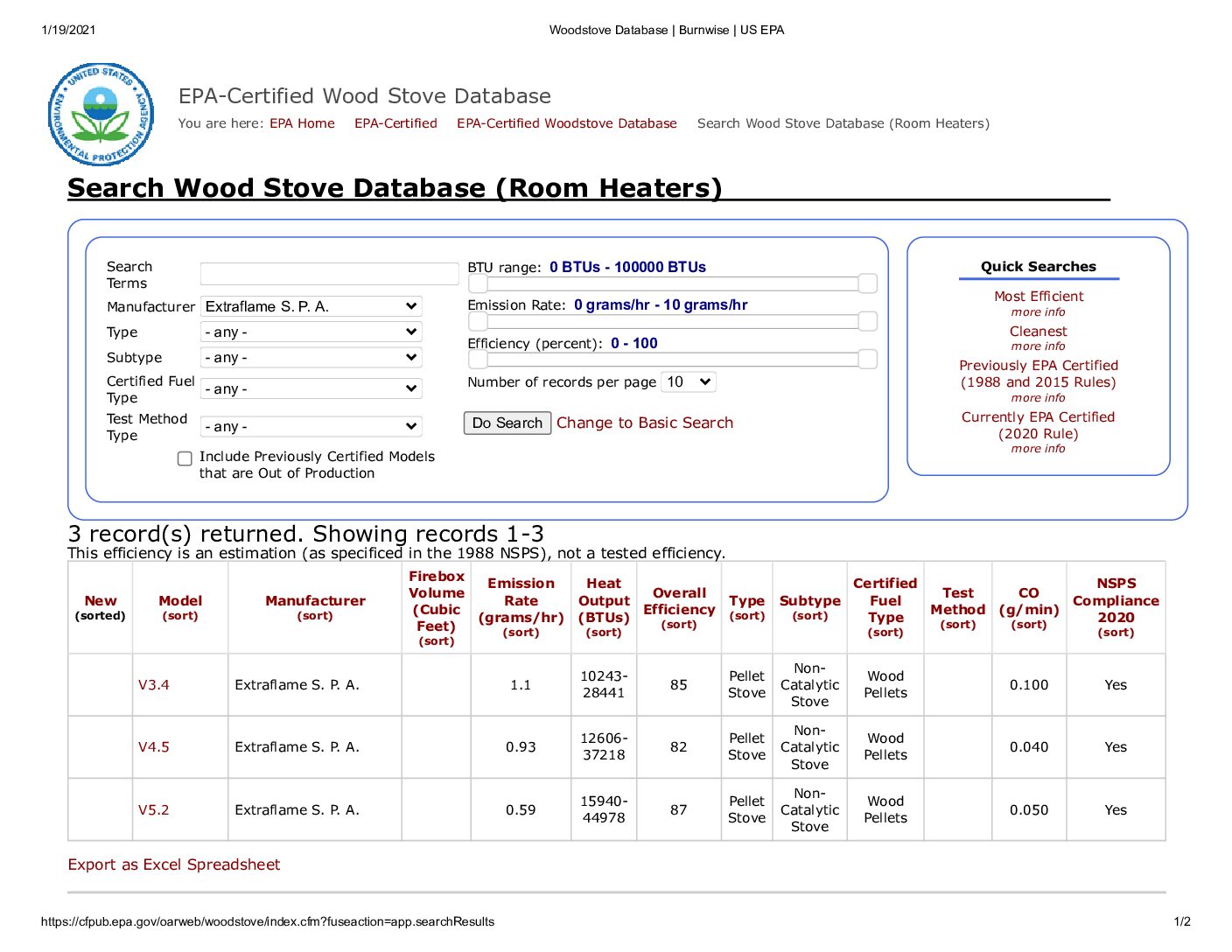

Tax Credit For Wood And Pellet Stoves Pellet Stove Pellet Stove

Tax Credit For Wood And Pellet Stoves Pellet Stove Pellet Stove

Web 28 juin 2021 nbsp 0183 32 THE FEDERAL 25C TAX CREDIT ON WOOD AND PELLET STOVES CAN SAVE YOU UP TO 2000 How so With the August 16 2022 signing of the Inflation

Web 8 ao 251 t 2022 nbsp 0183 32 This legislation provides a significant tax credit for the purchase of qualifying wood and pellet stoves that are highly energy efficient For the remainder of 2022 get a

Cash Tax Rebates For Pellet Stoves

Cash Tax Rebates For Pellet Stoves are the most straightforward type of Tax Rebates For Pellet Stoves. Clients receive a predetermined sum of money back when purchasing a item. These are often used for big-ticket items, like electronics and appliances.

Mail-In Tax Rebates For Pellet Stoves

Mail-in Tax Rebates For Pellet Stoves require that customers send in an evidence of purchase for their money back. They are a bit more involved, but can result in significant savings.

Instant Tax Rebates For Pellet Stoves

Instant Tax Rebates For Pellet Stoves are applied right at the point of sale and reduce the purchase cost immediately. Customers don't have to wait long for savings with this type.

How Tax Rebates For Pellet Stoves Work

WOOD STOVE PELLETS TAX EXEMPT The Family Center Super Stores

WOOD STOVE PELLETS TAX EXEMPT The Family Center Super Stores

Web 23 janv 2023 nbsp 0183 32 As of January 1 st 2023 the new IRS tax code of Sec 25 C allows for a tax credit of up to 30 of the total purchase price and cost of installation of any qualifying

The Tax Rebates For Pellet Stoves Process

The process usually involves a few simple steps

-

Purchase the product: First you purchase the product exactly as you would normally.

-

Complete your Tax Rebates For Pellet Stoves paper: You'll have be able to provide a few details including your name, address, and details about your purchase, in order to make a claim for your Tax Rebates For Pellet Stoves.

-

In order to submit the Tax Rebates For Pellet Stoves: Depending on the type of Tax Rebates For Pellet Stoves you might need to send in a form, or send it via the internet.

-

Wait for the company's approval: They will scrutinize your submission and ensure that it's compliant with requirements of the Tax Rebates For Pellet Stoves.

-

You will receive your Tax Rebates For Pellet Stoves Once it's approved, you'll get your refund, either by check, prepaid card, or through another option specified by the offer.

Pros and Cons of Tax Rebates For Pellet Stoves

Advantages

-

Cost savings Tax Rebates For Pellet Stoves could significantly reduce the cost for an item.

-

Promotional Offers Incentivize customers in trying new products or brands.

-

Help to Increase Sales Tax Rebates For Pellet Stoves can help boost sales for a company and also increase market share.

Disadvantages

-

Complexity: Mail-in Tax Rebates For Pellet Stoves, in particular the case of HTML0, can be a hassle and costly.

-

Day of Expiration A lot of Tax Rebates For Pellet Stoves have the strictest deadlines for submission.

-

The risk of non-payment Some customers might miss out on Tax Rebates For Pellet Stoves because they don't follow the rules exactly.

Download Tax Rebates For Pellet Stoves

Download Tax Rebates For Pellet Stoves

FAQs

1. Are Tax Rebates For Pellet Stoves equivalent to discounts? Not at all, Tax Rebates For Pellet Stoves provide partial reimbursement after purchase, whereas discounts reduce the purchase price at point of sale.

2. Do I have to use multiple Tax Rebates For Pellet Stoves for the same product It is contingent on the terms for the Tax Rebates For Pellet Stoves promotions and on the products quality and eligibility. Some companies may allow this, whereas others will not.

3. How long will it take to get an Tax Rebates For Pellet Stoves What is the timeframe? differs, but it can last from a few weeks until a several months to receive a Tax Rebates For Pellet Stoves.

4. Do I have to pay tax on Tax Rebates For Pellet Stoves funds? the majority of situations, Tax Rebates For Pellet Stoves amounts are not considered to be taxable income.

5. Should I be able to trust Tax Rebates For Pellet Stoves deals from lesser-known brands It's crucial to research and confirm that the company providing the Tax Rebates For Pellet Stoves has a good reputation prior to making an purchase.

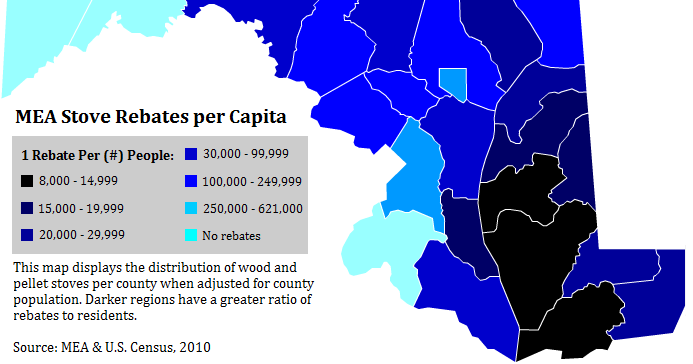

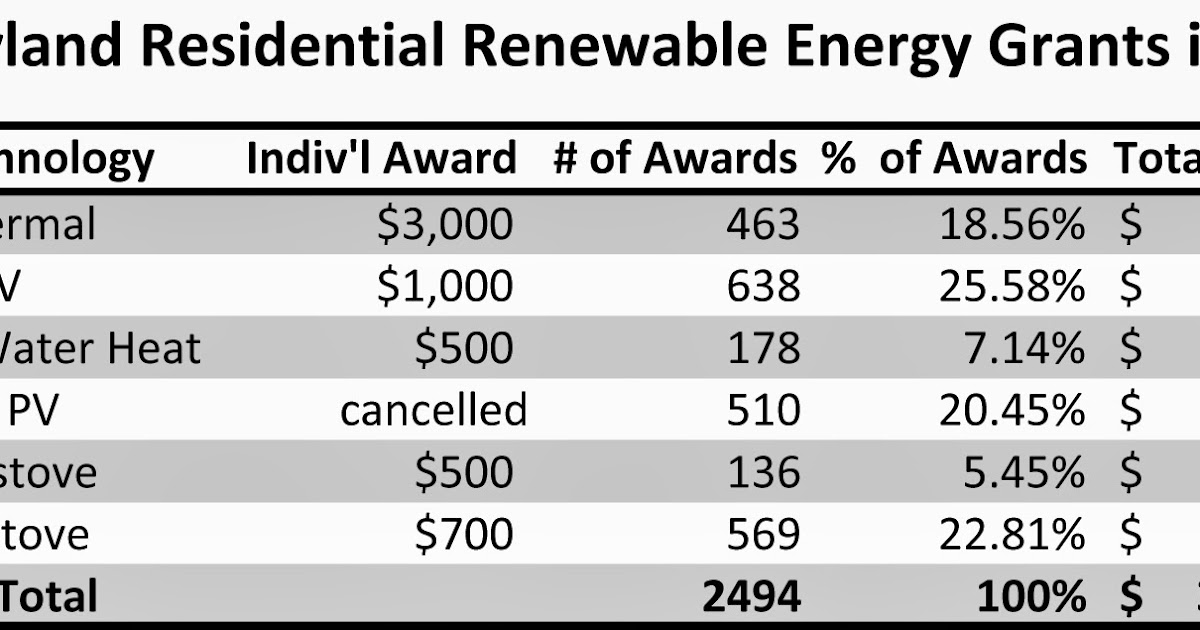

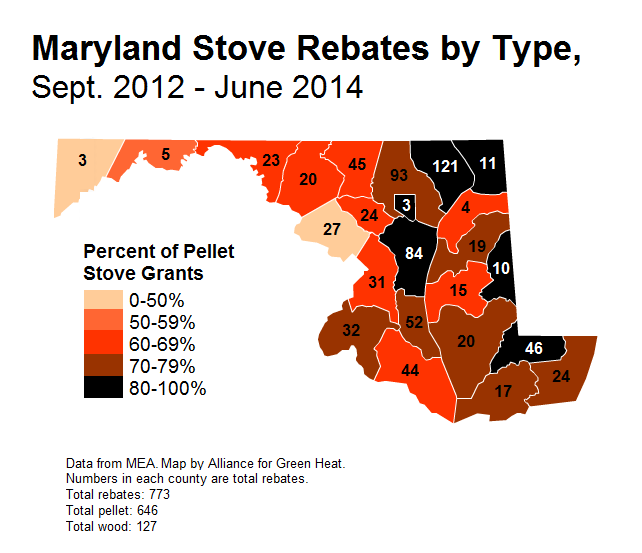

Heated Up Maryland Rebates For Wood Pellet Stoves Reach Less

Heated Up Pellet Stoves Are Hot Commodity In Maryland Rebate Program

Check more sample of Tax Rebates For Pellet Stoves below

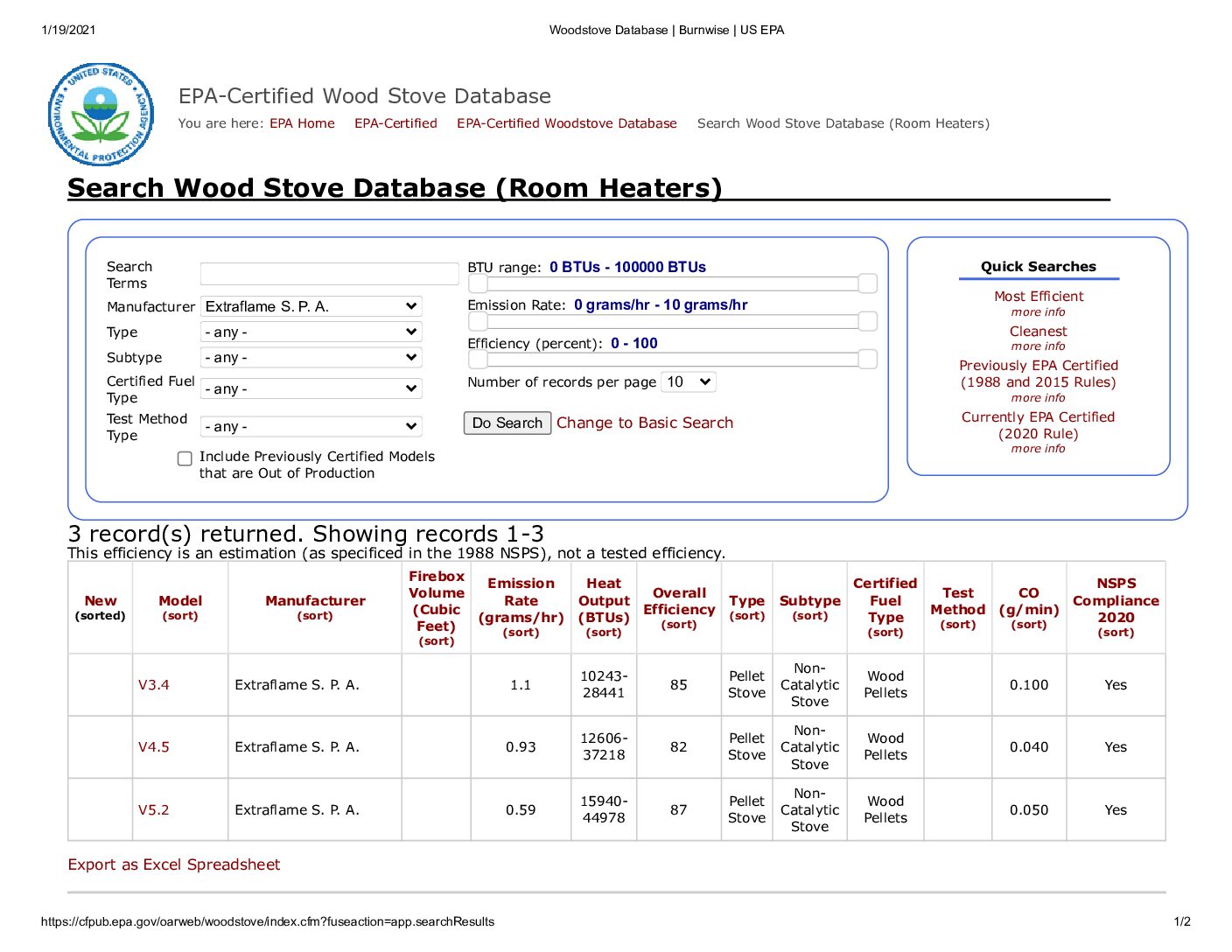

Tax Credit 2016 For Wood And Pellet Stoves Inserts Pellet Stove

Vicenza Pellet Stove V4 5R 2 699 26 IRS Tax Credit Approved

The 2022 Federal 26 Tax Credit On Wood Pellet Stoves We Love Fire

The U S Biomass Tax Credit Allows For A Tax Credit Up To 300 For

30 Tax Credit To Save On Unit Installation Costs Until 2032

Pellet Stove Rebate Program Provide Incentives Toward The Purchase And

https://www.lenergietoutcompris.fr/actualites-conseils/credit-d-impot...

Web Le montant du cr 233 dit d imp 244 t 2020 pour un po 234 le 224 granul 233 s Depuis le 1 er janvier 2020 le cr 233 dit d imp 244 t n est plus calcul 233 sur base du prix du po 234 le 224 granul 233 s 30 du montant

https://www.coolproducts.eu/wp-content/uploads/2020/12/An…

Web replace an existing wood heating system as well as pellet stoves The financing is exclusively for private individuals Amount the contribution is paid in the form of a non

Web Le montant du cr 233 dit d imp 244 t 2020 pour un po 234 le 224 granul 233 s Depuis le 1 er janvier 2020 le cr 233 dit d imp 244 t n est plus calcul 233 sur base du prix du po 234 le 224 granul 233 s 30 du montant

Web replace an existing wood heating system as well as pellet stoves The financing is exclusively for private individuals Amount the contribution is paid in the form of a non

The U S Biomass Tax Credit Allows For A Tax Credit Up To 300 For

Vicenza Pellet Stove V4 5R 2 699 26 IRS Tax Credit Approved

30 Tax Credit To Save On Unit Installation Costs Until 2032

Pellet Stove Rebate Program Provide Incentives Toward The Purchase And

Adirondack Hearth Home Fireplaces Stoves Outdoor Living 518

Heated Up Maryland Raises Rebate Amount And Indefinitely Extends Wood

Heated Up Maryland Raises Rebate Amount And Indefinitely Extends Wood

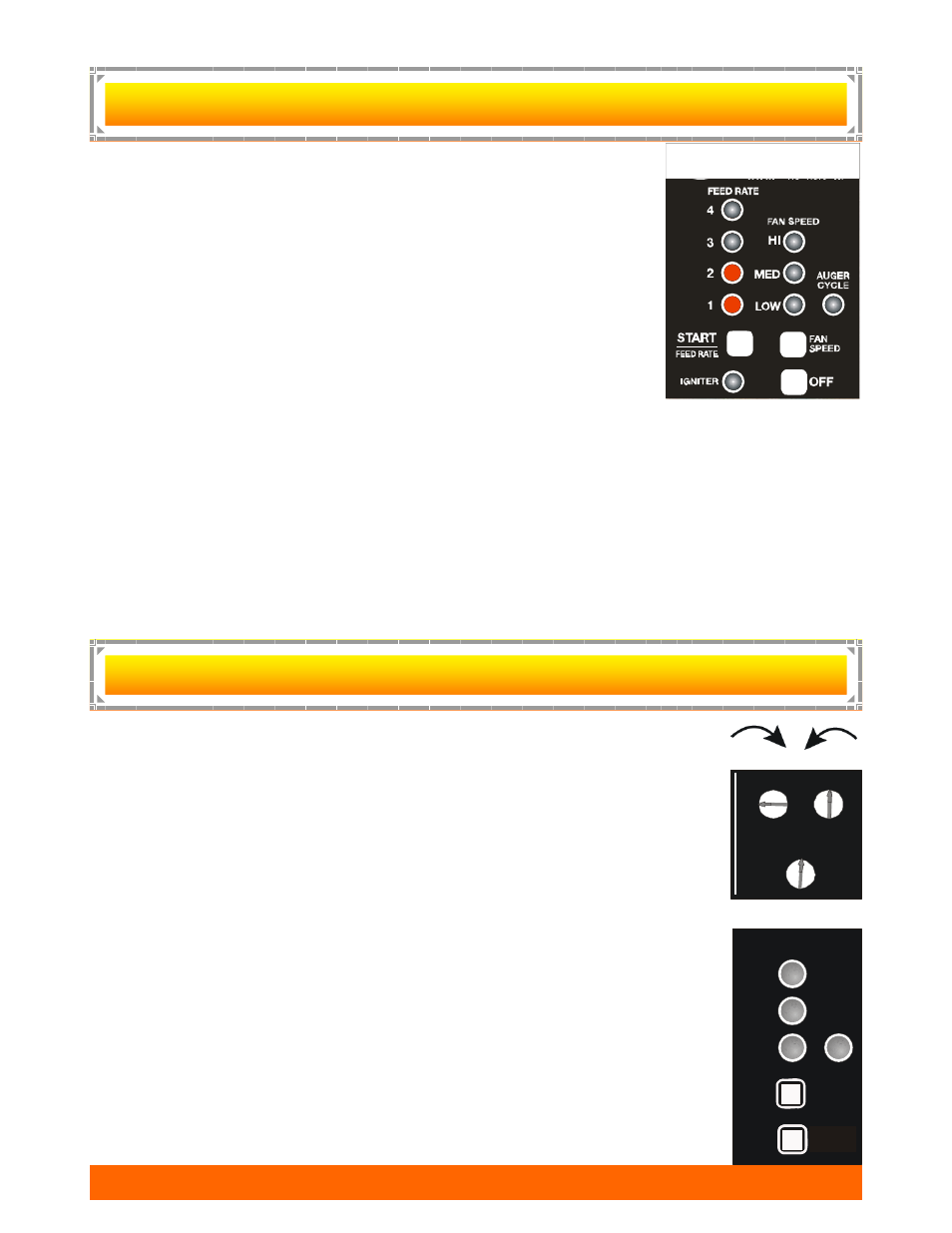

Perating Nstructions Feed Rates 1 2 PelPro Wood Pellet Stoves