In this day and age of consuming everybody loves a good bargain. One way to make significant savings for your purchases is through Tax Form For Stimulus Rebates. Tax Form For Stimulus Rebates are an effective marketing tactic employed by retailers and manufacturers to offer consumers a partial discount on purchases they made after they've created them. In this article, we will examine the subject of Tax Form For Stimulus Rebates, looking at the nature of them their purpose, how they function and the best way to increase the value of these incentives.

Get Latest Tax Form For Stimulus Rebate Below

Tax Form For Stimulus Rebate

Tax Form For Stimulus Rebate -

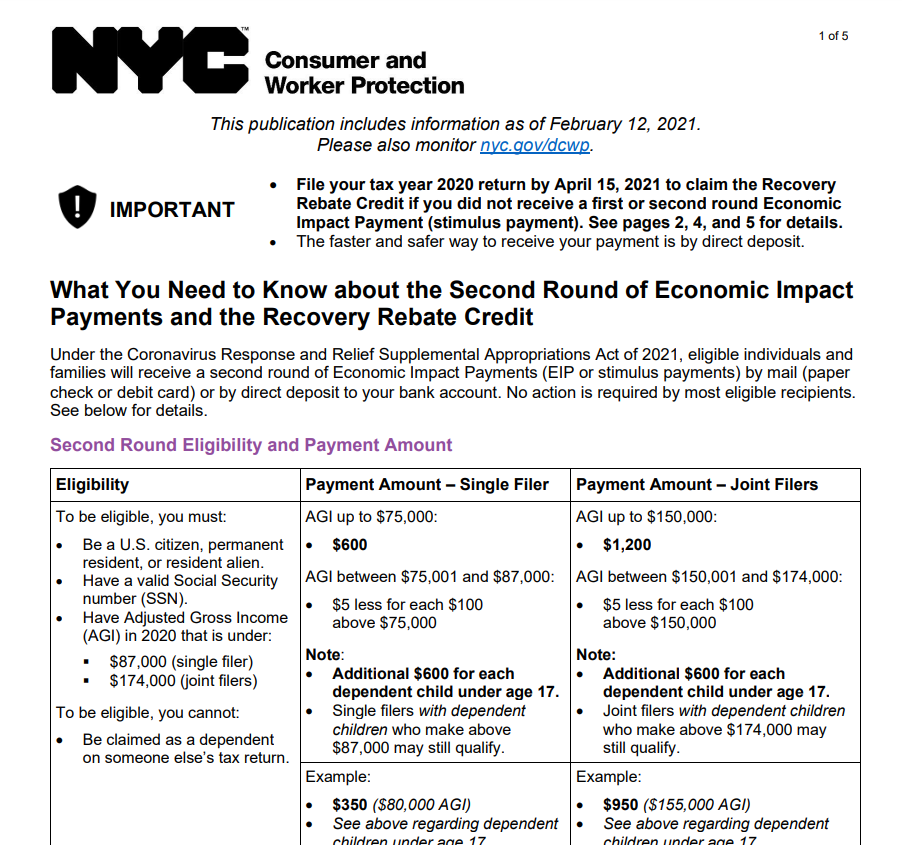

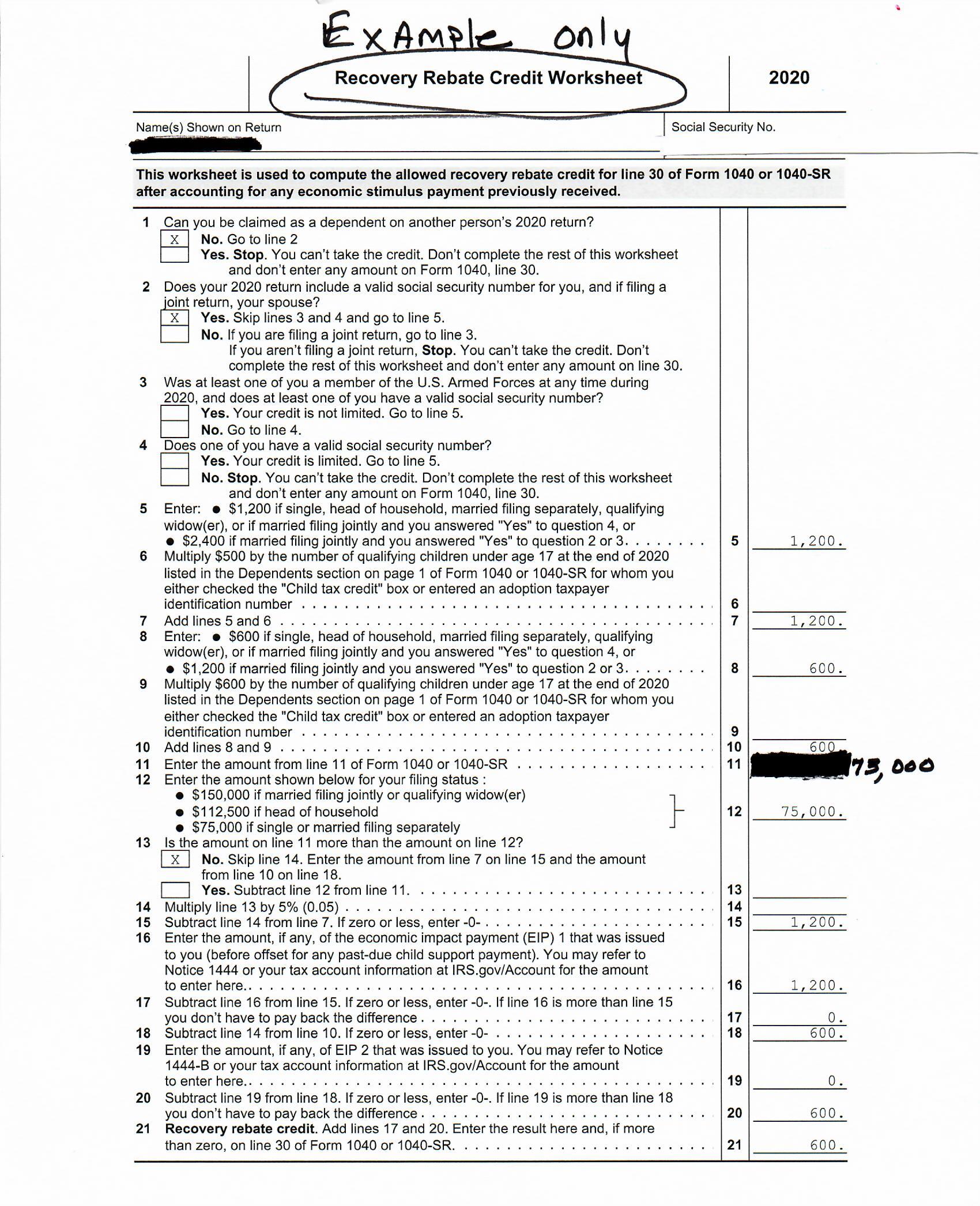

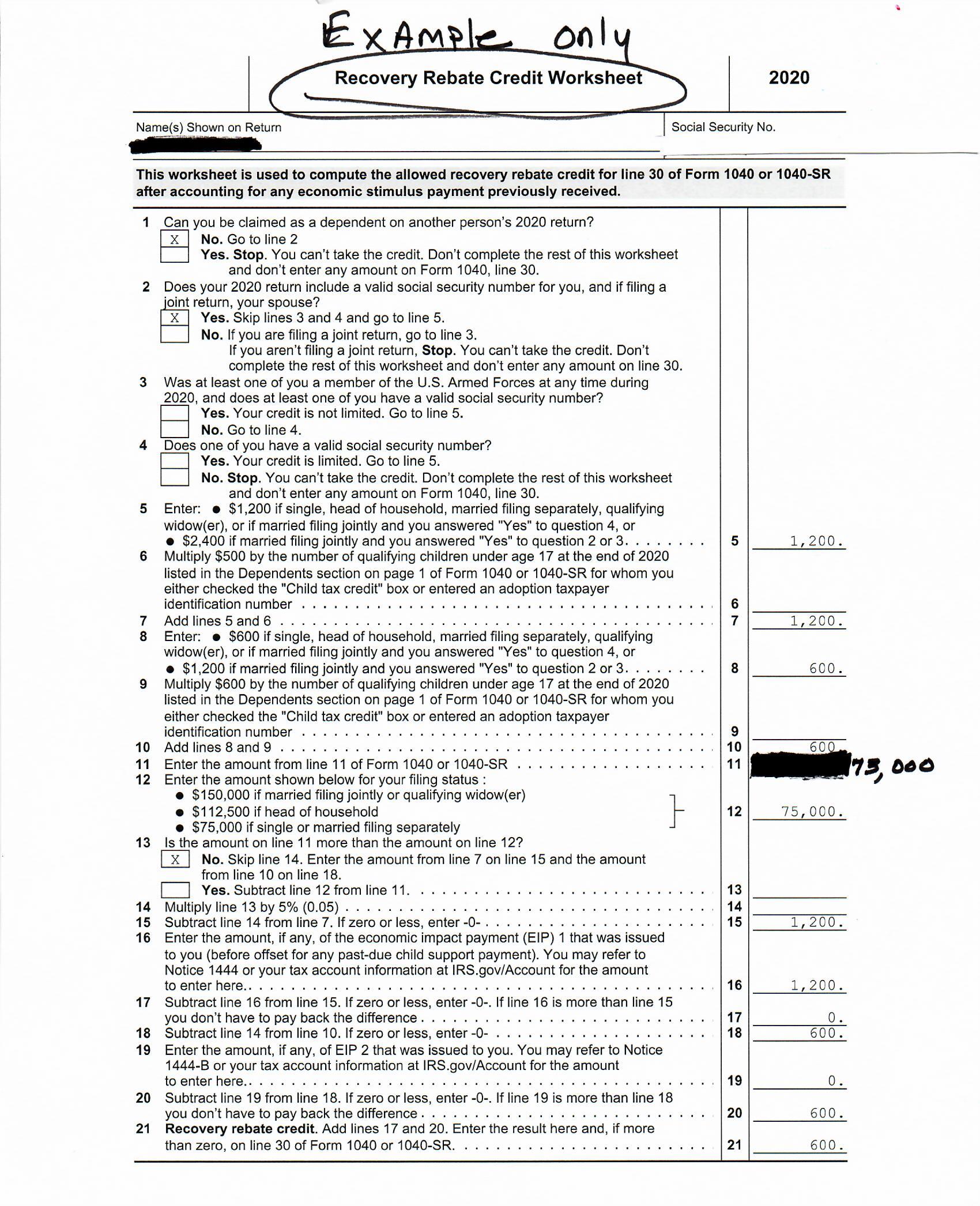

Web People who are missing stimulus payments should review the information on the Recovery Rebate Credit page to determine their eligibility to claim the credit for tax year 2020 or

Web 13 janv 2022 nbsp 0183 32 Compute the 2021 Recovery Rebate Credit amount using tax preparation software or the line 30 worksheet found in 2021 Form 1040 and Form 1040 SR

A Tax Form For Stimulus Rebate or Tax Form For Stimulus Rebate, in its most basic type, is a refund to a purchaser after purchasing a certain product or service. It's a highly effective tool used by companies to attract buyers, increase sales or promote a specific product.

Types of Tax Form For Stimulus Rebate

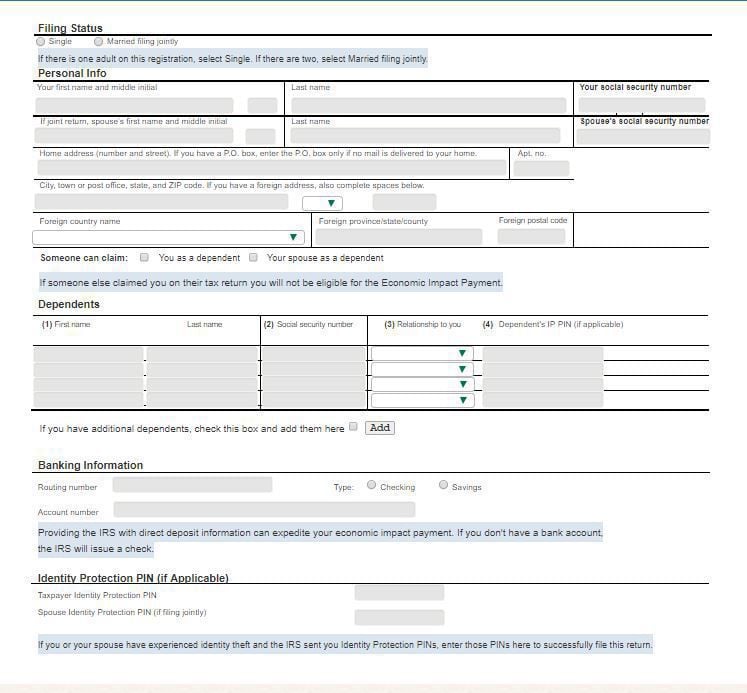

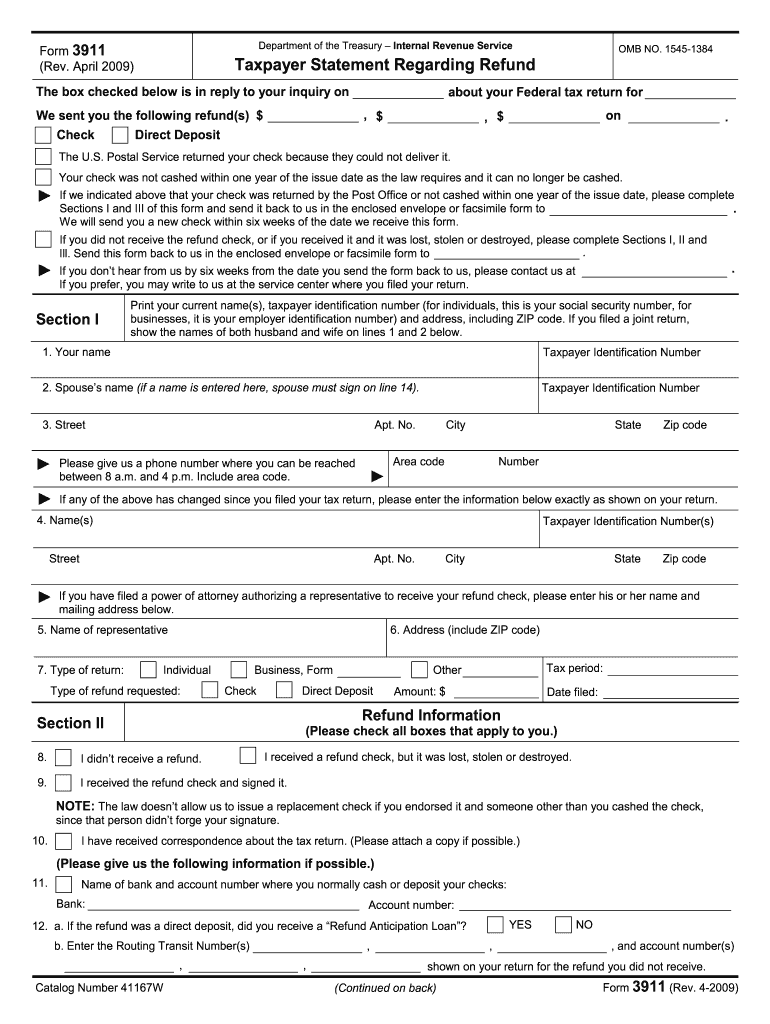

Stimulus Check Fillable Form Printable Forms Free Online

Stimulus Check Fillable Form Printable Forms Free Online

Web 15 janv 2021 nbsp 0183 32 IR 2021 15 January 15 2021 IRS Free File online tax preparation products available at no charge launched today giving taxpayers an early opportunity

Web 8 mars 2022 nbsp 0183 32 Even if you weren t otherwise required to file The same is true for the third stimulus payment sent out in 2021 When filing your tax return you will use Line 30 of

Cash Tax Form For Stimulus Rebate

Cash Tax Form For Stimulus Rebate are a simple type of Tax Form For Stimulus Rebate. Customers are offered a certain amount of money in return for buying a product. These are typically applied to the most expensive products like electronics or appliances.

Mail-In Tax Form For Stimulus Rebate

Mail-in Tax Form For Stimulus Rebate require the customer to send in proof of purchase to receive their reimbursement. They're more involved but offer significant savings.

Instant Tax Form For Stimulus Rebate

Instant Tax Form For Stimulus Rebate will be applied at point of sale, and can reduce the price of purchases immediately. Customers don't have to wait for savings with this type.

How Tax Form For Stimulus Rebate Work

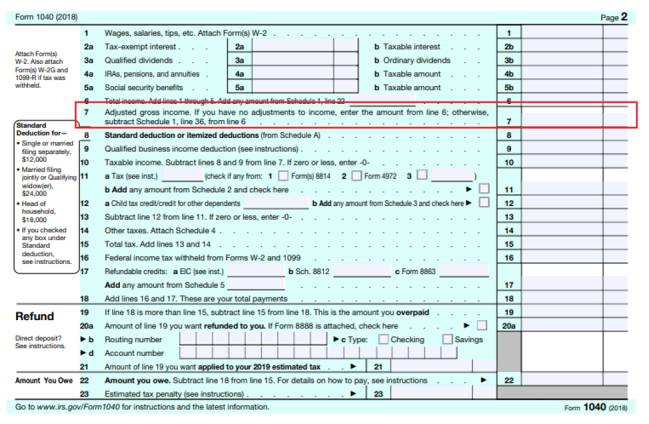

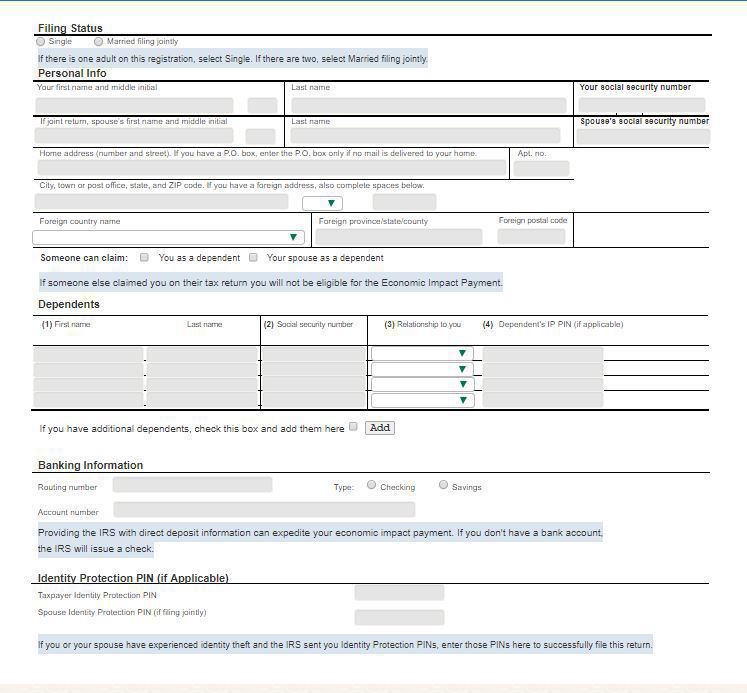

Second Stimulus Check What Is My AGI And Where Can I Find It AS

Second Stimulus Check What Is My AGI And Where Can I Find It AS

Web 27 avr 2023 nbsp 0183 32 The second full stimulus payment was 600 for single individuals 1 200 for married couples and 600 per dependent If you earned more than 99 000 198 000 for married couples you got no

The Tax Form For Stimulus Rebate Process

The procedure usually involves a couple of steps that are easy to follow:

-

When you buy the product, you buy the product in the same way you would normally.

-

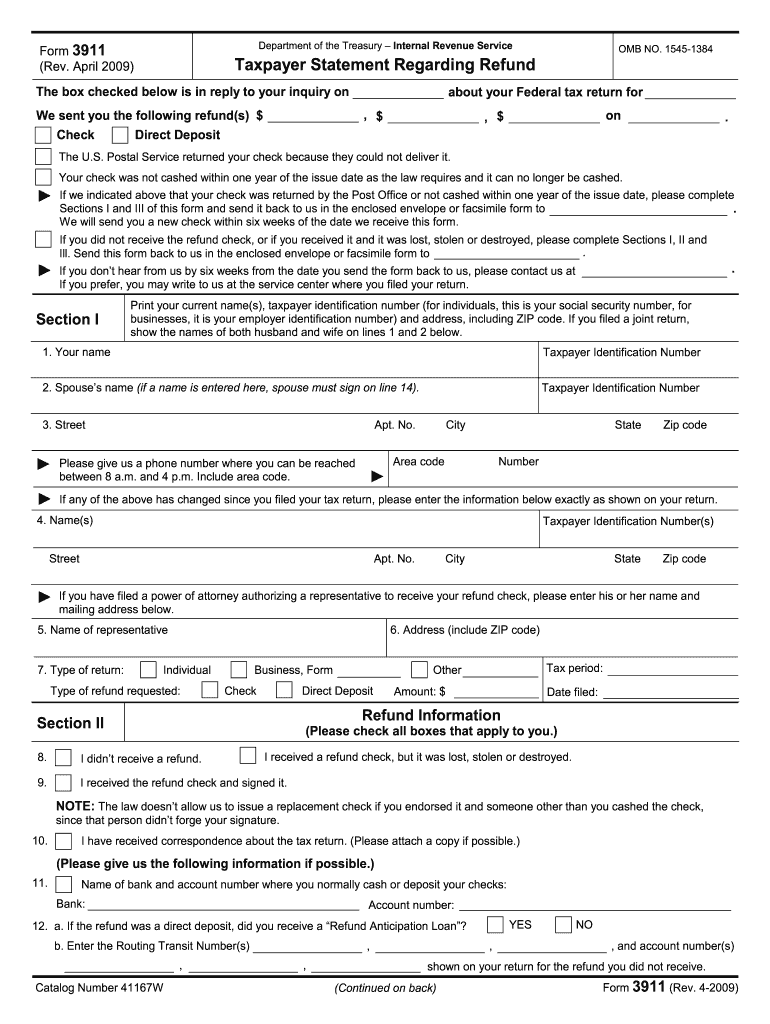

Fill in your Tax Form For Stimulus Rebate request form. You'll have to fill in some information like your name, address and details about your purchase, in order in order to make a claim for your Tax Form For Stimulus Rebate.

-

In order to submit the Tax Form For Stimulus Rebate Based on the type of Tax Form For Stimulus Rebate the recipient may be required to fill out a form and mail it in or upload it online.

-

Wait for the company's approval: They will examine your application to ensure it meets the terms and conditions of the Tax Form For Stimulus Rebate.

-

You will receive your Tax Form For Stimulus Rebate After approval, you'll receive the refund through a check, or a prepaid card, or a different method as specified by the offer.

Pros and Cons of Tax Form For Stimulus Rebate

Advantages

-

Cost Savings Tax Form For Stimulus Rebate can substantially reduce the cost for an item.

-

Promotional Deals The aim is to encourage customers to experiment with new products, or brands.

-

Increase Sales Tax Form For Stimulus Rebate can help boost the sales of a business and increase its market share.

Disadvantages

-

Complexity Reward mail-ins in particular difficult and take a long time to complete.

-

Days of expiration A majority of Tax Form For Stimulus Rebate have specific deadlines for submission.

-

The risk of non-payment Certain customers could not receive Tax Form For Stimulus Rebate if they don't follow the regulations exactly.

Download Tax Form For Stimulus Rebate

Download Tax Form For Stimulus Rebate

FAQs

1. Are Tax Form For Stimulus Rebate equivalent to discounts? Not necessarily, as Tax Form For Stimulus Rebate are a partial refund upon purchase, and discounts are a reduction of the cost of purchase at time of sale.

2. Are multiple Tax Form For Stimulus Rebate available on the same product? It depends on the terms of Tax Form For Stimulus Rebate offer and also the item's suitability. Certain companies might permit it, while others won't.

3. How long does it take to receive the Tax Form For Stimulus Rebate? The duration will differ, but can take anywhere from a couple of weeks to a couple of months to receive your Tax Form For Stimulus Rebate.

4. Do I have to pay tax for Tax Form For Stimulus Rebate values? most cases, Tax Form For Stimulus Rebate amounts are not considered taxable income.

5. Can I trust Tax Form For Stimulus Rebate deals from lesser-known brands it is crucial to conduct research and ensure that the brand offering the Tax Form For Stimulus Rebate is reputable prior to making any purchase.

10 Recovery Rebate Credit Worksheet

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

Check more sample of Tax Form For Stimulus Rebate below

How To Fill Out Stimulus Rebate Form By State Printable Rebate Form

Who could Qualify For 2nd Stimulus

How To Apply For The Stimulus Check Online House JUST Passed Extra

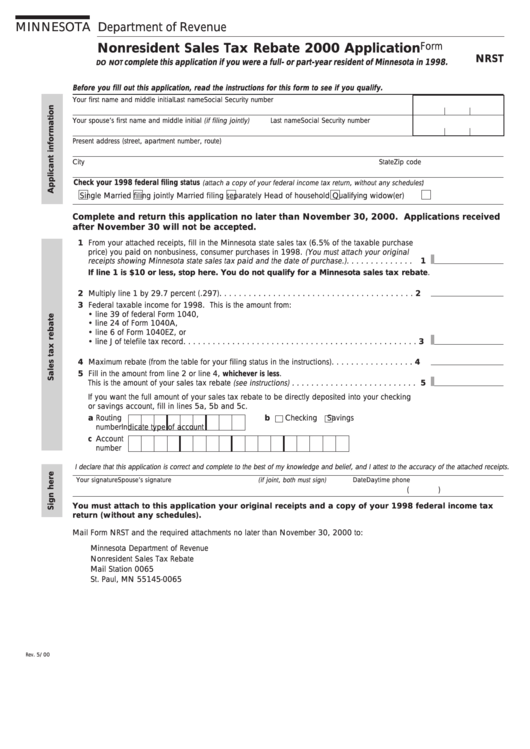

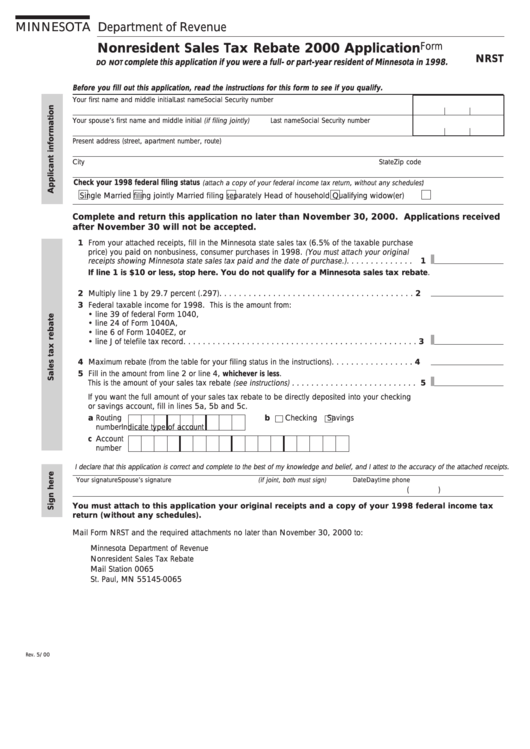

Form Nrst Nonresident Sales Tax Rebate 2000 Application Printable Pdf

Legal Structure Free Fillable Forms Stimulus Check

Government Rebate Program Fill Out Sign Online DocHub

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-b...

Web 13 janv 2022 nbsp 0183 32 Compute the 2021 Recovery Rebate Credit amount using tax preparation software or the line 30 worksheet found in 2021 Form 1040 and Form 1040 SR

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 13 janv 2022 nbsp 0183 32 Compute the 2021 Recovery Rebate Credit amount using tax preparation software or the line 30 worksheet found in 2021 Form 1040 and Form 1040 SR

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Form Nrst Nonresident Sales Tax Rebate 2000 Application Printable Pdf

Who could Qualify For 2nd Stimulus

Legal Structure Free Fillable Forms Stimulus Check

Government Rebate Program Fill Out Sign Online DocHub

HVAC Tax Stimulus Rebates Hvac Efficient Energy Use

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

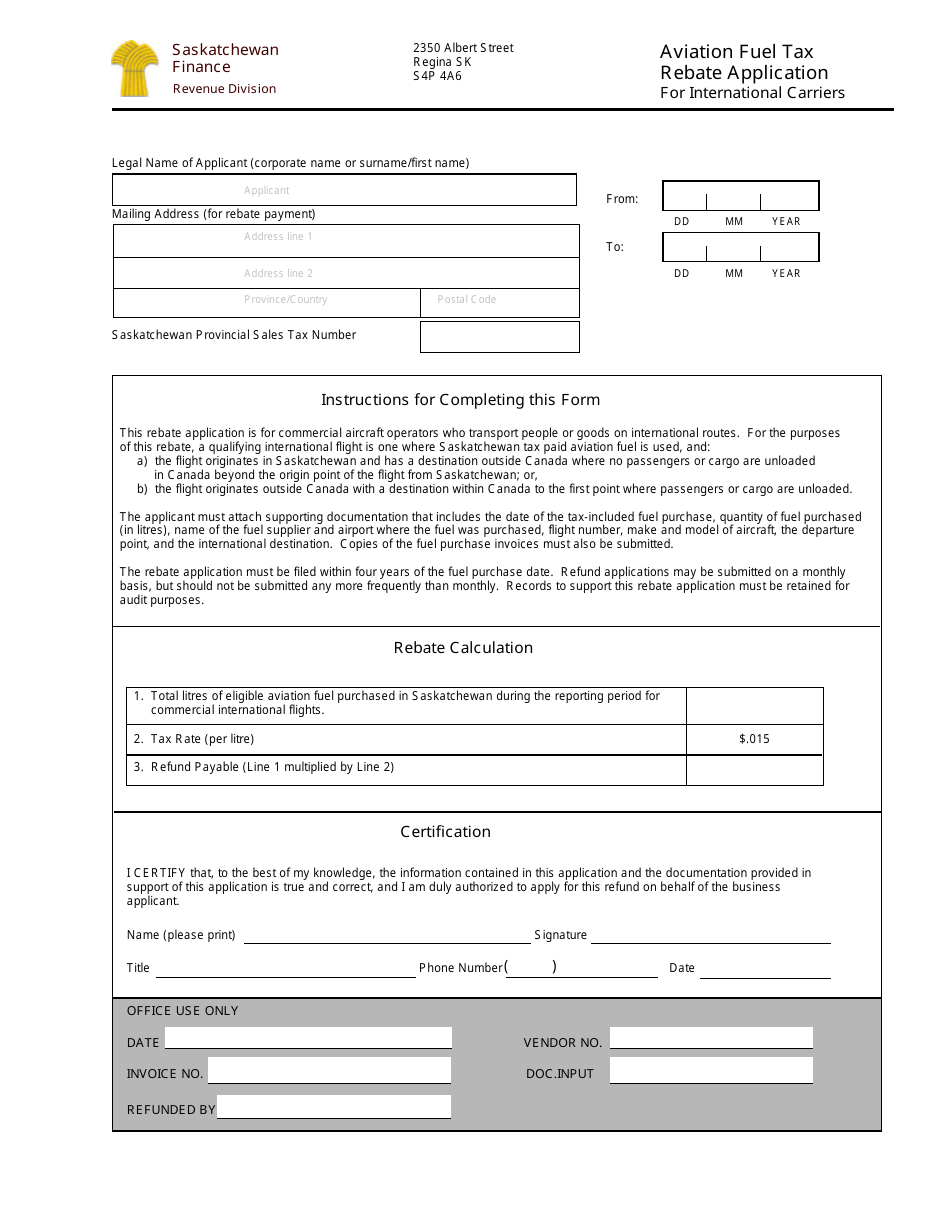

Saskatchewan Canada Aviation Fuel Tax Rebate Application For