Today, in a world that is driven by the consumer people love a good deal. One method of gaining significant savings on your purchases is to use Tax Rebate Electric Car 2023 Form Utahs. They are a form of marketing that retailers and manufacturers use to give customers a part return on their purchases once they have bought them. In this post, we'll take a look at the world that is Tax Rebate Electric Car 2023 Form Utahs. We'll explore the nature of them and how they operate, and how you can maximise your savings via these cost-effective incentives.

Get Latest Tax Rebate Electric Car 2023 Form Utah Below

Tax Rebate Electric Car 2023 Form Utah

Tax Rebate Electric Car 2023 Form Utah -

Home EV chargers purchased after January 1 2023 may qualify for a tax credit of up to 1 000 Electric Vehicle Charging for Low Income and Rural Households Receive a tax

To qualify for the full 7 500 credit electric vehicles must be Effective immediately all EVs must be built in North America to qualify for the tax credit Starting in 2023 EV models

A Tax Rebate Electric Car 2023 Form Utah as it is understood in its simplest version, is an ad-hoc refund that a client receives after having purchased a item or service. It's a powerful instrument that businesses use to draw customers, boost sales, and also to advertise certain products.

Types of Tax Rebate Electric Car 2023 Form Utah

Ri Electric Car Rebate 2023 Carrebate

Ri Electric Car Rebate 2023 Carrebate

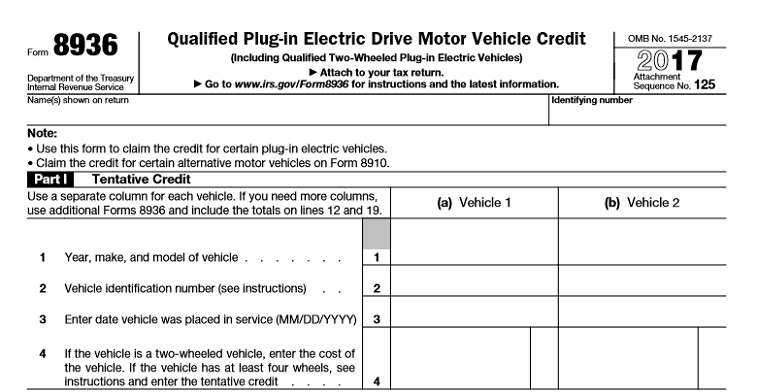

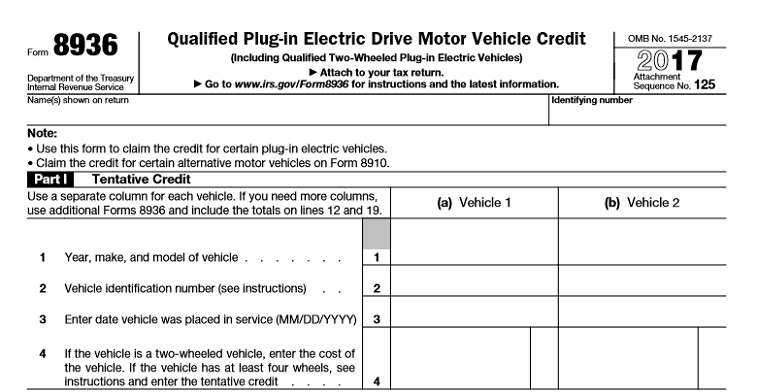

Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled

Utah based businesses and non profit organizations are eligible for a maximum rebate of 75 000 each Government entities are also eligible to apply For more information see

Cash Tax Rebate Electric Car 2023 Form Utah

Cash Tax Rebate Electric Car 2023 Form Utah are by far the easiest kind of Tax Rebate Electric Car 2023 Form Utah. Customers receive a specified amount of money after purchasing a product. These are often used for high-ticket items like electronics or appliances.

Mail-In Tax Rebate Electric Car 2023 Form Utah

Mail-in Tax Rebate Electric Car 2023 Form Utah need customers to present evidence of purchase to get their money back. They're somewhat more involved, but can result in significant savings.

Instant Tax Rebate Electric Car 2023 Form Utah

Instant Tax Rebate Electric Car 2023 Form Utah are made at the point of sale, which reduces the price of purchases immediately. Customers do not have to wait until they can save by using this method.

How Tax Rebate Electric Car 2023 Form Utah Work

Southern California Edison Hybrid Car Rebate 2023 Carrebate

Southern California Edison Hybrid Car Rebate 2023 Carrebate

Colorado Before January 1 2026 a 2 000 tax credit for purchase and 1 500 for lease of a light duty EV or plug in hybrid electric vehicle per calendar year For a light duty electric truck

The Tax Rebate Electric Car 2023 Form Utah Process

The procedure typically consists of a few easy steps:

-

Then, you purchase the product you purchase the product in the same way you would normally.

-

Fill in this Tax Rebate Electric Car 2023 Form Utah forms: The Tax Rebate Electric Car 2023 Form Utah form will have provide certain information including your name, address and information about the purchase in order to apply for your Tax Rebate Electric Car 2023 Form Utah.

-

Make sure you submit the Tax Rebate Electric Car 2023 Form Utah: Depending on the kind of Tax Rebate Electric Car 2023 Form Utah you will need to submit a form by mail or upload it online.

-

Wait for approval: The business will review your submission and ensure that it's compliant with guidelines and conditions of the Tax Rebate Electric Car 2023 Form Utah.

-

You will receive your Tax Rebate Electric Car 2023 Form Utah If it is approved, you'll get your refund, through a check, or a prepaid card, or a different option as per the terms of the offer.

Pros and Cons of Tax Rebate Electric Car 2023 Form Utah

Advantages

-

Cost savings Tax Rebate Electric Car 2023 Form Utah could significantly reduce the cost for the item.

-

Promotional Offers Incentivize customers to try new products or brands.

-

Help to Increase Sales Tax Rebate Electric Car 2023 Form Utah are a great way to boost sales for a company and also increase market share.

Disadvantages

-

Complexity Pay-in Tax Rebate Electric Car 2023 Form Utah via mail, in particular difficult and slow-going.

-

The Expiration Dates Many Tax Rebate Electric Car 2023 Form Utah are subject to strict time limits for submission.

-

Risque of Non-Payment Customers may not receive their refunds if they don't adhere to the requirements exactly.

Download Tax Rebate Electric Car 2023 Form Utah

Download Tax Rebate Electric Car 2023 Form Utah

FAQs

1. Are Tax Rebate Electric Car 2023 Form Utah similar to discounts? No, Tax Rebate Electric Car 2023 Form Utah involve some form of refund following the purchase, whereas discounts reduce the purchase price at point of sale.

2. Can I use multiple Tax Rebate Electric Car 2023 Form Utah on the same item It's contingent upon the conditions applicable to Tax Rebate Electric Car 2023 Form Utah provides and the particular product's potential eligibility. Certain companies may allow it, but others won't.

3. How long does it take to receive a Tax Rebate Electric Car 2023 Form Utah? The duration is variable, however it can take anywhere from a few weeks to a couple of months for you to receive your Tax Rebate Electric Car 2023 Form Utah.

4. Do I have to pay taxes upon Tax Rebate Electric Car 2023 Form Utah amounts? In most situations, Tax Rebate Electric Car 2023 Form Utah amounts are not considered taxable income.

5. Should I be able to trust Tax Rebate Electric Car 2023 Form Utah offers from brands that aren't well-known It's important to do your research and verify that the organization that is offering the Tax Rebate Electric Car 2023 Form Utah is legitimate prior to making a purchase.

Alcon Rebate Code 2023 Printable Rebate Form

Electric Vehicle Federal Incentives Tracker

Check more sample of Tax Rebate Electric Car 2023 Form Utah below

Maine Renters Rebate 2023 Printable Rebate Form

2500 Rebate Electric Car 2022 Carrebate

Federal Electric Car Rebate And Tax Withholdings 2023 Carrebate

Missouri Rent Rebate 2023 Printable Rebate Form

Claiming The 7 500 Electric Vehicle Tax Credit A Step by Step Guide

Rent Rebate 2023 Pa Printable Rebate Form

https://hub.utahcleanenergy.org/electric-vehicles/...

To qualify for the full 7 500 credit electric vehicles must be Effective immediately all EVs must be built in North America to qualify for the tax credit Starting in 2023 EV models

https://electrek.co/2023/06/30/ev-tax-credit-rebate-states-electric-vehicles

Rhode Island tax incentives rebate Texas electric vehicle tax rebate Utah offers big electric vehicle tax credits but only for heavy duty vehicles

To qualify for the full 7 500 credit electric vehicles must be Effective immediately all EVs must be built in North America to qualify for the tax credit Starting in 2023 EV models

Rhode Island tax incentives rebate Texas electric vehicle tax rebate Utah offers big electric vehicle tax credits but only for heavy duty vehicles

Missouri Rent Rebate 2023 Printable Rebate Form

2500 Rebate Electric Car 2022 Carrebate

Claiming The 7 500 Electric Vehicle Tax Credit A Step by Step Guide

Rent Rebate 2023 Pa Printable Rebate Form

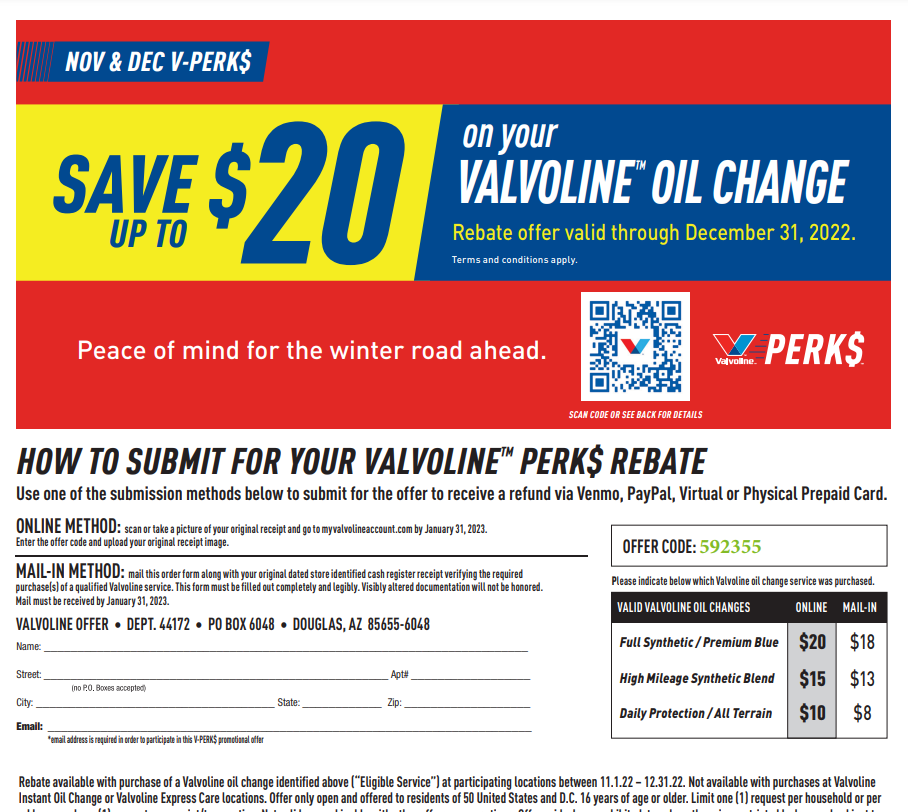

Valvoline Rebate Forms Printable Rebate Form

Washington State Tax Rebate Printable Rebate Form

Washington State Tax Rebate Printable Rebate Form

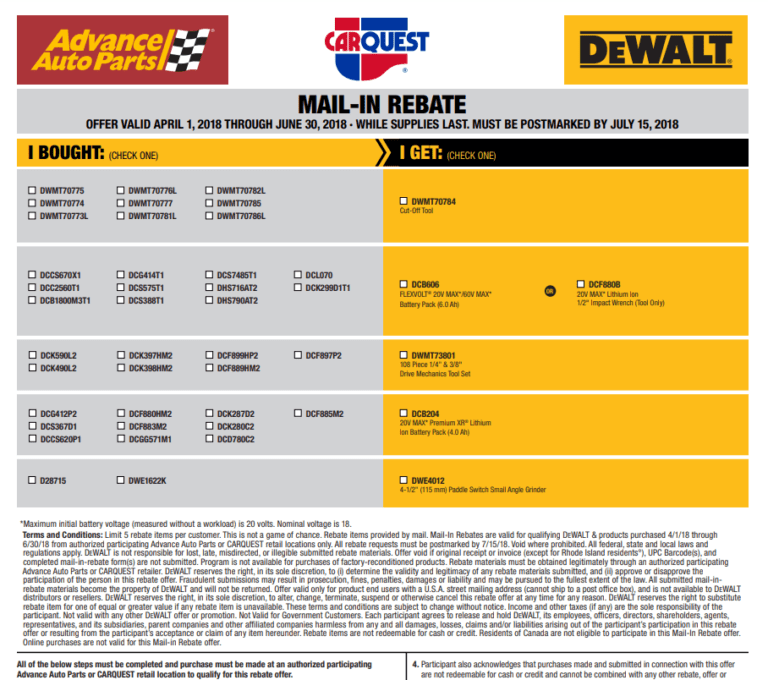

Advance Auto Parts Rebate Forms Printable Rebate Form