In this day and age of consuming everybody loves a good deal. One method of gaining significant savings on your purchases is to use Tax Rebate Form Ppis. Tax Rebate Form Ppis are marketing strategies employed by retailers and manufacturers to offer consumers a partial reimbursement on their purchases following the time they've completed them. In this article, we will examine the subject of Tax Rebate Form Ppis. We'll look at the nature of them as well as how they work and the best way to increase the value of these incentives.

Get Latest Tax Rebate Form Ppi Below

Tax Rebate Form Ppi

Tax Rebate Form Ppi - Tax Rebate Form For Ppi, Tax Refund Form For Ppi, Ppi Tax Rebate Form R40, Can I Claim Tax Back On Ppi

Web To claim your PPI tax rebate HMRC need you to complete an R40 form which is specifically for claiming back a tax refund from savings and investments You can complete the R40

Web a Self Assessment tax return a redundancy payment UK income if you live abroad interest from savings or payment protection insurance PPI income from a life or pension

A Tax Rebate Form Ppi the simplest form, is a refund given to a client after having purchased a item or service. It's an effective way that companies use to attract clients, increase sales and also to advertise certain products.

Types of Tax Rebate Form Ppi

How To Successfully Complete The UK GOV PPI TAX R40 Refund Claim Form

How To Successfully Complete The UK GOV PPI TAX R40 Refund Claim Form

Web 3 f 233 vr 2023 nbsp 0183 32 What is Form R40 PPI The R40 form PPI is a form used by individuals in the UK to claim tax relief or tax repayment for overpaid tax on savings and investment income The form is used specifically for

Web 1 juin 2021 nbsp 0183 32 How long does it take to receive a tax rebate on a PPI pay out Claim Today If you have received a PPI or payday loan refund or any other type of affordability refund tax may have been deducted Since

Cash Tax Rebate Form Ppi

Cash Tax Rebate Form Ppi are the simplest type of Tax Rebate Form Ppi. Customers receive a specified amount of cash back after purchasing a item. They are typically used to purchase high-ticket items like electronics or appliances.

Mail-In Tax Rebate Form Ppi

Mail-in Tax Rebate Form Ppi require the customer to present documents of purchase to claim the money. They're a bit more complicated, but they can provide significant savings.

Instant Tax Rebate Form Ppi

Instant Tax Rebate Form Ppi are made at the point of sale and reduce the purchase price immediately. Customers don't need to wait around for savings through this kind of offer.

How Tax Rebate Form Ppi Work

PPI Tax Rebate Tax Refund 4 U

PPI Tax Rebate Tax Refund 4 U

Web PPI tax claimants for 2015 2016 you may have missed the claim deadline This is because you can only backdate PPI tax by four tax years aka 6th April 2015 and 2016 meaning the deadline was on the 5th April 2020

The Tax Rebate Form Ppi Process

The procedure usually involves a few simple steps:

-

When you buy the product you purchase the item exactly as you would normally.

-

Fill in the Tax Rebate Form Ppi form: You'll have to fill in some information, such as your address, name, as well as the details of your purchase to get your Tax Rebate Form Ppi.

-

Make sure you submit the Tax Rebate Form Ppi Based on the kind of Tax Rebate Form Ppi you could be required to send in a form, or submit it online.

-

Wait until the company approves: The company will scrutinize your submission to ensure it meets the requirements of the Tax Rebate Form Ppi.

-

Accept your Tax Rebate Form Ppi After being approved, you'll get your refund, either through check, prepaid card, or by another method as specified by the offer.

Pros and Cons of Tax Rebate Form Ppi

Advantages

-

Cost Savings: Tax Rebate Form Ppi can significantly cut the price you pay for the product.

-

Promotional Deals they encourage their customers to try new products or brands.

-

boost sales Reward programs can boost a company's sales and market share.

Disadvantages

-

Complexity Pay-in Tax Rebate Form Ppi via mail, particularly the case of HTML0, can be a hassle and time-consuming.

-

The Expiration Dates Some Tax Rebate Form Ppi have deadlines for submission.

-

Risk of Not Being Paid: Some customers may lose their Tax Rebate Form Ppi in the event that they don't follow the regulations precisely.

Download Tax Rebate Form Ppi

FAQs

1. Are Tax Rebate Form Ppi the same as discounts? No, Tax Rebate Form Ppi are a partial refund upon purchase, whereas discounts cut their price at time of sale.

2. Are there multiple Tax Rebate Form Ppi I can get on the same product It's contingent upon the terms and conditions of Tax Rebate Form Ppi is offered as well as the merchandise's suitability. Some companies may allow it, but others won't.

3. How long does it take to receive an Tax Rebate Form Ppi? The duration will vary, but it may be from several weeks to several months to receive a Tax Rebate Form Ppi.

4. Do I need to pay taxes of Tax Rebate Form Ppi amounts? In most situations, Tax Rebate Form Ppi amounts are not considered to be taxable income.

5. Can I trust Tax Rebate Form Ppi deals from lesser-known brands It is essential to investigate and confirm that the brand that is offering the Tax Rebate Form Ppi is reputable prior to making the purchase.

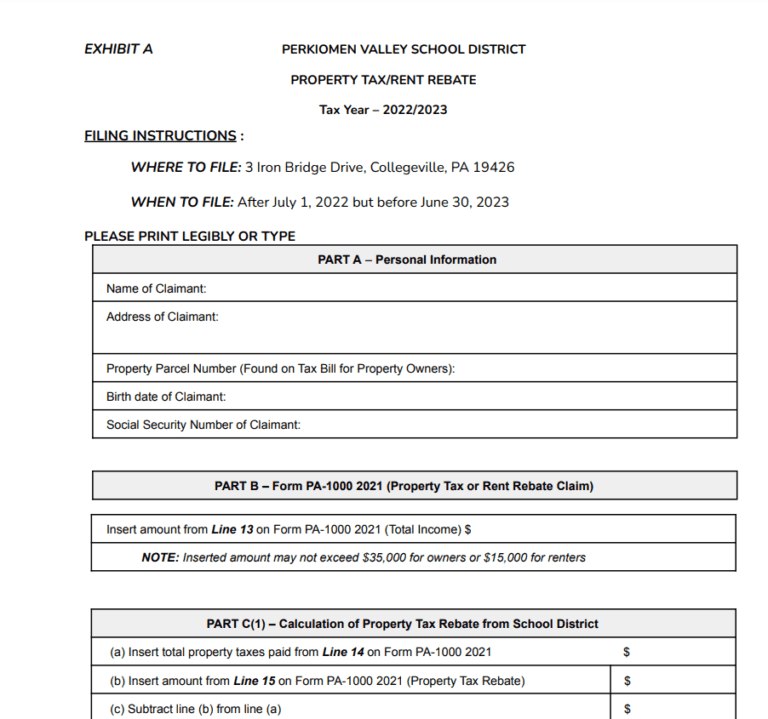

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

2021 Illinois Property Tax Rebate Printable Rebate Form

Check more sample of Tax Rebate Form Ppi below

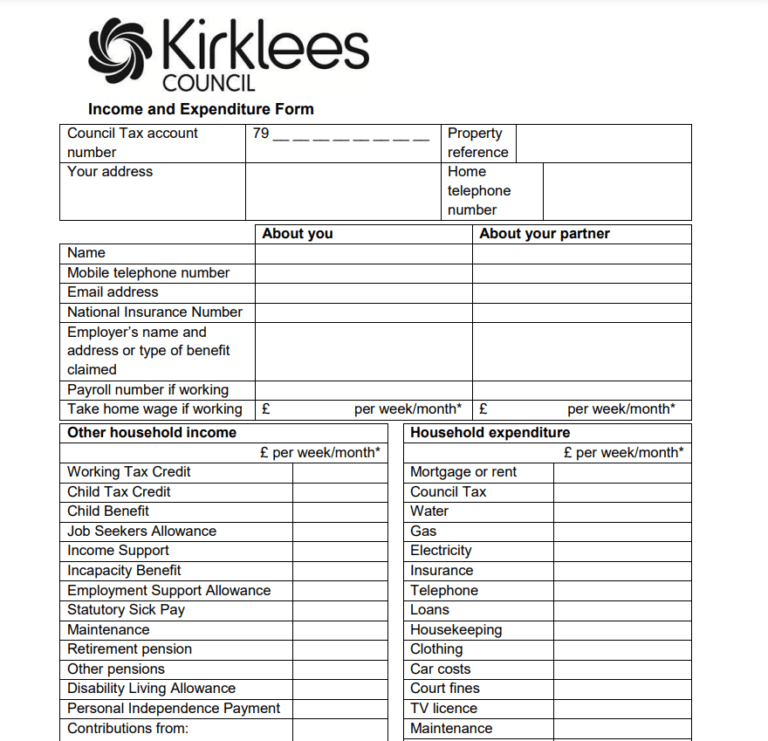

Council Tax Rebate Form Kirklees By Touch Printable Rebate Form

What Do I Need To Know About PPI Tax Claims Gowing Law

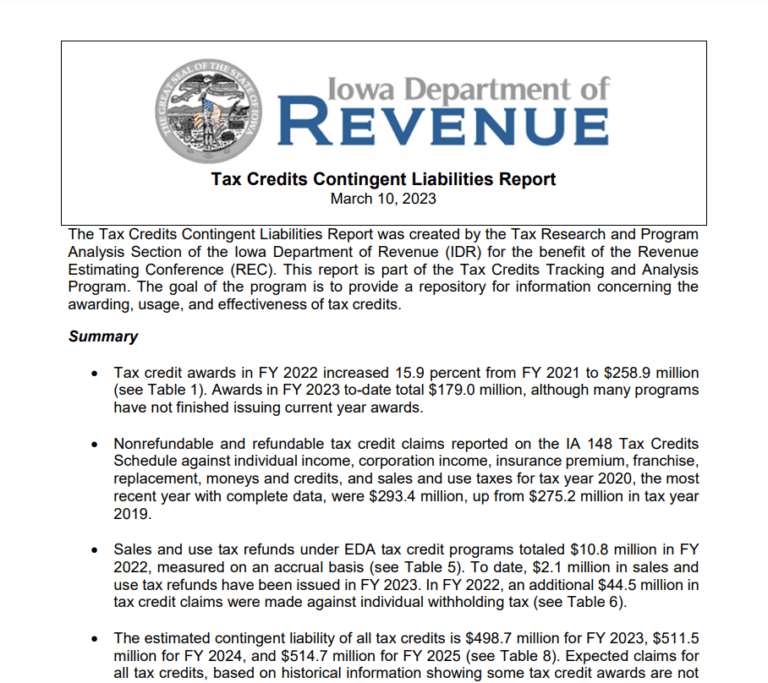

2023 Iowa Tax Brackets Printable Rebate Form

Carbon Tax Rebate 2022 Printable Rebate Form

Georgia Income Tax Rebate 2023 Printable Rebate Form

Washington State Tax Rebate Printable Rebate Form

https://www.gov.uk/claim-tax-refund

Web a Self Assessment tax return a redundancy payment UK income if you live abroad interest from savings or payment protection insurance PPI income from a life or pension

https://www.litrg.org.uk/resources/annotated-f…

Web 3 avr 2023 nbsp 0183 32 You can use form R40 to make a claim for repayment of tax in certain circumstances you are not within Self Assessment that is you do not have to submit an annual tax return you have paid too much tax on

Web a Self Assessment tax return a redundancy payment UK income if you live abroad interest from savings or payment protection insurance PPI income from a life or pension

Web 3 avr 2023 nbsp 0183 32 You can use form R40 to make a claim for repayment of tax in certain circumstances you are not within Self Assessment that is you do not have to submit an annual tax return you have paid too much tax on

Carbon Tax Rebate 2022 Printable Rebate Form

What Do I Need To Know About PPI Tax Claims Gowing Law

Georgia Income Tax Rebate 2023 Printable Rebate Form

Washington State Tax Rebate Printable Rebate Form

P G Printable Rebate Form

Claiming Tax Back On Your PPI Refund PPI Rebates

Claiming Tax Back On Your PPI Refund PPI Rebates

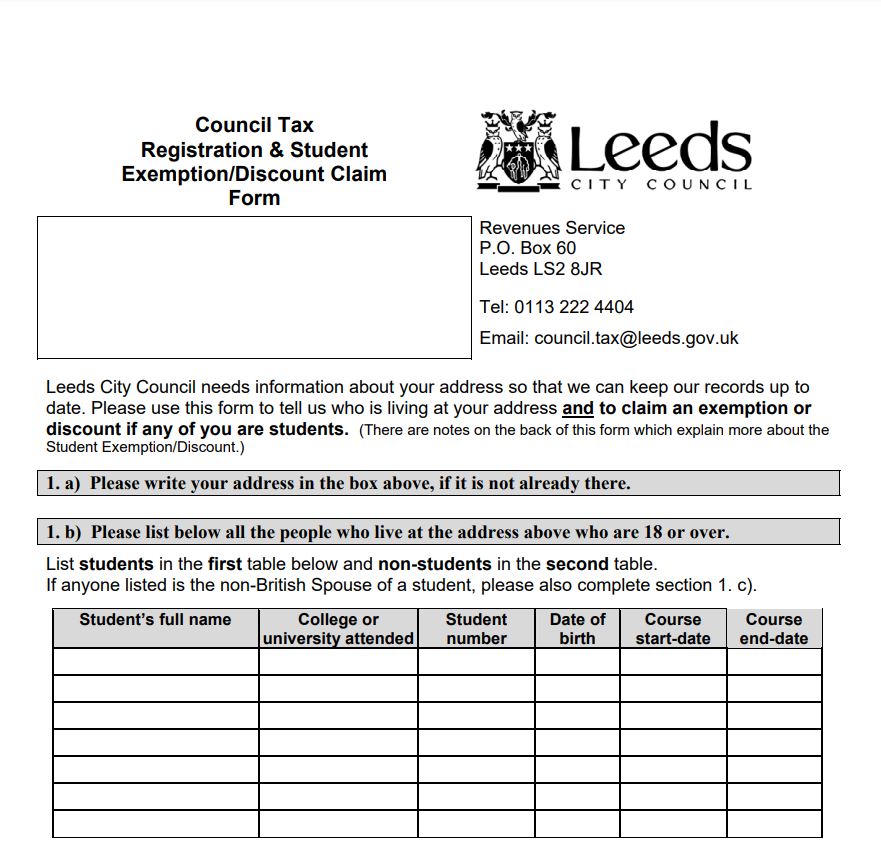

Leeds Council Tax Helpline Printable Rebate Form