Today, in a world that is driven by the consumer every person loves a great bargain. One way to score significant savings in your purchase is through Tax Rebate 2023 Georgias. Tax Rebate 2023 Georgias are a marketing strategy that retailers and manufacturers use to offer customers a partial refund on their purchases after they've completed them. In this post, we'll examine the subject of Tax Rebate 2023 Georgias. We will explore the nature of them and how they function, and the best way to increase the value of these incentives.

Get Latest Tax Rebate 2023 Georgia Below

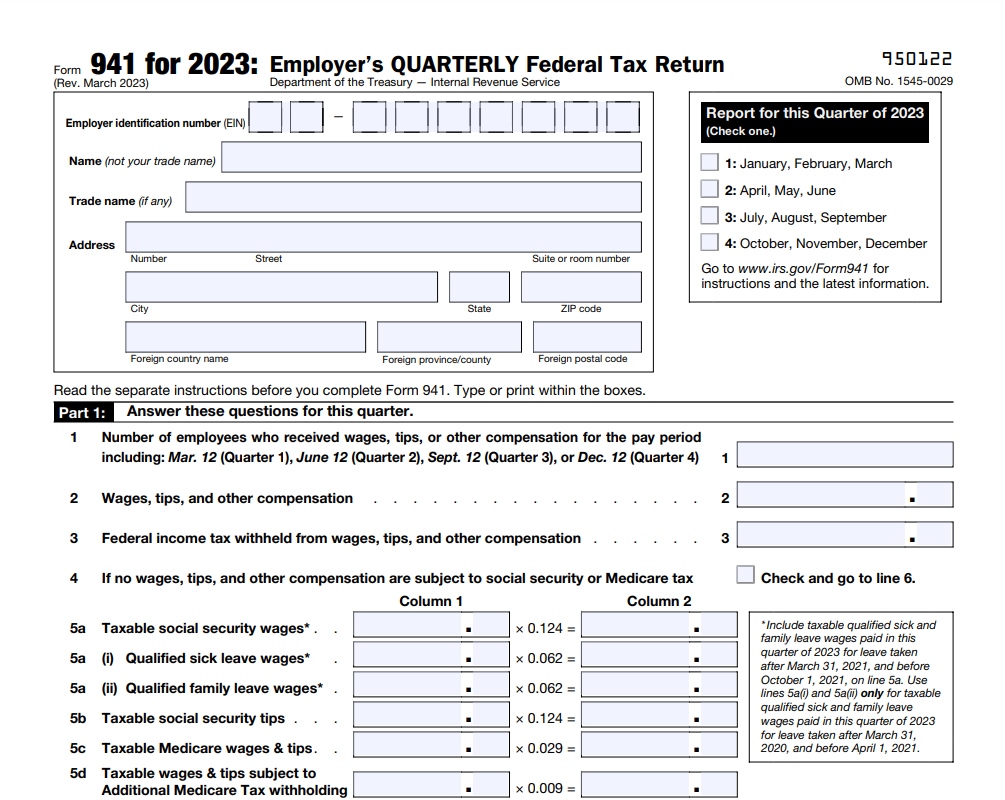

Tax Rebate 2023 Georgia

Tax Rebate 2023 Georgia -

Web 6 avr 2023 nbsp 0183 32 The Georgia tax rebate in 2023 offers taxpayers an opportunity to receive additional financial relief By understanding the eligibility requirements application

Web 12 juil 2022 nbsp 0183 32 Where is this tax rebate money coming from But Georgia residents might be wondering where this money is coming from well there is a 1 6 billion budget surplus

A Tax Rebate 2023 Georgia or Tax Rebate 2023 Georgia, in its most basic type, is a refund given to a client after they've purchased a good or service. It is a powerful tool utilized by businesses to attract buyers, increase sales and also to advertise certain products.

Types of Tax Rebate 2023 Georgia

Ga Tax Rebate 2023 Tax Rebate

Ga Tax Rebate 2023 Tax Rebate

Web 2 mai 2023 nbsp 0183 32 The Georgia Department of Revenue and the governor s office announced Monday that the first round of surplus tax refund checks have been issued The extra

Web 9 mai 2023 nbsp 0183 32 The Tax Rebate 2023 program is a government initiative aimed at providing financial relief to individuals and businesses in Georgia It offers eligible taxpayers the

Cash Tax Rebate 2023 Georgia

Cash Tax Rebate 2023 Georgia are the simplest kind of Tax Rebate 2023 Georgia. Customers are given a certain amount of money back after purchasing a item. These are usually used for large-ticket items such as electronics and appliances.

Mail-In Tax Rebate 2023 Georgia

Mail-in Tax Rebate 2023 Georgia require consumers to send in their proof of purchase before receiving their reimbursement. They are a bit more complicated but could provide huge savings.

Instant Tax Rebate 2023 Georgia

Instant Tax Rebate 2023 Georgia apply at the moment of sale, cutting the price of purchases immediately. Customers don't have to wait around for savings when they purchase this type of Tax Rebate 2023 Georgia.

How Tax Rebate 2023 Georgia Work

Georgia Renters Rebate 2023 Printable Rebate Form Gas Rebates

Georgia Renters Rebate 2023 Printable Rebate Form Gas Rebates

Web 17 ao 251 t 2023 nbsp 0183 32 If you are looking for Georgia Tax Rebate 2023 Status you ve come to the right place We have 35 rebates about Georgia Tax Rebate 2023 Status including

The Tax Rebate 2023 Georgia Process

It usually consists of a couple of steps that are easy to follow:

-

Buy the product: At first you purchase the product the way you normally do.

-

Fill out the Tax Rebate 2023 Georgia request form. You'll need to give some specific information, such as your address, name, and the purchase details, in order to claim your Tax Rebate 2023 Georgia.

-

Send in the Tax Rebate 2023 Georgia: Depending on the nature of Tax Rebate 2023 Georgia, you may need to fill out a paper form or upload it online.

-

Wait for approval: The company will scrutinize your submission to ensure it meets the guidelines and conditions of the Tax Rebate 2023 Georgia.

-

Pay your Tax Rebate 2023 Georgia Once it's approved, you'll receive a refund either through check, prepaid card, or a different option as per the terms of the offer.

Pros and Cons of Tax Rebate 2023 Georgia

Advantages

-

Cost Savings Rewards can drastically reduce the price you pay for products.

-

Promotional Deals they encourage their customers to test new products or brands.

-

Accelerate Sales The benefits of a Tax Rebate 2023 Georgia can improve the company's sales as well as market share.

Disadvantages

-

Complexity In particular, mail-in Tax Rebate 2023 Georgia in particular, can be cumbersome and take a long time to complete.

-

Day of Expiration Many Tax Rebate 2023 Georgia are subject to very strict deadlines for filing.

-

Risk of Not Being Paid Customers may not be able to receive their Tax Rebate 2023 Georgia if they don't adhere to the rules precisely.

Download Tax Rebate 2023 Georgia

Download Tax Rebate 2023 Georgia

FAQs

1. Are Tax Rebate 2023 Georgia equivalent to discounts? No, the Tax Rebate 2023 Georgia will be a partial refund upon purchase, but discounts can reduce costs at time of sale.

2. Can I use multiple Tax Rebate 2023 Georgia on the same product What is the best way to do it? It's contingent on conditions of the Tax Rebate 2023 Georgia deals and product's qualification. Certain businesses may allow it, while some won't.

3. How long does it take to receive the Tax Rebate 2023 Georgia? The duration differs, but could be anywhere from a few weeks up to a several months to receive a Tax Rebate 2023 Georgia.

4. Do I need to pay taxes of Tax Rebate 2023 Georgia values? the majority of instances, Tax Rebate 2023 Georgia amounts are not considered to be taxable income.

5. Can I trust Tax Rebate 2023 Georgia offers from brands that aren't well-known It is essential to investigate to ensure that the name which is providing the Tax Rebate 2023 Georgia has a good reputation prior to making an acquisition.

Ga State Tax Form 2023 Printable Forms Free Online

Most Residential Properties To Incur Higher Tax From Jan 1 2023

Check more sample of Tax Rebate 2023 Georgia below

This Is An Attachment Of 2023 LG Rebates Printable Rebate Form From

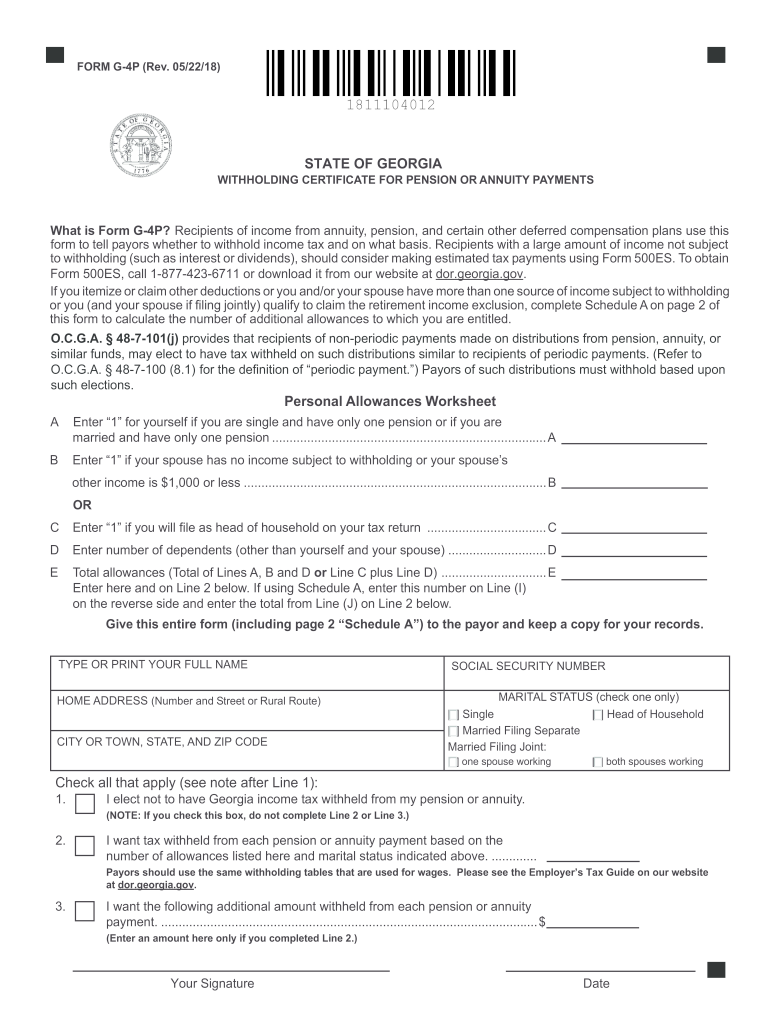

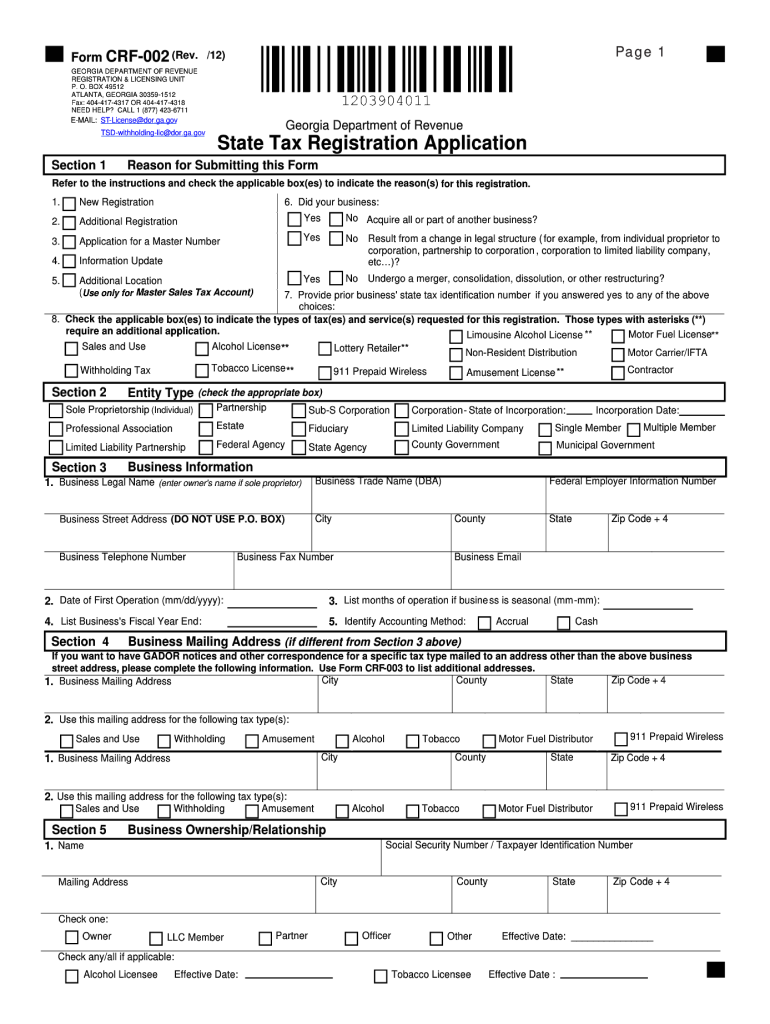

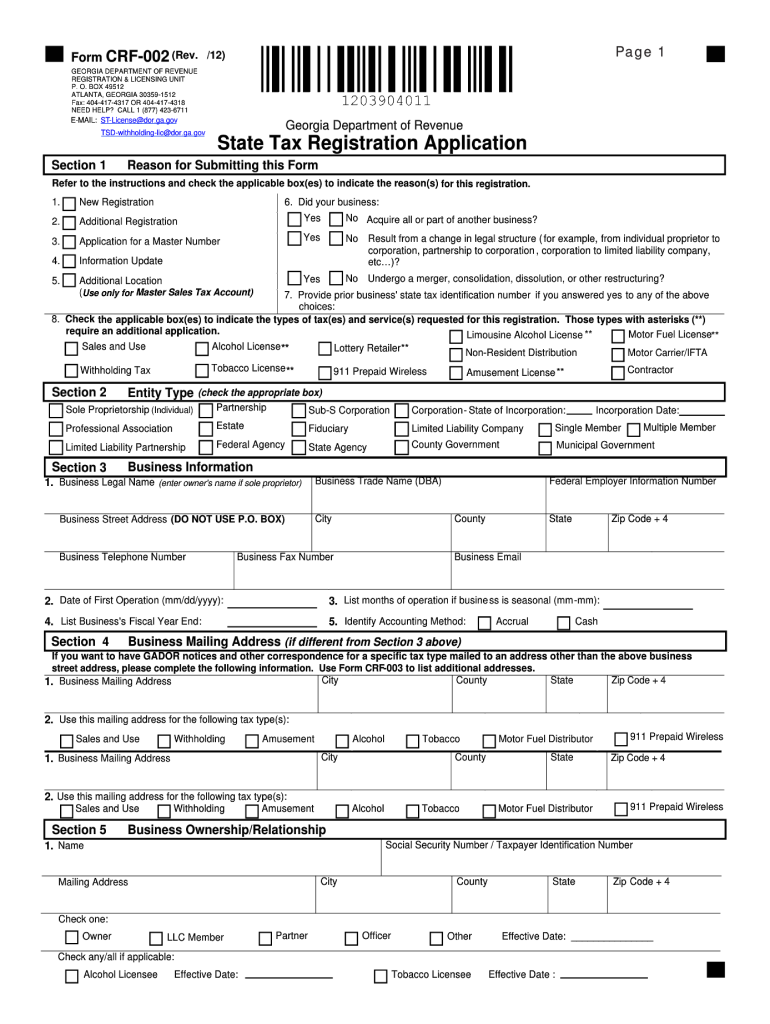

From Crf002 Fill Out Sign Online DocHub

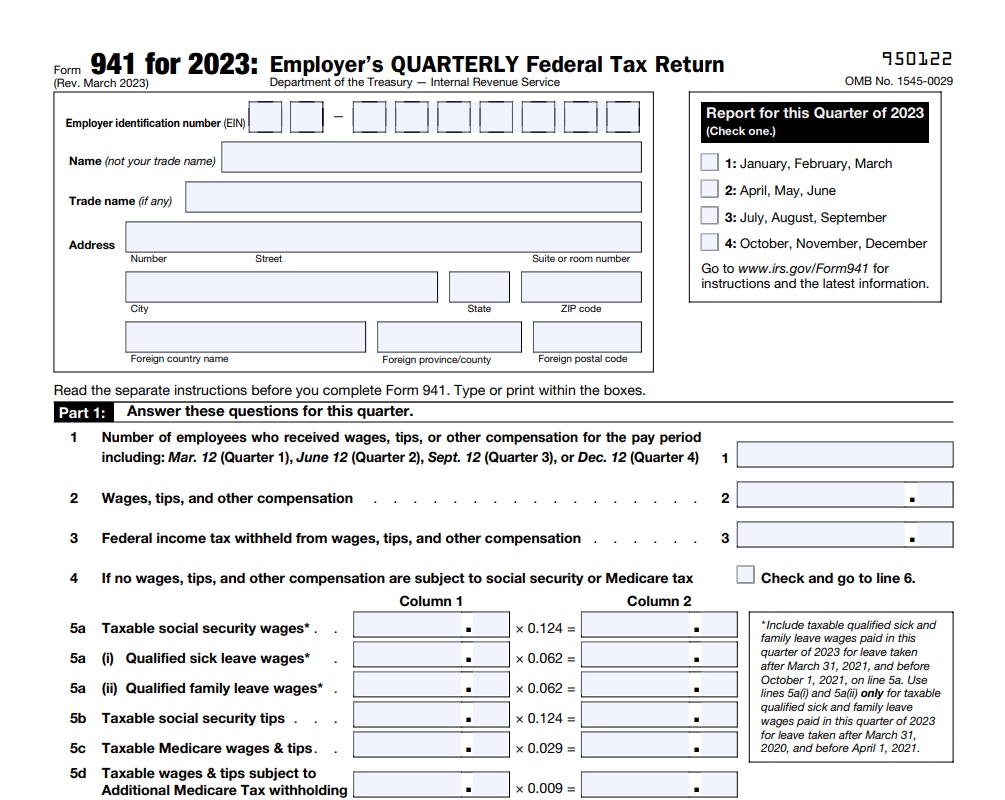

Federal Tax Rebate 2023 Maximize Your Savings And Boost Your Finances

Firestone Rebates 2023 Printable Rebate Form

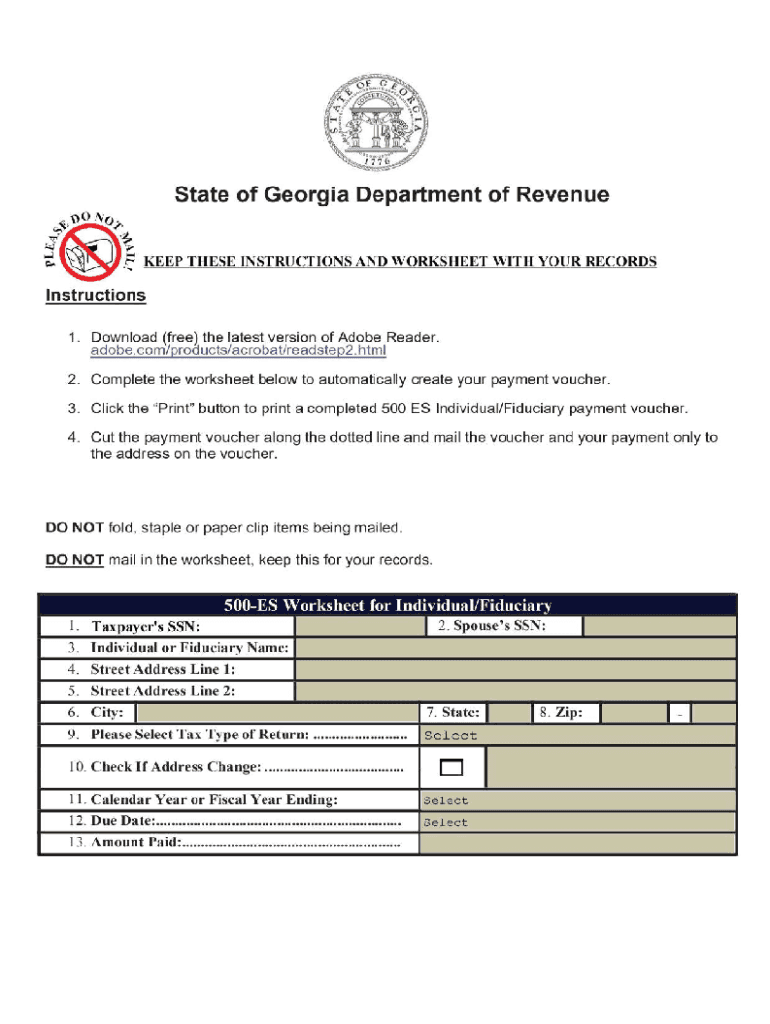

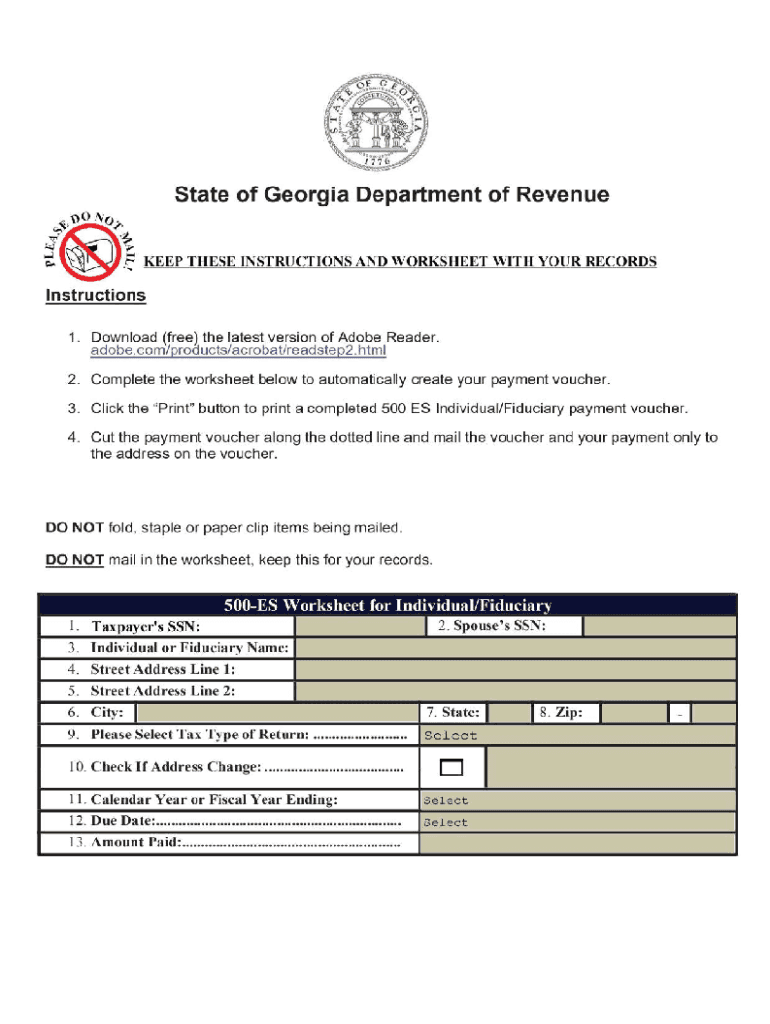

Irs Form 500es Fill Out Sign Online DocHub

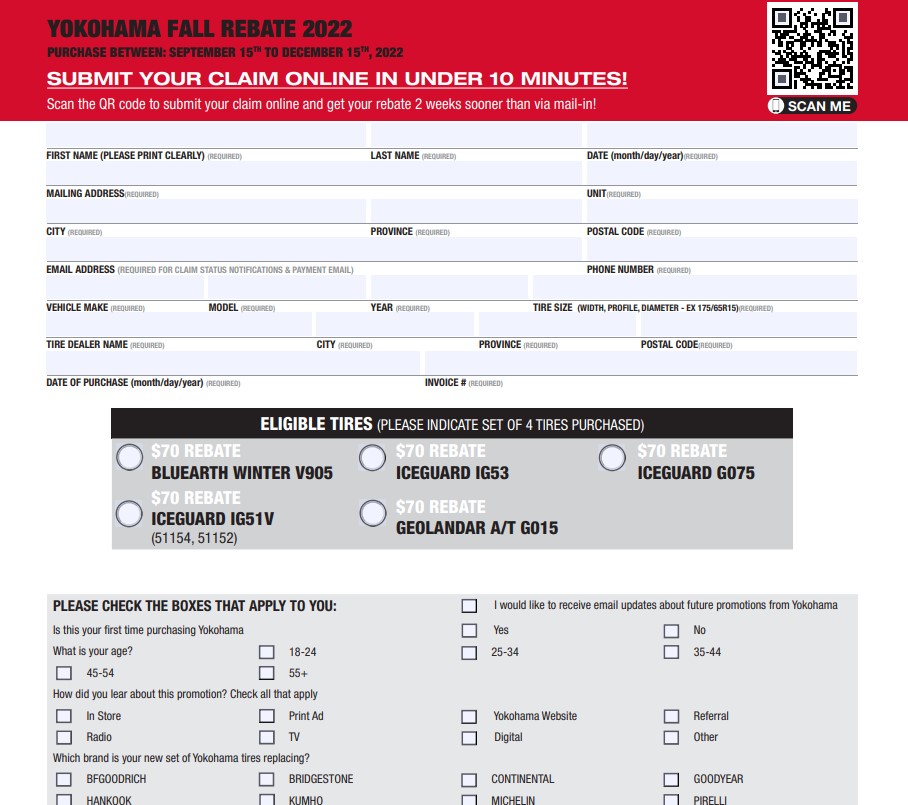

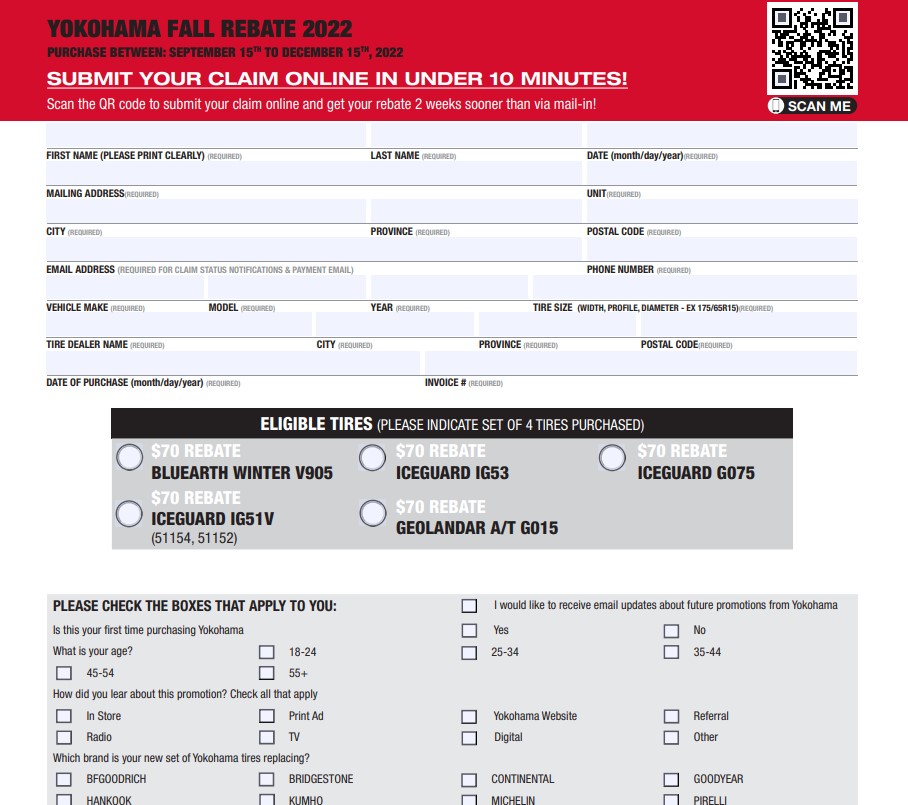

Yokohama Tire Rebate 2023 How To Qualify And Claim Your Rebate

https://www.marca.com/en/lifestyle/us-news/2022/07/12/62cd912aca4741b...

Web 12 juil 2022 nbsp 0183 32 Where is this tax rebate money coming from But Georgia residents might be wondering where this money is coming from well there is a 1 6 billion budget surplus

https://dor.georgia.gov/georgia-surplus-tax-refund

Web HB 162 allows for a tax refund out of the State s surplus to Georgia filers who meet eligibility requirements You may be eligible for the HB 162 Surplus Tax Refund if you

Web 12 juil 2022 nbsp 0183 32 Where is this tax rebate money coming from But Georgia residents might be wondering where this money is coming from well there is a 1 6 billion budget surplus

Web HB 162 allows for a tax refund out of the State s surplus to Georgia filers who meet eligibility requirements You may be eligible for the HB 162 Surplus Tax Refund if you

Firestone Rebates 2023 Printable Rebate Form

From Crf002 Fill Out Sign Online DocHub

Irs Form 500es Fill Out Sign Online DocHub

Yokohama Tire Rebate 2023 How To Qualify And Claim Your Rebate

National Budget Speech 2023 SimplePay Blog

Some Georgia Filers May Have To Pay Taxes On State Rebates Now Habersham

Some Georgia Filers May Have To Pay Taxes On State Rebates Now Habersham

Know New Rebate Under Section 87A Budget 2023