Today, in a world that is driven by the consumer we all love a good bargain. One way to score significant savings on your purchases is by using Tax Rebate Form Nzs. Tax Rebate Form Nzs can be a way of marketing employed by retailers and manufacturers to provide customers with a partial discount on purchases they made after they have created them. In this post, we'll take a look at the world that is Tax Rebate Form Nzs. We'll look at what they are as well as how they work and ways you can increase your savings with these cost-effective incentives.

Get Latest Tax Rebate Form Nz Below

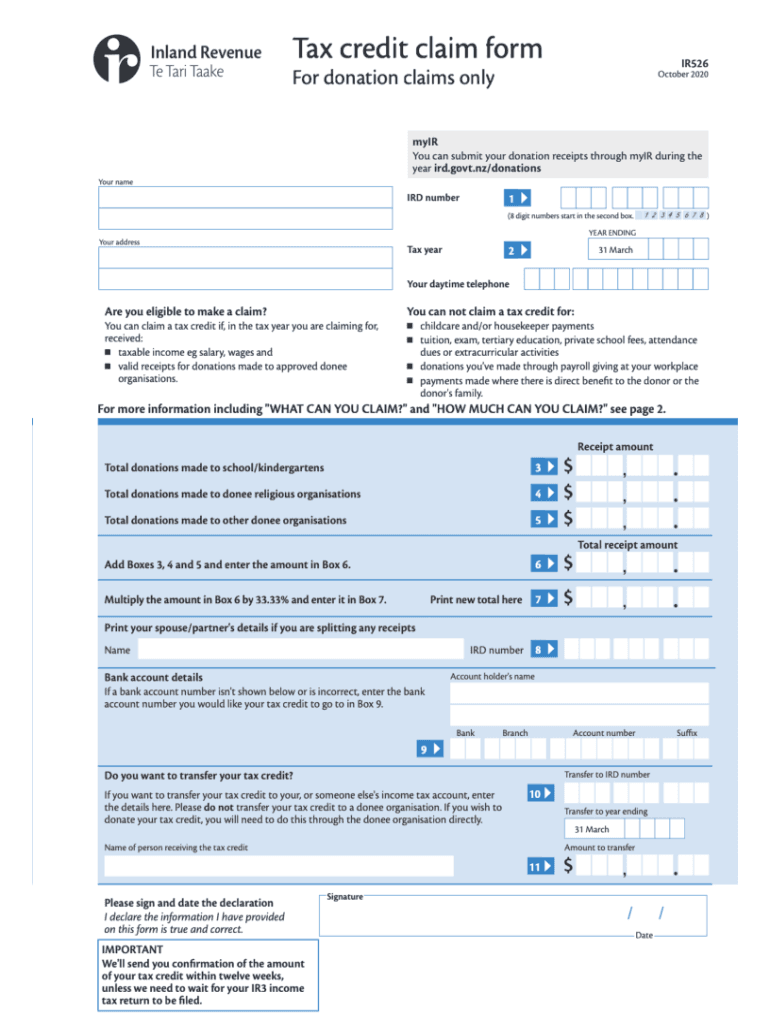

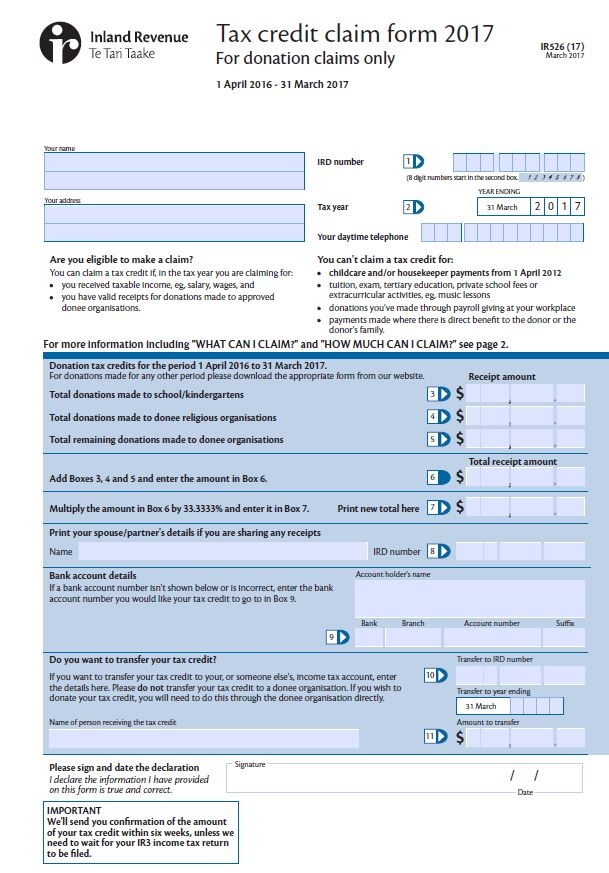

Tax Rebate Form Nz

Tax Rebate Form Nz -

Web Rates Rebate Application Form Application for the rating year 1 July 2022 to 30 June 2023 Applications close on 30 June 2023 and cannot be accepted after this date 1 Name

Web 4 year limit for claiming For a donation you made you can submit the receipt at any time within 4 years of 1 April following the end of the tax year in which you made the

A Tax Rebate Form Nz in its simplest description, is a return to the customer after they've purchased a good or service. It's an effective way used by companies to attract clients, increase sales and also to advertise certain products.

Types of Tax Rebate Form Nz

Tulsa Sales Tax Rebate Form Fill Online Printable Fillable Blank

Tulsa Sales Tax Rebate Form Fill Online Printable Fillable Blank

Web 1 avr 2022 nbsp 0183 32 If you think you could be eligible for a rebate complete the application form Contact your council if you have any questions Apply for a rates rebate application

Web How to apply What happens next Overview The Rates Rebates Scheme provides a rebate for eligible applicants To apply for a rebate for the current rating year you need

Cash Tax Rebate Form Nz

Cash Tax Rebate Form Nz are by far the easiest kind of Tax Rebate Form Nz. Customers receive a specific sum of money back when purchasing a item. This is often for products that are expensive, such as electronics or appliances.

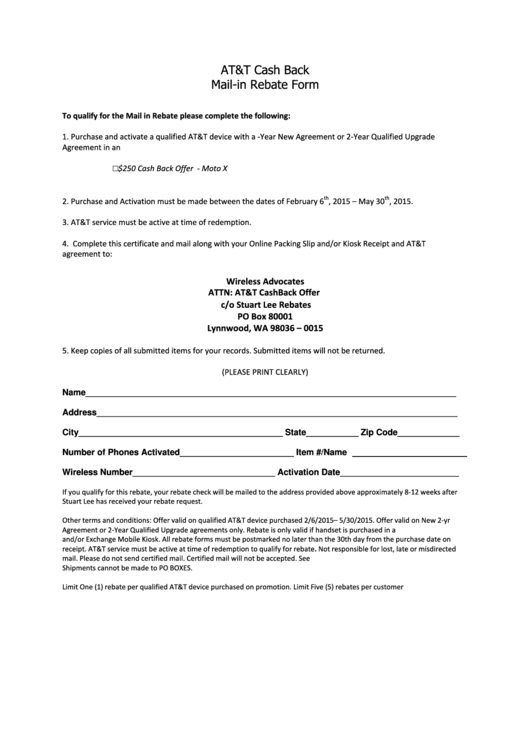

Mail-In Tax Rebate Form Nz

Mail-in Tax Rebate Form Nz require customers to send in their proof of purchase before receiving the money. They're more complicated but could provide huge savings.

Instant Tax Rebate Form Nz

Instant Tax Rebate Form Nz are applied at the point of sale, reducing the price of purchases immediately. Customers don't need to wait for their savings in this manner.

How Tax Rebate Form Nz Work

P G Printable Rebate Form

P G Printable Rebate Form

Web 1 Complete the application form You can print the form to fill it in Post or drop off your application as explained in Step 4 Rates rebate application form PDF 370KB You can

The Tax Rebate Form Nz Process

The process typically involves a few simple steps

-

When you buy the product you buy the product just like you normally would.

-

Fill out your Tax Rebate Form Nz forms: The Tax Rebate Form Nz form will have be able to provide a few details, such as your name, address, and purchase details in order to get your Tax Rebate Form Nz.

-

In order to submit the Tax Rebate Form Nz Based on the type of Tax Rebate Form Nz there may be a requirement to send in a form, or submit it online.

-

Wait for the company's approval: They will examine your application to make sure it is in line with the guidelines and conditions of the Tax Rebate Form Nz.

-

Accept your Tax Rebate Form Nz After being approved, you'll receive your refund via check, prepaid card or another option as per the terms of the offer.

Pros and Cons of Tax Rebate Form Nz

Advantages

-

Cost savings: Tax Rebate Form Nz can significantly lower the cost you pay for the product.

-

Promotional Deals they encourage their customers to try out new products or brands.

-

Boost Sales Tax Rebate Form Nz can help boost the sales of a business and increase its market share.

Disadvantages

-

Complexity Tax Rebate Form Nz that are mail-in, particularly the case of HTML0, can be a hassle and costly.

-

The Expiration Dates Many Tax Rebate Form Nz impose strict time limits for submission.

-

Risk of not receiving payment Certain customers could not receive Tax Rebate Form Nz if they don't adhere to the requirements exactly.

Download Tax Rebate Form Nz

FAQs

1. Are Tax Rebate Form Nz similar to discounts? No, the Tax Rebate Form Nz will be some form of refund following the purchase, but discounts can reduce your purchase cost at point of sale.

2. Are there multiple Tax Rebate Form Nz I can get on the same item It's contingent upon the terms and conditions of Tax Rebate Form Nz is offered as well as the merchandise's suitability. Certain companies allow it, but some will not.

3. How long will it take to receive a Tax Rebate Form Nz? The amount of time can vary, but typically it will last from a few weeks until a few months to get your Tax Rebate Form Nz.

4. Do I need to pay tax when I receive Tax Rebate Form Nz values? the majority of circumstances, Tax Rebate Form Nz amounts are not considered to be taxable income.

5. Should I be able to trust Tax Rebate Form Nz deals from lesser-known brands It's important to do your research and verify that the brand giving the Tax Rebate Form Nz is credible prior to making the purchase.

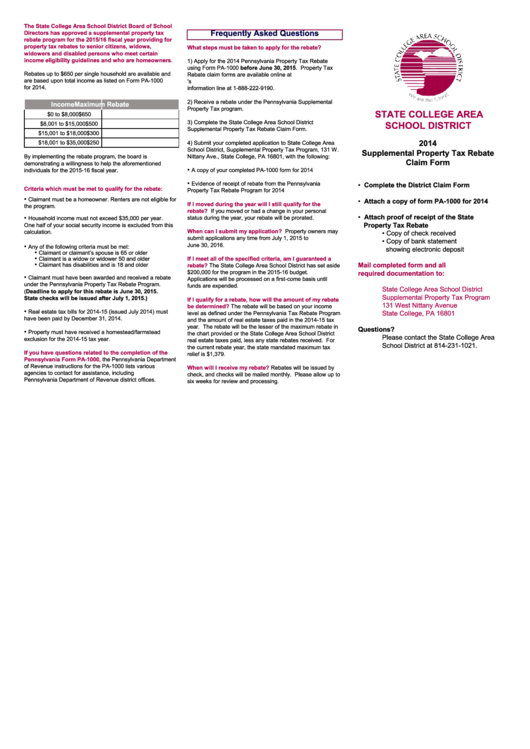

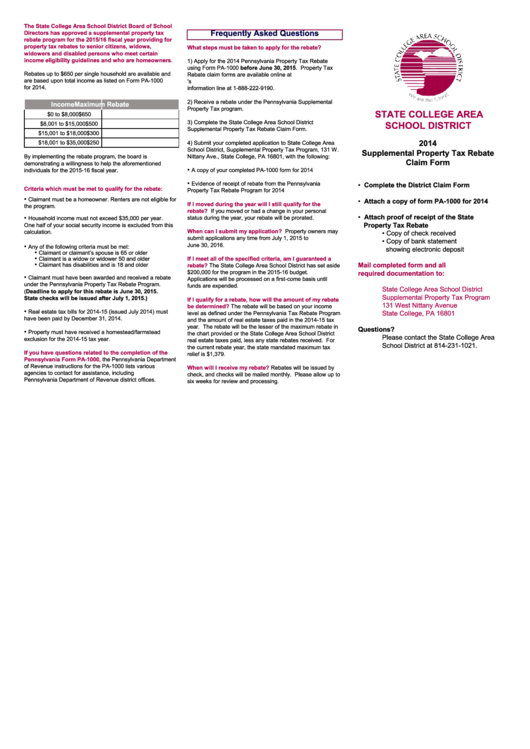

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Ptr Tax Rebate Libracha

Check more sample of Tax Rebate Form Nz below

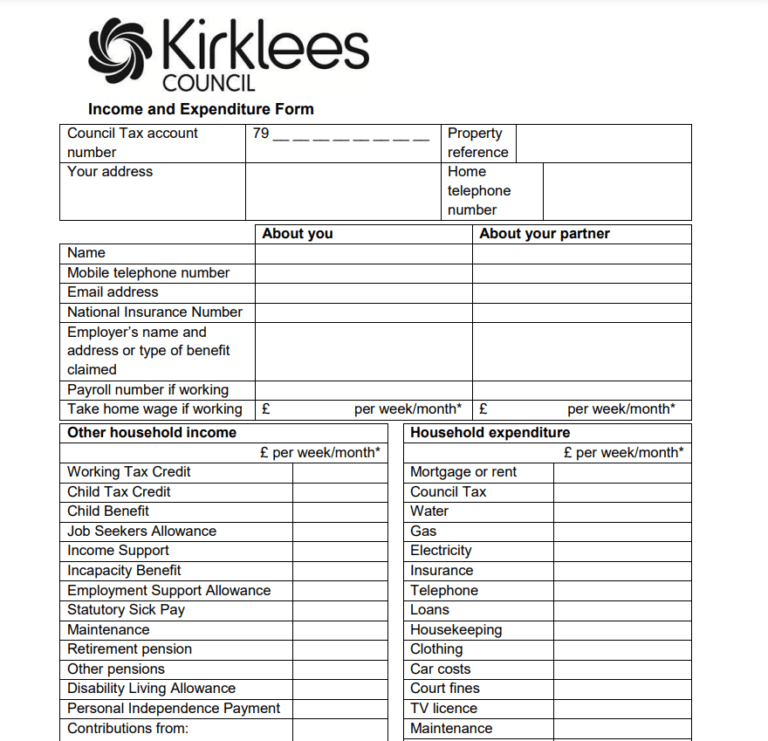

Council Tax Rebate Form Kirklees By Touch Printable Rebate Form

Ouc Rebates Pdf Fill Online Printable Fillable Blank PDFfiller

P55 Tax Rebate Form Business Printable Rebate Form

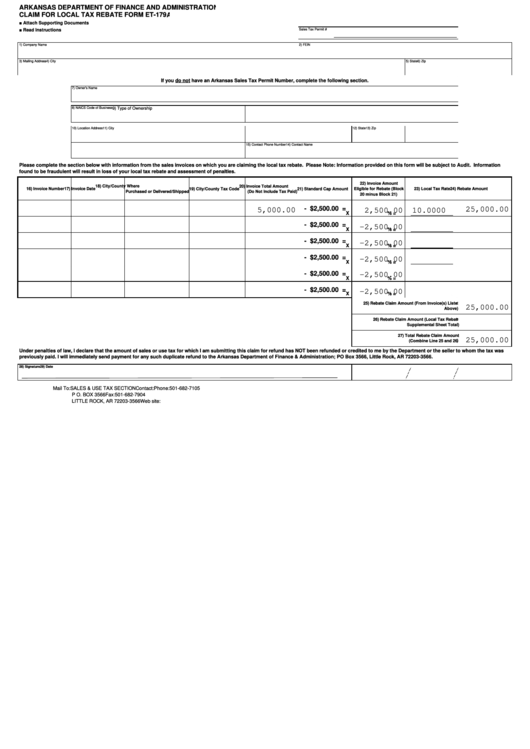

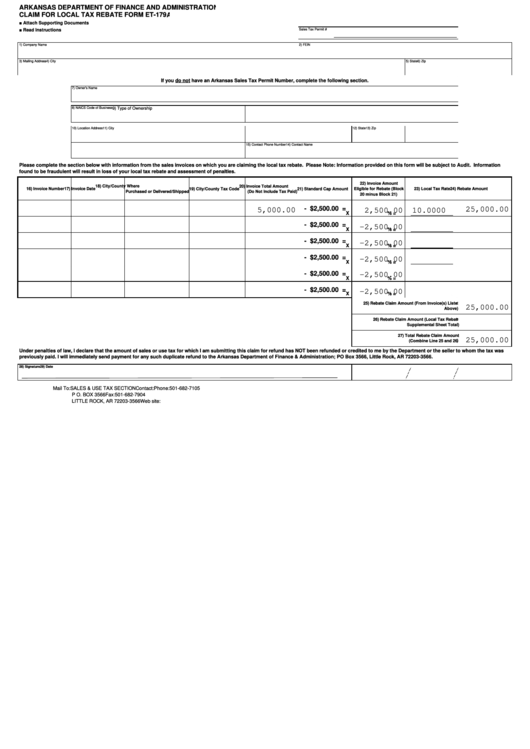

Fillable Form Et 179a Claim For Local Tax Rebate Printable Pdf Download

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

2021 2023 Form NZ IR330 Fill Online Printable Fillable Blank PdfFiller

https://www.ird.govt.nz/income-tax/income-tax-for-individuals/...

Web 4 year limit for claiming For a donation you made you can submit the receipt at any time within 4 years of 1 April following the end of the tax year in which you made the

https://www.ird.govt.nz/-/media/project/ir/home/documents/f…

Web donate your tax credit you will need to do this through the donee organisation directly 10 Transfer to year ending 31 March Name of person receiving the tax credit Amount to

Web 4 year limit for claiming For a donation you made you can submit the receipt at any time within 4 years of 1 April following the end of the tax year in which you made the

Web donate your tax credit you will need to do this through the donee organisation directly 10 Transfer to year ending 31 March Name of person receiving the tax credit Amount to

Fillable Form Et 179a Claim For Local Tax Rebate Printable Pdf Download

Ouc Rebates Pdf Fill Online Printable Fillable Blank PDFfiller

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

2021 2023 Form NZ IR330 Fill Online Printable Fillable Blank PdfFiller

Your Bullsh t Free Guide To New Zealand Tax For Working Holidaymakers

Supplemental Property Tax Rebate Claim Form State College Area

Supplemental Property Tax Rebate Claim Form State College Area

Free After Printable Mail In Rebate Forms Printable Forms Free Online