In this modern-day world of consumers, everyone loves a good deal. One way to earn substantial savings on your purchases is through Tax Rebate Form R40s. Tax Rebate Form R40s are an effective marketing tactic used by manufacturers and retailers for offering customers a percentage discount on purchases they made after they've done so. In this post, we'll look into the world of Tax Rebate Form R40s, examining the nature of them as well as how they work and ways you can increase the savings you can make by using these cost-effective incentives.

Get Latest Tax Rebate Form R40 Below

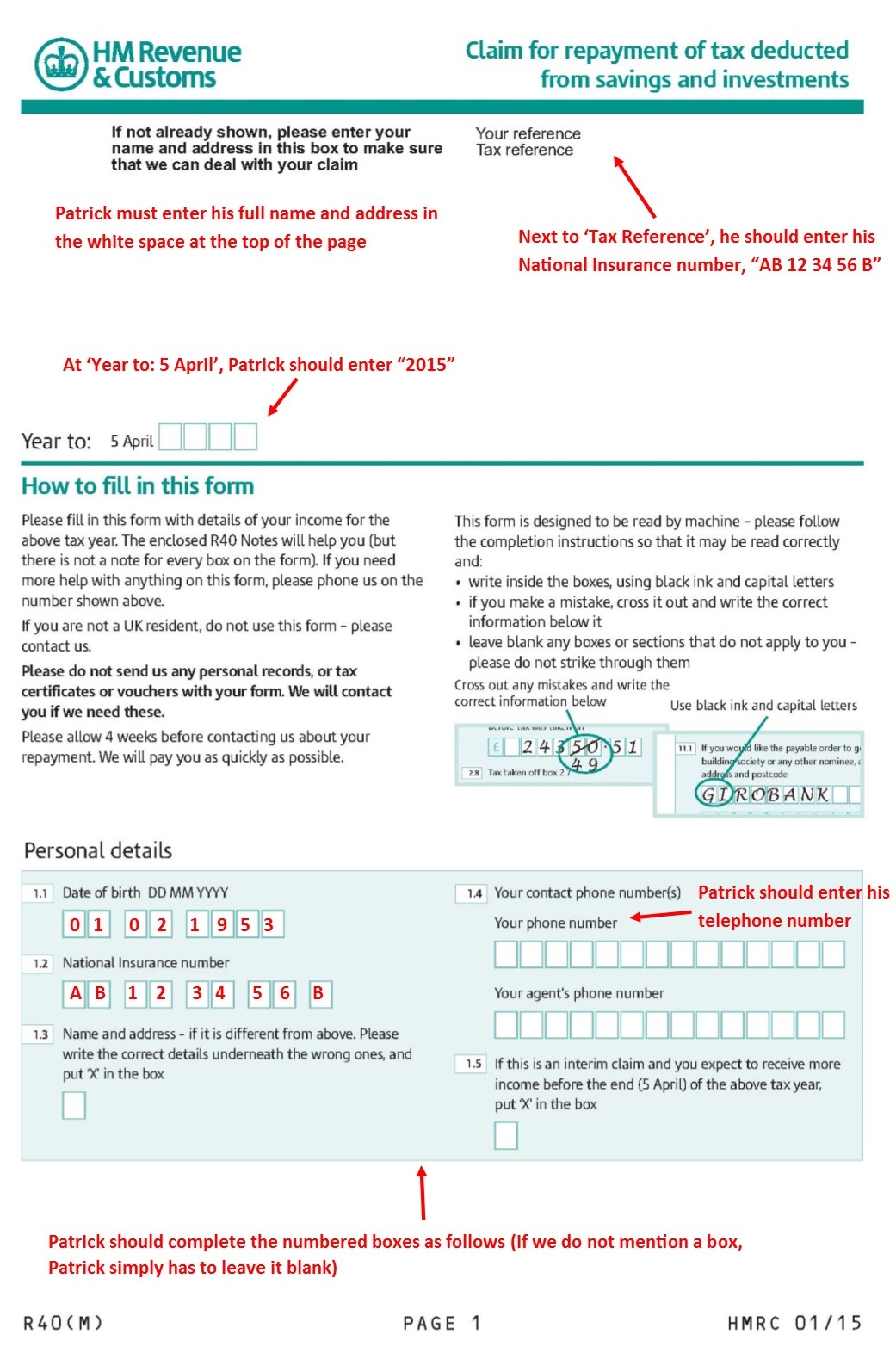

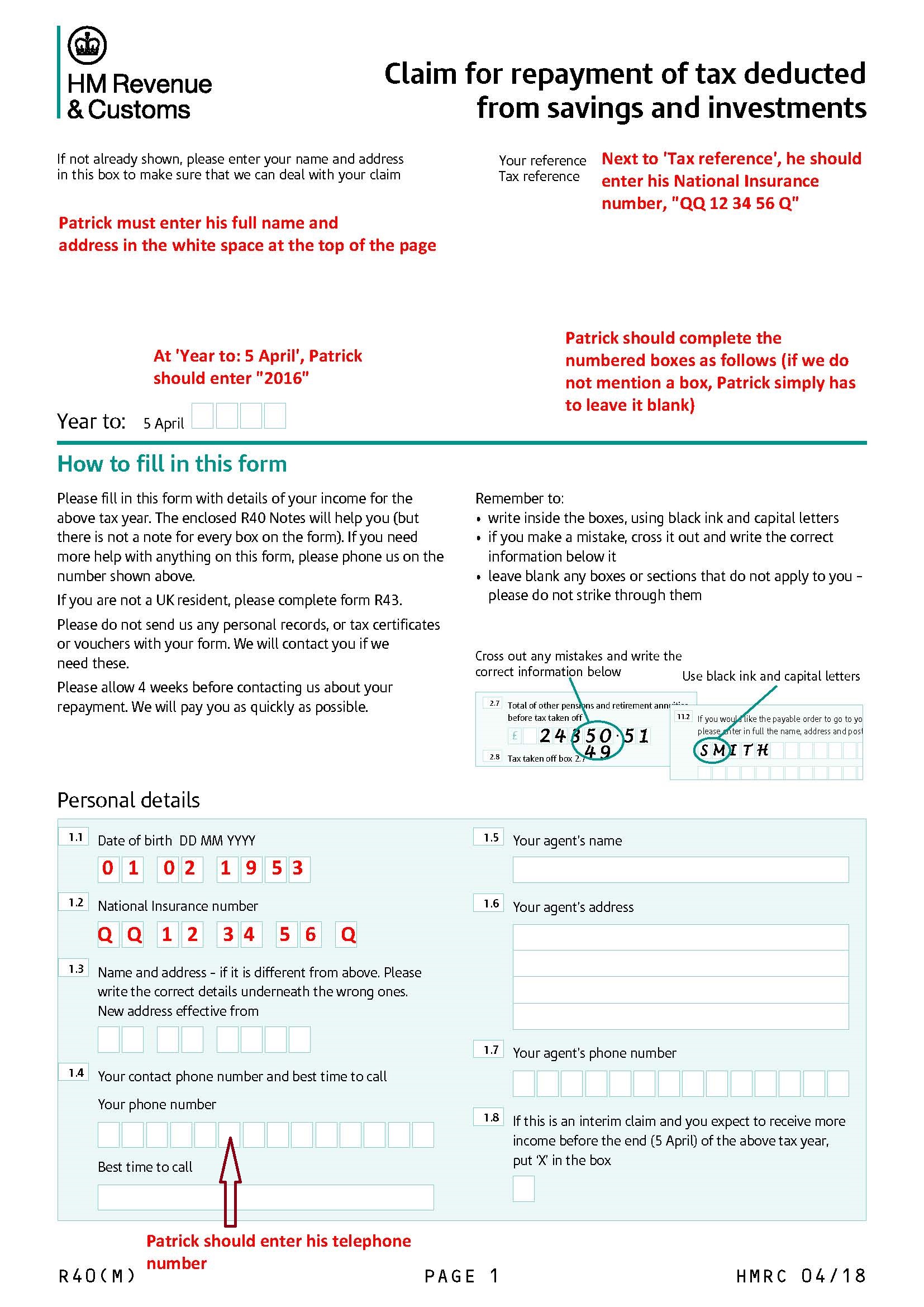

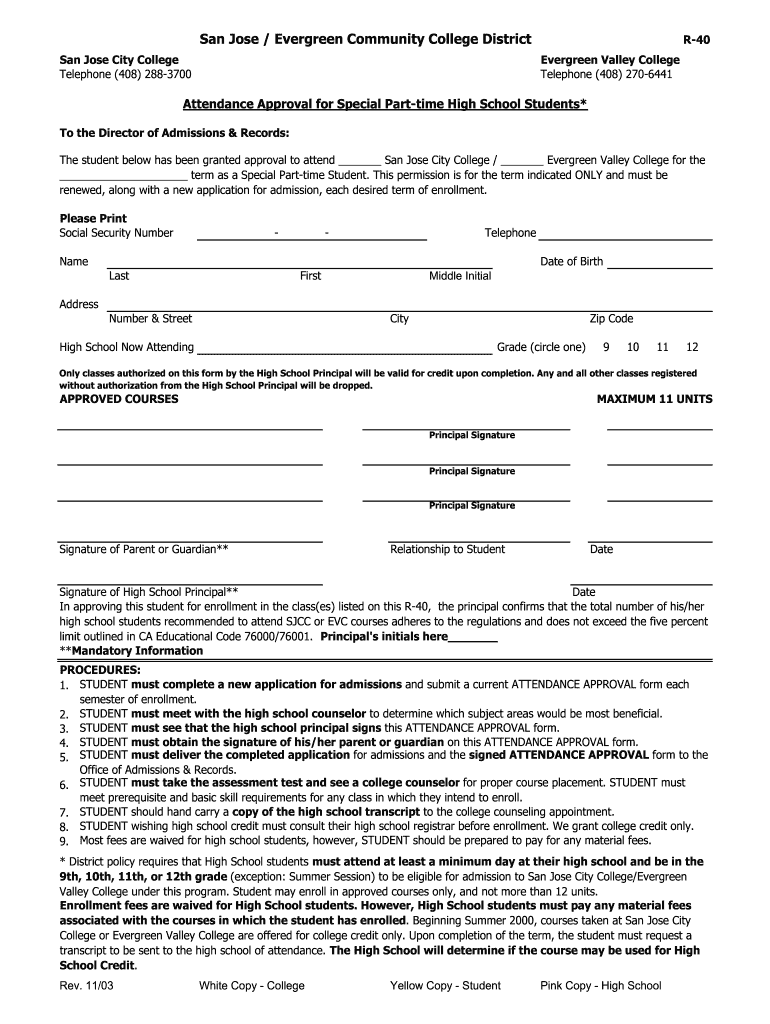

Tax Rebate Form R40

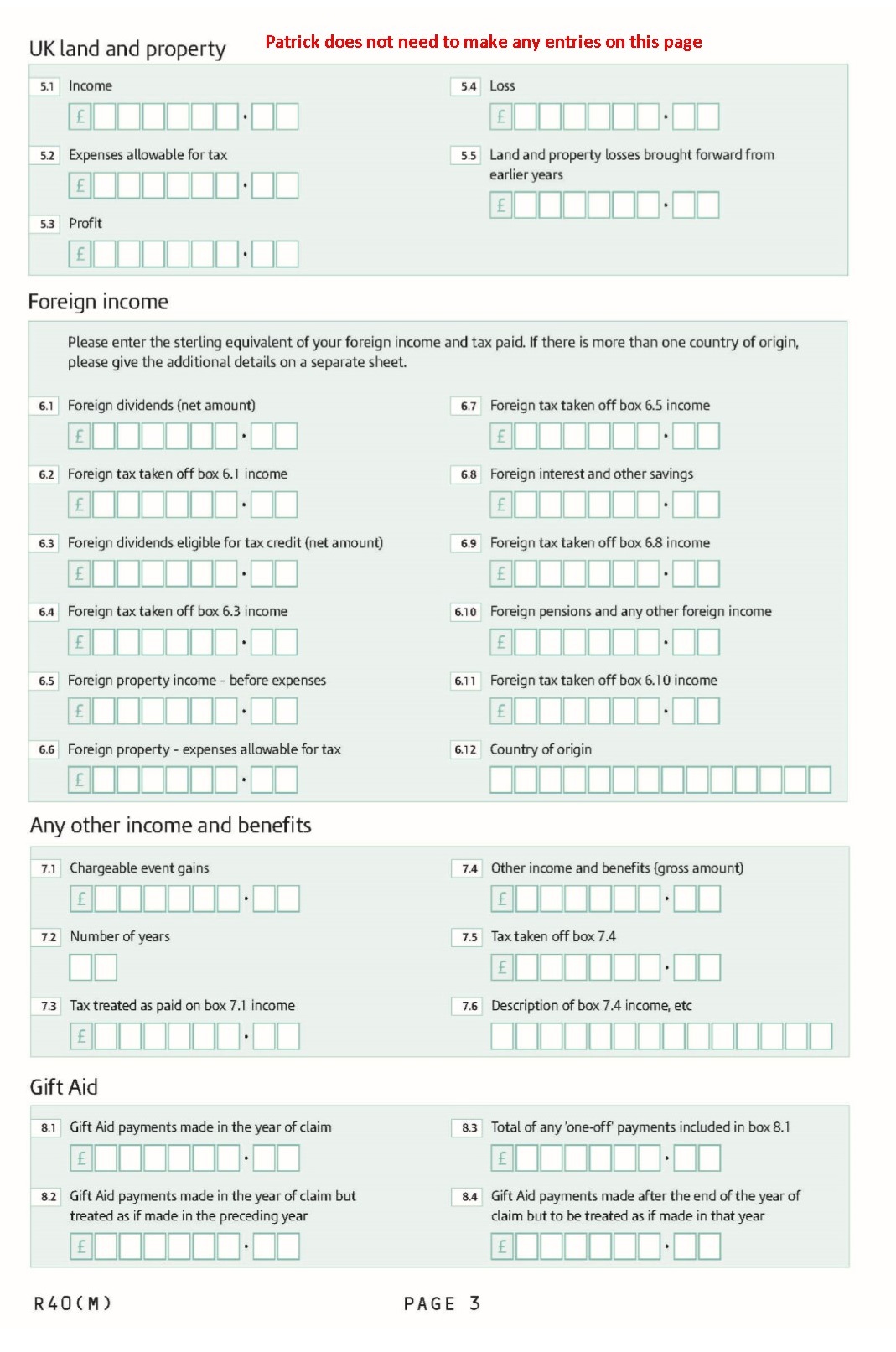

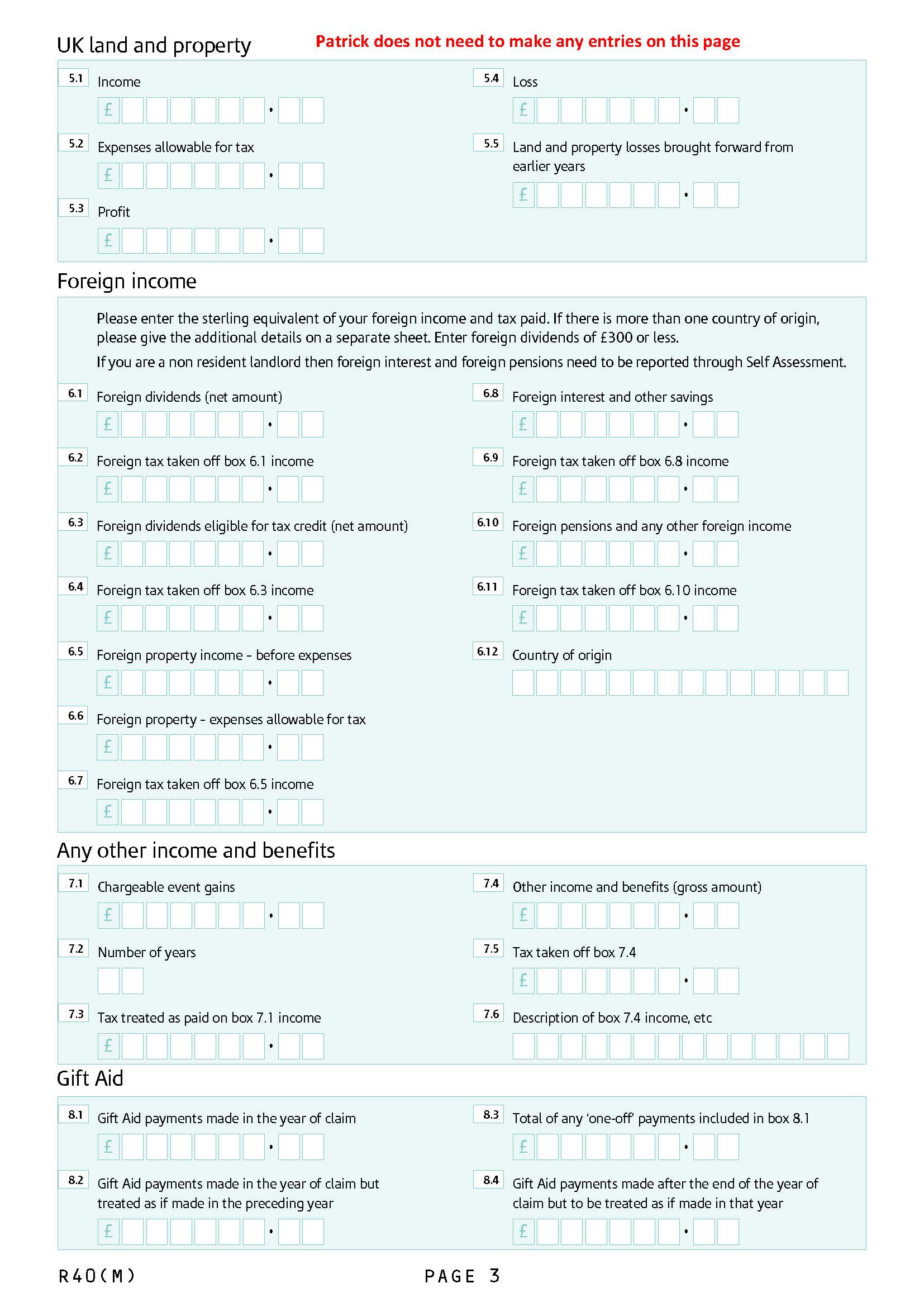

Tax Rebate Form R40 -

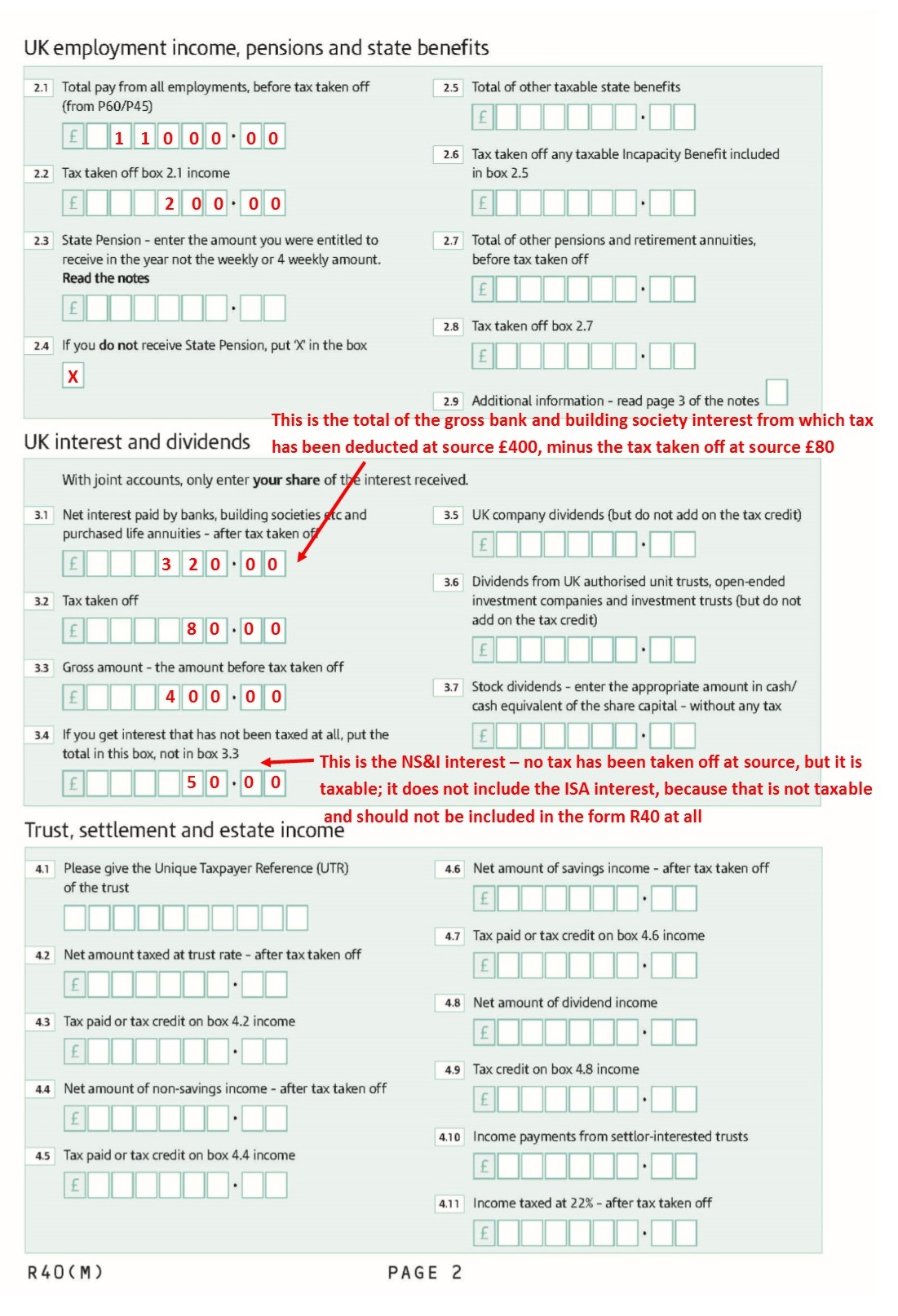

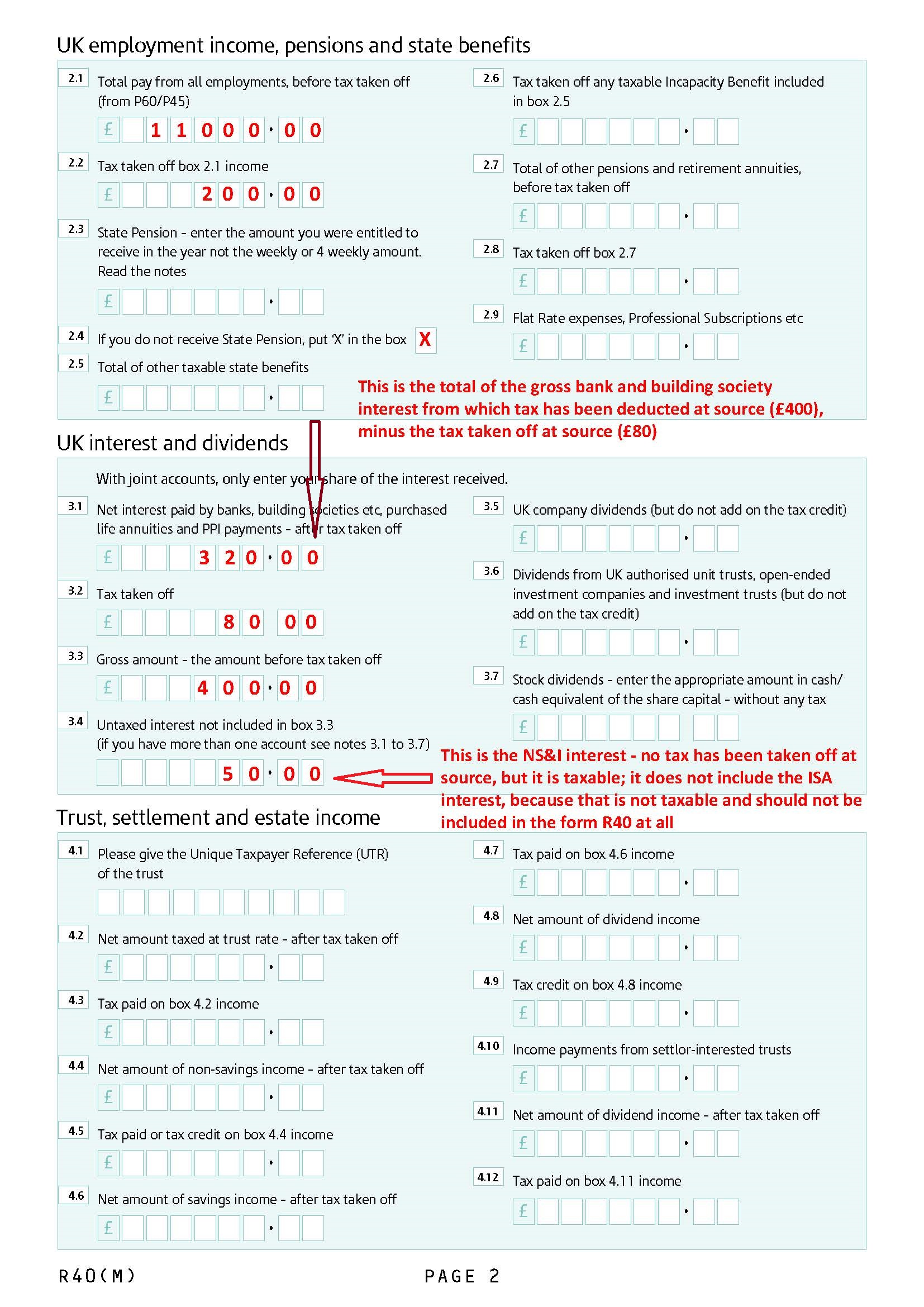

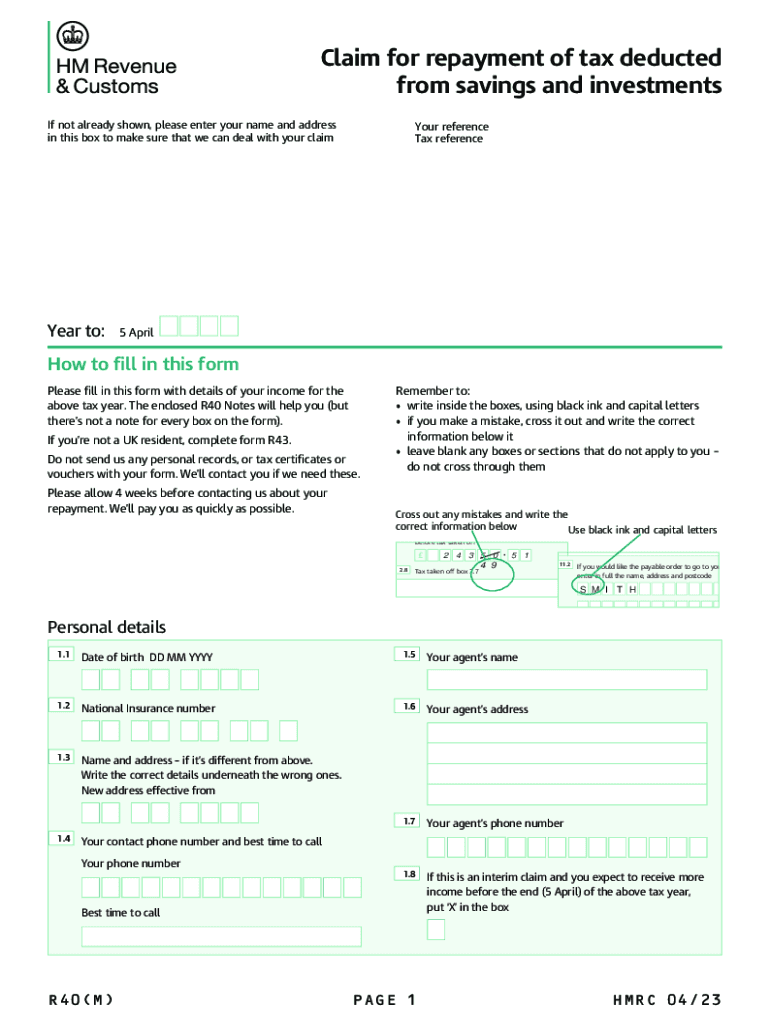

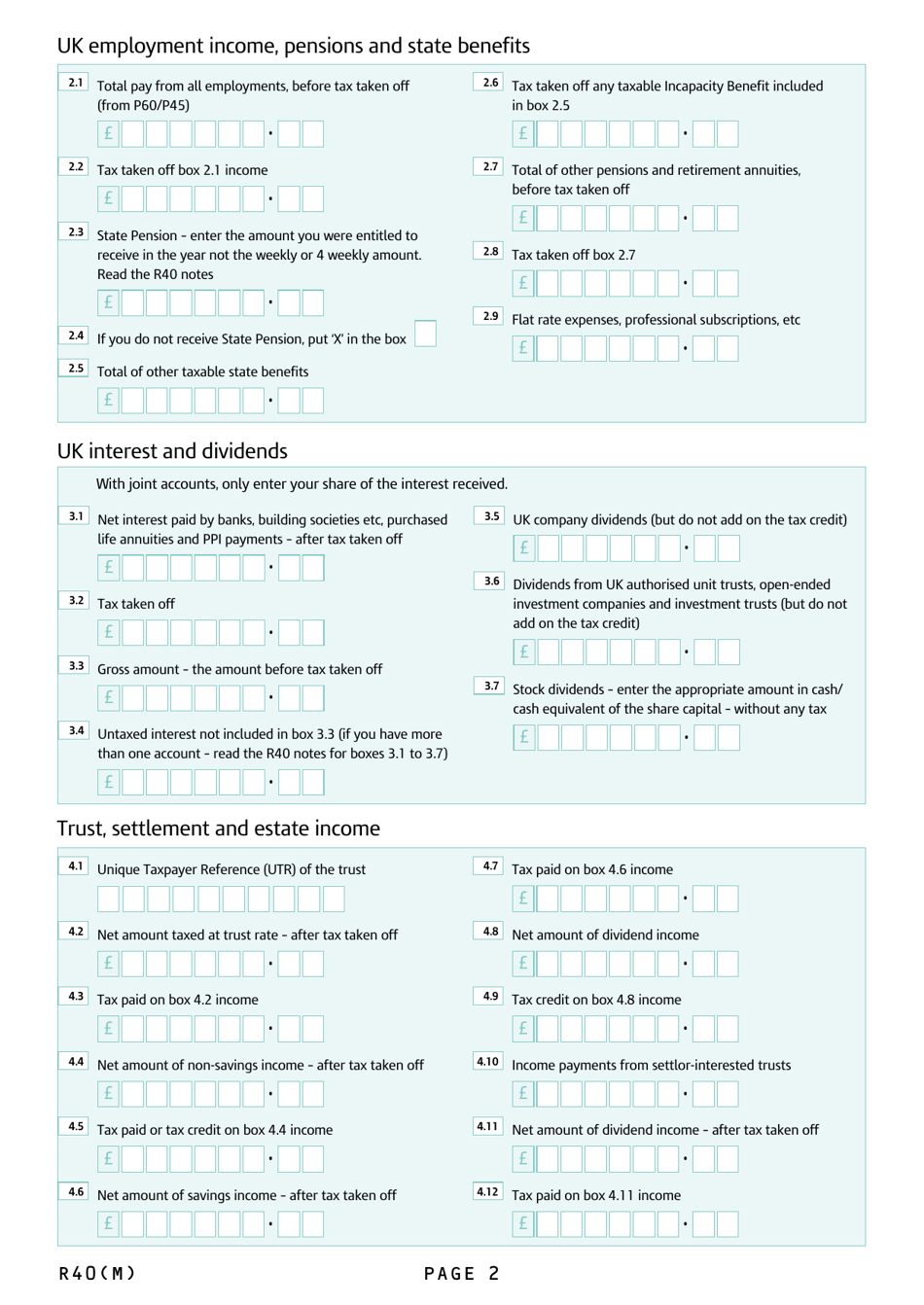

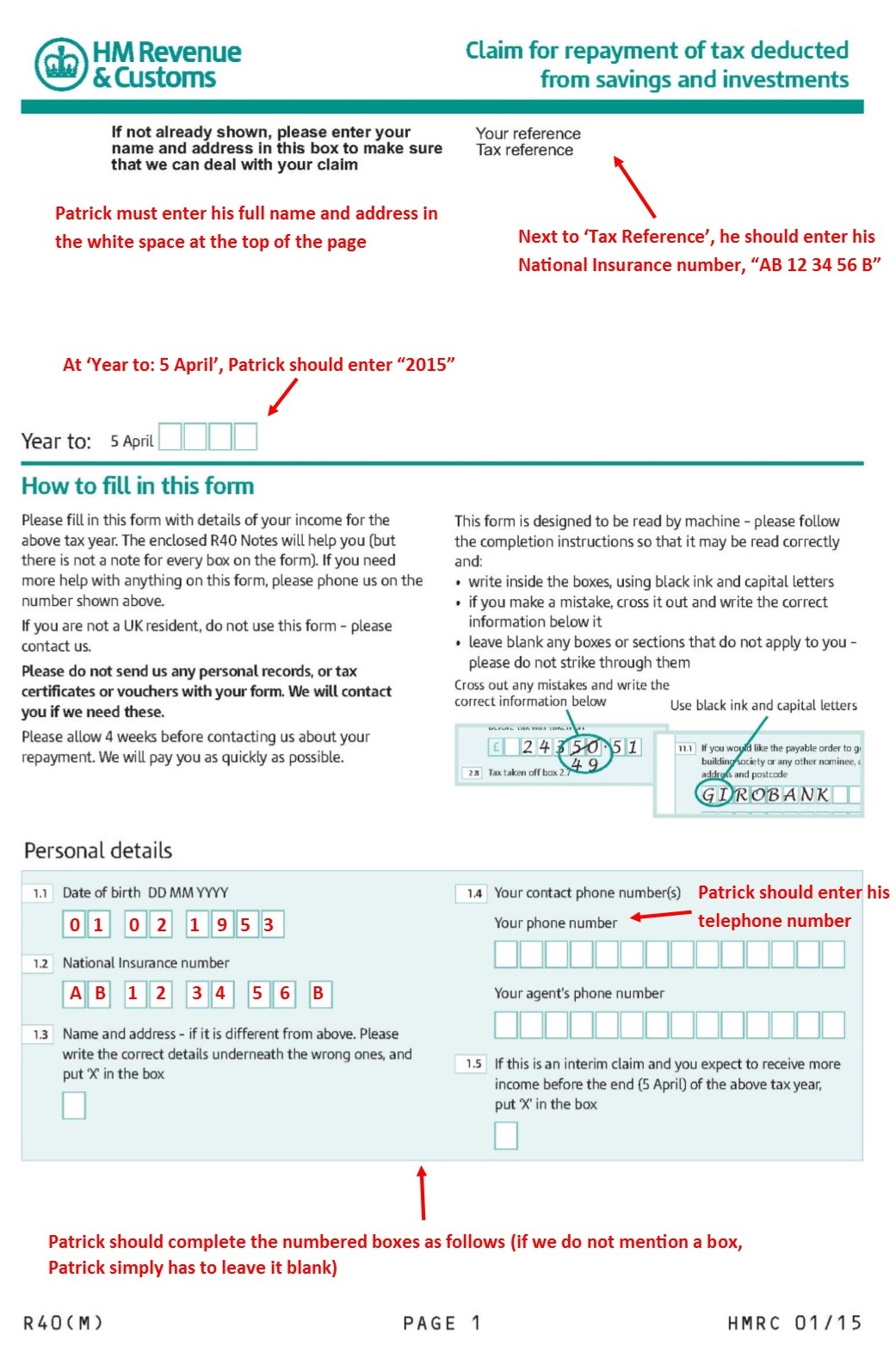

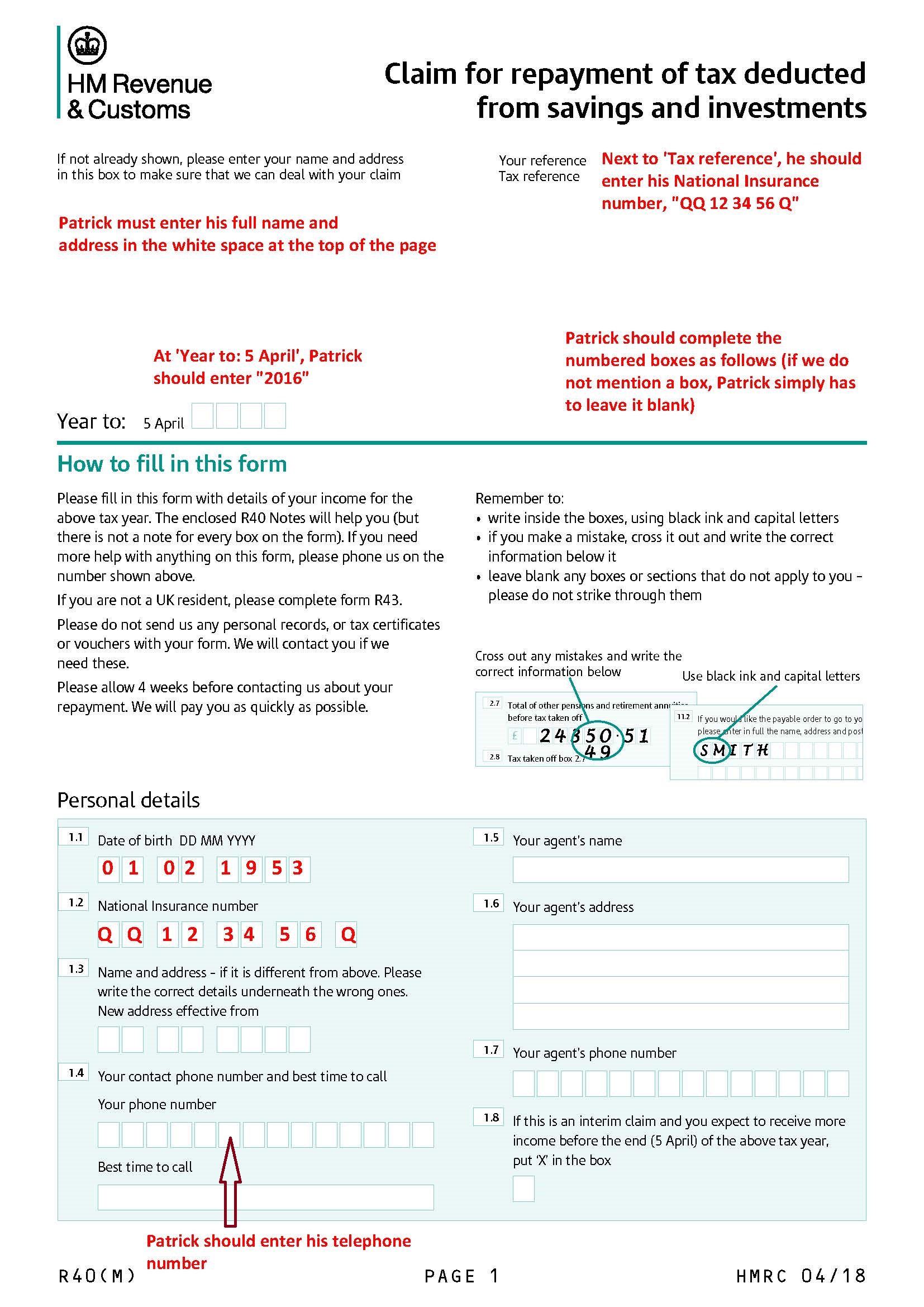

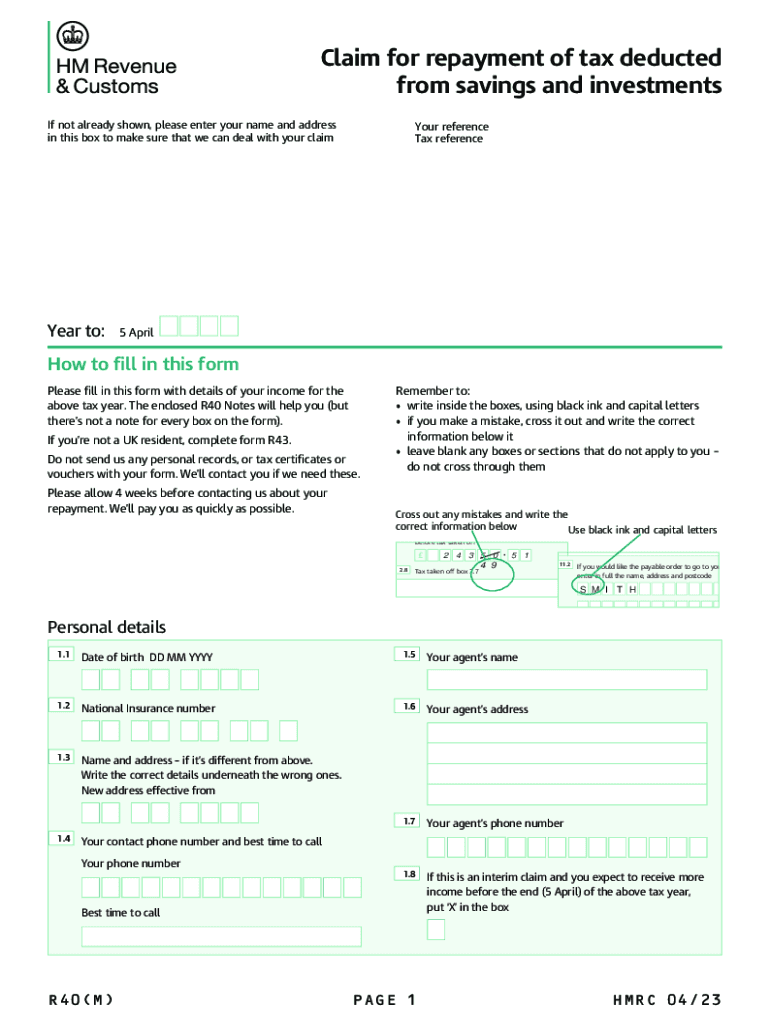

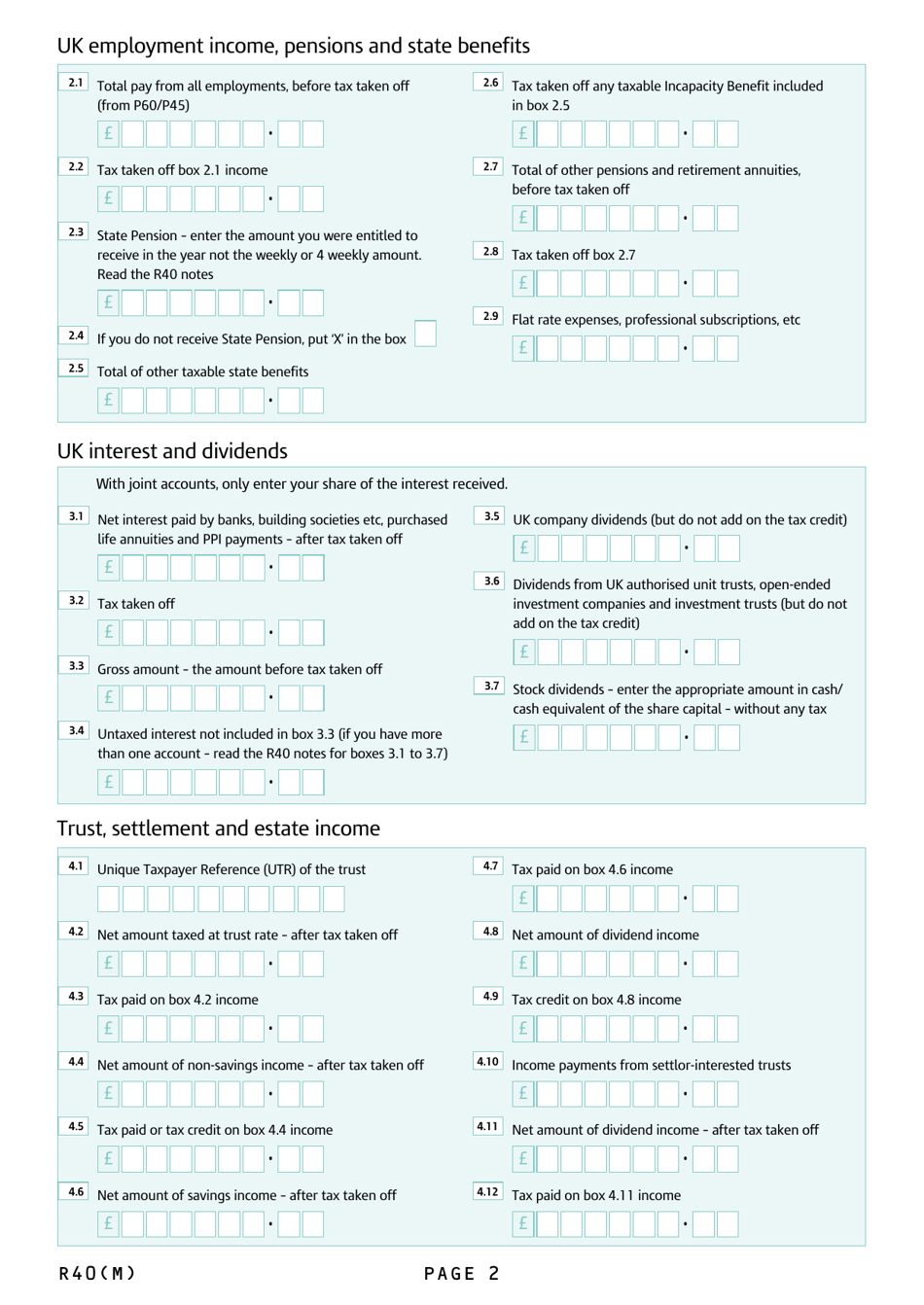

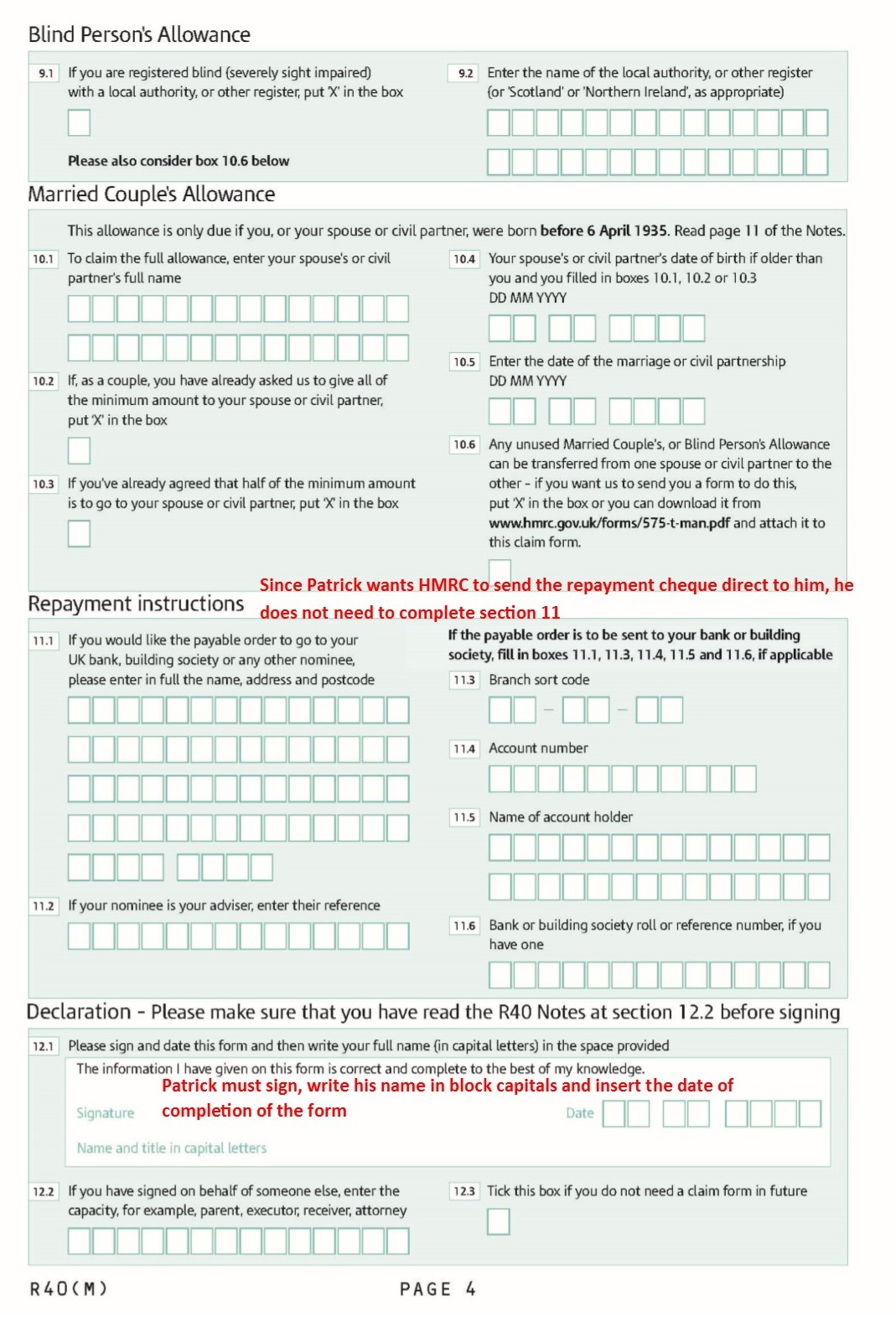

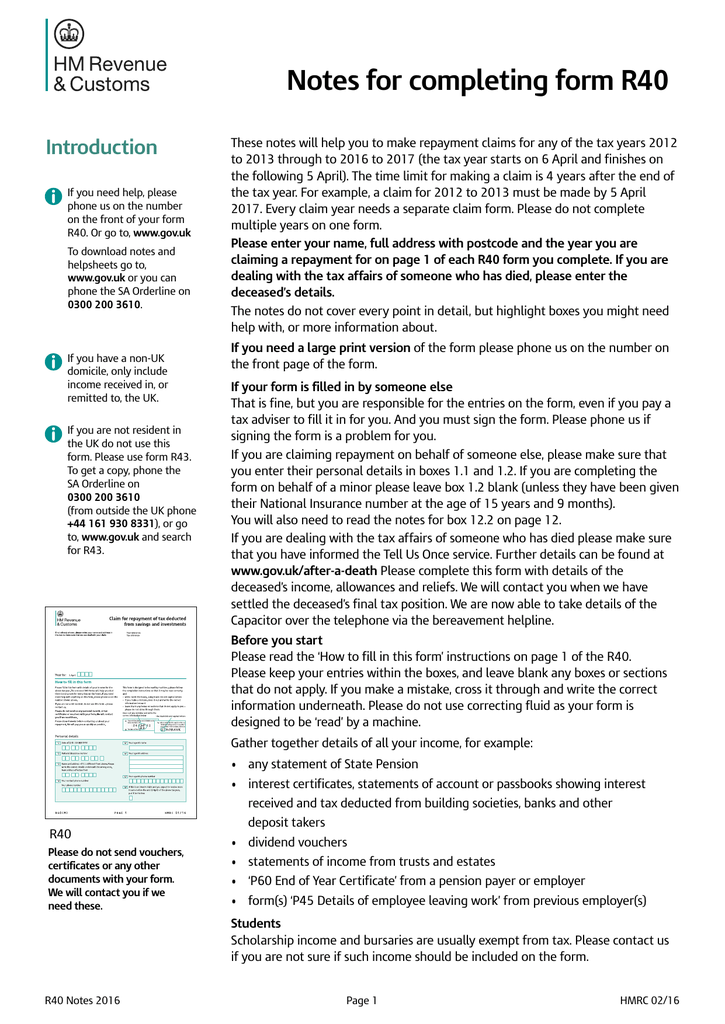

Web These notes will help you complete the form R40 You need to complete a separate claim for each tax year The tax year starts on 6 April and finishes on the following 5 April If

Web Please fill in this form with details of your income for the above tax year The enclosed R40 Notes will help you but there s not a note for every box on the form If you re not a UK

A Tax Rebate Form R40 in its simplest format, is a refund to a purchaser after they've purchased a good or service. It's a very effective technique employed by companies to attract customers, increase sales and advertise specific products.

Types of Tax Rebate Form R40

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

Web 3 avr 2023 nbsp 0183 32 As we are in 2023 24 you can make a claim going back to the 2019 20 tax year It is possible to use the form to claim a repayment of tax relating to the current tax year known as an interim claim if you know

Web 19 nov 2014 nbsp 0183 32 Find Income Tax forms for tax refunds allowances and reliefs savings and investments and leaving the UK

Cash Tax Rebate Form R40

Cash Tax Rebate Form R40 are the simplest kind of Tax Rebate Form R40. Clients receive a predetermined sum of money back when buying a product. These are often used for costly items like electronics or appliances.

Mail-In Tax Rebate Form R40

Mail-in Tax Rebate Form R40 require consumers to send in the proof of purchase in order to receive their money back. They're more complicated, but they can provide substantial savings.

Instant Tax Rebate Form R40

Instant Tax Rebate Form R40 are applied at the point of sale, and can reduce the cost of purchase immediately. Customers don't have to wait long for savings with this type.

How Tax Rebate Form R40 Work

2015 Form UK R40 Fill Online Printable Fillable Blank PdfFiller

2015 Form UK R40 Fill Online Printable Fillable Blank PdfFiller

Web 3 f 233 vr 2023 nbsp 0183 32 The HMRC Tax Refund Form R40 PPI is a tool for individuals in the UK who believe that they have been taxed on their personal pension income at the incorrect rate By completing the form and

The Tax Rebate Form R40 Process

The process generally involves a few easy steps:

-

Buy the product: Firstly make sure you purchase the product as you normally would.

-

Fill in your Tax Rebate Form R40 request form. You'll have to provide some information like your name, address, along with the purchase details, in order to receive your Tax Rebate Form R40.

-

To submit the Tax Rebate Form R40 In accordance with the nature of Tax Rebate Form R40 you could be required to fill out a form and mail it in or submit it online.

-

Wait for the company's approval: They is going to review your entry to determine if it's in compliance with the Tax Rebate Form R40's terms and conditions.

-

Receive your Tax Rebate Form R40 If it is approved, you'll receive the refund whether via check, credit card, or through another method as specified by the offer.

Pros and Cons of Tax Rebate Form R40

Advantages

-

Cost Savings Tax Rebate Form R40 can substantially cut the price you pay for the item.

-

Promotional Deals Incentivize customers to try new products and brands.

-

increase sales: Tax Rebate Form R40 can boost companies' sales and market share.

Disadvantages

-

Complexity The mail-in Tax Rebate Form R40 particularly may be lengthy and take a long time to complete.

-

End Dates Many Tax Rebate Form R40 are subject to certain deadlines for submitting.

-

Risk of Not Being Paid Customers may not get their Tax Rebate Form R40 if they don't comply with the rules precisely.

Download Tax Rebate Form R40

FAQs

1. Are Tax Rebate Form R40 equivalent to discounts? No, Tax Rebate Form R40 are partial reimbursement after purchase whereas discounts will reduce the cost of purchase at point of sale.

2. Are multiple Tax Rebate Form R40 available on the same item It's dependent on the conditions on the Tax Rebate Form R40 offered and product's suitability. Certain companies might allow it, but some will not.

3. What is the time frame to receive an Tax Rebate Form R40? The time frame can vary, but typically it will last from a few weeks until a couple of months to receive your Tax Rebate Form R40.

4. Do I need to pay taxes of Tax Rebate Form R40 amounts? In most circumstances, Tax Rebate Form R40 amounts are not considered to be taxable income.

5. Do I have confidence in Tax Rebate Form R40 offers from brands that aren't well-known it is crucial to conduct research and ensure that the business offering the Tax Rebate Form R40 is reputable prior to making an acquisition.

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

Check more sample of Tax Rebate Form R40 below

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

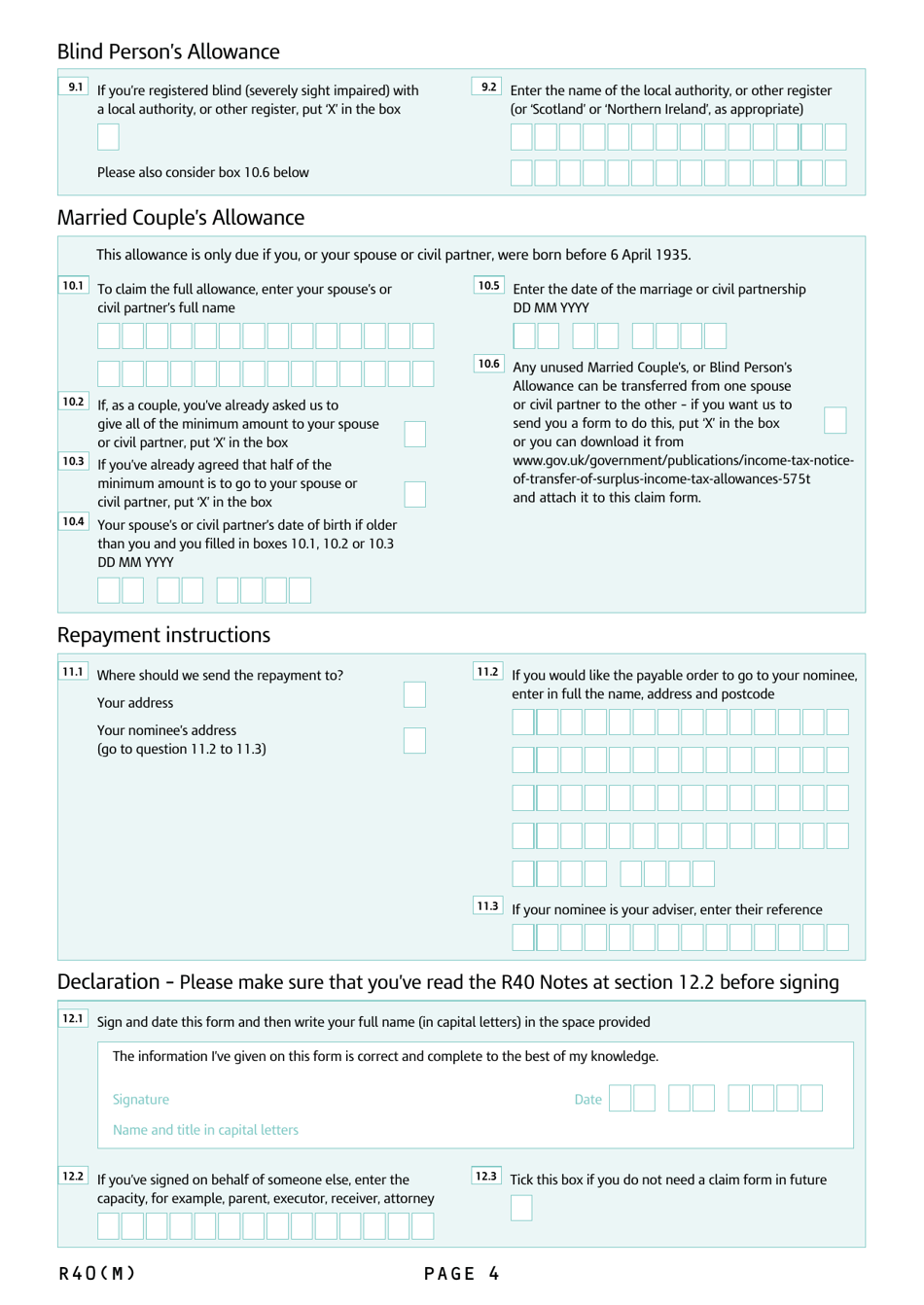

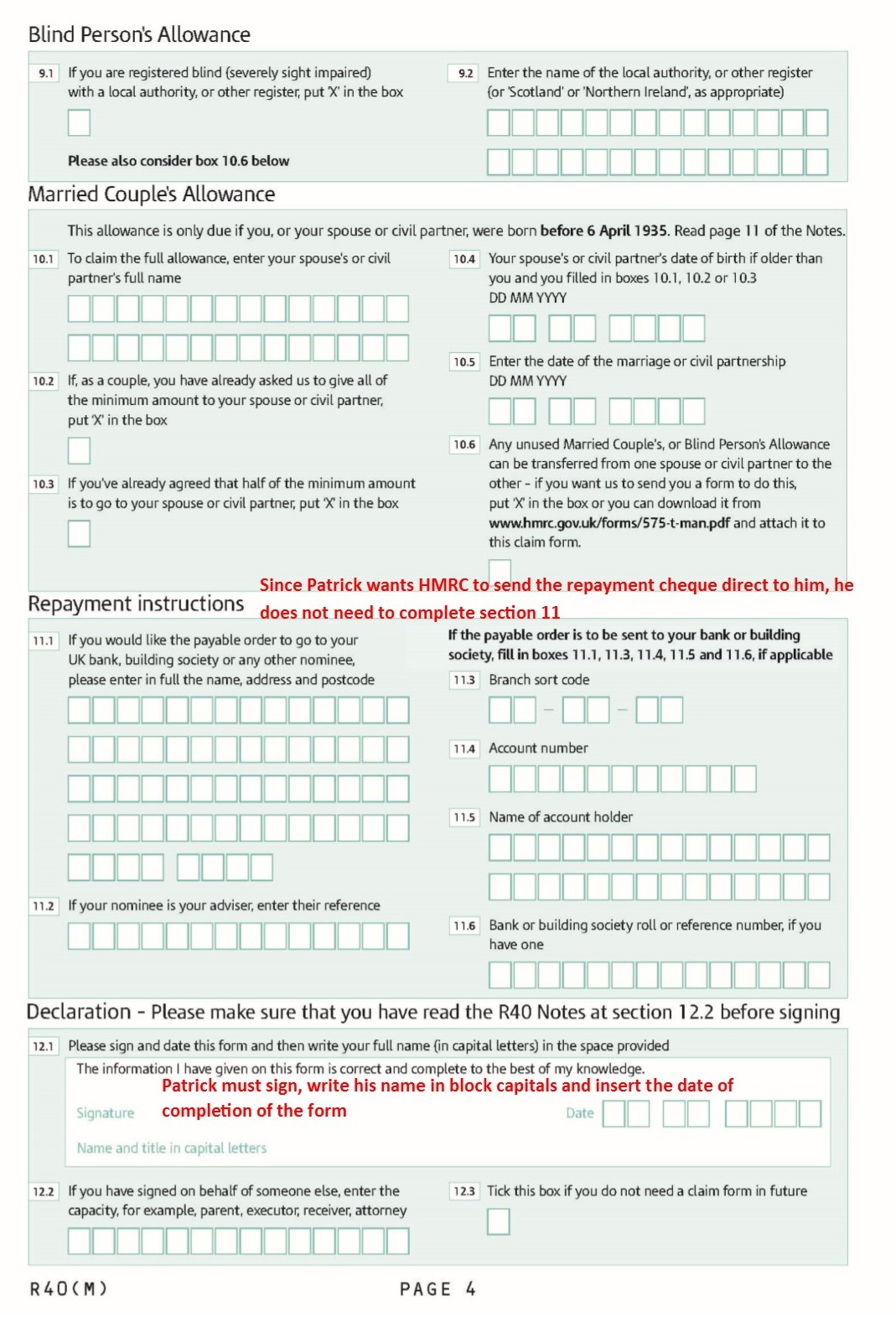

R40 Form Fill Out And Sign Printable PDF Template SignNow

R40 Form Fill Out Sign Online DocHub

Form R40 Download Printable PDF Or Fill Online Claim For Repayment Of

https://assets.publishing.service.gov.uk/.../file/1172652/R40…

Web Please fill in this form with details of your income for the above tax year The enclosed R40 Notes will help you but there s not a note for every box on the form If you re not a UK

https://www.gov.uk/.../contact/repayments-where-to-send-claim-forms

Web Complete form R40 to claim a refund if you think you ve paid too much tax on interest from your savings in an earlier tax year Use form R43 to claim personal allowances and

Web Please fill in this form with details of your income for the above tax year The enclosed R40 Notes will help you but there s not a note for every box on the form If you re not a UK

Web Complete form R40 to claim a refund if you think you ve paid too much tax on interest from your savings in an earlier tax year Use form R43 to claim personal allowances and

R40 Form Fill Out And Sign Printable PDF Template SignNow

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Form Fill Out Sign Online DocHub

Form R40 Download Printable PDF Or Fill Online Claim For Repayment Of

Form R40 Download Printable PDF Or Fill Online Claim For Repayment Of

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

Notes For Completing Form R40