In the modern world of consumerization everyone enjoys a good bargain. One way to score significant savings in your purchase is through Tax Rebate Form P87s. Tax Rebate Form P87s can be a way of marketing that retailers and manufacturers use to provide customers with a portion of a return on their purchases once they've created them. In this post, we'll go deeper into the realm of Tax Rebate Form P87s. We will explore the nature of them, how they work, and how you can make the most of your savings through these efficient incentives.

Get Latest Tax Rebate Form P87 Below

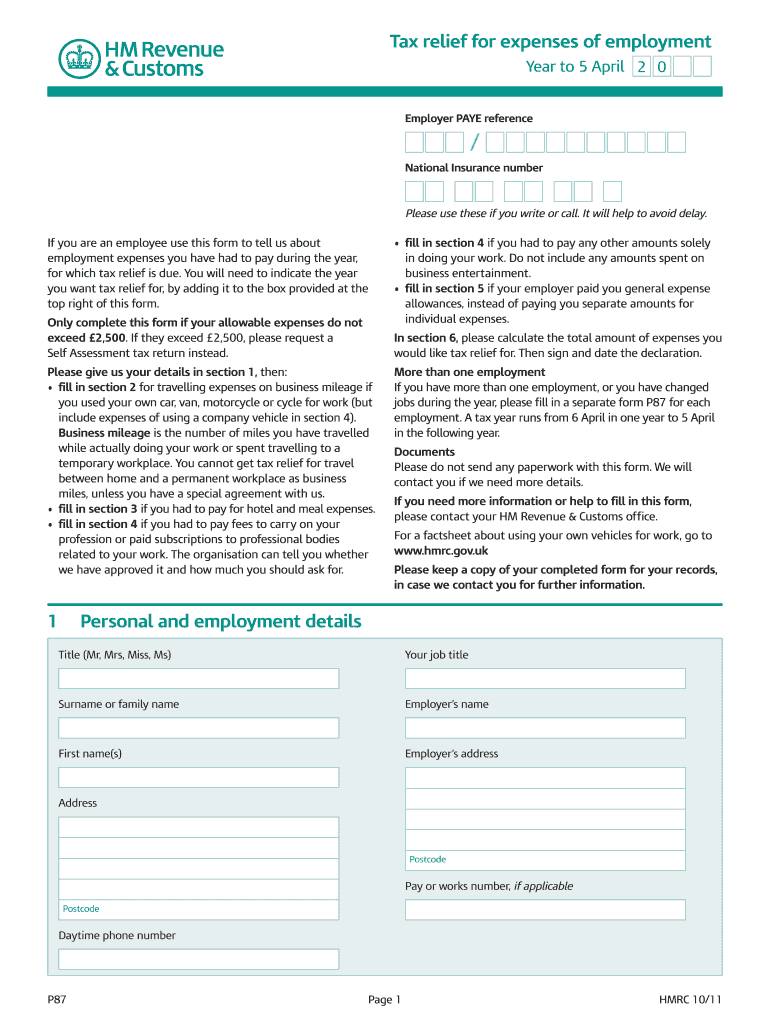

Tax Rebate Form P87

Tax Rebate Form P87 -

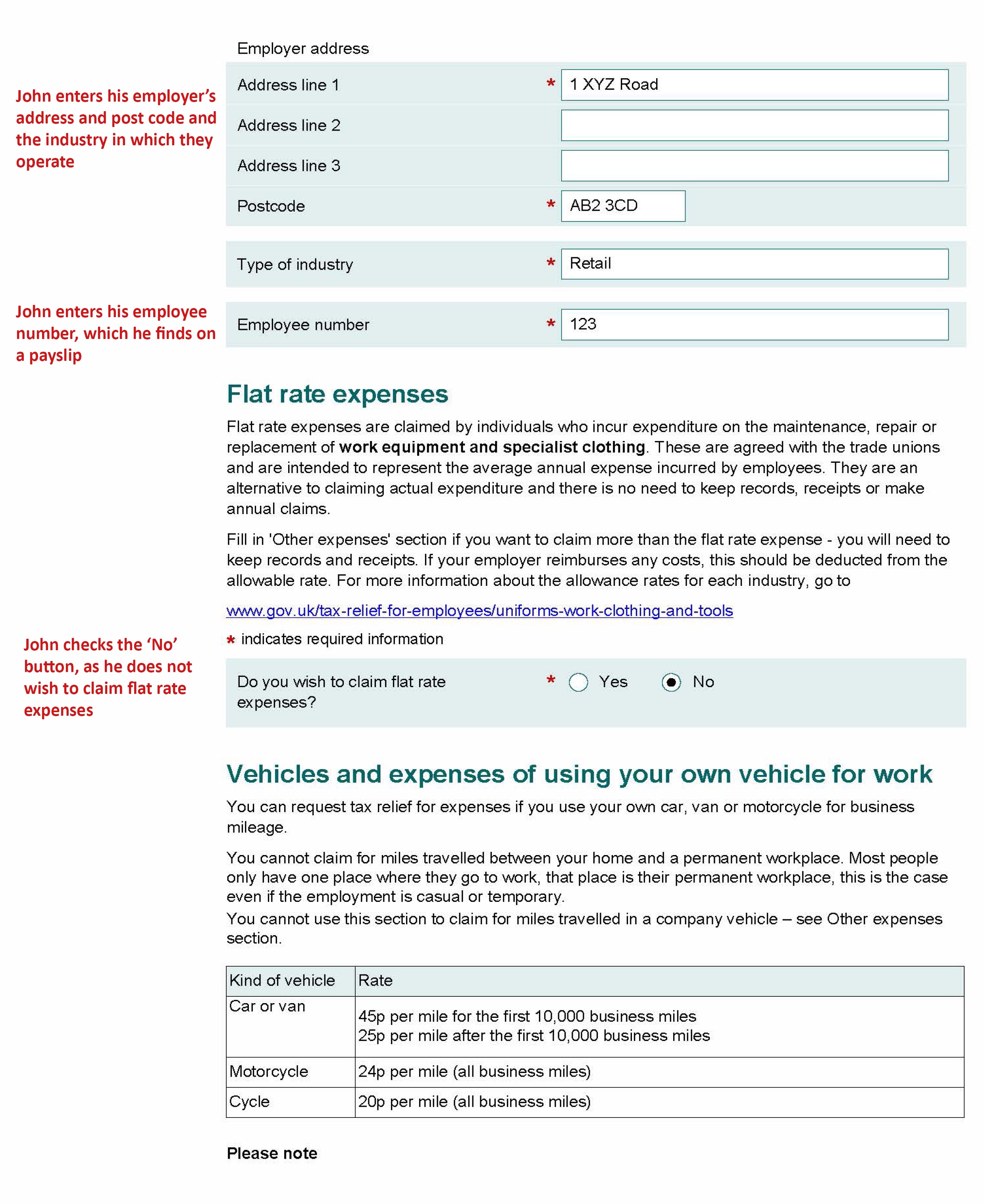

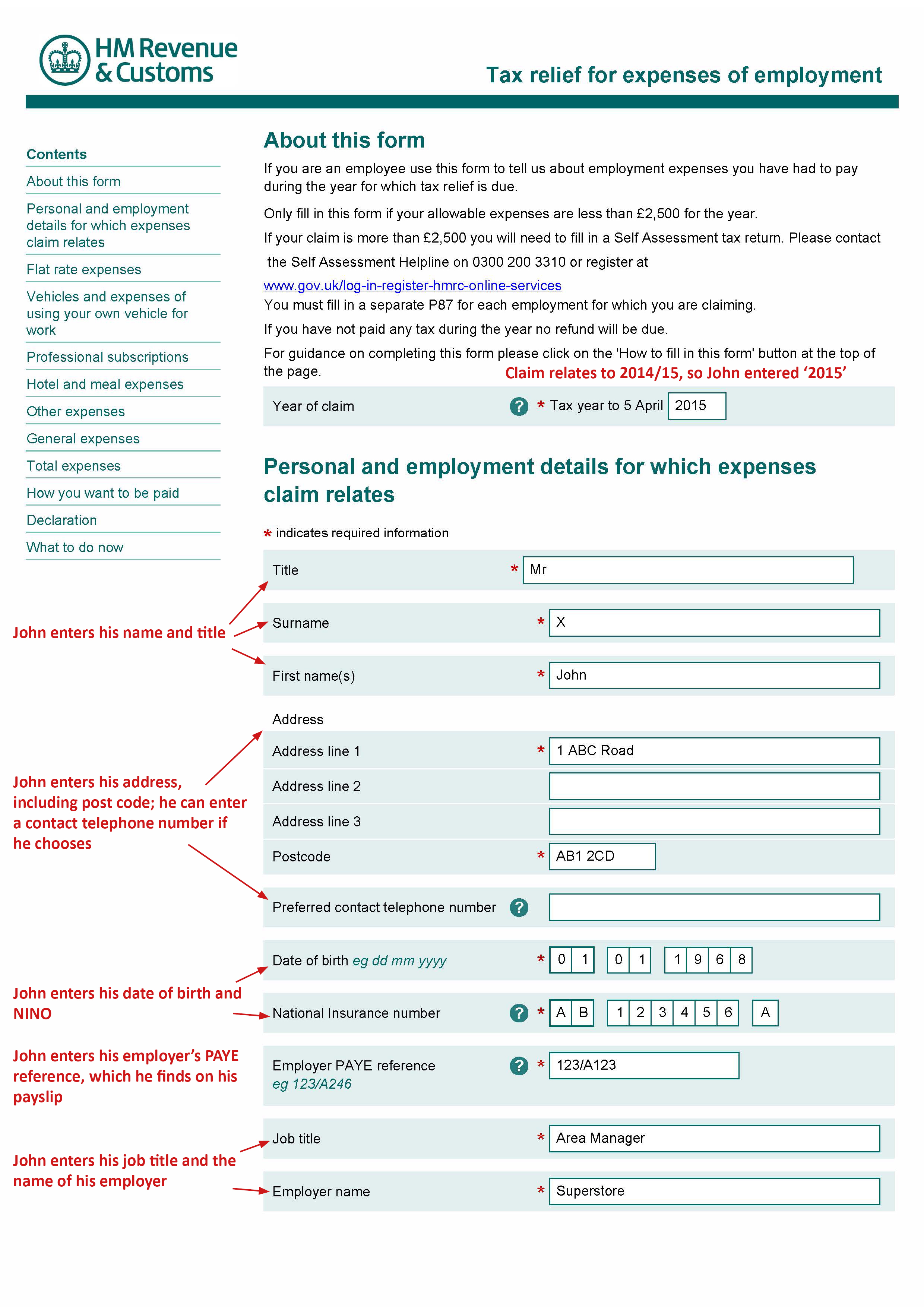

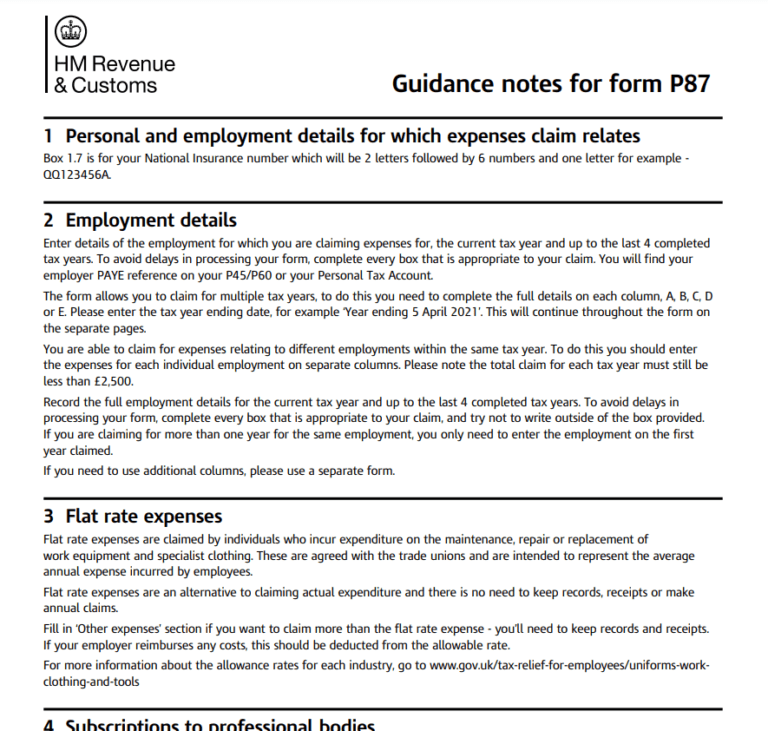

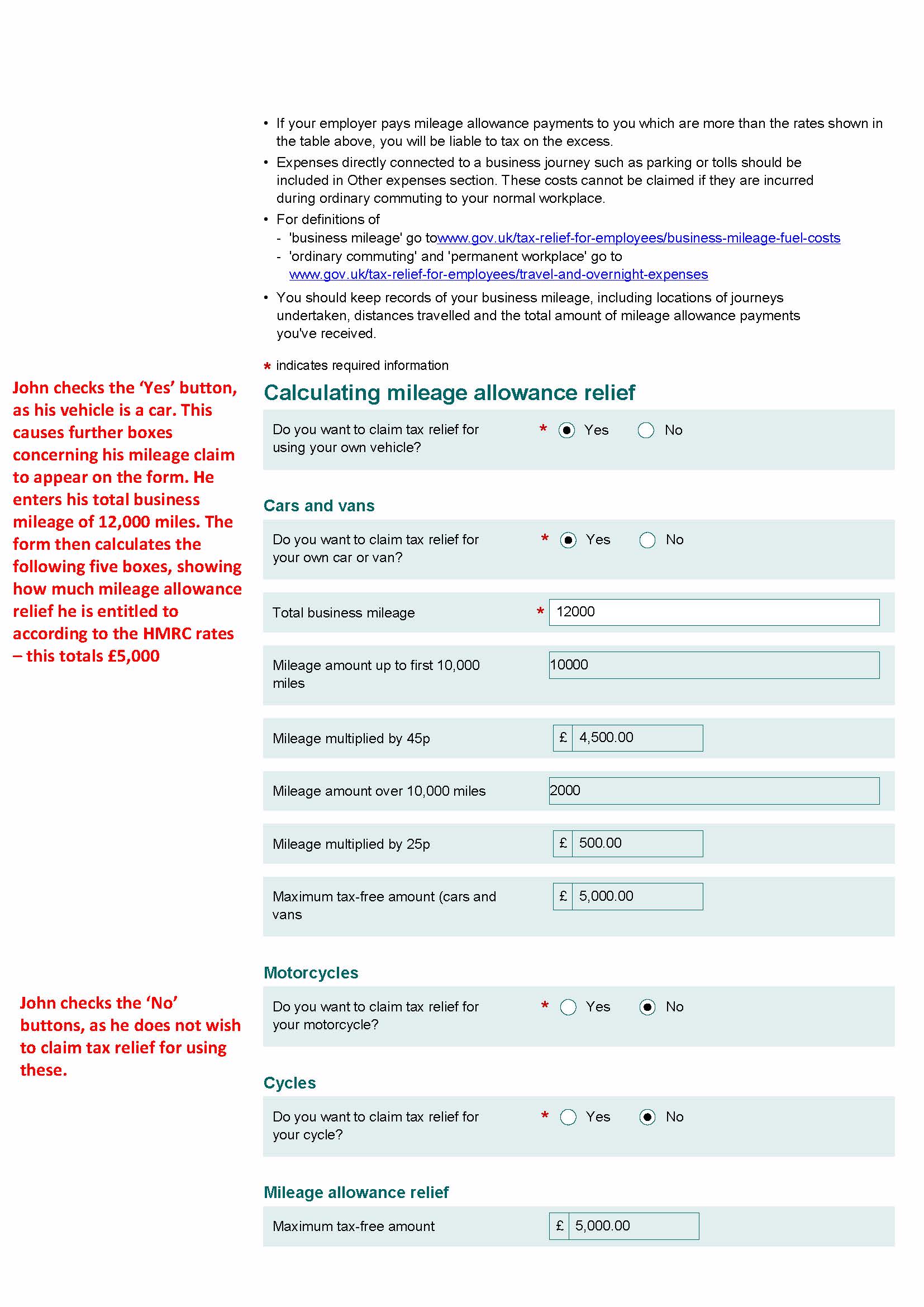

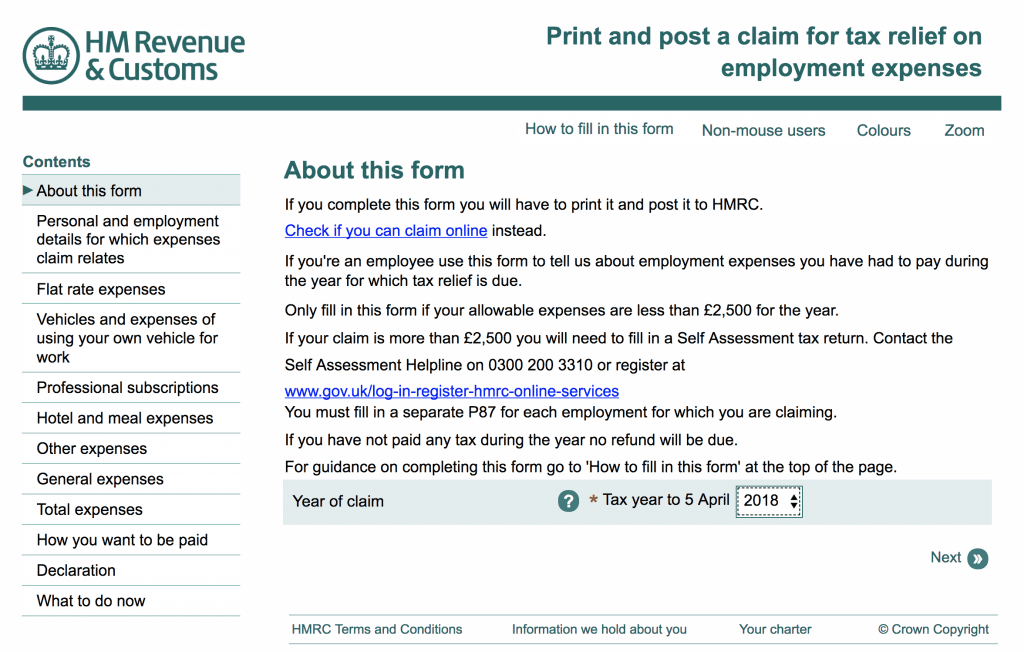

Web 21 mars 2022 nbsp 0183 32 From 7 May HMRC is mandating the use of the standard P87 form for claiming income tax relief on employment expenses on gov uk and will reject claims that are made on substitute claim forms The other options will remain available

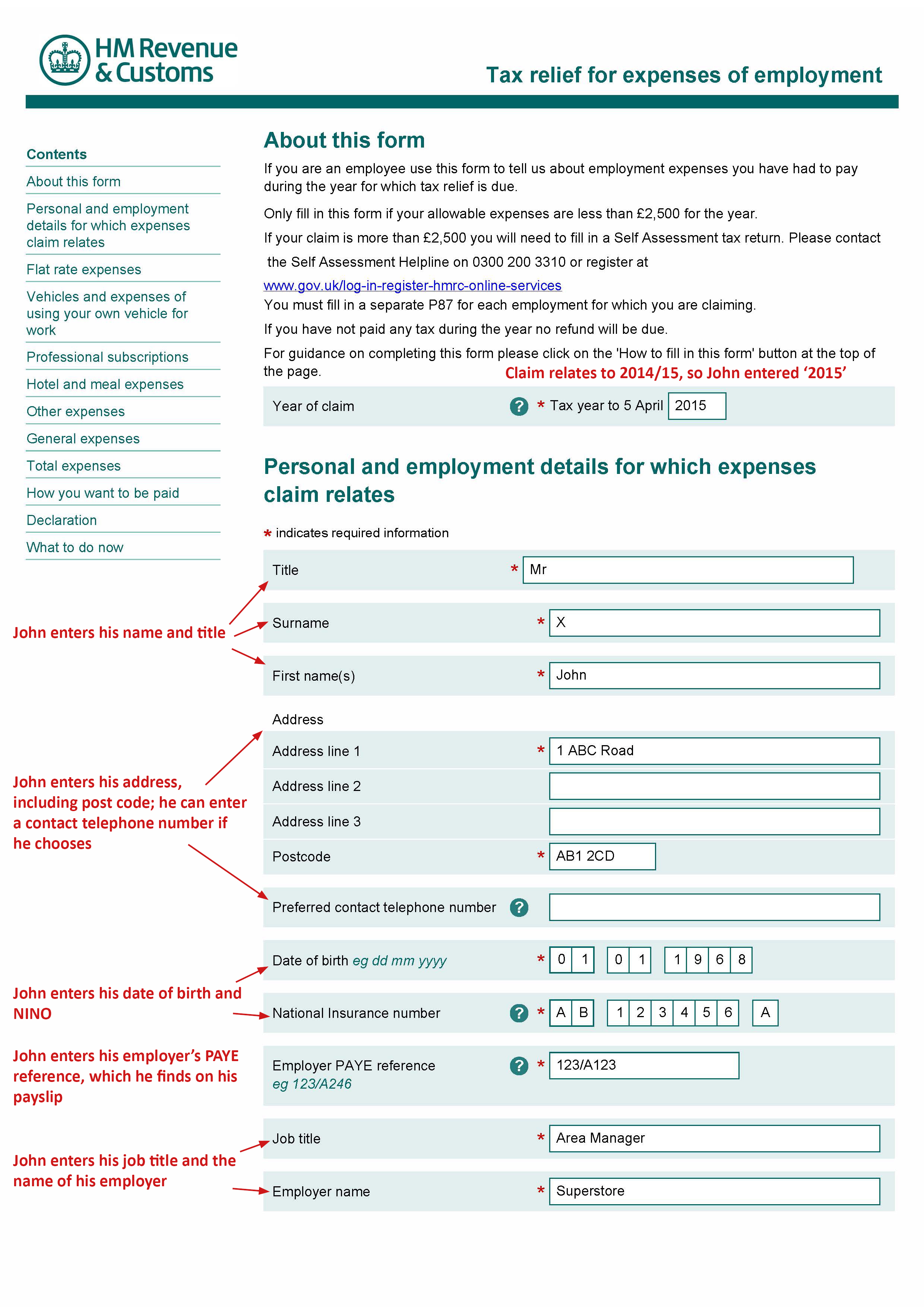

Web 5 sept 2023 nbsp 0183 32 Claim tax relief on your job expenses by post using form P87 if you cannot claim online or by phone From HM Revenue amp Customs Published 5 September 2023 Get emails about this page

A Tax Rebate Form P87, in its simplest type, is a reimbursement to a buyer after purchasing a certain product or service. This is a potent tool employed by companies to draw customers, increase sales and advertise specific products.

Types of Tax Rebate Form P87

P87 Claim Form Printable Printable Forms Free Online

P87 Claim Form Printable Printable Forms Free Online

Web 24 mai 2022 nbsp 0183 32 The P87 expenses claim form will become a prescribed form in May 2022 Regulations were laid 7 March 2022 to enable HMRC to prescribe the format of the form P87 from 7 May 2022 Many

Web 29 nov 2022 nbsp 0183 32 Since May 2022 the format of claims for tax relief on employment expenses has been mandated HMRC s version of the P87 form must be used for claims made by post From 21 December 2022 claims made on P87 forms must include the following

Cash Tax Rebate Form P87

Cash Tax Rebate Form P87 is the most basic kind of Tax Rebate Form P87. Customers are offered a certain amount of money in return for purchasing a product. These are typically applied to big-ticket items, like electronics and appliances.

Mail-In Tax Rebate Form P87

Mail-in Tax Rebate Form P87 require consumers to provide the proof of purchase in order to receive their money back. They're a bit more involved, but can result in significant savings.

Instant Tax Rebate Form P87

Instant Tax Rebate Form P87 are made at the moment of sale, cutting the price of your purchase instantly. Customers do not have to wait for their savings when they purchase this type of Tax Rebate Form P87.

How Tax Rebate Form P87 Work

P87 Printable Rebate Form

P87 Printable Rebate Form

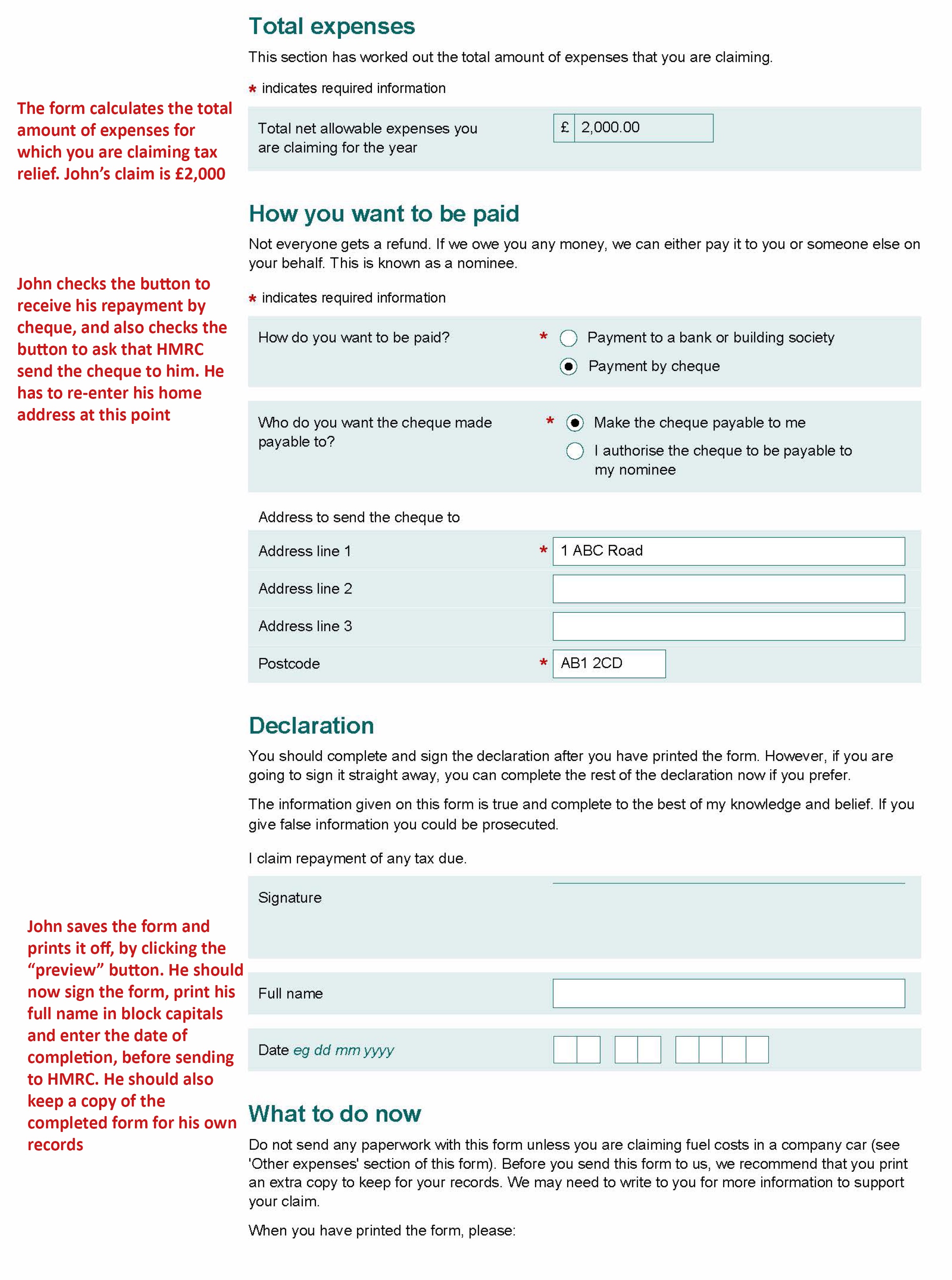

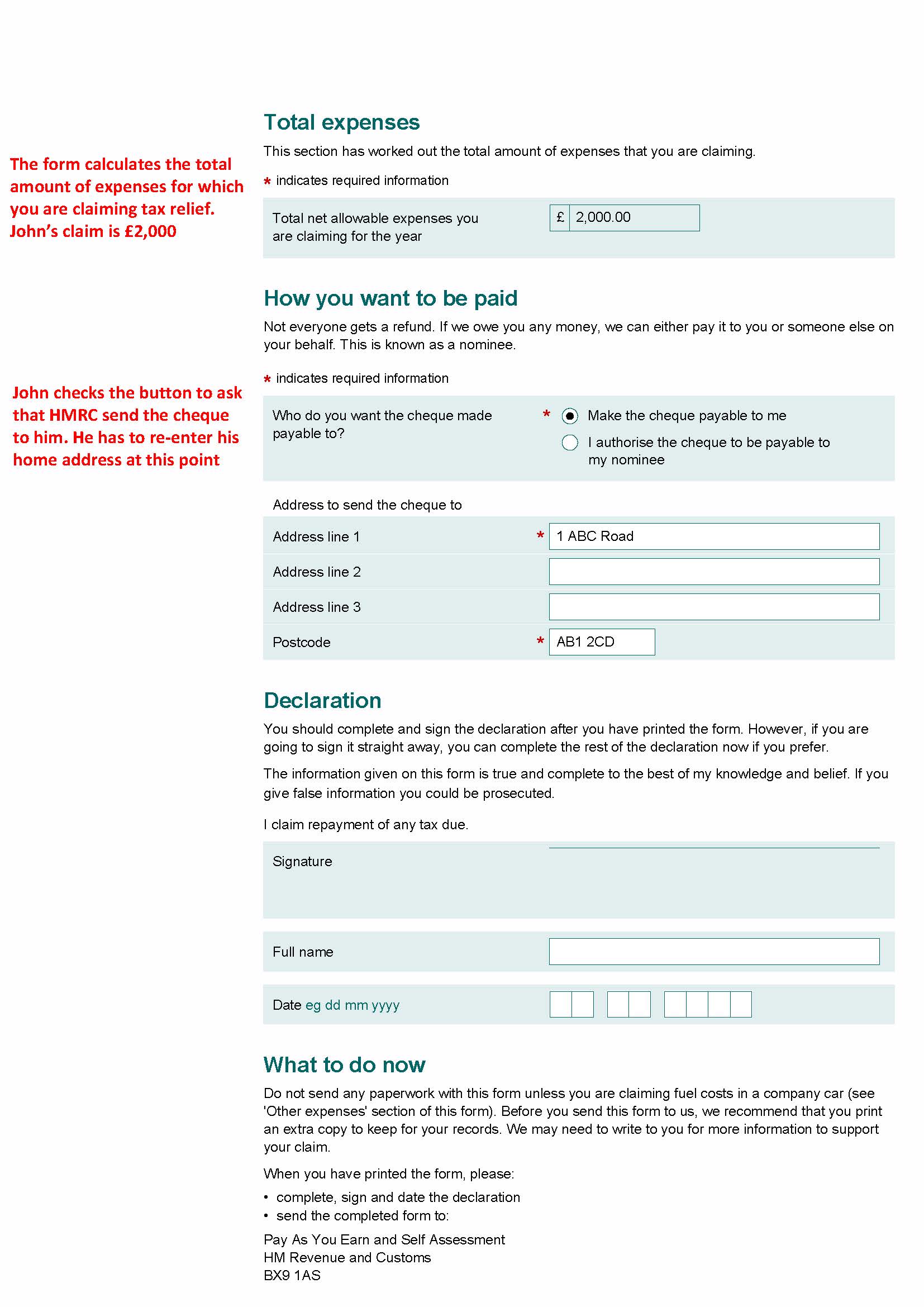

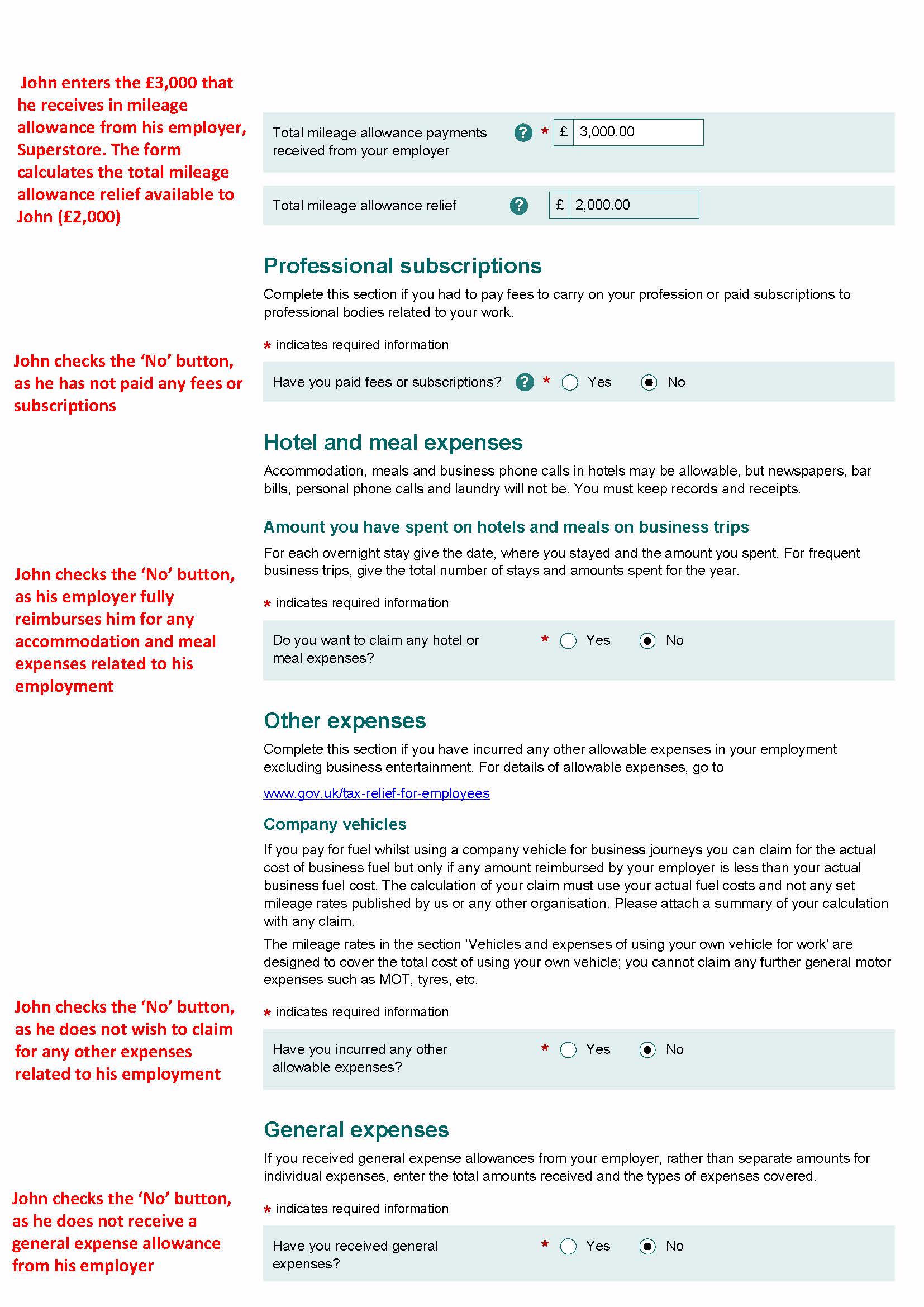

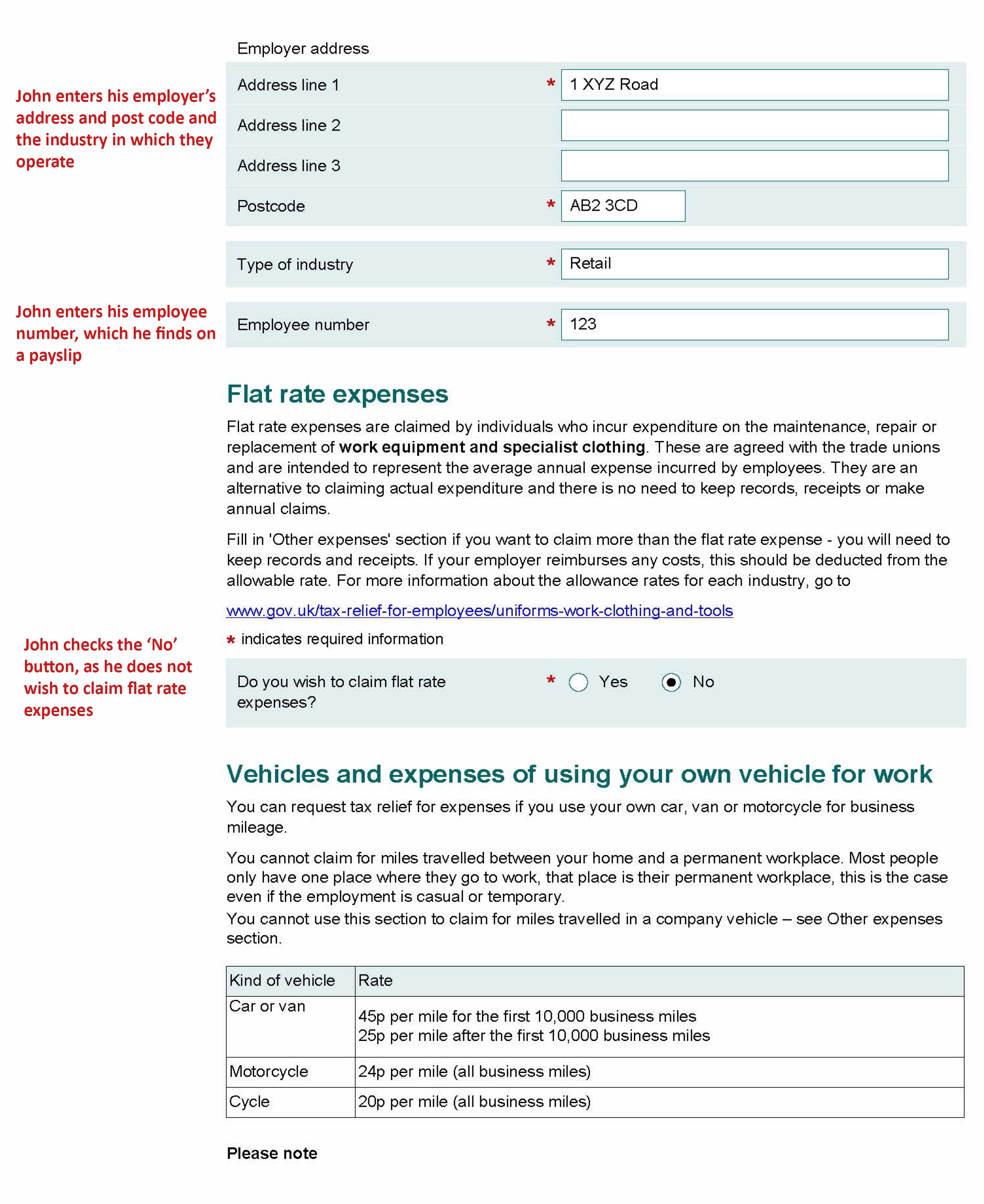

Web A P87 form is the document you use to use to claim tax relief for your work expenses You can only claim your tax rebates with a P87 if you re an employee If you re self employed you tell HMRC about your expenses through the Self Assessment system

The Tax Rebate Form P87 Process

The process generally involves a handful of simple steps:

-

Buy the product: Firstly you purchase the product the way you normally do.

-

Complete your Tax Rebate Form P87 questionnaire: you'll need to provide some data, such as your name, address and purchase information, in order to claim your Tax Rebate Form P87.

-

Send in the Tax Rebate Form P87 depending on the kind of Tax Rebate Form P87 you will need to send in a form, or upload it online.

-

Wait for approval: The business is going to review your entry to verify that it is compliant with the Tax Rebate Form P87's terms and conditions.

-

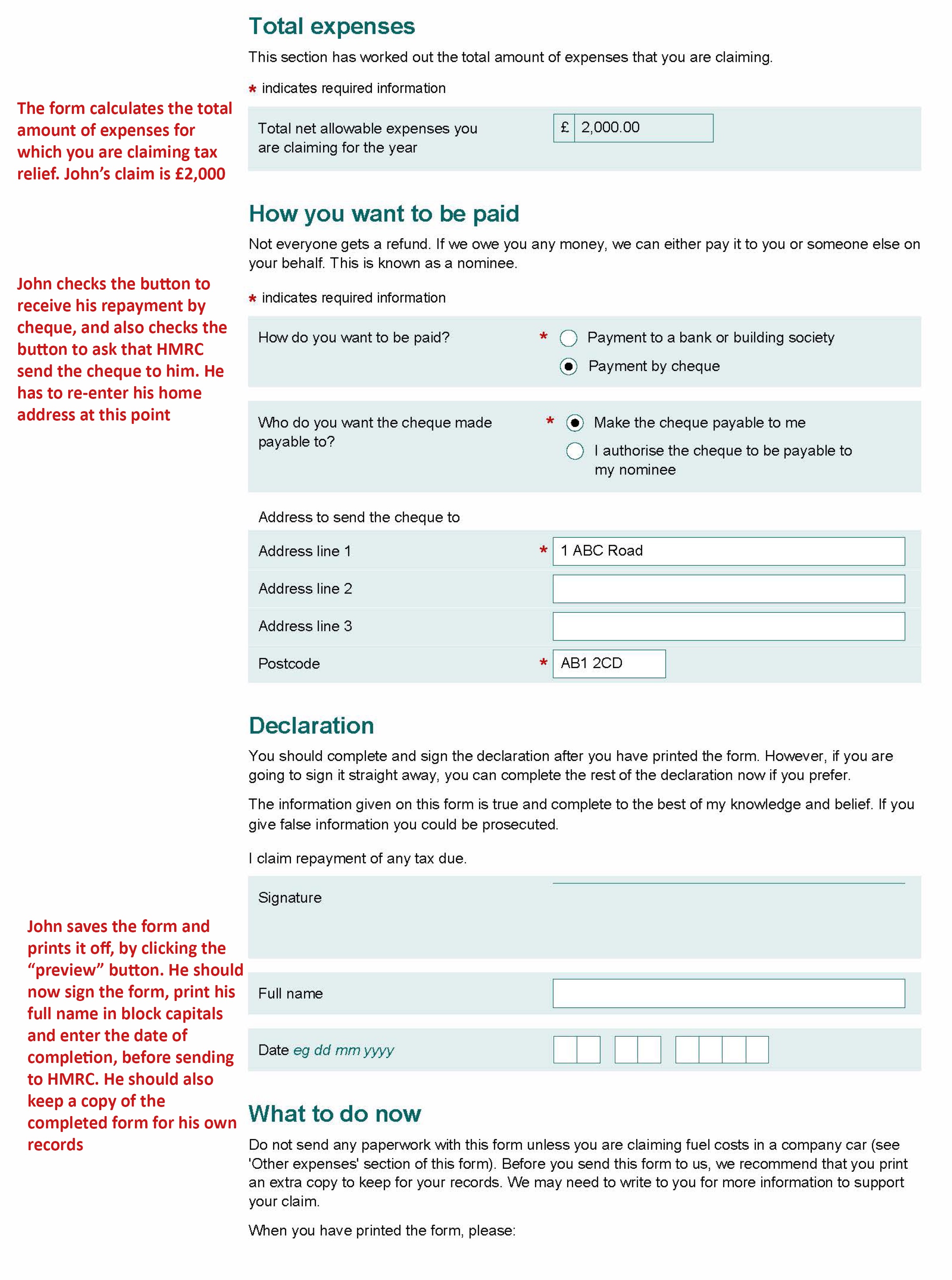

Pay your Tax Rebate Form P87 After you've been approved, you'll receive the refund whether via check, credit card, or through another way specified in the offer.

Pros and Cons of Tax Rebate Form P87

Advantages

-

Cost Savings The use of Tax Rebate Form P87 can greatly decrease the price for the item.

-

Promotional Deals They encourage customers in trying new products or brands.

-

Increase Sales A Tax Rebate Form P87 program can boost the sales of a business and increase its market share.

Disadvantages

-

Complexity Mail-in Tax Rebate Form P87 in particular are often time-consuming and slow-going.

-

End Dates Many Tax Rebate Form P87 are subject to rigid deadlines to submit.

-

Risk of Non-Payment Certain customers could not receive their Tax Rebate Form P87 if they don't observe the rules precisely.

Download Tax Rebate Form P87

FAQs

1. Are Tax Rebate Form P87 equivalent to discounts? Not at all, Tax Rebate Form P87 provide a partial refund after purchase, whereas discounts cut the purchase price at the point of sale.

2. Do I have to use multiple Tax Rebate Form P87 on the same product It's contingent upon the terms for the Tax Rebate Form P87 provides and the particular product's acceptance. Certain companies might allow it, while some won't.

3. What is the time frame to receive the Tax Rebate Form P87? The period can vary, but typically it will take anywhere from a couple of weeks to a several months to receive a Tax Rebate Form P87.

4. Do I have to pay tax with respect to Tax Rebate Form P87 quantities? most instances, Tax Rebate Form P87 amounts are not considered to be taxable income.

5. Should I be able to trust Tax Rebate Form P87 offers from brands that aren't well-known? It's essential to research to ensure that the name giving the Tax Rebate Form P87 is credible prior to making an acquisition.

Form P87 Claim For Tax Relief For Expenses Of Employment Low Incomes

P87 Form Fill Out Sign Online DocHub

Check more sample of Tax Rebate Form P87 below

P87 Fill Out And Sign Printable PDF Template SignNow

Hmrc P87 Printable Form Printable Forms Free Online

Working From Home Tax Relief Form P87 The Tax Implications Of Working

How To Claim The Work Mileage Tax Rebate Goselfemployed co

Hmrc P87 Printable Form Printable Forms Free Online

Hmrc P87 Printable Form Printable Forms Free Online

https://www.gov.uk/guidance/send-an-income-tax-relief-claim-for-job...

Web 5 sept 2023 nbsp 0183 32 Claim tax relief on your job expenses by post using form P87 if you cannot claim online or by phone From HM Revenue amp Customs Published 5 September 2023 Get emails about this page

https://www.cipp.org.uk/resources/news/hmrc …

Web 14 d 233 c 2022 nbsp 0183 32 If you want to use the Before 21 December 2022 use Tax relief for expenses of employment version of form P87 your form must reach HMRC by 20 December 2022 It is important to complete the

Web 5 sept 2023 nbsp 0183 32 Claim tax relief on your job expenses by post using form P87 if you cannot claim online or by phone From HM Revenue amp Customs Published 5 September 2023 Get emails about this page

Web 14 d 233 c 2022 nbsp 0183 32 If you want to use the Before 21 December 2022 use Tax relief for expenses of employment version of form P87 your form must reach HMRC by 20 December 2022 It is important to complete the

How To Claim The Work Mileage Tax Rebate Goselfemployed co

Hmrc P87 Printable Form Printable Forms Free Online

Hmrc P87 Printable Form Printable Forms Free Online

Hmrc P87 Printable Form Printable Forms Free Online

Hmrc P87 Printable Form Printable Forms Free Online

Hmrc P87 Printable Form Printable Forms Free Online

Hmrc P87 Printable Form Printable Forms Free Online

How To Fill Out Your P87 Tax Form FLiP